Global Biologics Market

Market Size in USD Billion

CAGR :

%

USD

264.00 Billion

USD

596.65 Billion

2021

2029

USD

264.00 Billion

USD

596.65 Billion

2021

2029

| 2022 –2029 | |

| USD 264.00 Billion | |

| USD 596.65 Billion | |

|

|

|

|

Market Analysis and Size

Biologics have acquired a lot of momentum in recent years since they are used to treat a variety of diseases and ailments, such as Crohn's disease, ulcerative colitis, rheumatoid arthritis, and other autoimmune diseases. The product's widespread use is expected to drive growth in the global biologics market in the coming years. Biologics are at the cutting edge of research, supporting the most recent advances. Such breakthroughs are expected to result in revolutionary treatments that give patients new treatment options. New developments and unique therapies are being developed for the production of new biologics, indicating that the global biologics market is anticipated to have a positive future outlook.

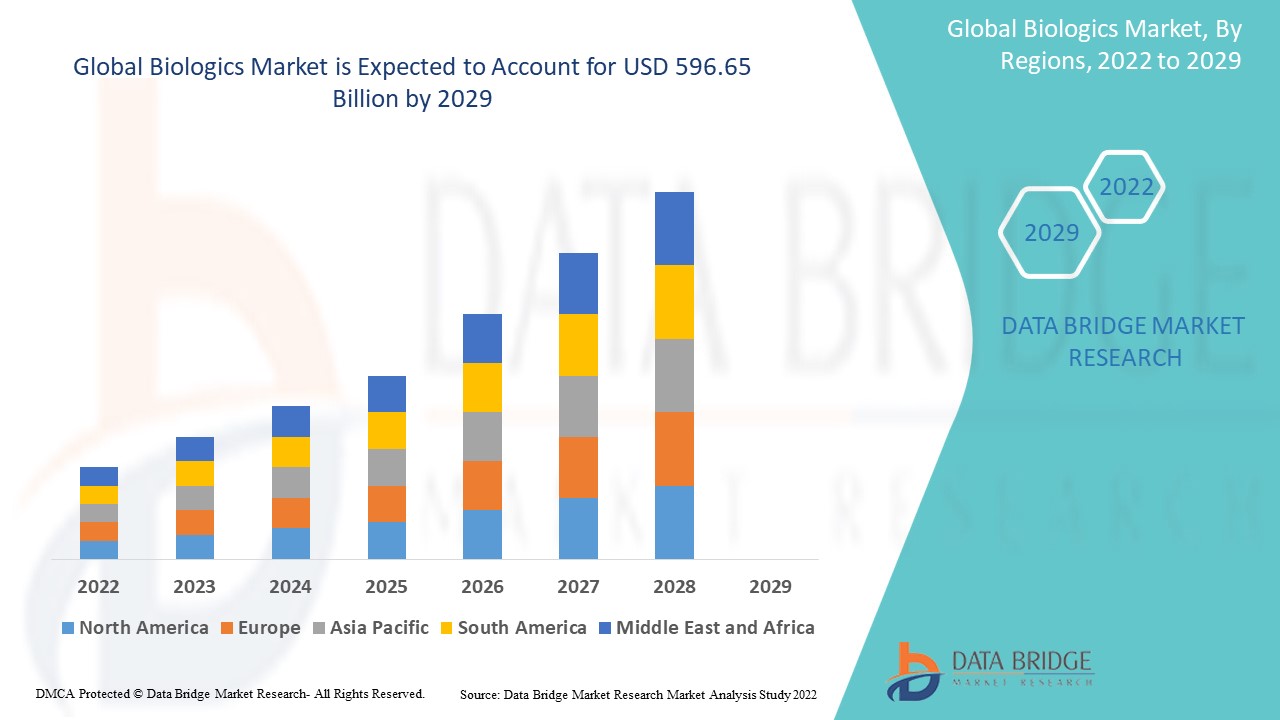

Data Bridge Market Research analyses that the biologics market was valued at USD 264 billion in 2021 and is expected to reach USD 596.65 billion by 2029, registering a CAGR of 9.25% during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Tumor Necrosis Factor (TNF) Inhibitor, T-cell Inhibitor, Selective Co-stimulation Modulators, Interleukin-6 (IL-6) or Interleukin-17 Blocker, Interleukin-1 (IL-1) Blocker, B-cell Inhibitor), Drug Class (Monoclonal Antibody, Recombinant Insulin, Vaccine, Blood Factor, Human Growth Hormone, Erythropoietin, Fusion Protein, Recombinant Enzyme, Interferon, Colony-stimulating Factor, Gene Therapy, Cell Therapy, Oligonucleotides, Others), Therapeutic Application (Oncology, Autoimmune/Immunologic Diseases, Metabolic Disorders, Ophthalmic Diseases, Respiratory Disorders, Inflammatory Bowel Diseases (IBDs), Neurological Disorders, Cardiovascular Diseases (CVDs), Musculoskeletal Disorders (MSDs), Infectious Diseases, Others), Source (Microbial, Mammalian, Others), Manufacturing (Outsourced, In-House), Drug Type (Branded Drugs, Generic Drugs), Mode of Purchase (Prescription Drugs, Over-The-Counter (OTC) Drugs), Dosage Form (Injection, Tablets, Others), Route of Administration (Oral, Parenteral, Others), End-Users (Hospitals, Specialty Clinics, Homecare, Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Pfizer Inc. (US), GlaxoSmithKline plc (UK), Novartis AG (Switzerland), Mylan N.V. (US), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), Boehringer Ingelheim International GmbH. (Germany), AstraZeneca (UK), Johnson & Johnson Private Limited (US), Merck & Co., Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Bristol-Myers Squibb Company (US), Eli Lilly and Company (US), Allergan (Ireland), Abbott (US), LEO Pharma A/S (Denmark), Sun Pharmaceutical Industries Ltd. (India), Aurobindo Pharma (India), Lupin (India), Hikma Pharmaceuticals PLC (UK), Zydus Cadila (India) |

