Europe E Bike Market

Market Size in USD Billion

CAGR :

%

USD

4.99 Billion

USD

9.56 Billion

2024

2032

USD

4.99 Billion

USD

9.56 Billion

2024

2032

| 2025 –2032 | |

| USD 4.99 Billion | |

| USD 9.56 Billion | |

|

|

|

|

Electric Bike (E-Bike) Market Size

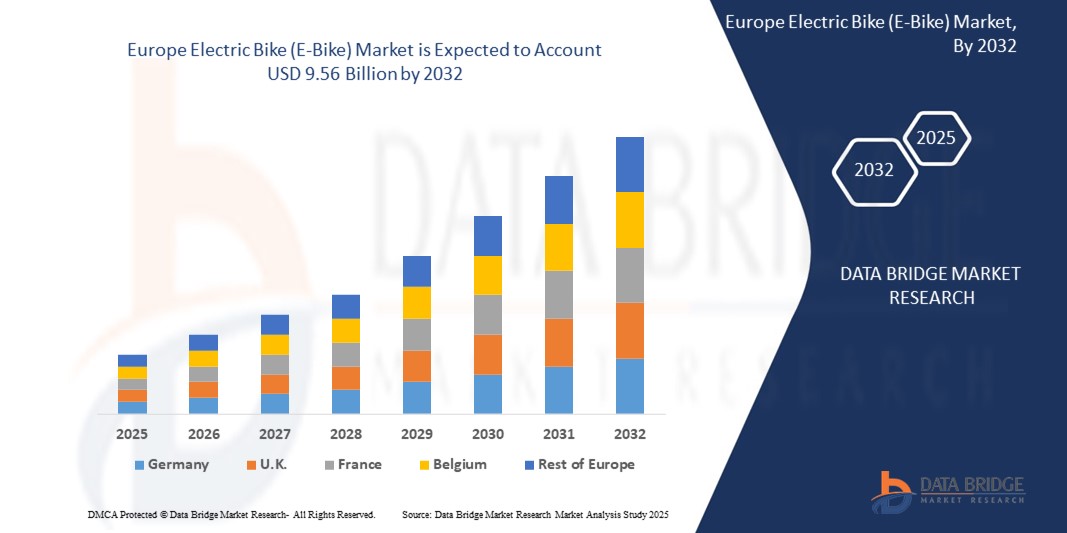

- The Europe electric bike (E-Bike) market size was valued at USD 4.99 billion in 2024 and is expected to reach USD 9.56 billion by 2032, at a CAGR of 8.5% during the forecast period

- The market growth is primarily driven by increasing consumer demand for eco-friendly transportation, supportive government policies promoting sustainable mobility, and advancements in battery technology enhancing e-bike performance

- Rising urbanization, growing awareness of health benefits associated with cycling, and the expansion of cycling infrastructure across European cities are further accelerating the adoption of e-bikes, positioning them as a preferred alternative to traditional vehicles

Electric Bike (E-Bike) Market Analysis

- Electric bikes, equipped with battery-powered motors to assist pedaling or provide throttle-based propulsion, are transforming urban mobility and leisure activities across Europe due to their affordability, environmental benefits, and versatility

- The surge in demand for e-bikes is fueled by increasing fuel prices, environmental concerns, and government incentives such as subsidies and tax benefits for electric vehicle adoption

- Germany dominated the Europe electric bike market with the largest revenue share of 38.5% in 2024, driven by robust cycling infrastructure, high consumer awareness, and a strong presence of leading e-bike manufacturers. The country’s focus on sustainable transport and innovation in battery and motor technology further supports market growth

- The U.K. is expected to be the fastest-growing country in the Europe electric bike market during the forecast period, propelled by increasing investments in cycling infrastructure, rising demand for e-bikes in urban areas, and supportive policies promoting green transportation

- The lithium-ion segment dominated the largest market revenue share of 39.2% in 2024, driven by its high energy density, lightweight design, and longer durability, making it ideal for e-bikes requiring extended range and performance

Report Scope and Electric Bike (E-Bike) Market Segmentation

|

Attributes |

Electric Bike (E-Bike) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electric Bike (E-Bike) Market Trends

“Increasing Integration of Smart Technologies and Connectivity”

- The Europe Electric Bike (E-Bike) market is experiencing a significant trend toward integrating smart technologies and connectivity features

- These technologies enable enhanced user experiences through features such as GPS navigation, smartphone connectivity, and real-time performance monitoring

