Global Pharmaceutical Packaging Equipment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

10.71 Billion

USD

19.86 Billion

2024

2032

USD

10.71 Billion

USD

19.86 Billion

2024

2032

| 2025 –2032 | |

| USD 10.71 Billion | |

| USD 19.86 Billion | |

|

|

|

|

Global Pharmaceutical Packaging Equipment Market Segmentation, By Product (Primary Packaging Equipment, Secondary Packaging Equipment, and Labelling and Serialization Equipment), Packaging Type (Liquids Packaging Equipment, Solid Packaging Equipment, and Semi-Solid Packaging Equipment), Equipment Type (Blenders, Granulators, Tablet Pressers, Tablet Coating Machine, and Allied Machines), Mode of Administration (Injectable Administration, Topical Administration, and Oral Administration) - Industry Trends and Forecast to 2032

Pharmaceutical Packaging Equipment Market Size

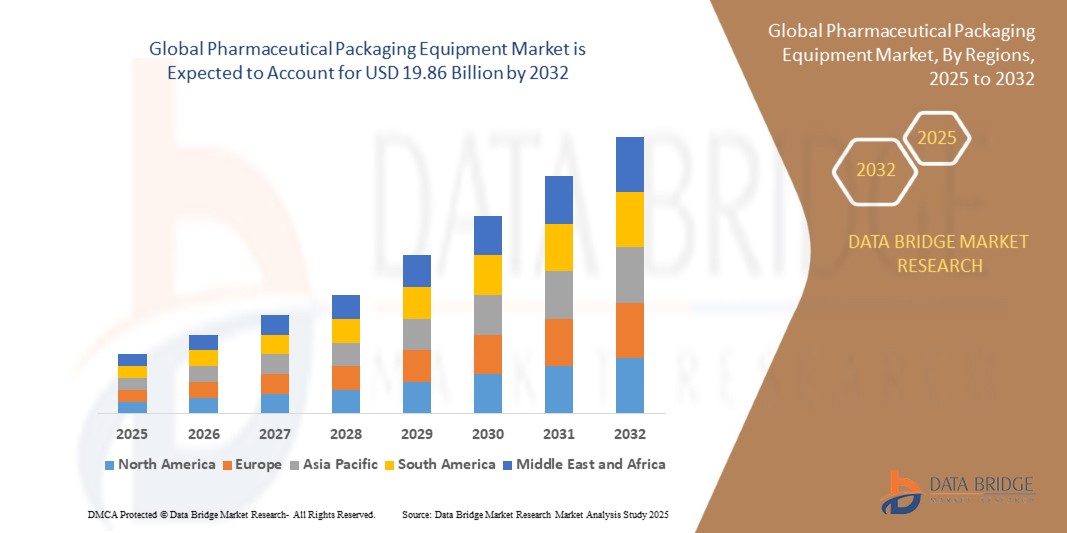

- The global pharmaceutical packaging equipment market size was valued atUSD 10.71 billion in 2024and is expected to reachUSD 19.86 billion by 2032, at aCAGR of 8.03%during the forecast period

- This growth is driven by factors such as rising drug demand, strict regulatory compliance, technological advancements, growth in biologics and personalized medicine, expansion of contract manufacturing, and a shift toward sustainable packaging solutions

Pharmaceutical Packaging Equipment Market Analysis

- Pharmaceutical packaging equipment is essential for ensuring drug safety, integrity, and compliance by efficiently packing, sealing, and labeling pharmaceutical products. It plays a critical role across various drug forms including solid, liquid, and semi-solid, supporting large-scale production and regulatory adherence

- The pharmaceutical packaging equipment market is experiencing robust growth driven by increasing pharmaceutical production, strict regulatory standards, and rising demand for automated, sterile, and flexible packaging solutions

- Asia-Pacificis expected to dominate the pharmaceutical packaging equipment market with a largest market share of 40.7%, due to the increasing demand for pharmaceutical products, expanding manufacturing capabilities, and supportive government policies across the region

- Europe is expected to be the fastest growing region in the pharmaceutical packaging equipment market during the forecast period due to strong pharmaceutical output, innovation in packaging technologies, and compliance with rigorous regulatory frameworks

- Filling machines segment is expected to dominate the market with alargest market shareof 36.1% due to due to growing demand for accurate, high-speed, and sterile filling solutions across various drug forms, especially injectables and liquid oral formulations. Their ability to maintain product integrity, reduce contamination risks, and enhance efficiency in aseptic environments makes them essential in modern pharmaceutical manufacturing, especially amid rising production volumes and stricter regulatory standards

Report Scope andPharmaceutical Packaging EquipmentMarket Segmentation

|

Attributes |

Pharmaceutical Packaging EquipmentKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Packaging EquipmentMarket Trends

