Global Electric Motorcycles Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

1.71 Billion

2024

2032

USD

1.30 Billion

USD

1.71 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 1.71 Billion | |

|

|

|

|

What is the Global Electric Motorcycle Market Size and Growth Rate?

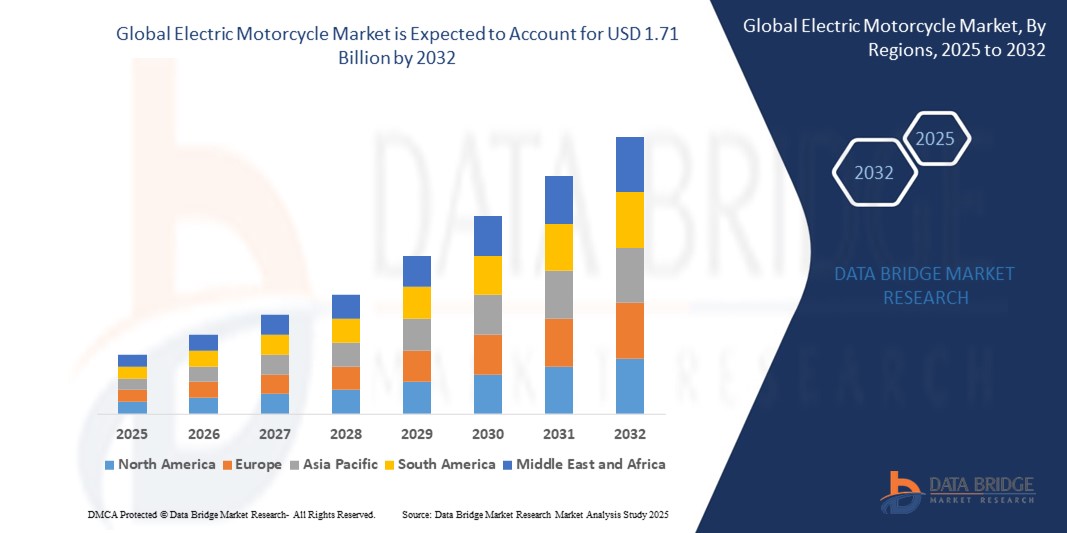

- The global electric motorcycle market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 1.71 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is primarily driven by the surge in fuel prices, increased environmental awareness, and rising government incentives promoting electric mobility across developed and emerging economies

- In addition, the advancement in battery technologies, improved vehicle range, and infrastructure expansion for electric vehicle (EV) charging are significantly accelerating the adoption of electric motorcycles, reinforcing market growth globally

What are the Major Takeaways of Electric Motorcycle Market?

- Electric Motorcycles offer a sustainable, cost-effective alternative to internal combustion engine (ICE) bikes, with lower maintenance costs, zero tailpipe emissions, and quiet operation, making them an ideal solution for urban transportation

- The rising demand for clean mobility, coupled with government subsidies, tax rebates, and EV-friendly policies, is a key growth driver in both developed and developing nations

- In addition, younger demographics are increasingly preferring electric motorcycles due to their tech integration, stylish designs, and smart features such as GPS tracking, regenerative braking, and mobile app connectivity, further boosting market demand

- Asia-Pacific dominated the electric motorcycle market with the largest revenue share of 81.3% in 2024, driven by rising environmental concerns, increasing fuel prices, and strong government support for electric mobility across countries such as China, India, and Japan

- North America electric motorcycle market is projected to register the fastest CAGR of 27.2% from 2025 to 2032, driven by increased environmental awareness, rising gas prices, and a growing consumer shift toward sustainable and tech-enabled transportation

- The hub motor segment dominated the electric motorcycle market with the largest revenue share of 47.8% in 2024, owing to its compact design, low maintenance requirements, and high energy efficiency

Report Scope and Electric Motorcycle Market Segmentation

|

Attributes |

Electric Motorcycle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Motorcycle Market?

