Solvents Market Analysis and Size

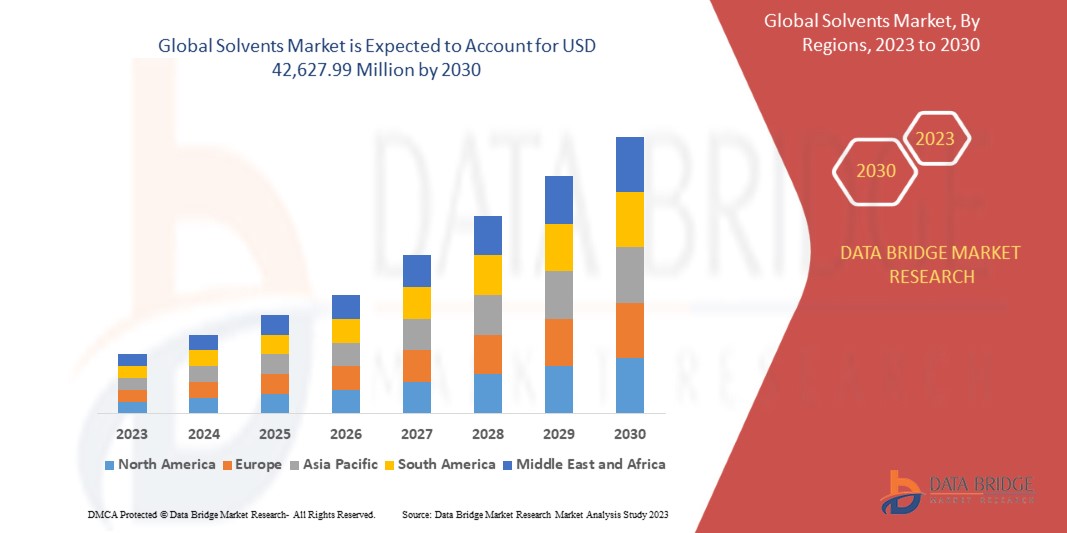

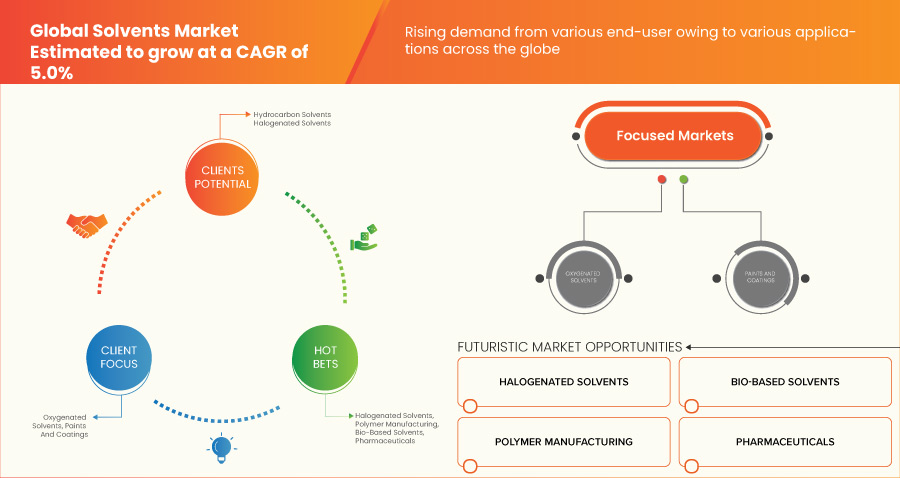

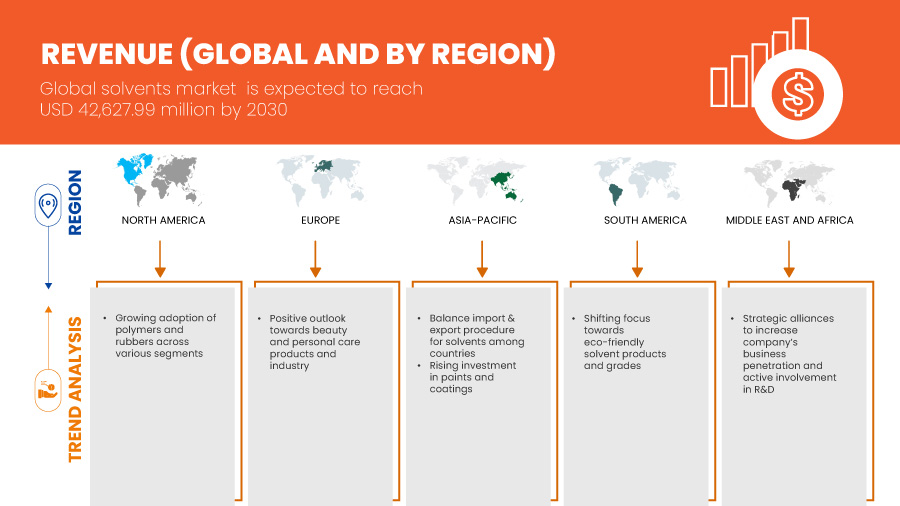

The global solvents market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.0% in the forecast period of 2023 to 2030 and is expected to reach USD 42,627.99 million by 2030. The major factor driving the growth of the solvents market is the rising usage of printing inks for different industrial applications and positive outlook toward beauty & personal care products industry.

