Europe Diagnostic Tests Market

Market Size in USD Million

CAGR :

%

USD

160,573.05 Million

USD

324,678.67 Million

2022

2030

USD

160,573.05 Million

USD

324,678.67 Million

2022

2030

| 2023 –2030 | |

| USD 160,573.05 Million | |

| USD 324,678.67 Million | |

|

|

|

|

Europe Diagnostic Tests Market Analysis and Size

According to the World Health Organization (WHO), chronic diseases will account for approximately 41 million deaths per year by April 2021, accounting for 71% of all fatalities. As a result, diagnostic tests have proven to be beneficial in the management of chronic illness conditions, as well as disease prevention, detection, and diagnosis. By identifying individual risk factors and early warning indicators, clinical diagnostics enable early prevention and intervention. As a result, as the prevalence of chronic illnesses rises, the overall market is expected to grow.

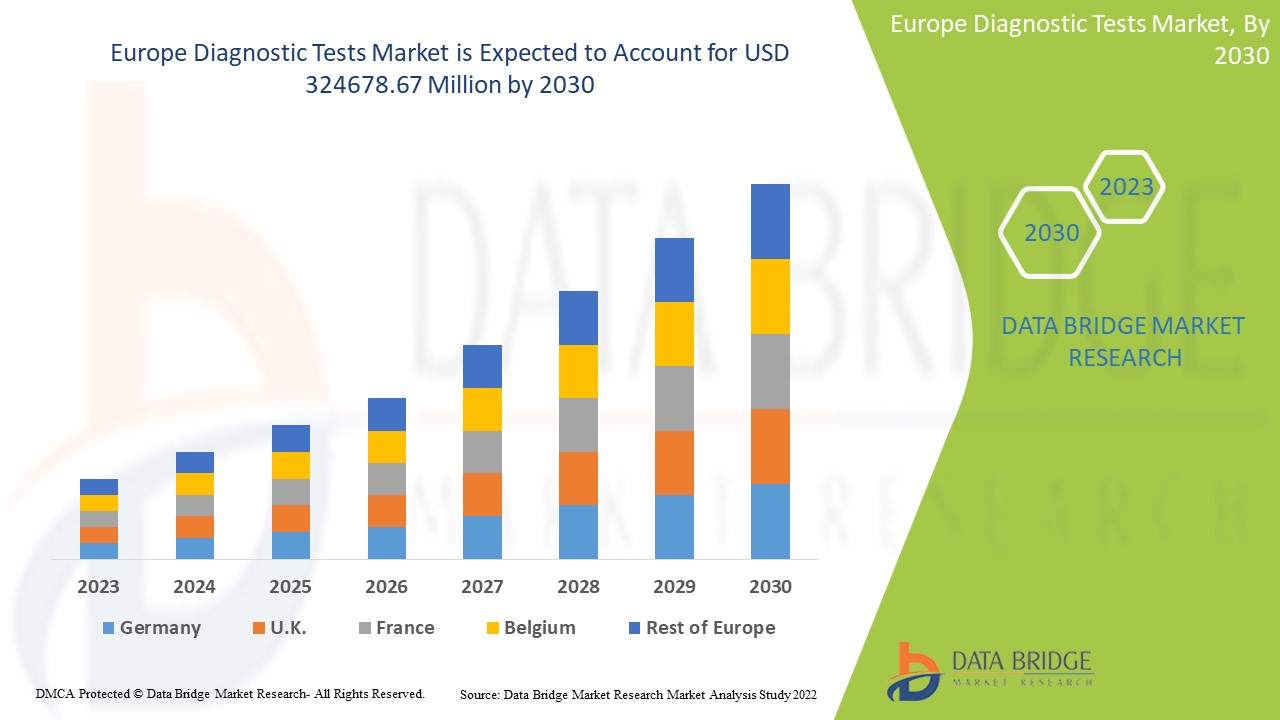

Data Bridge Market Research analyses that the diagnostic tests market, which was USD 160,573.05 million in 2022, is expected to reach USD 324678.67 million by 2030, at a CAGR of 9.2% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Europe Diagnostic Tests Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Glucose Test, Infectious Diseases Test, Cytology Test, CBC Test, Blood Culture Test, Syphilis Test, Urea Test, C-Reactive Protein Test, Antigen Test, HBA1C Test, Pregnancy Test, Lipid Profile Test, Electrolytes Test, Liver Function Test, Stool Helicobacter Pylori Test, Calcium Test, Crossmatch Test, Thyroid Function Test, Stool Microscopy Test, Urine Microscopy Test, Unit Packed RBCS Test, ESR Test and Others Test), Solutions (Services and Products), Technology (Immunoassay-Based, PCR-Based, Next Gene Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Substrate Technology and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Approach (Molecular Diagnostic Instrument, In-Vitro Diagnostic Instrument and Point Of Care Testing Instrument), Sample Type (Urine, Saliva, Blood, Hair, Sweat and Others), Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Odontology and Others), Testing Type (Biochemistry, Haematology, Microbiology, Histopathology and Others), Age (Pediatric, Adult and Geriatric), End User (Hospitals, Diagnostic Center, Research Labs and Institutes, Research Institute, Homecare, Blood Banks, Specialty Clinics, Ambulatory Surgical Centers and Others), Distribution Channel (Direct Tenders, Retail Sales and Online Sales) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

F-Hoffman La-Roche Ltd. (Switzerland), ABBOTT (U.S.), Danaher (U.S.), B.D. (U.S.), Thermo Fisher Scientific Inc. (U.S.), ACON Laboratories Inc. (U.S.), Hemosure, Inc. (U.S.), MicroGen Diagnostics (U.S.), QIAGEN (Germany), Grifols, S.A (Spain), BODITECH MED INC. (South Korea), Chembio Diagnostic Systems, Inc. (U.S.), Nanoentek (South Korea), DiaSorin S.p.A. (Italy), Bio-Rad Laboratories, Inc. (U.S.), BIOMEDOMICS INC (U.S.), EKF Diagnostics Holdings plc (U.K.), Siemens Healthcare GmbH (Germany), PerkinElmer Inc. (U.S.), BIOMÉRIEUX (France), ARKRAY USA, Inc. (U.S.), Biohit Oyj (Finland), Germaine Laboratories, Inc. (U.S.), Quidel Corporation (U.S.), Illumina, Inc. (U.S.), Lamdagen Corporation (U.S.), LifeSign LLC. (U.S.), Medixbiochemica (Finland), Nova Biomedical (U.S.), Ortho Clinical Diagnostics (U.S.), Sannuo Biosensing Co., Ltd. (U.S.), STRECK (U.S.), Sysmex Corporation (Japan), among others |

