China E Mobility Market

Taille du marché en milliards USD

TCAC :

%

USD

153.45 Billion

USD

919.56 Billion

2024

2032

USD

153.45 Billion

USD

919.56 Billion

2024

2032

| 2025 –2032 | |

| USD 153.45 Billion | |

| USD 919.56 Billion | |

|

|

|

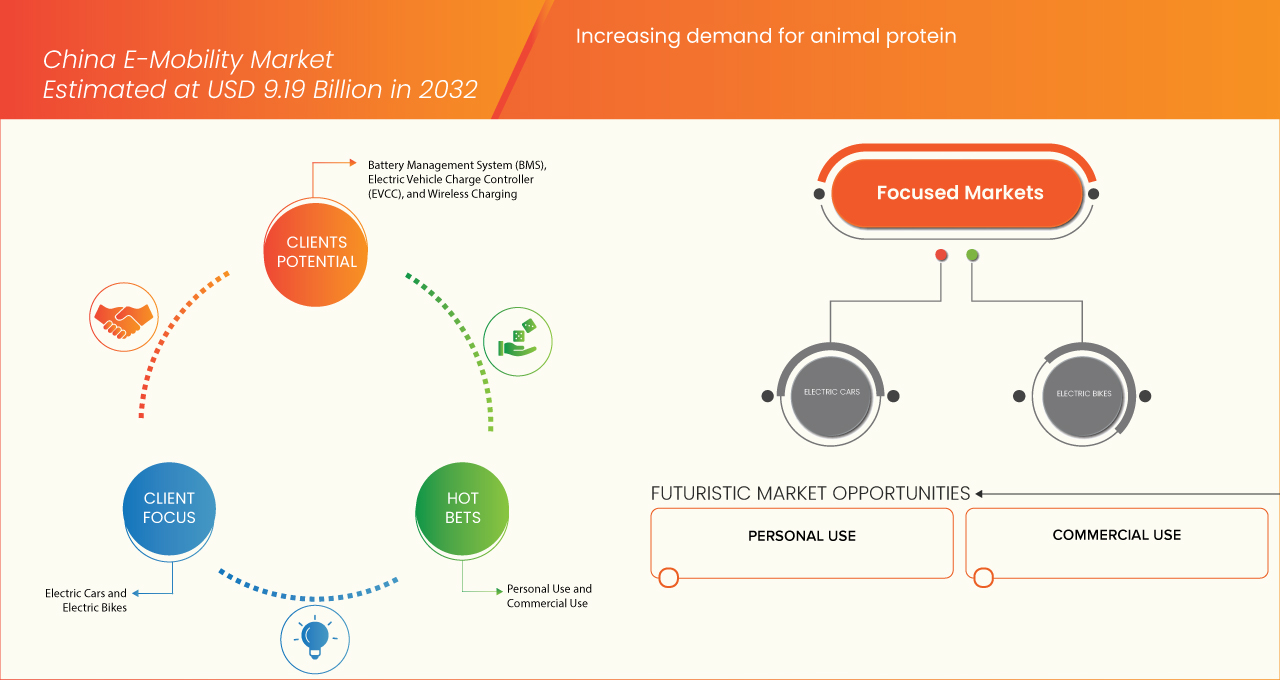

China E-MobilityMarket Segmentation, By Vehicle Type (Electric Cars, Electric Bikes, Electric Scooters/Motorized Scooters, Electric Motorcycles, and Others), Components (Battery Management System (BMS), Electric Vehicle Charge Controller (EVCC), E-Box (Electrical Distribution Box), Battery Disconnect Unit (BDU), and Others), Voltage (48V, 36V, Above 48V, 24V, and Less Than 24V), Battery Type (Li-Ion, Sealed Lead Acid, and NiMH), Charging Mode (Wired Charging and Wireless Charging), Usage (Personal Use, Commercial Use, and Shared Mobility Use) – Industry Trends and Forecast to 2032

E-Mobility Market Analysis

The E-Mobility market is growing rapidly as more consumers and businesses shift toward Electric Vehicles (EVs). This shift is driven by environmental concerns, government policies, and advancements in battery technology. Governments worldwide are offering subsidies, tax benefits, and emission regulations to encourage EV adoption. At the same time, investments in charging infrastructure are making electric transportation more accessible. Technological innovations, such as improved battery efficiency and faster charging, are making EVs more practical. In addition, smart charging and autonomous driving are enhancing the appeal of e-mobility.