- Smart e-bike systems allow for proactive maintenance alerts, tracking battery health, and optimizing ride efficiency based on real-time data such as terrain and weather conditions

- For instance, companies are developing connected e-bike platforms that offer personalized ride settings, route optimization, and integration with urban mobility apps, enhancing convenience for commuters

- This trend is making e-bikes more appealing to tech-savvy consumers and urban commuters, particularly in tech-forward markets such as Germany, which dominates the region, and the U.K., the fastest-growing market

- Advanced algorithms analyze rider behavior, such as pedaling patterns and speed preferences, to provide tailored assistance levels and improve energy efficiency

Electric Bike (E-Bike) Market Dynamics

Driver

“Rising Demand for Sustainable Mobility and Urban Commuting Solutions”

- Increasing consumer demand for eco-friendly transportation options, such as e-bikes, is a major driver for the Europe Electric Bike (E-Bike) market

- E-bikes enhance urban mobility by offering features such as pedal assist, throttle modes, and cargo-carrying capabilities, making them ideal for navigating congested city environments

- Government initiatives, particularly in Europe with mandates promoting low-carbon transport, are accelerating e-bike adoption across countries such as Germany and the U.K

- The proliferation of cycling infrastructure, such as dedicated bike lanes, and the rollout of 5G technology are enabling faster data transmission for smart e-bike features, supporting applications such as real-time traffic updates and remote diagnostics

- Manufacturers are increasingly offering e-bikes with factory-fitted smart components and versatile designs (e.g., city/urban, mountain/trekking, and cargo models) to meet consumer expectations and enhance market appeal

Restraint/Challenge

“High Initial Costs and Regulatory Compliance Issues”

- The substantial upfront cost of e-bikes, including advanced components such as lithium-ion batteries, mid-drive hub motors, and smart displays, can be a significant barrier to adoption, particularly in cost-sensitive markets

- Integrating advanced features, such as connected systems and high-capacity batteries (e.g., 750W-1500W or above 1500W), into e-bikes increases production and retail costs

- In addition, regulatory challenges related to e-bike classifications and speed limits pose complexities, as regulations vary across European countries

- Data privacy concerns arise from connected e-bikes that collect and transmit rider data, raising issues about potential breaches and compliance with stringent EU data protection laws, such as GDPR

- These factors can deter potential buyers, particularly in regions with high cost sensitivity or strict regulatory environments, potentially limiting market growth despite strong demand in leading markets such as Germany and rapidly growing markets such as the U.K

Electric Bike (E-Bike) market Scope

The market is segmented on the basis of battery type, hub motor location, mode, battery power, class, usage, speed, component, application, and gender.

- By Battery Type

On the basis of battery type, the Europe Electric Bike (E-Bike) Market is segmented into lithium-ion, lithium-ion polymer, nickel metal hydride, lead acid, sealed lead acid, and others. The lithium-ion segment dominated the largest market revenue share of 39.2% in 2024, driven by its high energy density, lightweight design, and longer durability, making it ideal for e-bikes requiring extended range and performance.

Lithium-ion batteries are preferred for their low maintenance and efficiency, particularly in urban and performance e-bikes. The lithium-ion polymer segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its flexibility in design, lighter weight, and improved safety features, appealing to manufacturers focusing on compact and high-performance e-bikes.

- By Hub Motor Location

On the basis of hub motor location, the Europe Electric Bike (E-Bike) Market is segmented into mid-drive hub motor, rear hub motor, and front hub motor. The mid drive hub motor segment dominated with a 66.2% market revenue share in 2024, attributed to its suitability for pedal-assisted e-bikes, offering better weight distribution and efficiency, particularly for mountain and trekking bikes.

The rear hub motor segment is anticipated to experience the fastest growth from 2025 to 2032, driven by its cost-effectiveness, ease of maintenance, and increasing adoption in urban and commuter e-bikes, where simplicity and reliability are prioritized.

- By Mode

On the basis of mode, the Europe Electric Bike (E-Bike) Market is segmented into pedal assist and throttle. The pedal assist segment held the largest market share of 85% in 2024, as it aligns with EU regulations requiring no licensing for e-bikes up to 25 km/h and 250W, appealing to commuters and fitness-conscious riders. Pedal assist e-bikes provide a natural cycling experience while extending battery life.