- A major trend reshaping the global electric motorcycle market is the continuous advancement in battery technology, charging infrastructure, and smart connectivity, leading to better performance, extended range, and enhanced user experience. Manufacturers are now focused on creating high-speed, long-range motorcycles that match or exceed the performance of traditional internal combustion engines

- For instance, in May 2023, Lightning Motorcycles partnered with LG Chem to develop next-generation lithium-ion batteries, aimed at improving energy density and reducing charging time—pivotal for long-distance EV riders

- The integration of AI-based systems for real-time diagnostics, riding behavior analytics, and smart navigation is becoming more prominent. Companies such as Zero Motorcycles and Energica are deploying connected dashboards and OTA (over-the-air) updates to elevate ride customization and predictive maintenance

- In addition, electric motorcycles with regenerative braking, multiple ride modes, and smartphone app integration are becoming standard. These features allow users to optimize energy use, monitor battery health, and locate nearby charging stations

- As urban mobility solutions evolve, lightweight electric motorcycles and e-scramblers designed for city commuting are gaining popularity, especially in Europe and Asia, where governments support cleaner transport modes

- This focus on performance, range, and intelligent features is setting a new benchmark in consumer expectations, positioning electric motorcycles as practical and desirable alternatives to petrol-powered bikes

What are the Key Drivers of Electric Motorcycle Market?

- The growing concern over carbon emissions, combined with stringent emission regulations and fuel economy standards, is a primary factor accelerating the shift toward electric motorcycles worldwide

- For instance, in November 2023, Honda Motor Co. announced plans to launch 30 electric motorcycle models globally by 2030, with a target of reaching 4 million unit sales annually, underscoring the rising OEM commitment to electric mobility

- Advancements in lithium-ion battery efficiency, declining battery costs, and government subsidies are making electric motorcycles increasingly affordable and accessible for urban and rural users asuch as

- Moreover, rising fuel prices and the need for low-maintenance vehicles are encouraging consumers, particularly in developing countries, to consider EV alternatives

- The growing demand for sustainable mobility, increasing availability of public charging stations, and the push for electrification in last-mile delivery fleets are also fueling the market’s growth trajectory

- Together, these factors are driving strong adoption across multiple end-user segments, ranging from daily commuters to performance-oriented riders

Which Factor is challenging the Growth of the Electric Motorcycle Market?

- One of the main challenges hindering the widespread adoption of electric motorcycles is the limited charging infrastructure, especially in rural or underdeveloped regions. Range anxiety remains a concern for consumers accustomed to petrol stations at every corner

- For instance, despite advancements, many countries still lack the fast-charging networks needed to support large-scale adoption, affecting long-distance travel viability and fleet usage

- In addition, the high upfront cost of premium electric motorcycles, due to the use of advanced battery packs and motor systems, can be a barrier—particularly in price-sensitive markets such as India and Southeast Asia

- Concerns around battery lifespan, replacement cost, and environmental impact of battery disposal also pose sustainability-related hurdles

- Furthermore, some consumers are deterred by the limited model variety and availability compared to traditional motorcycles, especially in the sports and touring categories.

- Overcoming these challenges will require collaborative efforts among governments, manufacturers, and energy providers to improve infrastructure, lower cost through innovation, and increase consumer education on the benefits and usability of electric motorcycles

How is the Electric Motorcycle Market Segmented?

The market is segmented on the basis of drive type, battery type, and end-use.

• By Drive Type

On the basis of drive type, the electric motorcycle market is segmented into Belt Drive, Chain Drive, and Hub Motor. The Hub Motor segment dominated the electric motorcycle market with the largest revenue share of 47.8% in 2024, owing to its compact design, low maintenance requirements, and high energy efficiency. Hub motors, being directly integrated into the wheel hub, eliminate the need for additional transmission components, making them ideal for lightweight urban electric motorcycles and scooters. Their simplicity and cost-effectiveness contribute to their widespread use, particularly in Asia-Pacific markets where e-mobility is rapidly growing.

