Marché du lait végétal au Moyen-Orient et en Afrique, par type ( lait d'amande , lait de coco, lait de cajou, lait de noix, lait de noisette, lait de soja, lait d'avoine, lait de riz, lait de lin et autres), type de produit (lait réfrigéré et lait de longue conservation), catégorie (biologique et conventionnel), formulation (sucré et non sucré), saveur (original/sans saveur, vanille, chocolat, miel, mélange de noix de coco, mélange de noisettes, caramel, érable, café et autres), fortification (régulière et fortifiée), nature (OGM et sans OGM), allégation (régulière, sans gluten, sans noix, sans soja, sans conservateurs ni colorants artificiels et autres), taille de l'emballage (moins de 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml et plus de 1000 ml), type d'emballage (Tetra Packs, bouteilles et canettes) et canal de distribution (en magasin) Détaillants et détaillants hors magasin) - Tendances et prévisions du secteur jusqu'en 2030.

Analyse et taille du marché du lait végétal au Moyen-Orient et en Afrique

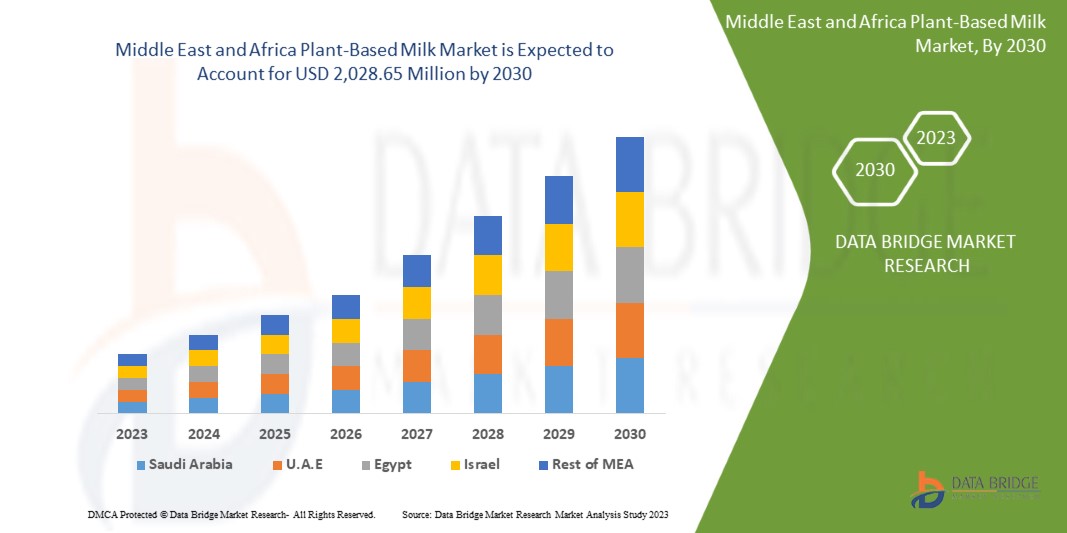

Le marché du lait végétal au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 10,6 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 028,65 millions USD d'ici 2030. L'augmentation de la population végétalienne à travers le monde est le facteur clé qui alimente l'expansion du marché du lait végétal.

La disponibilité d'une gamme plus large de produits laitiers à base de plantes stimule l'expansion du marché. En outre, le marché est encore plus influencé par l'augmentation de la population intolérante au lactose. De plus, l'augmentation des activités promotionnelles et du marketing sur les réseaux sociaux pour le lait végétal a stimulé le marché. En plus des expansions, la R&D et la modernisation des produits à base de plantes sur le marché ont ouvert un plus grand potentiel commercial pour le lait végétal.

Le rapport sur le marché du lait végétal au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (lait d'amande, lait de coco, lait de cajou, lait de noix, lait de noisette, lait de soja, lait d'avoine, lait de riz , lait de lin et autres), type de produit (lait réfrigéré et lait de longue conservation), catégorie (biologique et conventionnel), formulation (sucré et non sucré), saveur (original/sans saveur, vanille, chocolat, miel, mélange de noix de coco, mélange de noisettes, caramel, érable, café et autres), fortification (ordinaire et fortifiée), nature (OGM et sans OGM), allégation (ordinaire, sans gluten, sans noix, sans soja, sans conservateurs ni colorants artificiels et autres), taille de l'emballage (moins de 100 ml, 110 ml, 250 ml, 500 ml, 1 000 ml et plus de 1 000 ml), type d'emballage (packs Tetra, bouteilles et canettes) et canal de distribution (détaillants en magasin et détaillants hors magasin) |

|

Pays couverts |

Afrique du Sud, Émirats arabes unis, Arabie saoudite, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Silk, Alpro et THE HAIN CELESTIAL GROUP, INC., entre autres |