Solvents are low-molecular-weight fluorinated synthetic fluids. They are non-toxic and non-flammable in their natural state. A solvent can be utilized in severe temperatures ranging from 80°C to 200°C. Their molecular structure might be linear, branched, or a combination of both, depending on the application. Solvents have various properties such as temperature resistance, lubricity, wear resistance, and fluid volatility.

The global solvents market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons |

|

Segments Covered |

Category (Oxygenated Solvents, Hydrocarbon Solvents, Halogenated Solvents, Others), Source (Conventional, Bio-Based), Application (Paints and Coatings, Pharmaceuticals, Adhesives, Printing Inks, Personal Care, Polymer Manufacturing, Agricultural Chemicals, Metal Cleaning, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, Netherlands, U.K., Russia, Spain, Turkey, Switzerland, Belgium, Rest of Europe, China, India, Japan, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Rest of Asia-Pacific, South Africa, Saudi Arabia, Egypt, United Arab Emirates, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Arkema (France), INVISTA ( A Subsidiary of Koch Industries, Inc.)(USA), Ashland (USA), Bharat Petroleum Corporation Limited (India), Huntsman International LLC (USA), Solvay (Belgium), ADM (USA), Shell Global (Netherlands), BP p.l.c. (UK), Eastman Chemical Company (USA), INEOS GROUP HOLDINGS S.A.(UK), BASF SE (Germany), Celanese Corporation (USA), Cargill, Incorporated (USA), Reliance Industries Limited (India), Honeywell International Inc. (USA), LyondellBasell Industries Holding B.V. (Netherlands), Exxon Mobil Corporation (USA), Monument Chemical (USA), Dow (USA), Olin Corporation (USA), among others. |

Market Definition

Solvents are typically liquid substances with the capacity to dissolve or distribute a wide range of compounds, including solid, liquid, and gaseous substances. They are widely used in a variety of industries, including chemicals, pharmaceuticals, paints and coatings, adhesives, cleaning products, and many more. The market for solvents includes a variety of solvent types, such as hydrocarbons, oxygenated solvents, halogenated solvents, and other specialized solvents.

Global Solvents Market Dynamics

DRIVERS

- Growing demand for solvents in the paints and coatings industry

Solvents play an important role as carriers for surface coatings such as paints, varnishes, and adhesives. The chemicals used in paints and coatings rely on solvents as they can dissolve and disperse components that are employed in the coatings formulations. It further ensures the quality of the final product obtained and optimal performance. Solvents act as essential components in paints and coatings formulations in the construction industry as it can dissolve pigments, additives, and binders to form high-performance coatings. Various types of solvents are used depending on the requirements of the coatings such as drying time, film quality, and compatibility with other components. Solvent selection such as hydrocarbon solvents, ketones, esters, alcohols, and glycol ethers depends on factors such as solvating ability, polarity, and compatibility with other components in the formulation. Benzene, toluene, and xylenes are aromatic hydrocarbon solvents that are used in enamel-based paints, whereas lacquer-based paints need stronger solvents for faster drying.

For instances,

- In April 2022, According to the Biltrax Construction Data, By 2022, the Indian construction sector is predicted to grow at a compound annual growth rate (CAGR) of 15.7 percent, reaching a value of USD 738.5 billion. The expansion of the construction sector will create opportunities for solvent manufacturers and suppliers on a global scale

- In March 2022, According to the GROUPE BERKEM, Groupe Berkem, a leading player in bio-based chemicals, announced the launch of its range of 100% bio-based alkyd resins aimed at the construction paints market. This innovative development involves the transformation of existing products towards sustainable solutions, using bio-based oils, organic chemistry byproducts, and a 100% bio-based solvent. This contributes to the global solvent market by providing eco-friendly solutions in the construction paints industry.

Other than paints and coatings, solvents find applications in adhesives for binding materials. The adhesives are of different types such as polychloroprene, polyurethane, acrylate, and silicone-based adhesives. Moreover, solvents are used in cleaning and degreasing agents, paint removers, and varnishes. As the construction and automotive sector around the world is booming due to urbanization, infrastructure development, increasing construction activities, and growing demand for automobiles. This construction and automotive industry growth further drives the demand for paints, coatings, and adhesives and thus the solvents demand to increase.

