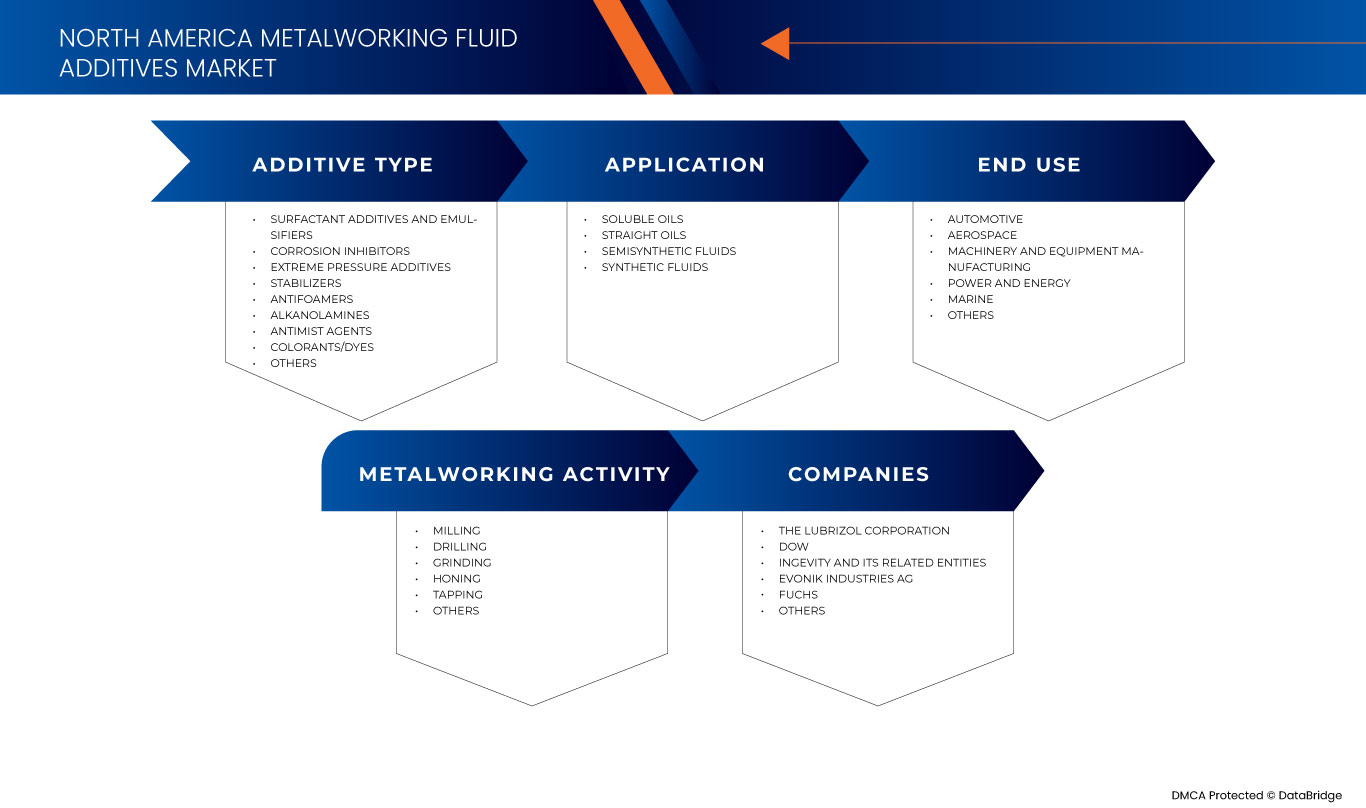

North America Metalworking Fluid Additives Market, By Additive Type (Surfactant Additives and Emulsifiers, Corrosion Inhibitors, Extreme Pressure Additives, Stabilizers, Antifoamers, Alkanolamines, Antimist Agents, Colorants/Dyes, and Others), Application (Soluble Oils, Straight Oils, Semisynthetic Fluids, and Synthetic Fluids), Metalworking Activity (Milling, Drilling, Grinding, Honing, Tapping, and Others), End Use (Automotive, Aerospace, Machinery and Equipment Manufacturing, Power and Energy, Marine, and Others) - Industry Trends and Forecast to 2030.

