Uk Thin Film Transistor Tft Display Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4,371.90 million

USD

12,079.15 million

2022

2030

USD

4,371.90 million

USD

12,079.15 million

2022

2030

| 2023 –2030 | |

| USD 4,371.90 million | |

| USD 12,079.15 million | |

|

|

|

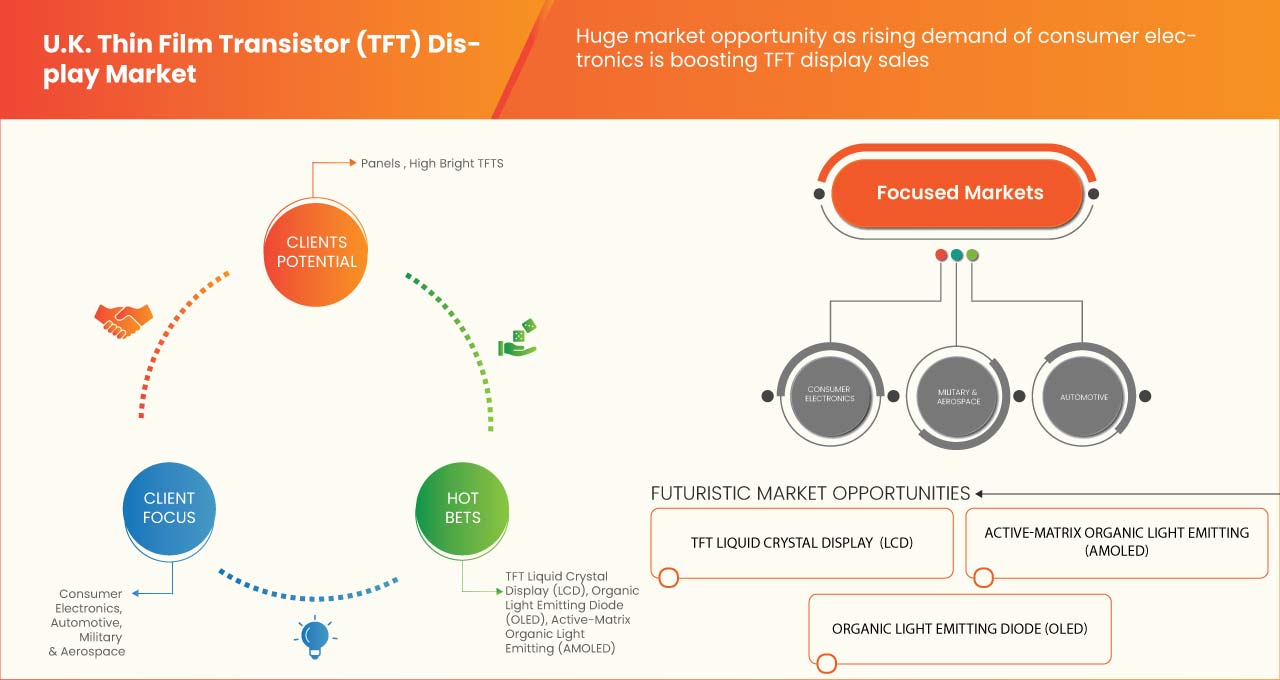

U.K. Thin Film Transistor (TFT) Display Market, By Type (Panels, High Bright TFTS, High Resolution TFT Displays, EMI Shielded TFT Displays, Stretch TFTS and Others), Technology (TFT Liquid Crystal Display (LCD), Organic Light Emitting Diode (OLED), Active-Matrix Organic Light Emitting Diode (AMOLED) and Others), Fabrication Type (Inorganic and Organic), Installation Type (Indoor and Outdoor), Layer (Semiconductor, Substrate, Gate Electrode, Dielectric, and Drain/Source Metal), Application (Domestic Use, Commercial Use, and Industrial Use), End User (Consumer Electronics, Automotive, Healthcare, and Military & Aerospace) - Industry Trends and Forecast to 2030.