E-Mobility Market Size

The China e-mobility market is expected to reach USD 919.56 billion by 2032 from USD 153.45 billion in 2024, growing with a substantial CAGR of 25.3% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

E-Mobility Market Trends

“Rising Consumer Awareness and Preference for Eco-Friendly Vehicles”

As environmental concerns, such as air pollution and carbon emissions, take center stage globally, Chinese consumers are increasingly prioritizing sustainability in their purchasing decisions. This shift in consumer behavior is not only reshaping the automotive landscape but also driving the demand for Electric Vehicles (EVs) and other forms of electric mobility.

China, as the world’s largest automotive market, has been grappling with severe environmental challenges, including urban smog and high greenhouse gas emissions. In response, the government has implemented stringent policies to promote clean energy and reduce reliance on fossil fuels. However, the success of these policies is being amplified by a growing segment of environmentally conscious consumers who are actively seeking greener alternatives. This trend is fueled by widespread media coverage, educational campaigns, and the visible impact of climate change, which have collectively influenced public perception and behavior. The preference for eco-friendly vehicles is further reinforced by the tangible benefits they offer. EVs are perceived as not only environmentally sustainable but also cost-effective in the long run, thanks to lower operating and maintenance costs compared to traditional Internal Combustion Engine (ICE) vehicles.

In addition, advancements in EV technology, such as improved battery life, faster charging infrastructure, and enhanced performance, have made electric vehicles more appealing to a broader audience. Chinese consumers, particularly in urban areas, are increasingly viewing EVs as a practical and responsible choice, aligning with their aspirations for a modern, sustainable lifestyle.

Report Scope and E-Mobility Market Segmentation

|

Attributes |

E-Mobility Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Volkswagen (Germany), BYD Co., Ltd. (China), Tesla (U.S.), BMW AG (Germany), General Motors (U.S.), NIO (China), Honda Motor Co., Ltd (Japan), Mercedes-Benz Group AG (Germany), KTM Sportmotorcycle GmbH (Austria), and Vmoto Limited (Australia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

E-Mobility Market Definition

An Electric Vehicle (EV) is a mode of transportation powered by electricity instead of traditional fossil fuels. EVs use rechargeable batteries to drive an electric motor, reducing carbon emissions and dependency on gasoline or diesel. They come in various types, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). The EV market refers to the global industry focused on the production, sale, and adoption of electric vehicles. Driven by technological advancements, environmental regulations, and consumer demand for sustainable mobility, the market is expanding rapidly. Key players include Tesla, BYD, and legacy automakers transitioning to EVs. Governments worldwide support EV adoption through incentives, charging infrastructure expansion, and stricter emissions regulations. The market also encompasses battery technology, charging networks, and supply chains for critical materials such as lithium and cobalt. As innovation continues, EVs are set to dominate the future of transportation.

E-Mobility Market Dynamics

Drivers

- Large-Scale Deployment of Public And Private EV (Electric Vehicle) Charging Stations Across China

As the world’s largest EV market, China’s strategic focus on building a robust charging infrastructure is addressing one of the most significant barriers to EV adoption: range anxiety. This infrastructure expansion is not only enhancing consumer confidence but also creating a seamless ecosystem that supports the widespread adoption of electric vehicles.

China’s charging network has grown exponentially in recent years, with over 1.7 million public charging points and millions more private installations as of 2023. This massive infrastructure rollout is a direct response to the increasing demand for EVs, fuelled by government policies, environmental awareness, and technological advancements. By ensuring that charging stations are widely accessible, China is eliminating the practical concerns that have historically deterred consumers from transitioning to electric mobility. The deployment of charging infrastructure is also catalyzing innovation and competition within the e-mobility sector. Companies are investing in fast-changing technologies, smart grid integration, and renewable energy-powered stations, enhancing the overall efficiency and sustainability of the network. This technological advancement is attracting global players and fostering partnerships between automakers, energy providers, and tech firms, further propelling market expansion.

