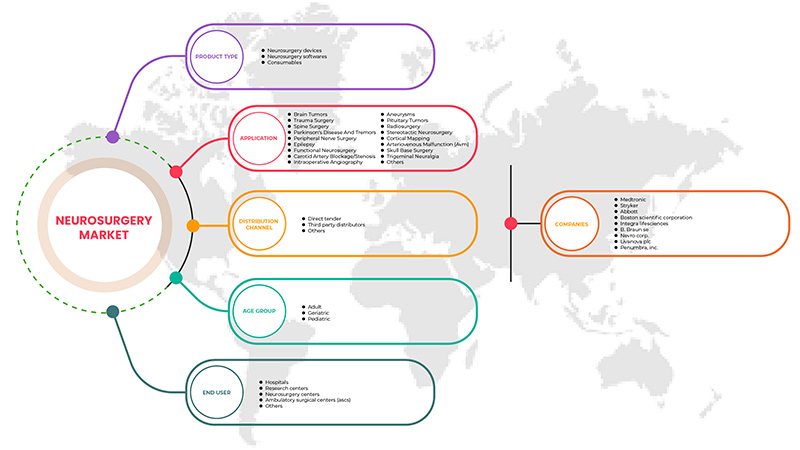

亚太神经外科市场,按产品类型(神经外科设备、神经外科软件、耗材)、应用(动脉瘤、动静脉畸形 (AVM)、脑肿瘤、颈动脉阻塞/狭窄、脑血管外科、皮质映射、癫痫、功能性神经外科、术中血管造影、帕金森病和震颤、周围神经外科、垂体瘤、放射外科、颅底手术、脊柱外科、立体定向神经外科、创伤外科、三叉神经痛、其他)、年龄组(儿科、成人、老年)、最终用户(医院、神经外科中心、研究中心、门诊手术中心、其他)、分销渠道(直接招标、第三方分销商、其他)行业趋势和预测到 2029 年

亚太神经外科市场分析与洞察

医疗保健领域的技术创新可以定义为引入一项新技术,从而引发临床实践的变革。神经外科是一门技术密集型的外科学科,新技术的出现先于手术神经外科技术的许多重大进步。目前的重点是开发可以降低手术过程中并发症概率的微创设备。随着微创技术的引入,医生正在使用高度专业化的手术器械,例如电动工具、神经血管栓塞装置和伽玛刀等放射外科系统。

此外,一系列新因素,例如监管标准的加强和神经系统疾病发病率的上升,导致采用先进治疗方案的人数增加,并且人们认为此类疗法将得到更广泛的应用。这增加了行业和政府对零偏差的需求,从而推动了对神经外科服务的需求。跨行业联盟和合作的增加是预计推动神经外科市场发展的主要因素。然而,神经内窥镜设备和程序的成本较高,以及缺乏训练有素的专业人员,可能会在预测期内抑制市场增长。

