Global Wireless Health And Fitness Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

226.84 Billion

USD

573.81 Billion

2024

2032

USD

226.84 Billion

USD

573.81 Billion

2024

2032

| 2025 –2032 | |

| USD 226.84 Billion | |

| USD 573.81 Billion | |

|

|

|

|

Global Wireless Health and Fitness Devices Market Segmentation, By Type (Mobile, Watch, USB, Bluetooth, Sensors and Others), Product (Sports & Fitness Devices, Remote Health Monitoring Devices and Professional Healthcare Devices), Application (Monitoring and Diagnosis), End-Users (Hospitals and Sports & Fitness Institutes) - Industry Trends and Forecast to 2032

Wireless Health and Fitness Devices Market Size

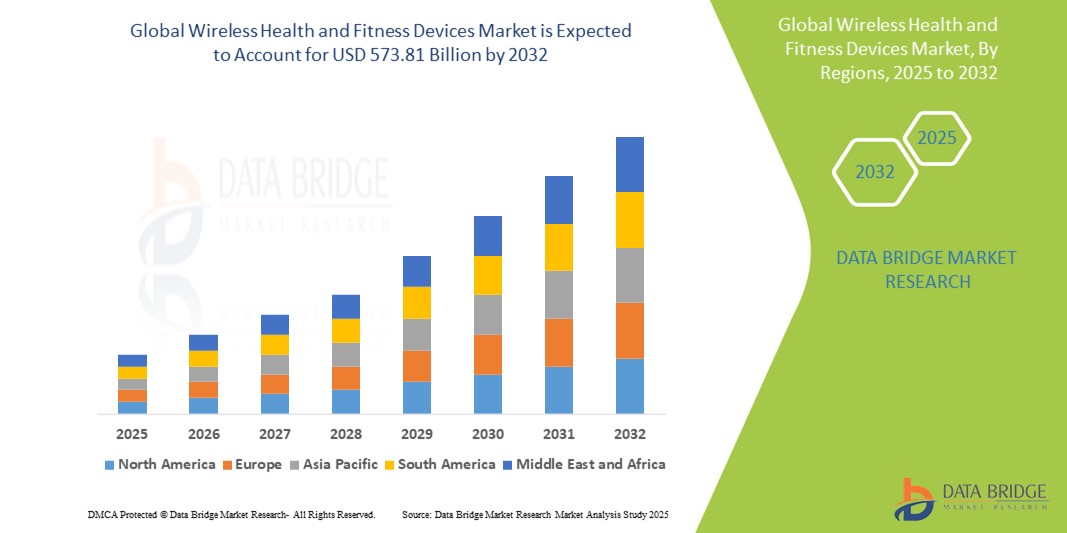

- The global Wireless Health and Fitness Devices market size was valued atUSD 226.84 billion in 2024and is expected to reachUSD 573.81 billion by 2032, at aCAGR of 12.3%during the forecast period

- This growth is driven by factors such as the technological advancements in sensors and AI, along with increasing health awareness and the rising prevalence of chronic diseases

Wireless Health and Fitness Devices Market Analysis

- Wireless health and fitness devices are wearable technologies that monitor and track physical activity, vital signs, sleep patterns, and other health metrics, promoting a healthier lifestyle

- The demand for these devices is significantly driven by increasing health awareness, the rise of chronic diseases, and advancements in sensor technologies and AI integration

- North America is expected to dominate the wireless health and fitness devices market with an estimated market share of 49.3%, driven by strong consumer demand, high adoption rates of wearable technology, and advanced healthcare infrastructure

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rising disposable income, increasing health awareness, and the growing adoption of wearable technology

- Sports and fitness devices segment is expected to dominate the market with a market share of 60.05% due to its increasing consumer focus on health and wellness, particularly among younger demographics. Devices such as fitness trackers and smartwatches have gained popularity due to their ability to monitor various health metrics such as steps taken, calories burned, and heart rate

Report Scope and Wireless Health and Fitness Devices Market Segmentation

|

Attributes |

Wireless Health and Fitness Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wireless Health and Fitness Devices Market Trends

“Integration of AI & Advanced Sensors for Personalized Health Monitoring”