|

Market Opportunities |

|

Market Definition

Diagnostic tests are medical procedures used to aid in the detection or diagnosis of disease. These tests play an important role in disease control, surveillance, and prevention. These tests aid in the enhancement of patient care, consumer safety, and healthcare spending. A diagnostic test is one that is used to figure out what is causing a condition. A diagnostic test performed as part of a medical examination may be used to identify a disease or to determine the cause of symptoms. When used for other purposes, a diagnostic test can be used to identify specific strengths and weaknesses.

Europe Diagnostic Tests Market Dynamics

Drivers

- Growing incidences of infectious and chronic diseases

Infectious diseases and chronic conditions are putting a strain on the global population. Infectious diseases like diphtheria, ebola, flu, hepatitis, HIV/AIDS, HPV, tuberculosis, and others are caused by microorganisms, and sudden outbreaks like dengue, Zika virus, COVID-19, and Swine flu drive international demand for clinical diagnostic tests. Furthermore, chronic diseases such as cancer, diabetes, cardiovascular disease, obesity, and others are driving up demand for clinical diagnostics.

- Rising clinical diagnostic tests

The most accurate techniques for identifying and describing microorganisms are clinical diagnostic tests. A practical test needs to be quick, precise, and able to identify the infection's severity. The time it takes to locate the proper antibiotic is decreased through faster, more accurate testing that identifies the strain of the organism and its medication susceptibility. According to a World Health Organization (WHO) report, tuberculosis (TB) was one of the top ten causes of death. This will probably have a big impact on market expansion. The rising prevalence of cancer cases in living standards can be largely attributed to the accessibility and availability of better diagnostic techniques. Because clinical cancer diagnostics equipment is widely used in these procedures, demand for diagnostic tests rises during the forecast period.

Opportunities

- Growing demand for advanced diagnostic solutions

Clinical diagnostics are used to manage patients' health. It allows for the earlier detection of diseases and aids in the progression of illnesses. Furthermore, it may aid infected individuals in avoiding long-term consequences, raising public awareness of the significance of clinical diagnosis. Increased healthcare spending and health awareness encourage market growth. As people grow more concerned about the possibility of disease transmission from infected patients, the demand for clinical diagnostic kits is anticipated to increase during the forecast period. Diagnostic testing can be carried out using services as well as equipment and supplies. This feature will almost certainly improve patient comfort, which will benefit the market.