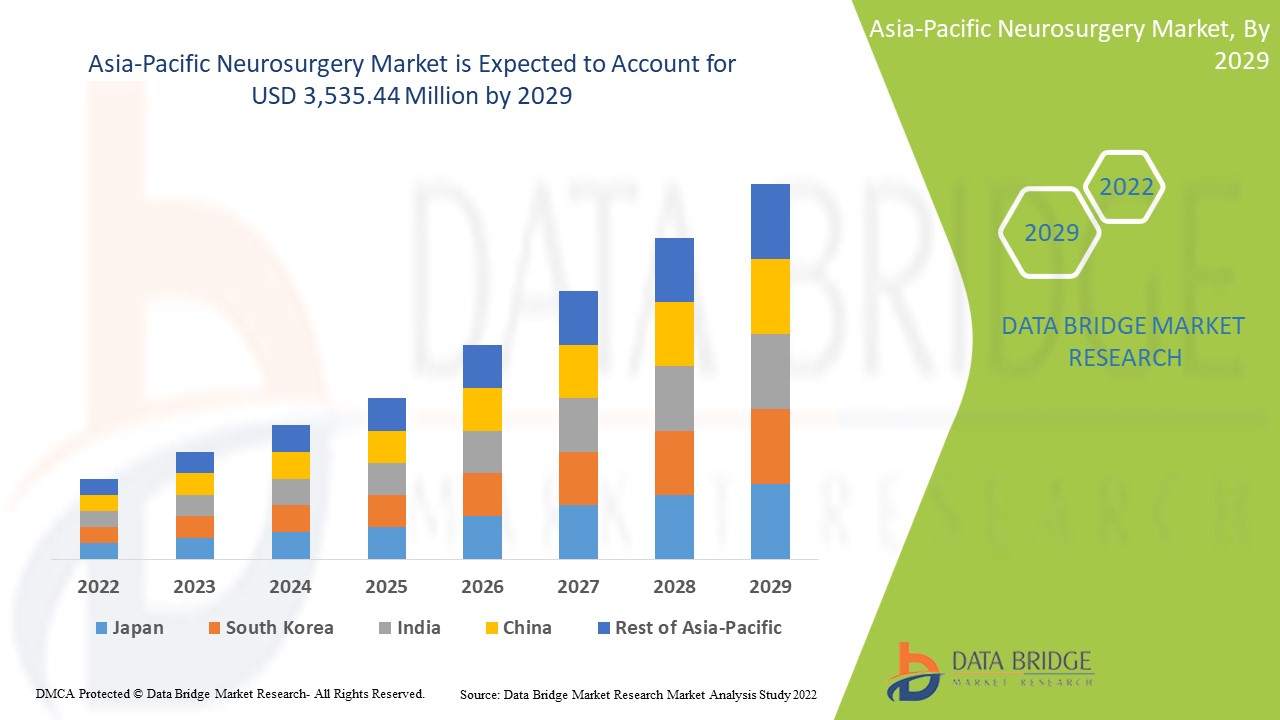

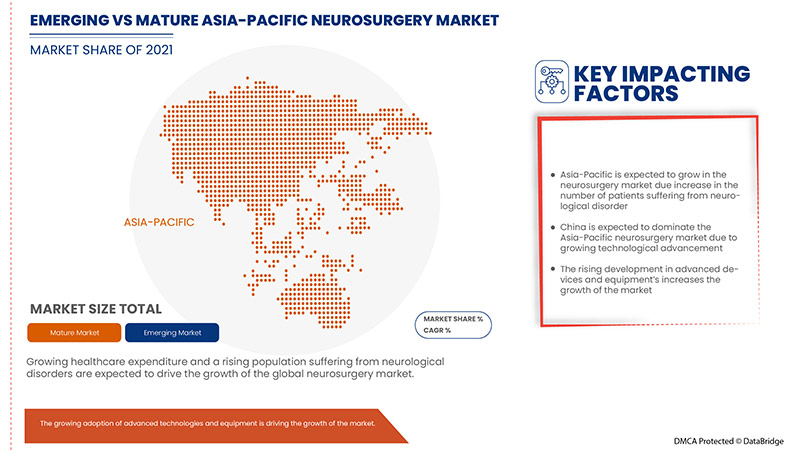

Data Bridge Market Research 分析称,预计到 2029 年,亚太神经外科市场价值将达到 35.3544 亿美元,预测期内复合年增长率为 15.7%。由于亚太地区患者人数不断增加,“产品类型”占据了市场中最大的类型部分。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按产品类型(神经外科设备、神经外科软件、耗材)、应用(动脉瘤、动静脉畸形 (AVM)、脑肿瘤、颈动脉阻塞/狭窄、脑血管外科、皮质映射、癫痫、功能性神经外科、术中血管造影、帕金森病和震颤、周围神经外科、垂体肿瘤、放射外科、颅底手术、脊柱外科、立体定向神经外科、创伤外科、三叉神经痛、其他)、年龄组(儿科、成人、老年)、最终用户(医院、神经外科中心、研究中心、门诊手术中心、其他)、分销渠道(直接招标、第三方分销商、其他) |

|

覆盖国家 |

中国、日本、印度、韩国、新加坡、泰国、马来西亚、澳大利亚、菲律宾、印度尼西亚和亚太地区其他地区 |

|

涵盖的市场参与者 |

美敦力、雅培、波士顿科学公司、医科达、ALEVA NEUROTHERAPEUTICS、町田内窥镜有限公司、Brainlab AG、adeor medical AG、LivaNova PLC、B. Braun SE、Optofine Instruments Pvt. Ltd.、Wallaby Medical、Terumo Medical Corporation、NEVRO CORP.、Integra LifeSciences、史赛克、Penumbra, Inc.、KARL STORZ SE & Co. KG、雷尼绍、Inomed Medizintechnik GmbH、ANT Neuro 和徕卡显微系统等 |