For instance,

XPENG and Volkswagen Group China have signed a Memorandum of Understanding (MOU) to jointly develop one of China's largest super-fast charging networks. This partnership enables mutual access to over 20,000 charging piles across 420 cities, significantly expanding charging infrastructure. Both companies will explore co-branded super-fast charging stations, accelerating network expansion and enhancing the EV charging experience, further driving large-scale deployment of public and private charging stations in China. These collaborations are accelerating the deployment of charging infrastructure, particularly in underserved rural areas, while also introducing innovative solutions that enhance user convenience.

- Technological Advancements and Innovations in Battery Technology and Fast Charging Solutions

These developments are addressing critical challenges such as range limitations, charging time, and cost, while also enhancing the overall appeal and feasibility of Electric Vehicles (EVs) for consumers and businesses alike. As a result, China is solidifying its position as a global leader in the EV industry, with technology acting as a key driver of market growth.

One of the most significant breakthroughs is in battery technology, where Chinese companies are leading the charge in developing high-performance, cost-effective solutions. For instance, CATL (Contemporary Amperex Technology Co. Ltd.), the world’s largest battery manufacturer, has introduced sodium-ion batteries and cell-to-pack (CTP) technology, which offer higher energy density, longer lifespans, and reduced costs. These innovations are making EVs more affordable and efficient, enabling automakers to produce vehicles with longer ranges—such as NIO’s ET7 sedan, which boasts a range of over 1,000 kilometres on a single charge. This is a game-changer for consumers, as it eliminates range anxiety and makes EVs a viable option for long-distance travel. In parallel, advancements in fast-charging solutions are revolutionizing the EV charging experience. Companies such as Star Charge and TELD are deploying ultra-fast chargers capable of delivering up to 350 kW, allowing EVs to charge from 20% to 80% in just 15-20 minutes. This is particularly impactful for commercial fleets and ride-hailing services, where downtime is a critical factor.

For instance,

Star Charge, one of China’s leading charging infrastructure providers, has deployed ultra-fast chargers capable of delivering 350 kW, allowing EVs to charge from 20% to 80% in just 15-20 minutes. These chargers are strategically located along highways and in urban centers, ensuring seamless long-distance travel.

Opportunities

- Rapidly Expanding EV Exports From China

The rapid expansion of Electric Vehicle (EV) exports from China presents a significant opportunity for the country's E-mobility market. As the global shift towards sustainable transportation accelerates, China is positioning itself as a dominant force in the electric vehicle sector, leveraging its robust manufacturing capabilities, advanced technology, and government support. China’s EV exports have seen exponential growth in recent years, driven by a combination of competitive pricing, innovative designs, and a growing demand for greener alternatives worldwide. With international markets, especially in Europe, Southeast Asia, and even emerging markets, increasingly embracing electric vehicles, China’s automakers are uniquely poised to lead this charge. The country's vast production capacity and economies of scale allow it to offer EVs at prices that are attractive to cost-sensitive markets, while its technological advancements continue to improve the performance and appeal of its electric offerings.

For instance,

In June 2024, according to an article published by APCO Worldwide LLC., China’s Electric Vehicle (EV) industry has rapidly expanded, overtaking Japan as the world’s largest exporter in 2023. This growth, fueled by innovation, favorable policies, and advanced battery technology, faces global scrutiny, with the EU, U.S., and other countries imposing tariffs. Multinationals must adapt to shifting trade dynamics and evolving market responses.

- Growth in Ride-Sharing & Mobility-as-a-Service (Maas)

As urbanization continues to increase, both globally and domestically, transportation systems are under pressure to adapt to the growing demand for efficient, sustainable, and cost-effective solutions. This is where Electric Vehicles (EVs) and MaaS platforms come into play, and China stands at the forefront of both trends, making it uniquely positioned to leverage the growth in these sectors.

