North America Underwater Robotics Market, By Type (Remotely Operated Vehicles (ROV) and Autonomous Underwater Vehicle (AUV)), Working Depth (Shallow, Deep Water and Ultra-Deep Water), Task Type (Observation, Survey, Inspection, Construction, Intervention, Burial and Trenching and Others), Depth (Less than 1000 Mts, 1000 Mts to 5000 Mts and More than 5000 Mts), Component (Light, Camera, Frame, Thrusters, Tethers, Pilot Controls and Others), Application (Oil and Gas, Commercial Exploration, Defense and Security, Scientific Research and Others) – Industry Trends and Forecast to 2029.

Market Analysis and Size

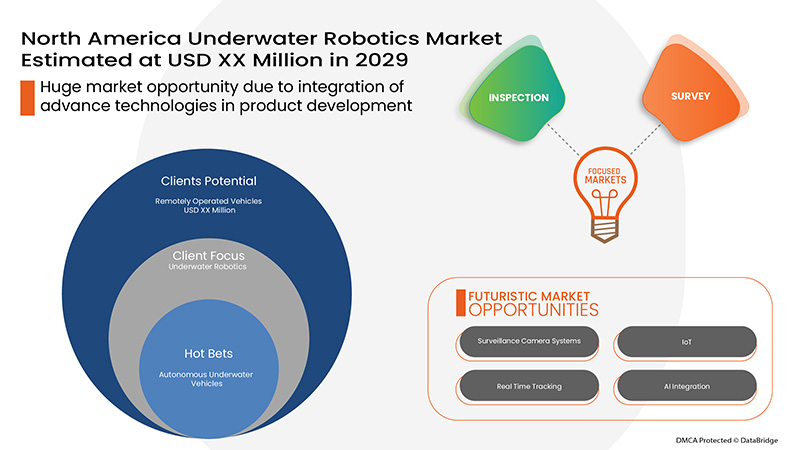

The North America underwater robotics market is primarily driven by the rising demands for ROVs in offshore oil and gas industries and its essential need for sea exploration and scientific research. In addition, the applications of underwater robotics for salvage, rescue, and repair operation is fueling the market growth at a rapid rate. However, the high cost of ROVs and AUVs after add-ons and threats related to cyber security may restrain the North America underwater robotics market growth. Further, the technical barrier to navigation and communication of AUVs and ROVs in strong water currents and below-ice sheets may challenge the market growth. Additionally, slow advancement in sensor technology and high technical complexity in underwater robotics may impede the market growth. However, the growing development of variable payload capabilities in underwater vehicles and the integration of advanced technologies to increase the efficiency and working of underwater robotics provide lucrative opportunities to the North America underwater robotics market.

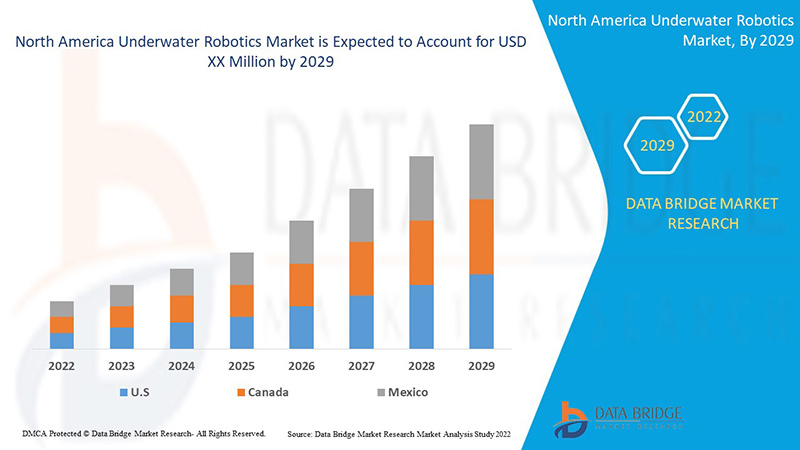

Data Bridge Market Research analyses that the North America underwater robotics market is expected to reach USD XX million by the year 2029, at a CAGR of 13.3% during the forecast period. "Remotely Operated Vehicles (ROV)" accounts for the most prominent type segment in the respective market. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Remotely Operated Vehicles (ROV) and Autonomous Underwater Vehicle (AUV)), Working Depth (Shallow, Deep Water and Ultra-Deep Water), Task Type (Observation, Survey, Inspection, Construction, Intervention, Burial and Trenching and Others), Depth (Less than 1000 Mts, 1000 Mts to 5000 Mts and More than 5000 Mts), Component (Light, Camera, Frame, Thrusters, Tethers, Pilot Controls and Others), Application (Oil and Gas, Commercial Exploration, Defense and Security, Scientific Research and Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