|

Market Opportunities |

|

Market Definition

Biologics, commonly referred to as biological medications, are disease-modifying antirheumatic drugs (DMARDs) that are manufactured from live creatures or contain living organism components. Vaccines, blood, blood components, tissues, cells, allergies, genes, and recombinant proteins are among the items derived from humans, insects, microbes, animals, plants, and birds. These products regulate the development of essential proteins, alter human hormones and cells, and produce compounds that either activate or suppress the immune system. They also alter the way natural biologic intracellular and cellular activities function.

Biologics Market Dynamics

Drivers

- Rise in the prevalence of chronic diseases

The surging prevalence of chronic diseases is a major factor driving the biologics market's growth rate during the forecast period of 2022-2029. As per World Health Organization (WHO), chronic diseases kill more than 41 million people worldwide each year. The most common chronic disease, cardiovascular disease, kills 17.9 million people per year, followed by cancer, diabetes and respiratory disorders. These four groups are responsible for 80% of all chronic disease mortality. Chronic diseases have prompted the development of sophisticated diagnostics and therapeutics. Biologics are medicines that have been genetically modified to target a portion of the immune system that causes inflammation.

- Increasing investment for healthcare infrastructure

Another significant factor influencing the growth rate of biologics market is the rising healthcare expenditure which helps in improving its infrastructure. Also, various government organizations aims to improve the healthcare infrastructure by increasing funding and this will further influence the market dynamics.

Furthermore, rising initiatives by public and private organizations to spread awareness will expand the biologics market. Additionally, sedentary lifestyle of people and surging geriatric population will result in the expansion of biologics market. Along with this, favourable reimbursement policies will enhance the market's growth rate.

Opportunities

- Increase in the number of research and development activities

Moreover, the market's growth is fueled by an increase in the number of research and development activities. This will provide beneficial opportunities for the biologics market growth. In addition, scientists and researchers are studying species and expression systems to improve biological products' productivity. In addition, a number of pharmaceutical companies are conducting research and development (R and D) to increase the efficacy of oral medications for rheumatoid arthritis and Crohn's disease. Along with this, rising drug approvals and launches will further propel the market's growth rate.

