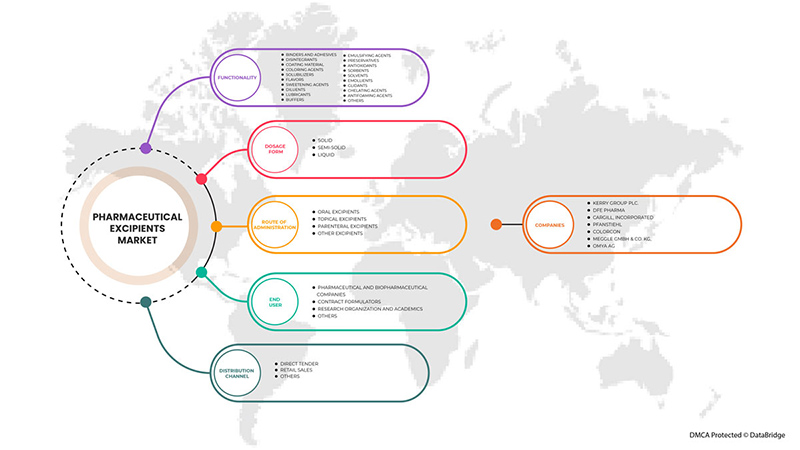

アジア太平洋地域の医薬品添加剤市場、機能別(結合剤および接着剤、崩壊剤、コーティング材、着色剤、可溶化剤、香料、甘味料、希釈剤、滑沢剤緩衝剤、乳化剤、保存料、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑剤、キレート剤、消泡剤、その他)、剤形別(固体、半固体、液体)、投与経路別(経口添加剤、局所添加剤、非経口添加剤、その他の添加剤)、エンドユーザー別(製薬およびバイオ医薬品会社、契約製剤製造業者、研究機関および学術機関、その他)、流通チャネル別(直接入札、小売販売、その他)、業界動向および2029年までの予測。

アジア太平洋地域の医薬品添加剤市場の分析と洞察

医薬品添加剤は、薬剤の処方と開発において重要な役割を果たします。これらの物質には、薬理学的に活性な薬物またはプロドラッグ以外の物質が含まれます。医薬品添加剤は、薬物を標的部位に効率的に送達します。これらの分子は、薬物が同化して薬効を高める際に、薬物が早期に放出されるのを防ぎます。一部の医薬品添加剤は、薬物の統合を促進し、血流中の薬物の吸収を高めます。

さらに、医薬品添加剤は薬物の識別にも使用されます。医薬品添加剤は薬物の風味を高めるためにも使用され、患者のコンプライアンス、特に子供のコンプライアンスを高めます。医薬品添加剤の化学的性質に基づいて、これらは有機および無機の供給源から得ることができます。有機化学物質には、炭水化物、石油化学製品、油脂化学製品、タンパク質などが含まれます。医薬品添加剤は、結合剤、充填剤、希釈剤、懸濁剤またはコーティング剤、香味剤、崩壊剤、着色剤、潤滑剤および流動化剤、甘味料、保存料などとして機能することができます。医薬品添加剤には、結合剤および接着剤、崩壊剤、可溶化剤、香味料、乳化剤、保存料、抗酸化剤、流動化剤、キレート剤など、さまざまな目的で使用されるいくつかの機能があります。

しかし、医薬品や添加剤の承認に関する規制が厳格化していることや、医薬品開発プロセスにコストと時間がかかることから、この市場の成長は抑制されると予想されます。

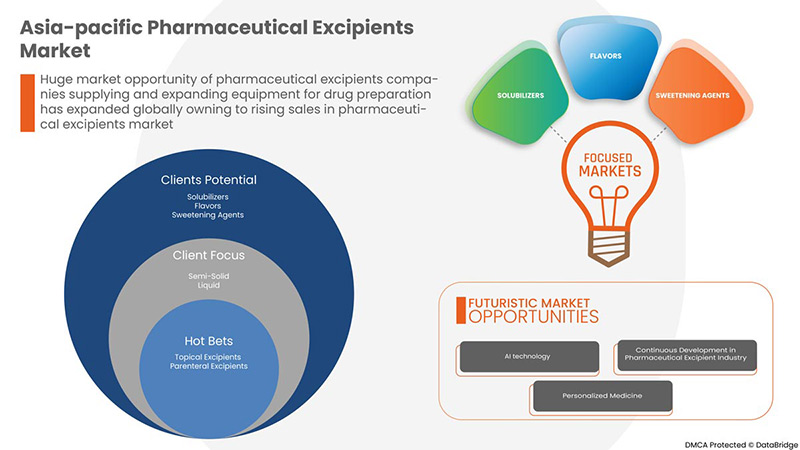

Data Bridge Market Research の分析によると、アジア太平洋地域の医薬品添加剤市場は、予測期間中に 7.5% の CAGR で成長し、2029 年までに 18 億 4,641 万米ドルに達する見込みです。アジア太平洋地域では IT ソリューションとサービスの需要が急増しているため、機能性が市場で最大のセグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

