Global Generic Drug Market

Market Size in USD Million

CAGR :

%

USD

622.02 Million

USD

1,323.68 Million

2022

2030

USD

622.02 Million

USD

1,323.68 Million

2022

2030

| 2023 –2030 | |

| USD 622.02 Million | |

| USD 1,323.68 Million | |

|

|

|

|

Generic Drug Market Analysis and Size

The World Health Organization estimates that each year there are between 2 and 3 million instances of non-melanoma skin cancer and 132,000 cases of melanoma skin cancer. In addition, the prevalence of psoriasis in the world varies from 0.09 percent to 11.43%, making it a serious condition that affects at least 100 million people worldwide. The fact is that topical drug administration is the primary therapy method for most skin conditions, and the market for advanced topical products is projected to grow in the upcoming years.

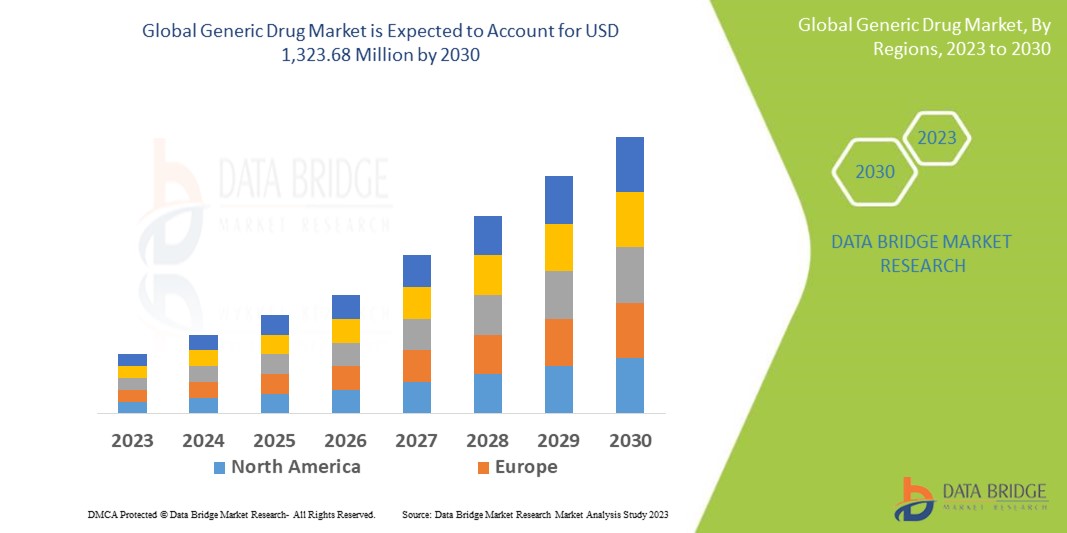

Data Bridge Market Research analyses that the generic drug market, which is USD 622.02 million in 2022, is expected to reach USD 1,323.68 million by 2030, at a CAGR of 9.9% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Generic Drug Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Simple Generics, Super Generics), Brand (Pure Generic, Branded Generic), Indication (Central Nervous System (CNS), Cardiovascular, Dermatology, Oncology, Respiratory Others), Route of Administration (Oral, Topical, Parenteral, Others), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Teva Pharmaceuticals Industries Ltd., (Israel), Mylan NV, (US), Novartis AG, (Switzerland), Pfizer Inc., (US), Sun Pharmaceutical Industries Ltd., (India), Fresenius SE & Co. KGaA., (Germany), Lupin (India), Endo International plc., (Ireland), Aurobindo Pharma (India), Novartis AG (Switzerland), Hikma Pharmaceuticals PLC., (UK), STADA Arzneimittel AG (Germany), Eli Lilly and Company (US) and Aspen Holdings (South Africa) |

|

Market Opportunities |

|

Market Definition

Generic medications differ from branded drugs in several aspects, such as the manufacturing process utilized in drug development, excipients, and packaging. Still, they are bioequivalent to branded drugs in terms of strength, dose, quality, safety, performance, and efficacy. Generic drugs become available when the patents for already marketed medications expire. Generic medications, not associated with a particular manufacturer, are often controlled by governments worldwide.

Generic Drug Market Dynamics

Drivers

- Rise in demand for artificial intelligence (AI) technology will bolster the mmarket growth

Robotic process automation uses artificial intelligence (AI) technology to automate routine, rules-based activities. The market's primary operational players can invest more time, effort, and resources in higher-value tasks to this automation. One of the key developments in the market for generic brands that will gain pace in the upcoming years is the use of RPA to ensure compliance with regulations and standards. Pharmaceutical companies frequently utilize RPA and other business process automation tools to carry out high-volume R&D and production tasks. These are the certain factors that propel the market growth.

- India’s thriving pharmaceutical industry propelling India generic drugs market

One of the biggest pharmaceutical markets in the world, India is home to several top pharmaceutical firms. The Indian pharmaceutical sector is ranked third globally in terms of volume and fourteenth globally in terms of value, according to Invest India, an agency of the Indian Government for Investment Promotion and Facilitation. Along with having more than 3,000 pharmaceutical businesses and more than 10,500 production facilities, India also has the most US-FDA compliant pharmaceutical plants outside of the United States.

Opportunities

- Rise in cancer cases will act as an opportunity

According to the International Agency for Research on Cancer's (IARC) 2020 report, which estimated the incidence and mortality of 36 cancers in 185 countries worldwide, an estimated 19.3 million new cases of cancer were diagnosed in 2020 throughout the world, with more than 10.1 million cases of cancer reported in men and 9.3 million cases in women. Additionally, the Global RA Network's 2021 study estimates that more than 350 million individuals worldwide have arthritis. That number is likely to rise due to several variables, including the growing global elderly population. As a result, it is anticipated that the rising prevalence of chronic diseases will increase the need for effective treatment, driving up the growth of the generic drug market throughout the forecast period.