Ride-sharing services, such as Didi Chuxing, have become deeply embedded in the transportation landscape of China. The increasing shift towards shared mobility, spurred by concerns over traffic congestion, pollution, and cost, aligns seamlessly with the rise of electric vehicles. As cities look to reduce carbon emissions, integrating EVs into ride-sharing fleets is becoming a priority. For China, with its advanced EV manufacturing ecosystem, this is an unparalleled opportunity

For instance,

In September 2023, according to an article published by Elsevier, The growth of Ride-Sharing and Mobility-as-a-Service (MaaS) in China has accelerated, with MaaS platforms expanding across 41 cities, mainly in developed regions. The rise of both public-controlled and partnership models reflects the growing integration of mobility services. However, balancing public control with private sector involvement remains a governance challenge.

Restraints/Challenges

- Issues Regarding Grid Load Management and Capacity

While the country’s push toward green energy and sustainable transportation is commendable, the increasing number of EVs places substantial pressure on the electrical grid, which may struggle to keep up with the growing demand. As more consumers switch to electric vehicles, the need for reliable charging infrastructure becomes critical. EV charging stations draw substantial amounts of electricity, especially during peak hours, which can overwhelm local grids. In densely populated areas, this can lead to power shortages, system inefficiencies, and potential grid instability. In addition, the irregular timing of EV charging—often at night when electricity demand is traditionally low—can create further imbalances in power supply and demand, complicating grid management

For instance,

In June 2024, according to an article published by Dynamic Ratings, the rise of electric vehicles (EVs) presents significant challenges to grid maintenance, including increased electricity demand, peak load issues, and strain on distribution networks. Dynamic Ratings addresses these challenges with real-time monitoring solutions, improving grid stability, predictive maintenance, and optimizing EV infrastructure to enhance reliability and support sustainable energy transitions.

- Intense Competition from Local and International Brands

As the world’s largest Electric Vehicle (EV) market, China has attracted a diverse range of players vying for market share, making it increasingly difficult for companies to maintain a competitive edge. On the local front, Chinese automakers, including established giants such as BYD, NIO, and Geely, are rapidly advancing in the EV space. These companies benefit from deep-rooted domestic market knowledge, favorable government incentives, and a well-established manufacturing base. Their aggressive strategies, including competitive pricing, expanding model offerings, and cutting-edge technological innovations, make it challenging for newcomers to break into the market.

For instance,

In October 2024, according to an article by Global Times, China's EV industry continues to thrive despite rising protectionism in Western nations. The US, Canada, and the EU have implemented high tariffs on Chinese EV imports, presenting challenges. However, China’s significant market potential, strong Research and Development (R&D) investments, and open approach to global competition help sustain the growth and competitiveness of its EV sector.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

E-Mobility Market Scope

The market is segmented on the basis of vehicle type, components, voltage, battery type, charging mode, and usage The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Vehicle Type

- Electric Cars

- Electric Cars, By Component

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

- Electric Cars, By Component

- Electric Bikes

- Electric Bikes, By Component

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

- Electric Bikes, By Component

- Electric Scooter/Motorized Scooters

- Electric Scooter/Motorized Scooters, By Component

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

- Electric Scooter/Motorized Scooters, By Component

- Electric Motorcycle

- Electric Motorcycle, By Component

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

- Electric Motorcycle, By Component

- Others

- Others, By Component

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

- Others, By Component

Components

- Battery Management System (BMS)

- Electric Vehicle Charge Controller (EVCC)

- E-Box (Electrical Distribution Box)

- Battery Disconnect Unit (BDU)

- Others

Voltage

- 48V

- 36V

- Above 48V

- 24V

- Less Than 24V

Battery Type

- Li-Ion

- Sealed Lead Acid

- NiMH

Charging Mode

- Wired Charging

- Wireless Charging

Usage

- Personal Use

- Commercial Use

- Shared Mobility Use

E-Mobility Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, China presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

E-Mobility Market Leaders Operating in the Market Are:

- Volkswagen (Germany)

- BYD Co., Ltd. (China)

- Tesla (U.S.)

- BMW AG (Germany)

- General Motors (U.S.)

