North America Inflation Device Market

Market Size in USD Million

CAGR :

%

USD

353.62 Million

USD

524.79 Million

2025

2033

USD

353.62 Million

USD

524.79 Million

2025

2033

| 2026 –2033 | |

| USD 353.62 Million | |

| USD 524.79 Million | |

|

|

|

|

North America Inflation Device Market Size

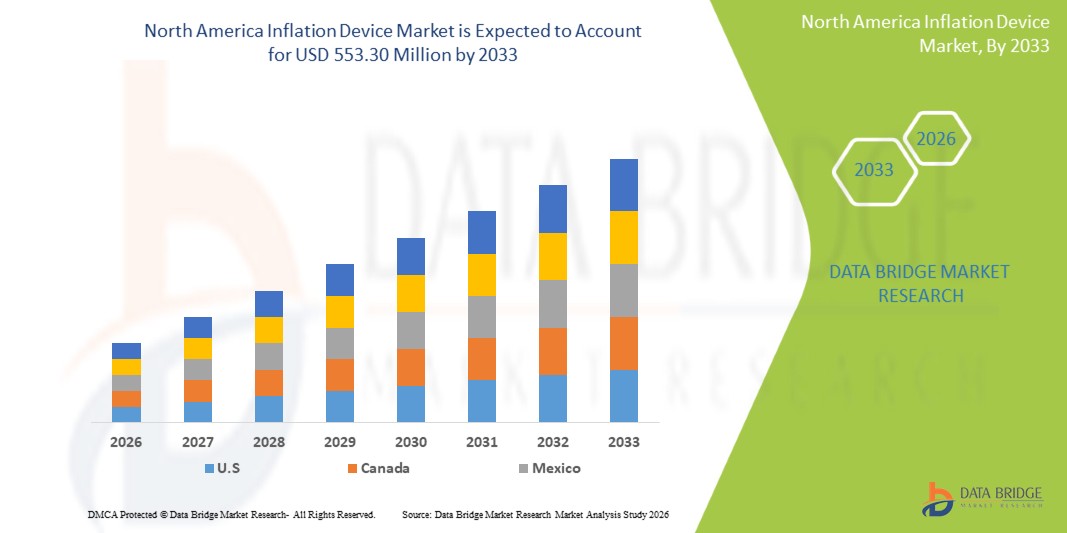

- The North America inflation device market size was valued at USD 371.65 million in 2025 and is expected to reach USD 553.30 million by 2033, at a CAGR of 5.10% during the forecast period

- The market expansion is driven primarily by the increasing volume of interventional cardiology and radiology procedures, where inflation devices are essential for precise balloon catheter pressure control across hospitals and ambulatory surgical centers

- In addition, the region benefits from advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and continuous technological upgrades in medical devices, accelerating product demand

North America Inflation Device Market Analysis

- Inflation devices, used to provide controlled pressure for balloon catheters during interventional cardiology, radiology, and vascular procedures, are becoming increasingly vital components of modern minimally invasive surgical systems in both hospital and ambulatory settings due to their precision, ease of use, and essential role in catheter-based treatments

- The escalating demand for inflation devices is primarily driven by the rising prevalence of cardiovascular and peripheral arterial diseases, the expanding adoption of minimally invasive procedures, and a growing preference among clinicians for accurate, reliable, and sterile pressure-delivery instruments

- The U.S. dominated the North America inflation device market with the largest revenue share of 84.7% in 2025, supported by advanced healthcare infrastructure, high interventional procedure volumes, and the presence of major medical device manufacturers, with the country experiencing substantial growth in inflation device usage, particularly in catheterization labs and high-throughput cardiac centers driven by continuous product innovation and ergonomic design enhancements

- Canada is expected to be the fastest growing country in the North America inflation device market during the forecast period due to increasing investments in interventional cardiology units, expansion of minimally invasive surgical capabilities, and a rising demand for disposable inflation devices that improve procedural efficiency and patient safety