The Belt Drive segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for smoother rides, quieter performance, and low-maintenance alternatives to chain drives. Belt drives are increasingly adopted in mid-to-premium range electric motorcycles due to their durability, corrosion resistance, and longer service life, making them particularly attractive for commuter and recreational riders.

• By Battery Type

On the basis of battery type, the electric motorcycle market is segmented into Lithium-ion, Lead Acid, and Others. The Lithium-ion segment held the largest market revenue share of 71.4% in 2024, driven by its superior energy density, lighter weight, faster charging capabilities, and longer lifecycle. Lithium-ion batteries are favored across all performance categories—from entry-level scooters to high-end electric motorcycles—supporting fast acceleration, extended range, and reduced downtime. Technological advancements and decreasing costs further reinforce lithium-ion’s dominance in the market.

The Others category, which includes solid-state and nickel-metal hydride batteries, is anticipated to exhibit the fastest CAGR during the forecast period, driven by research into next-generation battery technologies that offer higher safety, sustainability, and performance.

• By End-Use

On the basis of end-use, the electric motorcycle market is segmented into Personal and Commercial. The Personal segment accounted for the largest market revenue share of 68.9% in 2024, supported by rising environmental awareness, increasing urban congestion, and the demand for affordable, low-maintenance mobility solutions. Personal e-motorcycles are gaining strong traction among city commuters, especially in emerging markets with supportive EV policies and rising fuel costs.

The Commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the adoption of electric motorcycles for last-mile delivery services, food delivery platforms, and ride-hailing fleets. Fleet operators are increasingly transitioning to electric options to cut operational costs and meet emission reduction targets, especially in urban zones with vehicle restrictions and sustainability mandates.

Which Region Holds the Largest Share of the Electric Motorcycle Market?

- Asia-Pacific dominated the electric motorcycle market with the largest revenue share of 81.3% in 2024, driven by rising environmental concerns, increasing fuel prices, and strong government support for electric mobility across countries such as China, India, and Japan

- The region benefits from a robust two-wheeler culture, high population density, and rapidly expanding urban centers that are ideal for electric motorcycles as a cost-effective and eco-friendly mobility solution

- Favorable policies such as subsidies, tax rebates, and EV mandates, along with expanding EV charging infrastructure and local manufacturing capabilities, have further propelled Asia-Pacific to the forefront of the global electric motorcycle market

China Electric Motorcycle Market Insight

The China electric motorcycle market accounted for the largest market revenue share within Asia-Pacific in 2024, supported by the government's strong push for electric mobility, robust production ecosystems, and surging demand for urban transportation alternatives. China’s large population of daily commuters and extensive domestic electric vehicle industry are key growth enablers. Government regulations limiting gasoline motorcycle usage in major cities are also accelerating electric motorcycle adoption across urban regions.

India Electric Motorcycle Market Insight

The India electric motorcycle market is expected to grow at a notable CAGR through 2032, fueled by increasing fuel costs, government-led FAME incentives, and a growing shift toward sustainable transport. Indian consumers are increasingly choosing electric motorcycles for last-mile connectivity, daily commuting, and food delivery services. Domestic start-ups and major OEMs are investing heavily in product innovation, battery swapping networks, and affordability, boosting widespread market adoption.

Japan Electric Motorcycle Market Insight

The Japan electric motorcycle market is experiencing steady growth, driven by technological innovation, rising eco-consciousness, and strong consumer preference for quiet, compact, and efficient mobility solutions. Urban infrastructure tailored for two-wheelers and the nation’s advanced battery technologies support growth. Moreover, the aging population’s demand for lightweight, easy-to-use electric motorcycles is further strengthening market expansion in both personal and delivery applications.

Which Region is the Fastest Growing Region in the Electric Motorcycle Market?

North America electric motorcycle market is projected to register the fastest CAGR of 27.2% from 2025 to 2032, driven by increased environmental awareness, rising gas prices, and a growing consumer shift toward sustainable and tech-enabled transportation. The rise of electric mobility startups, investments in charging infrastructure, and a shift in consumer behavior toward premium electric motorcycles are key growth drivers. In addition, the demand for recreational electric motorcycles and government policies such as EV tax credits and zero-emission targets are contributing significantly to regional expansion.

