中東およびアフリカの屈折矯正手術機器市場

Market Size in USD Billion

CAGR :

%

USD

38.44 Million

USD

60.59 Million

2021

2029

USD

38.44 Million

USD

60.59 Million

2021

2029

| 2022 –2029 | |

| USD 38.44 Million | |

| USD 60.59 Million | |

|

|

|

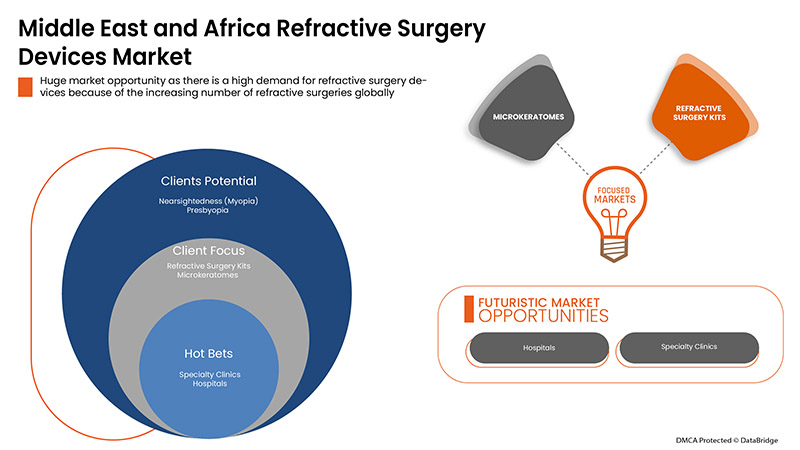

中東およびアフリカ屈折矯正手術機器市場、製品タイプ別(レーザー、有水晶体眼内レンズ(IOL)、アベロメーター/波面アベロメトリー、手術器具および付属品、屈折矯正手術キット、瞳孔径計、エピケラトーム、マイクロケラトーム、サーモケラトプラスティ、輪部弛緩切開キットなど)、手術タイプ別(LASIK(レーザー角膜切開術、フォトレフラクティブ角膜切除術(PRK)、有水晶体眼内レンズ(IOL)、乱視角膜切開術(AK)、自動ラメラ角膜形成術(ALK)、角膜内リング(INTACS)、レーザーサーマル角膜形成術(LTK)、導電性角膜形成術(CK)、放射状角膜切開術(RK)など)、用途別(近視(ミオピア)、遠視(ハイオピア)、乱視と老眼)、エンドユーザー(病院、専門クリニック、外来手術センターなど)、流通チャネル(直接入札、サードパーティの販売代理店など)の業界動向と2029年までの予測。

市場の定義と洞察

屈折矯正手術装置は、近視、遠視、老眼、乱視などの屈折異常を改善または矯正するために使用されます。これらの装置には、エキシマレーザー、YAGレーザー、マイクロケラトーム、フェムト秒レーザーなどがあります。屈折矯正手術により、眼鏡やコンタクトレンズへの依存度が大幅に軽減されます。市場では、視力障害の治療にさまざまな屈折矯正装置が使用されています。

屈折異常は、角膜または眼球の形状が不適切であるために発生します。屈折矯正手術には、高度なレーザー、レーシック治療、光屈折角膜切除術、有水晶体眼内レンズやトーリック眼内レンズなどのさまざまなレンズなど、さまざまな屈折矯正手術装置を使用して眼球または角膜の形状を変更することが含まれます。

