North America Inflation Device Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

353.62 Million

USD

524.79 Million

2025

2033

USD

353.62 Million

USD

524.79 Million

2025

2033

| 2026 –2033 | |

| USD 353.62 Million | |

| USD 524.79 Million | |

|

|

|

|

Segmentação do mercado de dispositivos de insuflação na América do Norte, por tipo (dispositivo de insuflação analógico e dispositivo de insuflação digital), capacidade (dispositivo de insuflação de 20 ml, dispositivo de insuflação de 25 ml, dispositivo de insuflação de 30 ml e dispositivo de insuflação de 60 ml), aplicação (cardiologia intervencionista, procedimentos vasculares periféricos, radiologia intervencionista, procedimentos urológicos, procedimentos gastroenterológicos e outros), pressão (30 atm, 40 atm, 55 atm e outras), função (implantação de stent e administração de fluidos), usuário final (hospitais, laboratórios de intervenção e clínicas), canal de distribuição (licitação direta, vendas no varejo e distribuidores terceirizados) - Tendências e previsões do setor até 2033.

Tamanho do mercado de dispositivos de inflação na América do Norte

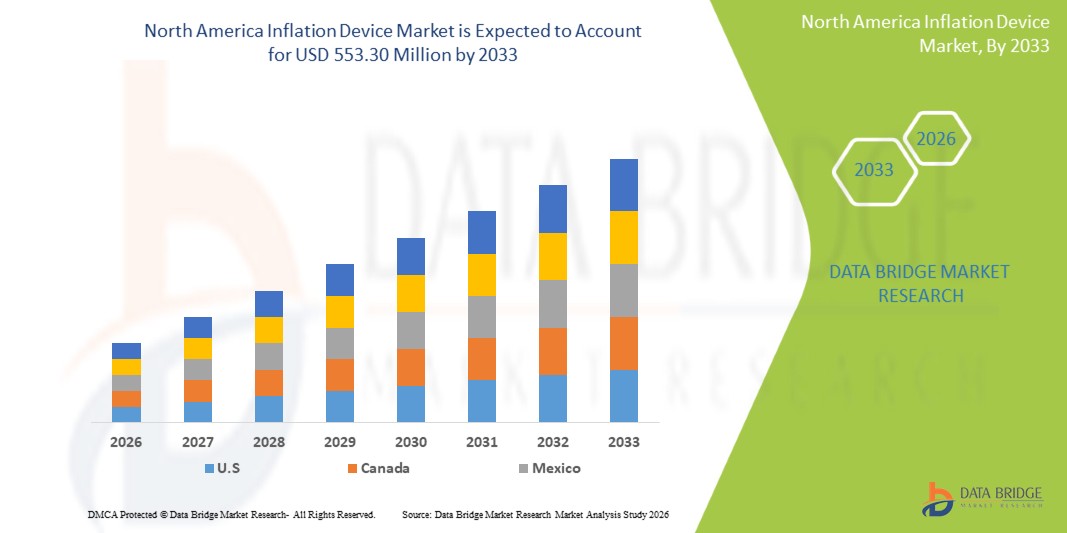

- O mercado de dispositivos de inflação na América do Norte foi avaliado em US$ 371,65 milhões em 2025 e deverá atingir US$ 553,30 milhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,10% durante o período de previsão.

- A expansão do mercado é impulsionada principalmente pelo crescente volume de procedimentos de cardiologia intervencionista e radiologia, nos quais os dispositivos de insuflação são essenciais para o controle preciso da pressão do cateter com balão em hospitais e centros cirúrgicos ambulatoriais.

- Além disso, a região beneficia-se de uma infraestrutura de saúde avançada, alta adoção de cirurgias minimamente invasivas e constantes atualizações tecnológicas em dispositivos médicos, acelerando a demanda por produtos.

Análise do mercado de dispositivos de inflação na América do Norte

- Os dispositivos de insuflação, utilizados para fornecer pressão controlada em cateteres com balão durante procedimentos intervencionistas em cardiologia, radiologia e vasculares, estão se tornando componentes cada vez mais vitais dos modernos sistemas cirúrgicos minimamente invasivos, tanto em ambiente hospitalar quanto ambulatorial, devido à sua precisão, facilidade de uso e papel essencial em tratamentos baseados em cateteres.