機能別(結合剤および接着剤、崩壊剤、コーティング材、着色剤、可溶化剤、香料、甘味料、希釈剤、潤滑剤、緩衝剤、乳化剤、保存料、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑沢剤、キレート剤、消泡剤、その他)、剤形別(固体、半固体、液体)、投与経路別(経口賦形剤、局所賦形剤、非経口賦形剤、その他の賦形剤)、最終使用者別(製薬会社およびバイオ医薬品会社、契約製剤製造業者、研究機関および学術機関、その他)、流通チャネル別(直接入札、小売販売、その他)。 |

|

対象国 |

中国、日本、インド、オーストラリア、韓国、シンガポール、タイ、マレーシア、インドネシア、フィリピン、ベトナム、その他のアジア太平洋諸国。 |

|

対象となる市場プレーヤー |

Kerry Group plc.、DFE Pharma、Cargill, Incorporated、Pfanstiehl、Colorcon、MEGGLE GmbH & Co. KG、Omya AG、Peter Greven GmbH & Co. KG、Ashland.、Evonik、Dow、Croda International Plc、Roquette Frères.、The Lubrizol Corporation、BASF SE、Avantor, Inc.、BENEO、Chemie Trade など。 |

アジア太平洋地域の医薬品添加剤市場の定義

医薬品添加剤には、医薬品有効成分以外のすべての成分が含まれます。これらの分子には薬効はなく、最終的には医薬品の生理的吸収を高めるために使用されます。医薬品添加剤は本質的に不活性であるため、医薬品分子を適切な形で患者に適用できます。従来、医薬品添加剤は単純な分子でしたが、技術革新と新しい薬物送達システムの需要の増加により、医薬品添加剤の複雑さが増しました。医薬品添加剤は、患者の薬物受容性を高め、薬物の安定性と生物学的利用能を高めます。

さらに、医薬品添加剤は薬剤の完全性を維持するのに役立ち、薬剤の保管に役立ちます。医薬品添加剤は、無機化学物質や有機化学物質など、化学的性質に基づいて分類されます。有機化学物質には、炭水化物、石油化学製品、油脂化学製品、タンパク質などがあります。医薬品添加剤は、結合剤、充填剤、希釈剤、懸濁剤またはコーティング剤、香味剤、崩壊剤、着色剤、潤滑剤、流動促進剤、甘味料、防腐剤などとして機能します。

The future of excipients science and technology has changed and continues to change. Better progress has been made in such areas as harmonizing excipient pharmacopeial monographs and applying new analytical methods to characterize excipients better.

Asia-Pacific Pharmaceutical Excipients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in Generic Drug Production and Uses

According to the U.S. Food and Drug Administration (U.S. Food and Drug Administration). FDA) and the National Center for Biotechnology Information (NCBI), a generic drug is a drug that has been created to look like an approved brand-name drug that is available in dosage form, with safety, strength, route of administration, quality, and performance. After the drug's patent expires, the cost savings associated with conventional drug use are not immediately apparent. Generic drugs, like brand-name drugs, require competition in the generic drug market before reducing costs; two to three years after the loss of exclusivity, the price of a generic drug is usually 60-70% lower than that of a brand-name drug. Since India has the highest per capita spending, these generic drugs will save a lot of money that can be used for other health problems. Nationally, the use of generic drugs has increased significantly in recent years. The fact that cheap substitutes for branded drugs are a major reason likely to spur the growth of the pharmaceutical industry. The generic drug industry in the near future.

Thus, increasing demand for generic drugs and rising production are expected to drive the growth of the Asia-Pacific pharmaceutical excipients market. Also, the cost of generic drugs is less, which increases the use of generic drugs.

- The Surge in Demand for Excipients

Pharmaceutical excipients are substances in pharmaceutical dosage forms not for direct therapeutic use but to facilitate the manufacture, protection, support, or improvement of stability and availability. With the increased development of the Asia-Pacific pharmaceutical industry, excipients also have a light part. Recently, there has been an increasing demand for generic drugs, which has led to an increase in the excipients demand. In addition, there has been a sharp increase in cases of chronic diseases.

