Asia Pacific Glyoxal Market

Размер рынка в млрд долларов США

CAGR :

%

USD

274.18 Million

USD

473.38 Million

2025

2033

USD

274.18 Million

USD

473.38 Million

2025

2033

| 2026 –2033 | |

| USD 274.18 Million | |

| USD 473.38 Million | |

|

|

|

|

Asia-PacificGlyoxal Market Segmentation, By Grade (Industrial Grade, Pharmaceutical Grade), Purity (90%–99%, 40%–60%, Others), Production Process (Catalytic Oxidation of Ethylene Glycol, Oxidation of Acetylene and Others), Packaging (Bottles, Drums, Jerrycans, Composite IBC, Bulk), Application (Cross-Linking, Chemical Intermediates and others), end-use chemicals (Dihydroxyethylene Urea (DHEU), 2-Imidazolidinone, Glyoxalated Polyacrylamide (GPAM), Glyoxylic Acid, Glyoxalated Starch, Glyoxal Phenol Resin, Glyoxal Urea Resin, Ethylene Glycol Diformate, Urea-Glyoxal Concentrate, Quinoxaline Derivatives, Methylol Glyoxal, Glyoxal-Bis(2-Hydroxyanil), Glyoxal Sodium Bisulfite, Quinoxaline, 2-Methylimidazole, Imidazole, Glycoluril, Allantoin, Tetramethylol Acetylenediurea), End-Use Industry (Textile, Pulp and Paper, Leather, Paints and Coatings, Water Treatment, Pharmaceuticals, Household Products, Cosmetics and Personal Care, Packaging, Electrical and Electronics, Oil and Gas, Others) - Industry Trends and Forecast to 2033

Asia-Pacific Glyoxal Market Size

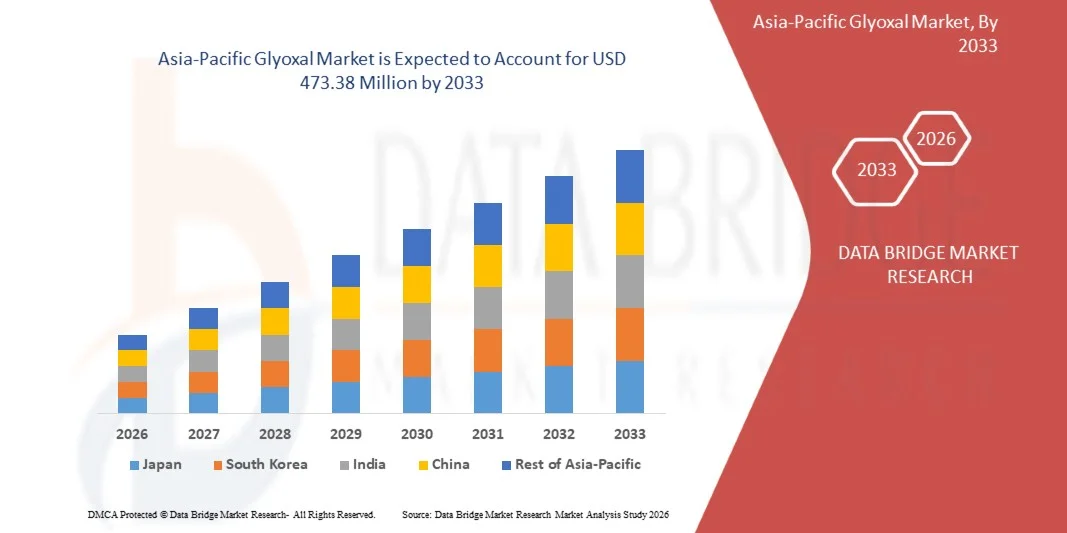

- The Asia-Pacific Glyoxal Market size was valued at USD 274.18 Million in 2025 and is expected to reach USD 473.38 Million by 2033, at a CAGR of 6.1% during the forecast period

- The rising utilization of glyoxal as a crosslinking agent in textile finishing is a major factor driving demand across the region.

- The growing adoption in paper and packaging for wet-strength and surface treatment applications is further strengthening market reach.

Asia-Pacific Glyoxal Market Analysis

- The Asia-Pacific Glyoxal Market serves diverse industries including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Demand is driven by its strong crosslinking properties and role as a key intermediate in specialty and performance chemical formulations.

