Global Blood Glucose Monitoring System Market

Market Size in USD Billion

CAGR :

%

USD

17.81 Billion

USD

33.56 Billion

2024

2032

USD

17.81 Billion

USD

33.56 Billion

2024

2032

| 2025 –2032 | |

| USD 17.81 Billion | |

| USD 33.56 Billion | |

|

|

|

Global Blood Glucose Monitoring System Market Analysis

The global blood glucose monitoring system market is experiencing significant growth due to the rising prevalence of diabetes worldwide. These systems, which include continuous glucose monitoring (CGM) and self-monitoring blood glucose (SMBG) devices, are essential for managing diabetes by providing real-time blood glucose levels. Technological advancements and the introduction of non-invasive and wearable devices are driving market expansion. Additionally, supportive reimbursement policies and increased awareness about diabetes management are contributing to the adoption of these devices. The market is also benefiting from the COVID-19 pandemic, which has highlighted the importance of home monitoring. Overall, the market is poised for continued growth as the demand for efficient diabetes management solutions increases.

Global Blood Glucose Monitoring System Market Size

The global blood glucose monitoring system market size was valued at USD 17.81 billion in 2024 and is projected to reach USD 33.56 billion by 2032, with a CAGR of 8.24%during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Global Blood Glucose Monitoring System Market Trends

"Empowering diabetes management with innovative glucose monitoring solutions."

The rising prevalence of diabetes is significantly driving the demand for blood glucose monitoring devices worldwide. By 2030, it is estimated that around 643 million people will be affected by diabetes, a number projected to rise to 783 million by 2045. This alarming increase highlights the critical need for accessible and advanced monitoring solutions. Blood glucose monitoring systems, including continuous glucose monitoring (CGM) and self-monitoring blood glucose (SMBG) devices, are essential tools for managing diabetes. Technological advancements in these devices, such as non-invasive and wearable options, are further enhancing their adoption. Supportive reimbursement policies and heightened awareness about diabetes management are also contributing to market growth. The surge in demand underscores the importance of these devices in providing real-time blood glucose data, thereby empowering individuals to manage their condition effectively.

Report Scope and Global Blood Glucose Monitoring System Market Segmentation

|

Attributes |

Global Blood Glucose Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Medtronic (Ireland), Abbott (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Johnson & Johnson Services Inc. (U.S.), PHC Holdings Corporation (Japan), Dexcom Inc. (U.S.), Ypsomed (Switzerland), B. Braun Melsungen AG (Germany), NIPRO (Japan), Sanofi (France), ARKRAY Inc. (Japan), Prodigy Diabetes Care LLC (U.S.), ACON Laboratories Inc. (U.S.), Nova Biomedical (U.S.), Bayer AG (Germany), BD (Becton, Dickinson and Company) (U.S.), Roper Technologies Inc. (U.S.), TERUMO CORPORATION (Japan), Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), LifeScan IP Holdings, LLC (U.S.). |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Global Blood Glucose Monitoring System Market Definition

The Blood Glucose Monitoring System (BGMS) market refers to the industry involved in the development, production, and distribution of devices used to measure blood glucose levels, primarily for managing diabetes. These systems are crucial for individuals with diabetes to monitor and maintain their blood sugar levels within a healthy range. BGMS includes a range of products such as blood glucose meters, test strips, lancets, continuous glucose monitors (CGMs), and related accessories. The market is driven by factors such as the rising prevalence of diabetes, advancements in technology, and the growing awareness of diabetes management. Innovations such as non-invasive monitoring and integration with mobile apps for real-time data tracking are further propelling growth. The market is also influenced by increasing healthcare access and the rising demand for personalized medicine. Major players include Medtronic, Abbott, Roche, and Dexcom, among others, contributing to the dynamic landscape of BGMS.

Global Blood Glucose Monitoring System Market Dynamics

Drivers

- Rising Prevalence of Diabetes

The rising global prevalence of diabetes, particularly type 1 and type 2 diabetes, is a major driver of the blood glucose monitoring system market. According to the World Health Organization (WHO) and other health authorities, the number of diabetes cases worldwide has surged due to factors such as unhealthy lifestyles, poor dietary habits, and an aging population. The increasing incidence of diabetes has created an urgent need for effective management and monitoring, which is essential for preventing complications such as heart disease, kidney failure, and nerve damage. Regular blood glucose monitoring is crucial for individuals with diabetes to track their glucose levels and make timely adjustments to their treatment plans. As more people are diagnosed with diabetes, the demand for blood glucose monitoring systems is expanding, especially with the growing trend of personalized and home-based healthcare solutions. In addition, the awareness of the importance of early diagnosis and proactive management is contributing to the market's growth, as both patients and healthcare providers recognize the need for consistent and accurate glucose measurement. The rising prevalence of diabetes is thus a significant factor fueling the demand for advanced and accessible blood glucose monitoring devices worldwide.