Définition du marché

Le lait végétal est une boisson à base de plantes qui ressemblent au lait. Le lait végétal est une boisson non laitière aromatisée et parfumée avec des extraits végétaux à base d'eau. Le lait végétal est consommé comme une alternative végétalienne au lait de vache. Le lait végétal a une texture crémeuse par rapport au lait de vache. Pour la production de lait végétal, diverses plantes sont utilisées. Parmi les laits végétaux les plus populaires au monde figurent le lait d'amande, d'avoine, de soja, de noix de coco et de noix de cajou. Depuis l'Antiquité, les gens boivent des boissons à base de plantes.

Dynamique du marché du lait végétal au Moyen-Orient et en Afrique

Conducteur

- Augmentation de la population végétalienne dans le monde

Le marché végétalien a connu une croissance exponentielle au cours des dix dernières années, poussant de plus en plus de personnes à se tourner vers des régimes à base de plantes chaque année. La sensibilisation accrue à la santé a fait augmenter la demande d'aliments naturels et biologiques. Cela a poussé une grande partie de la population à changer radicalement son mode de vie et son régime alimentaire. La communauté végétalienne se concentre sur la consommation d'aliments contenant des ingrédients ou d'autres composants d'origine végétale. Selon l'Académie de nutrition et de diététique, le risque de plusieurs maladies, telles que les maladies cardiaques, le diabète de type 2, l'hypertension, certains types de cancer et l'obésité, est réduit par des régimes végétaliens bien planifiés. En conséquence, certains de ces clients végétariens ou végétaliens ont commencé à prêter attention au lait végétal dans leur alimentation quotidienne

Ainsi, la croissance rapide de la population végétalienne dans le monde et l’adoption par les consommateurs de régimes végétariens ou flexitariens plus végétaliens vont également accroître le marché des aliments et boissons à base de plantes. Cela, à son tour, contribuera également à stimuler la croissance du marché du lait végétal au Moyen-Orient et en Afrique.