- Rising textile finishing activities, increasing paper packaging consumption, and growing use of eco-friendly resins are major demand drivers. Expansion of pharmaceutical manufacturing and stricter wastewater treatment regulations further support sustained glyoxal consumption worldwide.

- The market features a mix of multinational chemical producers and regional manufacturers. Competition is based on product purity, application-specific grades, pricing, supply reliability, and compliance with environmental and safety regulations across key end-use industries.

- China dominates the Asia-Pacific Glyoxal Market, holding a 43.69% market share, driven by large-scale manufacturing capacity, low production costs, and abundant raw material availability. Strong downstream demand from the textiles, resins, paper, and leather industries, combined with a well-established chemical supply chain, further reinforces its market leadership.

- In 2025, the Industrial Grade segment is expected to dominate the Asia-Pacific Glyoxal Market with an 81.39% share due to its widespread use in manufacturing resins, adhesives, and paper treatment chemicals. The segment benefits from high demand in large-scale industrial applications and cost-effectiveness for bulk production, making it the preferred choice over other grades.

Report Scope and Asia-Pacific Glyoxal Market Segmentation

|

Attributes |

Asia-Pacific Glyoxal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Glyoxal Market Trends

“Rising utilization of glyoxal as a crosslinking agent in textile finishing.”

- Glyoxal is increasingly used as a crosslinking agent in textile finishing due to its ability to enhance fabric performance without affecting texture or comfort.

- It improves wrinkle resistance, dimensional stability, crease recovery, and easy-care properties, especially in cotton and cellulose-based fabrics.

- Glyoxal is compatible with existing finishing processes and cost-effective, making it a preferred choice in large-scale textile manufacturing

- Industry reports (nbinno.com, Silver Fern Chemical, AlphaChem.biz, Ataman Chemicals, 2025) highlight its role in improving fabric strength, moisture resistance, and durability in textiles and leather.

- Its adoption reflects the apparel industry’s demand for durable, wrinkle-resistant, and easy-care fabrics, supporting value-added finishes and consistent product quality.

- Glyoxal is expected to remain an essential component in textile finishing formulations, sustaining demand in the Asia-Pacific Glyoxal Market.

Asia-Pacific Glyoxal Market Dynamics

Driver

Growing Demand from The Food & Beverage Sector

- Glyoxal adoption in paper and packaging is growing due to its ability to enhance wet strength, surface durability, and overall performance of paper-based products.

- It improves moisture resistance, dimensional stability, printability, and structural integrity, making it valuable for packaging papers, paperboard, and specialty paper products.

- Industry reports (ChemCeed, NBINNO.com, ivySCI, 2025) highlight glyoxal’s role in enhancing wet and dry strength, reducing water absorption, and improving tensile strength in paper and starch-based sizing formulations.

- Its compatibility with various paper grades and surface treatments enables manufacturers to produce high-quality, durable, and functional packaging papers that withstand humid or wet conditions.

- With rising demand for reliable packaging in food, consumer goods, and industrial sectors, glyoxal is expected to remain a key agent for wet-strength enhancement and surface treatment in the global paper and packaging market.

Restraint/Challenge

Handling complexity due to high reactivity and stability sensitivity

- The handling of glyoxal poses significant challenges due to its high chemical reactivity and sensitivity to storage and environmental conditions. Improper storage, temperature fluctuations, or prolonged exposure to air and light can lead to polymerization or degradation, necessitating strict safety protocols, specialized storage solutions, and controlled transportation methods. These requirements increase operational costs and demand skilled personnel, particularly in small and medium-scale manufacturing facilities.

- For example, as reported by Amzole India Pvt. Ltd. in July 2025, the safety data sheet for glyoxal 40% emphasizes its highly reactive nature and the critical need for specialized handling to prevent polymerization, irritant exposure, and reactions with incompatible substances such as strong oxidizers and bases. Similarly, ChemSpider documentation in April 2025 highlights that glyoxal can react violently with air, water, and chemical agents like sodium hydroxide, making controlled storage, careful transportation, and strict safety measures essential during handling.

- These handling complexities directly affect storage, transportation, and operational costs, posing particular challenges for smaller manufacturers. Despite these constraints, glyoxal continues to be widely used across textiles, paper, adhesives, and chemical intermediates due to its versatile applications and functional benefits.