Excipients are inert substances, other than pharmaceutically active drugs, introduced into the manufacturing process or included in the dosage form of pharmaceutical products. Excipients are widely used in drug formulations to add bulk to solid formulations, provide long-term stability, and facilitate drug absorption. Furthermore, it also improves the product's overall safety or functional properties during use or storage.

Thus, wide uses of excipients in drug formulation and applications of excipients are expected to drive the Asia-Pacific pharmaceutical excipients market.

Restraint

- Increasing Regulatory Stringency Regarding The Approval of Drugs and Excipients

Generic drug approval rules are largely the same worldwide, with little difference in developing countries. This is because he is not required to undergo bioequivalence (BE) study in this part of the world to obtain generic drug approval. Governments must ensure consistent quality of all generic drugs, medical experts say. Only then will doctors be happy and confident in prescribing generic drugs. A major reason for physicians' (and even patients') lack of confidence in generic drugs has been the lack of strict regulatory requirements regarding the number of generic drugs and the number of impurities allowed.

Controlling the manufacture and distribution of excipients is now considered a top priority by regulators and drug manufacturers, as mixing excipients has resulted in adverse patient events. Furthermore, with the emergence of new excipients and delivery systems, better control of the quality and supply of pharmaceutical excipients has become increasingly important in the context of in vivo activity. Recognizing the important role of excipients in pharmaceutical dosage forms requires excipient suppliers to meet the quality requirements of the pharmaceutical industry, and the pharmaceutical industry, in general, must work to ensure the product's safety. The integrity of use or storage in the supply chain. Hence, the increasing regulatory stringency regarding the approval of drugs and excipients is expected to restrain the Asia-Pacific pharmaceutical excipients market growth.

Opportunity

-

Strategic Initiatives by Market Players

The rise in the pharmaceutical excipients market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for pharmaceutical excipients, and to cope with this demand, companies are building new manufacturing sites, among other strategic initiatives.

These strategic initiatives, such as product launches, acquisitions, agreements, and business expansion by the major market player, will boost the pharmaceutical excipients market growth and is expected to act as an opportunity for the Asia-Pacific pharmaceutical excipients market.

Challenge

- Associated Side Effects

Adverse effects due to pharmaceutical excipients in drug formulations are generally uncommon, but the potential for toxicity is increased at high mg per kg doses, especially in neonates and infants. Methyl and Propyl para-hydroxybenzoate (Parabens), Benzyl Alcohol, Sodium Benzoate, Benzoic Acid, and Propylene Glycol, among others, are some of the common pharmaceutical excipients that have reported side effects.

Pharmaceutical excipients are not always the inert substances that we presume. They are intolerant to an individual or, if not properly screened, can cause chemical changes in the drug, causing the side-effect. This can affect the demand for the excipient and is expected to act as a challenge for the Asia-Pacific pharmaceutical excipients market.

Post-COVID-19 Impact on Asia-Pacific Pharmaceutical Excipients Market

The pharmaceutical industry has been severely affected by the COVID-19 pandemic. Lockdowns imposed due to the epidemic have disrupted the supply of raw materials from manufacturing centers such as India and China. This slowed drug development and production, severely affecting companies that relied heavily on outsourcing. Initially, the entire pharmaceutical ecosystem was disrupted. In addition, regulatory agencies had to draft and draft new laws to ensure maximum patient safety after using drugs. After the shutdowns ended, the pharmaceutical industry gained steam, especially due to the demand for drugs such as hydroxychloroquine and Remdesivir, which showed positive results against COVID-19. The growing demand for these drugs boosted the turnover of some companies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmaceutical excipients market.

Recent Developments

- In February 2022, Kerry Group Plc., the world’s leading taste and nutrition company, announced that it had made two significant biotechnology acquisitions that have expanded its expertise, technology portfolio, and manufacturing capabilities. The company has announced that it has acquired the leading biotechnology innovation company, c-LEcta, and Mexican-based enzyme manufacturer, Enmex. c-LEcta is a leading biotechnology innovation company specializing in precision fermentation, optimized bio-processing, and bio-transformation. Also, Enmex is a well-established enzyme manufacturer based in Mexico, supplying multiple bio-process solutions for food, beverage, and animal nutrition markets. This has helped company to increase its revenue.

- In September 2022, DFE Pharma, an Asia-Pacific leader in pharma- and nutraceutical excipient solutions, opened its new “Closer to the Formulator” (C2F), a Center of Excellence, in Hyderabad, India. C2F helped pharmaceutical companies to shorten the time from concept to finished commercial product through its expertise in all phases of pharmaceutical development. This has helped the company to showcase its progress.