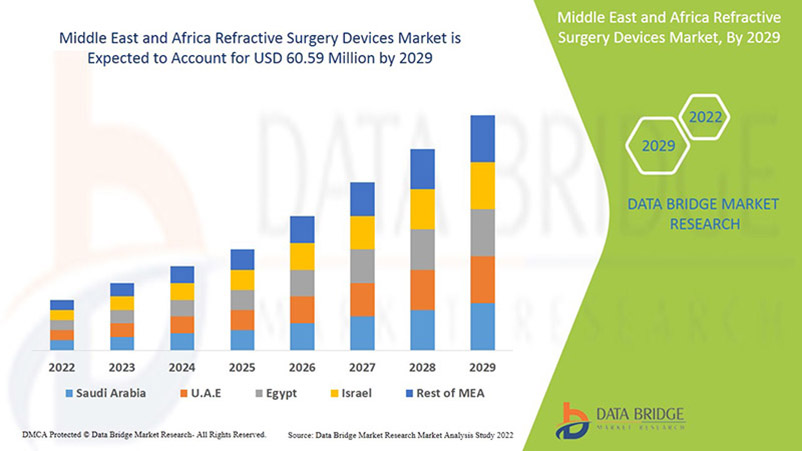

屈折矯正手術装置市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に6.1%のCAGRで成長し、2021年の3,844万米ドルから2029年には6,059万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別 (レーザー、有水晶体眼内レンズ (IOL)、収差計/波面収差測定器、手術器具および付属品、屈折矯正手術キット、瞳孔径計、エピケラトーム、マイクロケラトーム、サーモケラトプラスティ、輪部弛緩切開キットなど)、手術タイプ別 (LASIK (レーザー角膜切削術、フォトレフラクティブ角膜切除術 (PRK)、有水晶体眼内レンズ (IOL)、乱視角膜切開術 (AK)、自動ラメラ角膜形成術 (ALK)、角膜内リング (INTACS)、レーザーサーマル角膜形成術 (LTK)、導電性角膜形成術 (CK)、放射状角膜切開術 (RK) など)、用途別 (近視 (近視)、遠視 (遠視)、乱視および老眼)、エンドユーザー(病院、専門クリニック、外来手術センターなど)、流通チャネル (直接入札、サードパーティの販売業者など) |

|

対象国 |

南アフリカ、サウジアラビア、UAE、エジプト、イスラエル、クウェート、その他の中東およびアフリカ |

|

対象となる市場プレーヤー |

Tracey Technologies、Bausch + Lomb Incorporated、BD、STAAR SURGICAL、SCHWIND eye-tech-solutions、Hoya Surgical Optics、Johnson & Johnson Services、Inc.、Ophtec BV、Glaukos Corporation、Amplitude Laser、Reichert、Inc.、NIDEK CO.、LTD.、Ziemer Ophthalmic Systems、ROWIAK GmbH、Moria、LENSAR、Inc.、Topcon Canada Inc.(Topcon Corporation の子会社)、Aaren Scientific Inc.、Rayner Intraocular Lenses Limited.、iVIS Technologies、Alcon など |

屈折矯正手術機器市場の市場動向には以下が含まれます。

ドライバー

- 技術進歩の増加

ヘルスケア分野における技術開発の加速は、ここ数年で飛躍的に増加しています。屈折矯正手術装置の技術の進歩は、病気の治療中に痛みがなく、合併症のない治療をサポートします。さらに、さまざまな屈折矯正手術装置の革新とアップグレードは、病気の診断を正確かつ迅速に行うのに役立ちます。屈折矯正手術装置の革新は、病気の治療中に技術ベースの治療ツールの費用対効果も高めます。

例えば、

- Contoura Vision Indiaによると、Contoura Vision手術は眼鏡除去における最新の高度な眼科手術であることがわかりました。これは眼科手術における最も安全な技術的進歩の1つであり、眼鏡の度数を矯正するだけでなく、角膜の不規則性にも効果があります。

- 眼科レーザーセンター組織によると、2017年5月、Visumaxフェムト秒レーザー技術は最も先進的な屈折矯正手術の1つであることが判明しました。この技術は、目の視覚障害を治療することができます。

レーザー可変スポットスキャンの進歩など、さまざまな屈折矯正手術機器の技術的進歩の増加は、屈折矯正手術機器市場を牽引すると予想されます。したがって、屈折矯正手術機器の革新と技術的進歩の拡大は、予測期間中に市場の成長を促進すると予想されます。

- Rise in healthcare expenditure

Over the last decade, healthcare expenditure has risen drastically for better patient healthcare service. The U.S. is the largest healthcare market, where the total health expenditure has increased drastically in the last few years. The fundamental purpose behind growing expenditure is to provide appropriate, affordable, and high-quality refractive surgery devices. To promote a healthier population and address the healthcare emergencies in developed and developing countries, respective government bodies and healthcare organizations are taking the initiative under accelerating healthcare expenditure.