U.K. Thin Film Transistor (TFT) Display Market Analysis and Size

The U.K. thin film transistor (TFT) display market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that The U.K. thin film transistor (TFT) display market is expected to reach USD 12,079.15 million by 2030 from USD 4,371.90 million in 2022 growing with a substantial CAGR of 14.1% in the forecast period of 2023 to 2030. The major factor driving the growth of the thin film transistor (TFT) display market is the incorporation of TFT display in various sectors such as automotive and health care.

The thin film transistor (TFT) display is a type of screen used in devices such as smartphones, laptops, and monitors. It employs a special technology called thin-film transistors to individually control each pixel's brightness and color. TFT displays offer vibrant and clear visuals, making them popular choices for electronic devices. They provide sharper images and consume less power compared to traditional displays.

The U.K. thin film transistor (TFT) display market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Panels, High Bright TFTS, High Resolution TFT Displays, EMI Shielded TFT Displays, Stretch TFTS and Others), Technology (TFT Liquid Crystal Display (LCD), Organic Light Emitting Diode (OLED), Active-Matrix Organic Light Emitting Diode (AMOLED) and Others), Fabrication Type (Inorganic and Organic), Installation Type (Indoor and Outdoor), Layer (Semiconductor, Substrate, Gate Electrode, Dielectric, and Drain/Source Metal), Application (Domestic Use, Commercial Use, and Industrial Use), End User (Consumer Electronics, Automotive, Healthcare, and Military & Aerospace) |

|

Countries Covered |

U.K. |

|

Market Players Covered |

SAMSUNG, LG Display, Sony Group Corporation, Toshiba Tec Corporation, Fujitsu, Schneider Electric, Anders Electronics PLC, New Vision Display (Shenzhen) Co, Ltd. (An Subsidiary of Tianjin Jingwei Huikai Optoelectronic Co., Ltd)., EIZO Corporation., and Midas Components among others |

Market Definition

The thin film transistor (TFT) display is a type of screen used in devices such as smartphone, laptops, and monitors. It employs a special technology called thin-film transistors to individually control each pixel's brightness and color. TFT displays offer vibrant and clear visuals, making them popular choices for electronic devices. They provide sharper images and consume less power compared to traditional displays.

U.K. Thin Film Transistor (TFT) Display Market Dynamics

Drivers

- Rising Demand of Consumer Electronics

The increasing demand for consumer electronics in the U.K. is a promising trend that is expected to have a positive impact on the thin film transistor (TFT) display market. Several factors contribute to this rising demand, including the surge in online shopping, which has made it more convenient for consumers to access a wide range of electronic devices. The ease of online electronics purchases has led to increased adoption of TFT displays in gadgets such as smartphones and tablet. In addition to that smart home automation has increased demand for TFT-equipped devices, such as TVs, speakers, and appliances, providing intuitive interfaces and seamless interaction. Another significant contributor to the increasing demand for consumer electronics is the thriving gaming industry. Video gaming has become a mainstream entertainment activity, with TFT displays enhancing immersive gaming experiences with vivid graphics and smooth refresh rates. Furthermore, U.K. TFT displays demand surges due to 5G adoption, offering faster data speeds and low latency for seamless streaming. The demand for devices with TFT displays, capable of supporting higher resolutions and faster refresh rates, is expected to rise significantly, as users seek to leverage the benefits of 5G.

- Incorporation of TTF Display in Various Sectors Such as Automotive and Healthcare

In the automotive industry, TFT displays find widespread application in instrument clusters, head-up display (HUDs), and infotainment systems. Instrument clusters equipped with TFT displays offer clear and detailed information on vital vehicle parameters, including speed, fuel level, engine temperature, and more. These high-resolution displays with wide viewing angles ensure easy readability for drivers, even in bright sunlight, enhancing the overall driving experience and safety. Thin film transistor (TFT) display is a critical step in the generation of petroleum-based fuels. Alkylate is in great demand for the production of refinery products, and this is because refinery products are becoming increasingly popular over the world. In the healthcare sector, TFT displays have revolutionized medical imaging technologies. Medical imaging devices, such as X-ray machines, ultrasound machines, and MRI scanner, rely on TFT displays to deliver high-resolution and accurate images. These displays aid healthcare professionals in diagnosing and treating patients more effectively, providing detailed insights into medical conditions and guiding appropriate medical interventions.