- Increasing Health Awareness.

Increasing health awareness around diabetes management has played a significant role in driving the demand for blood glucose monitoring systems. As public health campaigns, educational initiatives, and community outreach programs highlight the importance of regular monitoring in controlling blood sugar levels, both individuals and healthcare providers are becoming more proactive in managing diabetes. This heightened awareness has led to a broader adoption of blood glucose monitoring systems, as people understand the critical role these devices play in preventing complications such as heart disease, kidney failure, and nerve damage. Additionally, healthcare professionals are emphasizing the need for frequent and accurate monitoring to tailor treatment plans, further boosting the market. As awareness of diabetes continues to grow, more individuals are seeking reliable, easy-to-use, and accessible glucose monitoring solutions, driving the demand for advanced blood glucose monitoring devices. Public health campaigns have also highlighted the significance of early diagnosis and continuous monitoring, which has encouraged patients to take a more active role in managing their condition. With the increasing focus on preventive healthcare and self-management, the need for efficient blood glucose monitoring systems is set to rise, making health awareness a key factor in the ongoing growth of the market.

Opportunities

- Integration with Digital Health Solutions.

The integration of blood glucose monitoring systems with digital health platforms, mobile apps, and cloud-based data storage is a significant opportunity in the market. These advancements allow patients and healthcare providers to monitor glucose levels in real time, enhancing the ability to track and manage diabetes more effectively. With the aid of mobile apps, patients can instantly view their glucose levels, trends, and patterns, enabling them to make timely adjustments to their diet, medication, or exercise routines. Healthcare providers can also access patient data remotely, offering more personalized and data-driven care, which is crucial for optimizing diabetes management. This integration fosters greater patient engagement and compliance, as individuals can receive instant alerts and feedback, improving their overall health outcomes. Additionally, the ability to store and analyze glucose data in the cloud allows for long-term tracking and more accurate decision-making. Companies have the opportunity to develop comprehensive solutions that combine monitoring devices with digital platforms, providing a seamless experience for users. As demand for personalized healthcare grows, these integrated systems are positioned to play a crucial role in the management of diabetes, offering new avenues for growth and innovation within the blood glucose monitoring system market.

- Personalized Healthcare and Home-based Monitoring

The growing trend toward personalized healthcare and the shift toward home-based monitoring are creating significant opportunities for the blood glucose monitoring system market. As patients increasingly seek tailored solutions to manage their diabetes, there is a rising demand for glucose monitoring systems that provide personalized insights into individual health conditions. These systems can analyze glucose trends in real time, offering customized feedback and recommendations based on the patient’s unique patterns, lifestyle, and treatment plans. This personalization not only improves diabetes management but also enhances patient satisfaction and compliance, as patients feel more in control of their health. Additionally, with the shift toward home-based monitoring, patients can track their glucose levels from the comfort of their homes, reducing the need for frequent visits to healthcare facilities. This convenience encourages consistent monitoring and empowers patients to make informed decisions about their treatment. Manufacturers have the opportunity to develop advanced, user-friendly devices that integrate with mobile apps or digital platforms to provide real-time data, alerts, and progress reports. By offering solutions that cater to individual needs, companies can tap into the growing demand for personalized and home-based healthcare, positioning themselves as leaders in the evolving blood glucose monitoring system market.

Restraints/Challenges

- High Cost of Devices.

Despite significant advancements in blood glucose monitoring technology, the high cost of devices, particularly continuous glucose monitoring (CGM) systems, remains a major barrier to widespread adoption. CGMs, which offer real-time, continuous tracking of glucose levels, are significantly more expensive than traditional blood glucose meters. The initial investment for purchasing the device, along with the ongoing costs for sensor replacements and maintenance, can be prohibitive for many patients, particularly those in emerging markets with limited healthcare budgets. This high cost makes CGMs less accessible to a broader population, especially in low- and middle-income countries, where affordability is a major concern. In addition, even in developed countries, the out-of-pocket expenses for these devices may not be fully covered by insurance plans, further limiting their accessibility. Many individuals with diabetes, particularly those without insurance or with inadequate coverage, may choose to stick with traditional methods, such as fingerstick testing, which are far less expensive. The economic burden of adopting advanced blood glucose monitoring systems, therefore, becomes a significant deterrent, slowing the market's potential growth and limiting the widespread use of more accurate and convenient monitoring solutions, especially in regions where healthcare access is a challenge.