Asia-Pacific Pharmaceutical Excipients Market Scope

アジア太平洋地域の医薬品添加剤市場は、機能性、剤形、投与経路、エンドユーザー、流通チャネルに分類されています。セグメント間の成長は、ニッチな成長分野と市場へのアプローチ戦略を分析し、コアアプリケーション領域とターゲット市場の違いを判断するのに役立ちます。

アジア太平洋地域の医薬品添加物市場(機能別)

- バインダーと接着剤

- 崩壊剤

- コーティング材

- 着色剤

- 可溶化剤

- フレーバー

- 甘味料

- 希釈剤

- 潤滑剤

- バッファ

- 乳化剤

- 防腐剤

- 抗酸化物質

- 吸着剤

- 溶剤

- エモリエント剤

- グライドン

- キレート剤

- 消泡剤

- その他

機能性に基づいて、アジア太平洋地域の医薬品賦形剤市場は、結合剤および接着剤、崩壊剤、コーティング材、着色剤、可溶化剤、香料、甘味料、希釈剤、潤滑剤、緩衝剤、乳化剤、防腐剤、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑剤、キレート剤、消泡剤、その他に分類されます。

アジア太平洋地域の医薬品添加物市場(剤形別)

- 固体

- 半固体

- 液体

剤形に基づいて、アジア太平洋地域の医薬品添加剤市場は、固体、半固体、液体に分類されます。

アジア太平洋地域の医薬品添加物市場(投与経路別)

- 経口添加剤

- 局所用添加剤

- 非経口添加剤

- その他の添加剤

投与経路に基づいて、アジア太平洋地域の医薬品添加剤市場は、経口医薬品添加剤、局所医薬品添加剤、非経口添加剤、およびその他の添加剤に分類されます。

アジア太平洋地域の医薬品添加物市場(エンドユーザー別)

- 製薬およびバイオ医薬品企業

- 契約策定者

- 研究組織と学術

- その他

エンドユーザーに基づいて、アジア太平洋地域の医薬品添加剤市場は、製薬会社およびバイオ医薬品会社、契約製剤会社、研究機関および学術機関、その他に分類されます。

アジア太平洋地域の医薬品添加物市場(流通チャネル別)

- 直接入札

- 小売販売

- その他

流通チャネルに基づいて、アジア太平洋地域の医薬品添加剤市場は、直接入札、小売販売、その他に分類されます。

アジア太平洋地域の医薬品添加剤市場の地域分析/洞察

アジア太平洋地域の医薬品添加剤市場が分析され、機能性、剤形、投与経路、エンドユーザー、流通チャネルに関する市場規模の情報が提供されます。

この市場レポートで取り上げられている国は、中国、日本、インド、オーストラリア、韓国、シンガポール、タイ、マレーシア、インドネシア、フィリピン、ベトナム、およびその他のアジア太平洋諸国です。

2022年には、最大の消費者市場に主要な市場プレーヤーが存在するため、アジア太平洋地域が優位に立つでしょう。中国は、ヘルスケアITの技術進歩の高まりにより成長すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と入手可能性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境とアジア太平洋地域の医薬品添加剤市場シェア分析

アジア太平洋の医薬品添加剤市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、アジア太平洋の医薬品添加剤市場への会社の重点にのみ関連しています。

アジア太平洋地域の医薬品添加剤市場で活動している主要企業としては、Kerry Group plc、DFE Pharma、Cargill, Incorporated、Pfanstiehl、Colorcon、MEGGLE GmbH & Co. KG、Roquette Frères.、The Lubrizol Corporation、BASF SE、Avantor, Inc.、BENEO、Chemie Trade などがあります。

調査方法: アジア太平洋地域の医薬品添加剤市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、アジア太平洋と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 FUNCTIONALITY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 INDUSTRIAL INSIGHTS:

4 ASIA PACIFIC PHARMACEUTICAL EXCIPIENT MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN GENERIC DRUG PRODUCTION AND USES