Opportunities

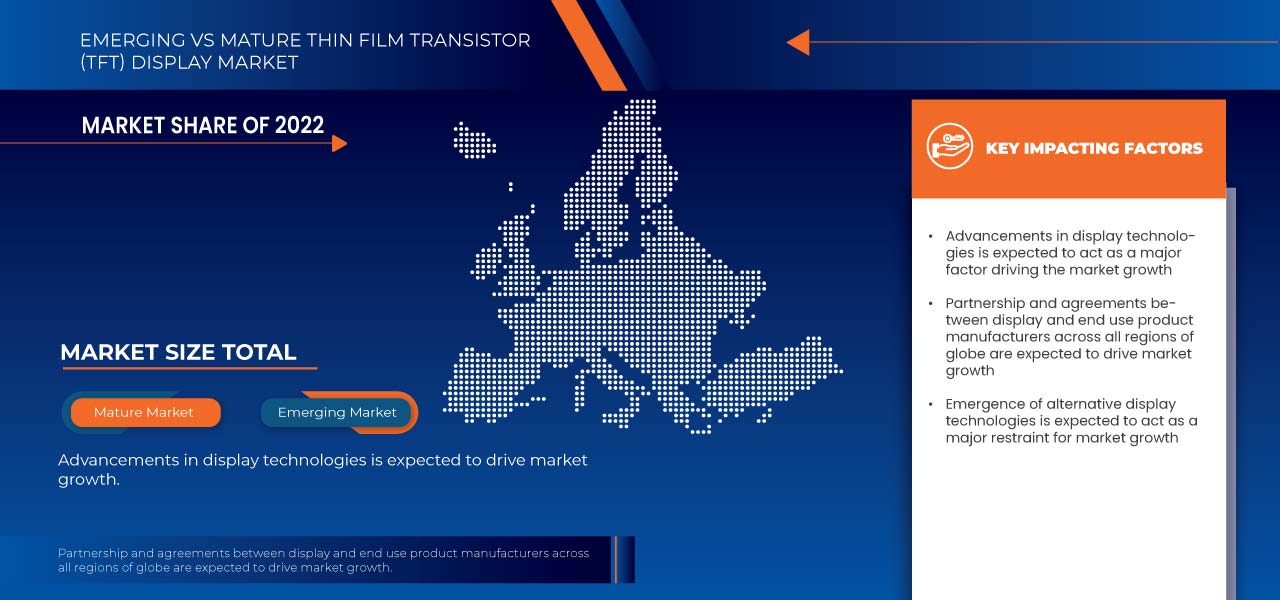

- Advancements in Display Technologies

Advancements in TFT display technologies have indeed led to improvements in performance, resolution, and flexibility, presenting opportunities for the U.K. thin film transistor (TFT) display market. The development of various TFT types, such as amorphous silicon (a-Si), polycrystalline silicon (poly-Si), oxide TFTs, and organic TFTs, has enabled manufacturers to cater to diverse applications and consumer demands.

The adoption of higher-performing TFT technologies, such as poly-Si and oxide TFTs, has facilitated the production of high-resolution displays with pixel densities exceeding 4K. This has enhanced visual experiences and also driven demand for advanced displays in sectors including smartphones, laptops, tablets, and TVs. Continuous improvements in TFT manufacturing processes have contributed to cost reduction and improved uniformity, making TFT displays more accessible and affordable to consumers, thereby expanding the U.K. market. In addition to that, the development of wider viewing angles in TFT displays has improved user experiences, particularly for devices namely smartphones and tablets, where users often view screens from different angles. This enhancement offers better visibility and readability, augmenting the appeal of TFT displays to a broader audience.