- NIO (China)

- Honda Motor Co., Ltd (Japan)

- Mercedes-Benz Group AG (Germany)

- KTM Sportmotorcycle GmbH (Austria)

- Vmoto Limited (Australia)

Latest Developments in E-Mobility Market

- In July 2024, Volkswagen was recognized as the most innovative volume brand for electric drive systems, receiving the prestigious Automotive INNOVATIONS Award 2024 from the Center of Automotive Management (CAM). This annual award highlights Volkswagen’s advancements in electric mobility, including improvements in range, power consumption, and charging capacity

- In November 2022, Tesla’s Model 3 was awarded a prestigious 5-star rating by Green NCAP, achieving a remarkable Weighted Overall Index of 9.8/10. Green NCAP, an independent initiative assessing vehicle sustainability, recognized Model 3 for its outstanding energy efficiency and minimal environmental impact

- In February 2025, NIO and ZF have achieved a milestone with the integration of ZF's steer-by-wire technology in the NIO ET9’s “SkyRide” chassis. This breakthrough provides a fully digital, customizable steering experience with variable steering ratios, enhancing safety, comfort, and precision, setting a new industry standard for smart electric vehicles

- In December 2024, Honda's next-generation e:HEV technology, presented in December 2024, focuses on enhancing fuel economy and driving performance. The system seamlessly switches between electric, hybrid, and engine drive modes. With improved components and the introduction of Honda S+ Shift, Honda aims to achieve carbon neutrality and optimize hybrid vehicle performance by 2030

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 COMPETITIVE RIVALRY

4.2 COMPANY COMPETITIVE ANALYSIS

4.2.1 STRATEGIC DEVELOPMENT

4.2.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.2.2.1 CHALLENGES

4.2.2.2 IN-HOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.2.3 CUSTOMER BASE

4.2.4 SERVICE POSITIONING

4.2.5 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

4.2.6 APPLICATION REACH

4.2.6.1 PASSENGER ELECTRIC VEHICLES (EVS)

4.2.6.2 COMMERCIAL VEHICLES (LOGISTICS, BUSES, AND FLEET EVS)

4.2.6.3 RIDE-HAILING & AUTONOMOUS MOBILITY

4.2.6.4 BATTERY & CHARGING INFRASTRUCTURE

4.2.6.5 SMART CITIES & INTEGRATED MOBILITY SOLUTIONS

4.2.7 SERVICE PLATFORM MATRIX

4.2.7.1 AUTOMAKER-OWNED DIGITAL ECOSYSTEMS

4.2.7.2 CHARGING & BATTERY NETWORK PLATFORMS

4.2.7.3 MOBILITY-AS-A-SERVICE (MAAS) & RIDE-HAILING PLATFORMS

4.2.7.4 FLEET & SMART MOBILITY MANAGEMENT PLATFORMS

4.3 COMPANY SERVICE PLATFORM MATRIX

4.4 INDUSTRY TRENDS AND FUTURISTIC SCENARIO

4.4.1 INDUSTRY OVERVIEW

4.4.2 MARKET DYNAMICS

4.4.2.1 GOVERNMENT POLICIES

4.4.2.2 TECHNOLOGY & INNOVATION

4.4.2.3 CHARGING INFRASTRUCTURE

4.4.2.4 CONSUMER ADOPTION

4.4.2.5 INVESTMENT & FUNDING

4.4.3 FUTURISTIC SCENARIO

4.4.3.1 MAINSTREAM ADOPTION

4.4.3.2 BATTERY TECHNOLOGY & RECYCLING

4.4.3.3 AUTONOMOUS & CONNECTED EVS

4.4.3.4 ELECTRIFICATION OF PUBLIC TRANSPORT

4.4.3.5 GLOBAL EXPANSION

4.4.4 CONCLUSION

4.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.5.1 BATTERY TECHNOLOGIES: ADVANCED CHEMISTRIES, RECYCLING, AND SECOND-LIFE APPLICATIONS

