Global Specialty Tape Market

Market Size in USD Billion

CAGR :

%

USD

58.59 Billion

USD

91.92 Billion

2024

2032

USD

58.59 Billion

USD

91.92 Billion

2024

2032

| 2025 –2032 | |

| USD 58.59 Billion | |

| USD 91.92 Billion | |

|

|

|

|

Specialty Tape Market Size

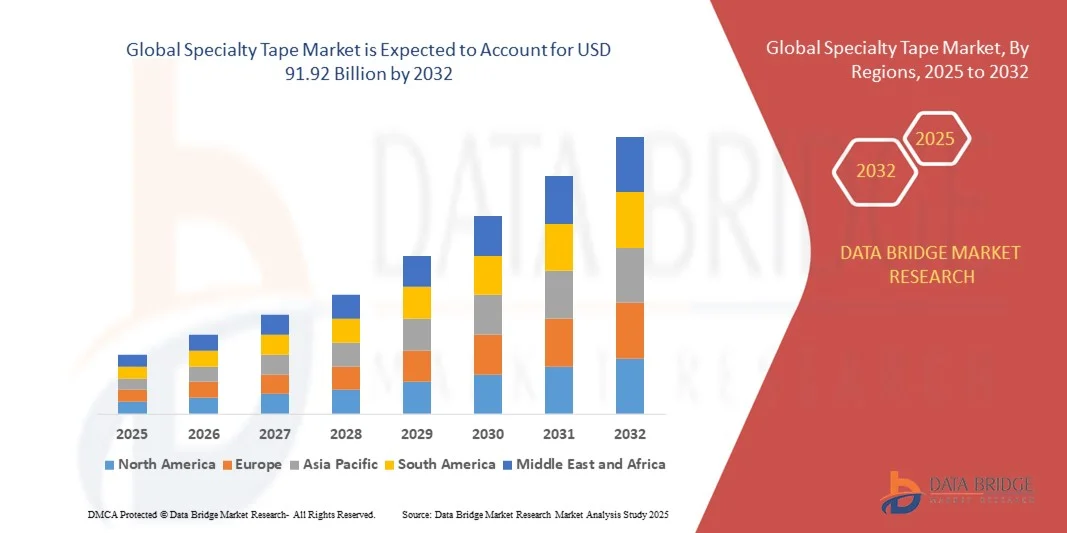

- The global specialty tape market size was valued at USD 58.59 billion in 2024 and is expected to reach USD 91.92 billion by 2032, at a CAGR of 5.79% during the forecast period

- The market growth is largely fuelled by increasing demand across automotive, electronics, and construction industries, where specialty tapes are used for bonding, insulation, masking, and protection purposes.

- Rising adoption of advanced tape technologies, such as double-sided, acrylic, and high-temperature resistant tapes, is further driving market expansion

Specialty Tape Market Analysis

- Technological advancements in adhesive formulations and backing materials are enhancing tape performance, durability, and application versatility across industries

- Increasing industrial automation and the need for high-precision bonding solutions in manufacturing processes are contributing to the rising adoption of specialty tapes globally

- North America dominated the specialty tape market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of advanced adhesive solutions across industries, stringent quality standards, and rising demand for reliable bonding in automotive, electronics, and construction sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global specialty tape market, driven by increasing urbanization, rising demand for consumer electronics, expansion of infrastructure projects, and the presence of emerging manufacturing hubs in countries such as China, Japan, and South Korea

- The Acrylic segment held the largest market revenue share in 2024, driven by its excellent adhesion, weather resistance, and versatility across industrial and commercial applications. Acrylic-based tapes are widely used for electrical insulation, packaging, and protective applications due to their reliable performance and long-term durability