- Consequently, careful management of glyoxal’s reactive properties is essential for safe and efficient utilization, ensuring that industries can leverage its advantages while mitigating risks in the global market.

Asia-Pacific Glyoxal Market Scope

The market is segmented on the basis of grade, purity, production process, packaging application, end-use chemicals and end-use industry.

By Grade

Based on grade, the Asia-Pacific Glyoxal Market is primarily segmented into Industrial Grade and Pharmaceutical Grade.

By 2026, the Industrial Grade segment is projected to dominate the market, accounting for 81.30% of the total share. This dominance is attributed to its extensive applications across various industries, including textiles, paper processing, resins, leather treatment, and water treatment. The high-volume consumption of industrial-grade glyoxal is further supported by its cost-effectiveness and efficiency in large-scale operations. Additionally, the rapid expansion of industrial and manufacturing sectors in the Asia-Pacific region is driving strong and sustained demand. As a result, industrial-grade glyoxal is expected to remain the key growth driver within the regional market.

The Pharmaceutical Grade segment in the Asia-Pacific Glyoxal Market is expected to grow fastest from 2026 to 2033, driven by rising demand in pharmaceutical synthesis, stringent regulatory requirements for high-purity chemicals, and the expansion of advanced drug manufacturing and specialty applications. These factors boost the adoption of high-quality glyoxal in APIs and innovative drug formulations.

By Purity

On the basis of purity, the Asia-Pacific Glyoxal Market is segmented into 90%–99%, 40%–60%, and Others.

By 2026, the 40%–60% purity segment is expected to dominate the market, accounting for 72.34%of the total share. This segment’s prominence is attributed to its superior performance, higher reactivity, and suitability for advanced applications across pharmaceuticals, specialty resins, textiles, and cosmetics. Its consistent quality, along with adherence to stringent industry standards, further drives strong and sustained demand. Additionally, the balance between effectiveness and cost-efficiency makes this purity range highly preferred by manufacturers. As a result, the 40%–60% purity segment is projected to remain the primary contributor to growth in the Asia-Pacific Glyoxal Market.

The 90%-99% purity segment in the Asia-Pacific Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its widespread use in pharmaceutical and specialty chemical applications that require high-purity glyoxal, along with increasing demand for advanced drug formulations and regulatory-compliant production processes.

By Production Process

On the basis of production process, the Asia-Pacific Glyoxal Market is segmented into Catalytic Oxidation of Ethylene Glycol, Oxidation of Acetylene, and Others.

By 2026, the Catalytic Oxidation of Ethylene Glycol segment is expected to dominate the market, accounting for 89.61% of the total share. This segment’s dominance is driven by its higher production efficiency, better yield control, and lower impurity levels compared to acetylene-based processes. Additionally, it offers improved safety and is more environmentally compliant, making it highly suitable for large-scale manufacturing. The cost-effectiveness and scalability of this method further reinforce its preference among manufacturers. As a result, the catalytic oxidation route is poised to remain the primary driver of growth in the Asia-Pacific Glyoxal Market.

The “Oxidation of Acetylene” production process segment in the Asia-Pacific Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its ability to produce high-purity glyoxal suitable for pharmaceutical and specialty chemical applications, along with rising demand for advanced drug formulations and compliance with strict quality and regulatory standards.

By Packaging

On the basis of packaging, the Asia-Pacific Glyoxal Market is segmented into Drums, Composite IBC, Bulk, Jerrycans, and Bottles.

By 2026, the Bottles segment is expected to dominate the market, accounting for 38.28% of the total share. This dominance is attributed to its versatility, ease of handling, and safe storage, particularly for small-quantity applications. Bottles are especially suitable for pharmaceuticals, cosmetics, and specialty chemical uses, where precision and safety are critical. Additionally, their wide availability and cost-effective production further drive strong adoption across industries. The convenience and reliability of bottle packaging make it a preferred choice for manufacturers and end-users alike.

The “Composite IBC” packaging segment in the Asia-Pacific Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its efficiency in storing and transporting bulk chemicals, enhanced safety and chemical resistance, and increasing demand from pharmaceutical, specialty chemical, and industrial users who require reliable, large-capacity packaging solutions.

By Application

On the basis of packaging, the Asia-Pacific Glyoxal Market is segmented into Drums, Composite IBC, Bulk, Jerrycans, and Bottles.