- A crescente demanda por dispositivos de insuflação é impulsionada principalmente pela prevalência cada vez maior de doenças cardiovasculares e arteriais periféricas, pela adoção crescente de procedimentos minimamente invasivos e pela preferência crescente dos médicos por instrumentos de administração de pressão precisos, confiáveis e estéreis.

- Os EUA dominaram o mercado de dispositivos de insuflação na América do Norte, com a maior participação na receita, de 84,7% em 2025, impulsionados por uma infraestrutura de saúde avançada, altos volumes de procedimentos intervencionistas e a presença de grandes fabricantes de dispositivos médicos. O país experimentou um crescimento substancial no uso de dispositivos de insuflação, particularmente em laboratórios de cateterismo e centros cardíacos de alto fluxo, impulsionado pela inovação contínua de produtos e aprimoramentos no design ergonômico.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de dispositivos de insuflação na América do Norte durante o período de previsão, devido ao aumento dos investimentos em unidades de cardiologia intervencionista, à expansão das capacidades cirúrgicas minimamente invasivas e à crescente demanda por dispositivos de insuflação descartáveis que melhoram a eficiência dos procedimentos e a segurança do paciente.

- O segmento de dispositivos de insuflação analógicos dominou o mercado de dispositivos de insuflação na América do Norte, com uma participação de mercado de 65,2% em 2025, impulsionado por sua relação custo-benefício, confiabilidade clínica comprovada e ampla compatibilidade com os sistemas de cateter existentes.

Escopo do relatório e segmentação do mercado de dispositivos de inflação na América do Norte

|

Atributos |

Principais informações sobre o mercado de dispositivos de inflação na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de dispositivos de inflação na América do Norte

“Avanços em Precisão, Automação e Integração Digital”

- Uma tendência significativa e crescente no mercado de dispositivos de insuflação na América do Norte é a mudança para sistemas de insuflação automatizados e aprimorados digitalmente, que melhoram a precisão da pressão, reduzem erros de operação manual e dão suporte a fluxos de trabalho avançados de cardiologia intervencionista em hospitais e laboratórios de cateterismo.

- Por exemplo, vários fabricantes líderes estão lançando dispositivos de inflação com manômetros digitais integrados e designs ergonômicos, permitindo que os médicos monitorem a pressão em tempo real com maior precisão e menor esforço operacional durante procedimentos de angioplastia ou implante de stent.

- A integração digital em dispositivos de insuflação permite recursos como sequências de desinsuflação automatizadas, estabilização de pressão aprimorada e alertas mais precisos para leituras anormais. Por exemplo, os modelos recém-lançados da Merit Medical incorporam telas digitais que proporcionam melhor visualização, eficiência do fluxo de trabalho e consistência nos procedimentos durante intervenções críticas.

- A integração perfeita dos dispositivos de insuflação com plataformas de imagem intervencionista mais abrangentes e sistemas de monitoramento de laboratório de cateterismo facilita o controle centralizado, permitindo que os médicos coordenem a operação do dispositivo com os resultados de imagem e os dados do procedimento para uma experiência de tratamento otimizada.

- Essa tendência em direção a soluções de insuflação mais inteligentes, automatizadas e com suporte digital está remodelando fundamentalmente as expectativas para procedimentos baseados em cateteres. Consequentemente, empresas como a Teleflex e a Boston Scientific estão desenvolvendo sistemas de insuflação com recursos avançados de assistência de pressão e usabilidade aprimorada, adaptados para aplicações intervencionistas complexas.

- A demanda por dispositivos de insuflação que ofereçam aplicação precisa de pressão, manuseio ergonômico e compatibilidade com fluxos de trabalho digitais está crescendo rapidamente em unidades de cardiologia intervencionista e radiologia, à medida que os profissionais de saúde priorizam cada vez mais a eficiência, a precisão e a melhoria dos resultados clínicos.