Moreover, the advent of flexible displays using TFT technology has created new possibilities for wearable devices and foldable smartphones. As consumers seek more innovative and versatile gadgets, flexible displays offer unique selling points, creating a niche market segment with growth potential for U.K. TFT display manufacturers.

- Partnerships and Agreements Between Display and End Use Product Manufacturers

Partnerships and agreements between display manufacturers and end-use product manufacturers can create significant opportunities for the market. When display manufacturers collaborate with companies that produce end-use products such as smartphones, tablets, TVs, monitors, and automotive display, it leads to a symbiotic relationship that benefits both parties and the overall market.

These partnerships enable display manufacturers to gain valuable insights into the specific requirements and preferences of end-use product manufacturers. This allows them to tailor their TFT display technologies to better meet the needs of the end products, leading to improved performance, higher efficiency, and enhanced user experiences. By understanding the demands of end-use products, TFT display manufacturers can develop customized solutions that cater to diverse applications, thus gaining a competitive edge in the market. In addition to that agreements with end-use product manufacturers often involve long-term supply contracts. These contracts provide stability and predictability for display manufacturers, ensuring a steady demand for their TFT displays. As a result, TFT display manufacturers can plan their production and investments more efficiently, leading to cost optimization and potential economies of scale. Moreover, secure supply contracts can attract investors and encourage innovation in the TFT display market, further driving growth opportunities in the U.K.

Restraints/Challenges

- Fluctuations in Raw Materials Prices

Fluctuations in raw materials can significantly impact the manufacturing and pricing of TFT (Thin-Film Transistor) displays. TFT displays rely on several key raw materials, including glass substrates, indium tin oxide (ITO) for transparent conductive layers, color filters, liquid crystals, and semiconductors. Changes in the availability and cost of these materials can affect the overall production costs and supply chain dynamics in the TFT display industry.

One of the main factors influencing raw material fluctuations is the country supply and demand dynamics. Shortages or disruptions in the supply chain can lead to price volatility for key raw materials. For instance, if there is an increased demand for TFT displays due to a surge in consumer electronics sales, the demand for raw materials such as glass substrate and semiconductors could outstrip supply, leading to higher prices. Additionally, geopolitical tensions or trade disputes can impact the availability of raw materials, further contributing to fluctuations.

- Environmental Issues Associated With Thin Film Transistor (TFT) Displays

The manufacturing and usage of TFT displays are associated with several environmental concerns and regulations. One of the major concerns is the usage of hazardous materials in the production process, such as indium, gallium, and arsenic, which can pose risks to both human health and the environment if not properly handled and disposed of. Additionally, the energy-intensive manufacturing process of TFT displays comes up with greenhouse gas emissions, contributing to climate change.

The disposal of outdated or faulty TFT displays also raises concerns about electronic waste (e-waste) management, as improper handling can lead to environmental contamination and resource wastage.

To address these concerns, various environmental regulations and standards have been put in place globally and in the U.K. to govern the manufacturing and usage of TFT displays. These regulations often focus on reducing the use of hazardous materials, promoting energy efficiency, and enforcing proper e-waste recycling and disposal practices. Compliance with these regulations may require manufacturers to invest in cleaner production methods and adopt more environmentally friendly materials, which can lead to increased production costs.

Recent Development

- In June 2023, LG Display earned the ‘Circadian Friendly’ certification from TÜV Rheinland. It lowers the impact on the viewer’s biological pattern while still guaranteeing impeccable picture quality. This ‘Circadian Friendly’ certification given by TÜV Rheinland to its products such as TV and monitor panels will ensure improving its customers' quality of life during the day and promote better sleep at night. This further will allow the company to gain the trust of its customer by providing innovative solutions.