Restraints/Challenges

- Affordability for diagnostics tests

Pricing pressures from reimbursement cuts and budget constraints, along with stringent regulatory policies, are expected to hamper market growth. Furthermore, the diagnostic tests market is expected to be challenged by a lack of alignment with definitive central lab methods and insufficient adoption of POC devices in professional settings during the forecast period of 2023-2030.

This diagnostic tests market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the diagnostic tests market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Diagnostic Tests Market

COVID-19 has negatively impacted the diagnostic test market because lab testing has increased, causing demand to rise even faster to keep up with suspected COVID-19 cases. According to the Atlantic Monthly Group, the number of COVID-19 tests worldwide increased dramatically from 760,441 in September 2020 to 964,792 in October 2020. As a result, the rising number of tests due to increased patient numbers and government funding is expected to drive demand for COVID-19 test kits and fuel the overall market's exponential growth.

Recent Developments

- In 2020, Siemens Healthcare GmbH officially announced the release of the RAPIDPoint 500e Blood Gas Analyzer, which broadened the company's product portfolio and is also used in COVID-19 efforts. This helps to increase revenue from the line.

- In 2020, Siemens Healthcare GmbH and the Marienhaus Hospital Group have announced a ten-year collaboration. This collaboration will benefit the company in diagnostics in the long run. This agreement will also help the company's financial situation.

Europe Diagnostic Tests Market Scope

The diagnostic tests market is segmented on the basis of type, solution, technology, mode of testing, approach, sample type, application, testing type, age, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Glucose Test

- Infectious Diseases Test

- Cytology Test

- CBC Test

- Blood Culture Test

- Syphilis Test

- Urea Test

- C-Reactive Protein Test

- Antigen Test

- HBA1C Test

- Pregnancy Test

- Lipid Profile Test

- Electrolytes Test

- Liver Function Test

- Stool Helicobacter Pylori Test

- Calcium Test, Crossmatch Test

- Thyroid Function Test

- Stool Microscopy Test

- Urine Microscopy Test

- Unit Packed Rbcs Test

- ESR Test and Others Test

Solutions

- Services

- Products

Technology

- Immunoassay-Based

- PCR-Based

- Next Gene Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Substrate Technology

- Others

Mode of Testing

- Prescription-Based Testing

- OTC Testing

Approach

- Molecular Diagnostic Instrument

- In-Vitro Diagnostic Instrument

- Point of Care Testing Instrument

Sample Type

- Urine

- Saliva

- Blood

- Hair

- Sweat

- Others

Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Odontology

- Others

Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

Age

- Pediatric

- Adult

- Geriatric

End User

- Hospitals

- Diagnostic Center

- Research Labs and Institutes

- Research Institute

- Homecare

- Blood Banks

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

Europe Diagnostic Tests Market Regional Analysis/Insights

The diagnostic tests market is analyzed and market size insights and trends are provided by country, type, solution, technology, mode of testing, approach, sample type, application, testing type, age, end user and distribution channel as referenced above.

The countries covered in the diagnostic tests market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany is dominating the Europe diagnostic tests market to government strategic initiatives such as acquisition and focused segment product launches, which are assisting them to expand their reach and also assisting them to expand and enhance the company's product portfolio, which will ultimately lead to more revenue generation in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Diagnostic Tests Market Share Analysis

The diagnostic tests market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to diagnostic tests market.

Some of the major players operating in the diagnostic tests market are:

- F-Hoffman La-Roche Ltd. (Switzerland)

- ABBOTT (U.S.)

- Danaher (U.S.)

- B.D. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- ACON Laboratories Inc. (U.S.)

- Hemosure, Inc. (U.S.)

- MicroGen Diagnostics (U.S.)

- QIAGEN (Germany)

- Grifols, S.A (Spain)

- BODITECH MED INC. (South Korea)

- Chembio Diagnostic Systems, Inc. (U.S.)

- Nanoentek (South Korea)

- DiaSorin S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (U.S.)

- BIOMEDOMICS INC (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Siemens Healthcare GmbH (Germany)

- PerkinElmer Inc. (U.S.)

- BIOMÉRIEUX (France)

- ARKRAY USA, Inc. (U.S.)