Restraints/Challenges

- Stringent regulations will hinders the growth

Stringent controls, as the FDA assesses the accuracy, side effects, and other substances used in generic pharmaceuticals, are one of the main factors limiting the expansion of generic drugs. Pharmaceutical drugs are typically recalled if the producers don't follow the regulatory requirements. The key elements that influence the quality of generic drugs are purity, potency, stability, and drug release. These should be managed within an appropriate limit, range, or distribution to obtain the desired drug quality. As a result of the strict governmental rules, approval is needed for generic pharmaceuticals, which is projected to hinder market expansion.

This generic drug market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the generic drug market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Generic Drug Market

The COVID-19 epidemic had a significant influence on the generic drug market. Following the COVID-19 pandemic, practically every business initially encountered supply chain interruptions due to various social distancing regulations. The pharmaceutical industry was no exception, which had a detrimental impact on the generic medication market. Later, due to the COVID-19 illness's multiple opportunities to generate drugs to treat this infection, the market witnessed an increase in demand for generic pharmaceuticals. The US Food and Drug Administration (FDA) established the Generic Drug Program to help generic drug producers develop new products by sending written messages, attending meetings early in the development process, and clarifying regulatory requirements throughout application review.

Recent Developments

- In 2020, ANI Pharmaceuticals, Inc., a US-based integrated specialty pharmaceutical company focused on developing, producing, and marketing high-quality branded and generic prescription pharmaceuticals acquired Commercial and Pipeline Generic Products from Amerigen Pharmaceuticals, Ltd. for $52.5 million in cash. The deal has greatly increased ANI Pharmaceuticals, Inc's commercial portfolio and late-stage generic pipeline.

Global Generic Drug Market Scope

The generic drug market is segmented on the basis of type, brand, indication, route of administration, end-users and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Simple Generics

- Super Generics

Brand

- Pure Generic

- Branded Generic

Indication

- Central Nervous System (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

Route of Administration

- Oral

- Topical

- Parenteral

- Others

End-Users

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Generic Drug Market Regional Analysis/Insights

The generic drug market is analysed and market size insights and trends are provided by country, type, brand, indication, route of administration, end-users and distribution channel as referenced above.

The countries covered in the generic drug market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the generic drug market due to the region's established framework for the approval process of generic medications and global leaders in research and development activities.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030, owing to the expanding healthcare infrastructure and rise in the government initiatives. Also due to rise in medical condition knowledge among the general public and an ageing regional population. In the Asia-Pacific area, countries such as China and India contribute more than other countries do.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Generic Drug Market Share Analysis

The generic drug market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to generic drug market.

Some of the major players operating in the generic drug market are:

- Teva Pharmaceuticals Industries Ltd., (Israel)

- Mylan NV, (US.)

- Novartis AG, (Switzerland)

- Pfizer Inc., (US.)

- Sun Pharmaceutical Industries Ltd., (India)

- Fresenius SE & Co. KGaA., (Germany)

- Lupin (India)

- Endo International plc., (Ireland)

- Aurobindo Pharma (India)

- Novartis AG (Switzerland)

- Hikma Pharmaceuticals PLC., (UK.)

- STADA Arzneimittel AG (Germany)

- Eli Lilly and Company (US)

- Aspen Holdings (South Africa)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GENERIC DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GENERIC DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL GENERIC DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUGS ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATEINT TREATMENT SUCCESS RATES

7 INDUSTRY INSIGHTS

7.1 PATENT ANALYSIS

7.2 DRUGS TREATMENT RATE BY MATURED MARKETS

7.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

7.4 PATIENT FLOW DIAGRAM

7.5 KEY PRICING STRATEGIES

7.6 KEY PATIENT ENROLLMENT STRATEGIES

7.7 INTERVIEWS WITH FORMULATION CHEMIST

7.8 OTHER KOL SNAPSHOTS

8 PIPELINE ANALYSIS

8.1 CLINICAL TRIALS AND PHASE ANALYSIS

8.2 DRUGS THERAPY PIPELINE

8.3 PHASE III CANDIDATES

8.4 PHASE II CANDIDATES

8.5 PHASE I CANDIDATES

8.6 OTHERS (PRE-CLINICAL AND RESEARCH)

9 REGULATORY FRAMEWORK

10 GLOBAL GENERIC DRUGS MARKET, BY TYPE

10.1 OVERVIEW

10.2 SIMPLE GENERICS

10.3 SUPER GENERICS

11 GLOBAL GENERIC DRUGS MARKET, BY BRAND

11.1 OVERVIEW

11.2 PURE GENERIC

11.3 BRANDED GENERIC

12 GLOBAL GENERIC DRUGS MARKET, BY INDICATION

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUBSEGMENTS OF INDICATION)