Report Scope and Specialty Tape Market Segmentation

|

Attributes |

Specialty Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Tape Market Trends

Increasing Adoption of Advanced Adhesive Solutions Across Industries

- The growing demand for specialty tapes in automotive, electronics, and construction industries is transforming the market by enabling faster assembly, improved product protection, and enhanced performance. These tapes reduce labor costs and enhance operational efficiency, driving widespread adoption across industrial sectors. The increasing need for lightweight, flexible, and durable alternatives to mechanical fasteners is further boosting market penetration globally

- The high adoption of specialty tapes in emerging sectors such as renewable energy, aerospace, and medical devices is accelerating market growth. Tapes with high heat resistance, electrical insulation, and chemical resistance are increasingly preferred for precision applications and durable bonding solutions. Manufacturers are leveraging these solutions to reduce equipment downtime, minimize errors, and comply with stringent industry standards

- The versatility and ease of use of modern specialty tapes are making them attractive for both large-scale industrial manufacturing and small-scale custom applications. Manufacturers benefit from reduced material wastage and streamlined assembly processes, enhancing overall productivity. In addition, these tapes allow for faster prototyping and simplified assembly workflows, helping companies stay competitive in fast-evolving markets

- For instance, in 2023, several electronics manufacturers in Europe incorporated high-performance adhesive tapes into flexible circuit assembly, resulting in faster production cycles, improved reliability, and reduced defect rates. This also enabled cost savings on rework and enhanced long-term durability of electronic components, providing a competitive advantage in high-precision markets

- While specialty tapes are driving efficiency and innovation, continued focus on material development, eco-friendly solutions, and application-specific customization is essential for sustained market growth. Companies investing in research for biodegradable and heat-resistant adhesives are expected to capitalize on evolving sustainability and performance demands

Specialty Tape Market Dynamics

Driver

Rising Demand For High-Performance And Durable Adhesive Solutions

- The need for durable, high-performance bonding solutions is driving the adoption of specialty tapes across automotive, aerospace, and electronics sectors. Tapes are increasingly used to replace traditional mechanical fasteners, offering lightweight and flexible alternatives. Their ability to withstand extreme temperatures, vibration, and chemical exposure is enhancing product reliability and safety standards

- Rapid industrialization and manufacturing expansion in emerging economies are creating high demand for specialty tapes in packaging, assembly, and protective applications. Businesses are leveraging tapes for operational efficiency and cost reduction. The growth of modern manufacturing hubs in Asia-Pacific and Latin America is also driving local production and adoption of advanced adhesive solutions

- Increasing consumer focus on product reliability and sustainability is promoting the adoption of advanced adhesive solutions. Companies adopting specialty tapes gain better product performance, brand value, and compliance with environmental standards. In addition, companies are increasingly incorporating eco-friendly and low-VOC adhesive tapes to meet evolving environmental regulations and corporate sustainability goals

- For instance, in 2022, a leading U.S. automotive manufacturer replaced mechanical fasteners with double-sided specialty tapes, reducing vehicle weight and improving fuel efficiency, while boosting production speed. This also enhanced design flexibility, minimized assembly errors, and contributed to meeting stricter fuel economy and emissions standards

- While industrial growth and performance needs drive the market, continuous innovation and customization remain critical for capturing diverse application requirements. Development of next-generation high-strength, flame-retardant, and conductive tapes is expected to further expand the addressable market

Restraint/Challenge

High Cost Of Premium Specialty Tapes And Limited Awareness In Emerging Markets

- Advanced specialty tapes with enhanced heat, chemical, and electrical resistance are costly, restricting adoption among small and medium enterprises. High price points limit penetration, particularly in price-sensitive emerging regions. Companies often face challenges in balancing performance requirements with cost constraints, slowing widespread adoption

- In several regions, lack of technical knowledge regarding optimal tape selection and application reduces effectiveness, impacting bonding performance. Training and technical support are essential to maximize benefits and adoption. In addition, the absence of local expertise in handling specialized tapes can lead to product failures, reduced efficiency, and increased operational costs