Dinâmica do mercado de dispositivos de inflação na América do Norte

Motorista

“Crescente necessidade devido ao aumento da carga cardiovascular e à preferência por procedimentos minimamente invasivos”

- A crescente prevalência de doenças cardiovasculares e arteriais periféricas nos EUA e no Canadá, combinada com a adoção acelerada de procedimentos intervencionistas minimamente invasivos, é um fator significativo para o aumento da demanda por dispositivos de insuflação.

- Por exemplo, em 2025, diversas instituições de saúde expandiram seus programas de cardiologia intervencionista com tecnologias de laboratório de cateterismo aprimoradas e capacidades de tratamento baseadas em cateter, permitindo maior utilização de dispositivos de insuflação em procedimentos diagnósticos e terapêuticos.

- À medida que os profissionais de saúde priorizam a precisão e a segurança em intervenções críticas, os dispositivos de insuflação oferecem controle preciso da pressão, monitoramento em tempo real e maior confiabilidade do procedimento, representando um avanço significativo em relação às soluções manuais básicas.

- Além disso, a crescente popularidade dos tratamentos baseados em cateteres e a preferência cada vez maior por tempos de recuperação mais curtos estão tornando os dispositivos de insuflação um componente essencial dos sistemas intervencionistas, facilitando a integração perfeita com equipamentos cirúrgicos e de imagem modernos.

- A conveniência da administração de pressão controlada, a ergonomia aprimorada do dispositivo e a capacidade de suportar procedimentos complexos, como angioplastia e implante de stents vasculares, são fatores-chave que impulsionam a adoção de dispositivos de insuflação em grandes centros médicos.

- A tendência de expansão dos serviços intervencionistas ambulatoriais e a crescente disponibilidade de sistemas avançados de inflação, adaptados para instalações de grande volume, contribuem ainda mais para o crescimento do mercado.

Restrição/Desafio

“Riscos relacionados a procedimentos, barreiras de custo e obstáculos à conformidade regulatória”

- Preocupações relacionadas a imprecisões associadas a dispositivos, riscos na administração de pressão e variabilidade de desempenho em certos dispositivos de insuflação manual representam desafios significativos para uma maior penetração no mercado, particularmente em procedimentos cardiovasculares de alto risco.

- Por exemplo, relatos de complicações decorrentes do controle inadequado da pressão ou mau funcionamento do dispositivo durante o enchimento do balão tornaram alguns profissionais de saúde cautelosos quanto à adoção de soluções de enchimento mais simples ou não digitais.

- Abordar essas preocupações operacionais por meio de calibração aprimorada do dispositivo, mecanismos avançados de controle de pressão e validação de qualidade mais rigorosa é crucial para aumentar a confiança dos profissionais de saúde. Empresas como a Cook Medical e a Zimmer enfatizam a engenharia de precisão e os recursos de segurança para tranquilizar os usuários quanto à confiabilidade do dispositivo.

- Além disso, o custo relativamente mais elevado dos sistemas digitais avançados de inflação, em comparação com os dispositivos manuais tradicionais, pode ser uma barreira à sua adoção por hospitais de menor porte e instalações com orçamentos limitados, especialmente em regiões com orçamentos de capital restritos.

- Embora os preços estejam se estabilizando gradualmente, o valor adicional percebido associado aos recursos digitais avançados pode dificultar a adoção em larga escala, especialmente entre os provedores que dependem de sistemas analógicos consolidados e não necessitam de atualizações digitais imediatas.

- Superar esses desafios por meio de uma padronização de produtos mais robusta, treinamento clínico e desenvolvimento de dispositivos de inflação de baixo custo e alta precisão será vital para sustentar o crescimento do mercado a longo prazo.

Escopo do mercado de dispositivos de inflação na América do Norte

O mercado é segmentado com base em tipo, capacidade, aplicação, pressão, função, usuário final e canal de distribuição.