- Biohit Oyj (Finland)

- Germaine Laboratories, Inc. (U.S.)

- Quidel Corporation (U.S.)

- Illumina, Inc. (U.S.)

- Lamdagen Corporation (U.S.)

- LifeSign LLC. (U.S.)

- Medixbiochemica (Finland)

- Nova Biomedical (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Sannuo Biosensing Co., Ltd. (U.S.)

- STRECK (U.S.)

- Sysmex Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE DIAGNOSTICS TESTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE DIAGNOSTICS TESTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE DIAGNOSTICS TESTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 EUROPE DIAGNOSTICS TESTS MARKET, BY TYPE

17.1 OVERVIEW

17.2 ROUTINE TESTS

17.2.1 GLUCOSE TEST

17.2.2 INFECTIOUS DISEASES TEST

17.2.3 CBC TEST

17.2.4 BLOOD CULTURE TEST

17.2.5 SYPHILIS TEST

17.2.6 UREA TEST

17.2.7 C-REACTIVE PROTEIN TEST

17.2.8 ANTIGEN TEST

17.2.9 HBA1C TEST

17.2.10 PREGNANCY TEST

17.2.11 LIPID PROFILE TEST

17.2.12 ELECTROLYTES TEST

17.2.13 LIVER FUNCTION TEST

17.2.14 STOOL HELICOBACTER PYLORI TEST

17.2.15 CALCIUM TEST

17.2.16 CROSSMATCH TEST

17.2.17 THYROID FUNCTION TEST

17.2.18 STOOL MICROSCOPY TEST

17.2.19 URINE MICROSCOPY TEST

17.2.20 UNIT PACKED RBCS TEST

17.2.21 ESR TEST

17.2.22 OTHERS

17.3 SPECIALIZED TESTS

17.3.1 MOLECULAR DIAGNOSTIC TESTS

17.3.2 IMMUNOLOGICAL TESTS

17.3.3 GENETIC TESTS

17.3.4 TOXICOLOGY TESTS

17.3.5 OTHERS

18 EUROPE DIAGNOSTICS TESTS MARKET, BY COMPONENT

18.1 OVERVIEW

18.2 PRODUCTS

18.2.1 INSTRUMENTS

18.2.1.1. BY TYPE

18.2.1.1.1. IN-VITRO DIAGNOSTIC INSTRUMENT

18.2.1.1.1.1 IMMUNOASSAY INSTRUMENT

18.2.1.1.1.1.1. BY TYPE

A. ELISA READERS

B. CLIA ANALYZERS

C. OTHERS

18.2.1.1.1.1.2. BY MODE

A. AUTOMATED

B. SEMI-AUTOMATED

C. MANUAL

18.2.1.1.1.1.3. BY MODALITY

A. BENCHTOP

B. FLOOR-STANDING

C. MODULAR

18.2.1.1.1.2 CLINICAL CHEMISTRY INSTRUMENT

18.2.1.1.1.2.1. BY TYPE

A. SPECTROPHOTOMETERS

B. ELECTROLYTE ANALYZERS

C. BLOOD GAS ANALYZERS

D. COAGULATION ANALYZERS

E. MICROPLATE READERS

18.2.1.1.1.2.2. BY MODE

A. AUTOMATED

B. SEMI-AUTOMATED

C. MANUAL

18.2.1.1.1.2.3. BY MODALITY

A. BENCHTOP

B. FLOOR-STANDING

C. MODULAR

18.2.1.1.1.3 HEMATOLOGY INSTRUMENT

18.2.1.1.1.3.1. BY MODE

A. AUTOMATED

B. SEMI-AUTOMATED

C. MANUAL

18.2.1.1.1.3.2. BY MODALITY

A. BENCHTOP

B. FLOOR-STANDING

C. MODULAR

18.2.1.1.1.4 MOLECULAR DIAGNOSTIC INSTRUMENT

18.2.1.1.1.4.1. BY MODE

A. PCR INSTRUMENTS

B. NGS INSTRUMENTS

