Europe Clinical Laboratory Services Market, By Specialty (Clinical Chemistry Testing, Hematology Testing, Microbiology Testing, Immunology Testing, Drugs Of Abuse Testing, Anatomic Pathology Services, Cytology Testing, Genetic Testing, and Other Esoteric Testing), Technology (Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, DNA Sequencing, Flow Cytometry, and Other Technologies), Provider (Independent & Reference Laboratories, Hospital-Based Laboratories, Clinical Based Laboratories, and Nursing and Physician Office-Based Laboratories), Application (Drug Discovery Related Services and Development Related Services, Bioanalytical & Lab Chemistry Services, Toxicology Testing Services, Cell & Gene Therapy Related Services, Preclinical & Clinical Trial Related Services, and Other Clinical Laboratory Services) - Industry Trends And Forecast to 2030.

Europe Clinical Laboratory Services Market Analysis and Size

The market is expected to gain market. Growing application of high-throughput assays and advancement in clinical diagnostic methods act as a driver for the market growth.

Clinical labs provide testing products to public and private health service agencies, including health centers, clinics, medical centers, and nursing homes. Laboratory research areas protected by accreditation include medicinal chemistry, clinical microbiology, hematology, anatomy, clinical physics, psychology, nuclear medicine, and clinical neurophysiology.

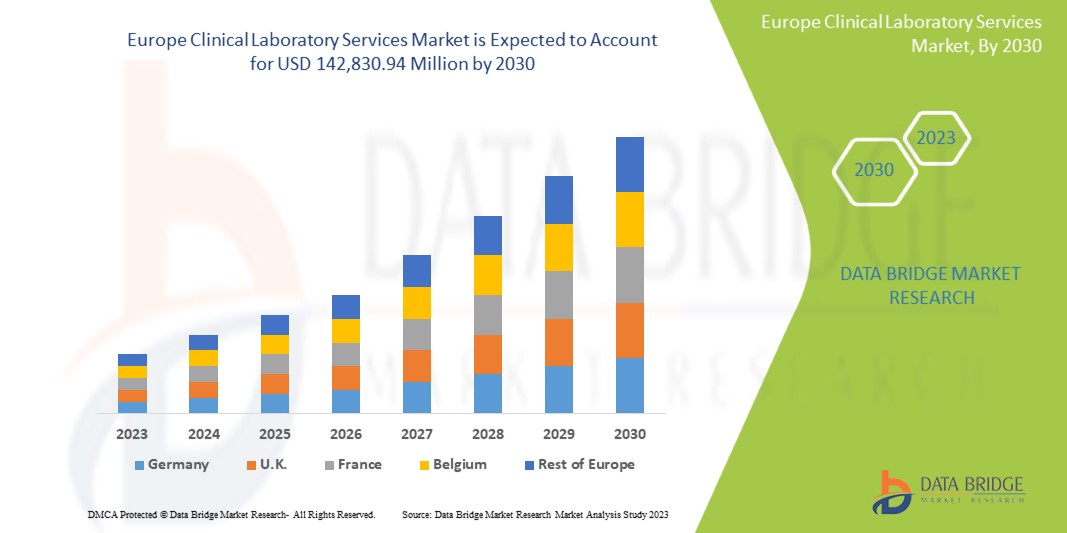

Data Bridge Market Research analyses that the Europe clinical laboratory services market is expected to reach the value of USD 142,830.94 million by 2030, at a CAGR of 6.6% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Specialty (Clinical Chemistry Testing, Hematology Testing, Microbiology Testing, Immunology Testing, Drugs Of Abuse Testing, Anatomic Pathology Services, Cytology Testing, Genetic Testing, and Other Esoteric Testing), Technology (Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, DNA Sequencing, Flow Cytometry, and Other Technologies), Provider (Independent & Reference Laboratories, Hospital-Based Laboratories, Clinical Based Laboratories, and Nursing and Physician Office-Based Laboratories), Application (Drug Discovery Related Services and Development Related Services, Bioanalytical & Lab Chemistry Services, Toxicology Testing Services, Cell & Gene Therapy Related Services, Preclinical & Clinical Trial Related Services, and Other Clinical Laboratory Services) |

|

Countries Covered |

Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland and Rest Of Europe |

|

Market Players Covered |

Mayo Foundation for Medical Education and Research, Quest Diagnostics Incorporated, Eurofins Scientific, UNILABS, SYNLAB International GmbH, H.U. Groups Holdings, Inc., Sonic Healthcare Limited, ACM Global Laboratories, Amedes Medical Services GmbH, Abbott, Charles River Laboratories, Cerba Healthcare, Q2 Solutions (A subsidiary of IQVIA Inc) and among others |