亚太神经外科市场定义

神经系统疾病包括痴呆症、头痛症、神经感染和多发性硬化症、创伤性脑损伤、与神经系统疾病相关的疼痛、与营养不良相关的神经系统疾病、中风、癫痫和帕金森病。这些疾病是致命的,无法通过治疗治愈。一些神经外科设备包括神经内窥镜、立体定向系统、导管、起搏器、单腔和双腔除颤器、植入式心脏复律除颤器等,用于各种神经外科手术。神经外科有助于诊断患有脑肿瘤、事故引起的脊髓损伤、颈部和背部不适以及脊髓液流动异常的患者。全世界约有 700 万至 1000 万人患有帕金森病。神经系统疾病是全世界发病和残疾的主要原因之一。在预测期内,神经外科的技术发展预计将推动市场发展。人口中神经系统疾病发病率和患病率的上升以及神经外科手术相对于其他传统手术的优势预计将推动全球神经外科手术市场的增长。此外,神经外科手术的进步,如脑肿瘤手术的三维重建、脑病变的X刀放射手术、脑肿瘤的MRI和脑肿瘤局部麻醉手术,预计将为神经外科手术市场的增长提供丰厚的机会。

亚太神经外科市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 神经外科的技术进步

自现代神经外科诞生以来,技术进步为更彻底、更深入地了解大脑形态和功能铺平了道路,从而更有效地治疗影响患者的复杂病症。技术进步带来了从传统设备向基于新技术的节能设备的转变。几种尖端技术很容易帮助神经外科。神经外科是一门技术密集型的外科学科,新技术先于手术神经外科技术的许多重大进步。图像引导和神经调节设备在专利和出版物方面表现出高度相关的快速增长,表明它们是技术扩展领域,预计将推动市场增长。

随着神经系统疾病患病率的上升,对神经外科的需求也随之增加。预计市场在预测期内将有所增长。

此外,内窥镜技术的采用是市场的一个重大进步。此外,神经外科手术的恢复时间更短。因此,所有这些因素都有望成为市场增长的驱动力。

- 神经系统疾病患病率上升

世界卫生组织 (WHO) 专注于对促进公共卫生至关重要的领域的研究。最近,WHO 特别关注那些对世界造成沉重负担的常见且致残的神经系统疾病。神经系统疾病发生在所有年龄组和不同地理区域。它们对世界各地的发病率和死亡率有重大影响。预计未来十年,中低收入国家 (LMIC) 的神经系统疾病负担将呈指数级增长。

经鼻出血、脑出血 (ICH)、创伤性脑损伤、慢性疼痛、抑郁症和帕金森氏症等神经系统疾病的患病率不断上升,预计将推动市场增长。

因此,越来越多的神经系统疾病(如鼻腔出血和脑出血 (ICH))正在推动市场增长。神经系统疾病已成为重大公共卫生危机,预计将推动亚太地区神经外科市场的增长。

克制

- 神经外科手术和设备费用高昂

近年来,神经外科产品的成本显著增加,医院和神经外科中心等终端用户不得不承担这些成本。神经血管栓塞装置、神经血管线圈装置和神经内窥镜等产品价格相当昂贵。制造商也投入更多资源进行研发,以推出具有成本效益的先进技术。一些复杂的神经外科手术需要大量的时间和精力,而且风险也很大。这些复杂的手术需要先进的技术和技能,因此设备和神经外科手术的成本增加。这些设施的维护和对电力供应的持续需求增加了手术成本。创伤性脑损伤 (TBI) 的减压开颅术是一种昂贵的手术,而且发病率和死亡率也很高。

与神经外科手术相关的成本相当高,预计这会成为市场增长的制约因素。

机会

-

提高对神经系统疾病的认识

随着亚太地区人口的增长,老年人口中很大一部分患有神经系统疾病,如癫痫、帕金森病、中风、脑瘤、痴呆症和多发性硬化症等。因此,了解神经系统疾病很重要,了解神经系统疾病可以促使人们寻求医疗帮助,从而得到正确的诊断和有效的治疗。所有神经系统疾病占 82.8%。这一巨大增长增加了神经系统疾病的负担,这可以归因于对神经系统疾病和治疗缺乏认识,导致延误检测,以及无法获得优质的医疗保健和康复中心。不断增加的医疗保健项目以及政府和公共医疗保健机构的资金增加有助于减轻神经系统疾病的负担,并开发有利于市场增长的神经系统产品。