Moreover, rising investment for the development of advanced technologies and an increase in the number of emerging markets will further provide beneficial opportunities for the growth of the biologics market during the forecast period.

Restraints/Challenges

On the other hand, the high cost associated with drug development and distribution will obstruct the market's growth rate. The lack of healthcare infrastructure in developing economies and dearth of skilled professionals will challenge the biologics market. Additionally, lack of awareness about the utilization of biologics in research centers will act as restrain and further impede the growth rate of market during the forecast period of 2022-2029. Biologics are sensitive to heat and light, due to which they require a superior refrigeration procedure that is not consistent over the world. This is estimated to obstruct the market's growth rate. .

This biologics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the biologics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

Biologics market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

COVID-19 Impact on Biologics Market

The COVID-19 outbreak and subsequent lockdown in numerous countries around the world had a huge impact on the financial status of enterprises in all sectors. The private healthcare sector is one of the areas where the pandemic had a significant impact. The coronavirus pandemic had a significant influence on medicine development, production, supply, and the businesses of different healthcare corporations around the world. The outbreak has resulted in the shutdown of industrial establishments, with the exception of those that manufacture critical commodities, and disruptions in product supply chains. As a result, the COVID-19 outbreak had impacted the economy in three ways: directly influencing production and demand, causing distribution channel disruptions, and having a financial impact on firms and financial markets.

On the brighter side, during the pandemic, there was a high need for biologics due to the increased COVID-19 burden, which further fuelled the market's growth rate. The National Research Council of Canada and CanSino Biologics, located in China, partnered in May 2020 to develop a COVID-19 vaccine for clinical use in Canada. Ad5-nCoV is an adenovirus Type 5 vector-based vaccination that is currently being developed in Wuhan, China. As a result, the COVID-19 outbreak had a positive impacted on the biologics market. Furthermore, the number of research and development activities on biologics for the treatment of COVID-19 is also increased. Additionally, the governments of various countries are also taking new initiatives for promoting the healthcare sector and ensuring the availability of biologics

Recent Development

- In November 2021, Bristol-Myers Squibb Company had received the U.S. Food and Drug Administration approval for Opdivo (nivolumab) plus Yervoy (ipilimumab) combined with limited chemotherapy as first-line treatment of metastatic or recurrent non-small cell lung cancer. Patients with squamous or non-squamous illness, independent of PD-L1 expression, are eligible for the treatment. 1 The FDA's Real-Time Oncology Examine (RTOR) pilot programme was used to review this application, which aims to ensure that safe and effective medicines are offered to patients as soon as feasible.

Global Biologics Market Scope

The biologics market is segmented on the basis of type, drug class, therapeutic application, source, manufacturing, drug type, mode of purchase, dosage form, route of administration, end-users and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Tumor Necrosis Factor (TNF) Inhibitor

- T-cell Inhibitor

- Selective Co-stimulation Modulators

- Interleukin-6 (IL-6) or Interleukin-17 Blocker

- Interleukin-1 (IL-1) Blocker

- B-cell Inhibitor

Drug Class

- Monoclonal Antibody

- Recombinant Insulin

- Vaccine

- Blood Factor

- Human Growth Hormone

- Erythropoietin

- Fusion Protein

- Recombinant Enzyme

- Interferon

- Colony-stimulating Factor

- Gene Therapy

- Cell Therapy

- Oligonucleotides

- Others

- Peptide

- Botulinum Toxin

- Others

Therapeutic Application

- Oncology

- Autoimmune/Immunologic Diseases

- Metabolic Disorders

- Ophthalmic Diseases

- Respiratory Disorders

- Inflammatory Bowel Diseases (IBDs)

- Neurological Disorders

- Cardiovascular Diseases (CVDs)

- Musculoskeletal Disorders (MSDs)

- Infectious Diseases

- Others

Source

- Microbial

- Mammalian

- Others

Manufacturing

- Outsourced

- In-House

Drug Type

- Branded Drugs

- Generic Drugs

Mode of Purchase

- Prescription Drugs

- Over-The-Counter (OTC) Drugs

Dosage Form

- Injection

- Tablets

- Others

Route of Administration

- Parenteral

- Oral

- Others

End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Biologics Market Regional Analysis/Insights

The biologics market is analysed and market size insights and trends are provided by country, drug type, drug class, therapeutic application, source, manufacturing, drug type, mode of purchase, dosage form, route of administration, end-users and distribution channel as referenced above.