U.S. Electric Motorcycle Market Insight

The U.S. electric motorcycle market captured the largest revenue share within North America in 2024, supported by the country’s growing adoption of smart transportation, high disposable income, and interest in clean energy vehicles. Increasing availability of high-performance models from companies such as Harley-Davidson (LiveWire) and Zero Motorcycles, along with the expansion of EV charging stations, is bolstering market penetration across urban and suburban areas.

Canada Electric Motorcycle Market Insight

The Canada electric motorcycle market is expected to grow steadily, driven by the government’s zero-emission vehicle targets, tax incentives for electric vehicles, and heightened awareness of climate change. The country's favorable policies and expanding electric vehicle infrastructure are promoting adoption, especially among young urban commuters and environmentally conscious consumers.

Which are the Top Companies in Electric Motorcycle Market?

The electric motorcycle industry is primarily led by well-established companies, including:

- Honda Motor Co., Ltd. (Japan)

- Harley-Davidson, Inc. (U.S.)

- Zero Motorcycles, Inc. (U.S.)

- KTM AG (Austria)

- BMW Motorrad (Germany)

- Maeving (U.K.)

- Energica Motor Company S.p.A. (Italy)

- CAKE (Sweden)

- SUR-RON USA (U.S.)

- Electric Motion (France)

- Fonz Moto Pty Limited (Australia)

- Arc Vector (U.K.)

- Emflux Motors (India)

- Evoke Motorcycles (China)

- Fuell Fllow (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Savic Motorcycles (Australia)

- Suzuki Motor Corporation (Japan)

- Tacita Motorcycles (Italy)

- Tarform Luna (U.S.)

What are the Recent Developments in Global Electric Motorcycle Market?

- In November 2023, Honda Motor Company unveiled an ambitious roadmap to expand its electric motorcycle business by raising its global annual sales target to 4 million units by 2030, up from the previous goal of 3.5 million units. The strategy includes the introduction of 30 electric motorcycle models globally and a total investment of 500 billion yen—100 billion yen from 2021 to 2025 and an additional 400 billion yen from 2026 to 2030. This significant financial commitment underscores Honda's intention to lead the transition toward electric mobility in the two-wheeler segment

- In November 2023, Orxa Energies, an electric vehicle manufacturer, launched Mantis, a premium electric motorcycle with a kerb weight of 182 kg, available in Urban Black and Jungle Grey variants. It comes equipped with a 1.3 kW charger, offering performance and design aimed at the urban rider. This launch signals Orxa’s entry into the high-performance EV motorcycle segment

- In June 2023, Revolt Motors revealed plans to introduce a new electric motorcycle model featuring extended range and advanced technology enhancements, aiming to diversify its product line and cater to evolving consumer expectations. This move aligns with the brand's strategy to remain competitive in the growing EV two-wheeler market

- In May 2023, Lightning Motorcycles entered a strategic partnership with LG Chem to develop next-generation lithium-ion battery technology. The collaboration focuses on improving energy density and charging efficiency, enabling longer ride times and faster recharges. This partnership marks a crucial step toward boosting the performance of electric motorcycles globally

- In April 2023, Harley-Davidson expanded its electric two-wheeler presence in Europe with the launch of its first electric motorcycle, the LiveWire. The move reflects Harley-Davidson’s commitment to innovation and sustainability while broadening its appeal to a new generation of environmentally conscious riders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTRIC MOTORCYCLES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ELECTRIC MOTORCYCLES MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ELECTRIC MOTORCYCLES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGY TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 KEY STRATEGIC INITIATIVES