- Rising usage of printing inks for different industrial applications

Solvents play a crucial role in the printing industry as they offer solvency to inks to dissolve pigments and vehicles such as water-soluble glycol vehicles into a solution. This is done so that the ink can be easily applied to the paper or any other substrates. The printing inks need solvents through which proper distribution of color and consistency could be achieved. The solvents that have high solvency power can yield vibrant and long-lasting prints. The solvents having a narrow boiling range evaporates rapidly after ink application, thus there is effective and proper drying of ink on the applied substrates.

For instances,

- In March 2022, According to the Gardner Business Media, Inc., Sun Chemical introduced SunSpectro SolvaWash solvent-based inks, designed to boost recycling rates for PET bottles. These washable/deinkable gravure and flexo-printable inks are specifically developed for reverse printing of crystallizable PET shrink sleeves. The Sun Chemical's SolvaWash solvent-based inks will support the global solvent market by enabling higher recycling rates for PET bottles.

- In July 2021, According to the Fint Group, Flint Group Packaging Inks introduced a new range of solvent-based inks and coatings called ONECode, specifically designed for European flexible packaging converters. It includes six new brands, offering ink systems for flexo printing (VertixCode), gravure printing (MatrixCode), dual-purpose inks (HelixCode), sustainable solutions (ZenCode), overprint varnishes and primers (NexisCode), and additives (AdmixCode). It will benefit the global solvent market by simplifying the printing process for European flexible packaging converters.

The application of solvents in printing inks is widely done in different applications such as printing, packaging, bottle printing, and plastic printing among others. The packaging industry plays a significant role in driving the demand for ink solvents for printing applications. There has been a rise in demand for flexible packaging due to its customizable nature, low cost, and lightweight properties. Such flexible packaging is used in various sectors ranging from consumer goods to healthcare, thus driving the demand for solvents during the forecast period. The growth of the food and beverage industry is also expected to increase the demand for packaging, which will further drive the demand for printing inks. The ink solvents help in achieving the required quality of printing and durability needed for packaging materials used in the food and beverages sector. In the upcoming, the demand for high-quality printing inks is going to rise for different applications in a wide range of industries such as packaging solutions for food and beverage, consumer goods, and healthcare applications thus propelling the global solvents market forward.

- Positive outlook toward beauty & personal care products industry

The beauty and personal care products industry is growing at a significant rate due to the factors such as increasing awareness about personal grooming and demand for beauty and wellness products. Moreover, evolving beauty trends and changing consumer preference due to the presence of social media contributes to the growth of the beauty and personal care industry.

For instances,

- According to The Cosmetic, Toiletry, and Perfumery Association, the European cosmetics market reached a value of USD 92.66 million at Retail Sales Price (RSP) in 2022. This provides a boost to the global solvent market by indicating the continued expansion and strength of the cosmetics industry in Europe

- According to Cosmetics Europe, Europe is a leading market for cosmetics and personal care products, with an estimated retail sales value of USD 92.66 billion in 2022. Among the European countries, Germany has the largest market size, valued at USD 15.06 billion

Solvents are mostly used to dissolve active ingredients that are hydrophobic and are used in skincare and cosmetic formulations. The solvents to enhance the stability, texture, and absorption of the beauty & personal care products. Solvents such as butylene glycol, propylene glycol, isopropyl alcohol, and ethyl alcohol are widely used in skincare, cosmetics, hair care, and fragrance products. Solvents too act as humectants, emollients, and viscosity controllers. They assist in hydration and moisturizing the skin, improving texture, and stabilizing formulations. In addition to it, the manufacturers too are focused to manufacture solvents that have increased performance, improved compatibility with different ingredients, and safety profiles. Thus, the demand for solvents is expected to grow in the forecast period as the beauty and personal care industry continues to expand, further driving the global solvents market.

OPPORTUNITIES

- Shifting the focus of manufacturers toward eco-friendly solvents

In recent years, there has been a significant shift of end-users towards environmentally friendly solvents which are also called bio-solvents or green solvents. Most of these solvents are derived from the processing of agricultural crops. As the solvents derived from petrochemicals contribute to the emissions of volatile organic compounds, they have serious side effects on the environment. These solvents are non-carcinogenic and non-corrosive which makes them safe to handle and reduces risks for workers.