Market Definition

Clinical laboratories are an important part of the healthcare field. Most diagnostic tests, starting from the blood test to the genetic analysis, are conducted in these clinical laboratories to detect different diseases. Clinical laboratories offer data and resources that optimize the required distribution in the healthcare system, such as diagnostics and test results. This maintains and provides reliable and correct test results that enable doctors to make appropriate clinical and diagnostic decisions across various levels of health care services. This allows clinicians to adapt, begin, and stop treatment, which would be hindered in the absence of medical laboratory facilities. Clinical laboratory services include drug discovery, drug development, bioanalytical & lab chemistry, toxicology testing, cell & gene therapy, and preclinical & clinical trial-related services. Independent and reference laboratories, hospital-based laboratories, nursing, and physician office-based laboratories are some of the major providers of clinical laboratory services.

Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Rise in the Cases of Infectious Diseases

In recent times, there has been an increasing incidence of infectious diseases, such as viral outbreaks and antibiotic-resistant pathogens that has raised the demand for diagnostic testing and clinical laboratory services. Infectious diseases affected by organisms such as viruses, parasites, fungi, and bacteria are directly or indirectly passed from one person to another. The clinical laboratories are investing substantially in advanced diagnostic technologies, including molecular diagnostics and serology testing, to effectively identify and manage these diseases. Increasing infectious diseases impact increasing the demand for clinical laboratories as laboratory diagnosis of infectious diseases of the patients. The clinical laboratory provides different types of services for the diagnosis and treatment of patients due to infectious diseases, including blood count, immunology and allergy testing, and urinalysis among others.

Opportunities

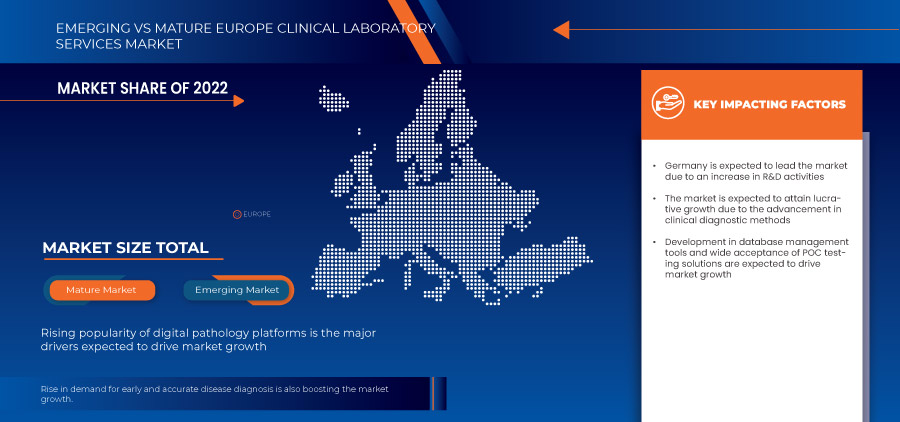

- Rising Popularity of Digital Pathology Platforms

Digital pathology platforms are computer workstations used to view digital whole slide images acquired from glass microscope high-resolution slide scanning. Digital pathology platforms use algorithms for analysis and diagnostic reporting to ensure reproducibility, greater accuracy, and standardization of studies. Applications of digital pathology platforms are increasing in various clinical laboratories to implement full-scale operations in the laboratories successfully. In addition, the adoption of digital pathology platforms has increased as whole slide imaging has shown various improvements in scanner capacities, scan times, image resolution, image management software, laboratory information systems integration, and simple image viewing and evaluation.