- Por tipo

Com base no tipo, o mercado de dispositivos de insuflação na América do Norte é segmentado em dispositivos analógicos e digitais. O segmento de dispositivos analógicos dominou o mercado, com a maior participação na receita, de 65,2% em 2025, impulsionado por sua ampla familiaridade clínica, custo-benefício e confiabilidade em procedimentos de cardiologia intervencionista de rotina e vasculares periféricos. Os dispositivos analógicos são amplamente preferidos em hospitais de grande volume e laboratórios de cateterismo devido à sua operação simples, configuração rápida e histórico comprovado em procedimentos de insuflação de balão. Sua compatibilidade com uma ampla gama de sistemas de cateter e práticas de fluxo de trabalho padronizadas contribui ainda mais para sua dominância. Além disso, os dispositivos analógicos continuam sendo a principal escolha em instalações que priorizam a aquisição com controle de custos.

Prevê-se que o segmento de dispositivos digitais de insuflação apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por monitoramento de pressão em tempo real e maior precisão durante intervenções cardiovasculares e radiológicas complexas. Os dispositivos digitais de insuflação oferecem recursos avançados, como displays digitais de pressão, ergonomia aprimorada e funções de controle automatizadas que ajudam a reduzir erros de procedimento. Sua crescente adoção é sustentada pela modernização dos laboratórios de cateterismo e salas de intervenção em hospitais com sistemas digitais. O aumento dos investimentos em tecnologias minimamente invasivas e os melhores resultados clínicos associados aos dispositivos digitais também contribuem para a rápida expansão do mercado.

- Por capacidade

Com base na capacidade, o mercado é segmentado em dispositivos de insuflação de 20 ml, 25 ml, 30 ml e 60 ml. O segmento de dispositivos de insuflação de 30 ml dominou o mercado em 2025, impulsionado pelo seu equilíbrio ideal entre capacidade de volume e pressão, necessário para a maioria dos procedimentos de angioplastia e implante de stent. Hospitais e centros intervencionistas frequentemente optam por dispositivos de 30 ml devido à sua versatilidade em aplicações coronárias, periféricas e radiológicas. Seu design ergonômico e controle preciso de pressão os tornam a escolha preferida para médicos que realizam procedimentos rotineiros de insuflação de balões. A forte presença de fabricantes líderes que oferecem modelos otimizados de 30 ml impulsiona ainda mais a demanda do segmento.

O segmento de dispositivos de insuflação de 60 ml deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção em procedimentos vasculares periféricos e gastroenterológicos que exigem maior capacidade de volume. Balões maiores, utilizados em tratamentos de doença arterial periférica e em certas aplicações de radiologia intervencionista, se beneficiam da faixa de volume ampliada proporcionada pelos dispositivos de insuflação de 60 ml. A crescente demanda por intervenções complexas e a prevalência cada vez maior de doença arterial periférica na América do Norte sustentam o crescimento acelerado desse segmento. O uso crescente de dispositivos de alta capacidade em centros especializados contribui ainda mais para as perspectivas promissoras do segmento.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em cardiologia intervencionista, procedimentos vasculares periféricos, radiologia intervencionista, procedimentos urológicos, procedimentos gastroenterológicos e outros. A cardiologia intervencionista dominou o mercado em 2025, impulsionada pelo alto volume de angioplastias, dilatações com balão e implantes de stents nos EUA e Canadá. A crescente prevalência de doença arterial coronariana e a preferência cada vez maior por intervenções minimamente invasivas contribuem significativamente para o aumento da demanda por dispositivos de inflação voltados para cardiologia. Hospitais e laboratórios de cateterismo priorizam ferramentas de inflação de precisão para garantir a expansão ideal do stent e a segurança do procedimento. Além disso, os investimentos contínuos em infraestrutura de cardiologia e a rápida adoção de tecnologias avançadas de cateteres reforçam a dominância desse segmento.