C. MICROARRAY INSTRUMENTS

D. ISOTHERMAL AMPLIFICATION INSTRUMENTS

E. NUCLEIC ACID EXTRACTION INSTRUMENTS

F. HYBRIDIZATION INSTRUMENTS

18.2.1.1.1.4.2. BY MODE

A. AUTOMATED

B. SEMI-AUTOMATED

C. MANUAL

18.2.1.1.1.4.3. BY MODALITY

A. BENCHTOP

B. FLOOR-STANDING

C. MODULAR

18.2.1.1.1.5 OTHERS

18.2.1.1.2. POINT OF CARE TESTING INSTRUMENT

18.2.1.1.2.1 BLOOD GLUCOSE MONITORING DEVICES

18.2.1.1.2.2 RAPID DIAGNOSTIC TEST DEVICES

18.2.1.1.2.3 CARDIAC MARKER DEVICES

18.2.1.1.2.4 INFECTIOUS DISEASE TESTING DEVICES

18.2.1.1.2.5 URINE ANALYSIS DEVICES

18.2.1.2. OTHER

18.2.2 KITS AND REAGENTS

18.2.2.1. PREGNANCY TESTING KITS

18.2.2.1.1. STRIPS

18.2.2.1.2. CASETTES

18.2.2.1.3. MIDSTREAM

18.2.2.1.4. DIP CARD

18.2.2.1.5. OTHERS

18.2.2.2. URINALYSIS TESTING KITS

18.2.2.2.1. CASSETTES TESTS

18.2.2.2.2. STRIP TESTS

18.2.2.3. GLUCOSE MONITORING KITS

18.2.2.3.1. STRIPS

18.2.2.3.2. CARTRIDGES

18.2.2.4. CARDIAC ASSAYS

18.2.2.4.1. TROPONIN

18.2.2.4.2. BNP

18.2.2.4.3. MYOGLOBIN

18.2.2.4.4. OTHERS

18.2.2.5. INFECTIOUS DISEASE TESTING KITS

18.2.2.5.1. HEPATITIS

18.2.2.5.2. INFLUENZA

18.2.2.5.3. HIV/AIDS

18.2.2.5.4. TUBERCULOSIS

18.2.2.5.5. HOSPITAL ACQUIRED INFECTIONS

18.2.2.5.6. COVID-19

18.2.2.5.7. OTHERS

18.2.2.6. DRUG TEST KITS

18.2.2.6.1. MARIJUANA

18.2.2.6.2. AMPHETAMINES

18.2.2.6.3. BARBITUATES

18.2.2.6.4. ANTI DEPRESSANTS

18.2.2.6.5. PCP

18.2.2.6.6. METHADONE

18.2.2.6.7. OTHERS

18.2.2.7. OTHERS

18.2.3 CONSUMABLES

18.2.3.1. NEEDLES AND SYRINGES

18.2.3.2. BLOOD COLLECTION DEVICES

18.2.3.3. MEDIA CULTURE

18.2.3.3.1. BROTH

18.2.3.3.2. AGAR

18.2.3.3.3. OTHERS

18.2.3.4. STAINS

18.2.3.4.1. GRAM STAINS

18.2.3.4.2. MYCOBACTERIA STAINS

18.2.3.4.3. FUNGAL STAINS

18.2.3.4.4. OTHERS

18.2.3.5. CONTROLS & CALIBRATORS

18.2.3.6. PLATES

18.2.3.7. OTHERS

18.3 SERVICES

19 EUROPE DIAGNOSTICS TESTS MARKET, BY TECHNOLOGY

19.1 OVERVIEW

19.2 PCR-BASED

19.2.1 REAL-TIME PCR

19.2.2 NESTED PCR

19.2.3 MULTIPLEX PCR

19.2.4 QUANTITATIVE PCR

19.2.5 OTHERS

19.3 IMMUNOASSAY-BASED

19.3.1 LATERAL FLOW IMMUNOASSAY

19.3.1.1. SANDWICH ASSAYS

19.3.1.2. COMPETITIVE ASSAYS

19.3.2 PAPER-BASED IMMUNOASSAYS

19.3.3 OTHERS

19.4 CHROMATOGRAPHY-BASED

19.4.1 LC-MS

19.4.2 GC-MS

19.4.3 LC-MS/MS

19.5 SPECTROSCOPY-BASED

19.5.1 MASS SPECTROMETRY

19.5.2 RAMAN SPECTROSCOPY

19.5.3 OPTICAL SPECTROSCOPY

19.5.4 OTHERS

19.6 MICROFLUIDICS

19.6.1 LUCIFERASE IMMUNOPRECIPITATION SYSTEMS (LIPS)