- Limited Insurance Coverage and Reimbursement

Limited insurance coverage and reimbursement issues are significant challenges in the global blood glucose monitoring system market. In many countries, especially those with less developed healthcare systems, insurance plans either do not cover or offer limited reimbursement for advanced glucose monitoring devices such as Continuous Glucose Monitors (CGMs). As a result, patients are often left to bear the high costs of these devices out-of-pocket. The initial expense of purchasing a CGM, along with ongoing costs for sensor replacements, can be financially burdensome, particularly for individuals in lower-income brackets or those without sufficient insurance coverage. This financial barrier discourages many patients from adopting advanced monitoring technologies, pushing them to rely on less expensive and less effective traditional methods such as fingerstick testing. Even in more developed countries, the inconsistency of coverage across different insurance plans adds to the complexity of access. Some insurance providers may offer limited reimbursement or impose strict eligibility criteria, making it difficult for all patients to afford the latest monitoring technology. These challenges hinder the widespread adoption of advanced glucose monitoring systems, particularly in regions where healthcare systems are less comprehensive, ultimately affecting the market growth potential and limiting patient access to better diabetes management solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Blood Glucose Monitoring System Market Scope

The market is segmented on the basis of product, Testing site, Patient Care Setting, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Self-Monitoring Blood Glucose Systems