For instance,

- According to the Health Affairs Organisation, U.S. health care spending has increased 9.7% to reach USD 4.1 trillion in 2020, which is a much faster rate than that seen in 2019

- According to the U.K. government, in 2020, the government have provided nearly GBP 250 million, which is about USD 300 million, to digitalize and advance diagnostics care across the NHS (National Health Service) using the latest technology. This funding has been allocated specifically for technological improvements to the NHS diagnostic services to detect and begin treating health conditions as early as possible

- The National Free Diagnostic Service Initiative has been rolled out as part of the National Health Mission by the Government of India. This was important to provide comprehensive and quality healthcare free of cost under one roof. With this initiative by the Indian government, several states have attempted several models to ensure the availability of diagnostics in public health facilities

Growing healthcare expenditure is also beneficial for further economic growth as well as healthcare sector growth. It significantly affects the development of new diagnostic tests and new surgical tools. Hence, huge health care expenditure is a favorable factor for the market's growth.

Opportunities

- Achievements in LASIK surgeries

The LASIK success rate or LASIK outcomes are well understood, with thousands of clinical studies looking at visual acuity and patient satisfaction. Recent research reported 99 percent of patients achieve better than 20/40 vision, and more than 90 percent achieve 20/20 or better. Furthermore, LASIK has an unprecedented 96 percent patient satisfaction rate, the highest of any elective procedure.

For instance,

- A 2016 study in the Journal of Cataract & Refractive Surgery found that LASIK has a 96% patient satisfaction rate

As per the article, "LASIK: Know the Rewards and the Risks," 2018

- Eric Donnenfeld, MD, a former president of the American Society of Cataract and Refractive Surgery, completed around 85,000 procedures over his 28-year career

- According to Market Scope, around 10 million Americans have had LASIK surgery since the FDA first approved it in 1999. Around 700,000 LASIK surgeries are done each year, but that's down from a peak of 1.4 million in 2000

Henceforth, the rising number of successful LASIK surgeries worldwide is positively associated with product development, product registration, and product launch. Thus, this is expected to drive the refractive surgery devices market in the coming years.

- Strategic initiatives by market players

An increase in the burden of refractive errors across the world have created more demand for the refractive surgery devices market. The main aim is to improve health management with the development of innovative products and surgery types for quality care with the convenient application. The key players in the refractive surgery devices market have taken strategic initiatives, which include product launches, acquisitions, and many more, and are expected to lead and create more opportunities in the refractive surgery devices market.

For instances,

- In June 2021, Glaukos Corporation received regulatory approval from the Therapeutic Goods Administration (TGA) of Australia for PRESERFLO MicroShunt. PRESERFLO MicroShunt aimed to lessen intraocular pressure (IOP) in the eyes of patients with primary open-angle glaucoma where IOP would remain uncontrollable along with being the maximum tolerated medical therapy and/or where glaucoma progression requires surgery

- In June 2021: Bausch & Lomb Incorporated signed an agreement with Lochan, a company in the Information Technology Services Industry. These companies aimed to develop the next generation of Bausch & Lomb Incorporated's eyeTELLIGENCE clinical decision support software. By utilizing the prevailing cloud-based infrastructure of eyeTELLIGENCE, this software would be developed to allow surgeons to effortlessly combine all factors of the cataract, retinal, and refractive surgery procedures to boost their total practice efficiency

- In March 2021, NIDEK unveiled RT-6100 CB for Windows, optional control software for the RT-6100 Intelligent Refractor, and the TS-610 Tabletop Refraction System. This software attunes to the distinct requirements of patients and operators. Moreover, the software enables refractions, which fulfill social distancing requirements

These many strategic products launched and acquisitions by major companies in the refractive surgery devices market have opened up an opportunity for companies worldwide. These strategies are allowing the companies to strengthen their footprints in the market. Therefore, it is predicted that strategic initiative is the golden opportunity for the market players to accelerate their revenue growth in the market.