19.6.2 PAPER-BASED MICROFLUDICS

19.7 NEXT GENE SEQUENCING

19.7.1 WHOLE GENOME SEQUENCING

19.7.2 TARGETED RESEQUENCING

19.7.3 WHOLE EXOME SEQUENCING

19.7.4 RNA SEQUENCING

19.7.5 OTHERS

19.8 OTHERS

20 EUROPE DIAGNOSTICS TESTS MARKET, BY MODE OF TESTING

20.1 OVERVIEW

20.2 PRESCRIPTION-BASED TESTING

20.3 OTC TESTING

21 EUROPE DIAGNOSTICS TESTS MARKET, BY APPLICATION

21.1 OVERVIEW

21.2 CARDIOLOGY

21.3 ONCOLOGY

21.4 NEUROLOGY

21.5 ORTHOPEDICS

21.6 GASTROENTROLOGY

21.7 GYNECOLOGY

21.8 ODONTOLOGY

21.9 OTHERS

22 EUROPE DIAGNOSTICS TESTS MARKET, BY SAMPLE TYPE

22.1 BLOOD

22.2 URINE

22.3 SALIVA

22.4 RESPIRATORY SAMPLES

22.5 STOOL

22.6 BIOPSY

22.7 OTHERS

23 EUROPE DIAGNOSTICS TESTS MARKET, BY TESTING SITE

23.1 OVERVIEW

23.2 AT HOME TESTING

23.3 LABROATORIES BASED TESTING

24 EUROPE DIAGNOSTICS TESTS MARKET, BY TESTING TYPE

24.1 OVERVIEW

24.2 BIOCHEMISTRY

24.3 HEMATOLOGY

24.4 MICROBIOLOGY

24.5 HISTOPATHOLOGY

24.6 OTHERS

25 EUROPE DIAGNOSTICS TESTS MARKET, BY AGE

25.1 OVERVIEW

25.2 PEDIATRIC

25.3 ADULT

25.4 GERIARTIC

26 EUROPE DIAGNOSTICS TESTS MARKET, BY END USER

26.1 OVERVIEW

26.2 HOSPITALS

26.2.1 PUBLIC

26.2.2 PRIVATE

26.3 DIAGNOSTIC CENTER

26.4 ACADEMIC LABS & INSTITUTES

26.5 RESEARCH INSTITUTE

26.6 HOMECARE

26.7 BLOOD BANKS

26.8 SPECILATY CLINICS

26.9 AMBULATORY SURGICAL CENTERS (ASCS)

26.1 OTHERS

27 EUROPE DIAGNOSTICS TESTS MARKET, BY DISTRIBUTION CHANNEL

27.1 OVERVIEW

27.2 DIRECT TENDERS

27.3 RETAIL SALES

27.3.1 ONLINE

27.3.2 OFFLINE

27.4 OTHERS

28 EUROPE DIAGNOSTICS TESTS MARKET, COMPANY LANDSCAPE

28.1 COMPANY SHARE ANALYSIS: EUROPE

28.2 MERGERS & ACQUISITIONS

28.3 NEW PRODUCT DEVELOPMENT & APPROVALS

28.4 EXPANSIONS

28.5 REGULATORY CHANGES

28.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

29 EUROPE DIAGNOSTICS TESTS MARKET, SWOT AND DBMR ANALYSIS

30 EUROPE DIAGNOSTICS TESTS MARKET, BY COUNTRY

EUROPE DIAGNOSTICS TESTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

30.1 EUROPE

30.1.1 GERMANY

30.1.2 FRANCE

30.1.3 U.K.

30.1.4 HUNGARY

30.1.5 LITHUANIA

30.1.6 AUSTRIA

30.1.7 IRELAND

30.1.8 NORWAY

30.1.9 POLAND

30.1.10 ITALY

30.1.11 SPAIN

30.1.12 RUSSIA

30.1.13 TURKEY

30.1.14 NETHERLANDS

30.1.15 SWITZERLAND

30.1.16 REST OF EUROPE

30.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

31 EUROPE DIAGNOSTICS TESTS MARKET, COMPANY PROFILE

31.1 ABBOTT

31.1.1 COMPANY OVERVIEW

31.1.2 REVENUE ANALYSIS

31.1.3 GEOGRAPHIC PRESENCE