12.1 OVERVIEW

12.2 CANCER DRUGS

12.2.1 ANTITUMOR ANTIBIOTICS

12.2.1.1. DAUNORUBICIN

12.2.1.1.1. MARKET VALUE(USD MILLION)

12.2.1.1.2. MARKET VOLUME(UNITS)

12.2.1.1.3. AVERAGE SELLING PRICE(ASP)

12.2.1.2. DOXORUBICIN

12.2.1.3. IDARUBICIN

12.2.1.4. MITOXANTRONE

12.2.1.5. OTHERS

12.2.2 DNA-DAMAGING AGENTS

12.2.2.1. CHLORAMBUCIL

12.2.2.2. CYCLOPHOSPHAMIDE

12.2.2.3. MELPHALAN

12.2.2.4. CARBOPLATIN

12.2.2.5. OTHERS

12.2.3 ANTIMETABOLITES

12.2.3.1. METHOTREXATE

12.2.3.2. FLUDARABINE

12.2.3.3. CYTARABINE

12.2.3.4. OTHERS

12.2.4 DNA-REPAIR ENZYME INHIBITORS

12.2.4.1. ETOPOSIDE

12.2.4.2. TOPOTECAN

12.2.4.3. OTHERS

12.2.5 ANTIMITOTIC DRUGS

12.2.5.1. VINCRISTINE

12.2.5.2. VINBLASTINE

12.2.5.3. OTHERS

12.2.6 OTHERS

12.3 CENTRAL NERVOUS SYSTEM PRODUCT

12.3.1 CHOLINESTERASE INHIBITORS

12.3.1.1. RIVASTIGMINE

12.3.1.2. DONEPEZIL

12.3.1.3. GALANTAMINE

12.3.1.4. TACRINE

12.3.1.5. OTHERS

12.3.2 NMDA RECEPTOR ANTAGONISTS

12.3.2.1. KETAMINE

12.3.2.2. DEXTROMETHORPHAN

12.3.2.3. MEMANTINE

12.3.2.4. AMANTADINE

12.3.3 ANTIEPILEPTIC

12.3.3.1. FIRST GENERATION

12.3.3.1.1. PHENOBARBITAL

12.3.3.1.2. PHENYTOIN

12.3.3.1.3. PRIMIDONE

12.3.3.1.4. ETHOSUXIMIDE

12.3.3.1.5. CARBAMAZEPINE

12.3.3.1.6. CLOBAZAM

12.3.3.2. SECOND GENERATION

12.3.3.2.1. VIGABATRIN

12.3.3.2.2. LAMOTRIGINE

12.3.3.2.3. GABAPENTIN

12.3.3.2.4. TOPIRAMATE

12.3.3.2.5. PREGABALIN

12.3.3.2.6. OTHERS

12.3.3.3. THIRD GENERATION

12.3.3.3.1. LACOSAMIDE

12.3.3.3.2. RUFINAMIDE

12.3.3.3.3. PERAMPANEL

12.3.3.3.4. OTHERS

12.3.4 ANTIPSYCHOTIC

12.3.4.1. TYPICAL ANTIPSYCHOTIC

12.3.4.1.1. HALOPERIDOL

12.3.4.1.2. LOXAPINE

12.3.4.1.3. THIORIDAZINE

12.3.4.1.4. MOLINDONE

12.3.4.1.5. THIOTHIXENE

12.3.4.1.6. FLUPHENAZINE

12.3.4.1.7. MESORIDAZINE

12.3.4.1.8. TRIFLUOPERAZINE

12.3.4.1.9. PERPHENAZINE

12.3.4.1.10. CHLORPROMAZINE

12.3.4.2. ATYPICAL ANTIPSYCHOTIC

12.3.4.2.1. ARIPIPRAZOLE

12.3.4.2.2. CLOZAPINE

12.3.4.2.3. ZIPRASIDONE

12.3.4.2.4. RISPERIDONE

12.3.4.2.5. QUETIAPINE

12.3.4.2.6. OLANZAPINE

12.3.5 OTHERS

12.4 DERMATOLOGICAL PRODUCTS

12.4.1 CORTICOSTEROIDS, BY TYPE

12.4.1.1. TOPICAL

12.4.1.1.1. MOMETASONE

12.4.1.1.2. BETAMETHASONE

12.4.1.1.3. HYDROCORTISONE

12.4.1.1.4. FLUTICASONE PROPIONATE

12.4.1.1.5. ALCLOMETASONE

12.4.1.1.6. TRIAMCINOLONE

12.4.1.1.7. FLUOCINOLONE ACETONIDE

12.4.1.1.8. CLOBETASOL PROPIONATE

12.4.1.1.9. OTHERS

12.4.1.2. ORAL

12.4.1.2.1. PREDNISOLONE

12.4.1.2.2. PREDNISONE

12.4.1.2.3. CORTISONE

12.4.1.2.4. METHYLPREDNISOLONE

12.4.1.2.5. OTHERS

12.4.2 RETINOIDS

12.4.2.1. ACITRETIN

12.4.2.2. ADAPALENE

12.4.2.3. ISOTRETINOIN

12.4.2.4. OTHERS

12.4.3 ANTIHISTAMINES AGENTS

12.4.3.1. CYPROHEPTADINE

12.4.3.2. DIPHENHYDRAMINE

12.4.3.3. HYDROXYZINE

12.4.3.4. OTHERS

12.4.4 CALCINEURIN INHIBITORS

12.4.4.1. TACROLIMUS

12.4.4.2. PIMECROLIMUS

12.4.5 ANTIINFECTIVES

12.4.5.1. ANTIBIOTICS

12.4.5.1.1. DOXYCYCLINE

12.4.5.1.2. RETAPAMULIN

12.4.5.1.3. DELAFLOXACIN

12.4.5.1.4. MINOCYCLINE

12.4.5.1.5. MUPIROCIN

12.4.5.1.6. OTHERS

12.4.5.2. ANTIFUNGAL

12.4.5.2.1. SYNTHETIC

12.4.5.2.1.1 CLOTRIMAZOLE

12.4.5.2.1.2 MICONAZOLE

12.4.5.2.1.3 OTHERS

12.4.5.2.2. IMIDAZOLES DRUGS

12.4.5.2.2.1 KETOCONAZOLE

12.4.5.2.2.2 CLONAZEPAM

12.4.5.2.3. OTHERS

12.4.5.2.4. OTHERS

12.4.5.3. ANTIVIRAL

12.4.5.3.1. ACYCLOVIR