- The analog inflation device segment dominated the North America inflation device market with a market share of 65.2% in 2025, driven by its cost-effectiveness, proven clinical reliability, and widespread compatibility with existing catheter systems

Report Scope and North America Inflation Device Market Segmentation

|

Attributes |

North America Inflation Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Inflation Device Market Trends

“Advancements in Precision, Automation, and Digital Integration”

- A significant and accelerating trend in the North America inflation device market is the growing shift toward digitally enhanced and automated inflation systems that improve pressure accuracy, reduce manual operation errors, and support advanced interventional cardiology workflows across hospitals and catheterization labs

- For instance, several leading manufacturers are introducing inflation devices with integrated digital pressure gauges and ergonomic designs, enabling clinicians to monitor real-time pressure with greater precision and reduced operational strain during angioplasty or stent deployment procedures

- Digital integration in inflation devices enables features such as automated deflation sequences, improved pressure stabilization, and enhanced user alerts for abnormal readings. For instance, newly launched models from Merit Medical incorporate digital displays that support better visualization, workflow efficiency, and procedural consistency during critical interventions

- The seamless integration of inflation devices with broader interventional imaging platforms and cath lab monitoring systems facilitates centralized control, allowing clinicians to coordinate device operation with imaging outputs and procedural data for a streamlined treatment experience

- This trend toward more intelligent, automated, and digitally supported inflation solutions is fundamentally reshaping expectations for catheter-based procedures. Consequently, companies such as Teleflex and Boston Scientific are developing inflation systems with advanced pressure-assist features and enhanced usability tailored for complex interventional applications

- The demand for inflation devices offering precise pressure delivery, ergonomic handling, and digital workflow compatibility is growing rapidly across interventional cardiology and radiology units, as healthcare providers increasingly prioritize efficiency, accuracy, and improved clinical outcomes

North America Inflation Device Market Dynamics

Driver

“Growing Need Due to Rising Cardiovascular Burden and Preference for Minimally Invasive Procedures”

- The increasing prevalence of cardiovascular and peripheral arterial diseases across the U.S. and Canada, combined with the accelerating adoption of minimally invasive interventional procedures, is a significant driver for the heightened demand for inflation devices

- For instance, in 2025, several healthcare facilities expanded their interventional cardiology programs with upgraded cath lab technologies and improved catheter-based treatment capabilities, supporting higher utilization of inflation devices across diagnostic and therapeutic procedures

- As clinicians prioritize precision and safety in critical interventions, inflation devices offer accurate pressure control, real-time monitoring, and improved procedural reliability, providing a compelling advancement over basic manual solutions

- Furthermore, the growing popularity of catheter-based treatments and the rising preference for shorter recovery times are making inflation devices an essential component of interventional systems, facilitating seamless integration with modern surgical and imaging equipment

- The convenience of controlled pressure delivery, enhanced device ergonomics, and the ability to support complex procedures such as angioplasty and vascular stenting are key factors propelling the adoption of inflation devices across major medical centers

- The trend toward expanding outpatient interventional services and the increasing availability of advanced inflation systems tailored for high-volume facilities further contribute to market growth

Restraint/Challenge

“Procedure-Related Risks, Cost Barriers, and Regulatory Compliance Hurdles”

- Concerns surrounding device-associated inaccuracies, pressure-delivery risks, and performance variability in certain manual inflation devices pose significant challenges to broader market penetration, particularly in high-risk cardiovascular procedures

- For instance, reports regarding complications arising from pressure mismanagement or device malfunction during balloon inflation have made some healthcare providers cautious about adopting lower-end or non-digital inflation solutions

- Addressing these operational concerns through enhanced device calibration, advanced pressure-control mechanisms, and stronger quality validation is crucial for building clinician confidence. Companies such as Cook Medical and Zimmer emphasize precision engineering and safety features to reassure users about device reliability

- In addition, the relatively higher cost of advanced digital inflation systems compared to traditional manual devices can be a barrier to adoption for smaller hospitals and budget-constrained facilities, particularly in regions with limited capital budgets

- While prices are gradually stabilizing, the perceived premium associated with advanced digital features can hinder widespread adoption, especially among providers who rely on established analog systems and do not immediately require digital upgrades

- Overcoming these challenges through stronger product standardization, clinician training, and the development of cost-efficient yet high-precision inflation devices will be vital for sustaining long-term market growth

North America Inflation Device Market Scope

The market is segmented on the basis of type, capacity, application, pressure, function, end user, and distribution channel.