Digital pathology platforms have displayed their utility in team communication, case management, workflow acceleration and facilitation in image analytics, slide imaging, tumor boards, and remote consultations, which is creating a more collaborative, efficient, and rewarding environment for researchers and clinicians, which in increasing adoption of digital pathology platforms around the world.

The adoption of digital pathology platforms is increasing in developed and developing countries due to increasing functional ability in various departments in the clinical laboratory, including training, teaching, team communication, research activities, and primary diagnostic reporting. Digital pathology platforms have shown their efficacy in clinical laboratories with many benefits in clinical laboratory operations.

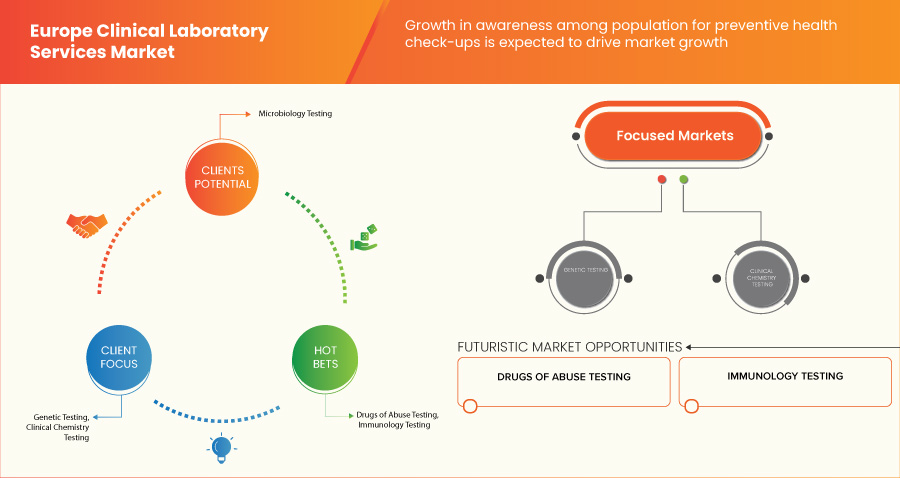

- Growth in Awareness Among Population for Preventive Health Check-Ups

Preventive health check-ups are preventive actions performed for the initial detection of disease and to safeguard against likely exposure to any disease in the future. The check-up is comprised of the identification of disease and examinations of risk factors to limit loss at an early stage. Preventive health check-ups are performed with the help of various lab tests, including blood chemistry, hemoglobin, urinalysis, screening for prostate cancer, screening for ovarian cancer, ECG, lipid panel, and others.

Preventive health check-ups are increasing worldwide as various studies and research have proven their effectiveness in disease prevention and economics. Furthermore, the demand for preventive health check-ups has increased as preventive health check-ups are insured by health insurance companies in various counties, and the current COVID-19 situation has added up as a necessity for the safety of individuals. When a communicable disease outbreak begins, the ideal response is for public health officials to begin testing for it early. That leads to quick identification of cases, quick treatment for those people, and immediate isolation to prevent spread. Early testing also helps to identify anyone who came into contact with infected people so they too can be quickly treated.

Restraints/Challenges

- Lack of Skilled and Certified Professionals

The requirement for skilled and certified professionals is a big restraint for clinical laboratories. Clinical laboratory services have increased due to the high growth in the number of people aged 65 or older who need a routine diagnostic test for their health, but the number of skilled professionals present in the laboratory center is expected to restrain the market growth. The method and laboratory procedure have advantages, but there are certain gaps in standardization, equalization, and knowledge. Technicians are facing technical training gaps related to problems in adopting advanced methods safely to perform procedures efficiently. There is a need for highly skilled professionals in the clinical laboratory for method development, validation, operation, and troubleshooting activities.

- Inaccurate Test Outcomes Undermining Precision and Reliability

Inaccuracies in diagnostic test outcomes have negative consequences for patient safety, potentially leading to misdiagnoses or delayed diagnoses that harm patients' health. Many Inaccurate results and diagnostic test errors are linked to laboratory practices. Laboratory practice could be divided into three segments which are pre-analytical, analytical, and post-analytical.