For instance,

- In November 2021, According to the Woodcote Media Limited, Celtic Renewables, a cleantech innovator, announced a partnership with Caldic to launch Scotland's first sustainable chemical plant in Grangemouth. Celtic Renewables' patented low-carbon technology enables the conversion of unwanted biological material into renewable chemicals, biofuel, and other valuable products. This development will support Caldic's customers in their sustainability journey by providing them with high-quality bio-solvents with a significantly lower carbon footprint

- In February 2023, According to the LUMITOS AG, Clariter and TotalEnergies Fluids premiered the first sustainable ultra-pure solvents made from plastic waste. This breakthrough technology, which resulted from an 18-month collaboration, combines Clariter's innovative upcycling process with TotalEnergies Fluids' Hydro-De-Aromatization technology. The resulting solvents meet the highest purity standards required by demanding industries such as pharmaceuticals and cosmetics.

Ethyl lactate is one of the green solvents that is derived from the processing of corn and has advantages such as biodegradability when compared to conventional solvents. They too are used in applications such as paint stripper, and the removal of greases, oils, adhesives, and solid fuels from various metal surfaces. There are further ongoing research and development efforts from manufacturers for the improvement of the performance and range of eco-friendly solvents.

- Immense potential in the renewable energy sector

As there has been a rise in demand for cleaner and sustainable energy sources, the renewable energy sector is experiencing significant growth in recent years. Solar panel systems and wind turbines, essential components of renewable energy generation require semiconductors for effective power conversion and control.

For instance,

- In April 2023, According to the Cision US Inc., Lowe's, made a recent development in renewable energy by announcing the installation of rooftop solar panels at 174 of its store and distribution center locations across the U.S.. The solar panels, once completed, are expected to provide approximately 90% of the energy usage at each location. Lowe's had partnered with DSD Renewables, Greenskies Clean Focus, and Infiniti Energy to execute these installations in California, Illinois, and New Jersey.

- In December 2022, According to the HT Digital Streams Ltd, Jindal Stainless, had partnered with ReNew Power, the largest renewable energy company in India, to establish a 300 MW renewable energy project. This project will employ a combination of solar and wind technologies and is estimated to generate 700 million units of electricity annually.

Solvents and combinations of solvents are widely used in the semiconductor industry for various purposes such as equipment cleaning, wafer drying, and deposition or removal of substrates. The semiconductor grade solvents have an important role in the fabrication of semiconductors. They are designed for the semiconductor industry and electronic industries, which requires low impurities level. Isopropyl alcohol and acetone are among the most popular cleaning solvents in the semiconductor industry. The solvent manufacturers thus can invest in research and development activities for the development of new solvents including eco-friendly solvents that fulfil the requirements of semiconductor manufacturing. Such steps will help the expansion of renewable energy systems worldwide, thus offering a wide range of opportunities for the growth of the global solvents market.

RESTRAINTS/CHALLENGES

- Health and safety concerns related to the usage of solvents

Solvents are used for varied applications for dissolving or diluting components. Solvents used in construction products such as paints, paint strippers, and thinners pose potential health hazards to the individuals that are exposed to it. The solvents such as dichloromethane, toluene, and ethyl acetate influence the health of humans in different ways such as skin contact, ingestion, inhalation, and eye contact. While the application of such products takes place, breathing happens that leads to side effects such as headaches, nausea, and irritation to the eyes, skin, lungs, and skin. Moreover, long exposures to such solvents results in health issues such as dermatitis, and damage to the body parts such as eyes, kidney, lungs, nervous system, and skin. High doses of solvents can even lead to unconsciousness and death, especially in the case of occupational exposure.

For instance,

- In May 2023, According to the HealthNews, A published study suggests a possible link between the chemical solvent tetrachloroethylene (TCE) and Parkinson's disease. The research reviewed several studies that examined the effects of prolonged exposure to TCE, which was once widely used in industries such as healthcare, dry cleaning, and manufacturing. The study found evidence that exposure to TCE may cause neuroinflammation, loss of dopamine neurons, and alterations in brain proteins associated with Parkinson disease.

Such health and safety concerns related to solvents will lead to the reduction in demand for solvent consisting products. These industries such as paints, coatings, and adhesives too can face significant challenges thus restraining the growth of the global solvents market.

- Issues in transportation and storage of solvents

The solvents are used in various industries such as pharmaceuticals, paints, agrochemicals, and many more. Most of the solvents are flammable and require careful handling and storage. If they are not properly managed it can lead to severe consequences, including workplace accidents, property damage, and environmental pollution. Due to such risks, there is a need for safety regulations that should be implemented in the transportation and storage of solvents. The solvents too exit fumes that can cause health issues and risks to the workers. Improper storage and transportation of solvents can have severe effects on the environment. The solvents if spilled out could contaminate soil and water sources, which further faces a threat to ecosystems and potentially harm wildlife.

