Us Adhesives Tapes Market

Размер рынка в млрд долларов США

CAGR :

%

USD

210.20 Million

USD

289.40 Million

2024

2032

USD

210.20 Million

USD

289.40 Million

2024

2032

| 2025 –2032 | |

| USD 210.20 Million | |

| USD 289.40 Million | |

|

|

|

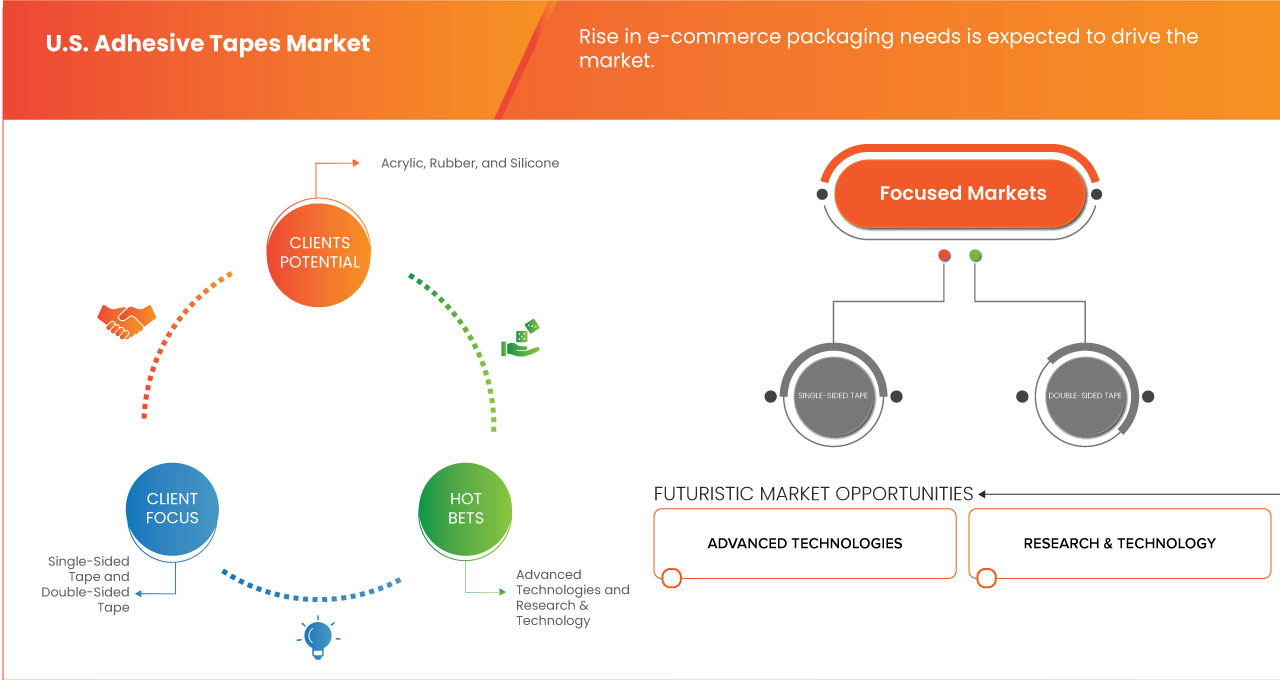

U.S. Adhesive Tapes Market Segmentation, By Product (Single-Sided Tape, Double-Sided Tape, Transfer Tape, and Specialty Tape), Adhesive (Acrylic, Rubber, Silicone, and Others), Backing Material (Polypropylene (PP), Polyethylene (PE), Paper, Polyvinyl Chloride (PVC), and Others), Technology (Water-Based, Solvent-Based, Hot Melt, UV-Cured, and Thermal Cured), Application (Food and Beverages, Electrical and Electronics, Healthcare, Automotive, Manufacturing, Construction, Consumer Goods, Aerospace and Defense, and Others) – Industry Trends and Forecast to 2032

Adhesive Tapes Market Analysis

The adhesive tapes growth is driven by robust demand from industries such as automotive, healthcare, packaging, and construction. Major players, including 3M, Berry Global, and Avery Dennison, leverage their established U.S. presence to meet domestic and export needs.

Packaging tapes dominate due to the rise in e-commerce and logistics, while specialty tapes are gaining traction in electronics and healthcare. Innovations like eco-friendly and bio-compatible tapes reflect the industry's response to sustainability trends. Growth is further supported by advancements in adhesives and increasing DIY activities.