12.4.5.3.2. FAMCICLOVIR

12.4.5.3.3. VALACYCLOVIR

12.4.5.3.4. OTHERS

12.4.5.4. OTHERS

12.4.6 HAIR GROWTH

12.4.6.1. MINOXIDIL

12.4.6.2. FINASTERIDE

12.4.6.3. SPIRONOLACTONE

12.4.6.4. DUTASTERIDE

12.4.6.5. OTHERS

12.4.7 OTHERS

12.5 GASTROINTESTINAL PRODUCTS

12.5.1 LAXATIVES

12.5.1.1. OSMOTIC LAXATIVES

12.5.1.1.1. GOLYTELY

12.5.1.1.2. COLYTE

12.5.1.1.3. MACROGOL 400

12.5.1.2. STIMULANT LAXATIVES

12.5.1.2.1. BISACODYL

12.5.1.2.2. CASTOR OIL

12.5.1.2.3. PHENOLPHTHALEIN

12.5.1.2.4. SENNA

12.5.1.3. BULK LAXATIVES

12.5.1.3.1. PSYLLIUM

12.5.1.3.2. METHYL CELLULOSE

12.5.1.3.3. POLYCARBOPHIL

12.5.1.3.4. OTHERS

12.5.1.4. LUBRICANT & EMOLLIENT LAXATIVES

12.5.1.4.1. MINERAL OIL

12.5.1.4.2. GLYCERIN SUPPOSITORIES

12.5.1.4.3. OTHERS

12.5.2 ANTACIDS

12.5.2.1. SODIUM ANTACIDS

12.5.2.2. CALCIUM ANTACIDS

12.5.2.3. MAGNESIUM ANTACIDS

12.5.2.4. ALUMINIUM ANTACIDS

12.5.2.5. OTHERS

12.5.3 ANTIDIARRHEALS

12.5.3.1. DIPHENOXYLATE

12.5.3.2. LOPERAMIDE

12.5.3.3. CODEINE

12.5.3.4. OTHERS

12.5.4 H2 BLOCKERS

12.5.4.1. FAMOTIDINE

12.5.4.2. RANITIDINE

12.5.4.3. OTHERS

12.5.5 PROTON PUMP INHIBITORS

12.5.5.1. OMEPRAZOLE

12.5.5.2. LANSOPRAZOLE

12.5.5.3. OTHERS

12.5.6 BILE ACID SEQUESTRANTS

12.5.6.1. CHOLESTYRAMINE

12.5.6.2. COLESTIPOL

12.5.7 OTHERS

12.6 RESPIRATORY PRODUCT

12.6.1 BRONCHODILATORS

12.6.1.1. ALBUTEROL

12.6.1.2. LEVALBUTEROL

12.6.1.3. SALMETEROL

12.6.1.4. FORMOTEROL

12.6.1.5. OTHERS

12.6.2 CORTICOSTEROIDS

12.6.2.1. RACEMIC EPINEPHRINE

12.6.2.2. FLUTICASONE

12.6.2.3. BUDESONIDE

12.6.2.4. OTHERS

12.6.3 MAST CELL STABILIZERS

12.6.3.1. MOMETASONE FUROATE

12.6.3.2. NEDOCROMIL

12.6.3.3. OTHERS

12.6.4 LEUKOTRIENE RECEPTOR ANTAGONISTS

12.6.4.1. CROMOLYN SODIUM

12.6.4.2. OMALIZUMAB

12.6.4.3. OTHERS

12.6.5 ANTIHISTAMINES

12.6.5.1. ZAFIRLUKAST

12.6.5.2. MONTELUKAST

12.6.5.3. ZILEUTON

12.6.5.4. OTHERS

12.6.6 RESPIRATORY STIMULANTS

12.6.6.1. LORATIDINE

12.6.6.2. FEXOFENADINE

12.6.6.3. CETIRIZINE

12.6.6.4. EPINEPHRINE

12.6.6.5. OTHERS

12.6.7 PULMONARY SURFACTANTS

12.6.7.1. DOXAPRAM

12.6.7.2. THEOPHYLLINE

12.6.7.3. PROGESTERONE

12.6.7.4. CAFFEINE

12.6.7.5. OTHERS

12.6.8 OXYGEN ANTIMICROBIALS

12.6.8.1. COLFOSCERIL PALMITATE

12.6.8.2. BERACTANT

12.6.8.3. CALFACTANT

12.6.8.4. PORACTANT ALFA

12.6.8.5. OTHERS

12.6.9 OTHERS

12.7 OPHTHALMIC PRODUCTS

12.7.1 ARTIFICIAL TEARS

12.7.1.1. DEMULCENT

12.7.1.1.1. POLYETHYLENE GLYCOL (PEG)

12.7.1.1.2. PROPYLENE GLYCOL

12.7.1.1.3. GLYCERIN

12.7.1.1.4. POLYVINYL ALCOHOL (PVA)

12.7.1.1.5. OTHERS

12.7.1.2. EMOLLIENTS

12.7.1.2.1. PARAFFIN

12.7.1.2.2. ANHYDROUS LANOLIN

12.7.1.2.3. WHITE WAX

12.7.1.2.4. OTHERS

12.7.1.3. OTHERS

12.7.2 NONSTEROIDAL ANTI-INFLAMMATORY DRUGS

12.7.2.1. BROMFENAC

12.7.2.2. KETOROLAC

12.7.2.3. DICLOFENAC

12.7.2.4. OTHERS

12.7.3 CORTICOSTEROID

12.7.3.1. PREDNISOLONE

12.7.3.2. LOTEPREDNOL

12.7.3.3. FLUOROMETHOLONE

12.7.3.4. OTHERS

12.7.4 BETA BLOCKERS

12.7.4.1. LEVOBUNOLOL

12.7.4.2. TIMOLOL

12.7.4.3. BETAXOLOL

12.7.4.4. OTHERS

12.7.5 PROSTAGLANDIN ANALOGS

12.7.5.1. BIMATOPROST

12.7.5.2. TRAVOPROST

12.7.5.3. LATANOPROST

12.7.5.4. OTHERS

12.7.6 CARBONIC ANHYDRASE INHIBITORS

12.7.6.1. BRINZOLAMIDE

12.7.6.2. DORZOLAMIDE

12.7.7 COMBINATION DRUGS

12.7.7.1. BRIMONIDINE/TIMOLOL