Challenges/Restraints

- Lack of awareness and people trust regarding the benefits of the procedure

In many countries, the general population is not aware of refractive surgery or its various benefits for refractive errors such as myopia astigmatism, presbyopia, and others. People are scared of surgeries that it will lead to some serious side effects which are expected to give a market a great challenge.

For instance,

- According to the study by the National Institute of Health (NIH) 2021, it stated that people refused to undergo surgery because they were worried about its complications and lacked information regarding the procedure. Moreover, the study showed that 82.5% of participants were unaware that refractive surgery could enhance their visual acuity due to the lack of awareness

- According to the study by the International Journal of Medicine in Developing Countries in 2019, it was stated that-

- 32.2% of the total participants thought that refractive surgery was dangerous and 9.5% thought that it causes advanced complications

- Also, the study from India showed that 64% of participants did not know that refractive surgery was able to improve their vision

The lack of awareness regarding the benefits of refractive surgery and people's fear of surgery complications is expected to create a great challenge for the market growth.

- Lack of healthcare facilities for eye treatment

The poverty-stricken population in low- and middle-income countries suffer more from blindness and ophthalmic disorders than the wealthier population. The advancement and strategic plans taken in developed countries are not equally initiated in low-income countries. Many low-income countries usually rely on community health workers, physician assistants, and cataract surgeons for their initial primary eye care. Ophthalmology in low-income countries (LIC) is very challenging due to its complexities such as tropical climates, frail electric grids, poor road and water infrastructure, limited diagnostic capability, and limited treatment options.

For instance,

- As per the article, "Innovative Diagnostic Tools for Ophthalmology in Low-Income Countries," the 2020 report states that the prevalence of blindness and ocular disorders in high-income countries is 0.3 per 1,000 people, but in low-income countries, the estimation is 1.5 per 1,000. This shows the unmet need for ophthalmology care in low-income countries

Another major problem in low-income countries is the lack of awareness among people regarding ocular pain and other disorders. Many research studies report the high requirement of low-income countries for eye health care, and their unmet needs are still gaining attention among many health care organizations.

For instance,

- In 2014, the British Journal of Ophthalmology reported that the vision 2020 plan initiated by the government is still far from achieved due to the lack of initiatives taken targeting middle and low-income countries

Hence, the poor healthcare facility for eye treatments in low and middle-income countries are considered the greatest challenge to the growth of the refractive surgery devices market.

Post COVID-19 Impact on Refractive Surgery Devices Market

COVID-19は市場に影響を与えています。パンデミック中のロックダウンと隔離により、大衆の移動が制限されました。その結果、手術の日時が遅れました。したがって、パンデミックはこの市場に悪影響を及ぼしました。

最近の開発

- 2021年7月、ジョンソン・エンド・ジョンソン・ビジョンは、次世代の超音波乳化吸引術(フェイコ)システムであるVERITAS Vision Systemを発売しました。このシステムは、外科医の効率、患者の安全性、快適性の3つの重要な領域を考慮して開発されました。これにより、同社の製品ポートフォリオが拡大しました。

屈折矯正手術機器市場の範囲

屈折矯正手術装置市場は、製品タイプ、手術タイプ、アプリケーション、エンドユーザー、流通チャネルに分類されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品タイプ

- レーザ

- 有水晶体眼内レンズ(IOL)

- 波面収差測定装置

- 手術器具および付属品

- 屈折矯正手術キット

- 瞳孔径メートル

- エピケラトーム

- マイクロケラトーム

- 熱角膜形成術

- 輪部弛緩切開キット

- その他

製品タイプに基づいて、屈折矯正手術装置市場は、レーザー、有水晶体眼内レンズ(IOL)、収差計/波面収差測定装置、手術器具および付属品、屈折矯正手術キット、瞳孔径計、エピケラトーム、マイクロケラトーム、サーモケラトプラスティ、輪部弛緩切開キットなどに分類されます。

手術の種類

- レーシック(レーザー上皮内角膜炎)

- 屈折矯正角膜切除術(PRK)

- 有水晶体眼内レンズ(IOL)

- 乱視角膜切開術(AK)

- 自動ラメラ角膜移植術(ALK)

- 角膜内リング(INTACS)

- レーザー熱角膜移植術 (LTK)