The countries covered in the biologics market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the biologics market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and rising healthcare expenditure will further propel the market's growth rate in this region. Additionally, increase in strategic collaborations for the development of biologics treatment for acute as well as chronic diseases will further propel the market's growth rate in this region.

Asia-Pacific are expected to grow during the forecast period of 2022-2029 due to surging prevalence of rheumatoid arthritis, kidney and liver disorders in this region. Also, development of healthcare infrastructure and rising geriatric population will further propel the market's growth rate in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Biologics Market Share Analysis

The biologics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to biologics market.

Some of the major players operating in the biologics market are:

- Pfizer Inc. (US)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

- Mylan N.V. (US)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Boehringer Ingelheim International GmbH. (Germany)

- AstraZeneca (UK)

- Johnson & Johnson Private Limited (US)

- Merck & Co., Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bristol-Myers Squibb Company (US)

- Eli Lilly and Company (US)

- Allergan (Ireland)

- Abbott (US)

- LEO Pharma A/S (Denmark)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma (India)

- Lupin (India)

- Hikma Pharmaceuticals PLC (UK)

- Zydus Cadila (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BIOLOGICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL XX SIZE

2.2.1.1. VENDOR POSITIONING GRID

2.2.1.2. TECHNOLOGY LIFE LINE CURVE

2.2.1.3. TRIPOD DATA VALIDATION MODEL

2.2.1.4. MARKET GUIDE

2.2.1.5. MULTIVARIATE MODELLING

2.2.1.6. TOP TO BOTTOM ANALYSIS

2.2.1.7. CHALLENGE MATRIX

2.2.1.8. APPLICATION COVERAGE GRID

2.2.1.9. STANDARDS OF MEASUREMENT

2.2.1.10. VENDOR SHARE ANALYSIS

2.2.1.11. DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.1.12. DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BIOLOGICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1.1. PATENT LANDSCAPE

5.1.1.2. USPTO NUMBER

5.1.1.3. PATENT EXPIRY

5.1.1.4. EPIO NUMBER

5.1.1.5. PATENT STRENGTH AND QUALITY

5.1.1.6. PATENT CLAIMS

5.1.1.7. PATENT CITATIONS

5.1.1.8. PATENT LITIGATION AND LICENSING

5.1.1.9. FILE OF PATENT

5.1.1.10. PATENT RECEIVED CONTRIES

5.1.1.11. TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR BIOLOGICS

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL BIOLOGICS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1.1. BRAND NAME