31.1.4 PRODUCT PORTFOLIO

31.1.5 RECENT DEVELOPMENTS

31.2 BIO-RAD LABORATORIES, INC.

31.2.1 COMPANY OVERVIEW

31.2.2 REVENUE ANALYSIS

31.2.3 GEOGRAPHIC PRESENCE

31.2.4 PRODUCT PORTFOLIO

31.2.5 RECENT DEVELOPMENTS

31.3 DANAHER

31.3.1 COMPANY OVERVIEW

31.3.2 REVENUE ANALYSIS

31.3.3 GEOGRAPHIC PRESENCE

31.3.4 PRODUCT PORTFOLIO

31.3.5 RECENT DEVELOPMENTS

31.4 BD

31.4.1 COMPANY OVERVIEW

31.4.2 REVENUE ANALYSIS

31.4.3 GEOGRAPHIC PRESENCE

31.4.4 PRODUCT PORTFOLIO

31.4.5 RECENT DEVELOPMENTS

31.5 F. HOFFMANN-LA ROCHE LTD

31.5.1 COMPANY OVERVIEW

31.5.2 REVENUE ANALYSIS

31.5.3 GEOGRAPHIC PRESENCE

31.5.4 PRODUCT PORTFOLIO

31.5.5 RECENT DEVELOPMENTS

31.6 EKF DIAGNOSTICS

31.6.1 COMPANY OVERVIEW

31.6.2 REVENUE ANALYSIS

31.6.3 GEOGRAPHIC PRESENCE

31.6.4 PRODUCT PORTFOLIO

31.6.5 RECENT DEVELOPMENTS

31.7 SIEMENS HEALTHINEERS

31.7.1 COMPANY OVERVIEW

31.7.2 REVENUE ANALYSIS

31.7.3 GEOGRAPHIC PRESENCE

31.7.4 PRODUCT PORTFOLIO

31.7.5 RECENT DEVELOPMENTS

31.8 THERMO FISHER SCIENTIFIC INC.

31.8.1 COMPANY OVERVIEW

31.8.2 REVENUE ANALYSIS

31.8.3 GEOGRAPHIC PRESENCE

31.8.4 PRODUCT PORTFOLIO

31.8.5 RECENT DEVELOPMENTS

31.9 ACON LABORATORIES, INC.

31.9.1 COMPANY OVERVIEW

31.9.2 REVENUE ANALYSIS

31.9.3 GEOGRAPHIC PRESENCE

31.9.4 PRODUCT PORTFOLIO

31.9.5 RECENT DEVELOPMENTS

31.1 BIOMEDOMICS INC

31.10.1 COMPANY OVERVIEW

31.10.2 REVENUE ANALYSIS

31.10.3 GEOGRAPHIC PRESENCE

31.10.4 PRODUCT PORTFOLIO

31.10.5 RECENT DEVELOPMENTS

31.11 QUIDELORTHO CORPORATION.

31.11.1 COMPANY OVERVIEW

31.11.2 REVENUE ANALYSIS

31.11.3 GEOGRAPHIC PRESENCE

31.11.4 PRODUCT PORTFOLIO

31.11.5 RECENT DEVELOPMENTS

31.12 ARKRAY, INC.

31.12.1 COMPANY OVERVIEW

31.12.2 REVENUE ANALYSIS

31.12.3 GEOGRAPHIC PRESENCE

31.12.4 PRODUCT PORTFOLIO

31.12.5 RECENT DEVELOPMENTS

31.13 STRECK

31.13.1 COMPANY OVERVIEW

31.13.2 REVENUE ANALYSIS

31.13.3 GEOGRAPHIC PRESENCE

31.13.4 PRODUCT PORTFOLIO

31.13.5 RECENT DEVELOPMENTS

31.14 PERKINELMER

31.14.1 COMPANY OVERVIEW

31.14.2 REVENUE ANALYSIS

31.14.3 GEOGRAPHIC PRESENCE

31.14.4 PRODUCT PORTFOLIO

31.14.5 RECENT DEVELOPMENTS

31.15 DIASORIN S.P.A

31.15.1 COMPANY OVERVIEW

31.15.2 REVENUE ANALYSIS

31.15.3 GEOGRAPHIC PRESENCE

31.15.4 PRODUCT PORTFOLIO

31.15.5 RECENT DEVELOPMENTS

31.16 BIOHIT HEALTHCARE LTD

31.16.1 COMPANY OVERVIEW

31.16.2 REVENUE ANALYSIS

31.16.3 GEOGRAPHIC PRESENCE

31.16.4 PRODUCT PORTFOLIO

31.16.5 RECENT DEVELOPMENTS