Adhesive Tapes Market Size

The U.S. adhesive tapes market is expected to reach USD 289.40 million by 2032 from USD 210.20 million in 2024, growing with a substantial CAGR of 4.1% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Adhesive Tapes Market Trends

“Rising Demand for Adhesive Tapes in Healthcare and Medical Applications”

Rising demand for adhesive tapes in healthcare and medical applications is a key driver for the growth of the adhesive tape market. Adhesive tapes are essential in various medical procedures, from wound care to surgical applications, offering convenience, effectiveness, and ease of use. The healthcare sector has increasingly recognized the value of adhesive tapes in providing secure, hygienic, and pain-free solutions for patients, which has led to their widespread adoption.

One of the main factors for this rising trend is the growing need for wound care products. Medical adhesive tapes are widely used for securing bandages, dressings, and other medical devices, ensuring they stay in place without causing discomfort. These tapes help minimize the risk of infection and facilitate faster healing by maintaining a clean and protected environment for wounds. With the rise in chronic diseases, injuries, and an aging population, there is a higher demand for effective wound care solutions, which is propelling the market for medical adhesive tapes.

Moreover, medical adhesive tapes are integral to other applications, such as securing IV catheters, respiratory devices, and sensors, which are commonly used in hospitals and clinics. Their hypoallergenic, gentle, and reliable adhesive properties make them a preferred choice for medical professionals. Additionally, with the increasing trend of home healthcare, more patients require adhesive products for self-care, boosting demand further.

Report Scope and U.S. Adhesive Tapes Market Segmentation

|

Attributes |

U.S. Adhesive Tapes Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S. |

|

Key Market Players |

Shurtape Technologies, LLC (U.S.), Pro Tapes (U.S.), Cactus Tape (U.S.), Valley Industrial Products (U.S.), 3F GmbH Klebe- & Kaschiertechnik (Germany), 3M (U.S.), tesa SE (A Beiersdorf Company) (Germany), Berry Global Inc. (U.S.), Nitto Denko Corporation (Japan), Specialty Tapes (U.S.), G-Tape (U.S.), AVERY DENNISON CORPORATION (U.S.), Worthen Industries (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Adhesive Tapes Market Definition

Adhesive tapes are flexible strips coated with a layer of adhesive, designed to bond surfaces together or provide temporary or permanent fastening. They are composed of three main layers: a backing material (such as paper, plastic, or fabric), an adhesive layer (pressure-sensitive, heat-activated, or water-activated), and sometimes a release liner for easy handling. Adhesive tapes are versatile and used across industries, including construction, automotive, healthcare, and packaging. Their applications range from sealing, masking, and mounting to electrical insulation and wound care. Adhesive tapes are valued for their ease of use, durability, and ability to bond diverse materials efficiently.

U.S. Adhesive Tapes Market Dynamics

Drivers

- Rise in E-Commerce Packaging Needs

With the rapid expansion of online shopping, businesses require efficient and secure packaging solutions to ensure products are delivered safely to consumers. Adhesive tapes, particularly packaging tapes, are essential for sealing boxes, preventing tampering, and ensuring the integrity of shipments during transit. As e-commerce sales continue to surge, the demand for high-quality, durable adhesive tapes has increased.

Packaging tapes made from materials like polypropylene, vinyl, and paper are in high demand for their strength, durability, and ability to seal packages securely. E-commerce companies, including large players like Amazon, rely on adhesive tapes to streamline their packaging processes, ensuring items are securely packed and protected from damage.

In addition, the shift toward environmentally conscious practices in the e-commerce industry has led to increased demand for eco-friendly adhesive tapes. As consumers become more environmentally aware, businesses are seeking sustainable alternatives, such as biodegradable and recyclable tapes, to meet customer expectations and regulatory requirements. The growth of e-commerce also drives the need for more specialized adhesive tapes, including custom-branded tapes, for businesses looking to enhance their branding and improve customer experience. Custom packaging helps companies create a unique identity and provide a more personalized touch, which can increase customer loyalty.