- One prominent trend in the wireless health and fitness devices market is the growing integration ofArtificial Intelligence (AI) and advanced sensors, which are enhancing personalized health monitoring

- These innovations enable devices to provide more accurate, real-time insights into various health metrics such as heart rate, blood pressure, and sleep patterns, offering users tailored recommendations for improving their health

- For instance, AI-powered fitness trackers and smartwatches can learn users' habits and adapt to their specific fitness goals, improving motivation and long-term health outcomes

- These advancements are transforming the way individuals approach personal wellness, driving the demand for more sophisticated devices that offer deeper, data-driven insights

Wireless Health and Fitness Devices Market Dynamics

Driver

“Rising Health Consciousness and Prevalence of Chronic Diseases”

- The increasing awareness about personal health and fitness, combined with the rising prevalence of chronic diseases such as diabetes, obesity, and cardiovascular conditions, is significantly driving the demand for wireless health and fitness devices

- With more individuals becoming proactive about managing their health, there is a growing reliance on wearable devices that monitor vital health metrics, track fitness goals, and encourage healthier lifestyle

- Chronic diseases, which require continuous monitoring and lifestyle adjustments, are prompting consumers to adopt devices that provide real-time insights into their health status

For instance,

- In a 2023 report by the World Health Organization, the global prevalence of chronic diseases is projected to increase substantially, particularly among aging populations, further fueling the demand for remote monitoring devices

- This growing health consciousness and the need for chronic disease management are contributing to the expanding market for wireless health and fitness devices.

Opportunity

“Integration of AI and Machine Learning for Enhanced Health Monitoring”

- AI and machine learning integration in wireless health and fitness devices offers a significant opportunity to enhance personalized health monitoring and predictive analytics, enabling more tailored and proactive health management

- AI-powered devices can analyze large datasets from wearables to provide real-time insights, detect early signs of health issues such as irregular heart rates or sleep apnea, and offer actionable recommendations for improving wellness

- By leveraging machine learning algorithms, these devices can adapt to users' behaviors and offer more accurate, individualized health advice, improving overall health outcomes

For instance,

- In a 2024 report by the Journal of Medical Internet Research, AI algorithms used in wearable health devices have been shown to predict cardiac events by analyzing real-time data from users' heart rate and activity patterns, leading to early interventions that prevent major health issues

- The integration of AI and machine learning in health and fitness devices presents an opportunity to not only enhance user engagement but also revolutionize preventive healthcare by providing earlier detection and personalized interventions

Restraint/Challenge

“High Costs and Affordability Concerns Limiting Widespread Adoption”

- The high cost of advanced wireless health and fitness devices remains a significant challenge, particularly in emerging markets where affordability is a concern

- Devices such as AI-powered wearables, advanced fitness trackers, and health monitoring systems can cost hundreds to thousands of dollars, making them inaccessible for a large portion of the population

- These price barriers can prevent broader adoption, especially among low-income individuals or smaller healthcare providers that cannot afford to invest in the latest devices, potentially leading to a reliance on older, less advanced technology

For instance,

- In a 2023 report by GlobalData, the high upfront costs of premium wearables, particularly those integrated with advanced sensors and AI capabilities, have been identified as a key factor limiting adoption in price-sensitive regions such as Southeast Asia and parts of Africa

- Consequently, the high costs of these devices can exacerbate health disparities and slow down the overall growth of the wireless health and fitness devices market, especially in developing economies

Wireless Health and Fitness Devices Market Scope

The market is segmented on the basis of type, product, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By End User

|

|

In 2025, the sports and fitness devices is projected to dominate the market with a largest share in product segment

The sports and fitness devices segment is expected to dominate the wireless health and fitness devices market with the largest share of 60.05% in 2025 due to its increasing consumer focus on health and wellness, particularly among younger demographics. Devices such as fitness trackers and smartwatches have gained popularity due to their ability to monitor various health metrics such as steps taken, calories burned, and heart rate. In addition, advancements in wearable technology and the growing trend of active lifestyles contribute to the sustained growth of this segment

The watch is expected to account for the largest share during the forecast period in type market

In 2025, the watch segment is expected to dominate the market with the largest market share of 36.5% due to its growing popularity as a multi-functional wearable device. Smartwatches offer a seamless combination of fitness tracking, health monitoring, and convenience, all in one compact, accessible form. With advancements in sensor technology and increased consumer demand for continuous health tracking, smartwatches are becoming an essential tool for fitness enthusiasts and health-conscious individuals.

