Global Rail Brake Frame Market

Размер рынка в млрд долларов США

CAGR :

%

USD

75.25 Billion

USD

96.81 Billion

2025

2033

USD

75.25 Billion

USD

96.81 Billion

2025

2033

| 2026 –2033 | |

| USD 75.25 Billion | |

| USD 96.81 Billion | |

|

|

|

|

Global Rail Brake Frame Market Segmentation, By Material Type (Steel Plate Brake Frame, Cast Steel Brake Frame, and Aluminum Brake Frame), Rail Type (Passenger Rail and Transit Rail) - Industry Trends and Forecast to 2033

Rail Brake Frame Market Size

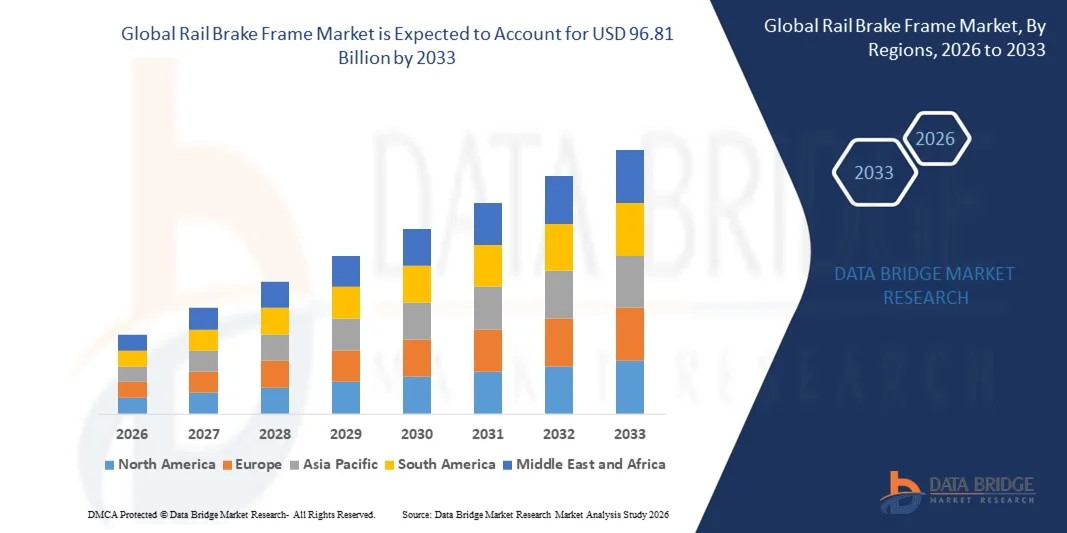

- The global rail brake frame market size was valued at USD 75.25 billion in 2025 and is expected to reach USD 96.81 billion by 2033, at a CAGR of 3.2% during the forecast period

- The market growth is largely fueled by the increasing expansion of passenger and transit rail networks, which is driving demand for durable and reliable brake frames capable of withstanding high operational loads and frequent start-stop cycles

- Furthermore, rising investments in rail infrastructure modernization, including high-speed rail projects and urban metro systems, are creating a need for advanced braking solutions. These converging factors are accelerating the adoption of modern rail brake frames, thereby significantly boosting the industry’s growth

Rail Brake Frame Market Analysis

- Rail brake frames, providing structural support and housing for braking components, are increasingly critical for ensuring safe and efficient rail operations across passenger and transit systems due to their strength, durability, and compatibility with advanced braking technologies

- The escalating demand for rail brake frames is primarily fueled by rapid urbanization, government initiatives supporting public transportation, and growing emphasis on rail safety and performance optimization. In addition, the shift toward lightweight, energy-efficient, and low-maintenance materials is further propelling market growth

- Asia-Pacific dominated the rail brake frame market in 2025, due to rapid expansion of passenger and transit rail networks, increasing investments in urban mobility infrastructure, and a growing presence of rail component manufacturers

- North America is expected to be the fastest growing region in the rail brake frame market during the forecast period due to increasing investments in urban rail infrastructure, high-speed rail projects, and replacement of aging fleets