- By Type

On the basis of type, the North America inflation device market is segmented into analog inflation devices and digital inflation devices. The analog inflation device segment dominated the market with the largest revenue share 65.2% in 2025, driven by its widespread clinical familiarity, cost-effectiveness, and reliability in routine interventional cardiology and peripheral vascular procedures. Analog devices are widely preferred across high-volume hospitals and cath labs due to their simple operation, quick setup, and strong track record in balloon inflation procedures. Their compatibility with a wide range of catheter systems and standardized workflow practices further contributes to their dominance. In addition, analog devices remain the leading choice in facilities prioritizing cost-controlled procurement.

The digital inflation device segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for real-time pressure monitoring and enhanced precision during complex cardiovascular and radiology interventions. Digital inflation devices offer advanced features such as digital pressure displays, improved ergonomics, and automated control functions that help reduce procedural errors. Their growing adoption is supported by hospitals upgrading their cath labs and interventional suites to digital systems. Increasing investments in minimally invasive technologies and enhanced clinical outcomes associated with digital devices also contribute to their rapid market expansion.

- By Capacity

On the basis of capacity, the market is segmented into 20 ml, 25 ml, 30 ml, and 60 ml inflation devices. The 30 ml inflation device segment dominated the market in 2025, driven by its ideal balance of volume capacity and pressure delivery needed for the majority of angioplasty and stent deployment procedures. Hospitals and interventional centers frequently choose 30 ml devices due to their versatility across coronary, peripheral, and radiology applications. Their ergonomic design and precise pressure control make them the preferred choice for clinicians performing routine balloon inflation procedures. The strong presence of leading manufacturers offering optimized 30 ml models further boosts segment demand.

The 60 ml inflation device segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising adoption in peripheral vascular and gastroenterological procedures requiring higher volume capacity. Larger balloons used in PAD treatments and certain interventional radiology applications benefit from the extended volume range provided by 60 ml inflation devices. Increasing demand for complex interventions and the growing prevalence of peripheral artery disease in North America support this segment’s accelerated growth. The expanding use of high-capacity devices in specialized centers contributes further to the segment’s strong outlook.

- By Application

On the basis of application, the market is segmented into interventional cardiology, peripheral vascular procedures, interventional radiology, urological procedures, gastroenterological procedures, and others. Interventional cardiology dominated the market in 2025, driven by the high volume of angioplasty, balloon dilation, and stent deployment procedures across the U.S. and Canada. The rising prevalence of coronary artery disease and the growing preference for minimally invasive interventions significantly contribute to inflated demand for cardiology-focused inflation devices. Hospitals and cath labs prioritize precision inflation tools to ensure optimal stent expansion and procedural safety. In addition, continued investments in cardiology infrastructure and rapid adoption of advanced catheter technologies reinforce this segment's dominance.

Interventional radiology is expected to be the fastest growing application segment from 2026 to 2033, fueled by increasing adoption of image-guided procedures for both vascular and non-vascular interventions. Inflation devices play a key role in angioplasty, balloon dilation, and device placement in radiology suites, where precision and visibility are critical. The expansion of outpatient radiology centers and broader use of minimally invasive therapies across abdominal, renal, and hepatic treatments contribute to rapid segment growth. Improved imaging integration and technology advancements further increase demand for high-performance inflation systems in radiology settings.

- By Pressure

On the basis of pressure rating, the market is segmented into 30 atm, 40 atm, 55 atm, and others. The 30 atm segment dominated the market in 2025, driven by its suitability for most routine coronary and peripheral balloon inflation procedures. The segment benefits from broad clinical adoption across both small- and large-scale facilities due to its proven reliability and safety in standard angioplasty applications. 30 atm devices are also widely available, cost-effective, and compatible with commonly used catheter systems. Their ability to meet the procedural requirements of high-volume interventions contributes significantly to their leadership position.