Wireless Health and Fitness Devices Market Regional Analysis

“North America Holds the Largest Share in the Wireless Health and Fitness Devices Market”

- North America dominates the wireless health and fitness devices market, with an estimated market share of 49.3%, driven by strong consumer demand, high adoption rates of wearable technology, and advanced healthcare infrastructure

- U.S. holds the largest market share of 67.6%, owing to its tech-savvy population, strong presence of major fitness technology companies, and increasing awareness of health and wellness

- In addition, North America benefits from a well-established market for preventive healthcare, with consumers increasingly focusing on fitness tracking, remote health monitoring, and personalized wellness solutions

- The rising prevalence of chronic diseases such as obesity, diabetes, and heart disease further boost the demand for these devices in managing and preventing health condition

“Asia-Pacific is Projected to Register the Highest CAGR in the Wireless Health and Fitness Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the wireless health and fitness devices market, driven by improving healthcare infrastructure, rising disposable incomes, and increasing health awareness

- Countries such as China, India, and Japan are emerging as key markets due to the growing interest in fitness technology, the rise of wearable devices, and increasing government support for health initiatives

- China and India, in particular, are seeing rapid growth in the adoption of wireless health devices as the demand for health monitoring, fitness tracking, and preventive care rises among the middle-class population

- The expanding consumer base, increasing health-consciousness, and the growing prevalence of lifestyle-related diseases are the primary drivers of market growth in the region

Wireless Health and Fitness Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Garmin Ltd.(U.S.)

- Apple Inc.(U.S.)

- SAMSUNG (South Korea)

- Huawei Technologies Co., Ltd(China)

- Withings(France)

- Polar Electro (Finland)

- Xiaomi (China)

- WHOOP (U.S.)

- SUUNTO (Finland)

- TomTom International BV (Netherlands)

- Zepp INC. (China)

- COROS Wearables, Inc. (U.S.)

- OMRON Healthcare, Inc. (Japan)

- Bose Corporation (U.S.)

- Beurer GmbH (Germany)

- Under Armour Inc. (U.S.)

- Eargo Inc. (U.S.)

- Lifesense (China)

Latest Developments in Global Wireless Health and Fitness Devices Market

- In January 2025, Fitbit (a subsidiary of Google) announced the launch of its new Charge 6 fitness tracker, which now includes advanced sensors for continuous blood oxygen level monitoring and enhanced heart rate tracking. The device also integrates more personalized coaching, helping users optimize their fitness routines based on real-time data. The new Charge 6 is also compatible with Google’s Health Connect for better data syncing across devices

- In December 2024, Samsung launched its Galaxy Watch 6 Active, which features enhanced fitness tracking capabilities, including a new stress management feature that uses skin temperature and heart rate variability to track stress levels throughout the day. It also includes an improvedECGsensor for better heart health monitoring and an advanced sleep tracking system to help users optimize their sleep patterns for overall well-being

- In October 2024, Garmin introduced its Venu 3 smartwatch, designed for fitness enthusiasts and athletes. This new model includes an advanced heart rate sensor, built-in GPS, and a new health metric feature that tracks blood pressure levels, providing users with detailed reports on their cardiovascular health. The Venu 3 also offers personalized workout suggestions based on users' fitness goals and performance

- In September 2024, WHOOP released its Strap 5.0, a fitness band designed for professional athletes and health-conscious individuals. The new version includes improved sensors for more accurate sleep tracking, HRV (heart rate variability), and stress monitoring. The device also integrates with WHOOP’s updated mobile app, which now includes AI-driven health insights and recommendations tailored to individual health trends

- In September 2024, Apple introduced the Apple Watch Series 9, which now includes a sensor capable ofmonitoring blood glucoselevels and a new sleep-tracking algorithm that provides users with detailed analysis on their sleep stages. The Series 9 model also integrates with Apple's Health app, offering users personalized insights on fitness, nutrition, and overall wellness based on data collected from the watch and other connected devices

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.