- Passenger rail segment dominated the market with a market share of 61.8% in 2025, due to the extensive expansion of high-speed and intercity rail networks globally. Passenger rail operators prioritize brake frames with high reliability, performance, and safety features to ensure smooth and secure travel for commuters. The growing modernization of rail fleets and replacement of older brake systems further contributes to the segment’s dominance. Advanced braking technologies integrated into passenger trains, such as regenerative braking, also rely on durable brake frames to maximize operational efficiency and longevity

Report Scope and Rail Brake Frame Market Segmentation

|

Attributes |

Rail Brake Frame Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Rail Brake Frame Market Trends

Growing Adoption of Advanced and Lightweight Brake Frame Materials

- A significant trend in the rail brake frame market is the increasing use of advanced and lightweight materials, including high-strength steel alloys and aluminum, to improve performance, reduce overall train weight, and enhance energy efficiency. These materials are enabling manufacturers to design brake frames that meet the rigorous safety and durability requirements of modern passenger and transit rail systems

- For instance, Knorr‑Bremse and Wabtec are supplying high-performance lightweight brake frames for metro and high-speed trains, which improve braking efficiency while reducing energy consumption and maintenance needs. Such innovations are positioning these companies as leaders in modern rail component solutions

- The adoption of lightweight brake frames is growing rapidly in high-speed and urban transit systems, where weight reduction directly contributes to faster acceleration, lower energy costs, and extended equipment lifespan. This is reinforcing the role of advanced materials as critical enablers for next-generation rail mobility

- Rail operators are increasingly integrating these materials to meet sustainability and operational efficiency targets, ensuring compliance with emerging environmental and safety regulations. The trend is also driving research into corrosion-resistant alloys and modular frame designs that simplify installation and maintenance

- Manufacturers are leveraging these innovations to enhance the performance of both freight and passenger rail applications, improving braking responsiveness and safety under heavy load conditions. This focus on material optimization is shaping procurement strategies and influencing long-term rail infrastructure investments

- The market is witnessing strong growth in lightweight and high-strength brake frame adoption as rail operators aim to modernize aging fleets and implement energy-efficient solutions. This rising incorporation of advanced materials is reinforcing overall market expansion and creating competitive differentiation across global rail component suppliers

Rail Brake Frame Market Dynamics

Driver

Expansion of Passenger and Transit Rail Networks

- The growing construction and expansion of passenger and transit rail networks worldwide is driving demand for robust and reliable rail brake frames that ensure operational safety and efficiency. These infrastructure projects are creating opportunities for manufacturers to supply advanced braking components tailored to diverse rail applications

- For instance, Wabtec Corporation is supplying brake systems and frames for India’s expanding high-speed and freight rail projects, supporting modernization and fleet upgrades. These contracts reinforce the importance of durable brake frames in sustaining performance under intensive operational conditions

- Rapid urbanization and increasing public transport adoption are fueling investments in metro, light rail, and regional rail systems, thereby boosting demand for high-performance brake frames that meet stringent safety and maintenance standards

- Rail operators’ focus on reducing operational downtime, enhancing passenger safety, and optimizing braking efficiency is further supporting the adoption of advanced rail brake frames. The demand for modular and easily maintainable frames is growing in parallel with infrastructure expansion

- The ongoing modernization of aging fleets across developed and developing economies is reinforcing this driver, as operators seek to integrate lightweight, energy-efficient, and long-lasting brake frames. These factors collectively accelerate market growth and establish rail brake frames as essential components of modern rail systems

Restraint/Challenge

High Manufacturing and Maintenance Costs

- The rail brake frame market faces challenges due to the high costs associated with manufacturing advanced, high-strength, and lightweight components. These frames require specialized materials, precision engineering, and strict quality control to ensure safety and reliability, which increases production complexity and overall expenses

- For instance, companies such as Knorr‑Bremse employ advanced forging and machining techniques to produce lightweight, corrosion-resistant brake frames. These processes demand skilled labor, high-end equipment, and stringent testing, contributing to elevated costs across the supply chain

- The maintenance of advanced brake frames also incurs significant expenses, particularly for high-speed and heavy-duty rail applications that experience substantial wear and operational stress. This limits cost flexibility for operators and can slow adoption rates

- Reliance on rare or specialized alloys further increases production costs and creates supply-side vulnerabilities, impacting pricing stability and availability. Manufacturers must balance performance requirements with economic feasibility to remain competitive

- The market continues to face constraints in scaling production while maintaining high quality and compliance with safety standards. These challenges collectively place pressure on manufacturers and rail operators to optimize processes, reduce costs, and sustain long-term growth in the rail brake frame sector

Rail Brake Frame Market Scope

The market is segmented on the basis of material type and rail type.