“Increasing Global Health Needs”

- One prominent trend in the global pharmaceutical packaging equipment market is the increasing global health needs

- This trend is driven by the growing prevalence of chronic diseases, aging populations, and expanding access to healthcare, necessitating more pharmaceutical products and thus more advanced packaging equipment

- For instance, companies such as Krones AG and Marchesini Group are investing in high-speed, automated packaging systems to meet the rising demand for both mass-produced and personalized medicines

- The growing global health needs are also pushing for more sustainable packaging solutions, as companies focus on reducing environmental impact while meeting regulatory standards

- As the healthcare sector continues to expand, this trend is expected to significantly influence the future growth and innovation within the pharmaceutical packaging equipment market

Pharmaceutical Packaging EquipmentMarket Dynamics

Driver

“Increasing Pharmaceutical Production”

- Increasing pharmaceutical production is a key driver for growth in the pharmaceutical packaging equipment market, as it demands more efficient and scalable packaging solutions to accommodate higher output volumes

- This shift is particularly evident in the mass production ofgeneric drugs,biologics, and personalized medicines, where advanced packaging systems are crucial for maintaining product quality, safety, and compliance with regulatory standards

- As pharmaceutical production scales up, there is growing demand for more advanced packaging technologies such as automated filling, labeling, and serialization systems to streamline processes and reduce manual errors

- Manufacturers are advancing packaging equipment to incorporate features such as automation, smart packaging, and integration with production lines, enabling more efficient workflows and higher output

- The need for faster production cycles, enhanced product protection, and regulatory compliance is driving the demand for cutting-edge pharmaceutical packaging solutions across the industry

For instance,

- Krones AG provides automated packaging solutions that offer high-speed filling and sealing, ensuring greater production efficiency for large-scale pharmaceutical manufacturers

- Uhlmann Packaging Systems offers packaging equipment with integrated serialization and tamper-evident features, enhancing product security and compliance

- The pharmaceutical packaging equipment market is expected to grow significantly, driven by increasing production volumes, demand for automation, and the need for compliance with evolving industry standards

Opportunity

“Growing Shift towards Biopharmaceuticals and Specialty Drugs”

- The growing shift towards biopharmaceuticals and specialty drugs presents a significant opportunity for the pharmaceutical packaging equipment market, driven by the increasing need for specialized packaging solutions to protect sensitive biologic formulations and complex therapies

- Industries, particularly those focused on biologics, gene therapies, and specialty drugs, are seeking advanced packaging solutions that ensure product stability, sterility, and compliance with stringent regulations, creating a demand for innovative packaging technologies

- This opportunity aligns with the expanding focus on biopharmaceutical development, where packaging equipment plays a crucial role in ensuring safety, efficacy, and regulatory compliance, especially for temperature-sensitive and small-batch drugs

For instance,

- Stevanato Group provides advanced primary packaging solutions for biologics, offering high-quality vials and syringes designed to protect biologic drugs and ensure safe delivery

- Siegwerk specializes in providing packaging solutions with tamper-evident features and compatibility with biologic drug formulations, ensuring product integrity and compliance with regulatory standards

- As the shift towards biopharmaceuticals and specialty drugs continues to grow, the pharmaceutical packaging equipment market is poised for significant expansion, offering essential solutions for the evolving needs of the biopharmaceutical industry

Restraint/Challenge

“Lack of Skilled Workforce”

- The lack of a skilled workforce presents a significant challenge for the pharmaceutical packaging equipment market, particularly as companies require highly trained professionals to operate and maintain advanced packaging machinery

- The need for continuous innovation and the integration of new technologies, such as automation, serialization, and smart packaging, requires skilled personnel capable of adapting to evolving systems, which increases the demand for specialized training and expertise

- This challenge is particularly noticeable in emerging markets, where limited access to skilled labor and technical training programs hinders the adoption of advanced packaging equipment, and smaller manufacturers struggle to meet the workforce requirements

For instance,

- Uhlmann Packaging Systems has developed a training and support program for its automated packaging systems, but many smaller manufacturers in developing regions face difficulty in accessing such resources, leading to underutilization of advanced equipment

- The lack of a skilled workforce may slow the pace of technological adoption and limit the efficiency of packaging operations, posing a barrier to broader market growth and innovation in regions with limited access to specialized talent

Pharmaceutical Packaging Equipment Market Scope

The market is segmented on the basis of product, packaging type, equipment type, and mode of administration.

|

Segmentation |

Sub-Segmentation |

|

ByProduct |

|

|

ByPackaging Type |

|

|

ByEquipment Type |

|

|

ByMode of Administration

|

|

In 2025, the filling machines is projected to dominate the market with a largest share in equipment type segment

The filling machines segment is expected to dominate the pharmaceutical packaging equipment market with the largest share of 36.1% in 2025 due to growing demand for accurate, high-speed, and sterile filling solutions across various drug forms, especially injectables and liquid oral formulations. Their ability to maintain product integrity, reduce contamination risks, and enhance efficiency in aseptic environments makes them essential in modern pharmaceutical manufacturing, especially amid rising production volumes and stricter regulatory standards.