12.7.7.2. DORZOLAMIDE/TIMOLOL

12.7.7.3. PHENYLEPHRINE

12.7.7.4. PROPARACAINE

12.7.7.5. TROPICAMIDE

12.7.7.6. OTHERS

12.8 CARDIOVASCULAR DRUGS

12.8.1 ACE INHIBITORS

12.8.1.1. BENAZEPRIL

12.8.1.2. CAPTOPRIL

12.8.1.3. ENALAPRIL MALEATE

12.8.1.4. LISINOPRIL

12.8.1.5. OTHERS

12.8.2 ANGIOTENSIN II RECEPTOR ANTAGONISTS (ARBS)

12.8.2.1. CANDESARTAN CILEXETIL

12.8.2.2. EPROSARTAN MESYLATE

12.8.2.3. IRBESARTAN

12.8.2.4. LOSARTAN

12.8.2.5. OTHERS

12.8.3 ANTIARRHYTHMICS

12.8.3.1. AMIODARONE

12.8.3.2. DISOPYRAMIDE PHOSPHATE

12.8.3.3. DOFETILIDE

12.8.3.4. FLECAINIDE

12.8.3.5. MEXILETINE HCL

12.8.3.6. PROCAINAMIDE

12.8.3.7. OTHERS

12.8.4 ANTICOAGULANTS

12.8.4.1. NON-VKA ORAL ANTICOAGULANTS (NOACS)

12.8.4.1.1. RIVAROXABAN

12.8.4.1.2. EDOXABAN

12.8.4.1.3. APIXABAN

12.8.4.1.4. OTHERS

12.8.4.2. HEPARIN & LMWH

12.8.4.2.1. DALTEPARIN

12.8.4.2.2. ENOXAPARIN

12.8.4.2.3. TINZAPARIN

12.8.4.2.4. OTHERS

12.8.4.3. VITAMIN K ANTAGONIST

12.8.4.3.1. WARFARIN

12.8.4.3.2. PHENPROCOUMON

12.8.4.3.3. OTHERS

12.8.4.4. THROMBIN INHIBITORS

12.8.4.4.1. BIVALIRUDIN

12.8.4.4.2. ARGATROBAN

12.8.4.4.3. DABIGATRAN

12.8.4.4.4. OTHERS

12.8.4.5. OTHERS

12.8.5 PLATELET INHIBITORS

12.8.5.1. ASPIRIN

12.8.5.2. CILOSTAZOL

12.8.5.3. CLOPIDOGRIL BISULFATE

12.8.5.4. DIPYRAMIDAMOLE

12.8.5.5. OTHERS

12.8.6 ANTIHYPERTENSIVES

12.8.6.1. CLONIDINE HCL

12.8.6.2. DOXAZOSIN MESYLATE

12.8.6.3. HYDRALAZINE HCI

12.8.6.4. METHYLDOPA

12.8.6.5. MINOXIDIL

12.8.6.6. OTHERS

12.8.7 BETA BLOCKERS

12.8.7.1. ACEBUTOLOL HCL

12.8.7.2. ATENOLOL

12.8.7.3. BETAXOLOL

12.8.7.4. BISOPROLOL

12.8.7.5. CARVEDILOL

12.8.7.6. LABETALOL HCL

12.8.7.7. METOPROLOL

12.8.7.8. METOPROLOL

12.8.7.9. NADOLOL

12.8.7.10. OTHERS

12.8.8 CALCIUM CHANNEL BLOCKERS

12.8.8.1. DIHYDROPYRIDINES

12.8.8.1.1. AMLODIPINE BESYLATE

12.8.8.1.2. NIFEDIPINE

12.8.8.1.3. NIMODIPINE

12.8.8.1.4. NISOLDIPINE

12.8.8.1.5. NICARDIPINE HCL

12.8.8.2. NONDIHYDROPYRIDINES

12.8.8.2.1. DILTIAZEM HCL

12.8.8.2.2. VERAPAMIL HCL

12.8.9 DIURETICS

12.8.9.1. THIAZIDE DIURETICS

12.8.9.1.1. CHLORTHALIDONE

12.8.9.1.2. HYDROCHLOROTHIAZIDE

12.8.9.1.3. METOLAZONE

12.8.9.1.4. INDAPAMIDE

12.8.9.2. LOOP DIURETICS

12.8.9.2.1. TORSEMIDE

12.8.9.2.2. FUROSEMIDE

12.8.9.2.3. BUMETANIDE

12.8.9.3. POTASSIUM-SPARING DIURETICS

12.8.9.3.1. AMILORIDE

12.8.9.3.2. TRIAMTERENE

12.8.9.3.3. SPIRONOLACTONE

12.8.9.3.4. EPLERENONE

12.8.9.4. OTHERS

12.8.10 LIPID MEDICATIONS

12.8.10.1. STATINS

12.8.10.1.1. ATORVASTATIN CALCIUM

12.8.10.1.2. FLUVASTATIN SODIUM

12.8.10.1.3. LOVASTATIN

12.8.10.1.4. OTHERS

12.8.10.2. FIBRATES

12.8.10.2.1. FENOFIBRATE

12.8.10.2.2. GEMFIBROZIL

12.8.10.3. BILE ACID SEQUESTRANTS

12.8.10.3.1. COLESEVELAM HCL

12.8.10.3.2. CHOLESTYRAMINE

12.8.10.3.3. COLESTIPOL HCL

12.8.10.4. OTHER LIPID MEDICATIONS

12.8.11 NITRATES

12.8.11.1. ORAL NITROGLYCERIN

12.8.11.2. NITROGLYCERIN OINTMENT

12.8.11.3. NITROGLYCERIN SKIN PATCHES

12.8.11.4. NITROGLYCERIN SUBLINGUAL TABLETS

12.8.11.5. OTHER NITROGLYCERIN TABLETS, CAPSULES, AND SPRAYS

12.8.12 OTHERS

12.9 VITAMIN

12.9.1 VITAMIN B

12.9.2 VITAMIN E

12.9.3 VITAMIN D

12.9.4 VITAMIN C

12.9.5 VITAMIN A

12.9.6 VITAMIN K

12.1 MINERALS

12.10.1 CALCIUM

12.10.2 MAGNESIUM

12.10.3 IRON

12.10.4 POTASSIUM

12.10.5 ZINC

12.10.6 CHROMIUM

