سوق مختبرات الأسنان في منطقة آسيا والمحيط الهادئ، حسب المنتجات (الأجهزة العامة والتشخيصية، والأجهزة القائمة على العلاج وغيرها)، واتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى

تشمل المعدات في مختبر الأسنان مجموعة كاملة من الأنظمة المستخدمة في تصنيع أطقم الأسنان الثابتة أو المتحركة. تتمثل مهمة فني مختبر الأسنان في تصنيع التيجان والجسور وأطقم الأسنان والأجهزة التقويمية بناءً على وصفة طبيب الأسنان. تتطلب العديد من هذه المهام دقة عالية، وتؤثر مهارة الفني بشكل كبير على النجاح النهائي للعلاج. يتم تدريب فنيي المختبر في العمل أو في برامج التعليم الرسمي.

إن التقدم التكنولوجي في صناعة طب الأسنان هو استخدام عملية التصميم بمساعدة الكمبيوتر والتصنيع بمساعدة الكمبيوتر (CAD / CAM) ؛ العملية، من خلال تطوير أجهزة المسح الضوئي ثلاثية الأبعاد عالية الدقة، وتصميم البرمجيات أكثر دقة وأسرع وأبسط، والتصنيع الدقيق الطرحي أو الإضافي للمواد المبتكرة.

تعريف السوق

إن الدور الأساسي لمختبر الأسنان هو توفير طب الأسنان الترميمي، وهو نسخ جميع المعايير الوظيفية والجمالية التي حددها طبيب الأسنان إلى حل ترميمي. وخلال عملية الترميم بأكملها، من الاستشارة الأولية للمريض والتشخيص وتخطيط العلاج إلى وضع الترميم النهائي، يمكن لطرق الاتصال بين طبيب الأسنان وفني المختبر الآن توفير نقل كامل للمعلومات. المكونات الوظيفية ومعايير الإطباق والصوتيات والمتطلبات الجمالية ليست سوى بعض الأنواع الأساسية من المعلومات الضرورية للفنيين لإكمال تصنيع الترميمات الناجحة والوظيفية والجمالية. واليوم، كما في الماضي، تشمل أدوات الاتصال بين طبيب الأسنان وفني المختبر التصوير الفوتوغرافي والتوثيق المكتوب وانطباعات الأسنان الموجودة لدى المريض.