4.5.1.1 BATTERY INNOVATION AND ADVANCED CHEMISTRIES

4.5.1.2 BATTERY RECYCLING AND SECOND-LIFE APPLICATIONS

4.5.2 CHARGING INFRASTRUCTURE AND SMART ENERGY INTEGRATION

4.5.2.1 PUBLIC AND PRIVATE CHARGING NETWORK EXPANSION

4.5.2.2 BATTERY SWAPPING AND SUBSCRIPTION-BASED CHARGING SERVICES

4.5.3 MOBILITY-AS-A-SERVICE (MAAS) AND SOFTWARE-DRIVEN BUSINESS MODELS

4.5.3.1 EV RIDE-SHARING, LEASING, AND SUBSCRIPTION MODELS

4.5.3.2 SMART MOBILITY SOFTWARE, AI, AND AUTONOMOUS TECHNOLOGY

4.5.4 RENEWABLE ENERGY AND GRID INTEGRATION

4.5.4.1 VEHICLE-TO-GRID (V2G) AND GREEN ENERGY INTEGRATION

4.5.5 CONCLUSION

4.6 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.1 MARKET PENETRATION IN CHINA’S E-MOBILITY SECTOR

4.6.1.1 ADOPTION TRENDS: CONSUMER, FLEET, AND CORPORATE PREFERENCES

4.6.1.2 CHARGING INFRASTRUCTURE & ECOSYSTEM READINESS

4.6.1.3 KEY INDUSTRY PLAYERS AND COMPETITIVE LANDSCAPE

4.6.1.4 REGULATORY AND POLICY LANDSCAPE

4.6.2 GROWTH PROSPECTS OF CHINA’S E-MOBILITY MARKET

4.6.2.1 TECHNOLOGICAL INNOVATIONS DRIVING MARKET EXPANSION

4.6.2.2 SUPPLY CHAIN & LOCALIZATION STRATEGIES

4.6.2.3 INTERNATIONAL MARKET EXPANSION

4.6.2.4 CHALLENGES & RISKS IN SUSTAINING GROWTH

4.6.2.5 FUTURE OUTLOOK & LONG-TERM IMPLICATIONS

4.6.3 CONCLUSION

4.7 TECHNOLOGICAL ANALYSIS

4.8 USE CASE ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CONSUMER AWARENESS AND PREFERENCE FOR ECO-FRIENDLY VEHICLES