Opportunité

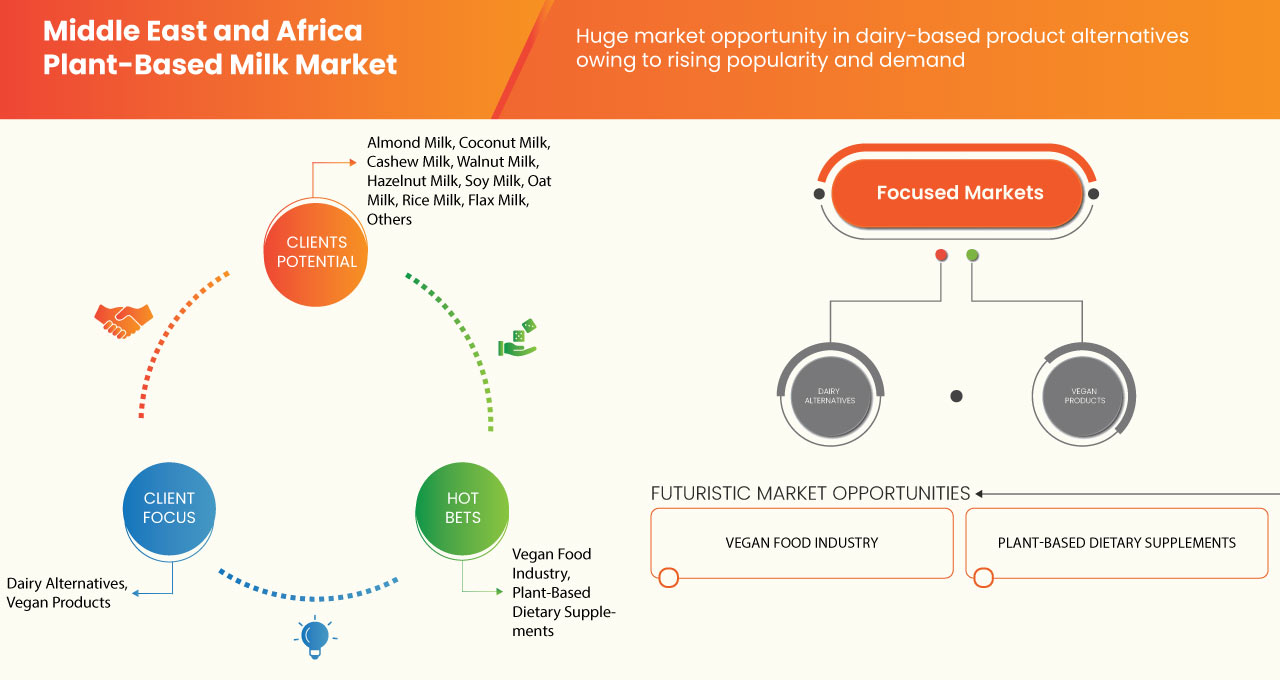

- Lancement de nouveaux produits et nouveaux partenariats, acquisition auprès d'acteurs clés

Les consommateurs et les fabricants de produits alimentaires et de boissons procèdent à divers développements et prennent des décisions stratégiques pour développer leurs activités et faire face à la demande croissante d'aliments à base de plantes tels que le lait végétal. Du lancement de nouveaux produits aux investissements en passant par les acquisitions, les principaux acteurs du marché font évoluer leurs pratiques commerciales et élargissent leurs portefeuilles de produits.

Ainsi, de tels développements attireront davantage d’opportunités de croissance pour le marché du lait végétal au Moyen-Orient et en Afrique et attireront de plus en plus de consommateurs vers le marché du lait à base de noix.

Retenue/Défi

- Augmentation des allergies aux fruits à coque chez les consommateurs

Les allergies aux noix sont un type d'allergie alimentaire qui peut provoquer des réactions graves et potentiellement mortelles, comme l'anaphylaxie. Différents types de noix sont une cause bien définie d'allergie alimentaire. Il semble y avoir des différences dans la fréquence des allergies aux noix entre les pays en raison d'autres habitudes alimentaires et procédures de cuisson. L'allergie aux noix est très courante, en particulier chez les enfants et les adultes, et cette population augmente de jour en jour. La croissance des ventes est en baisse depuis que les consommateurs sont conscients de leurs choix de santé.

De plus, les fruits à coque et les graines font partie des aliments déclencheurs les plus courants de réactions allergiques graves potentiellement mortelles. En Europe, les allergies aux fruits à coque sont courantes, l'allergie aux noisettes étant la plus répandue. Les noix de cajou sont la deuxième noix la plus allergène et constituent un problème de santé important aux États-Unis. Outre le fait d'éviter les noix et les aliments qui en contiennent, il n'existe aucun traitement contre les allergies aux noix. Par conséquent, cette situation a eu un impact considérable sur l'industrie des noix et devrait perdurer.

Impact post-COVID-19 sur le marché du lait végétal au Moyen-Orient et en Afrique

Cependant, le marché du lait végétal au Moyen-Orient et en Afrique connaît une tendance à la hausse. L'utilisation de lait végétal, comme le lait d'amande, le lait de cajou et le lait de noisette, a augmenté parmi les consommateurs. La raison de cette demande accrue est la sensibilisation croissante des consommateurs à la santé, et aussi, en ces temps périlleux, les consommateurs ont montré un vif intérêt pour la préservation de l'environnement.

Compte tenu des baisses importantes dans de nombreux secteurs, le gouvernement, les chefs d'entreprise et les consommateurs doivent travailler ensemble pour vaincre le COVID-19. Dans cette situation, l'impact de la pandémie de COVID-19 sur le marché du lait végétal au Moyen-Orient et en Afrique est quelque peu bénéfique. Les gouvernements du monde entier adhèrent étroitement aux mesures générales de santé publique, qui comprennent la sensibilisation à l'obésité et aux aliments et boissons à valeur nutritionnelle ajoutée. La connaissance par les consommateurs d'une immunité élevée est devenue une préoccupation légitime pendant la pandémie. Les clients font de plus en plus leurs achats plus sains plutôt que plus savoureux en termes d'aliments. Dans ce scénario, le lait végétal a été amélioré en termes d'utilisation parmi les consommateurs en raison de ses avantages. Une autre raison de l'essor du marché à l'ère de la pandémie est sa polyvalence. Par exemple, différents types de saveurs, d'origines, de formulations et de fortifications sont disponibles sur le marché. De plus, dans cette ère post-pandémique, la situation s'est améliorée en raison de la demande accrue des consommateurs et de l'évolution vers les produits à base de plantes par rapport aux produits à base d'animaux.