North America Metalworking Fluid Additives Market Analysis and Insights

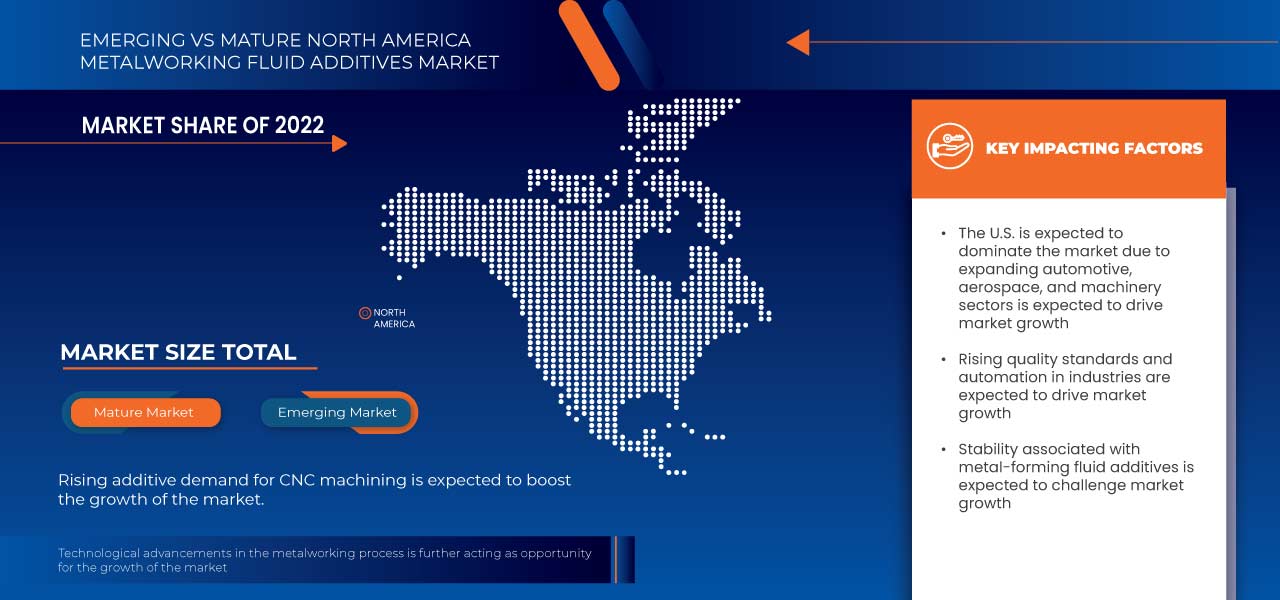

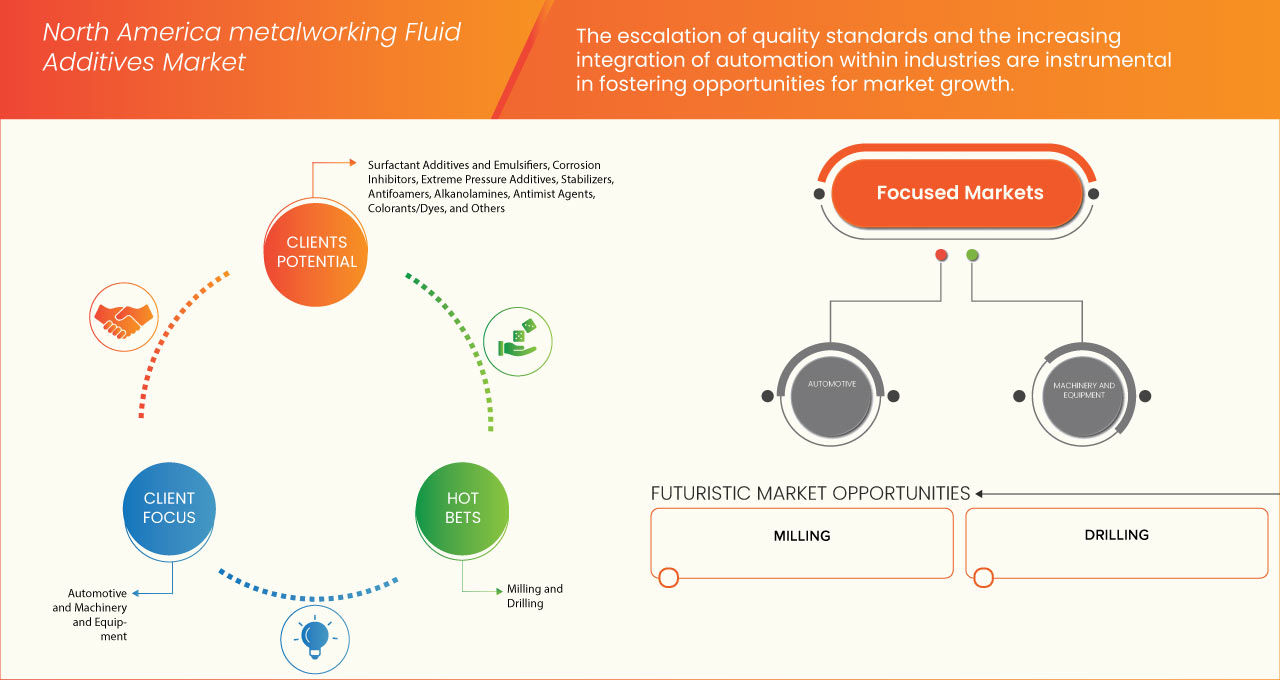

The expanding automotive, aerospace, and machinery sectors is the key factor fueling the market expansion. The escalation of quality standards and the increasing integration of automation within industries are instrumental in fostering opportunities for market growth.

The increasing adoption of dry machining across industries is a notable restraint affecting the market. Furthermore, fluctuations in raw material prices and availability represent a substantial challenge to market growth. The shift towards eco-friendly additives appears to be a rising opportunity that has the potential to lead to market growth.

The North America metalworking fluid additives market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

The North America metalworking fluid additives market is expected to drive market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing at a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 1,664,813.35 thousand by 2030. The rising additive demand for CNC machining is the driving factors expected to propel the market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Additive Type (Surfactant