10.1.1.2. GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1.1. FORECAST MARKET OUTLOOK

10.13.1.2. CROSS COMPETITION

10.13.1.3. THERAPEUTIC PORTFOLIO

10.13.1.4. CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 MARKET OVERVIEW

12.1 DRIVERS

12.2 RESTRAINTS

12.3 OPPORTUNITIES

12.4 CHALLENGES

13 GLOBAL BIOLOGICS MARKET, BY TYPE

13.1 OVERVIEW

13.2 TUMOR NECROSIS FACTOR-A (TNF) INHIBITORS

13.2.1.1. BY TYPE

13.2.1.2. ADALIMUMAB

13.2.1.3. CERTOLIZUMAB PEGOL

13.2.1.4. ETANERCEPT

13.2.1.5. INFLIXIMAB

13.2.1.6. GOLIMUMAB

13.2.1.7. OTHERS

13.2.1.8. BY ROUTE OF ADMINISTRATION

13.2.1.9. INJECTION

13.2.1.10. INFUSION

13.2.1.11. OTHERS

13.2.1.12. BY SOURCE MATERIAL

13.2.1.13. MICROBIAL

13.2.1.14. MAMMALIAN

13.2.1.15. OTHERS

13.3 B-CELL INHIBITORS

13.3.1.1. BY TYPE

13.3.1.2. RITUXIMAB

13.3.1.3. OTHERS

13.3.1.4. BY ROUTE OF ADMINISTRATION

13.3.1.5. INJECTION

13.3.1.6. INFUSION

13.3.1.7. OTHERS

13.3.1.8. BY SOURCE MATERIAL

13.3.1.9. MICROBIAL

13.3.1.10. MAMMALIAN

13.3.1.11. OTHERS

13.4 INTERLEUKIN INHIBITORS

13.4.1.1. BY TYPE

13.4.1.2. ANAKINRA

13.4.1.3. CANAKINUMAB

13.4.1.4. RILONACEPT

13.4.1.5. SECUKINUMAB

13.4.1.6. IXEKIZUMAB

13.4.1.7. TOCILIZUMAB

13.4.1.8. SARILUMAB

13.4.1.9. OTHERS

13.4.1.10. BY ROUTE OF ADMINISTRATION

13.4.1.11. INJECTION

13.4.1.12. INFUSION

13.4.1.13. OTHERS

13.4.1.14. BY SOURCE MATERIAL

13.4.1.15. MICROBIAL

13.4.1.16. MAMMALIAN

13.4.1.17. OTHERS

13.5 T-CELL INHIBITORS (ABATACEPT)

13.6 OTHERS

14 GLOBAL BIOLOGICS MARKET, BY DRUG CLASSIFICATION

14.1 OVERVIEW

14.2 BRANDED DRUGS

14.2.1.1. HUMIRA

14.2.1.2. RITUXAN

14.2.1.3. ENBREL

14.2.1.4. HERCEPTIN

14.2.1.5. AVASTIN

14.2.1.6. REMICADE

14.2.1.7. NEULASTA

14.2.1.8. AVONEX

14.2.1.9. LUCENTIS

14.2.1.10. ORENCIA

14.2.1.11. EYLEA

14.2.1.12. SIMULECT

14.2.1.13. OTHERS

14.3 GENERIC DRUGS

15 GLOBAL BIOLOGICS MARKET, BY DRUG CLASS

15.1 OVERVIEW

15.2 MONOCLONAL ANTIBODIES (MABS)

15.2.1.1. ANTI-CANCER MABS

15.2.1.2. IMMUNOLOGICAL MABS

15.2.1.3. ANTI-INFECTIVE MONOCLONAL ANTIBODIES (MABS)

15.2.1.4. CARDIOVASCULAR AND CEREBROVASCULAR MABS

15.2.1.5. NEUROPHARMACOLOGICAL MABS

15.2.1.6. OTHERS MABS

15.3 THERAPEUTIC PROTEINS

15.3.1.1. METABOLIC DISORDERS THERAPEUTIC PROTEINS

15.3.1.2. CANCER THERAPEUTIC PROTEINS

15.3.1.3. CARDIOVASCULAR THERAPEUTIC PROTEINS

15.3.1.4. IMMUNOLOGICAL THERAPEUTIC PROTEINS

15.3.1.5. OTHERS THERAPEUTIC PROTEINS

15.4 VACCINES

15.4.1.1. ANTI-INFECTIVE VACCINES

15.4.1.2. AUTOIMMUNITY VACCINES

15.4.1.3. OTHERS

15.5 CELLULAR BASED BIOLOGICS

15.6 RECOMBINANT INSULIN

15.7 GENE BASED BIOLOGICS

15.8 OTHER PRODUCTS

16 GLOBAL BIOLOGICS MARKET, BY ROUTE OF ADMINISTRATION

16.1 OVERVIEW

16.2 INJECTION