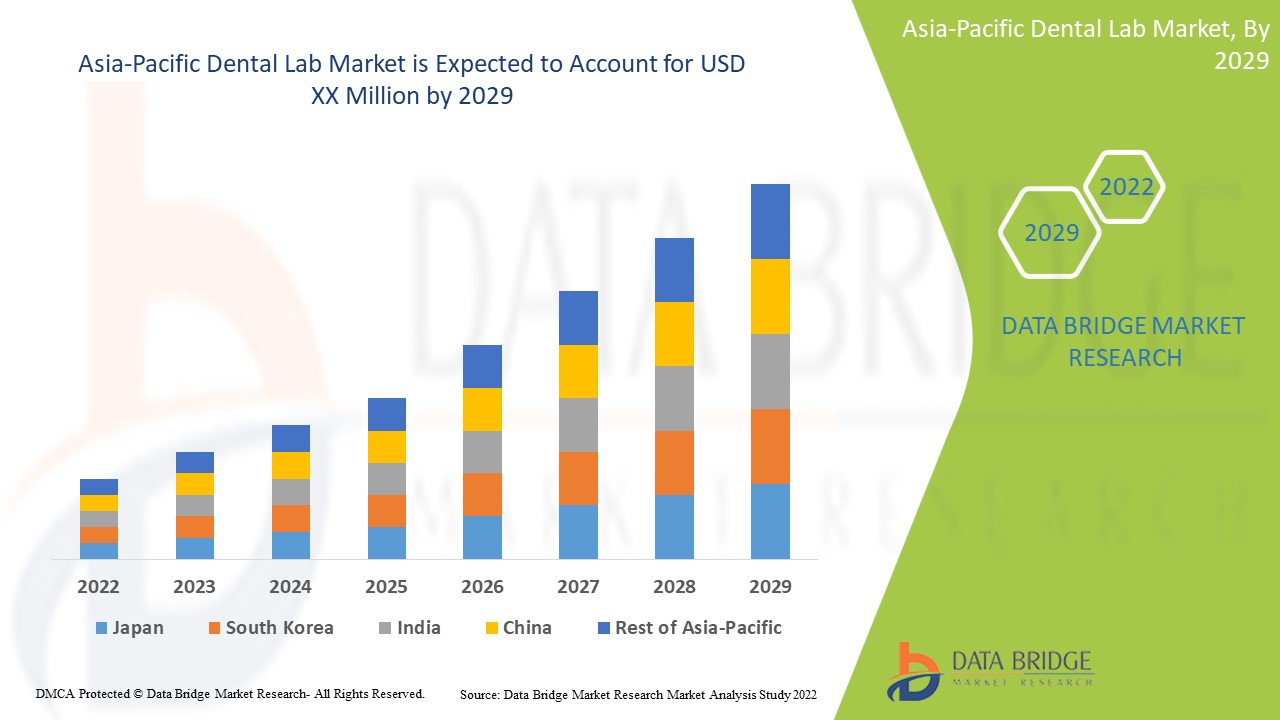

يقدم مختبر الأسنان في منطقة آسيا والمحيط الهادئ الدعم ويهدف إلى تقليل شدة الأعراض. وتشير تحليلات Data Bridge Market Research إلى أن سوق مختبرات الأسنان سوف ينمو بمعدل نمو سنوي مركب يبلغ 13.4%، خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

المنتجات حسب النوع (الأجهزة العامة والتشخيصية، والأجهزة القائمة على العلاج وغيرها) |

|

الدول المغطاة |

اليابان والهند والصين وكوريا الجنوبية وأستراليا وسنغافورة وتايلاند وماليزيا وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ |

|

الجهات الفاعلة في السوق المشمولة |

Ultradent Products Inc.، A-dec Inc.، BioHorizons IPH Inc.، Carestream Health، Dentatus، Roland DGA Corporation، 3Shape A/S، Formlabs، PLANMECA OY، Septodont، 3M، BEGO GmbH & Co. KG، VOCO Gmbh، Henry Schein, Inc.، GC Corporation، BIOLASE, Inc.، Bicon, LLC، Dentsply Sirona، Envista (شركة تابعة لشركة Danaher Corporation).، Kulzer GmbH. (شركة تابعة لشركة Mitsui Chemicals, Inc)، CAMLOG Biotechnologies GmbH، Zimvie Inc. (شركة تابعة لشركة Zimmer Biomet)، Institut Straumann AG وOSSTEM UK |

ديناميكيات سوق مختبرات الأسنان في منطقة آسيا والمحيط الهادئ

السائقين

- ارتفاع معدل انتشار اضطرابات الأسنان

تعد صحة الفم من أهم جوانب الحفاظ على صحة اللثة والأسنان والجهاز الفموي الوجهي الذي يسمح بالتحدث والمضغ والابتسام، ووفقًا لتقرير منظمة الصحة العالمية في مارس 2022، يعاني حوالي 2.0 مليار شخص حول العالم من تسوس الأسنان الدائمة، ومن بينهم حوالي 520 مليون طفل يعانون من تسوس الأسنان اللبنية.

تشمل اضطرابات الأسنان الأكثر شيوعًا تسوس الأسنان وأمراض اللثة وسرطان الفم.

على سبيل المثال،

- في عام 2021، في الولايات المتحدة، تشير بيانات مركز السيطرة على الأمراض والوقاية منها (CDC) إلى أن أكثر من 1 من كل 4 (26%) من البالغين في الولايات المتحدة يعانون من تسوس الأسنان غير المعالج. يعاني 70.1% من البالغين الذين تبلغ أعمارهم 65 عامًا أو أكثر من أمراض اللثة، ويعاني 47.2% من البالغين الذين تبلغ أعمارهم 30 عامًا أو أكثر من شكل من أشكال أمراض اللثة.