- Continuous Glucose Monitoring Systems

Testing site

- Fingertip Testing

- Alternate Site Testing

Patient Care Setting

- Self/Home Care

- Hospitals

- Clinics

Application

- Type 2 Diabetes

- Type 1 Diabetes

- Gestational Diabetes

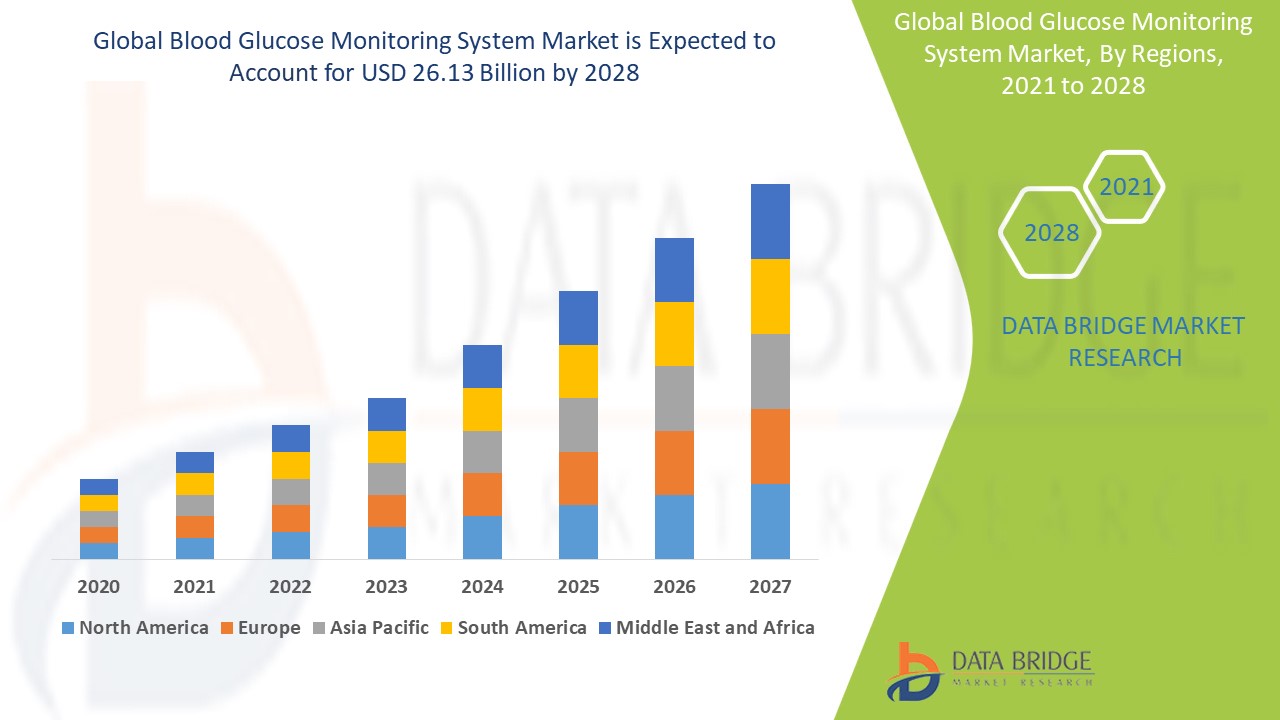

Global Blood Glucose Monitoring System Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, Testing site, Patient Care Setting, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is the dominant region in the global blood glucose monitoring system market, driven by several key factors. The high prevalence of diabetes, particularly in the U.S. creates substantial demand for blood glucose monitoring devices. The region boasts advanced healthcare infrastructure, facilitating the widespread adoption of these devices. Supportive reimbursement policies for continuous glucose monitoring (CGM) systems and self-monitoring blood glucose (SMBG) devices enhance accessibility for patients. Additionally, North America is a hub for technological advancements, with ongoing research and development leading to innovative blood glucose monitoring solutions. There is also a high level of awareness about diabetes management and the importance of regular blood glucose monitoring among healthcare professionals and patients. These factors collectively position North America as the leading region in the blood glucose monitoring system market.

The Asia-Pacific region is the fastest-growing market for blood glucose monitoring systems. This rapid growth is driven by the increasing prevalence of diabetes, particularly in countries such as China and India Rising healthcare expenditure, growing awareness about diabetes management, and technological advancements are also contributing to the market expansion in this region. The demand for efficient and accessible blood glucose monitoring devices is surging as more individuals seek to manage their diabetes effectively.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Blood Glucose Monitoring System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Blood Glucose Monitoring System Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Johnson & Johnson Services Inc. (U.S.)

- PHC Holdings Corporation (Japan)

- Dexcom Inc. (U.S.)

- Ypsomed (Switzerland)

- B. Braun Melsungen AG (Germany)

- NIPRO (Japan)

- Sanofi (France)

- ARKRAY Inc. (Japan)

- Prodigy Diabetes Care LLC (U.S.)

- ACON Laboratories Inc. (U.S.)

- Nova Biomedical (U.S.)

- Bayer AG (Germany)

- BD (Becton, Dickinson and Company) (U.S.)

- Roper Technologies Inc. (U.S.)

- TERUMO CORPORATION (Japan)

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- LifeScan IP Holdings, LLC (U.S.)

Latest Developments in Global Blood Glucose Monitoring System Market

- In June 2024, Prevounce Health launched the Pylo GL1-LTE, a technologically advanced, cellular-connected blood glucose meter designed for remote patient monitoring. This device is rigorously tested and FDA-approved, ensuring high accuracy comparable to laboratory testing equipment1. It is widely available in the US and global markets, offering reliable data transmission through multiple cellular networks. The Pylo GL1-LTE integrates seamlessly with Prevounce's remote care management platform and other health software via the Pylo cloud API1. This launch represents a significant advancement in diabetes management, providing patients and healthcare providers with a dependable and user-friendly solution for real-time blood glucose monitoring

- In June 2024, the U.S. FDA approved Abbott's two new over-the-counter continuous glucose monitoring (CGM) devices, Libre Rio and Lingo. Libre Rio is designed for adults with Type 2 diabetes who do not use insulin and typically manage their diabetes through lifestyle modifications1. Lingo, on the other hand, is aimed at consumers who want to improve their overall health and wellness by tracking glucose levels and providing personalized insights and coaching. Both devices are based on Abbott's world-leading FreeStyle Libre® sensing technology and are used by more than 6 million people globally

- In May 2024, Smart Meter launched the iGlucose Plus, a handheld glucose monitoring device designed for global use. This innovative device connects to smartphones and Wi-Fi systems, providing real-time blood glucose monitoring1. The iGlucose Plus features a color LED screen for easy viewing of instructions and results, and it automatically transmits data to healthcare providers via built-in cellular technology. This eliminates the need for manual syncing or pairing, making diabetes management more convenient and efficient1. The device also supports multiple languages and can receive notifications and reminders directly on the screen, enhancing user experience and adherence to testing protocols

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.