- 導電性角膜移植(CK)

- 放射状角膜切開術(RK)

- その他

手術の種類に基づいて、屈折矯正手術装置市場は、LASIK(レーザー角膜内切削術)、光屈折角膜切除術(PRK)、有水晶体眼内レンズ(IOL)、乱視角膜切開術(AK)、自動ラメラ角膜移植術(ALK)、角膜内リング(INTACS)、レーザー熱角膜移植術(LTK)、導電性角膜移植術(CK)、放射状角膜切開術(RK)などに分類されます。

応用

- 近視

- 遠視

- 乱視

- 老眼

用途に基づいて、屈折矯正手術装置市場は、近視、遠視、乱視、老眼に分類されます。

エンドユーザー

- 病院

- 専門クリニック

- 外来手術センター

- その他

エンドユーザーに基づいて、屈折矯正手術装置市場は、病院、専門クリニック、外来手術センター、その他に分類されます。

流通チャネル

- 直接入札

- サードパーティ販売業者

- その他

流通チャネルに基づいて、屈折矯正手術装置市場は、直接入札、サードパーティの販売業者、その他に分類されます。

屈折矯正手術機器市場の地域分析/洞察

屈折矯正手術装置市場が分析され、市場規模の洞察と傾向が、上記のように国、製品タイプ、手術タイプ、アプリケーション、エンドユーザー、流通チャネル別に提供されます。

屈折矯正手術装置市場レポートで取り上げられている国は、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、クウェート、その他の中東およびアフリカ諸国です。

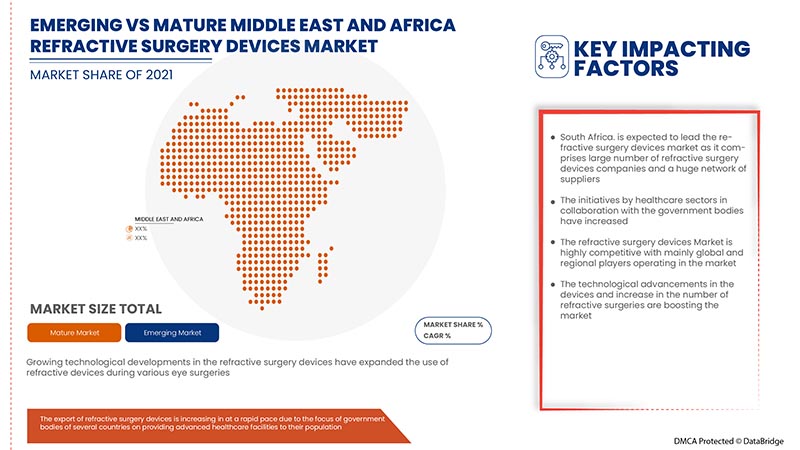

南アフリカは、市場シェアと市場収益の面で屈折矯正手術機器市場を支配しており、この地域での屈折矯正手術件数の増加と技術の進歩により、予測期間中もその優位性を高め続けるでしょう。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、ブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境と屈折矯正手術機器の市場シェア分析

屈折矯正手術装置市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、プレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供された上記のデータ ポイントは、屈折矯正手術装置市場における会社の重点にのみ関連しています。

屈折矯正手術機器市場を扱っている大手企業には、Tracey Technologies、Bausch + Lomb Incorporated、BD、STAAR SURGICAL、SCHWIND eye-tech-solutions、Hoya Surgical Optics、Johnson & Johnson Services、Inc.、Ophtec BV、Glaukos Corporation、Amplitude Laser、Reichert、Inc.、NIDEK CO., LTD.、Ziemer Ophthalmic Systems、ROWIAK GmbH、Moria、LENSAR、Inc.、Topcon Canada Inc. (Topcon Corporation の子会社)、Aaren Scientific Inc.、Rayner Intraocular Lenses Limited.、iVIS Technologies、Alcon などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、地域およびベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合ったデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場、製品ベース分析などを含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社を必要なだけ追加できます。必要な形式とデータ スタイルでデータを追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクトブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 KUWAIT

12.1.7 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 EGYPT LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 EGYPT REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 KUWAIT LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 REST OF MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。