Développements récents

- En janvier 2023, Reitan, un important détaillant de la région nordique et balte, et Oatly Inc. ont récemment annoncé l'expansion de leur relation. Reitan possède et exploite environ 300 magasins de proximité Pressbyrn et 90 magasins de proximité 7-Eleven dans toute la Suède. Ce partenariat aidera l'entreprise à dynamiser son activité et à attirer une nouvelle clientèle

- En 2021, Silk a annoncé le lancement de son nouveau produit, Silk Oat. Ce lancement a permis à l'entreprise d'élargir son portefeuille, attirant ainsi une base de consommateurs plus large

Portée du marché du lait végétal au Moyen-Orient et en Afrique

Le marché du lait végétal au Moyen-Orient et en Afrique est segmenté en onze segments notables en fonction du type, du type de produit, de la catégorie, de la formulation, de la saveur, de la fortification, de la nature, de l'allégation, de la taille de l'emballage, du type d'emballage et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

PAR TYPE

- Lait d'avoine

- Lait de soja

- Lait d'amande

- Lait de coco

- Lait de riz

- Lait de noix de cajou

- Lait de noix

- Lait de noisette

- Lait de lin

- Autres

Sur la base du type, le marché du lait végétal du Moyen-Orient et de l'Afrique est segmenté en lait d'amande, lait de coco, lait de cajou, lait de noix, lait de noisette, lait de soja, lait d'avoine, lait de riz, lait de lin et autres.

PAR TYPE DE PRODUIT

- Lait réfrigéré

- Lait à longue conservation

Sur la base du type de produit, le marché du lait végétal du Moyen-Orient et de l’Afrique est segmenté en lait réfrigéré et en lait de longue conservation.

PAR CATÉGORIE

- Conventionnel

- Organique

Sur la base de la catégorie, le marché du lait végétal du Moyen-Orient et de l’Afrique est segmenté en biologique et conventionnel.

PAR FORMULATION

- Sans sucre

- Sucré

Sur la base de la formulation, le marché du lait végétal du Moyen-Orient et de l’Afrique est segmenté en sucré et non sucré.

PAR SAVEUR

- Original/Sans saveur

- Vanille

- Chocolate

- Coffee

- Coconut Blend

- Caramel

- Honey

- Hazelnut Blend

- Maple

- Others

On the basis of flavor, the Middle East and Africa plant-based milk market is segmented into original/unflavored, vanilla, chocolate, honey, coconut blend, hazelnut blend, caramel, maple, coffee, and others.

BY FORTIFICATION

- Regular

- Fortified

On the basis of fortification, the Middle East and Africa plant-based milk market is segmented into regular and fortified.

BY NATURE

- Non-GMO

- GMO

On the basis of nature, the Middle East and Africa plant-based milk market is segmented into GMO and non-GMO.

BY CLAIM

- Regular

- Gluten Free

- Artificial Preservatives & Color Free

- Soy Free

- Nut Free

- Others

On the basis of claim, the Middle East and Africa plant-based milk market is segmented into regular, gluten free, nut free, soy free, artificial preservatives, color free, and others.

BY PACKAGING SIZE

- 1000 ML

- 250 ML

- 500 ML

- 110 ML

- More Than 1000 ML

- Less Than 100 ML

On the basis of packaging size, the Middle East and Africa plant-based milk market is segmented into less than 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml, and more than 1000 ml.

BY PACKAGING TYPE

- Tetra Packs

- Bottles

- Can

On the basis of packaging type, the Middle East and Africa plant-based milk market is segmented into tetra packs, bottles, and can.

BY DISTRIBUTION CHANNEL

- Non-Store Retailers

- Store Based Retailers

On the basis of distribution channel, the Middle East and Africa plant-based milk market is segmented into store based retailers and non-store based retailers.

Middle East and Africa Plant-Based Milk Market Regional Analysis/Insights

The Middle East and Africa plant-based milk market is segmented on the basis of type, product type, category, formulation, flavor, fortification, nature, claim, packaging size, packaging type, and distribution channel.

Some countries in the Middle East and Africa plant-based milk market are South Africa, Saudi Arabia, United Arab Emirates, Kuwait, and the Rest of the Middle East and Africa.