For instance,

- In August 2024, according to an article published by H.B. Fuller Company, e-commerce packaging requires unique solutions due to challenges like right-sizing, consumer expectations, and sustainability. Right-sizing reduces waste by creating custom packaging for each product, while adhesives must perform across various conditions. Consumer trends emphasize well-designed, easy-to-open, and recyclable packaging. Sustainability is a key focus, with regulations like Extended Producer Responsibility (EPR) in the U.S. and EU packaging rules pushing companies toward eco-friendly innovations. H.B. Fuller addresses these needs with custom adhesives, fiber-based tear tapes, and water-based coatings to support sustainable packaging

Technological Innovations and Advancements in Adhesive Technology

U.S. adhesive tapes market is expanding rapidly, fueled by technological innovations that enhance performance, sustainability, and versatility. These advancements are transforming various industries, including e-commerce, automotive, electronics, and packaging. These tapes offer specialized features like temperature resistance, conductivity, and high bonding strength, making them ideal for use in electronics, automotive, and medical applications. For example, adhesive tapes used in automotive manufacturing now provide better heat resistance, improving safety and performance in demanding environments.

New material innovations are enabling the production of adhesive tapes with improved strength and durability. These tapes are designed to withstand extreme conditions, such as high temperatures, moisture, and physical stress. Applications requiring superior bonding, like heavy-duty packaging, automotive manufacturing, and construction, are benefitting from these advancements. High-performance tapes now provide long-lasting, reliable adhesion, even under challenging environments. Automation in adhesive tape production is boosting efficiency and reducing costs. This trend is enabling companies to offer highly customizable adhesive solutions that meet specific needs across different industries. Automated systems ensure more consistent application, especially in sectors like e-commerce and logistics, where speed and precision are critical. The ability to tailor tapes for unique applications is helping businesses optimize their packaging processes and improve overall productivity.

For instance,

- In September 2024, according to an article published by Adhesive Tape Manufacturer, recent advancements in Pressure-Sensitive Adhesive (PSA) tape technology have led to stronger, more versatile products suitable for various industries. Modern PSA tapes offer enhanced adhesion, improved temperature and chemical resistance, greater surface versatility, and eco-friendly options. Innovations in materials like acrylic, silicone, and nanotechnology have further enhanced their performance in challenging environments. These advancements contribute to efficiency, cost savings, and sustainability across sectors such as construction, electronics, and automotive

Opportunities

- Increasing Consumer and Regulatory Focus on Eco-Friendly Adhesive Tape Products

The growing consumer awareness and increasing regulatory emphasis on sustainability present a significant opportunity for the U.S. adhesive tapes market. As environmentally responsible practices gain momentum across industries, adhesive tape manufacturers are well-positioned to meet the rising demand for eco-friendly products, creating pathways for growth and innovation.

Simultaneously, stringent government regulations aimed at reducing waste and carbon emissions are encouraging industries to adopt greener alternatives. Extended producer responsibility programs and stricter waste management policies are pushing companies to rethink their material choices. Adhesive tape producers that innovate in sustainable materials and recyclable designs are poised to capture new opportunities in compliance-driven markets. This regulatory push not only fosters technological advancements but also strengthens partnerships with environmentally focused industries.

For instance,

- In November 2024, according to an article published by Sustainable Package Coalition, California implemented policies requiring manufacturers to manage the end-of-life disposal of packaging materials. This has created demand for recyclable adhesive tapes that meet compliance requirements. Companies that adapt their products to these laws are gaining traction in one of the largest consumer markets in the U.S.

Increasing Demand for Personalized and Tailored Adhesive Tape Solutions

Product increasing demand for personalized and tailored adhesive tape solutions presents a substantial growth opportunity for the U.S. adhesive tapes market. As industries across sectors prioritize customization to enhance performance and efficiency, manufacturers that can deliver specialized adhesive solutions are poised to gain a competitive edge and expand their market presence.

Industries such as automotive, electronics, healthcare, and packaging are driving this trend by seeking adhesive tapes designed to meet specific operational requirements. For instance, the automotive sector demands tapes that offer enhanced heat resistance, vibration damping, and compatibility with lightweight materials, while the electronics industry requires high-performance tapes for thermal management, electrical insulation, and precise assembly processes. These tailored solutions ensure optimal functionality and contribute to product innovation, creating new avenues for adhesive tape manufacturers to cater to niche demands.