Additives and Emulsifiers, Corrosion Inhibitors, Extreme Pressure Additives, Stabilizers, Antifoamers, Alkanolamines, Antimist Agents, Colorants/Dyes, and Others), Application (Soluble Oils, Straight Oils, Semisynthetic Fluids, and Synthetic Fluids), Metalworking Activity (Milling, Drilling, Grinding, Honing, Tapping, and Others), End Use (Automotive, Aerospace, Machinery and Equipment Manufacturing, Power and Energy, Marine, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

The Lubrizol Corporation(U.S.), Dow(U.S.), Evonik Industries AG Ingevity and its related entities (U.S.), Ashland (U.S.), Italmatch Chemicals S.p.), Colonial Chemical (U.S.), Biosynthetic Technologies (U.S.), DOVER CHEMICAL CORPORATION (U.S.), Emery Oleochemicals (U.S.), Pilot Chemical Corp. (U.S.), and R.T. Vanderbilt Holding Company, Inc. (U.S.) among others |

North America Metalworking Fluid Additives Market Dynamics

Drivers

- Expanding Automotive, Aerospace, and Machinery Sectors

The demand for metalworking fluid additives is being driven by the rapid growth and expansion of important industry sectors, including the automotive, aerospace, and machines. These industries represent modern manufacturing by continually pushing the boundaries of innovation and technical development.