The United Arab Emirates is expected to dominate the Middle East and Africa plant-based milk market with a CAGR of around 11.3%. The availability of a wide range of plant-based milk with different characteristics in the United Arab Emirates is a factor promoting the growth of the plant-based milk market.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Plant-Based Milk Market Share Analysis

Le paysage concurrentiel du marché du lait végétal au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du lait végétal au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché du lait végétal au Moyen-Orient et en Afrique sont Silk, Alpro et THE HAIN CELESTIAL GROUP, INC., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 PROCESSING

4.1.3 MANUFACTURING

4.1.4 MARKETING AND DISTRIBUTION

4.1.5 END USERS

4.2 BRAND COMPARATIVE ANALYSIS

4.3 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.3.1 OVERVIEW

4.3.1.1 SOCIAL FACTORS

4.3.1.2 CULTURAL FACTORS

4.3.1.3 PSYCHOLOGICAL FACTORS

4.3.1.4 PERSONAL FACTORS

4.3.1.5 ECONOMIC FACTORS

4.3.2 PRODUCT TRAITS

4.3.2.1 MARKET ATTRIBUTES

4.3.2.2 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING ADOPTION OF ADVANCED TECHNOLOGIES IN THE PLANT-BASED MILK INDUSTRY

4.4.2 CERTIFICATIONS AND LABELLING CLAIMS AMONG MANUFACTURERS

4.4.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.1.1 LINE EXTENSION

4.5.1.2 NEW PACKAGING

4.5.1.3 RELAUNCHED

4.5.1.4 NEW FORMULATION

4.6 CONSUMER LEVEL TRENDS AND MEETING CONSUMERS' REQUIREMENTS

4.6.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.6.2 LACTOSE INTOLERANCE

4.6.3 VARIETY OF FLAVORS

4.7 FACTORS INFLUENCING PURCHASE DECISION

4.7.1 LARGE PRODUCT RANGE

4.7.2 PRODUCT PRICING

4.7.3 AUTHENTICITY OF PRODUCT

4.8 SHOPPING BEHAVIOR AND DYNAMICS

4.8.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.8.2 RESEARCH

4.8.3 IMPULSIVE

4.8.4 ADVERTISEMENT

4.8.5 TELEVISION ADVERTISEMENT

4.8.5.1 ONLINE ADVERTISEMENT

4.8.5.2 IN-STORE ADVERTISEMENT

4.8.5.3 OUTDOOR ADVERTISEMENT

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

5 REGULATIONS, CERTIFICATIONS, AND LABELING CLAIMS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN VEGAN POPULATION AROUND THE GLOBE

6.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

6.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

6.1.4 AVAILABILITY AND ACCESSIBILITY OF A WIDER RANGE OF PLANT-BASED MILK PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

6.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

6.2.3 FLUCTUATING RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING ENVIRONMENTAL CONCERNS IS FUELING THE MARKET GROWTH

6.3.2 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS, ACQUISITION AMONG KEY PLAYERS