The 55 atm segment is expected to witness the fastest growth during the forecast period, primarily due to its increased use in high-pressure applications such as calcified lesion treatment, CTO interventions, and complex stent expansions. As clinicians increasingly encounter complex vascular cases, higher-pressure inflation devices provide improved lumen expansion and procedural control. The growing adoption of specialty high-pressure balloons in interventional cardiology and radiology further accelerates growth. Continued innovation in balloon materials and device safety also supports rising demand for this high-pressure segment.

- By Function

On the basis of function, the market is segmented into stent deployment and fluid delivery. Stent deployment dominated the market in 2025, driven by the central role inflation devices play in delivering precise and controlled expansion of coronary and peripheral stents. High procedure volumes in the U.S. for angioplasty and stenting significantly boost demand for inflation tools designed for accurate pressure delivery. The need for reliability in critical cardiovascular interventions ensures that stent deployment continues to be the leading function for inflation devices. The rising prevalence of cardiovascular diseases further sustains segment dominance.

Fluid delivery is expected to be the fastest growing function from 2026 to 2033, supported by the increasing use of inflation devices in non-vascular and diagnostic procedures requiring precise fluid administration. As clinicians adopt minimally invasive approaches across diverse specialties such as urology and gastroenterology, demand for controlled fluid delivery systems increases. Technological improvements enabling smoother and more efficient fluid handling further contribute to rapid segment growth. Expanding outpatient and ambulatory use cases also strengthen this segment's trajectory.

- By End User

On the basis of end user, the market is segmented into hospitals, interventional laboratories, and clinics. Hospitals dominated the market in 2025, driven by the high volume of coronary and peripheral interventions performed in hospital cath labs and surgical centers. Their strong procurement capacity and availability of advanced interventional infrastructure support widespread adoption of both analog and digital inflation devices. Hospitals also account for the majority of complex cases requiring advanced pressure control and specialized device compatibility. Continuous investments in cardiovascular and radiology units reinforce this segment’s leadership.

Interventional laboratories are expected to witness the fastest growth from 2026 to 2033, fueled by the increasing establishment of specialized cath labs and standalone interventional centers across North America. These facilities prioritize advanced inflation tools to support high-precision procedures and efficient workflow management. Growing demand for outpatient angioplasty and office-based vascular interventions also contributes to rapid segment expansion. Technological upgrades and the shift toward digital interventional systems further accelerate adoption in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and third-party distributors. The direct tender segment dominated the market in 2025, driven by large-volume purchasing by hospitals, integrated health systems, and government-affiliated facilities. Direct procurement ensures consistent device supply, competitive pricing, and access to advanced inflation systems for high-volume centers. Strong relationships between manufacturers and healthcare institutions further support this segment's dominance in North America.

The retail sales segment is expected to witness the fastest growth during 2026 to 2033, supported by the increasing adoption of inflation devices by clinics, ambulatory centers, and smaller interventional facilities that rely on flexible purchasing options. Retail distribution also benefits from the growing availability of advanced inflation devices through specialized medical suppliers and online professional platforms. Rising demand from independent practitioners and outpatient facilities contributes significantly to this segment’s rapid growth.

North America Inflation Device Market Regional Analysis

- The U.S. dominated the North America inflation device market with the largest revenue share of 84.7% in 2025, supported by advanced healthcare infrastructure, high interventional procedure volumes, and the presence of major medical device manufacturers, with the country experiencing substantial growth in inflation device usage, particularly in catheterization labs and high-throughput cardiac centers driven by continuous product innovation and ergonomic design enhancements

- Hospitals and surgical centers in the region emphasize high-standard clinical outcomes, driving consistent demand for advanced inflation devices with enhanced accuracy, ergonomic design, and digital monitoring capabilities