16.3 INFUSION

16.4 OTHERS

17 GLOBAL BIOLOGICS MARKET, BY APPLICATION

17.1 OVERVIEW

17.2 ONCOLOGY

17.2.1.1. BREAST CANCER

17.2.1.2. LEUKEMIA

17.2.1.3. OVARIAN CANCER

17.2.1.4. NON-HODGKIN LYMPHOMA

17.2.1.5. PROSTATE CANCER

17.2.1.6. COLORECTAL CANCER

17.2.1.7. OTHERS

17.2.1.8. BLADDER CANCER

17.2.1.9. LUNG CANCER

17.2.1.10. OTHERS

17.3 AUTOIMMUNE DISEASES

17.3.1.1. SYSTEMIC SCLEROSIS

17.3.1.2. CROHN’S DISEASE

17.3.1.3. RHEUMATOID ARTHRITIS

17.3.1.4. SYSTEMIC LUPUS ERYTHEMATOUS

17.3.1.5. OTHERS

17.3.1.6. SJOGREN'S SYNDROME

17.3.1.7. MULTIPLE SCLEROSIS

17.3.1.8. PERNICIOUS ANEMIA

17.3.1.9. OTHERS

17.4 DIABETES

17.5 INFECTIOUS DISEASES

17.6 CARDIOVASCULAR DISEASES

17.7 OPHTHALMIC CONDITIONS

17.8 DERMATOLOGICAL DISEASES

17.9 OTHERS

18 GLOBAL BIOLOGICS MARKET, BY SOURCE MATERIAL

18.1 OVERVIEW

18.2 MICROBIAL

18.3 MAMMALIAN

18.4 OTHERS

19 GLOBAL BIOLOGICS MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.2.1.1. ACUTE CARE HOSPITALS

19.2.1.2. LONG-TERM CARE HOSPITALS

19.2.1.3. NURSING FACILITIES

19.2.1.4. REHABILITATION CENTERS

19.3 SPECIALTY CLINICS

19.4 AMBULATORY SURGICAL CENTERS

19.5 OTHERS

20 GLOBAL BIOLOGICS MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 RETAIL SALES

20.3.1.1. HOSPITAL PHARMACIES

20.3.1.2. RETAIL PHARMACIES

20.3.1.3. ONLINE PHARMACIES

20.4 OTHERS (IF ANY)

21 GLOBAL BIOLOGICS MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL BIOLOGICS MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL BIOLOGICS MARKET, BY REGION

23.1 GLOBAL BIOLOGICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.2 NORTH AMERICA

23.2.1.1. U.S.

23.2.1.2. CANADA

23.2.1.3. MEXICO

23.3 EUROPE

23.3.1.1. GERMANY

23.3.1.2. U.K.

23.3.1.3. ITALY

23.3.1.4. FRANCE

23.3.1.5. SPAIN

23.3.1.6. RUSSIA

23.3.1.7. SWITZERLAND

23.3.1.8. TURKEY

23.3.1.9. BELGIUM

23.3.1.10. NETHERLANDS

23.3.1.11. DENMARK

23.3.1.12. SWEDEN

23.3.1.13. POLAND

23.3.1.14. NORWAY

23.3.1.15. FINLAND

23.3.1.16. REST OF EUROPE

23.4 ASIA-PACIFIC

23.4.1.1. JAPAN

23.4.1.2. CHINA

23.4.1.3. SOUTH KOREA

23.4.1.4. INDIA

23.4.1.5. SINGAPORE

23.4.1.6. THAILAND

23.4.1.7. INDONESIA

23.4.1.8. MALAYSIA

23.4.1.9. PHILIPPINES

23.4.1.10. AUSTRALIA

23.4.1.11. NEW ZEALAND

23.4.1.12. VIETNAM

23.4.1.13. TAIWAN

23.4.1.14. REST OF ASIA-PACIFIC

23.5 SOUTH AMERICA

23.5.1.1. BRAZIL

23.5.1.2. ARGENTINA

23.5.1.3. REST OF SOUTH AMERICA

23.6 MIDDLE EAST AND AFRICA

23.6.1.1. SOUTH AFRICA

23.6.1.2. EGYPT

23.6.1.3. BAHRAIN

23.6.1.4. UNITED ARAB EMIRATES

23.6.1.5. KUWAIT

23.6.1.6. OMAN

23.6.1.7. QATAR

23.6.1.8. SAUDI ARABIA

23.6.1.9. REST OF MEA

23.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL BIOLOGICS MARKET, COMPANY PROFILE