5.1.2 THE SURGE IN DEMAND FOR EXCIPIENTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MULTIFUNCTIONAL EXCIPIENTS

5.1.4 RISING FOCUS ON ORPHAN DRUGS

5.2 RESTRAINTS

5.2.1 INCREASING REGULATORY STRINGENCY REGARDING THE APPROVAL OF DRUGS AND EXCIPIENTS

5.2.2 HIGH PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 RISING DEMAND FOR EASE OF USE

5.3.3 RISING DISPOSABLE INCOME

5.3.4 INCREASING DEMAND FOR ALTERNATIVE ROUTES OF DELIVERY/DOSAGE FORMS

5.4 CHALLENGES

5.4.1 ASSOCIATED SIDE EFFECTS

5.4.2 SAFETY CONSIDERATION OF PHARMACEUTICAL EXCIPIENTS IN STORAGE & TRANSPORTATION

5.4.3 LACK OF NOVEL PHARMACEUTICAL PHARMACEUTICAL EXCIPIENTS

6 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

6.1 OVERVIEW

6.2 BINDERS AND ADHESIVES

6.2.1 ORGANIC

6.2.2 INORGANIC

6.3 DISINTEGRANTS

6.3.1 ORGANIC

6.3.2 INORGANIC

6.4 COATING MATERIAL

6.4.1 ORGANIC

6.4.2 INORGANIC

6.5 COLORING AGENTS

6.5.1 ORGANIC

6.5.2 INORGANIC

6.6 SOLUBILIZERS

6.6.1 ORGANIC

6.6.2 INORGANIC

6.7 FLAVORS

6.7.1 ORGANIC

6.7.2 INORGANIC

6.8 SWEETENING AGENTS

6.8.1 ORGANIC

6.8.2 INORGANIC

6.9 DILUENTS

6.9.1 ORGANIC

6.9.2 INORGANIC

6.1 LUBRICANTS

6.10.1 ORGANIC

6.10.2 INORGANIC

6.11 BUFFERS

6.11.1 ORGANIC

6.11.2 INORGANIC

6.12 EMULSIFYING AGENTS

6.12.1 ORGANIC

6.12.2 INORGANIC

6.13 PRESERVATIVES

6.13.1 ORGANIC

6.13.2 INORGANIC

6.14 ANTIOXIDANTS

6.14.1 ORGANIC

6.14.2 INORGANIC

6.15 SORBENTS

6.15.1 ORGANIC

6.15.2 INORGANIC

6.16 SOLVENTS

6.16.1 ORGANIC

6.16.2 INORGANIC

6.17 EMOLLIENTS

6.17.1 ORGANIC

6.17.2 INORGANIC

6.18 GLIDENTS

6.18.1 ORGANIC

6.18.2 INORGANIC

6.19 CHELATING AGENTS

6.19.1 ORGANIC

6.19.2 INORGANIC

6.2 ANTIFOAMING AGENTS

6.20.1 ORGANIC

6.20.2 INORGANIC

6.21 OTHERS

7 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

7.1 OVERVIEW

7.2 SOLID

7.2.1 PLANT

7.2.2 ANIMALS

7.2.3 SYNTHETIC

7.2.4 MINERALS

7.3 SEMI-SOLID

7.3.1 PLANT

7.3.2 ANIMALS

7.3.3 SYNTHETIC

7.3.4 MINERALS

7.4 LIQUID

7.4.1 PLANT

7.4.2 ANIMALS

7.4.3 SYNTHETIC

7.4.4 MINERALS

8 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 ORAL EXCIPIENTS

8.3 TOPICAL EXCIPIENTS

8.4 PARENTERAL EXCIPIENTS

8.5 OTHER EXCIPIENTS

9 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.2.1 COMPANY TENDER

9.2.2 TENDER THROUGH MARCH MERCHANDISER

9.3 RETAIL SALES

9.4 OTHERS

10 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.3 CONTRACT FORMULATORS

10.4 RESEARCH ORGANIZATION

10.5 OTHERS

11 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 INDONESIA

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 VIETNAM

11.1.12 REST OF ASIA-PACIFIC

12 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DOW

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROQUETTE FRÈRES.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EVONIK

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THE LUBRIZOL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 BASF SE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASHLAND (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BENEO

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CARGILL, INCORPORATED.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CHEMIE TRADE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 COLORCON

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 CRODA INTERNATIONAL PLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 DFE PHARMA (SUBSIDIARY OF ROYAL FRIESLANDCAMPINA N.V)

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 KERRY GROUP PLC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEGGLE GMBH & CO. KG

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 OMYA AG

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PETER GREVEN GMBH & CO. KG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PFANSTIEHL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKETS, BY REGION, 2015-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC SOLVENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC SOLVENTS PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION, 2015-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC ORAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC TOPICAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC PARENTERAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC OTHER EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC RETAIL SALES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER, 2015-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC CONTRACT FORMULATORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC RESEARCH ORGANIZATION AND ACADEMICS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 12 THE RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS ON PHARMACEUTICAL EXCIPIENTS IS DRIVING THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE BINDERS AND ADHESIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET

FIGURE 15 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2021

FIGURE 16 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2021

FIGURE 20 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 24 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2021

FIGURE 32 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY FUNCTIONALITY (2022-2029)

FIGURE 40 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。