The automobile sector, a pillar of economies worldwide, is constantly looking for ways to increase vehicle performance, safety, and efficiency. To produce precision components, this activity requires complex machining procedures. Metalworking fluid additives play a crucial role in guaranteeing smooth operations and enabling the production of high-quality automotive parts by offering lubrication, cooling, and chip removal.

- Rising Quality Standards and Automation In Industries

The escalation of quality standards and the increasing integration of automation within industries are instrumental in fostering opportunities for market growth. These two factors, in tandem, have initiated a paradigm shift in manufacturing practices and are reshaping the demand dynamics for metalworking fluid additives. Elevated quality standards have become paramount in modern manufacturing processes.

Industries are pressured to maintain precision, consistency, and adherence to stringent specifications to ensure product integrity and performance. Metalworking fluid additives play a pivotal role in achieving these goals. Additives that enhance lubrication, cooling, and anti-corrosion properties have become imperative for optimizing machining processes, improving tool longevity, and achieving superior product finishes. The demand for advanced metalworking fluid additives is set to rise as industries across sectors strive to meet or exceed these quality benchmarks, boosting market growth.

Opportunities

- Technological Advancements in the Metalworking Process

Advancements in technology have emerged as a pivotal driver for the market's growth. These technological developments have significantly influenced the formulation, application, and performance of metalworking fluid additives, creating a host of opportunities for market expansion.

One key area of technological advancement is the refinement of additive formulations. Manufacturers are leveraging cutting-edge research and innovation to develop additives that offer superior lubrication, corrosion protection, and cooling properties. Such precision-engineered additives enhance machining processes, improve tool life, and contribute to higher-quality finished products. This level of performance optimization creates a compelling value proposition for end-users, driving the demand for metalworking fluid additives. In addition, the advancements in nanotechnology have opened new avenues for enhancing the efficiency of metalworking fluid additives. Nanoparticles can impart enhanced lubrication, heat transfer, and anti-wear characteristics to metalworking fluids due to their unique properties.

- Shift toward Eco-Friendly Additives

The market is undergoing a transformative shift driven by the increasing emphasis on environmental sustainability. As industries strive to reduce their ecological footprint, adopting eco-friendly additives within metalworking processes has become a pivotal driver for the market's growth.

The traditional metalworking fluid additives landscape has long been dominated by formulations containing petroleum-based compounds and additives with potential health and environmental risks. However, the escalating awareness of these hazards, stringent regulations, and growing consumer demands for sustainable products have ushered in a paradigm shift towards more environmentally responsible alternatives.

Restraints/ Challenges

- Industries Shifting to Traditional Dry Machining

The increasing adoption of dry machining across industries is a notable restraint affecting the market. Dry machining, a technique where little to no coolant or lubricant is used during the machining process, has gained traction due to its potential for reduced costs, environmental benefits, and improved workplace conditions. This transition is not challenging, and its impact reverberates through the market.

One of the primary factors driving the shift to dry machining is the potential cost savings. Traditional metalworking fluids, along with the associated additives, require procurement, maintenance, and disposal efforts. Dry machining eliminates these costs, making it an attractive option for cost-conscious industries. In addition, dry machining reduces waste generation, streamlining waste disposal and contributing to a leaner manufacturing process.

- Fluctuation in Raw Material Prices

This factor, intricately linked to economic, geopolitical, and supply chain dynamics, directly impacts the production costs, pricing, and overall stability of the market. Metalworking fluid additives are formulated using key raw materials, including base oils, additive packages encompassing extreme pressure agents, anti-wear compounds, anti-foam agents, corrosion inhibitors, and specialty chemicals such as emulsifiers, biocides, and solvents.

These components collectively enhance the lubrication, cooling, corrosion resistance, and overall performance of metalworking fluids, crucially impacting machining processes. The formulation's composition is adapted to specific applications and machining requirements, making it a versatile solution for a range of metalworking operations. From this, we can infer that the raw materials, such as base oils, additives, and specialty chemicals, constitute a significant portion of the cost structure for metalworking fluid additives. The market's susceptibility to price fluctuations of these raw materials is a result of factors such as geopolitical tensions, shifts in supply-demand dynamics, and disruptions in North America trade routes. Rapid changes in prices can lead to unpredictable cost escalations for manufacturers, exerting pressure on profit margins. Such volatility not only increases operational uncertainties but also hinders the ability to offer competitive pricing to end-users.