The solid packaging equipment is expected to account for the largest share during the forecast period in packaging type segment

In 2025, the solid packaging equipment segment is expected to dominate the market due to high global demand for solid oral dosage forms such as tablets and capsules, which are preferred for their ease of administration, long shelf life, and cost-effectiveness in mass production. In addition, advancements in tablet compression, coating, and blister packaging technologies further enhance efficiency and scalability, reinforcing this segment’s leading position.

Pharmaceutical Packaging Equipment Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Pharmaceutical packaging equipment Market”

- Asia-Pacificdominates the pharmaceutical packaging equipmentmarket with a largest market share of 40.7%, driven by the increasing demand for pharmaceutical products, expanding manufacturing capabilities, and supportive government policies across the region

- China holds alargest market share of12.4% in Asia-Pacfic due to its rapidly growing pharmaceutical sector, increased investments in drug manufacturing infrastructure, and strict regulatory actions against counterfeit medicines

- The region’s leadership is also fueled by rising healthcare needs, aging populations, and the shift toward automation in pharmaceutical packaging processes to meet export quality standards

- In addition, the implementation of serialization laws and growing foreign investments in local pharmaceutical industries are expected to maintain Asia-Pacific’s dominance through 2032

“Europe is Projected to Register the HighestCAGR in the Pharmaceutical packaging equipment Market”

- Europeis expected to witness the highest growth rate in the pharmaceutical packaging equipmentmarket, driven by strong pharmaceutical output, innovation in packaging technologies, and compliance with rigorous regulatory frameworks

- Germany holdslargest market share of12.4% in Europe due to its advanced pharmaceutical manufacturing infrastructure, continuous investment in automation, and leadership in packaging machinery exports

- The region’s focus on high-quality drug production, sustainability in packaging materials, and increasing exports of pharmaceuticals is significantly contributing to market expansion

- As demand rises for precision packaging of biologics and specialty drugs, Europe is expected to remain a major growth hub, with companies investing in both speed and flexibility of packaging solutions through 2032

Pharmaceutical Packaging Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Robert Bosch GmbH(Germany)

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.(Italy)

- Körber AG(Germany)

- Romaco Group (Germany)

- Uhlmann Group (Germany)

- Maquinaria Industries Dara, SL (Spain)

- MULTIVAC (Germany)

- Coesia S.p.A(Italy)

- Syntegon Technology GmbH(Germany)

- Accutek packaging Companies (U.S.)

- Vanguard Pharmaceutical Machinery, Inc. (U.S.)

- OPTIMA (Germany)

- Trustar Pharma Pack Equipment, Co. Ltd. (China)

- Busch Machinery Inc, (U.S.)

- Inline Filling Systems (U.S.)

- Duke Technologies, LLC. (India)

- ARPAC LLC (U.S.)

- ACIC Pharmaceuticals Inc. (Canada)

- AST, Inc. (U.S.)

- Truking Technology Limited (China)

- NJM Packaging (U.S.)

Latest Developments in Global Pharmaceutical Packaging Equipment Market

- In August 2024, I.M.A. Industria Macchine Automatiche S.p.A. acquired Sarong’s packaging machinery and e-packaging materials divisions, a strategic move aimed at strengthening its position in the pharmaceutical and food packaging equipment market. This acquisition expands I.M.A.'s capabilities in delivering innovative and sustainable packaging solutions, enabling the company to better address evolving industry needs. By integrating Sarong’s technological expertise, I.M.A. is expected to enhance its competitive edge and broaden its product portfolio, supporting its growth in key global markets

- In December 2023, MULTIVAC Group launched its newest production facility in India. This state-of-the-art Sales and Production complex, representing an investment of around USD 9 million, covers an area of 10,000 square meters and is scheduled to start operations in early 2024. Initially, the facility will hire approximately 60 employees and aims to improve customer service in India, Sri Lanka, and Bangladesh by strategically positioning itself in the region and reducing delivery times

- In May 2023, MULTIVAC Group introduced the Pouch Loader, a semi-automatic solution designed for chamber belt machines. This innovation significantly enhances the performance, hygiene, efficiency, and ergonomics of filling film pouches and loading them into the packaging machine

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.