12.10.7 SELENIUM

12.10.8 OTHERS

12.11 OTHERS

13 GLOBAL GENERIC DRUGS MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 ORAL

13.2.1 SOLID

13.2.1.1. SOLID, BY TYPE

13.2.1.1.1. TABLETS

13.2.1.1.2. CAPSULES

13.2.1.1.3. POWDER

13.2.1.1.4. PILLS

13.2.1.1.5. OTHERS

13.2.1.2. SOLID , BY DOSE

13.2.1.2.1. LESS THAN 100 MG

13.2.1.2.2. 100- 5OO MG

13.2.1.2.3. 500 MG – 1000 MG

13.2.1.2.4. MORE THAN 1000 MG

13.2.2 SEMI-SOLID

13.2.2.1. SEMI-SOLID, BY TYPE

13.2.2.1.1. GELS

13.2.2.1.2. EMULSIONS

13.2.2.1.3. ELIXIRS

13.2.2.1.4. OTHERS

13.2.2.2. SEMI-SOLID, BY DOSE

13.2.2.2.1. LESS THAN 25 ML

13.2.2.2.2. 25-50 ML

13.2.2.2.3. MORE THAN 50 ML

13.2.3 LIQUID

13.2.3.1. LIQUID, BY TYPE

13.2.3.1.1. SOLUTIONS

13.2.3.1.2. SYRUPS

13.2.3.1.3. OTHERS

13.2.3.2. LIQUID, BY DOSE

13.2.3.2.1. LESS THEN 25 ML

13.2.3.2.2. 25-50 ML

13.2.3.2.3. MORE THAN 50 ML

13.3 TOPICAL

13.3.1 LIQUID

13.3.1.1. LIQUID, BY TYPE

13.3.1.1.1. SOLUTIONS

13.3.1.1.2. SUSPENSIONS

13.3.1.2. LIQUID, BY DOSE

13.3.1.2.1. LESS THEN 25 ML

13.3.1.2.2. 25-50 ML

13.3.1.2.3. MORE THAN 50 ML

13.3.2 SEMI-SOLID

13.3.2.1. SEMI-SOLID, BY TYPE

13.3.2.1.1. CREAM

13.3.2.1.2. OINTMENT

13.3.2.1.3. GELS

13.3.2.1.4. PASTES

13.3.2.1.5. LOTIONS

13.3.2.1.6. OTHERS

13.3.2.2. SEMI-SOLID, BY DOSE

13.3.2.2.1. LESS THAN 25 MG

13.3.2.2.2. 25-50 MG

13.3.2.2.3. MORE THAN 50 MG

13.3.3 SOLID

13.3.3.1. SOLID, BY TYPE

13.3.3.1.1. SUPPOSITORIES

13.3.3.1.2. POWDERS

13.3.3.2. SOLID, BY DOSE

13.3.3.2.1. LESS THAN 1GM

13.3.3.2.2. 1GM

13.3.3.2.3. MORE THAN 1GM

13.3.4 OTHERS

13.4 PARENTERAL

13.4.1 PARENTERAL, BY TYPE

13.4.1.1. CONVENTIONAL DRUGS DELIVERY FORMULATIONS

13.4.1.1.1. SOLUTIONS

13.4.1.1.2. RECONSTITUTED/LYOPHILIZED

13.4.1.1.3. SUSPENSIONS

13.4.1.1.4. EMULSIONS

13.4.1.1.5. OTHERS

13.4.1.2. NOVEL DRUGS DELIVERY FORMULATIONS

13.4.1.2.1. COLLOIDAL DISPERSIONS

13.4.1.2.2. MICROPARTICLES

13.4.1.2.3. LONG ACTING INJECTION FORMULATION

13.4.2 PARENTERAL, BY DOSE

13.4.2.1. 1 MG/ML

13.4.2.2. 1-5 MG/ML

13.4.2.3. MORE THAN 5 MG/ML

13.5 OCCULAR

13.5.1 OCCULAR, BY TYPE

13.5.1.1. LIQUID

13.5.1.1.1. EYE DROPS

13.5.1.1.2. SPRAYS

13.5.1.2. SEMI-SOLID

13.5.1.2.1. GELS

13.5.1.2.2. OINTMENTS

13.5.2 OCCULAR, BY DOSE

13.5.2.1. 2.5ML

13.5.2.2. 5ML

13.5.2.3. 10 ML

13.6 INTRANASAL

13.6.1 INTRANASAL, BY TYPE

13.6.1.1. DROPS

13.6.1.2. SPRAYS

13.6.1.3. POWDERS

13.6.1.4. GELS

13.6.1.5. OTHERS

13.6.2 INTRANASAL, BY DOSE

13.6.2.1. 10 ML

13.6.2.2. 20 ML

13.6.3 OTHERS

13.6.4

14 GLOBAL GENERIC DRUGS MARKET, BY POPULATION TYPE

14.1 OVERVIEW

14.2 PEDIATRIC

14.3 ADULT

14.4 GERIATRIC

15 GLOBAL GENERIC DRUGS MARKET, BY MODE OF PURCHASE

15.1 OVERVIEW

15.2 OVER THE COUNTER

15.3 PRESCRIPTION

16 GLOBAL GENERIC DRUGS MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 PRIVATE

16.2.2 PUBLIC

16.3 SPECIALTY CLINICS

16.4 HOME HEALTHCARE

16.5 AMBULATORY SURGICAL CENTERS

16.6 COMMUNITY CENTRE

16.7 OTHERS

17 GLOBAL GENERIC DRUGS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACIES

17.3.2 RETAIL PHARMACIES

17.3.3 OTHER

17.4 ONLINE PHARMACIES

17.5 OTHER

18 GLOBAL GENERIC DRUGS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.2 COMPANY SHARE ANALYSIS: EUROPE

18.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL GENERIC DRUGS MARKET, BY REGION