- Supply chain constraints and limited availability of high-performance tapes can affect timely delivery and operational efficiency, particularly in remote or underdeveloped regions. This may hinder adoption in industrial applications requiring specialized solutions. Manufacturers are also challenged by fluctuations in raw material prices and geopolitical trade restrictions, impacting production and supply consistency

- For instance, in 2023, several packaging companies in South Asia faced challenges sourcing high-temperature resistant tapes, leading to delays and increased production costs. These disruptions affected contract fulfillment and customer satisfaction, highlighting the need for diversified suppliers and local inventory management

- While the specialty tape market continues to innovate with high-performance and eco-friendly solutions, addressing cost, knowledge, and supply chain constraints is essential to fully unlock the global market potential. Companies focusing on regional manufacturing, affordable alternatives, and technical training programs are expected to overcome these barriers and accelerate market growth

Specialty Tape Market Scope

The market is segmented on the basis of resin type, backing material, and end user.

- By Resin Type

On the basis of resin type, the specialty tape market is segmented into Acrylic, Rubber, Silicone, and Others. The Acrylic segment held the largest market revenue share in 2024, driven by its excellent adhesion, weather resistance, and versatility across industrial and commercial applications. Acrylic-based tapes are widely used for electrical insulation, packaging, and protective applications due to their reliable performance and long-term durability.

The Rubber segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior tack, flexibility, and performance in high-stress bonding applications. Rubber-based tapes are particularly preferred for automotive, construction, and general-purpose industrial uses, offering cost-effective adhesion and easy handling across diverse surfaces.

- By Backing Material

On the basis of backing material, the specialty tape market is segmented into Polyvinyl Chloride (PVC), Woven/Non-Woven, Paper, Polyethylene Terephthalate (PET), Foam, Polypropylene (PP), and Others. The PVC segment held the largest market share in 2024 due to its durability, chemical resistance, and adaptability for electrical, automotive, and general-purpose applications. PVC-backed tapes are commonly used in insulation, packaging, and protective coverings, providing a balance of strength and flexibility.

The PET segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high tensile strength, dimensional stability, and resistance to heat and chemicals. PET-backed tapes are widely adopted in aerospace, electronics, and industrial applications for precision masking, insulation, and surface protection, meeting stringent industry standards.

- By End User

On the basis of end user, the specialty tape market is segmented into Electrical and Electronics, Healthcare and Hygiene, Aerospace and Defense, Automotive, White Goods, Paper and Printing, Building and Construction, Retail and Graphics, and Others. The Electrical and Electronics segment held the largest market revenue share in 2024, driven by the growing demand for insulation, protective, and assembly solutions in consumer electronics, industrial equipment, and renewable energy systems.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing use of specialty tapes in lightweight bonding, assembly, and surface protection applications. Automotive manufacturers prefer these tapes for vehicle interiors, exterior trim, and electrical assembly, improving production efficiency while reducing weight and material costs.

Specialty Tape Market Regional Analysis

- North America dominated the specialty tape market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of advanced adhesive solutions across industries, stringent quality standards, and rising demand for reliable bonding in automotive, electronics, and construction sectors

- Manufacturers and end users in the region highly value the durability, high performance, and ease of application offered by specialty tapes, which reduce labor costs and improve operational efficiency

- This widespread adoption is further supported by high industrialization, well-developed infrastructure, and growing emphasis on product reliability and sustainability, establishing specialty tapes as a preferred solution across multiple industrial applications

U.S. Specialty Tape Market Insight

The U.S. specialty tape market captured the largest revenue share in 2024 within North America, fueled by rapid industrial growth, technological advancements, and increasing utilization in automotive, electronics, aerospace, and medical sectors. The adoption of lightweight, flexible, and eco-friendly bonding solutions is driving the replacement of traditional fasteners with high-performance tapes. Moreover, growing focus on process efficiency, cost reduction, and compliance with environmental regulations is significantly contributing to the market expansion.