A radiologia intervencionista deverá ser o segmento de aplicação com o crescimento mais rápido entre 2026 e 2033, impulsionada pela crescente adoção de procedimentos guiados por imagem para intervenções vasculares e não vasculares. Os dispositivos de insuflação desempenham um papel fundamental na angioplastia, dilatação com balão e posicionamento de dispositivos em salas de radiologia, onde a precisão e a visibilidade são cruciais. A expansão de centros de radiologia ambulatoriais e o uso mais amplo de terapias minimamente invasivas em tratamentos abdominais, renais e hepáticos contribuem para o rápido crescimento do segmento. A melhoria na integração de imagens e os avanços tecnológicos aumentam ainda mais a demanda por sistemas de insuflação de alto desempenho em ambientes de radiologia.

- Por pressão

Com base na classificação de pressão, o mercado é segmentado em 30 atm, 40 atm, 55 atm e outros. O segmento de 30 atm dominou o mercado em 2025, impulsionado por sua adequação à maioria dos procedimentos de inflação de balão coronário e periférico de rotina. O segmento se beneficia da ampla adoção clínica em instalações de pequeno e grande porte, devido à sua comprovada confiabilidade e segurança em aplicações de angioplastia padrão. Os dispositivos de 30 atm também são amplamente disponíveis, têm um bom custo-benefício e são compatíveis com os sistemas de cateter comumente utilizados. Sua capacidade de atender aos requisitos de procedimentos de intervenções de alto volume contribui significativamente para sua posição de liderança.

O segmento de 55 atm deverá apresentar o crescimento mais rápido durante o período de previsão, principalmente devido ao seu uso crescente em aplicações de alta pressão, como tratamento de lesões calcificadas, intervenções em oclusões totais crônicas (CTO) e expansões complexas de stents. À medida que os médicos se deparam com casos vasculares cada vez mais complexos, os dispositivos de inflação de alta pressão proporcionam melhor expansão do lúmen e controle do procedimento. A crescente adoção de balões especiais de alta pressão em cardiologia e radiologia intervencionistas acelera ainda mais o crescimento. A inovação contínua em materiais para balões e na segurança dos dispositivos também sustenta a crescente demanda por esse segmento de alta pressão.

- Por função

Com base na função, o mercado é segmentado em implante de stent e administração de fluidos. O implante de stent dominou o mercado em 2025, impulsionado pelo papel fundamental que os dispositivos de inflação desempenham na expansão precisa e controlada de stents coronários e periféricos. O alto volume de procedimentos de angioplastia e implante de stent nos EUA impulsiona significativamente a demanda por ferramentas de inflação projetadas para a administração precisa de pressão. A necessidade de confiabilidade em intervenções cardiovasculares críticas garante que o implante de stent continue sendo a principal função dos dispositivos de inflação. A crescente prevalência de doenças cardiovasculares sustenta ainda mais a dominância do segmento.

A administração de fluidos deverá ser a função de crescimento mais rápido entre 2026 e 2033, impulsionada pelo uso crescente de dispositivos de insuflação em procedimentos não vasculares e diagnósticos que exigem administração precisa de fluidos. À medida que os médicos adotam abordagens minimamente invasivas em diversas especialidades, como urologia e gastroenterologia, a demanda por sistemas de administração controlada de fluidos aumenta. Os avanços tecnológicos que permitem um manuseio de fluidos mais suave e eficiente contribuem ainda mais para o rápido crescimento do segmento. A expansão dos casos de uso em pacientes ambulatoriais também fortalece a trajetória desse segmento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, laboratórios de intervenção e clínicas. Os hospitais dominaram o mercado em 2025, impulsionados pelo alto volume de intervenções coronárias e periféricas realizadas em laboratórios de cateterismo e centros cirúrgicos hospitalares. Sua forte capacidade de aquisição e a disponibilidade de infraestrutura intervencionista avançada sustentam a ampla adoção de dispositivos de insuflação analógicos e digitais. Os hospitais também representam a maioria dos casos complexos que exigem controle de pressão avançado e compatibilidade com dispositivos especializados. Investimentos contínuos em unidades cardiovasculares e de radiologia reforçam a liderança desse segmento.