19.1 GLOBAL GENERIC DRUGS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.2 NORTH AMERICA

19.2.1 U.S.

19.2.2 CANADA

19.2.3 MEXICO

19.3 EUROPE

19.3.1 GERMANY

19.3.2 U.K.

19.3.3 ITALY

19.3.4 FRANCE

19.3.5 SPAIN

19.3.6 RUSSIA

19.3.7 SWITZERLAND

19.3.8 TURKEY

19.3.9 BELGIUM

19.3.10 NETHERLANDS

19.3.11 DENMARK

19.3.12 SWEDEN

19.3.13 POLAND

19.3.14 NORWAY

19.3.15 FINLAND

19.3.16 REST OF EUROPE

19.4 ASIA-PACIFIC

19.4.1 JAPAN

19.4.2 CHINA

19.4.3 SOUTH KOREA

19.4.4 INDIA

19.4.5 SINGAPORE

19.4.6 THAILAND

19.4.7 INDONESIA

19.4.8 MALAYSIA

19.4.9 PHILIPPINES

19.4.10 AUSTRALIA

19.4.11 NEW ZEALAND

19.4.12 VIETNAM

19.4.13 TAIWAN

19.4.14 REST OF ASIA-PACIFIC

19.5 SOUTH AMERICA

19.5.1 BRAZIL

19.5.2 ARGENTINA

19.5.3 REST OF SOUTH AMERICA

19.6 MIDDLE EAST AND AFRICA

19.6.1 SOUTH AFRICA

19.6.2 EGYPT

19.6.3 BAHRAIN

19.6.4 UNITED ARAB EMIRATES

19.6.5 KUWAIT

19.6.6 OMAN

19.6.7 QATAR

19.6.8 SAUDI ARABIA

19.6.9 REST OF MEA

19.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20 GLOBAL GENERIC DRUGS MARKET, COMPANY PROFILE

20.1 BAYER

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPEMENTS

20.2 SANOFI

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPEMENTS

20.3 PFIZER, INC.

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPEMENTS

20.4 GLAXOSMITHKLINE PLC

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPEMENTS

20.5 TAKEDA PHARMACEUTICAL COMPANY LTD

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPEMENTS

20.6 ABBOTT

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPEMENTS

20.7 NOVARTIS AG

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPEMENTS

20.8 SUN PHARMACEUTICAL INDUSTRIES

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPEMENTS

20.9 TEVA PHARMACEUTICAL INDUSTRIES LTD.

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPEMENTS

20.1 DR. REDDY’S LABORATORIES

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPEMENTS

20.11 ENDO PHARMACEUTICALS INC.

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPEMENTS

20.12 AMNEAL PHARMACEUTICALS INC

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPEMENTS

20.13 ALKEM LABORATORIES LTD

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPEMENTS

20.14 DAIICHI SANKYO COMPANY, LIMITED

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPEMENTS

20.15 MYLAN N.V. (VIATRIS INC.)

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPEMENTS

20.16 AUROBINDO PHARMA

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPEMENTS

20.17 ZYDUS PHARMACEUTICALS, INC.

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPEMENTS

20.18 LUPIN

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPEMENTS

20.19 SANDOZ INTERNATIONAL GMBH

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPEMENTS

20.2 FRESENIUS MEDICAL CARE AG & CO. KGAA

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPEMENTS

20.21 SANOFI

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHIC PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPEMENTS

20.22 CIPLA INC.

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHIC PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPEMENTS

20.23 ASTRAZENECA

20.23.1 COMPANY OVERVIEW

20.23.2 REVENUE ANALYSIS

20.23.3 GEOGRAPHIC PRESENCE

20.23.4 PRODUCT PORTFOLIO

20.23.5 RECENT DEVELOPEMENTS

20.24 BRISTOL-MYERS SQUIBB

20.24.1 COMPANY OVERVIEW

20.24.2 REVENUE ANALYSIS

20.24.3 GEOGRAPHIC PRESENCE

20.24.4 PRODUCT PORTFOLIO

20.24.5 RECENT DEVELOPEMENTS

20.25 PAR PHARMACEUTICALS

20.25.1 COMPANY OVERVIEW

20.25.2 REVENUE ANALYSIS

20.25.3 GEOGRAPHIC PRESENCE

20.25.4 PRODUCT PORTFOLIO

20.25.5 RECENT DEVELOPEMENTS

20.26 HIKMA PHARMACEUTICALS PLC

20.26.1 COMPANY OVERVIEW

20.26.2 REVENUE ANALYSIS

20.26.3 GEOGRAPHIC PRESENCE

20.26.4 PRODUCT PORTFOLIO

20.26.5 RECENT DEVELOPEMENTS

20.27 RECKITT BENCKISER

20.27.1 COMPANY OVERVIEW

20.27.2 REVENUE ANALYSIS

20.27.3 GEOGRAPHIC PRESENCE

20.27.4 PRODUCT PORTFOLIO

20.27.5 RECENT DEVELOPEMENTS

20.28 PERRIGO

20.28.1 COMPANY OVERVIEW

20.28.2 REVENUE ANALYSIS

20.28.3 GEOGRAPHIC PRESENCE

20.28.4 PRODUCT PORTFOLIO

20.28.5 RECENT DEVELOPEMENTS

20.29 TAISHO PHARMACEUTICAL

20.29.1 COMPANY OVERVIEW

20.29.2 REVENUE ANALYSIS

20.29.3 GEOGRAPHIC PRESENCE

20.29.4 PRODUCT PORTFOLIO

20.29.5 RECENT DEVELOPEMENTS

20.3 MALLINCKRODT

20.30.1 COMPANY OVERVIEW

20.30.2 REVENUE ANALYSIS

20.30.3 GEOGRAPHIC PRESENCE

20.30.4 PRODUCT PORTFOLIO

20.30.5 RECENT DEVELOPEMENTS

20.31 AMGEN, INC.

20.31.1 COMPANY OVERVIEW

20.31.2 REVENUE ANALYSIS

20.31.3 GEOGRAPHIC PRESENCE

20.31.4 PRODUCT PORTFOLIO

20.31.5 RECENT DEVELOPEMENTS

20.32 ARENA PHARMACEUTICALS, INC.

20.32.1 COMPANY OVERVIEW

20.32.2 REVENUE ANALYSIS

20.32.3 GEOGRAPHIC PRESENCE

20.32.4 PRODUCT PORTFOLIO

20.32.5 RECENT DEVELOPEMENTS

20.33 STADA ARZNEIMITTEL AG

20.33.1 COMPANY OVERVIEW

20.33.2 REVENUE ANALYSIS

20.33.3 GEOGRAPHIC PRESENCE

20.33.4 PRODUCT PORTFOLIO

20.33.5 RECENT DEVELOPEMENTS

20.34 ACCORD HEALTHCARE GMBH

20.34.1 COMPANY OVERVIEW

20.34.2 REVENUE ANALYSIS

20.34.3 GEOGRAPHIC PRESENCE

20.34.4 PRODUCT PORTFOLIO

20.34.5 RECENT DEVELOPEMENTS

20.35 ASCENDIS PHARMA GROUP

20.35.1 COMPANY OVERVIEW

20.35.2 REVENUE ANALYSIS

20.35.3 GEOGRAPHIC PRESENCE

20.35.4 PRODUCT PORTFOLIO

20.35.5 RECENT DEVELOPEMENTS

20.36 ALVOGEN

20.36.1 COMPANY OVERVIEW

20.36.2 REVENUE ANALYSIS

20.36.3 GEOGRAPHIC PRESENCE

20.36.4 PRODUCT PORTFOLIO

20.36.5 RECENT DEVELOPEMENTS

20.37 ANI PHARMACEUTICALS, INC.

20.37.1 COMPANY OVERVIEW

20.37.2 REVENUE ANALYSIS

20.37.3 GEOGRAPHIC PRESENCE

20.37.4 PRODUCT PORTFOLIO

20.37.5 RECENT DEVELOPEMENTS

20.38 ACELLA PHARMACEUTICALS, LLC

20.38.1 COMPANY OVERVIEW

20.38.2 REVENUE ANALYSIS

20.38.3 GEOGRAPHIC PRESENCE

20.38.4 PRODUCT PORTFOLIO

20.38.5 RECENT DEVELOPEMENTS

20.39 GLENMARK PHARMACEUTICALS

20.39.1 COMPANY OVERVIEW

20.39.2 REVENUE ANALYSIS

20.39.3 GEOGRAPHIC PRESENCE

20.39.4 PRODUCT PORTFOLIO

20.39.5 RECENT DEVELOPEMENTS

20.4 HORIZON THERAPEUTICS PLC

20.40.1 COMPANY OVERVIEW

20.40.2 REVENUE ANALYSIS

20.40.3 GEOGRAPHIC PRESENCE

20.40.4 PRODUCT PORTFOLIO

20.40.5 RECENT DEVELOPEMENTS

20.41 SANIS

20.41.1 COMPANY OVERVIEW

20.41.2 REVENUE ANALYSIS

20.41.3 GEOGRAPHIC PRESENCE

20.41.4 PRODUCT PORTFOLIO

20.41.5 RECENT DEVELOPEMENTS

20.42 MAYNE PHARMA

20.42.1 COMPANY OVERVIEW

20.42.2 REVENUE ANALYSIS

20.42.3 GEOGRAPHIC PRESENCE

20.42.4 PRODUCT PORTFOLIO

20.42.5 RECENT DEVELOPEMENTS

20.43 OTSUKA PHARMACEUTICALS

20.43.1 COMPANY OVERVIEW

20.43.2 REVENUE ANALYSIS

20.43.3 GEOGRAPHIC PRESENCE

20.43.4 PRODUCT PORTFOLIO

20.43.5 RECENT DEVELOPEMENTS

20.44 WACKHARDT

20.44.1 COMPANY OVERVIEW

20.44.2 REVENUE ANALYSIS

20.44.3 GEOGRAPHIC PRESENCE

20.44.4 PRODUCT PORTFOLIO

20.44.5 RECENT DEVELOPEMENTS

20.45 TORQUE PHARMACEUTICALS PVT. LTD

20.45.1 COMPANY OVERVIEW

20.45.2 REVENUE ANALYSIS

20.45.3 GEOGRAPHIC PRESENCE

20.45.4 PRODUCT PORTFOLIO

20.45.5 RECENT DEVELOPEMENTS

20.46 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

20.46.1 COMPANY OVERVIEW

20.46.2 REVENUE ANALYSIS

20.46.3 GEOGRAPHIC PRESENCE

20.46.4 PRODUCT PORTFOLIO

20.46.5 RECENT DEVELOPEMENTS

20.47 KRKA LTD

20.47.1 COMPANY OVERVIEW

20.47.2 REVENUE ANALYSIS

20.47.3 GEOGRAPHIC PRESENCE

20.47.4 PRODUCT PORTFOLIO

20.47.5 RECENT DEVELOPEMENTS

20.48 HYPERA PHARMA

20.48.1 COMPANY OVERVIEW

20.48.2 REVENUE ANALYSIS

20.48.3 GEOGRAPHIC PRESENCE

20.48.4 PRODUCT PORTFOLIO

20.48.5 RECENT DEVELOPEMENTS

20.49 HEBEI TIANCHENG PHARMACEUTICAL COMPANY LTD

20.49.1 COMPANY OVERVIEW

20.49.2 REVENUE ANALYSIS

20.49.3 GEOGRAPHIC PRESENCE

20.49.4 PRODUCT PORTFOLIO

20.49.5 RECENT DEVELOPEMENTS

20.5 POLY PHARMACEUTICALS, INC.

20.50.1 COMPANY OVERVIEW

20.50.2 REVENUE ANALYSIS

20.50.3 GEOGRAPHIC PRESENCE

20.50.4 PRODUCT PORTFOLIO

20.50.5 RECENT DEVELOPEMENTS

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.