Analytical Errors: During the establishment and verification of test methods as per the performance specifications to test precision, accuracy, specificity, sensitivity, and linearity are the areas where errors are high in clinical laboratory testing.

Pre-Analytical Errors: The pre-analytical error phase is the process where the maximum laboratory errors occur. Pre-analytical errors can arise during patient assessment, patient identification, request completion, test order entry, specimen transport, specimen collection, and specimen receipt in the laboratory.

Post-Analytical Errors: The post-analytical phase is the phase of diagnostic and therapeutic decisions. Post-analytical errors can arise due to inappropriate use of laboratory test outcomes, the transmission of correct outcomes, and critical outcomes reporting are areas of potential error in the post-analytical phase of the total laboratory testing process.

Recent Developments

- In August 2023, Abbott received FDA clearance for its Alinity h-series hematology system, expanding its diagnostic Service lineup for complete blood counts (CBC) testing. This system is crucial in routine checkups, aiding in the screening of various disorders such as infections, anemia, immune system diseases, and blood cancers. The Alinity h-series comprises Alinity hq, an automated hematology analyzer, and Alinity hs, an integrated slide maker and stainer. Notably, Alinity HQ employs MAPSSTM technology for advanced cell identification using light scattering.

- In November 2022, Microba Life Sciences announced a strategic partnership with Sonic Healthcare Limited, a global leader in medical diagnostics. Sonic is set to acquire a 19.99% stake in Microba, with an option for an additional 5% pending shareholder approval.

Market Scope

Europe clinical laboratory services market is categorized into four notable segments on the basis of specialty, technology, provider, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Specialty

- Clinical Chemistry Testing

- Hematology Testing

- Microbiology Testing

- Immunology Testing

- Drugs of Abuse Testing

- Cytology Testing

- Genetic Testing

- Anatomic Pathology Services

- Other Estoric Testing

On the basis of specialty, the market is segmented into clinical chemistry testing, hematology testing, microbiology testing, immunology testing, drugs of abuse testing, cytology testing, genetic testing, anatomic pathology services and other esoteric testing.

Technology

- Enzyme-Linked Immunosorbent Assay

- Real-Time PCR

- Chemiluminescence Immunoassay

- Mass Spectrometry

- Flow Cytometry

- DNA Sequencing

- Other Technologies

On the basis of technology, the market is segmented into enzyme-linked immunosorbent assay, real-time PCR, chemiluminescence immunoassay, mass spectrometry, flow cytometry, DNA sequencing and other technologies.

Provider

- Hospital-Based Laboratories

- Independent & Reference Laboratories

- Nursing and Physician Office-Based Laboratories

- Clinic Based Laboratories

On the basis of provider, the market is segmented into hospital-based laboratories, independent & reference laboratories, nursing and physician office-based laboratories, and clinic-based laboratories.

Application

- Bioanalytical & Lab Chemistry Services

- Drug Discovery and Development Related Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Other Clinical Laboratory Services

On the basis of application, the market is segmented into drug discovery and development related services, bioanalytical & lab chemistry services, toxicology testing services, cell & gene therapy related services, preclinical & clinical trial related services, and other clinical laboratory services.

Regional Analysis/Insights

The Europe clinical laboratory services market is categorized into four notable segments on the basis of specialty, technology, provider, and application.

The countries covered in the Europe clinical laboratory services market report are Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland and Rest Of Europe.

Germany is expected to dominate the market due to its advanced healthcare infrastructure and extensive network of high-quality clinical laboratories.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Share Analysis

The Europe clinical laboratory services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the Europe clinical laboratory services market.