31.17 MICROGEN, INC.

31.17.1 COMPANY OVERVIEW

31.17.2 REVENUE ANALYSIS

31.17.3 GEOGRAPHIC PRESENCE

31.17.4 PRODUCT PORTFOLIO

31.17.5 RECENT DEVELOPMENTS

31.18 TRINITY BIOTECH IRELAND

31.18.1 COMPANY OVERVIEW

31.18.2 REVENUE ANALYSIS

31.18.3 GEOGRAPHIC PRESENCE

31.18.4 PRODUCT PORTFOLIO

31.18.5 RECENT DEVELOPMENTS

31.19 SYSMEX EUROPE SE

31.19.1 COMPANY OVERVIEW

31.19.2 REVENUE ANALYSIS

31.19.3 GEOGRAPHIC PRESENCE

31.19.4 PRODUCT PORTFOLIO

31.19.5 RECENT DEVELOPMENTS

31.2 QIAGEN

31.20.1 COMPANY OVERVIEW

31.20.2 REVENUE ANALYSIS

31.20.3 GEOGRAPHIC PRESENCE

31.20.4 PRODUCT PORTFOLIO

31.20.5 RECENT DEVELOPMENTS

31.21 BIOMÉRIEUX SA

31.21.1 COMPANY OVERVIEW

31.21.2 REVENUE ANALYSIS

31.21.3 GEOGRAPHIC PRESENCE

31.21.4 PRODUCT PORTFOLIO

31.21.5 RECENT DEVELOPMENTS

31.22 CHEMBIO DIAGNOSTICS, INC

31.22.1 COMPANY OVERVIEW

31.22.2 REVENUE ANALYSIS

31.22.3 GEOGRAPHIC PRESENCE

31.22.4 PRODUCT PORTFOLIO

31.22.5 RECENT DEVELOPMENTS

31.23 PTS DIAGNOSTICS

31.23.1 COMPANY OVERVIEW

31.23.2 REVENUE ANALYSIS

31.23.3 GEOGRAPHIC PRESENCE

31.23.4 PRODUCT PORTFOLIO

31.23.5 RECENT DEVELOPMENTS

31.24 AGILENT TECHNOLOGIES, INC.

31.24.1 COMPANY OVERVIEW

31.24.2 REVENUE ANALYSIS

31.24.3 GEOGRAPHIC PRESENCE

31.24.4 PRODUCT PORTFOLIO

31.24.5 RECENT DEVELOPMENTS

31.25 ILLUMINA, INC.

31.25.1 COMPANY OVERVIEW

31.25.2 REVENUE ANALYSIS

31.25.3 GEOGRAPHIC PRESENCE

31.25.4 PRODUCT PORTFOLIO

31.25.5 RECENT DEVELOPMENTS

31.26 EXACT SCIENCES CORPORATION

31.26.1 COMPANY OVERVIEW

31.26.2 REVENUE ANALYSIS

31.26.3 GEOGRAPHIC PRESENCE

31.26.4 PRODUCT PORTFOLIO

31.26.5 RECENT DEVELOPMENTS

31.27 MYRIAD GENETICS, INC.

31.27.1 COMPANY OVERVIEW

31.27.2 REVENUE ANALYSIS

31.27.3 GEOGRAPHIC PRESENCE

31.27.4 PRODUCT PORTFOLIO

31.27.5 RECENT DEVELOPMENTS

31.28 QUEST DIAGNOSTICS INCORPORATED.

31.28.1 COMPANY OVERVIEW

31.28.2 REVENUE ANALYSIS

31.28.3 GEOGRAPHIC PRESENCE

31.28.4 PRODUCT PORTFOLIO

31.28.5 RECENT DEVELOPMENTS

31.29 LABORATORY CORPORATION OF AMERICA HOLDINGS.

31.29.1 COMPANY OVERVIEW

31.29.2 REVENUE ANALYSIS

31.29.3 GEOGRAPHIC PRESENCE

31.29.4 PRODUCT PORTFOLIO

31.29.5 RECENT DEVELOPMENTS

31.3 PHC HOLDINGS CORPORATION

31.30.1 COMPANY OVERVIEW

31.30.2 REVENUE ANALYSIS

31.30.3 GEOGRAPHIC PRESENCE

31.30.4 PRODUCT PORTFOLIO

31.30.5 RECENT DEVELOPMENTS

32 RELATED REPORTS

33 CONCLUSION

34 QUESTIONNAIRE

35 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.