- Environmental Regulations and Sustainability Factors Involved

Environmental regulations and sustainability factors have emerged as significant challenges impacting the growth trajectory of the market. These factors stem from an increasing North America focus on reducing the environmental footprint of industrial processes and aligning with sustainable practices.Environmental regulations and sustainability factors present intricate challenges for the market. The evolving regulatory landscape, the need to align with sustainability goals, the demand for eco-friendly packaging, and the emergence of circular economy concepts collectively challenge manufacturers regarding compliance, formulation, cost, and innovation. Successfully navigating these challenges will require strategic adaptation and a focus on environmentally responsible solutions, which are expected to challenge market growth.

Recent Developments

- In August 2023, Boecore selected Colorado Springs for expansion, driven by cybersecurity expertise. Growth incentives and the aerospace ecosystem reinforce Colorado's appeal amid considerations of Huntsville, Alabama, and Weber County, Utah

- In July 2023, Godrej Aerospace played a crucial role in India's space missions, supplying components for Chandrayaan-3. The company's expertise showcases its commitment to aerospace advancement and innovation, supporting both space exploration and commercial aviation industries

- In June 2023, According to BBC, OPEC controls almost 40% of the world’s supply of oil reserves. In addition to the former cutting down of production in April 2003 Saudi Arabia and other OPEC+ oil producers announced further oil output cuts of around 1.16 million barrels per day. OPEC can impact the North America oil supply and, consequently, influence oil and gas prices all around the world, which will ultimately affect the cost of the products which utilize crude oil as their raw material

- In July 2023, according to an article published by LNG, The European Chemicals Agency proposes a seven-year transition period for medium-chain chlorinated paraffin and other substances containing chloroalkanes with C14 to C17 range carbon chain lengths. The restriction aims to assess potential risks to human health or the environment from the manufacture, use, or trade of these substances. Medium-chain chlorinated paraffin is used in metalworking fluids as an extreme-pressure agent for difficult operations, protecting tools and components from friction, wear, and overheating at high speeds and pressures

North America Metalworking Fluid Additives Market Scope

North America metalworking fluid additives market is segmented into four notable segments on the basis of additive type, application, metalworking activity, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Additive Type

- Surfactant Additives and Emulsifiers

- Corrosion Inhibitors

- Extreme Pressure Additives

- Stabilizers

- Antifoamers

- Alkanolamines

- Antimist agents

- Colorants/Dyes

- Others

On the basis of additive type, the market is segmented into surfactant additives and emulsifiers, corrosion inhibitors, extreme pressure additives, stabilizers, antifoamers, alkanolamines, antimist agents, colorants/dyes, and others.

Application

- Soluble Oils

- Straight Oils

- Semisynthetic Fluids

- Synthetic Fluids

On the basis of application, the market is segmented into soluble oils, straight oils, semisynthetic fluids, and synthetic fluids.

Metalworking Activity

- Milling

- Drilling

- Grinding

- Honing

- Tapping

- Others

On the basis of metalworking activity, the market is segmented into milling, drilling, grinding, honing, tapping, and others.

End Use

- Automotive

- Aerospace

- Machinery and Equipment Manufacturing

- Power and Energy

- Marine

- Others

On the basis of end use, the market is segmented into automotive, aerospace, machinery and equipment manufacturing, power and energy, marine, and others.

North America Metalworking Fluid Additives Market : Regional Analysis

The North America metalworking fluid additives market is analyzed and market size information is provided by additive type, application, metalworking activity, and end use as referenced above.