For instance,

- TESA’s provide custom solutions for electronics, which includes custom-designed tapes for the electronics sector. Their tailored tapes are used for precise assembly of smartphones, tablets, and wearable devices, meeting requirements for ultra-thin designs, thermal management, and high adhesion to unique substrates

Restraints/Challenges

- Fluctuations in the Costs of Raw Materials

The adhesive tapes are manufactured using a variety of raw materials, including backing materials like plastic films, paper, and fabric, along with adhesives such as synthetic rubbers, resins, and acrylics. Many of these materials are derived from petroleum-based products, making them vulnerable to price fluctuations linked to global oil prices.

These fluctuations can arise from factors like shifts in supply and demand, global production changes, geopolitical tensions, and natural disasters. For instance, an increase in oil prices often leads to higher costs for petroleum-based adhesives and plastic films, both essential components of adhesive tapes. Supply chain disruptions, such as trade conflicts or pandemics, can exacerbate price volatility, making it difficult for manufacturers to predict costs and plan production schedules effectively.

Moreover, raw material price volatility makes it challenging to maintain stable pricing structures. Manufacturers may struggle to offer predictable prices to customers, which can harm long-term contracts and customer relationships, particularly in industries reliant on cost-effective solutions like e-commerce packaging. Fluctuating raw material prices also hinder investment in innovation. Manufacturers may face difficulties allocating resources for research and development, slowing the introduction of new products or improvements in efficiency. This can delay the adoption of advanced, environmentally friendly, or more specialized adhesive solutions.

For instance,

- In December 2023, according to an article published by Baywater Packaging & Supply, the price of packing tape could increase due to several factors, including rising raw material costs, supply chain disruptions, and inflation. Materials like plastic resins and adhesives, derived from petrochemicals, are subject to market fluctuations. Additionally, logistical challenges and transportation costs can drive up prices. The demand for packing tape, especially with the rise of e-commerce, may also contribute to price hikes if supply cannot meet the growing need

Stiff Competition from Other Bonding Solutions and Alternatives

While adhesive tapes are versatile and widely used across various industries, they face increasing competition from alternative bonding technologies such as liquid adhesives, hot-melt adhesives, and mechanical fasteners, which can offer certain advantages in terms of strength, durability, and performance.

Similarly, hot-melt adhesives offer advantages like faster bonding times, higher shear strength, and the ability to handle a variety of substrates. These adhesives can be more reliable in high-stress or high-temperature environments, limiting the use of adhesive tapes in such applications. Mechanical fasteners, such as screws, bolts, and rivets, are also widely used in industries requiring high-strength bonds, such as construction, automotive, and aerospace. These fasteners provide a permanent, secure bond that can withstand heavy-duty stresses, making them a more suitable choice in situations where adhesive tapes may not provide the necessary strength or long-term reliability.

For instance,

- В феврале 2023 года, согласно статье, опубликованной palamo на платформе shopify, в статье обсуждается рост альтернативных клеев, которые являются веганскими и экологически чистыми. Исторически клеи изготавливались из натуральных материалов, таких как древесная смола и продукты животного происхождения, но с тех пор преобладают синтетические клеи. Поскольку устойчивость становится приоритетом, исследования продвигаются в направлении клеев на биологической основе с использованием растительных масел, крахмалов и растительных волокон. Эти экологически чистые клеи направлены на замену компонентов, полученных из нефти, и удовлетворение растущего спроса на экологически чистые упаковочные решения

Влияние и текущий рыночный сценарий нехватки сырья и задержек поставок

Data Bridge Market Research предлагает высокоуровневый анализ рынка и предоставляет информацию, учитывая влияние и текущую рыночную среду нехватки сырья и задержек поставок. Это приводит к оценке стратегических возможностей, созданию эффективных планов действий и оказанию помощи предприятиям в принятии важных решений.

Помимо стандартного отчета, мы также предлагаем углубленный анализ уровня закупок на основе прогнозируемых задержек поставок, картирования дистрибьюторов по регионам, анализа товаров, анализа производства, тенденций ценового картирования, поиска поставщиков, анализа эффективности категорий, решений по управлению рисками в цепочке поставок, расширенного сравнительного анализа и других услуг по закупкам и стратегической поддержке.

Ожидаемое влияние экономического спада на ценообразование и доступность продукции

Когда экономическая активность замедляется, отрасли начинают страдать. Прогнозируемое влияние экономического спада на ценообразование и доступность продуктов учитывается в отчетах по анализу рынка и услугах по разведке, предоставляемых DBMR. Благодаря этому наши клиенты обычно могут быть на шаг впереди своих конкурентов, прогнозировать свои продажи и доходы, а также оценивать свои расходы на прибыль и убытки.