6.3.3 INCREASED DEMAND FOR FORTIFIED BEVERAGES IN THE MARKET

6.4 CHALLENGES

6.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

6.4.2 STRINGENT GOVERNMENT REGULATIONS

6.4.3 RISE IN THE NUMBER OF PLANT-BASED MILK PRODUCERS IN THE MARKET

7 IMPACT OF COVID-19

7.1 CONSUMERS WITH CARDIOVASCULAR DISEASE AND OBESITY AT HIGH RISK OF COVID-19

7.2 INCREASED DEMAND FOR SPECIFIC FOOD PRODUCTS FOR VEGAN DIETS

7.3 IMPACT ON DEMAND

7.4 IMPACT ON SUPPLY

7.5 CONCLUSION

8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE

8.1 OVERVIEW

8.2 OAT MILK

8.2.1 OAT MILK, BY FORMULATION

8.2.1.1 UNSWEETENED

8.2.1.2 SWEETENED

8.3 SOY MILK

8.3.1 SOY MILK, BY FORMULATION

8.3.1.1 UNSWEETENED

8.3.1.2 SWEETENED

8.4 ALMOND MILK

8.4.1 ALOMIN MILK, BY FORMULATION

8.4.1.1 UNSWEETENED

8.4.1.2 SWEETENED

8.5 COCONUT MILK

8.5.1 COCONUT MILK, BY FORMULATION

8.5.1.1 UNSWEETENED

8.5.1.2 SWEETENED

8.6 RICE MILK

8.6.1 RICE MILK, BY FORMULATION

8.6.1.1 UNSWEETENED

8.6.1.2 SWEETENED

8.7 CASHEW NUT MILK

8.7.1 CASHEW MILK, BY FORMULATION

8.7.1.1 UNSWEETENED

8.7.1.2 SWEETENED

8.8 WALNUT MILK

8.8.1 WALNUT MILK, BY FORMULATION

8.8.1.1 UNSWEETENED

8.8.1.2 SWEETENED

8.9 HAZELNUT MILK

8.9.1 HAZELNUT MILK, BY FORMULATION

8.9.1.1 UNSWEETENED

8.9.1.2 SWEETENED

8.1 FLAX MILK

8.10.1 FLAX MILK, BY FORMULATION

8.10.1.1 UNSWEETENED

8.10.1.2 SWEETENED

8.11 OTHERS

8.11.1 OTHERS, BY FORMULATION

8.11.1.1 UNSWEETENED

8.11.1.2 SWEETENED

9 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 REFRIGERATED MILK

9.3 SHELF STABLE MILK

10 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION

10.1 OVERVIEW

10.2 UNSWEETENED

10.3 SWEETENED

11 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 ORIGINAL/UNFLAVORED

12.2.1 ORIGINAL/UNFLAVORED, BY MILK TYPE

12.2.1.1 ALMOND MILK

12.2.1.2 OAT MILK

12.2.1.3 SOY MILK

12.2.1.4 COCONUT MILK

12.2.1.5 RICE MILK

12.2.1.6 CASHEW NUT MILK

12.2.1.7 FLAX MILK

12.2.1.8 WALNUT MILK

12.2.1.9 HAZELNUT MILK

12.2.1.10 OTHERS

12.3 VANILLA

12.3.1 VANILLA, BY MILK TYPE

12.3.1.1 ALMOND MILK

12.3.1.2 OAT MILK

12.3.1.3 SOY MILK

12.3.1.4 COCONUT MILK

12.3.1.5 RICE MILK

12.3.1.6 CASHEW NUT MILK

12.3.1.7 FLAX MILK

12.3.1.8 WALNUT MILK

12.3.1.9 HAZELNUT MILK

12.3.1.10 OTHERS

12.4 CHOCOLATE

12.4.1 CHOCOLATE, BY MILK TYPE

12.4.1.1 ALMOND MILK

12.4.1.2 OAT MILK

12.4.1.3 SOY MILK

12.4.1.4 COCONUT MILK

12.4.1.5 RICE MILK

12.4.1.6 CASHEW NUT MILK

12.4.1.7 FLAX MILK

12.4.1.8 WALNUT MILK

12.4.1.9 HAZELNUT MILK

12.4.1.10 OTHERS

12.5 COFFEE

12.5.1 COFFEE, BY MILK TYPE

12.5.1.1 ALMOND MILK

12.5.1.2 OAT MILK

12.5.1.3 SOY MILK

12.5.1.4 COCONUT MILK

12.5.1.5 RICE MILK

12.5.1.6 CASHEW NUT MILK

12.5.1.7 FLAX MILK

12.5.1.8 WALNUT MILK

12.5.1.9 HAZELNUT MILK

12.5.1.10 OTHERS

12.6 COCONUT BLEND

12.6.1 COCONUT BLEND, BY MILK TYPE

12.6.1.1 ALMOND MILK

12.6.1.2 OAT MILK

12.6.1.3 SOY MILK

12.6.1.4 COCONUT MILK

12.6.1.5 RICE MILK

12.6.1.6 CASHEW NUT MILK

12.6.1.7 FLAX MILK

12.6.1.8 WALNUT MILK

12.6.1.9 HAZELNUT MILK

12.6.1.10 OTHERS

12.7 CARAMEL

12.7.1 CARAMEL, BY MILK TYPE

12.7.1.1 ALMOND MILK

12.7.1.2 OAT MILK

12.7.1.3 SOY MILK

12.7.1.4 COCONUT MILK

12.7.1.5 RICE MILK

12.7.1.6 CASHEW NUT MILK

12.7.1.7 FLAX MILK

12.7.1.8 WALNUT MILK

12.7.1.9 HAZELNUT MILK

12.7.1.10 OTHERS

12.8 HONEY

12.8.1 HONEY, BY MILK TYPE

12.8.1.1 ALMOND MILK

12.8.1.2 OAT MILK

12.8.1.3 SOY MILK

12.8.1.4 COCONUT MILK

12.8.1.5 RICE MILK

12.8.1.6 CASHEW NUT MILK

12.8.1.7 FLAX MILK

12.8.1.8 WALNUT MILK

12.8.1.9 HAZELNUT MILK

12.8.1.10 OTHERS

12.9 HAZELNUT BLEND

12.9.1 HAZELNUT BLEND, BY MILK TYPE

12.9.1.1 ALMOND MILK

12.9.1.2 OAT MILK

12.9.1.3 SOY MILK

12.9.1.4 COCONUT MILK

12.9.1.5 RICE MILK

12.9.1.6 CASHEW NUT MILK

12.9.1.7 FLAX MILK

12.9.1.8 WALNUT MILK

12.9.1.9 HAZELNUT MILK

12.9.1.10 OTHERS

12.1 MAPLE