Europe Specialty Tape Market Insight

The Europe specialty tape market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent industrial quality regulations and the rising need for high-performance adhesive solutions across automotive, electronics, and packaging industries. Urbanization, manufacturing expansion, and increasing awareness of energy-efficient and sustainable products are fostering the adoption of specialty tapes. The market is witnessing growth across industrial manufacturing, healthcare, and construction applications, with tape solutions being increasingly integrated into both new projects and retrofits.

U.K. Specialty Tape Market Insight

The U.K. specialty tape market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for reliable bonding solutions in manufacturing, automotive, and electronics sectors. Rising adoption of lightweight and multi-functional tapes for operational efficiency, combined with robust industrial infrastructure and awareness of sustainability, is expected to continue to stimulate market growth.

Germany Specialty Tape Market Insight

The Germany specialty tape market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strong industrial base, high adoption of advanced adhesive technologies, and growing focus on eco-friendly and high-performance solutions. The integration of specialty tapes into automotive assembly, electronics manufacturing, and aerospace applications is driving demand. Local manufacturers and industrial players increasingly prefer solutions that enhance productivity while ensuring compliance with environmental and safety standards.

Asia-Pacific Specialty Tape Market Insight

The Asia-Pacific specialty tape market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, technological advancements, and increasing demand across automotive, electronics, healthcare, and construction sectors in countries such as China, Japan, and India. Government initiatives promoting industrial modernization, rising disposable incomes, and expanding manufacturing capabilities are further accelerating adoption. As APAC emerges as a manufacturing hub for adhesive materials and specialty tape solutions, affordability, accessibility, and local production capabilities are boosting market penetration.

Japan Specialty Tape Market Insight

The Japan specialty tape market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech manufacturing culture, focus on product reliability, and demand for precision bonding solutions. Adoption is driven by extensive use in electronics, automotive, and medical device industries. Integration with automated assembly lines and lightweight, high-performance tape solutions is fueling growth.

China Specialty Tape Market Insight

The China specialty tape market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, industrial expansion, and rising adoption of advanced adhesive solutions in automotive, electronics, packaging, and construction industries. The push toward smart manufacturing, increasing demand for lightweight and high-performance tapes, and strong local production capabilities are key factors propelling market growth in China.

Specialty Tape Market Share

The Specialty Tape industry is primarily led by well-established companies, including:

- 3M (U.S.)

- NITTO DENKO CORPORATION (Japan)

- tesa Tapes (India) Private Limited (India)

- LINTEC Corporation (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- Scapa (U.K.)

- Berry Global Inc. (U.S.)

- Intertape Polymer Group (Canada)

- Saint-Gobain (France)

- Lohmann GmbH & Co.KG (Germany)

- NICHIBAN Co., Ltd. (Japan)

- DermaMed Coatings Company, LLC (U.S.)

- Coating & Converting Technologies, Inc. (U.S.)

- Advance Tapes International (U.K.)

- Shurtape Technologies, LLC (U.S.)

- American Biltrite Inc. (U.S.)

- ATP adhesive systems AG (Germany)

- Henkel Adhesives Technologies India Private Limited (India)

- DuPont (U.S.)

- ECHOtape (U.S.)

Latest Developments in Global Specialty Tape Market

- In May 2021, Intertape Polymer Group launched a new product, PEFR, a flame-retardant polyethylene (PE) tape, aimed at heavy-duty industrial applications. The tape is designed for use in healthcare facilities, laboratories, shipyards, and construction sites, providing enhanced safety and fire resistance. This development allows users to maintain compliance with stringent safety standards while ensuring durable performance. By introducing this innovative tape, Intertape strengthened its product portfolio and addressed growing demand for high-performance, safety-focused adhesive solutions, positively impacting adoption across multiple industrial sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Specialty Tape Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Specialty Tape Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Specialty Tape Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.