24.1 BRISTOL-MYERS SQUIBB COMPANY

24.1.1.1. COMPANY OVERVIEW

24.1.1.2. REVENUE ANALYSIS

24.1.1.3. GEOGRAPHIC PRESENCE

24.1.1.4. PRODUCT PORTFOLIO

24.1.1.5. RECENT DEVELOPMENTS

24.2 ABBVIE

24.2.1.1. COMPANY OVERVIEW

24.2.1.2. REVENUE ANALYSIS

24.2.1.3. GEOGRAPHIC PRESENCE

24.2.1.4. PRODUCT PORTFOLIO

24.2.1.5. RECENT DEVELOPMENTS

24.3 AMGEN INC.

24.3.1.1. COMPANY OVERVIEW

24.3.1.2. REVENUE ANALYSIS

24.3.1.3. GEOGRAPHIC PRESENCE

24.3.1.4. PRODUCT PORTFOLIO

24.3.1.5. RECENT DEVELOPMENTS

24.4 GENENTECH USA, INC. (PARENT COMPANY F. HOFFMANN-LA ROCHE AG)

24.4.1.1. COMPANY OVERVIEW

24.4.1.2. REVENUE ANALYSIS

24.4.1.3. GEOGRAPHIC PRESENCE

24.4.1.4. PRODUCT PORTFOLIO

24.4.1.5. RECENT DEVELOPMENTS

24.5 BAYER AG

24.5.1.1. COMPANY OVERVIEW

24.5.1.2. REVENUE ANALYSIS

24.5.1.3. GEOGRAPHIC PRESENCE

24.5.1.4. PRODUCT PORTFOLIO

24.5.1.5. RECENT DEVELOPMENTS

24.6 SANOFI

24.6.1.1. COMPANY OVERVIEW

24.6.1.2. REVENUE ANALYSIS

24.6.1.3. GEOGRAPHIC PRESENCE

24.6.1.4. PRODUCT PORTFOLIO

24.6.1.5. RECENT DEVELOPMENTS

24.7 BIOGEN

24.7.1.1. COMPANY OVERVIEW

24.7.1.2. REVENUE ANALYSIS

24.7.1.3. GEOGRAPHIC PRESENCE

24.7.1.4. PRODUCT PORTFOLIO

24.7.1.5. RECENT DEVELOPMENTS

24.8 CLINIGEN, INC.

24.8.1.1. COMPANY OVERVIEW

24.8.1.2. REVENUE ANALYSIS

24.8.1.3. GEOGRAPHIC PRESENCE

24.8.1.4. PRODUCT PORTFOLIO

24.8.1.5. RECENT DEVELOPMENTS

24.9 NOVARTIS AG

24.9.1.1. COMPANY OVERVIEW

24.9.1.2. REVENUE ANALYSIS

24.9.1.3. GEOGRAPHIC PRESENCE

24.9.1.4. PRODUCT PORTFOLIO

24.9.1.5. RECENT DEVELOPMENTS

24.1 GSK

24.10.1.1. COMPANY OVERVIEW

24.10.1.2. REVENUE ANALYSIS

24.10.1.3. GEOGRAPHIC PRESENCE

24.10.1.4. PRODUCT PORTFOLIO

24.10.1.5. RECENT DEVELOPMENTS

24.11 SEAGEN INC.

24.11.1.1. COMPANY OVERVIEW

24.11.1.2. REVENUE ANALYSIS

24.11.1.3. GEOGRAPHIC PRESENCE

24.11.1.4. PRODUCT PORTFOLIO

24.11.1.5. RECENT DEVELOPMENTS

24.12 LILLY

24.12.1.1. COMPANY OVERVIEW

24.12.1.2. REVENUE ANALYSIS

24.12.1.3. GEOGRAPHIC PRESENCE

24.12.1.4. PRODUCT PORTFOLIO

24.12.1.5. RECENT DEVELOPMENTS

24.13 JANSSEN BIOTECH, INC. (SUBSIDIARY OF JOHNSON & JOHNSON)

24.13.1.1. COMPANY OVERVIEW

24.13.1.2. REVENUE ANALYSIS

24.13.1.3. GEOGRAPHIC PRESENCE