12.10.1 MAMPLE, BY MILK TYPE

12.10.1.1 ALMOND MILK

12.10.1.2 OAT MILK

12.10.1.3 SOY MILK

12.10.1.4 COCONUT MILK

12.10.1.5 RICE MILK

12.10.1.6 CASHEW NUT MILK

12.10.1.7 FLAX MILK

12.10.1.8 WALNUT MILK

12.10.1.9 HAZELNUT MILK

12.10.1.10 OTHERS

12.11 OTHERS

12.11.1 OTHERS, BY MILK TYPE

12.11.1.1 ALMOND MILK

12.11.1.2 OAT MILK

12.11.1.3 SOY MILK

12.11.1.4 COCONUT MILK

12.11.1.5 RICE MILK

12.11.1.6 CASHEW NUT MILK

12.11.1.7 FLAX MILK

12.11.1.8 WALNUT MILK

12.11.1.9 HAZELNUT MILK

12.11.1.10 OTHERS

13 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION

13.1 OVERVIEW

13.2 REGULAR

13.3 FORTIFIED

14 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE

14.1 OVERVIEW

14.2 NON-GMO

14.3 GMO

15 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM

15.1 OVERVIEW

15.2 REGULAR

15.3 GLUTEN FREE

15.4 ARTIFICIAL PRESERVATIVES & COLOR FREE

15.5 SOY FREE

15.6 NUT FREE

15.7 OTHERS

16 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 1000 ML

16.3 250 ML

16.4 500 ML

16.5 110 ML

16.6 MORE THAN 1000 ML

16.7 LESS THAN 100 ML

17 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 TETRA PACKS

17.2.1 GLASS

17.2.2 PLASTICS

17.2.3 OTHERS

17.3 BOTTLES

17.4 CAN

18 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 NON-STORE RETAILERS

18.2.1 ONLINE RETAILERS

18.2.2 COMPANY WEBSITES

18.2.3 VENDING

18.3 STORE BASED RETAILERS

18.3.1 SUPERMARKETS/HYPERMARKETS

18.3.2 CONVENIENCE STORES

18.3.3 GROCERY STORES

18.3.4 SPECIALTY STORES

18.3.5 OTHERS

19 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY REGION

19.1 MIDDLE EAST & AFRICA

19.1.1 UAE

19.1.2 SAUDI ARABIA

19.1.3 KUWAIT

19.1.4 SOUTH AFRICA

19.1.5 REST OF MIDDLE EAST & AFRICA

20 COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 ALPRO

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 OATLY INC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 THE HAIN CELESTIAL GROUP, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 SANITARIUM

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CALIFIA FARMS, LLC

22.5.1 COMPANY SNAPSHOT

22.5.2 COMPANY SHARE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENTS

22.6 AUSTRALIA'S OWN

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 ELMHURST MILKED DIRECT LLC

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENTS

22.8 HERSHEY INDIA PRIVATE LIMITED

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 HP HOOD LLC.

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENT

22.1 LIFE HEALTH FOODS

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENT

22.11 MANITOBA MILLING COMPANY

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 NATUR-A

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 NOTCO

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 NUTRISSLIM

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 PLENISH

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 PROVAMEL ORGANIC-BIO

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 RUDE HEALTH

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 SILK

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 SIMPLE FOODS

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 SUNOPTA GRAINS AND FOODS INC.

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 VALSOIA S.P.A

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 YEO HIAP SENG LTD.

22.22.1 COMPANY SNAPSHOT

22.22.2 REVENUE ANALYSIS

22.22.3 PRODUCT PORTFOLIO

22.22.4 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

Liste des tableaux

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 LACTOSE INTOLERANT POPULATION IN THE YEAR 2023

TABLE 3 TEN COUNTRIES WITH THE HIGHEST PREVALENCE OF LACTOSE INTOLERANCE

TABLE 4 PRICES FOR PLANT-BASED MILK

TABLE 5 PRICES FOR ANIMAL MILK

TABLE 6 SOYBEAN PRICES OVER THE YEARS (2019-2023)

TABLE 7 OAT PRICES OVER THE YEARS (2019-2023)