The countries covered in this market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate the market due to the rapid industrialization and strong demand for manufacturing in the region.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Share Analysis: North America Metalworking Fluid Additives Market

The North America metalworking fluid additives market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the market.

Some of the major players covered in this report are The Lubrizol Corporation(U.S.), Dow(U.S.), Evonik Industries AG Ingevity and its related entities (U.S.), Ashland (U.S.), Italmatch Chemicals S.p.), Colonial Chemical (U.S.), Biosynthetic Technologies (U.S.), DOVER CHEMICAL CORPORATION (U.S.), Emery Oleochemicals (U.S.), Pilot Chemical Corp. (U.S.), and R.T. Vanderbilt Holding Company, Inc. (U.S.), among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANDING AUTOMOTIVE, AEROSPACE, AND MACHINERY SECTORS

5.1.2 RISING QUALITY STANDARDS AND AUTOMATION IN INDUSTRIES

5.1.3 RISING ADDITIVE DEMAND IN CNC MACHINING

5.2 RESTRAINTS

5.2.1 SUPPLY CHAIN DISRUPTIONS IN THE METALWORKING FLUID ADDITIVES MARKET

5.2.2 INDUSTRIES SHIFTING TO TRADITIONAL DRY MACHINING

5.2.3 FLUCTUATION IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE METALWORKING PROCESS

5.3.2 SHIFT TOWARDS ECO-FRIENDLY ADDITIVES

5.3.3 RISING PRODUCT INNOVATIONS IN METALWORKING FLUID ADDITIVES

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY FACTORS INVOLVED

5.4.2 STABILITY ASSOCIATED WITH METAL FORMING FLUID ADDITIVES

6 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE

6.1 OVERVIEW

6.2 SURFACTANT ADDITIVES AND EMULSIFIERS

6.2.1 SURFACTANT ADDITIVES AND EMULSIFIERS, BY CHEMICAL COMPOUNDS

6.2.1.1 ETHOXYLATED ALCOHOL

6.2.1.2 SULFONATES

6.2.1.3 ETHOXYLATED FATTY ACIDS AND ESTERS

6.2.1.4 AMINES

6.2.1.5 PHOSPHATE ESTERS

6.2.1.6 SORBITAN ESTERS

6.2.1.7 BIODEGRADABLE SURFACTANTS

6.2.1.8 POLYMERIC SURFACTANTS

6.2.1.9 OTHERS

6.3 CORROSION INHIBITORS

6.3.1 CORROSION INHIBITORS, BY CHEMICAL COMPOUNDS

6.3.1.1 AMINES

6.3.1.2 AZOLES

6.3.1.3 PHOSPHATES

6.3.1.4 NITRITES

6.3.1.5 PHOSPHONATES

6.3.1.6 CARBOXYLIC ACIDS

6.3.1.7 SULFONATES

6.3.1.8 OTHER COMPOUNDS

6.4 EXTREME PRESSURE ADDITIVES

6.4.1 EXTREME PRESSURE ADDITIVES, BY CHEMICAL COMPOUNDS

6.4.1.1 MOLYBDENUM DISULFIDE (MOS2)

6.4.1.2 GRAPHITE

6.4.1.3 PHOSPHORUS-CONTAINING COMPOUNDS

6.4.1.4 SULFUR-CONTAINING COMPOUNDS

6.4.1.5 SULFUR-PHOSPHORUS COMPOUNDS

6.4.1.6 CHLORINATED COMPOUNDS

6.4.1.7 BORON COMPOUNDS

6.4.1.8 POLYMERS

6.4.1.9 OTHERS

6.5 STABILIZERS

6.5.1 STABILIZERS, BY CHEMICAL COMPOUNDS

6.5.1.1 BIOCIDES

6.5.1.2 ANTIOXIDANTS

6.5.1.3 RUST INHIBITORS

6.5.1.4 DISPERSANTS

6.5.1.4.1 DISPERSANTS, BY TYPE

6.5.1.4.1.1 POLYMERIC DISPERSANTS

6.5.1.4.1.2 SURFACTANT-BASED DISPERSANTS

6.5.1.4.1.3 ORGANIC ACID DISPERSANTS

6.5.1.5 METAL DEACTIVATORS

6.5.1.6 OTHERS

6.6 ANTIFOAMERS

6.6.1 ANTIFOAMERS, BY CHEMICAL COMPOUNDS

6.6.1.1 SILICON-BASED ANTIFOAMERS

6.6.1.2 MINERAL OIL BASED ANTIFOAMERS

6.6.1.3 FATTY ACID ESTERS

6.6.1.4 POLYMER-BASED ANTIFOAMERS

6.6.1.5 HYDROPHOBIC SILICA

6.6.1.6 OTHERS

6.7 ALKANOLAMINES

6.7.1 ALKANOLAMINES, BY CHEMICAL COMPOUNDS

6.7.1.1 TRIETHANOLAMINE (TEA)

6.7.1.2 DIETHANOLAMINE (DEA)

6.7.1.3 MONOETHANOLAMINE (MEA)

6.7.1.4 METHYLDIETHANOLAMINE (MDEA)

6.7.1.5 DIISOPROPANOLAMINE (DIPA)

6.7.1.6 OTHERS

6.8 ANTIMIST AGENTS

6.8.1 ANTIMIST AGENTS, BY CHEMICAL COMPOUNDS

6.8.1.1 SILICON-BASED COMPOUNDS

6.8.1.2 FATTY ACID ETHOXYLATES

6.8.1.3 POLYMERIC ANTI-MIST AGENTS

6.8.1.4 AMINE DERIVATIVES

6.8.1.5 OTHERS

6.9 COLORANTS/DYES

6.1 OTHERS

7 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SOLUBLE OILS