By 2026, the Bottles segment is expected to dominate the market, accounting for 64.31% of the total share. This dominance is attributed to its versatility, ease of handling, and safe storage, particularly for small-quantity applications. Bottles are especially suitable for pharmaceuticals, cosmetics, and specialty chemical uses, where precision and safety are critical. Additionally, their wide availability and cost-effective production further drive strong adoption across industries. The convenience and reliability of bottle packaging make it a preferred choice for manufacturers and end-users alike.

The Chemical Intermediates application segment in the Asia-Pacific Glyoxal Market is expected to be the fastest-growing segment from 2026 to 2033, driven by increasing demand for resins, polymers, and specialty chemicals, the expansion of the chemical manufacturing industry, and the use of glyoxal as a versatile cross-linking and reactive intermediate in industrial and specialty applications.

By End-Use Chemicals

On the basis of end-use chemicals, the Asia-Pacific Glyoxal Market is segmented into Dihydroxyethylene Urea (DHEU), 2-Imidazolidinone, Glyoxalated Polyacrylamide (GPAM), Glyoxylic Acid, Glyoxalated Starch, Glyoxal Phenol Resin, Glyoxal Urea Resin, Ethylene Glycol Diformate, Urea-Glyoxal Concentrate, Quinoxaline Derivatives, Methylol Glyoxal, Glyoxal-Bis(2-Hydroxyanil), Glyoxal Sodium Bisulfite, Quinoxaline, 2-Methylimidazole, Imidazole, Glycoluril, Allantoin, and Tetramethylol Acetylenediurea.

By 2026, the Dihydroxyethylene Urea (DHEU) segment is expected to dominate the market, accounting for 17.79% of the total share. Its dominance is driven by its wide applicability in textile finishing, paper treatment, and resin manufacturing. The segment benefits from high reactivity, consistent performance, and compatibility with various industrial processes. Additionally, growing demand for high-quality textiles and specialty chemical products in the Asia-Pacific region supports its strong market position. DHEU’s cost-effectiveness and efficiency further reinforce its preference among manufacturers and end-users.

The 2-Imidazolidinone end-use chemicals segment in the Asia-Pacific Glyoxal Market is expected to be the fastest-growing from 2026 to 2033, driven by its increasing use in pharmaceuticals, agrochemicals, and specialty chemical applications. Its growth is fueled by the rising demand for high-purity glyoxal as a key intermediate in synthesizing 2-Imidazolidinone for advanced formulations and regulatory-compliant chemical production.

By End-User

On the basis of end-user, the Asia-Pacific Glyoxal Market is segmented into Textile, Pulp and Paper, Leather, Paints and Coatings, Water Treatment, Pharmaceuticals, Household Products, Cosmetics and Personal Care, Packaging, Electrical and Electronics, Oil and Gas, and Others.

By 2026, the Textile segment is expected to dominate the market, accounting for 33.55% of the total share. This growth is driven by its widespread use in fabric finishing, wrinkle resistance, and crease-proof treatments. The increasing demand for durable and high-quality textiles, coupled with rapid expansion in the apparel and home furnishing industries, further supports market growth. Additionally, rising consumer preference for premium and long-lasting fabrics boosts the adoption of glyoxal-based solutions. As a result, the Textile segment is poised to remain the key contributor to the Asia-Pacific Glyoxal Market.

The Pulp and Paper end-user segment in the Asia-Pacific Glyoxal Market is expected to be the fastest-growing from 2026 to 2033, driven by the increasing demand for wet-strength resins and chemical additives that enhance paper durability and quality. Growth is supported by the expansion of the paper and packaging industry and the shift toward high-performance, sustainable paper products.

Asia-Pacific Glyoxal Market Regional Analysis

- In 2026, China is projected to dominate the Asia-Pacific Glyoxal Market, accounting for 43.88% of total revenue. This leadership is driven by rapid industrialization, strong demand from the textiles and paper industries, and the country’s well-established chemical manufacturing infrastructure.

- India is experiencing rapid growth due to increasing textile and paper production, expanding industrial applications, and rising investment in chemical manufacturing and value-added finishing processes.

- Japan is witnessing growth due to advanced chemical manufacturing technologies, high demand for specialty chemicals, and adoption of glyoxal in textiles, paper, and coatings industries.