5.6 COMPANY COMPARITIVE ANALYSIS

5.7 PATENT ANALYSIS

5.8 PRICING ANALYSIS

5.9 MARKET SIZE OF BOTH MOTORBIKES VS MOPEDS OVER THE NEXT FIVE YEARS ALONG WITH GROWTH RATE

5.1 STARTUP/DISRUPTORS EVALUATION GRID

5.11 BATTERY MANUFACTURERS LIST (WITH BATTERY TYPES)

5.12 BATTERY MANUFACTURERS SUPPLY CHAIN ANALYSIS

5.13 CELL CONETOR TECHNOLOGY – MARKET OVERVIEW (DRIVERS & CHALLENGES)

6 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY TYPE

6.1 OVERVIEW

6.2 MOTORCYCLE

6.2.1 CRUISER

6.2.2 SPORTS BIKE

6.2.3 STANDARD

6.2.4 TOURING

6.2.5 OTHERS

6.3 MOPEDS

6.3.1 CITY/URBAN MOPEDS

6.3.2 SPORT/PERFORMANCE MOPEDS

6.3.3 DELIVERY/UTILITY MOPEDS

6.3.4 FOLDING MOPEDS

6.3.5 OTHERS

7 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY PEDELECS TYPE

7.1 OVERVIEW

7.2 WITH PEDAL

7.3 WITHOUT PEDAL

8 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY BATTERY TYPE

8.1 OVERVIEW

8.2 SEALED LEAD ACID

8.3 LITHIUM ION

8.4 NICKEL METAL HYDRIDE

9 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY VOLTAGE RANGE (USD & UNITS)