ATLAS ELEKTRONIK GmbH, Deep Ocean Engineering, Inc., General Dynamics Mission Systems, Inc., ECA GROUP, International Submarine Engineering Limited, Eddyfi, Phoenix International Holdings, Inc., Boeing, MacArtney A/S, Oceaneering International, Inc., VideoRay LLC, Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, SeaRobotics Corp., Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd., Huntington Ingalls Industries, Inc., Deep Trekker Inc. |

Market Definition

Underwater robotics is a branch of robotics that covers the research and development, design, manufacture, and application of robots operating in underwater environments. The term can refer to any robot functioning at or below water level (marine robotic systems). Still, it usually refers specifically to autonomous vehicles designed for use underwater. An underwater robot also called an autonomous underwater vehicle, is a machine that can be remotely operated. It is designed to work underwater for continuous oceanic surveillance. Robotics has been utilized in manufacturing in the past few years. The marvelous expansion has made them more cultured and dependable for military and law implementation applications. Underwater robots play a significant role in the expansion of the offshore industry. In addition, it has numerous implementations in marine biology, underwater archaeology, and maritime security.

Market Dynamics of the North America Underwater Robotics Market Include:

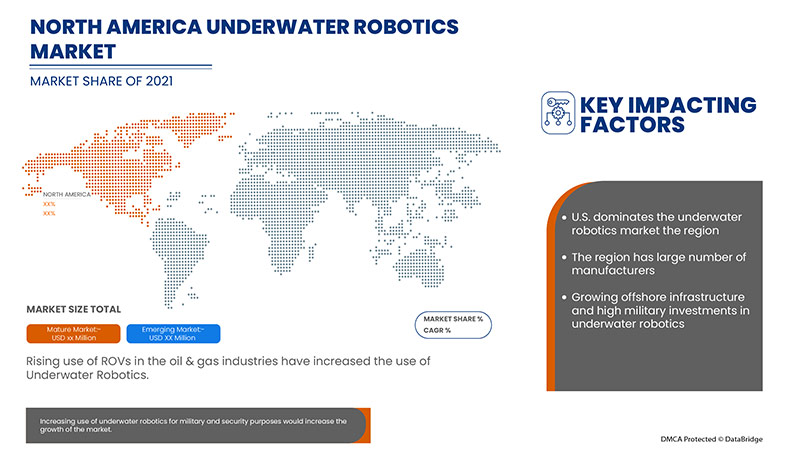

- Increasing use of underwater robotics for military and security purposes

The region has experienced huge investment in military and navy equipment in recent years to carry out an ocean operations. The role of AUVs will increase in the future, especially in the military, as various nations are developing AUVs to secure their maritime interest across the region.

- Rising use of ROVs in the oil & gas industries

Demands for oil and gas are increasing with the urbanization and industrialization in the region. The investments in modern infrastructure and equipment to increase the efficiency of offshore operations are driving the demand in the market

- Increasing demand for AUVs for underwater exploration and scientific research

The demand for ROVs and AUVs for deep-sea exploration and research operations by the institute in collaboration with many industries is driving the demand in the market.

- Growing demand for underwater robotics for search, rescue and repair operation

Underwater search and rescue, recovery, and investigations are time-sensitive operations often performed in extremely challenging conditions. The increasing emphasis on moving away from the use of human divers and robotics equipment is driving the demand in the market.

Restraints/Challenges faced by the North America Underwater Robotics Market

- High cost of underwater robots/vehicles

There are a variety of features and add-ons that can be highly beneficial for ocean-related industries. Underwater vehicles are used in a variety of industries. The underwater robots are mission-critical and constitute many critical and costly components. This increases the cost of the system and acts as a restrain for the adoption in commercial applications.