Объем рынка клейких лент

Рынок сегментирован на основе продукта, клея, материала подложки, технологии и применения. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

Клей

- Акрил

- Резина

- Силикон

- Другие

Подложка Материал

- Полипропилен (ПП)

- Полиэтилен (ПЭ)

- Бумага

- Бумага, по типу

- Крафт-бумага

- Крепированная бумага

- Специальная бумага

- Другие

- Поливинилхлорид (ПВХ)

- Другие

Технологии

- На водной основе

- На основе растворителя

- Горячий расплав

- УФ-отверждаемый

- Термически отвержденный

Приложение

- Еда и напитки

- Еда и напитки, по применению

- Упаковка для пищевых продуктов

- Сумки

- Мешочки

- Контейнеры

- Другие

- Алкогольные напитки

- Безалкогольные напитки

- Еда и напитки, по продуктам

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Электрика и электроника

- Электрика и электроника, по области применения

- Бытовая электроника

- Смартфоны

- Таблетки

- Телевидение

- Другие

- Центры обработки данных

- Серверные комнаты

- Электротехника и электроника, по видам продукции

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Здравоохранение

- Здравоохранение, по применению

- Фармацевтическая упаковка

- Хирургическое применение

- Ортопедия

- Стоматология

- Другие

- Здравоохранение, по продукту

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Автомобильный

- Автомобильная промышленность, по применению

- Внутренняя сборка

- Внешнее склеивание

- Другие

- Автомобильная промышленность, по видам продукции

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Производство

- Производство, по продукту

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Строительство

- Строительство, по продукту

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Потребительские товары

- Потребительские товары, по назначению

- Упаковка подарков

- Скрапбукинг

- Изготовление карт

- Домашний декор

- Другие

- Потребительские товары, по видам продукции

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Аэрокосмическая промышленность и оборона

- Аэрокосмическая и оборонная промышленность, по применению

- Самолеты

- Спутники

- Космический корабль

- Другие

- Аэрокосмическая и оборонная промышленность, по видам продукции

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

- Другие

- Другие, по продукту

- Односторонний скотч

- Двусторонний скотч

- Лента для переноса

- Специальная лента

Доля рынка клейких лент

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии в стране, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Лидерами рынка клейких лент, работающими на рынке, являются:

- Shurtape Technologies, LLC (США)

- Профессиональные ленты (США)

- Кактусовая лента (США)

- Valley Industrial Products (США)

- 3F GmbH Klebe- & Kaschiertechnik (Германия)

- 3M (США)

- tesa SE (компания Beiersdorf) (Германия)

- Berry Global Inc. (США)

- Корпорация Нитто Денко (Япония)

- Специальные ленты (США)

- G-Tape (США)

- КОРПОРАЦИЯ AVERY DENNISON (США)

- Worthen Industries (США)

Последние разработки на рынке клейких лент в США

- В феврале 2024 года компания Avery Dennison Performance Tapes выпустила новый ассортимент лент PSA для бытовой техники, предлагая решения для простоты использования, долговечности и демпфирования NVH. Эти ленты предназначены для различных применений, включая склеивание, шумоподавление и высокопроизводительную долговечность в бытовой технике.

- В сентябре 2024 года Shurtape Technologies приобрела Preferred Finishing Technologies (PFT), производителя текстиля, специализирующегося на отделке тканей и струйной сублимационной печати. Приобретение укрепляет цепочку поставок Shurtape, способствуя росту в индустрии лент для искусства и развлечений, сохраняя при этом непрерывность работы

- В феврале 2024 года Berry Global и Glatfelter объявят о слиянии, объединяющем бизнес Berry's Health, Hygiene, and Specialties с Glatfelter, чтобы создать мирового лидера в области специальных материалов. Сделка на сумму 3,6 млрд долларов США позиционирует объединенную компанию для долгосрочного роста и инноваций

- В декабре 2023 года tesa SE заключила партнерство с BASF SE для использования возобновляемого сырья. Это сотрудничество направлено на замену ископаемого сырья на акриловые мономеры Biomass-Balanced (BMB), что снижает выбросы CO₂ в продукции tesa без ущерба для качества или производительности. Партнерство ускоряет достижение целей tesa в области устойчивого развития, помогая компании предлагать более экологичную продукцию, сохраняя при этом высокие стандарты