There are various regulations such as proper labeling, storage conditions, segregation, ventilation, and identification with respect to the storage and transportation of solvents. If such regulations are overlooked it can cause much damage to the place where the spilling of solvents takes place. The transportation of chemicals such as solvents to comes with different risks and challenges. If the solvents are improperly labeled it can result in the wrong chemicals being transported and stored. Moreover, factors such as inadequate storage practices, exhausted workers, equipment malfunctions, and unforeseen natural or man-made catastrophes can all contribute to transportation accidents which could have detrimental effects. The challenges in the transportation and storage of solvents to have a direct impact on solvent manufacturers. Incidents resulting from improper transportation or storage can disrupt the supply chain, leading to delays, loss of customers' trust, and potential financial losses, thus challenging the global solvent market growth in the forecast period.

Recent Development

- In June 2023, Bharat Petroleum Corporation Limited (BPCL) was recognized at the highly esteemed FIPI Oil & Gas Awards 2022 by securing five coveted accolades. The awards were presented by Shri. Hardeep Singh Puri, Hon'ble Minister of Petroleum and Natural Gas and Housing & Urban Development, Government of India, at a grand ceremony held recently

- In August 2022, Eastman had been named on the Forbes list of Best-in-State Employers 2022. This prestigious award is presented by Forbes and Statista Inc., the world-leading statistics portal and industry ranking provider. This will help the company to grow as a brand and in recognition

Global Solvents Market Scope

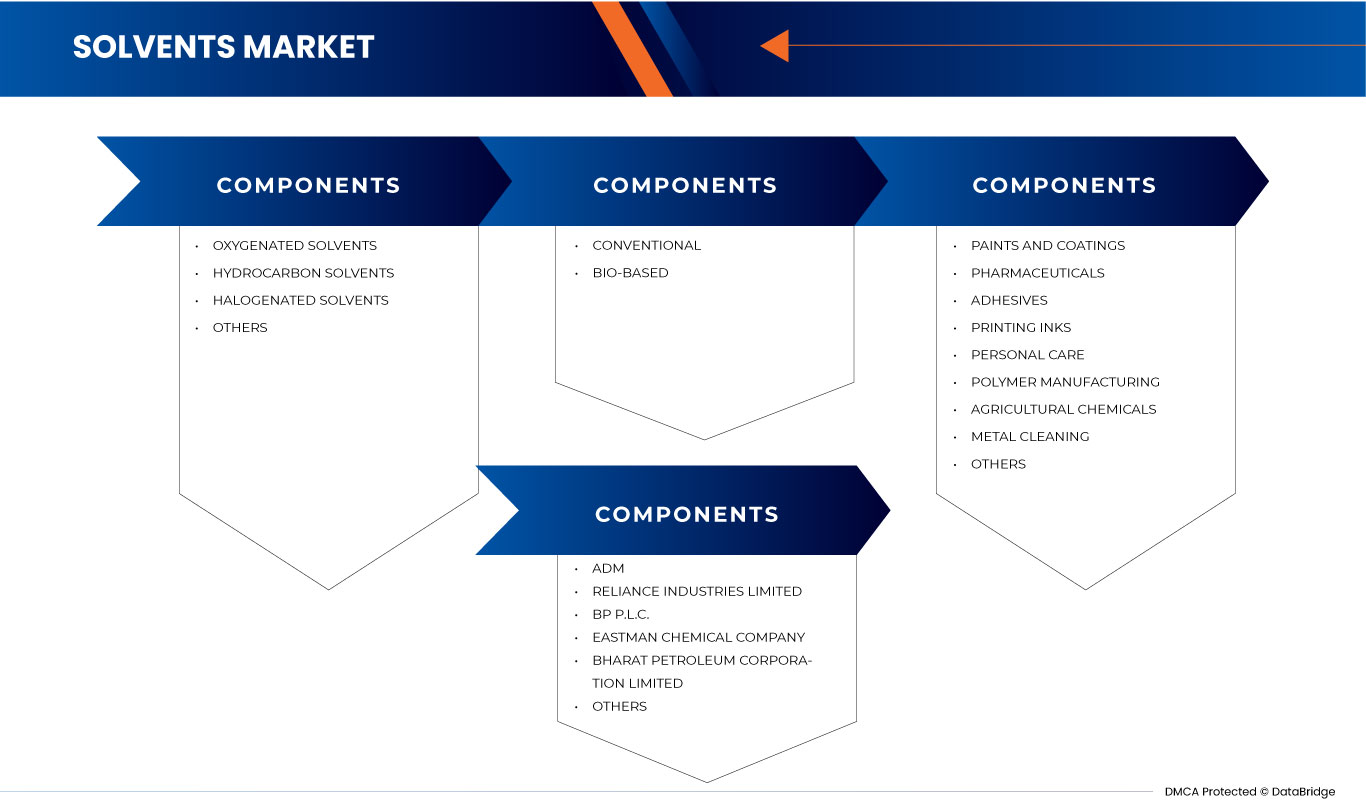

The solvents market is categorized based on category, source, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Category

- Oxygenated Solvents

- Hydrocarbon Solvents

- Halogenated Solvents

- Others

On the basis of category, the market is segmented into oxygenated solvents, hydrocarbon solvents, halogenated solvents, others.