TABLE 8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REFRIGERATED MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SHELF STABLE MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA UNSWEETENED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA SWEETENED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CONVENTIONAL IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA ORGANIC IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA REGULAR IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA FORTIFIED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA NON-GMO IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA GMO IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA REGULAR IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA GLUTEN FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA ARTIFICIAL PRESERVATIVES & COLOR FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA SOY FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA NUT FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA 1000 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA 250 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA 500 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA 110 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA MORE THAN 1000 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA LESS THAN 100 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA TETRA PACKS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA BOTTLES IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA CAN IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 114 UAE PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 UAE ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 116 UAE OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 117 UAE SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 118 UAE COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 119 UAE CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 120 UAE WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 121 UAE HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 122 UAE RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 123 UAE FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 124 UAE OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 125 UAE PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 UAE PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 127 UAE PLANT-BASED MILK, BY FORTIFICATION, 2021- 2023 (USD MILLION)

TABLE 128 UAE PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 129 UAE ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 UAE VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 UAE CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 UAE COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 UAE COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 UAE CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 UAE HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 UAE HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 UAE MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 UAE OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 UAE PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 140 UAE PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 141 UAE PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 142 UAE PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 143 UAE PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 144 UAE BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 145 UAE PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 146 UAE STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 147 UAE NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 148 SAUDI ARABIA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 SAUDI ARABIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 150 SAUDI ARABIA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 151 SAUDI ARABIA SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 152 SAUDI ARABIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 153 SAUDI ARABIA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 154 SAUDI ARABIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 155 SAUDI ARABIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 156 SAUDI ARABIA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 157 SAUDI ARABIA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 158 SAUDI ARABIA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 159 SAUDI ARABIA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 160 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 161 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 162 SAUDI ARABIA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SAUDI ARABIA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 SAUDI ARABIA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SAUDI ARABIA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 SAUDI ARABIA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 SAUDI ARABIA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 SAUDI ARABIA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SAUDI ARABIA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SAUDI ARABIA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SAUDI ARABIA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 173 SAUDI ARABIA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 174 SAUDI ARABIA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 175 SAUDI ARABIA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 176 SAUDI ARABIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 177 SAUDI ARABIA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 178 SAUDI ARABIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 179 SAUDI ARABIA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 180 SAUDI ARABIA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 181 KUWAIT PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 KUWAIT ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 183 KUWAIT OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 184 KUWAIT SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 185 KUWAIT COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 186 KUWAIT CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 187 KUWAIT WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 188 KUWAIT HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 189 KUWAIT RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 190 KUWAIT FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 191 KUWAIT OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 192 KUWAIT PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 193 KUWAIT PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 194 KUWAIT PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 195 KUWAIT PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 196 KUWAIT ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 KUWAIT VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 KUWAIT CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 KUWAIT COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 KUWAIT COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 KUWAIT CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 KUWAIT HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 KUWAIT HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 KUWAIT MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 KUWAIT OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 KUWAIT PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 207 KUWAIT PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 208 KUWAIT PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 209 KUWAIT PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 210 KUWAIT PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 211 KUWAIT BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 212 KUWAIT PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 213 KUWAIT STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 214 KUWAIT NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 215 SOUTH AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 SOUTH AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 217 SOUTH AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 218 SOUTH AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 219 SOUTH AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 220 SOUTH AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 221 SOUTH AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 222 SOUTH AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 223 SOUTH AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 224 SOUTH AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 225 SOUTH AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 226 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 227 SOUTH AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 229 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 230 SOUTH AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 SOUTH AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 SOUTH AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 233 SOUTH AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 SOUTH AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 SOUTH AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 SOUTH AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 SOUTH AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 SOUTH AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 SOUTH AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 241 SOUTH AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 242 SOUTH AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 243 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 244 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 245 SOUTH AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 246 SOUTH AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 247 SOUTH AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 248 SOUTH AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 9 INCREASE IN VEGAN POPULATION AROUND THE GLOBE IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET IN THE FORECAST PERIOD

FIGURE 10 OAT MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET IN 2023 & 2030

FIGURE 11 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

FIGURE 12 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPENDING DYNAMICS OF THE CONSUMERS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

FIGURE 14 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY TYPE, 2022

FIGURE 15 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FORMULATION, 2022

FIGURE 17 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY CATEGORY, 2022

FIGURE 18 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FLAVOR, 2022

FIGURE 19 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FORTIFICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY NATURE, 2022

FIGURE 21 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY CLAIM, 2022

FIGURE 22 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY PACKAGING SIZE, 2022

FIGURE 23 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2022

FIGURE 24 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SNAPSHOT (2022)

FIGURE 26 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2022)

FIGURE 27 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY TYPE (2023-2030)

FIGURE 30 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.