- In December 2022, LG Display introduced a new semiconductor technology Oxide TFTs to replace a–Si TFTs. This technology advancement boosts electron transfer rates 10x resulting in high definition and can be used to produce transparent OLEDs. It helped the company to offer innovative solutions to its customer and further expand and strengthen its market across various regions.

U.K. Thin Film Transistor (TFT) Display Market Scope

The U.K. thin film transistor (TFT) display market is categorized based on type, technology, fabrication type, installation type, layer, application, and end user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Panels

- High Bright Tfts

- High Resolution Tft Displays

- Emi Shielded Tft Displays

- Stretch Tfts

- Others

On the basis of type, the market is segmented into high bright tfts, stretch tfts, panels, emi shielded tft displays, high resolution tft displays, and others.

Technology

- TFT Liquid Crystal Display (LCD)

- Organic Light Emitting Diode (OLED)

- Active-Matrix Organic Light Emitting Diode (AMOLED)

- Others

On the basis of technology, the market is segmented into TFT liquid crystal display (LCD), organic light emitting diode (OLED), active-matrix organic light emitting diode (AMOLED), and others.

Layer

- Substrate

- Semiconductor

- Dielectric

- Gate Electrode

- Drain/Source Metal

On the basis of layer, the market is segmented into substrate, semiconductor, dielectric and gate electrode, and drain/source metal.

Installation Type

- Indoor

- Outdoor

On the basis of installation type, the market is segmented into indoor and outdoor.

Fabrication Type

- Inorganic

- Organic

On the basis of fabrication type, the market is segmented into inorganic and organic.

Application

- Domestic Use

- Industrial Use

- Commercial Use

On the basis of application, the market is segmented into domestic use, industrial use, and commercial use.

End User

- Consumer Electronics

- Automotive

- Healthcare

- Military

- Aerospace

On the basis of end user, the market is segmented into consumer electronics, automotive, healthcare, military, and aerospace.

Competitive Landscape and U.K. Thin Film Transistor (TFT) Display Market Share Analysis

The U.K. thin film transistor (TFT) display market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the U.K. thin film transistor (TFT) display market.

Some of the prominent participants operating in the U.K. thin film transistor (TFT) display market are SAMSUNG, LG Display, Sony Group Corporation, Toshiba Tec Corporation, Fujitsu, Schneider Electric, Anders Electronics PLC, New Vision Display (Shenzhen) Co, Ltd. (An Subsidiary of Tianjin Jingwei Huikai Optoelectronic Co., Ltd)., EIZO Corporation., and Midas Components among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKET S COVERED

2 MARKET SEGMENTATION

2.1 MARKET S COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 FUNCTION COVERAGE GRID

2.8 THE CATEGORY VS TIME GRID

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 MULTIVARIATE MODELLING

2.11 TYPE TIMELINE CURVE

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND OF CONSUMER ELECTRONICS

5.1.2 INCORPORATION OF TTF DISPLAY IN VARIOUS SECTORS SUCH AS AUTOMOTIVE AND HEALTHCARE

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN RAW MATERIALS PRICES

5.2.2 EMERGENCE OF ALTERNATIVE DISPLAY TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN DISPLAY TECHNOLOGIES

5.3.2 PARTNERSHIP AND AGREEMENTS BETWEEN DISPLAY AND END USE PRODUCT MANUFACTURERS

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL CONCERNS ASSOCIATED WITH TFT DISPLAYS