6.1.2 LARGE-SCALE DEPLOYMENT OF PUBLIC AND PRIVATE EV (ELECTRIC VEHICLE) CHARGING STATIONS ACROSS CHINA

6.1.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN BATTERY TECHNOLOGY AND FAST CHARGING SOLUTIONS

6.2 RESTRAINTS

6.2.1 EXTENSIVE INITIAL INVESTMENT DEPLOYED ON EV’S

6.2.2 DISPOSAL AND RECYCLING OF EV BATTERIES POSE ENVIRONMENTAL RISKS

6.3 OPPORTUNITIES

6.3.1 RAPIDLY EXPANDING EV EXPORTS FROM CHINA

6.3.2 GROWTH IN RIDE-SHARING & MOBILITY-AS-A-SERVICE (MAAS)

6.4 CHALLENGES

6.4.1 ISSUES REGARDING GRID LOAD MANAGEMENT AND CAPACITY

6.4.2 INTENSE COMPETITION FROM LOCAL AND INTERNATIONAL BRANDS

7 CHINA E-MOBILITY MARKET, BY VEHICLE TYPE

7.1 OVERVIEW

7.2 ELECTRIC CARS

7.3 ELECTRIC BIKES

7.4 ELECTRIC SCOOTER/MOTORIZED SCOOTERS

7.5 ELECTRIC MOTORCYCLE

7.6 OTHERS

8 CHINA E-MOBILITY MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 BATTERY MANAGEMENT SYSTEM (BMS)

8.3 ELECTRIC VEHICLE CHARGE CONTROLLER (EVCC)

8.4 E-BOX (ELECTRICAL DISTRIBUTION BOX)

8.5 BATTERY DISCONNECT UNIT (BDU)

8.6 OTHERS

9 CHINA E-MOBILITY MARKET, BY VOLTAGE

9.1 OVERVIEW

9.2 48V

9.3 36V

9.4 ABOVE 48V

9.5 24V

9.6 LESS THAN 24V

10 CHINA E-MOBILITY MARKET, BY BATTERY TYPE

10.1 OVERVIEW

10.2 LI-ION

10.3 SEALED LEAD ACID

10.4 NIMH

11 CHINA E-MOBILITY MARKET, BY CHARGING MODE

11.1 OVERVIEW

11.2 WIRED CHARGING

11.3 WIRELESS CHARGING

12 CHINA E-MOBILITY MARKET, BY USAGE

12.1 OVERVIEW

12.2 PERSONAL USE

12.3 COMMERCIAL USE

12.4 SHARED MOBILITY USE

13 CHINA E-MOBILITY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: CHINA

14 SWOT

15 COMPANY PROFILES

15.1 BYD CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 VOLKSWAGEN

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT NEWS

15.3 TESLA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT NEWS

15.4 NIO

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT/NEWS

15.5 GENERAL MOTORS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT/BRAND PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 BMW AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 HONDA MOTOR CO., LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 KTM SPORTMOTORCYCLE GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 BRAND PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 MERCEDES-BENZ GROUP AG

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT/NEWS

15.1 VMOTO LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANY SERVICE PLATFORM MATRIX

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 CHINA E-MOBILITY MARKET: USE CASE ANALYSIS

TABLE 4 CHINA E-MOBILITY MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 5 CHINA ELECTRIC CARS IN E-MOBILITY MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 6 CHINA ELECTRIC BIKES IN E-MOBILITY MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 7 CHINA ELECTRIC SCOOTER/MOTORIZED SCOOTERS IN E-MOBILITY MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 8 CHINA ELECTRIC MOTORCYCLE IN E-MOBILITY MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 9 CHINA OTHERS IN E-MOBILITY MARKET, BY COMPONENT, 2018-2032 (USD MILLION)..

TABLE 10 CHINA E-MOBILITY MARKET, BY COMPONENTS, 2018-2032 (USD MILLION)

TABLE 11 CHINA E-MOBILITY MARKET, BY VOLTAGE, 2018-2032 (USD MILLION)

TABLE 12 CHINA E-MOBILITY MARKET, BY BATTERY TYPE, 2018-2032 (USD MILLION)

TABLE 13 CHINA E-MOBILITY MARKET, BY CHARGING MODE, 2018-2032 (USD MILLION)

TABLE 14 CHINA E-MOBILITY MARKET, BY USAGE, 2018-2032 (USD MILLION)

Liste des figures

FIGURE 1 CHINA E-MOBILITY MARKET

FIGURE 2 CHINA E-MOBILITY MARKET: DATA TRIANGULATION

FIGURE 3 CHINA E-MOBILITY MARKET: DROC ANALYSIS

FIGURE 4 CHINA E-MOBILITY MARKET: CHINA VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA E-MOBILITY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA E-MOBILITY MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA E-MOBILITY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 CHINA E-MOBILITY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 CHINA E-MOBILITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 CHINA E-MOBILITY MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY: CHAIN E-MOBILITY MARKET

FIGURE 12 RISING CONSUMER AWARENESS AND PREFERENCE FOR ECO-FRIENDLY VEHICLES IS EXPECTED TO DRIVE THE CHINA E-MOBILITY MARKET IN THE FORECAST PERIOD

FIGURE 13 THE ELECTRIC CARS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CHINA E-MOBILITY MARKET IN 2025 AND 2032

FIGURE 14 FIVE SEGMENTS COMPRISE IN CHIAN E-MOBILITY MARKET, BY VEHICLE TYPE

FIGURE 15 CHINA E-MOBILITY MARKET: STRATEGIC DECISIONS

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF CHINA E-MOBILITY MARKET

FIGURE 18 CHINA E-MOBILITY MARKET, BY VEHICLE TYPE, 2024

FIGURE 19 CHINA E-MOBILITY MARKET, BY COMPONENTS, 2024

FIGURE 20 CHINA E-MOBILITY MARKET, BY VOLTAGE, 2024

FIGURE 21 CHINA E-MOBILITY MARKET, BY BATTERY TYPE, 2024

FIGURE 22 CHINA E-MOBILITY MARKET, BY CHARGING MODE, 2024

FIGURE 23 CHINA E-MOBILITY MARKET, BY USAGE, 2024

FIGURE 24 CHINA E-MOBILITY MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.