- В октябре 2022 года компания 3F GmbH Klebe- & Kaschiertechnik приняла участие в выставке Foam Expo Europe в Штутгарте, представив свои универсальные вспененные клейкие ленты. В ходе мероприятия компания подчеркнула свои возможности в области разработки и производства, предложив экспертные консультации по всем аспектам технологии склеивания.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BUYER/CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICE INDEX

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.7.5 CONCLUSION

4.8 PRODUCTION CAPACITY OVERVIEW

4.9 RAW MATERIAL COVERAGE

4.9.1 ADHESIVE RESINS

4.9.2 BACKING MATERIALS

4.9.3 RELEASE LINERS

4.9.4 PLASTICIZERS

4.9.5 FILLERS

4.9.6 SOLVENTS

4.9.7 TACKIFIERS

4.9.8 ENVIRONMENTAL CONSIDERATIONS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTICS COST SCENARIO

4.10.2.1 FUEL PRICES AND TRANSPORTATION COSTS

4.10.2.2 WAREHOUSING COSTS

4.10.2.3 LABOR COSTS

4.10.2.4 GLOBAL SUPPLY CHAIN DISRUPTIONS

4.10.2.5 SUSTAINABILITY INITIATIVES

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.10.3.1 SUPPLY CHAIN INTEGRATION

4.10.3.2 SCALABILITY AND FLEXIBILITY

4.10.3.3 TECHNOLOGY AND AUTOMATION

4.10.3.4 COST MANAGEMENT

4.10.3.5 SUSTAINABILITY AND GREEN LOGISTICS

4.10.3.6 RISK MITIGATION

4.10.4 CONCLUSION

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.11.1 ADVANCED ADHESIVE FORMULATIONS

4.11.2 ECO-FRIENDLY AND SUSTAINABLE SOLUTIONS

4.11.3 AUTOMATION AND MANUFACTURING PROCESS ENHANCEMENTS

4.11.4 SMART ADHESIVE TAPES

5.1 FDA (FOOD AND DRUG ADMINISTRATION) COMPLIANCE

5.2 EPA (ENVIRONMENTAL PROTECTION AGENCY)

5.3 ISO (INTERNATIONAL ORGANIZATION FOR STANDARDIZATION)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ADHESIVE TAPES IN HEALTHCARE AND MEDICAL APPLICATIONS

6.1.2 RISE IN E-COMMERCE PACKAGING NEEDS

6.1.3 TECHNOLOGICAL INNOVATIONS AND ADVANCEMENTS IN ADHESIVE TECHNOLOGY

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN THE COSTS OF RAW MATERIALS

6.2.2 STIFF COMPETITION FROM OTHER BONDING SOLUTIONS AND ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 INCREASING CONSUMER AND REGULATORY FOCUS ON ECO-FRIENDLY ADHESIVE TAPE PRODUCTS

6.3.2 INCREASING DEMAND FOR PERSONALIZED AND TAILORED ADHESIVE TAPE SOLUTIONS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION AND PRESENCE OF NUMEROUS LOCAL AND GLOBAL PLAYERS IN THE MARKET

6.4.2 STRICTER ENVIRONMENTAL POLICIES AND REGULATIONS RELATED TO VOLATILE ORGANIC COMPOUNDS (VOCS) IN ADHESIVE FORMULATIONS