Source

- Conventional

- Bio-based

On the basis of source, the market is segmented into conventional and bio-based.

Application

- Paints and Coatings

- Pharmaceuticals

- Adhesives

- Printing Inks

- Personal Care

- Polymer Manufacturing

- Agricultural Chemicals

- Metal Cleaning

- Others

On the basis of application, the market is segmented into paints and coatings, pharmaceuticals, adhesives, printing inks, personal care, polymer manufacturing, agricultural chemicals, metal cleaning, others.

Global Solvents Market Regional Analysis/Insights

The solvents market is segmented on the basis of category, source, and application.

The countries in the solvents market are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, Netherlands, U.K., Russia, Spain, Turkey, Switzerland, Belgium, Rest of Europe, China, India, Japan, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Rest of Asia-Pacific South Africa, Saudi Arabia, Egypt, United Arab Emirates, Israel, Rest of Middle East and Africa.

Asia-Pacific is dominating the global solvents market in terms of market share and market revenue. China is dominating due to the growing demand for solvents in the paints and coatings industry. Additionally, rising usage of printing inks in different industrial applications also contribute in the market growth. The U.S. dominates the market due to rising usage of printing inks in different industrial applications. Germany is dominating due to increasing awareness about personal grooming and demand for beauty and wellness products. Additionally, evolving beauty trends and changing consumer preference also contribute in the market growth.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Solvents Market Share Analysis

The global solvents market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the global solvents market.

Some of the prominent participants operating in the global solvents market are Arkema (France), INVISTA ( A Subsidiary of Koch Industries, Inc.)(USA), Ashland (USA), Bharat Petroleum Corporation Limited (India), Huntsman International LLC (USA), Solvay (Belgium), ADM (USA), Shell Global (Netherlands), BP p.l.c. (UK), Eastman Chemical Company (USA), INEOS GROUP HOLDINGS S.A.(UK), BASF SE (Germany), Celanese Corporation (USA), Cargill, Incorporated (USA), Reliance Industries Limited (India), Honeywell International Inc. (USA), LyondellBasell Industries Holding B.V. (Netherlands), Exxon Mobil Corporation (USA), Monument Chemical (USA), Dow (USA), Olin Corporation (USA) among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRODUCTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

4.7 LIST OF KEY BUYERS

4.8 RAW MATERIAL COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 POSITIVE OUTLOOK TOWARD BEAUTY & PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 INCREASING SPENDING IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 GLOBAL SOLVENTS MARKET, BY REGION

7.1 OVERVIEW

7.2 ASIA-PACIFIC

7.2.1 CHINA

7.2.2 INDIA

7.2.3 JAPAN

7.2.4 SOUTH KOREA

7.2.5 SINGAPORE

7.2.6 THAILAND

7.2.7 INDONESIA

7.2.8 MALAYSIA

7.2.9 PHILIPPINES

7.2.10 AUSTRALIA & NEW ZEALAND

7.2.11 REST OF ASIA-PACIFIC

7.3 NORTH AMERICA

7.3.1 U.S.

7.3.2 CANADA

7.3.3 MEXICO

7.4 EUROPE

7.4.1 GERMANY

7.4.2 FRANCE

7.4.3 ITALY

7.4.4 NETHERLANDS

7.4.5 U.K.

7.4.6 RUSSIA

7.4.7 SPAIN

7.4.8 TURKEY

7.4.9 SWITZERLAND

7.4.10 BELGIUM

7.4.11 REST OF EUROPE

7.5 MIDDLE EAST AND AFRICA

7.5.1 SOUTH AFRICA

7.5.2 SAUDI ARABIA

7.5.3 EGYPT

7.5.4 UNITED ARAB EMIRATES

7.5.5 ISRAEL

7.5.6 REST OF MIDDLE EAST AND AFRICA

7.6 SOUTH AMERICA

7.6.1 BRAZIL

7.6.2 ARGENTINA

7.6.3 REST OF SOUTH AMERICA

8 GLOBAL SOLVENTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 AGREEMENT

8.7 ACQUISITION

8.8 AWARD

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ADM

10.1.1 COMPANY SNAPSHOT

10.1.2 COMPANY SHARE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 REVENUE ANALYSIS

10.1.5 RECENT DEVELOPMENTS

10.2 RELIANCE INDUSTRIES LIMITED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 BP P.L.C.

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 EASTMAN CHEMICAL COMPANY (2022)