The throttle mode segment is expected to grow significantly from 2025 to 2032, driven by demand for effortless riding in urban settings and for users seeking reduced physical exertion, particularly in countries with less restrictive regulations.

- By Battery Power

On the basis of battery power, the Europe Electric Bike (E-Bike) Market is segmented into under 750W, 750W-1500W, and above 1500W The under 750W segment accounted for the largest market share of 61.5% in 2024, due to its compliance with EU regulations for pedal-assisted e-bikes, widespread use in urban commuting, and affordability.

The 750W-1500W segment is projected to witness the fastest growth from 2025 to 2032, driven by rising demand for high-performance e-bikes, such as speed pedelecs and cargo bikes, which cater to specialized applications such as long-distance commuting and commercial use..

- By Class

On the basis of class, the Europe Electric Bike (E-Bike) Market is segmented into Class I, Class II, and Class III. The Class I segment dominated with a 60.2% market share in 2024, driven by its regulatory simplicity, requiring no licensing or insurance, and its popularity among urban commuters and recreational riders.

The Class III segment is expected to see robust growth from 2025 to 2032, fueled by increasing adoption of speed pedelecs for longer commutes, particularly in countries such as Germany and the Netherlands, where cycling infrastructure supports higher-speed e-bikes.

- By Usage

On the basis of usage, the Europe Electric Bike (E-Bike) Market is segmented into city/urban, mountain/trekking bikes, racing, cargo, and others. The city/urban segment held the largest market share of 28.5% in 2024, driven by the growing demand for eco-friendly and cost-effective commuting solutions in urban areas, supported by investments in cycling infrastructure.

The cargo segment is anticipated to experience the fastest growth from 2025 to 2032, driven by the rising use of e-bikes for last-mile delivery and commercial applications, particularly in urban centers with traffic congestion.

- By Speed

On the basis of speed, the Europe Electric Bike (E-Bike) Market is segmented into up to 25Km/hr and 25-45Km/hr. The up to 25 km/hr segment dominated with a 70% market share in 2024, as it aligns with EU regulations for standard pedelecs, requiring no registration or licensing, making it accessible for a wide range of users.

The 25-45 km/hr segment is expected to grow significantly from 2025 to 2032, driven by the increasing popularity of speed pedelecs for long-distance commuting and professional use, particularly in countries with advanced cycling infrastructure such as Germany.

- By Component

On the basis of component, the Europe Electric Bike (E-Bike) Market is segmented into battery, motor, frame, display, tire, throttle, light and reflector, and others. The battery segment is expected to hold a significant market share, being a critical and high-value component that significantly influences the e-bike's range, weight, and overall performance.

The display segment is projected to witness the fastest growth from 2025 to 2032, fueled by consumer demand for interactive, user-friendly interfaces that integrate navigation, battery status, and smart connectivity features.

- By Application

On the basis of application, the Europe Electric Bike (E-Bike) Market is segmented into utility, leisure, and speed. The utility segment is expected to hold the largest market share, encompassing daily commuting, last-mile delivery, and cargo transport, driven by the practical benefits and cost-effectiveness of e-bikes for these purposes.

The leisure segment is expected to experience rapid growth from 2025 to 2032, fueled by increasing consumer interest in e-bikes for recreational activities, such as trekking and touring, supported by advancements in battery life and motor efficiency.

- By Gender

On the basis of gender, the Europe Electric Bike (E-Bike) Market is segmented into men, women, and unisex. The unisex segment is expected to hold the largest market share, reflecting a growing trend in e-bike design towards versatile frames and adjustable components that cater to a wide range of riders, regardless of gender, promoting broader accessibility and appeal.

The women’s segment is anticipated to witness the fastest growth from 2025 to 2032, driven by targeted designs, such as lower step-through frames and lighter models, catering to female riders, particularly in urban commuting and leisure applications.

Electric Bike (E-Bike) Market Regional Analysis

- Germany dominated the Europe electric bike market with the largest revenue share of 38.5% in 2024, driven by robust cycling infrastructure, high consumer awareness, and a strong presence of leading e-bike manufacturers. The country’s focus on sustainable transport and innovation in battery and motor technology further supports market growth

- The U.K. is expected to be the fastest-growing country in the Europe electric bike market during the forecast period, propelled by increasing investments in cycling infrastructure, rising demand for e-bikes in urban areas, and supportive policies promoting green transportation

Germany Electric Bike (E-Bike) Market Insight

Germany dominated the Europe electric bike market with the largest revenue share of 66.6% in 2024, fueled by its advanced cycling infrastructure and strong consumer focus on sustainable transportation. The trend towards urban mobility and increasing regulations promoting eco-friendly vehicles further boost market expansion. German manufacturers’ integration of high-performance E-Bikes with advanced lithium-ion batteries complements both OEM and aftermarket sales, creating a robust product ecosystem.