7 U.S. ADHESIVE TAPES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SINGLE-SIDED TAPE

7.3 DOUBLE-SIDED TAPE

7.4 TRANSFER TAPE

7.5 SPECIALTY TAPE

8 U.S. ADHESIVE TAPES MARKET, BY ADHESIVE

8.1 OVERVIEW

8.2 ACRYLIC

8.3 RUBBER

8.4 SILICONE

8.5 OTHERS

9 U.S. ADHESIVE TAPES MARKET, BY BACKING MATERIAL

9.1 OVERVIEW

9.2 POLYPROPYLENE (PP)

9.3 POLYETHYLENE (PE)

9.4 PAPER

9.5 POLYVINYL CHLORIDE (PVC)

9.6 OTHERS

10 U.S. ADHESIVE TAPES MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 WATER-BASED

10.3 SOLVENT-BASED

10.4 HOT MELT

10.5 UV-CURED

10.6 THERMAL CURED

11 U.S. ADHESIVE TAPES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD AND BEVERAGES

11.3 ELECTRICAL AND ELECTRONICS

11.4 HEALTHCARE

11.5 AUTOMOTIVE

11.6 MANUFACTURING

11.7 CONSTRUCTION

11.8 CONSUMER GOODS

11.9 AEROSPACE AND DEFENSE

11.1 OTHERS

12 U.S. ADHESIVE TAPES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

13.1 SWOT: CUSTOMERS' PERSPECTIVE

13.2 SWOT: MANUFACTURERS' PERSPECTIVE

13.3 SWOT: SUPPLIERS' PERSPECTIVE

14 COMPANY PROFILES

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AVERY DENNISON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 SHURTAPE TECHNOLOGIES, LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 BERRY GLOBAL INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 TESA SE (A BEIERSDORF COMPANY)

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 3F GMBH KLEBE- & KASCHIERTECHNIK

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CACTUS TAPE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 G-TAPE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 NITTO DENKO CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 PRO TAPES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 SPECIALTY TAPES

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 VALLEY INDUSTRIAL PRODUCTS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 WORTHEN INDUSTRIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 REGULATIONS ACROSS U.S.

TABLE 2 U.S. ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 3 U.S. ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (MILLION SQUARE METER)

TABLE 4 U.S. ADHESIVE TAPES MARKET, BY ADHESIVE, 2018-2032 (USD MILLION)

TABLE 5 U.S. ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2018-2032 (USD MILLION)

TABLE 6 U.S. PAPER IN ADHESIVE TAPES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 U.S. ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 8 U.S. ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 9 U.S. FOOD AND BEVERAGES IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 10 U.S. FOOD PACKAGING IN ADHESIVE TAPES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 U.S. FOOD AND BEVERAGES IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 12 U.S. ELECTRICAL AND ELECTRONICS IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 13 U.S. CONSUMER ELECTRONICS IN ADHESIVE TAPES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 U.S. ELECTRICAL AND ELECTRONICS IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 15 U.S. HEALTHCARE IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 16 U.S. HEALTHCARE IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 17 U.S. AUTOMOTIVE IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 18 U.S. AUTOMOTIVE IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 19 U.S. MANUFACTURING IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 20 U.S. CONSTRUCTION IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 21 U.S. CONSUMER GOODS IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 22 U.S. CONSUMER GOODS IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 23 U.S. AEROSPACE AND DEFENSE IN ADHESIVE TAPES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 24 U.S. AEROSPACE AND DEFENSE IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 25 U.S. OTHERS IN ADHESIVE TAPES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

Список рисунков

FIGURE 1 U.S. ADHESIVE TAPES MARKET

FIGURE 2 U.S. ADHESIVE TAPES MARKET: DATA TRIANGULATION

FIGURE 3 U.S. ADHESIVE TAPES MARKET: DROC ANALYSIS

FIGURE 4 U.S. ADHESIVE TAPES MARKET: REGIONAL VS COUNTRIES MARKET ANALYSIS

FIGURE 5 U.S. ADHESIVE TAPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. ADHESIVE TAPES MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. ADHESIVE TAPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. ADHESIVE TAPES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. ADHESIVE TAPES MARKET: APPLICATION COVERAGE GRID

FIGURE 10 U.S. ADHESIVE TAPES MARKET: SEGMENTATION

FIGURE 11 FOUR SEGMENTS COMPRISE THE U.S. ADHESIVE TAPES MARKET, BY PRODUCT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DEMAND FOR ADHESIVE TAPES IN HEALTHCARE AND MEDICAL APPLICATIONS IS EXPECTED TO DRIVE THE U.S. ADHESIVE TAPES MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SINGLE-SIDED TAPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. ADHESIVE TAPES MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 U.S. ADHESIVE TAPES MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/SQUARE METER)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR U.S. ADHESIVE TAPES MARKET

FIGURE 23 U.S. ADHESIVE TAPES MARKET: BY PRODUCT, 2024

FIGURE 24 U.S. ADHESIVE TAPES MARKET: BY ADHESIVE, 2024

FIGURE 25 U.S. ADHESIVE TAPES MARKET: BY BACKING MATERIAL, 2024

FIGURE 26 U.S. ADHESIVE TAPES MARKET: BY TECHNOLOGY, 2024

FIGURE 27 U.S. ADHESIVE TAPES MARKET: BY APPLICATION, 2024

FIGURE 28 U.S. ADHESIVE TAPES MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.