Prevê-se que os laboratórios de intervenção apresentem o crescimento mais rápido entre 2026 e 2033, impulsionados pelo crescente estabelecimento de laboratórios de cateterismo especializados e centros de intervenção independentes em toda a América do Norte. Essas instalações priorizam ferramentas avançadas de insuflação para dar suporte a procedimentos de alta precisão e gerenciamento eficiente do fluxo de trabalho. A crescente demanda por angioplastia ambulatorial e intervenções vasculares realizadas em consultório também contribui para a rápida expansão do segmento. As atualizações tecnológicas e a transição para sistemas de intervenção digitais aceleram ainda mais a adoção nesse segmento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta, vendas no varejo e distribuidores terceirizados. O segmento de licitação direta dominou o mercado em 2025, impulsionado por compras em grande volume por hospitais, sistemas de saúde integrados e instalações governamentais. A aquisição direta garante o fornecimento consistente de dispositivos, preços competitivos e acesso a sistemas avançados de inflação para centros de alto volume. Relações sólidas entre fabricantes e instituições de saúde reforçam ainda mais a dominância desse segmento na América do Norte.

Espera-se que o segmento de vendas no varejo apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de dispositivos de insuflação por clínicas, centros ambulatoriais e instalações intervencionistas de menor porte que dependem de opções de compra flexíveis. A distribuição no varejo também se beneficia da crescente disponibilidade de dispositivos de insuflação avançados por meio de fornecedores médicos especializados e plataformas profissionais online. A crescente demanda de profissionais autônomos e instalações ambulatoriais contribui significativamente para o rápido crescimento desse segmento.

Análise Regional do Mercado de Dispositivos de Inflação na América do Norte

- Os EUA dominaram o mercado de dispositivos de insuflação na América do Norte, com a maior participação na receita, de 84,7% em 2025, impulsionados por uma infraestrutura de saúde avançada, altos volumes de procedimentos intervencionistas e a presença de grandes fabricantes de dispositivos médicos. O país experimentou um crescimento substancial no uso de dispositivos de insuflação, particularmente em laboratórios de cateterismo e centros cardíacos de alto fluxo, impulsionado pela inovação contínua de produtos e aprimoramentos no design ergonômico.

- Hospitais e centros cirúrgicos da região priorizam resultados clínicos de alto padrão, impulsionando uma demanda constante por dispositivos de insuflação avançados com maior precisão, design ergonômico e recursos de monitoramento digital.

- A adoção é ainda mais impulsionada pela indústria de dispositivos médicos bem estabelecida na região, pelos altos gastos com saúde e pela rápida integração de procedimentos minimamente invasivos em aplicações cardiovasculares, gastroenterológicas e urológicas.

Análise do Mercado de Dispositivos de Inflação nos EUA

O mercado de dispositivos de insuflação nos EUA detinha a maior participação de receita, com 84,7% em 2025, na América do Norte, impulsionado pelo alto volume de procedimentos de cardiologia intervencionista e vasculares periféricos. Hospitais e laboratórios de cateterismo estão priorizando cada vez mais dispositivos de insuflação com controle de precisão para aumentar a segurança dos procedimentos e os resultados clínicos. A crescente preferência por sistemas de insuflação digitais com monitoramento de pressão em tempo real e designs ergonômicos impulsiona ainda mais o crescimento do mercado. Além disso, a adoção de procedimentos minimamente invasivos e a integração com tecnologias avançadas de cateteres contribuem significativamente para a expansão do mercado. Uma infraestrutura de saúde robusta e o alto volume de procedimentos também sustentam a demanda contínua por dispositivos analógicos e digitais.

Análise do Mercado de Dispositivos de Inflação no Canadá

O mercado canadense de dispositivos de insuflação deverá expandir a uma taxa de crescimento anual composta (CAGR) substancial durante o período de previsão, impulsionado principalmente pelo aumento dos investimentos em programas de cardiologia intervencionista e pela modernização de laboratórios de cateterismo. A crescente conscientização sobre a saúde cardiovascular, combinada com o aumento do volume de procedimentos, está fomentando a adoção de dispositivos de insuflação avançados. Os profissionais de saúde canadenses são atraídos por dispositivos que oferecem maior precisão, confiabilidade e integração com sistemas de imagem. A região está experimentando um crescimento notável em hospitais, laboratórios de intervenção e centros especializados, com a incorporação de dispositivos analógicos e digitais em instalações novas e modernizadas.