U.K. Electric Bike (E-Bike) Market Insight

The U.K. market for electric bikes is expected to witness the fastest growth rate, driven by rising demand for efficient urban commuting and reduced environmental impact. Increased interest in fitness and leisure cycling, alongside growing awareness of E-Bike benefits, encourages adoption. Evolving regulations supporting cycling infrastructure and safety standards influence consumer choices, balancing performance with compliance.

Electric Bike (E-Bike) Market Share

The electric bike (E-Bike) industry is primarily led by well-established companies, including:

- Accell Group (Netherlands)

- AIMA Ebike (U.K.)

- Jiangsu Xinri E-Vehicle Co.,Ltd (China)

- ITALJET S.P.A. (Italy)

- Riese & Müller GmbH (Germany)

- F.I.V. E. Bianchi S.p.A. (Italy)

- Kawasaki Motors Corp. (U.S.)

- Yadea Technology Group Co.,Ltd. (China)

- Giant Bicycles (Taiwan)

- Trek Bicycle Corporation (U.S.)

- Rad Power Bikes Inc. (U.S.)

- Yamaha Motor Co., Ltd. (Japan)

What are the Recent Developments in Europe Electric Bike (E-Bike) Market?

- In June 2025, the UK Office for Product Safety and Standards issued a product safety alert and recall for Ridstar E-Bikes and chargers, specifically models Q20-Plus, Q20-Mini, and E26 Pro. The alert cited a serious fire risk due to non-compliant chargers, plugs, and transformers, which could overheat if left plugged in, potentially causing fires. The products failed to meet UK safety regulations, including BS 1363 standards, and were rejected at the border. This action highlights the critical role of rigorous product safety standards in protecting consumers and ensuring compliance within the European market

- In June 2025, Valeo partnered with French startup Velco to introduce the Velco Suite, a comprehensive digital ecosystem designed to enhance connectivity and user experience in e-bikes. Alongside this, Valeo launched a new remanufacturing service for electric bike motors and batteries, reinforcing its commitment to sustainable mobility and the circular economy. These initiatives aim to extend product lifecycles, reduce environmental impact, and support the growing micromobility sector across Europe. The partnership and service expansion were showcased at Eurobike 2025, highlighting Valeo’s leadership in innovative and eco-conscious mobility solutions

- In April 2025, Ampler Bikes introduced the Nova and Nova Pro, the world’s first commercial e-bikes featuring USB-C charging ports. This pioneering move aligns with EU regulations promoting universal charging standards and enhances convenience for urban commuters by eliminating the need for proprietary chargers. Both models are equipped with 336Wh batteries that can be fully charged in approximately 3.5 hours using a 140W USB-C PD 3.1 charger. The bikes also support reverse charging, allowing users to power mobile devices on the go. This innovation underscores Ampler’s commitment to sustainability, user-centric design, and technological leadership in the e-bike market

- In March 2025, BMW Motorrad announced a voluntary recall of select R 1300 GS and R 1300 GS Adventure motorcycles due to a safety concern involving the right-hand combined switch. Moisture intrusion into the switch could cause ignition malfunctions, such as engine stalling or delayed lighting, increasing the risk of accidents. The recall affects units manufactured before March 18, 2024, with approximately 25,000 motorcycles impacted globally. This proactive measure underscores BMW’s dedication to product reliability and rider safety, particularly in the European market, where regulatory compliance and consumer protection are paramount

- In February 2025, Zaragoza, Spain, rolled out a fully upgraded version of its BiZi public bike-sharing system, featuring 2,500 pedal-assist electric bikes and 276 docking stations accessible 24/7 across the city. This initiative, supported by €6.57 million from the EU’s NextGenerationEU Recovery Plan, aims to boost urban mobility, improve last-mile connectivity, and encourage a shift toward sustainable transportation. The project was awarded to Serveo Servicios and PBSC Urban Solutions under a 10-year contract, with additional municipal funding ensuring full deployment citywide. The system enhances access to cycling infrastructure and supports Zaragoza’s broader environmental and mobility goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.