- Threats and concerns for cyber security and operational security

As information technology (IT) has advanced, the opportunity for cybercrime has also increased. These threats and concerns for cyber security and operational security for underwater vehicles may restrain the growth of the North America underwater robotics market.

Recent Developments

- In July 2019, Deep Ocean Engineering, Inc. launched a new ROV named the Phantom X8 in its product line. Phantom X8 is a light work class that is designed for deep-sea manoeuvrability. The company had set up high definition front and rear camera, a lighting control system, and auto functions for heading, altitude, depth, and positioning of ROV. The company aimed to sell this machine for deep-sea exploration and light intervention for depths up to 1,000 meters

- In January 2022, General Dynamics partnered with MIT during the U.S. Navy's biennial Ice Exercise to develop a product that can navigate autonomously under the ice. Company UUV, named Bluefin-21, and has been used to integrate with a new communication and navigation system developed with MIT for a machine capable of navigating automatically under the ice for navigation and maneuvering purposes. Through this, the company aims to sell the same product to the different market players and gain more market share in underwater robotics

North America Underwater Robotics Market Scope

North America underwater robotics market is segmented based on type, working depth, task type, depth, components and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Remotely Operated Vehicles (ROV)

- Autonomous Underwater Vehicle (AUV)

On the basis of type, North America underwater robotics market is segmented into remotely operated vehicles (ROV) and autonomous underwater vehicle (AUV).

Working Depth

- Shallow

- Deep water

- Ultra-Deep Water

On the basis of working depth, the North America underwater robotics market is segmented into shallow, deep water, and ultra-deep water.

Task Type

- Observation

- Survey

- Inspection

- Construction

- Intervention

- Burial and Trenching

- Others

On the basis of the task type, the North America underwater robotics market is segmented into observation, survey, inspection, construction, intervention, burial and trenching and others.

Depth

- Less Than 1000 Mts

- 1000 Mts to 5000 Mts

- More Than 5000 Mts

On the basis of depth, the North America underwater robotics market is segmented into less than 1000 mts, 1000 mts to 5000 mts and more than 5000 mts.

Component

- Light

- Camera

- Frame

- Thrusters

- Tethers

- Pilot Controls

- Others

On the basis of component, the North America underwater robotics market is segmented into light, camera, frame, thrusters, tethers, pilot controls and others.

Application

- Oil and Gas

- Commercial Exploration

- Defense and Security

- Scientific Research

- Others

On the basis of application, the North America underwater robotics market is segmented into oil and gas, commercial exploration, defense and security, scientific research and others.

North America Underwater Robotics Market Regional Analysis/Insights

North America underwater robotics market is analyzed, and market size insights and trends are provided by country, type, working depth, task type, depth, components and application, as referenced above.

The countries covered in the North America underwater robotics market report are the U.S., Canada and Mexico in North America.

U.S. dominates the North America underwater robotics market because of a large number of manufacturers and developed offshore infrastructure.

The U.S. is expected to witness significant growth during the forecast period of 2022 to 2029 as the region has seen high investments in equipment for search and rescue, military, recreation and discovery, aquaculture, marine biology, oil, gas, offshore energy, shipping, submerged infrastructure, and more.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Underwater Robotics Market Share Analysis

North America underwater robotics market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the North America underwater robotics market.

Some of the major players operating in the North America underwater robotics market are ATLAS ELEKTRONIK GmbH, Deep Ocean Engineering, Inc., General Dynamics Mission Systems, Inc., ECA GROUP, International Submarine Engineering Limited, Eddyfi, Phoenix International Holdings, Inc., Boeing, MacArtney A/S, Oceaneering International, Inc., VideoRay LLC, Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, SeaRobotics Corp., Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd., Huntington Ingalls Industries, Inc., Deep Trekker Inc. among others.

Research Methodology: North America North America Underwater Robotics Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry.

The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Expert Analysis, Import/Export Analysis, Pricing Analysis, Production Consumption Analysis, Climate Chain Scenario, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.S. UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 U.S. UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 U.S. UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 U.S. CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 CANADA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 CANADA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 CANADA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 MEXICO UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 MEXICO REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 MEXICO UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 MEXICO UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 MEXICO CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET

FIGURE 16 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TYPE (2022-2029)

FIGURE 27 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.