- By Material Type

On the basis of material type, the rail brake frame market is segmented into steel plate brake frame, cast steel brake frame, and aluminum brake frame. The steel plate brake frame segment dominated the market with the largest revenue share of 55.1% in 2025, driven by its high strength, durability, and resistance to heavy loads and impact. Rail operators prefer steel plate frames for their proven performance in high-speed passenger trains and freight locomotives, offering reliability and longevity under rigorous operating conditions. The availability of advanced steel alloys and enhanced manufacturing techniques further strengthens the segment’s market position, as these frames ensure safety and minimal maintenance requirements. In addition, steel plate brake frames are compatible with most existing braking systems, allowing for seamless integration into conventional rail infrastructure.

The aluminum brake frame segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for lightweight components to improve fuel efficiency and reduce overall train weight. Aluminum frames offer corrosion resistance, ease of manufacturing, and lower maintenance costs, making them particularly attractive for modern passenger and transit rail systems. The shift toward sustainable and energy-efficient rail solutions encourages the adoption of aluminum materials in new rail projects. Rail manufacturers are investing in advanced aluminum alloys and designs to balance strength with weight reduction, further accelerating market adoption. The growing focus on reducing operational costs and enhancing train performance supports the segment’s rapid growth.

- By Rail Type

On the basis of rail type, the rail brake frame market is segmented into passenger rail and transit rail. The passenger rail segment held the largest market revenue share of 61.8% in 2025, driven by the extensive expansion of high-speed and intercity rail networks globally. Passenger rail operators prioritize brake frames with high reliability, performance, and safety features to ensure smooth and secure travel for commuters. The growing modernization of rail fleets and replacement of older brake systems further contributes to the segment’s dominance. Advanced braking technologies integrated into passenger trains, such as regenerative braking, also rely on durable brake frames to maximize operational efficiency and longevity.

The transit rail segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rapid urbanization and the expansion of metro and light rail networks in emerging economies. Transit rail systems demand lightweight, cost-effective, and easy-to-maintain brake frames to support frequent start-stop operations and high passenger turnover. Aluminum and modular brake frames are increasingly being adopted in this segment due to their efficiency and reduced energy consumption. Investments in urban transport infrastructure projects and smart transit systems accelerate the demand for modernized brake frames. In addition, city planners and operators focus on enhancing passenger safety and operational reliability, driving growth in the transit rail segment.

Rail Brake Frame Market Regional Analysis

- Asia-Pacific dominated the rail brake frame market with the largest revenue share in 2025, driven by rapid expansion of passenger and transit rail networks, increasing investments in urban mobility infrastructure, and a growing presence of rail component manufacturers

- The region’s cost-effective manufacturing landscape, rising investments in high-speed rail projects, and supportive government policies for public transportation development are accelerating market expansion

- The availability of skilled labor, rapid industrialization in developing economies, and growing focus on modernizing rail fleets are contributing to increased adoption of advanced brake frame technologies

China Rail Brake Frame Market Insight

China held the largest share in the Asia-Pacific rail brake frame market in 2025, owing to its status as a global leader in rail manufacturing and high-speed rail network expansion. The country’s strong industrial base, government initiatives supporting rail infrastructure development, and active export of rail components are major growth drivers. Demand is further bolstered by continuous investments in urban transit projects and modernization of existing rail fleets.

India Rail Brake Frame Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urbanization, expansion of metro and light rail systems, and increasing government investment in sustainable transport infrastructure. Initiatives such as “Smart Cities” and modernization programs for existing rail networks are strengthening the demand for rail brake frames. In addition, growing domestic manufacturing capabilities and adoption of lightweight and energy-efficient brake frames are contributing to robust market expansion.

Europe Rail Brake Frame Market Insight

The Europe rail brake frame market is expanding steadily, supported by stringent safety regulations, high demand for durable and reliable braking systems, and growing investments in high-speed and regional rail modernization projects. The region emphasizes sustainability, energy efficiency, and advanced rail technologies, particularly in passenger and transit systems. Increasing replacement and upgrade cycles for older rail fleets are further enhancing market growth.