提高对神经系统疾病的认识对神经外科市场有利。在大多数地区,许多政府和非政府机构都开展了一些提高认识的计划,以便及早发现神经系统疾病。

挑战

- 神经系统疾病的替代疗法

药物疗法是治疗神经系统疾病的第一线治疗方法。只有当非手术治疗无效时,才会选择神经外科手术。补充和替代疗法越来越多地用于补充神经外科治疗。这包括针灸、自然疗法、脊椎按摩疗法和阿育吠陀医学等。最近,医生越来越接受使用替代疗法,国家卫生研究院对补充和替代方案的安全性和有效性进行了科学研究,这可能会对神经外科市场的增长构成挑战。

因此,替代治疗方案预计将给亚太神经外科市场带来重大挑战。

新冠肺炎疫情对亚太地区神经外科市场的影响

COVID-19 疫情对亚太地区的医疗保健产生了巨大影响,中国是受影响最严重的国家之一。由于该领域的研究活动暂时停止,再加上医院和诊断中心的患者流入量较低,疫情对神经外科市场的增长产生了负面影响。此外,COVID-19 疫情对神经外科产品交付的影响对神经外科医生获得外科产品的交付提出了挑战。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动和产品发布,并建立战略合作伙伴关系,以改进神经外科市场的技术。

最新动态

- 2022 年 3 月,亚太地区医疗技术领导者美敦力宣布在 TITAN 2 关键研究中进行了首批患者植入,该研究评估了美敦力的试验性植入式胫骨神经调节 (TNM) 设备对膀胱过度活动症 (OAB) 患者的安全性和有效性。植入式 TNM 有可能通过一种新方法为数百万患有膀胱失禁的人带来缓解,这种方法为医生和患者提供了更大的便利和更多的选择。这将有助于该公司评估其产品的安全性和有效性

- 2022 年 4 月,雅培宣布推出 NeuroSphere myPath 数字健康应用的升级版,该应用具有增强的功能,可帮助医生在患者试用雅培神经刺激设备治疗慢性疼痛时更密切地跟踪患者。此次升级是雅培对互联护理技术的承诺的一部分,旨在让人们掌控自己的健康并促进与医生的更好沟通。通过推出该应用,该公司增强了产品的使用

亚太神经外科市场范围

神经外科市场细分为产品类型、应用、年龄组、最终用户和分销渠道。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

按产品类型

- 神经外科设备

- 神经外科软件

- 耗材

根据产品类型,神经外科市场分为神经外科设备、神经外科软件和消耗品。

按应用

- 动脉瘤

- 动静脉畸形 (AVM)

- 脑肿瘤

- 颈动脉阻塞/狭窄

- 脑血管外科

- 皮质映射

- 癫痫

- 功能神经外科

- 术中血管造影

- 帕金森病和震颤

- 周围神经手术

- 垂体瘤

- 放射外科

- 颅底手术

- 脊柱手术

- 立体定向神经外科手术

- 创伤手术

- 三叉神经痛

- 其他的

根据应用,神经外科市场细分为动脉瘤、动静脉畸形 (AVM)、脑肿瘤、颈动脉阻塞/狭窄、脑血管外科、皮质映射、癫痫、功能性神经外科、术中血管造影、帕金森病和震颤、周围神经外科、垂体瘤、放射外科、颅底手术、脊柱外科、立体定向神经外科、创伤手术、三叉神经痛等。

按年龄组

- 儿科

- 成人

- 老年

根据最终用户,神经外科市场分为儿科、成人和老年科。

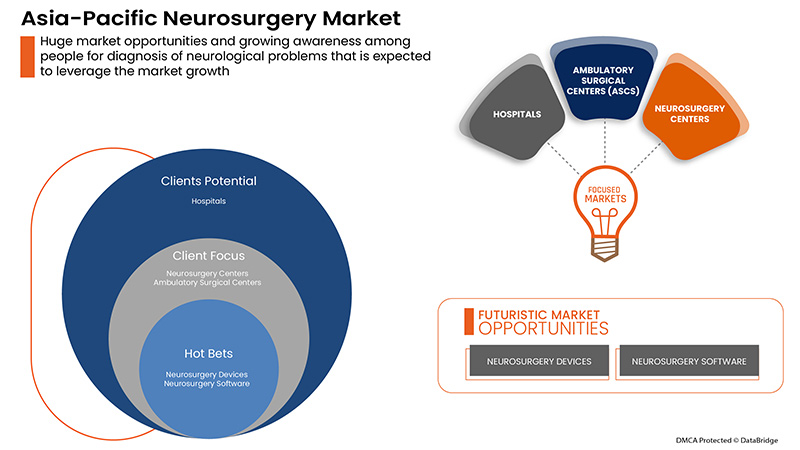

按最终用户

- 医院

- 研究中心

- 神经外科中心

- 门诊手术中心(ASCS)