5.4.2 DEPENDENCY ON THE DYNAMICS OF END USE MARKET

6 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY INSTALLATION TYPE

6.1 OVERVIEW

6.2 INDOOR

6.3 OUTDOOR

7 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEWB

7.2 TFT LIQUID CRYSTAL DISPLAY (LCD)

7.2.1 ON THE BASIS OF BACKLIGHT

7.2.1.1 LIGHT GUIDE PLATE (LGP)

7.2.1.2 BRIGHTNESS ENHANCEMENT FILM (BEF)

7.2.1.3 DUAL BRIGHTNESS ENHANCEMENT FILM (DBEF)

7.2.2 ON THE BASIS OF INTERFACES

7.2.2.1 LVDS

7.2.2.2 MCU

7.2.2.3 MPU

7.2.2.4 TTL

7.2.2.5 CMOS

7.2.2.6 OTHERS

7.2.3 ON THE BASIS OF COATINGS

7.2.3.1 ANTI-GLARE (AG)

7.2.3.2 ANTI—REFLECTIVE (AR)

7.2.4 ON THE BASIS OF APPLICATION

7.2.4.1 HANDHELD DEVICES

7.2.4.2 TV

7.2.4.3 PERSONAL DIGITAL ASSISTANTS

7.2.4.4 NAVIGATION SYSTEMS

7.2.4.5 VIDEO GAME SYSTEMS

7.2.4.6 PROJECTORS

7.2.4.7 OTHERS

7.3 ORGANIC LIGHT EMITTING DIODE (OLED)

7.4 ACTIVE-MATRIX ORGANIC LIGHT EMITTING DIODE (AMOLED)

7.5 OTHERS

8 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE

8.1 OVERVIEW

8.2 PANELS

8.2.1 TWISTED NEMATIC (TN)

8.2.2 FHD PANELS

8.2.3 MULTI-DOMAIN VERTICAL ALIGNMENT (MVA)

8.2.3.1 S-MVA

8.2.3.2 A-MVA

8.2.3.3 P-MVA

8.2.4 4K UHD PANELS

8.2.5 TOUCH DISPLAY PANELS

8.2.6 TRANSPARENT PANELS

8.2.7 COMPACT PANELS

8.2.8 TRANSFLECTIVE PANELS

8.2.9 IOT COMPACT PANELS

8.2.10 FRINGE FIELD SWITCHING (FFS)

8.2.11 OTHERS

8.3 HIGH BRIGHT TFTS

8.4 HIGH RESOLUTION TFT DISPLAYS

8.5 EMI SHIELDED TFT DISPLAYS

8.6 STRETCH TFTS

8.7 OTHERS

9 U.K. THIN FI LM TRANSISTOR (TFT) DISPLAY MARKET, BY APLLICATION

9.1 OVERVIEW

9.2 DOMESTIC USE

9.3 COMMERCIAL USE

9.4 INDUSTRIAL USE

10 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY FABRICATION TYPE

10.1 OVERVIEW

10.2 INORGANIC

10.3 ORGANIC

11 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY LAYER

11.1 OVERVIEW

11.2 SEMICONDUCTOR

11.2.1 SILICON

11.2.2 METAL OXIDE

11.2.3 ORGANIC SEMICONDUCTORS

11.2.4 CARBON NANOTUBES

11.2.5 CADMIUM SELENIDE

11.2.6 OTHERS

11.3 SUBSTRATE

11.3.1 GLASS

11.3.2 PLASTIC

11.4 GATE ELECTRODE

11.4.1 POLYSILICON

11.4.2 TIN

11.4.3 TAN

11.4.4 WN

11.5 DIELECTRIC

11.5.1 SILICON OXIDE

11.5.2 SILICON NITRIDE

11.6 DRAIN/SOURCE METAL

12 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY END USER

12.1 OVERVIEW

12.2 CONSUMER ELECTRONICS

12.2.1 PANELS

12.2.2 HIGH BRIGHT TFTS

12.2.3 HIGH RESOLUTION TFT DISPLAYS

12.2.4 EMI SHIELDED TFT DISPLAYS

12.2.5 STRETCH TFTS

12.2.6 OTHERS

12.3 AUTOMOTIVE

12.3.1 PANELS

12.3.2 HIGH BRIGHT TFTS

12.3.3 HIGH RESOLUTION TFT DISPLAYS

12.3.4 EMI SHIELDED TFT DISPLAYS

12.3.5 STRETCH TFTS

12.3.6 OTHERS

12.4 HEALTHCARE

12.4.1 PANELS

12.4.2 HIGH BRIGHT TFTS

12.4.3 HIGH RESOLUTION TFT DISPLAYS

12.4.4 EMI SHIELDED TFT DISPLAYS

12.4.5 STRETCH TFTS

12.4.6 OTHERS

12.5 MILITARY & AEROSPACE

12.5.1 PANELS

12.5.2 HIGH BRIGHT TFTS

12.5.3 HIGH RESOLUTION TFT DISPLAYS

12.5.4 EMI SHIELDED TFT DISPLAYS

12.5.5 STRETCH TFTS

12.5.6 OTHERS

12.6 OTHERS

13 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.K.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SAMSUNG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 LG DISPLAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SONY GROUP CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 TOSHIBA TEC CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 FUJITSU