- South Korea is experiencing growth driven by its strong industrial base, increasing use of glyoxal in textiles, paper, and adhesives, and focus on high-performance and value-added chemical applications.

India Asia-Pacific Glyoxal Market Insight

India is experiencing rapid growth in the Asia-Pacific Glyoxal Market due to expanding textile and paper production and rising industrial applications. Growing investment in chemical manufacturing and value-added finishing processes supports increased adoption. The demand for durable, easy-care fabrics and high-performance paper products is driving market expansion. As industries focus on efficiency and quality, India’s Asia-Pacific Glyoxal Market is expected to continue its upward trajectory.

Japan Asia-Pacific Glyoxal Market Insight

Japan’s Asia-Pacific Glyoxal Market is witnessing growth driven by advanced chemical manufacturing technologies and strong demand for specialty chemicals. The adoption of glyoxal in textiles, paper, coatings, and adhesives supports diverse industrial applications. Focus on high-performance and value-added chemical products further fuels market development. Continuous innovation and technological advancement are expected to sustain Japan’s market growth.

The Major Market Leaders Operating in the Market Are:

-

Amzole India Pvt. Ltd (India)

- Asis Scientific Pty Ltd (Australia)

- Ataman Chemicals (India)

- BASF SE (Germany)

- Bidvest Chemical (South Africa)

- Bisley Asia (M) Sdn Bhd (Malaysia)

- Eastman Chemical Company (U.S.)

- Fluorochem Limited (U.K.)

- Fujifilm Wako Pure Chemical Corporation (Japan)

- Glentham Life Sciences Limited (U.K.)

- GetChem Co., Ltd. (China)

- Hanna Instruments Ltd (U.S.)

- Himedia Laboratories (India)

- Kanto Kagaku (Japan)

- Kemira Oyj (Finland)

- Merck KGaA (Germany)

- Meru Chem Pvt. Ltd (India)

- Muby Chemicals (India)

- Multichem Specialities Private Limited (India)

- Oakwood Products Inc. (U.S.)

- Otto Chemie Pvt. Ltd (India)

- Oxford Lab Fine Chem LLP (India)

- Santa Cruz Biotechnology Inc. (U.S.)

- Sasol (South Africa)

- Silver Fern Chemical, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Univar Solutions LLC (U.S.)

- Weylchem International GmbH (Germany)

- Zhishang Chemical (China)

Latest Developments in Asia-Pacific Glyoxal Market

- In June 2022, Univar Solutions was appointed the exclusive distributor of BASF’s Chemical Intermediates’ Glyoxal in the United States and Canada. This partnership aims to provide customers in textiles, disinfection, paper, leather, cosmetics, and epoxy industries with reliable access to BASF’s Glyoxal, a biodegradable crosslinking agent that enhances flexibility, viscosity, anti-wrinkle properties, softening, and moisture resistance in various formulations. This collaboration will help BASF strengthen its market presence in North America by leveraging Univar Solutions’ extensive distribution network and supply chain capabilities, ensuring wider reach and reliable delivery of Glyoxal to customers.

- In January, Merck KGaA announced the completion of its acquisition of the chemical business of Mecaro, now operating as M Chemicals Inc. This acquisition expanded Merck’s research and development capabilities as well as production facilities, strengthening its portfolio in semiconductor precursor materials and electronics chemicals. While it represents a strategic growth in Merck’s chemical business, the acquisition is not related to glyoxal (glyoxyl) products, as the focus remains on advanced materials for the semiconductor and electronics industry rather than specialty aldehyde chemistry.

- In December 2025, Thermo Fisher Scientific Inc. announced the launch of two new products Gibco Bacto CD Supreme FPM Plus and Gibco Bacto CD Supreme Feed (2X) which expand the company’s Gibco Bacto CD line of chemically defined media to enhance and simplify Escherichia coli (E. coli) biomanufacturing workflows. These next‑generation chemically defined formulations are designed to support higher yields, consistent performance, and scalable production of plasmid DNA and recombinant proteins, particularly for applications in gene therapy and mRNA vaccine development.

- In May 2025, Alpha Chemika expanded its portfolio of laboratory reagents and fine chemicals by introducing additional AR/GR/LR grade products and diversified specialty laboratory chemicals to support analytical, pharmaceutical, and life-science research applications, reinforcing its commitment to meeting evolving global research and industrial demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.