- 其他的

根据最终用户,神经外科市场细分为医院、神经外科中心、研究中心、门诊手术中心和其他

按分销渠道

- Direct tender

- Third party distributors

- Others

On the basis of distribution channel, the Asia-Pacific neurosurgery market is segmented into direct tender, third party distributors, and others

Asia-Pacific Neurosurgery Market Regional Analysis/Insights

The Asia-Pacific neurosurgery market is analyzed, and market size information is provided by product type, application, age group, end user, and distribution channel.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia, and the rest of Asia-Pacific.

In 2022, Asia-Pacific is expected to be the third most dominating region due to the increasing healthcare expenditure. China is expected to dominate the Asia-Pacific neurosurgery market and grow due to the rise in technological advancement in neurosurgical equipment.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Neurosurgery Market Share Analysis

Asia-Pacific neurosurgery market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus on the Asia-Pacific neurosurgery market.

Some of the major players operating in the Asia-Pacific neurosurgery market are Medtronic, Abbott, Boston Scientific Corporation, Elekta, ALEVA NEUROTHERAPEUTICS, Machida Endoscope Co., Ltd., Brainlab AG, adeor medical AG, LivaNova PLC, B. Braun SE, Optofine Instruments Pvt. Ltd., Wallaby Medical, Terumo Medical Corporation, NEVRO CORP., Integra LifeSciences, Stryker, Penumbra, Inc., KARL STORZ SE & Co. KG, Renishaw plc, Inomed Medizintechnik GmbH, ANT Neuro, and Leica Microsystems among others.

Research Methodology: Asia-Pacific Neurosurgery Market

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、亚太地区与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC NEUROSURGERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 REGULATIONS OF THE ASIA PACIFIC NEUROSURGERY MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 TECHNOLOGICAL ADVANCEMENT IN NEUROSURGERY

6.1.2 RISING PREVALENCE OF NEUROLOGICAL CONDITIONS

6.1.3 DEVELOPMENTS IN SURGICAL EQUIPMENT

6.2 RESTRAINTS

6.2.1 THE HIGH COST ASSOCIATED WITH NEUROSURGERIES AND EQUIPMENT

6.2.2 UNFAVOURABLE REIMBURSEMENT POLICIES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS ABOUT NEUROLOGICAL DISORDERS

6.3.2 INCREASING NUMBER OF KEY PLAYERS IN MARKET

6.3.3 ADVANCE PRODUCT DEVELOPMENT AND LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 ALTERNATIVE TREATMENTS FOR NEUROLOGICAL DISEASE