7.3 STRAIGHT OILS

7.4 SEMISYNTHETIC FLUIDS

7.5 SYNTHETIC FLUIDS

8 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY

8.1 OVERVIEW

8.2 MILLING

8.3 DRILLING

8.4 GRINDING

8.5 HONING

8.6 TAPPING

8.7 OTHERS

9 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY END USE

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 AEROSPACE

9.4 MACHINERY AND EQUIPMENT MANUFACTURING

9.5 POWER AND ENERGY

9.6 MARINE

9.7 OTHERS

10 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY COUNTRY

10.1 U.S.

10.2 CANADA

10.3 MEXICO

11 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 PARTNERSHIPS & CONTRACTS

11.3 EVENT

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 THE LUBRIZOL CORPORATION (BERKSHIRE HATHAWAY INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 DOW

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 INGEVITY AND ITS RELATED ENTITIES

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 EVONIK INDUSTRIES AG

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 FUCHS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ASHLAND

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 BIOSYNTHETIC TECHNOLOGIES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BP P.L.C.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 COLONIAL CHEMICAL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CLARIANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DOVER CHEMICAL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 EMERY OLEOCHEMICALS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ITALMATCH CHEMICALS S.P.A

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 KAO CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 LANXESS

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PILOT CHEMICAL

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 R.T. VANDERBILT HOLDING COMPANY, INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SOLVAY

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 UMICORE

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 ZSCHIMMER & SCHWARZ, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 3 NORTH AMERICA SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVS MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 16 U.S. METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 18 U.S. SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 31 CANADA SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 CANADA ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 39 CANADA METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 42 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 44 MEXICO SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 45 MEXICO CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 46 MEXICO EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 47 MEXICO STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 50 MEXICO ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 54 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 10 RISING ADDITIVE DEMAND IN CNC MACHINING IS DRIVING THE GROWTH OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 11 THE SURFACTANT ADDITIVES AND EMULSIFIERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET

FIGURE 13 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY ADDITIVE TYPE, 2022

FIGURE 14 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY APPLICATION, 2022

FIGURE 15 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY METALWORKING ACTIVITY, 2022

FIGURE 16 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY END USE, 2022

FIGURE 17 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.