9.1 OVERVIEW

9.2 BELOW 24 VOLT

9.3 24-48 VOLT

9.4 49-60 VOLT

9.5 ABOVE 60 VOLT

10 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY DISTANCE COVERED

10.1 OVERVIEW

10.2 BELOW 75 MILES

10.3 75 TO 100 MILES

10.4 ABOVE 100 MILES

11 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY DRIVE TYPE

11.1 OVERVIEW

11.2 BELT DRIVE

11.3 CHAIN DRIVE

11.4 OTHER

12 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY CHARGING POWER

12.1 OVERVIEW

12.2 UP TO 3.3

12.3 3.3 KW - 6.6 KW

12.4 ABOVE 6.6 KW

13 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY WEIGHT

13.1 OVERVIEW

13.2 LESS THAN 500 LBS

13.3 MORE THAN 500 LBS

14 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY TECHNOLOGY

14.1 OVERVIEW

14.2 PLUG-IN

14.3 BATTERY

15 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY USAGE

15.1 OVERVIEW

15.2 PERSONAL

15.2.1 BY TYPE

15.2.1.1. MOTORCYCLE

15.2.1.1.1. CRUISER

15.2.1.1.2. SPORTS BIKE

15.2.1.1.3. STANDARD

15.2.1.1.4. TOURING

15.2.1.1.5. OTHERS

15.2.1.2. MOPEDS

15.2.1.2.1.1 WITH PEDAL

15.2.1.2.1.2 WITHOUT PEDAL

15.2.1.2.2. TYPE

15.2.1.2.2.1 UTILITY ELECTRIC MOPEDS

15.2.1.2.2.2 FOLDING ELECTRIC MOPEDS

15.2.1.2.2.3 OTHERS

15.3 COMMERCIAL

15.3.1 BY TYPE

15.3.1.1. MOTORCYCLE

15.3.1.1.1. CRUISER

15.3.1.1.2. SPORTS BIKE

15.3.1.1.3. STANDARD

15.3.1.1.4. TOURING

15.3.1.1.5. OTHERS

15.3.1.2. MOPEDS

15.3.1.2.1.1 WITH PEDAL

15.3.1.2.1.2 WITHOUT PEDAL

15.3.1.2.2. TYPE

15.3.1.2.2.1 UTILITY ELECTRIC MOPEDS

15.3.1.2.2.2 FOLDING ELECTRIC MOPEDS

15.3.1.2.2.3 OTHERS

16 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY SALES CHANNEL

16.1 OVERVIEW

16.2 DIRECT SALES

16.2.1 COMPANY WEBSITE

16.2.2 E-COMMERCE

16.3 INDIRECT SALES

17 GLOBAL ELECTRIC MOTORCYCLES MARKET, BY REGION

17.1 GLOBAL ELECTRIC MOTORCYCLES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1.1 NORTH AMERICA

17.1.1.1. U.S.

17.1.1.2. CANADA

17.1.1.3. MEXICO

17.1.2 EUROPE

17.1.2.1. GERMANY

17.1.2.2. FRANCE

17.1.2.3. U.K.

17.1.2.4. ITALY

17.1.2.5. SPAIN

17.1.2.6. RUSSIA

17.1.2.7. TURKEY

17.1.2.8. BELGIUM

17.1.2.9. NETHERLANDS

17.1.2.10. SWITZERLAND

17.1.2.11. SWEDEN

17.1.2.12. DENMARK

17.1.2.13. POLAND

17.1.2.14. REST OF EUROPE

17.1.3 ASIA PACIFIC

17.1.3.1. JAPAN

17.1.3.2. CHINA

17.1.3.3. SOUTH KOREA

17.1.3.4. INDIA

17.1.3.5. AUSTRALIA AND NEW ZEALAND

17.1.3.6. SINGAPORE

17.1.3.7. GLOBAL

17.1.3.8. MALAYSIA

17.1.3.9. INDONESIA

17.1.3.10. PHILIPPINES

17.1.3.11. TAIWAN

17.1.3.12. VIETNAM

17.1.3.13. REST OF ASIA PACIFIC

17.1.4 SOUTH AMERICA

17.1.4.1. BRAZIL

17.1.4.2. ARGENTINA

17.1.4.3. REST OF SOUTH AMERICA

17.1.5 MIDDLE EAST AND AFRICA

17.1.5.1. SOUTH AFRICA

17.1.5.2. SAUDI ARABIA

17.1.5.3. EGYPT

17.1.5.4. ISRAEL

17.1.5.5. KUWAIT

17.1.5.6. QATAR

17.1.5.7. REST OF MIDDLE EAST AND AFRICA

17.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL ELECTRIC MOTORCYCLES MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 MERGERS & ACQUISITIONS

18.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.4 EXPANSIONS

18.5 REGULATORY CHANGES

18.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL ELECTRIC MOTORCYCLES MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL ELECTRIC MOTORCYCLES MARKET, COMPANY PROFILE

20.1 ATHER ENERGY

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 BMW

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 KTM SPORTMOTORCYCLE GMBH,

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.4 PIAGGIO & C. SPA

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 OKINAWA AUTOTECH INTERNATIONALL PRIVATE LIMITED

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 GOGORO

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 GOVECS AG

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENTS

20.8 ASKOLL EVA S.P.A.

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 VMOTO LIMITED

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 AIMA INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENTS

20.11 NIU INTERNATIONAL

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 JIANGSU SINSKI VEHICLE SCIENCE & TECHNOLOGY CO.,LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENTS

20.13 ELECTRIC MOTION

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENTS

20.14 JOHAMMER E-MOBILITY GMBH

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 ESSENCE MOTOCYCLES

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

20.16 ZERO MOTORCYCLES, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENTS

20.17 RAZOR USA LLC.

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENTS

20.18 TORK MOTORS PVT. LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENTS

20.19 REVOLT INTELLICORP PRIVATE LIMITED.

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 BRP

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENTS

20.21 HUSQVARNA MOTORCYCLES

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENTS

20.22 HARLEY-DAVIDSON, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 REVENUE ANALYSIS

20.22.3 PRODUCT PORTFOLIO

20.22.4 RECENT DEVELOPMENTS

20.23 DECO

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 HONDA MOTOR CO., LTD.

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT DEVELOPMENTS

20.25 CAKE

20.25.1 COMPANY SNAPSHOT

20.25.2 REVENUE ANALYSIS

20.25.3 PRODUCT PORTFOLIO

20.25.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.