6.4.2 STRINGENT REGULATIONS FOR APPROVAL OF MEDICAL DEVICES

7 ASIA PACIFIC NEUROSURGERY MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 NEUROSURGERY DEVICES

7.2.1 NEUROMODULATION DEVICES

7.2.1.1 INTERNAL NEUROMODULATION DEVICES

7.2.1.1.1 SPINAL CORD STIMULATION DEVICES

7.2.1.1.1.1 RECHARGEABLE

7.2.1.1.1.2 NON- RECHARGEABLE

7.2.1.1.2 DEEP BRAIN STIMULATION DEVICES

7.2.1.1.2.1 SINGLE-CHANNEL DEEP BRAIN STIMULATION

7.2.1.1.2.2 DUAL-CHANNEL DEEP BRAIN STIMULATION

7.2.1.1.3 SACRAL NERVE STIMULATION DEVICES

7.2.1.1.3.1 IMPLANTABLE

7.2.1.1.3.2 EXTERNAL

7.2.1.1.4 VAGUS NERVE STIMULATION DEVICES

7.2.1.1.4.1 INVASIVE

7.2.1.1.4.2 EXTERNAL

7.2.1.1.5 GASTRIC ELECTRICAL STIMULATION DEVICES

7.2.1.1.5.1 LOW FREQUENCY GASTRIC ELECTRICAL STIMULATORS

7.2.1.1.5.2 HIGH FREQUENCY GASTRIC ELECTRICAL STIMULATORS

7.2.1.1.6 EXTERNAL NEUROMODULATION DEVICES

7.2.1.1.6.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

7.2.1.1.6.2 TRANSCRANIAL MAGNETIC STIMULATION (TMS)

7.2.1.1.6.3 OTHERS

7.2.2 NEURO-INTERVENTIONAL DEVICES

7.2.2.1 EMBOLIZATION COILS

7.2.2.1.1 DETACHABLE

7.2.2.1.2 PUSHABLE

7.2.2.2 CAROTID STENTS

7.2.2.3 INTRACRANIAL STENTS

7.2.2.4 NEUROVASCULAR THROMBECTOMY

7.2.2.4.1 COIL RETRIEVERS

7.2.2.4.2 ASPIRATION DEVICES

7.2.2.4.3 STENT RETRIEVERS

7.2.2.5 INTRASSACULAR DEVICES

7.2.2.6 BALLOONS

7.2.2.7 OTHERS

7.2.3 NEUROSURGERY SURGICAL POWER TOOLS

7.2.3.1 DRILL

7.2.3.1.1 PNEUMATIC NEUROSURGICAL DRILLS

7.2.3.1.2 ELECTRICAL NEUROSURGICAL DRILLS

7.2.3.2 SAW

7.2.3.3 OTHERS

7.2.4 NEUROSURGICAL NAVIGATION SYSTEMS

7.2.5 CEREBROSPINAL FLUID (CSF) MANAGEMENT DEVICES

7.2.5.1 CSF SHUNTS

7.2.5.2 EXTERNAL DRAINAGE SYSTEM

7.2.6 NEUROSURGICAL MICROSCOPE

7.2.7 CRANIAL STABILIZATION

7.2.8 NEUROENDOSCOPY DEVICES

7.2.9 INTRA OPERATIVE IMAGING

7.2.10 BRAIN MONITORING

7.2.11 NEUROSURGICAL EVACUATION DEVICES

7.2.12 STEREOTACTIC SYSTEMS

7.2.13 ULTRASONIC ASPIRATOR

7.2.14 BIPOLAR EQUIPMENT

7.3 NEUROSURGERY SOFTWARE

7.3.1 IMAGING NEUROSURGERY SOFTWARE

7.3.2 PRE-OPERATION PLANNING NEUROSURGERY SOFTWARE

7.3.3 OTHERS

7.4 CONSUMABLES

8 ASIA PACIFIC NEUROSURGERY MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 PEDIATRIC

8.3 ADULT

8.4 GERIATRIC

9 ASIA PACIFIC NEUROSURGERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BRAIN TUMORS

9.3 TRAUMA SURGERY

9.4 SPINE SURGERY

9.5 PARKINSON’S DISEASE AND TREMORS

9.6 PERIPHERAL NERVE SURGERY

9.7 EPILEPSY

9.8 FUNCTIONAL NEUROSURGERY

9.9 CAROTID ARTERY BLOCKAGE/STENOSIS

9.1 INTRAOPERATIVE ANGIOGRAPHY

9.11 CEREBROVASCULAR SURGERY

9.12 ANEURYSMS

9.13 PITUITARY TUMORS

9.14 RADIOSURGERY

9.15 STEREOTACTIC NEUROSURGERY

9.16 CORTICAL MAPPING

9.17 ARTERIOVENOUS MALFUNCTION (AVM)

9.18 SKULL BASE SURGERY

9.19 TRIGEMINAL NEURALGIA

9.2 OTHERS

10 ASIA PACIFIC NEUROSURGERY MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 ACUTE CARE HOSPITALS

10.2.2 LONG-TERM CARE HOSPITALS

10.2.3 NURSING FACILITIES

10.2.4 REHABILITATION CENTERS

10.3 RESEARCH CENTERS

10.4 NEUROSURGERY CENTERS

10.5 AMBULATORY SURGICAL CENTERS (ASCS)

10.6 OTHERS

11 ASIA PACIFIC NEUROSURGERY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 ASIA PACIFIC NEUROSURGERY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC NEUROSURGERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MEDTRONIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 STRYKER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ABBOTT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 INTEGRA LIFESCIENCES (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ADEOR MEDICAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ADVANTIS MEDICAL IMAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALEVA NEUROTHERAPEUTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ANT NEURO