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT UPDATES

10.5 BHARAT PETROLEUM CORPORATION LIMITED (2022)

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 OLIN CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENTS

10.7 ARKEMA (2022)

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 ASHLAND.(2022)

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT UPDATE

10.9 BASF SE

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT UPDATE

10.1 CARGILL, INCORPORATED

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 CELANESE CORPORATON(2022)

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT UPDATE

10.12 DOW

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 EXXON MOBIL CORPORATION(2022)

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT UPDATES

10.14 HONEYWELL INTERNATIONAL INC. (2022)

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 HUNTSMAN INTERNATIONAL LLC (2022)

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENT

10.16 INEOS GROUP HOLDINGS S.A. (2022)

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT UPDATE

10.19 MONUMENT CHEMICAL

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 SHELL GLOBAL (2022)

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT UPDATES

10.21 SOLVAY (2022)

10.21.1 COMPANY SNAPSHOT

10.21.2 REVENUE ANALYSIS

10.21.3 PRODUCT PORTFOLIO

10.21.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (KILO TONS)

TABLE 4 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 6 GLOBAL OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 19 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 21 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 23 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 25 ASIA-PACIFIC OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 ASIA-PACIFIC ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 ASIA-PACIFIC GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 38 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 40 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 42 CHINA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 CHINA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CHINA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 53 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 54 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 55 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 57 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 59 INDIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 60 INDIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 INDIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 INDIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 INDIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 INDIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 67 INDIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 INDIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 INDIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 70 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 71 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 72 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 74 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 75 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 76 JAPAN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 JAPAN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JAPAN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JAPAN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JAPAN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JAPAN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JAPAN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JAPAN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 84 JAPAN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JAPAN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JAPAN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 88 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 89 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 91 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 92 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 93 SOUTH KOREA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 SOUTH KOREA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SOUTH KOREA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SOUTH KOREA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 106 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 108 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 109 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 110 SINGAPORE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 123 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 125 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 126 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 127 THAILAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 128 THAILAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 THAILAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 THAILAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 THAILAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 THAILAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 THAILAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 THAILAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 135 THAILAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 THAILAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 THAILAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 138 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 139 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 140 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 142 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 143 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 144 INDONESIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 145 INDONESIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 INDONESIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 INDONESIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 INDONESIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 INDONESIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 INDONESIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 INDONESIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 152 INDONESIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 INDONESIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 INDONESIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 155 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 157 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 159 MALAYSIA SOLVENTS MARKET