Germany Rail Brake Frame Market Insight

Germany’s rail brake frame market is driven by its leadership in precision rail manufacturing, strong engineering expertise, and export-oriented rail industry. The country’s well-established R&D networks and focus on innovation in rail safety and performance are fostering continuous development of advanced brake frames. Demand is particularly strong for high-speed passenger trains and modern regional rail systems.

U.K. Rail Brake Frame Market Insight

The U.K. market is supported by investments in urban transit, ongoing modernization of rail fleets, and rising focus on passenger safety and system reliability. Initiatives to enhance commuter rail and metro systems, coupled with collaborations between rail manufacturers and research institutions, are driving demand for high-quality brake frames. The emphasis on lightweight and energy-efficient materials is further boosting adoption in the region.

North America Rail Brake Frame Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing investments in urban rail infrastructure, high-speed rail projects, and replacement of aging fleets. Rising focus on energy efficiency, safety standards, and adoption of advanced braking technologies are boosting demand. In addition, reshoring of rail manufacturing and expansion of domestic production capacities are supporting market growth.

U.S. Rail Brake Frame Market Insight

The U.S. accounted for the largest share in the North America rail brake frame market in 2025, underpinned by its extensive passenger and transit rail networks, strong R&D infrastructure, and investment in modern rail technologies. The country’s focus on rail safety, performance optimization, and sustainable materials is encouraging adoption of advanced brake frames. Presence of leading rail component manufacturers and a mature supply chain further solidify the U.S.’s dominant position in the region.

Rail Brake Frame Market Share

The rail brake frame industry is primarily led by well-established companies, including:

- CRRC Corporation Limited (China)

- Alstom (France)

- Wabtec Corporation (U.S.)

- Simplex Engineering & Foundry Works Pvt. Ltd. (India)

- Fundiciones Del Estanda, S.A. (Spain)

- Knorr-Bremse AG (Germany)

- Rane Holdings Limited (India)

- Caterpillar (U.S.)

- Miner Enterprises Inc. (U.S.)

- L.B. Foster (U.S.)

- AKEBONO BRAKE INDUSTRY CO., LTD. (Japan)

- Japan Brake Industrial Co., Ltd. (Japan)

Latest Developments in Global Rail Brake Frame Market

- In June 2025, Knorr‑Bremse won new contracts from CRRC to supply braking systems for over 1,000 metro cars across multiple Chinese cities. This expansion significantly strengthens Knorr‑Bremse’s presence in the world’s largest rail market and reflects growing demand for modern brake frames and systems in dense urban transit networks. The deal underscores the increasing preference for reliable, high-performance braking solutions in metro operations and supports further technological adoption in Asia-Pacific urban rail infrastructure

- In May 2025, Knorr‑Bremse secured a supply deal to outfit up to 30 trains of the Rome Metro with advanced braking, coupling, and entrance systems. This development highlights the rising demand for integrated brake-system solutions in metro operations and demonstrates how modern brake frames are being incorporated into comprehensive rail system upgrades. The project is expected to drive innovation in lightweight, energy-efficient brake frames that meet stringent safety and performance standards

- In April 2024, Knorr‑Bremse completed the acquisition of Alstom Signaling’s conventional rail-signaling business in North America. This strategic expansion broadens Knorr‑Bremse’s portfolio beyond braking to signaling and control systems, enabling integrated rail solutions. The acquisition is expected to create synergies with the brake frame segment, promote adoption of advanced, system-level rail components, and enhance the company’s market footprint in North America and globally

- In January 2024, Wabtec Corporation was awarded a $157 million contract by Siemens India Private Limited to supply brake systems for 1,200 new 9000 HP electric locomotives for Indian Railways. This large-scale order reflects strong market demand for high-performance brake frames and signals significant replacement and modernization activity in India’s rail network. The project accelerates the adoption of advanced braking components and establishes a benchmark for durability, reliability, and efficiency in freight and passenger operations

- In September 2023, Knorr‑Bremse introduced its next-generation CubeControl brake control system for high-speed trains commissioned by Alstom. This technology upgrade enhances braking precision, reliability, and responsiveness, directly influencing the demand for modern brake frames compatible with advanced control systems. It sets a new standard for high-speed rail safety and efficiency while encouraging manufacturers to adopt integrated, intelligent braking solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.