- Adoption is further fueled by the region’s well-established medical device industry, high healthcare spending, and rapid integration of minimally invasive procedures across cardiovascular, gastroenterology, and urology applications

U.S. Inflation Device Market Insight

The U.S. inflation device market captured the largest revenue share of 84.7% in 2025 within North America, fueled by the high volume of interventional cardiology and peripheral vascular procedures. Hospitals and catheterization labs are increasingly prioritizing precision-controlled inflation devices to enhance procedural safety and clinical outcomes. The growing preference for digital inflation systems with real-time pressure monitoring and ergonomic designs further propels market growth. Moreover, the adoption of minimally invasive procedures and integration with advanced catheter technologies is significantly contributing to the market’s expansion. Strong healthcare infrastructure and high procedural volumes also support continuous demand for both analog and digital devices.

Canada Inflation Device Market Insight

The Canada inflation device market is expected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing investments in interventional cardiology programs and modernization of cath labs. Increasing awareness of cardiovascular health, combined with rising procedural volumes, is fostering the adoption of advanced inflation devices. Canadian healthcare providers are drawn to devices offering improved precision, reliability, and integration with imaging systems. The region is experiencing notable growth across hospitals, interventional laboratories, and specialty centers, with both analog and digital devices being incorporated into new and upgraded facilities.

Mexico Inflation Device Market Insight

The Mexico inflation device market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for minimally invasive procedures and rising incidence of cardiovascular diseases. Hospitals and private clinics are adopting inflation devices to enhance patient safety and procedural efficiency. In addition, growing investments in healthcare infrastructure and expansion of interventional cardiology centers are expected to continue to stimulate market growth. The adoption of user-friendly devices suitable for both analog and digital workflows is also contributing to rising demand.

North America Inflation Device Market Share

The North America Inflation Device industry is primarily led by well-established companies, including:

- Merit Medical Systems, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- B. Braun SE (U.S.)

- CONMED Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- US Endovascular, LLC (U.S.)

- Atrion Corporation (U.S.)

- BD (U.S.)

- Cook (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- TZ Medical, Inc. (U.S.)

- Cardinal Health (U.S.)

- Olympus Corporation (Japan)

- Terumo Corporation (Japan)

- Medtronic (Ireland)

- Acclarent, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Abbot (U.S.)

- AngioDynamics, Inc. (U.S.)

- Vygon SAS (France)

What are the Recent Developments in North America Inflation Device Market?

- In January 2025, Olympus Latin America acquired Sur Medical SpA’s distribution business in Chile, establishing Olympus Corporation Chile. This acquisition enables direct access to Chile’s growing healthcare market, streamlining the distribution of Olympus products and enhancing customer service and support in the region

- In November 2024, Merit Medical Systems completed the acquisition of Cook Medical’s lead management portfolio for approximately USD 210 million. This acquisition enhances Merit’s electrophysiology and cardiac rhythm management business by adding a comprehensive range of devices used in lead removal and replacement procedures for pacemakers and implantable cardioverter-defibrillator

- In May 2024, Merit Medical Systems announced the U.S. commercial release of the basixSKY Inflation Device. This analog device is designed for endovascular interventions such as balloon angioplasty and stent placement. It features a comfort-grip handle for one-handed preparation and minimizes rotational torque and handle revolutions to reach pressure. The device is available as a standalone solution and in kits with Merit Angioplasty Packs, configured to offer complementing AccessPLUS, Honor, and PhD hemostasis valves

- In April 2024, Integra LifeSciences Corporation has completed the acquisition of Acclarent, Inc., a company specializing in ENT (ear, nose, and throat) solutions. This acquisition enhances Integra's portfolio in the ENT market, expanding its capabilities in innovative medical technologies for sinus, ear, and nasal treatments, driving further growth in the healthcare sector

- In January 2022, Medtronic acquired Affera, a cardiac technology company specializing in mapping, navigation, and ablation systems for treating arrhythmias such as atrial fibrillation. The acquisition marks Medtronic's entry into the cardiac mapping segment, expanding its cardiac ablation portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.