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 B. BRAUN SE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 BIOINDUCTION

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BRAINLAB AG

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ELEKTA

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMS HANDELS GESELLSCHAFT MBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 INOMED MEDIZINTECHNIK GMBH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 KARL STORZ SE & CO. KG

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 LEICA MICROSYSTEMS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LIVANOVA PLC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 NEVRO CORP.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 OPTOFINE INSTRUMENTS PVT. LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 PENUMBRA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 RENISHAW PLC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 SYNAPSE BIOMEDICAL INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 TERUMO MEDICAL CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENTS

15.25 MACHIDA ENDOSCOPE CO., LTD.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 NALU MEDICAL, INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 WALLABY MEDICAL

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 ASIA PACIFIC NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NEUROSURGERY DEVICES IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC NEUROSURGERY DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC INTERNAL NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SPINAL CORD STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC DEEP BRAIN STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SACRAL NERVE STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC VAGUS NERVE STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC GASTRIC ELECTRICAL STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC EXTERNAL NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC NEURO-INTERVENTIONAL DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC EMBOLIZATION COILS IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC NEUROVASCULAR THROMBECTOMY IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC NEUROSURGICAL POWER TOOLS IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DRILL IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CEREBROSPINAL FLUID (CSF) MANAGEMENT DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC NEUROSURGERY SOFTWARE IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC NEUROSURGERY SOFTWARE IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC CONSUMABLES IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NEUROSURGERY MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC PEDIATRIC IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ADULT IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC GERIATRIC IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC NEUROSURGERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC BRAIN TUMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC TRAUMA SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SPINE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC PARKINSON’S DISEASE AND TREMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC PERIPHERAL NERVE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC EPILEPSY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC FUNCTIONAL NEUROSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC CAROTID ARTERY BLOCKAGE/STENOSIS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC INTERAOPERATIVE ANGIOGRAPHY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC CEREBROVASCULAR SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC ANEURYSMS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC PITUITARY TUMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC RADIOSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC STEREOTACTIC NEUROSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC CORTICAL MAPPING IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC ARTERIOVENOUS MALFUNCTION (AVM) IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SKULL BASE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC TRIGEMINAL NEURALGIA IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC NEUROSURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC HOSPITALS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC HOSPITALS IN NEUROSURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC RESEARCH CENTERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC NEUROSURGERY CENTERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC AMBULATORY SURGICAL CENTERS (ASCS) IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC NEUROSURGERY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC DIRECT TENDER IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC NEUROSURGERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC NEUROSURGERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC NEUROSURGERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC NEUROSURGERY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC NEUROSURGERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC NEUROSURGERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC NEUROSURGERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC NEUROSURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC NEUROSURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC NEUROSURGERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING PREVALENCE OF NEUROLOGICAL DISEASES, EFFORTS TO DEVELOP THE APPLICATION BASE FOR NEUROMODULATION, AND THE BENEFITS OF NEUROENDOSCOPIC SURGERIES OVER CONVENTIONAL BRAIN SURGERIES ARE EXPECTED TO DRIVE THE ASIA PACIFIC NEUROSURGERY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NEUROSURGERY DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC NEUROSURGERY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND, CHALLENGES OF ASIA PACIFIC NEUROSURGERY MARKET

FIGURE 14 ASIA PACIFIC NEUROSURGERY MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA PACIFIC NEUROSURGERY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC NEUROSURGERY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC NEUROSURGERY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC NEUROSURGERY MARKET: BY AGE GROUP, 2021

FIGURE 19 ASIA PACIFIC NEUROSURGERY MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC NEUROSURGERY MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC NEUROSURGERY MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC NEUROSURGERY MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC NEUROSURGERY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC NEUROSURGERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC NEUROSURGERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC NEUROSURGERY MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC NEUROSURGERY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC NEUROSURGERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC NEUROSURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 ASIA PACIFIC NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 ASIA-PACIFIC NEUROSURGERY MARKET: SNAPSHOT (2021)

FIGURE 35 ASIA-PACIFIC NEUROSURGERY MARKET: BY COUNTRY (2021)

FIGURE 36 ASIA-PACIFIC NEUROSURGERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 ASIA-PACIFIC NEUROSURGERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 ASIA-PACIFIC NEUROSURGERY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 39 ASIA PACIFIC NEUROSURGERY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。