Análise do Mercado de Dispositivos de Inflação no México

Prevê-se que o mercado de dispositivos de insuflação no México cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pela crescente demanda por procedimentos minimamente invasivos e pela crescente incidência de doenças cardiovasculares. Hospitais e clínicas privadas estão adotando dispositivos de insuflação para aumentar a segurança do paciente e a eficiência dos procedimentos. Além disso, espera-se que os crescentes investimentos em infraestrutura de saúde e a expansão de centros de cardiologia intervencionista continuem a estimular o crescimento do mercado. A adoção de dispositivos fáceis de usar, adequados tanto para fluxos de trabalho analógicos quanto digitais, também contribui para o aumento da demanda.

Participação de mercado de dispositivos de inflação na América do Norte

O setor de dispositivos de inflação na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Merit Medical Systems, Inc. (EUA)

- Boston Scientific Corporation (EUA)

- B. Braun SE (EUA)

- Corporação CONMED (EUA)

- Teleflex Incorporated (EUA)

- US Endovascular, LLC (EUA)

- Atrion Corporation (EUA)

- BD (EUA)

- Cook (EUA)

- Argon Medical Devices, Inc. (EUA)

- TZ Medical, Inc. (EUA)

- Cardinal Health (EUA)

- Corporação Olympus (Japão)

- Corporação Terumo (Japão)

- Medtronic (Irlanda)

- Acclarent, Inc. (EUA)

- Johnson & Johnson Services, Inc. (EUA)

- Abade (EUA)

- AngioDynamics, Inc. (EUA)

- Vygon SAS (França)

Quais são os desenvolvimentos recentes no mercado de dispositivos de inflação na América do Norte?

- Em janeiro de 2025, a Olympus Latin America adquiriu o negócio de distribuição da Sur Medical SpA no Chile, estabelecendo a Olympus Corporation Chile. Essa aquisição permite o acesso direto ao crescente mercado de saúde do Chile, otimizando a distribuição dos produtos da Olympus e aprimorando o atendimento e o suporte ao cliente na região.

- Em novembro de 2024, a Merit Medical Systems concluiu a aquisição do portfólio de gerenciamento de eletrodos da Cook Medical por aproximadamente US$ 210 milhões. Essa aquisição fortalece os negócios da Merit em eletrofisiologia e gerenciamento do ritmo cardíaco, adicionando uma gama completa de dispositivos utilizados em procedimentos de remoção e substituição de eletrodos para marca-passos e cardioversores-desfibriladores implantáveis.

- Em maio de 2024, a Merit Medical Systems anunciou o lançamento comercial nos EUA do dispositivo de insuflação basixSKY. Este dispositivo analógico foi projetado para intervenções endovasculares, como angioplastia com balão e implante de stent. Possui uma alça com pegada confortável para preparação com uma só mão e minimiza o torque rotacional e as rotações da alça necessárias para atingir a pressão. O dispositivo está disponível como solução independente e em kits com os Pacotes de Angioplastia Merit, configurados para oferecer válvulas de hemostasia complementares AccessPLUS, Honor e PhD.

- Em abril de 2024, a Integra LifeSciences Corporation concluiu a aquisição da Acclarent, Inc., empresa especializada em soluções para otorrinolaringologia (ouvido, nariz e garganta). Essa aquisição fortalece o portfólio da Integra no mercado de otorrinolaringologia, expandindo suas capacidades em tecnologias médicas inovadoras para tratamentos de seios da face, ouvido e nariz, impulsionando ainda mais o crescimento no setor de saúde.

- Em janeiro de 2022, a Medtronic adquiriu a Affera, uma empresa de tecnologia cardíaca especializada em sistemas de mapeamento, navegação e ablação para o tratamento de arritmias como a fibrilação atrial. A aquisição marca a entrada da Medtronic no segmento de mapeamento cardíaco, expandindo seu portfólio de ablação cardíaca.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.