TABLE 160 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 161 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 162 MALAYSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 163 MALAYSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 MALAYSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 MALAYSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MALAYSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 MALAYSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 MALAYSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 MALAYSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 170 MALAYSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 MALAYSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 MALAYSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 174 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 175 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 177 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 178 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 179 PHILIPPINES OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 180 PHILIPPINES ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 PHILIPPINES GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 PHILIPPINES KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 PHILIPPINES ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 192 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 194 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 196 AUSTRALIA & NEW ZEALAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 AUSTRALIA & NEW ZEALAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 AUSTRALIA & NEW ZEALAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 AUSTRALIA & NEW ZEALAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 AUSTRALIA & NEW ZEALAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 204 AUSTRALIA & NEW ZEALAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 AUSTRALIA & NEW ZEALAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 AUSTRALIA & NEW ZEALAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 207 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 209 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 211 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 212 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 213 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 214 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 215 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 217 NORTH AMERICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 218 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 225 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 NORTH AMERICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 230 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 232 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 233 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 234 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 235 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 242 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 245 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 246 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 247 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 248 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 249 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 250 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 251 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 252 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 259 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 262 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 263 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 264 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 266 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 267 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 268 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 269 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 276 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 279 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 281 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 282 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 283 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 284 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 285 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 286 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 287 EUROPE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 288 EUROPE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 289 EUROPE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 EUROPE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 EUROPE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 EUROPE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 EUROPE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 EUROPE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 295 EUROPE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 EUROPE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 EUROPE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 298 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 299 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 300 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 302 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 303 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 304 GERMANY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 305 GERMANY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 GERMANY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 GERMANY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 GERMANY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 309 GERMANY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 GERMANY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 GERMANY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 312 GERMANY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 GERMANY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 GERMANY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 315 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 316 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 317 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 319 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 320 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 321 FRANCE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 322 FRANCE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 FRANCE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 324 FRANCE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 FRANCE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 326 FRANCE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 FRANCE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 328 FRANCE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 329 FRANCE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 330 FRANCE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 331 FRANCE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 332 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 333 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 334 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 335 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 336 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 337 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 338 ITALY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 339 ITALY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 340 ITALY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 ITALY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 342 ITALY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 ITALY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 ITALY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 ITALY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 346 ITALY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 ITALY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 ITALY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 349 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 350 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 351 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 353 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 354 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 355 NETHERLANDS OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 356 NETHERLANDS ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 NETHERLANDS GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 358 NETHERLANDS KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 NETHERLANDS ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 360 NETHERLANDS GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 NETHERLANDS ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 362 NETHERLANDS HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 363 NETHERLANDS AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 364 NETHERLANDS XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 365 NETHERLANDS HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 366 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 367 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 368 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 369 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 370 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 371 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 372 U.K. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 373 U.K. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 374 U.K. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 375 U.K. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 376 U.K. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 377 U.K. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 378 U.K. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 379 U.K. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 380 U.K. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 381 U.K. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 382 U.K. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 383 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 384 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 385 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 386 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 387 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 388 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 389 RUSSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 390 RUSSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 391 RUSSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 392 RUSSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 393 RUSSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 394 RUSSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 395 RUSSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 396 RUSSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 397 RUSSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 398 RUSSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 399 RUSSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 400 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 401 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 402 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 403 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 404 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 405 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 406 SPAIN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 407 SPAIN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 408 SPAIN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 409 SPAIN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 410 SPAIN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 411 SPAIN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 412 SPAIN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 413 SPAIN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 414 SPAIN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 415 SPAIN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 416 SPAIN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 417 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 418 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 419 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 420 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 421 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 422 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 423 TURKEY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 424 TURKEY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 425 TURKEY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 426 TURKEY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 427 TURKEY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 428 TURKEY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 429 TURKEY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 430 TURKEY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 431 TURKEY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 432 TURKEY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 433 TURKEY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 434 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 435 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 436 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 437 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 438 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 439 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 440 SWITZERLAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 441 SWITZERLAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 442 SWITZERLAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 443 SWITZERLAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 444 SWITZERLAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 445 SWITZERLAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 446 SWITZERLAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 447 SWITZERLAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 448 SWITZERLAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 449 SWITZERLAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 450 SWITZERLAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 451 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 452 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 453 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 454 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 455 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 456 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 457 BELGIUM OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 458 BELGIUM ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 459 BELGIUM GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 460 BELGIUM KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 461 BELGIUM ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 462 BELGIUM GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 463 BELGIUM ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 464 BELGIUM HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 465 BELGIUM AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 466 BELGIUM XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 467 BELGIUM HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 468 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 469 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 470 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 471 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 472 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 473 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 474 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 475 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 476 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 477 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 478 MIDDLE EAST AND AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 479 MIDDLE EAST AND AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 480 MIDDLE EAST AND AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 481 MIDDLE EAST AND AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 482 MIDDLE EAST AND AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 483 MIDDLE EAST AND AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 484 MIDDLE EAST AND AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 485 MIDDLE EAST AND AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 486 MIDDLE EAST AND AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 487 MIDDLE EAST AND AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 488 MIDDLE EAST AND AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 489 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 490 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 491 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 492 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 493 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 494 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 495 SOUTH AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 496 SOUTH AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 497 SOUTH AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 498 SOUTH AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 499 SOUTH AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 500 SOUTH AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 501 SOUTH AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 502 SOUTH AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 503 SOUTH AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 504 SOUTH AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 505 SOUTH AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 506 SOUTH AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 507 SOUTH AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 508 SOUTH AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 509 SOUTH AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 510 SAUDI ARABIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 511 SAUDI ARABIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 512 SAUDI ARABIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 513 SAUDI ARABIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 514 SAUDI ARABIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 515 SAUDI ARABIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 516 SAUDI ARABIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 517 SAUDI ARABIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 518 SAUDI ARABIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 519 SAUDI ARABIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 520 SAUDI ARABIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 521 SAUDI ARABIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 522 SAUDI ARABIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 523 SAUDI ARABIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 524 SAUDI ARABIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 525 SAUDI ARABIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 526 SAUDI ARABIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 527 EGYPT SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 528 EGYPT SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 529 EGYPT OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 530 EGYPT ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 531 EGYPT GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 532 EGYPT KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 533 EGYPT ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 534 EGYPT GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 535 EGYPT ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 536 EGYPT HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 537 EGYPT AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 538 EGYPT XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 539 EGYPT HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 540 EGYPT SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 541 EGYPT SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 542 EGYPT SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 543 EGYPT SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)