Some of the major players operating in the Europe clinical laboratory services market are Mayo Foundation for Medical Education and Research, Quest Diagnostics Incorporated, Eurofins Scientific, UNILABS, SYNLAB International GmbH, H.U. Groups Holdings, Inc., Sonic Healthcare Limited, ACM Global Laboratories, Amedes Medical Services GmbH, Abbott, Charles River Laboratories, Cerba Healthcare, Q2 Solutions (A subsidiary of IQVIA Inc) and among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE CLINICAL LABORATORY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE CASES OF INFECTIOUS DISEASES

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE CLINICAL DIAGNOSTIC METHODS

6.1.3 DEVELOPMENT IN DATABASE MANAGEMENT TOOLS AND WIDE ACCEPTANCE OF POINT-OF-CARE (POC) TESTING SOLUTIONS

6.1.4 RISE IN DEMAND FOR EARLY AND ACCURATE DISEASE DIAGNOSIS

6.2 RESTRAINTS

6.2.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

6.2.2 STRICT REGULATORY POLICIES

6.3 OPPORTUNITIES

6.3.1 RISING POPULARITY OF DIGITAL PATHOLOGY PLATFORMS

6.3.2 GROWTH IN AWARENESS AMONG POPULATION FOR PREVENTIVE HEALTH CHECK-UPS

6.4 CHALLENGE

6.4.1 INACCURATE TEST OUTCOMES UNDERMINING PRECISION AND RELIABILITY

7 EUROPE

8 EUROPE CLINICAL LABORATORY SERVICES MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 ABBOTT

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 SERVICE PORTFOLIO

10.1.4 RECENT DEVELOPMENTS

10.2 SONIC HEALTHCARE LIMITED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 SERVICE PORTFOLIO

10.2.4 RECENT DEVELOPMENT

10.3 SYNLAB INTERNATIONAL GMBH

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 SERVICE PORTFOLIO

10.3.4 RECENT DEVELOPMENTS

10.4 QUEST DIAGNOSTICS INCORPORATED

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 SERVICE PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 SIEMENS HEALTHINEERS AG

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 SERVICE PORTFOLIO

10.5.4 RECENT DEVELOPMENTS

10.6 ACM GLOBAL LABORATORIES

10.6.1 COMPANY SNAPSHOT

10.6.2 SERVICE PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 AMEDES MEDICAL SERVICES GMBH

10.7.1 COMPANY SNAPSHOT

10.7.2 SERVICE PORTFOLIO

10.7.3 RECENT DEVELOPMENT

10.8 CERBA HEALTHCARE

10.8.1 COMPANY SNAPSHOT

10.8.2 SERVICE PORTFOLIO

10.8.3 RECENT DEVELOPMENT

10.9 CHARLES RIVER LABORATORIES

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 SERVICE PORTFOLIO

10.9.4 RECENT DEVELOPMENT

10.1 EUROFINS SCIENTIFIC

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 SERVICE PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 EXACT SCIENCES CORPORATION

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 SERVICE PORTFOLIO

10.11.4 RECENT DEVELOPMENT

10.12 H.U. GROUP HOLDINGS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 SERVICE PORTFOLIO

10.12.4 RECENT DEVELOPMENT

10.13 MAYO FOUNDATION FOR MEDICAL EDUCATION AND RESEARCH

10.13.1 COMPANY SNAPSHOT

10.13.2 SERVICE PORTFOLIO

10.13.3 RECENT DEVELOPMENT

10.15 Q2 SOLUTIONS (A SUBSIDIARY OF IQVIA INC)

10.15.1 COMPANY SNAPSHOT

10.15.2 SERVICE PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 UNILABS

10.16.1 COMPANY SNAPSHOT

10.16.2 SERVICE PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Figura

FIGURE 1 EUROPE CLINICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE CLINICAL LABORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CLINICAL LABORATORY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CLINICAL LABORATORY SERVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CLINICAL LABORATORY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CLINICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CLINICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE CLINICAL LABORATORY SERVICES MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE CLINICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 10 RISING INFECTIOUS DISEASES WORLDWIDE AND RISING DEMAND FOR EARLY AND ACCURATE DISEASE DIAGNOSIS ARE EXPECTED TO DRIVE THE EUROPE CLINICAL LABORATORY SERVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE ROUTINE TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CLINICAL LABORATORY SERVICES MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CLINICAL LABORATORY SERVICES MARKET

FIGURE 13 EUROPE CLINICAL LABORATORY SERVICES MARKET: SNAPSHOT (2022)

FIGURE 14 EUROPE CLINICAL LABORATORY SERVICES MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.