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ANDERS ELECTRONICS PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EIZO CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 MIDAS COMPONENTS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 NEW VISION DISPLAY (SHENZHEN) CO, LTD. (A SUBSIDIARY OF TIANJIN JINGWEI HUIKAI OPTOELECTRONIC CO., LTD)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 SCHNEIDER ELECTRIC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY INSTALLATION TYPE, 2021-2030 (USD MILLION)

TABLE 2 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 3 U.K. TFT LIQUID CRYSTAL DISPLAY (LCD) IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY BACKLIGHT UNIT, 2021-2030 (USD MILLION)

TABLE 4 U.K. TFT LIQUID CRYSTAL DISPLAY (LCD) IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY INTERFACES, 2021-2030 (USD MILLION)

TABLE 5 U.K. TFT LIQUID CRYSTAL DISPLAY (LCD) IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY COATINGS, 2021-2030 (USD MILLION)

TABLE 6 U.K. TFT LIQUID CRYSTAL DISPLAY (LCD) IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 U.K. PANELS IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.K. MULTI-DOMAIN VERTICAL ALIGNMENT (MVA) IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY APPLICATION 2021-2030 (USD MILLION)

TABLE 11 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY FABRICATION TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY LAYER, 2021-2030 (USD MILLION)

TABLE 13 U.K. SEMICONDUCTOR IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 U.K. SUBSTRATE IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.K. GATE ELECTRODE IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 U.K. DIELECTRIC IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 18 U.K. CONSUMER ELECTRONICS IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 U.K. AUTOMOTIVE IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.K. HEALTHCARE IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.K. MILITARY & AEROSPACE IN THIN FILM TRANSISTOR (TFT) DISPLAY MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: SEGMENTATION

FIGURE 2 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: APPLICATION COVERAGE GRID ANALYSIS

FIGURE 9 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: THE CATEGORY VS TIME GRID

FIGURE 10 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: MULTIVARIATE MODELLING

FIGURE 12 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: TYPE TIMELINE CURVE

FIGURE 13 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: SEGMENTATION

FIGURE 15 GROWING DEMAND FOR CONSUMER ELECTRONICS ACROSS U.K. S IS EXPECTED TO BE KEY DRIVER FOR THE U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 PANELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET IN 2023 TO 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET

FIGURE 18 COMPARATIVE REPRESENTATION BETWEEN THE PERCENTAGES OF SMART PHONE-USING ADULTS IN THE U.K.

FIGURE 19 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY INSTALLATION TYPE, 2022

FIGURE 20 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY TECHNOLOGY, 2022

FIGURE 21 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY TYPE, 2022

FIGURE 22 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY APPLICATION, 2022

FIGURE 23 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY FABRICATION TYPE, 2022

FIGURE 24 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY LAYER, 2022

FIGURE 25 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: BY END USER, 2022

FIGURE 26 U.K. THIN FILM TRANSISTOR (TFT) DISPLAY MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.