24.13.1.4. PRODUCT PORTFOLIO

24.13.1.5. RECENT DEVELOPMENTS

24.14 TEVA PHARMACEUTICAL INDUSTRIES LTD.

24.14.1.1. COMPANY OVERVIEW

24.14.1.2. REVENUE ANALYSIS

24.14.1.3. GEOGRAPHIC PRESENCE

24.14.1.4. PRODUCT PORTFOLIO

24.14.1.5. RECENT DEVELOPMENTS

24.15 TAKEDA PHARMACEUTICAL COMPANY LIMITED.

24.15.1.1. COMPANY OVERVIEW

24.15.1.2. REVENUE ANALYSIS

24.15.1.3. GEOGRAPHIC PRESENCE

24.15.1.4. PRODUCT PORTFOLIO

24.15.1.5. RECENT DEVELOPMENTS

24.16 UNITED THERAPEUTICS CORPORATION.

24.16.1.1. COMPANY OVERVIEW

24.16.1.2. REVENUE ANALYSIS

24.16.1.3. GEOGRAPHIC PRESENCE

24.16.1.4. PRODUCT PORTFOLIO

24.16.1.5. RECENT DEVELOPMENTS

24.17 MERCK & CO., INC.

24.17.1.1. COMPANY OVERVIEW

24.17.1.2. REVENUE ANALYSIS

24.17.1.3. GEOGRAPHIC PRESENCE

24.17.1.4. PRODUCT PORTFOLIO

24.17.1.5. RECENT DEVELOPMENTS

24.18 ASTRAZENECA

24.18.1.1. COMPANY OVERVIEW

24.18.1.2. REVENUE ANALYSIS

24.18.1.3. GEOGRAPHIC PRESENCE

24.18.1.4. PRODUCT PORTFOLIO

24.18.1.5. RECENT DEVELOPMENTS

24.19 CELLTRION HEALTHCARE CO.,LTD.

24.19.1.1. COMPANY OVERVIEW

24.19.1.2. REVENUE ANALYSIS

24.19.1.3. GEOGRAPHIC PRESENCE

24.19.1.4. PRODUCT PORTFOLIO

24.19.1.5. RECENT DEVELOPMENTS

24.2 SUN PHARMACEUTICAL INDUSTRIES, INC.

24.20.1.1. COMPANY OVERVIEW

24.20.1.2. REVENUE ANALYSIS

24.20.1.3. GEOGRAPHIC PRESENCE

24.20.1.4. PRODUCT PORTFOLIO

24.20.1.5. RECENT DEVELOPMENTS

24.21 HIKMA PHARMACEUTICALS PLC

24.21.1.1. COMPANY OVERVIEW

24.21.1.2. REVENUE ANALYSIS

24.21.1.3. GEOGRAPHIC PRESENCE

24.21.1.4. PRODUCT PORTFOLIO

24.21.1.5. RECENT DEVELOPMENTS

24.22 LEO PHARMA A/S

24.22.1.1. COMPANY OVERVIEW

24.22.1.2. REVENUE ANALYSIS

24.22.1.3. GEOGRAPHIC PRESENCE

24.22.1.4. PRODUCT PORTFOLIO

24.22.1.5. RECENT DEVELOPMENTS

24.23 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

24.23.1.1. COMPANY OVERVIEW

24.23.1.2. REVENUE ANALYSIS

24.23.1.3. GEOGRAPHIC PRESENCE

24.23.1.4. PRODUCT PORTFOLIO

24.23.1.5. RECENT DEVELOPMENTS

24.24 BIOCON BIOLOGICS LIMITED (A SUBSIDIARY OF BIOCON LIMITED)

24.24.1.1. COMPANY OVERVIEW

24.24.1.2. REVENUE ANALYSIS

24.24.1.3. GEOGRAPHIC PRESENCE

24.24.1.4. PRODUCT PORTFOLIO

24.24.1.5. RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.