وبما أن الشركات منخرطة باستمرار في أنشطة البحث والتطوير، فإن المعرفة حول انتشار اضطرابات الفم من شأنها أن تساعد في إيجاد حلول جديدة، وهذا من شأنه أن يساعد في المزيد من التعاون والشراكات مع اللاعبين في السوق في بلدان مثل منطقة آسيا والمحيط الهادئ. وبالتالي، من المتوقع أن تعمل حالات الاضطرابات السنية المتزايدة مثل تسوس الأسنان وتآكل الأسنان وسرطانات الفم على تعزيز نمو سوق مختبرات الأسنان العالمية.

- ارتفاع نشاط البحث والتطوير في صناعات طب الأسنان

لقد أدى ضغط الأسعار إلى تغييرات في الديناميكيات الأساسية لصناعة زراعة الأسنان. لقد خلقت الابتكارات زيادة كبيرة في عدد اللاعبين المحليين والإقليميين المشاركين في إنشاء منتجات مماثلة وتقديمها بتكلفة أقل.

على سبيل المثال،

- في عام 2018، أعلنت شركة Young Innovations (الولايات المتحدة) عن استحواذها على شركة Johnson-Promidet (الولايات المتحدة). تركز الشركة على حلول القطع اليدوية عالية الجودة لطب الأسنان. سيؤدي هذا الاستحواذ إلى تقديم منتجات وحلول مبتكرة وعالية الجودة للأطباء ومرضاهم، كما سيعزز محفظتها من العلامات التجارية والمنتجات من خلال النمو العضوي والاستحواذات.

لقد أدى زيادة أنشطة البحث والتطوير إلى جعل الشركات أكثر نشاطًا في توسيع خدماتها في السوق واستهداف المزيد من العملاء في السوق مما أدى إلى نمو سوق مختبرات الأسنان العالمية.

فرص

- إصدارات المنتجات الجديدة

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

The companies which are involved in the dental lab market have been coming up with various new products based on new technologies most noticeable launches amongst these in the field of dental labs are in the field of Dental Imaging and digital dentistry.

For instance,

- In 2019, Zimmer Biomet (Indiana, U.S.) announced the launch of its new line of non-resorbable membranes and sutures which are specifically designed to eliminate bacterial infiltration into the surgical site

These strategic initiatives such as by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity that is helping them to drive market growth.

Restraints/Challenges

- Lack Of Proper Reimbursement Scenario

There is a rapid change that is occurring in the dentistry treatments, dental insurance, reimbursement rates, and rules and regulations are also changing. The dental billing services have been aiming at submitting accurate claims to insurance payers and have been receiving maximum reimbursement; these claims are being declined due to many factors which may include invalid documentation amongst others. The survey conducted by Bankers Healthcare Group (BHG) revealed that the decline in the reimbursement rates is a very major concern amongst the dental professionals.

The current coverage evaluation procedure lacks transparency, and also it differs among different payers, which ultimately leads to inconsistent coverage decisions and hence limits healthcare professionals and patients' to access the best treatment. This insurance issue hinders the market and creates various challenges for the industry making it an accountable restrain to the market.

- Lack Of Skilled Technicians

There is a shortage of skilled labor in the field of healthcare in emerging or developing countries due to migrations and several other factors.

Africa had the most inadequate health system especially dealing with the regions in sub-Saharan Africa, which have been severely damaged due to the migration of the health professionals. On average 57 countries were noted to have a critical shortage of healthcare workers with a deficit of around 2.4 million doctors and nurses.

Covid-19 Impact on the Dental Lab Market

During the pandemic, dental lab has a remarkable effect on reducing mortality and morbidity of patients with COVID-19. Further large-scale studies are needed to approve these results. A protocol for dental lab in COVID-19 infection should be defined to achieve the best possible clinical outcomes. Dental laboratories and the technicians are leaving declining levels of extinction. According to National Center of Biotechnology Information, studies have shown that there is high level of contamination for dental impressions arriving in a dental laboratory.

Recent Development

- In September, Envista formed an agreement with Planmeca OY. The agreement stated that, Envista, would sell its KaVo Treatment Unit and Instrument business to Planmeca OY for USD 455 million, for the potential earn-out payment of up to USD 30 million. It would increase the number of customers and increase the availability of KaVo Treatment Unit across dental clinics.

Asia-Pacific Dental Lab Market Scope

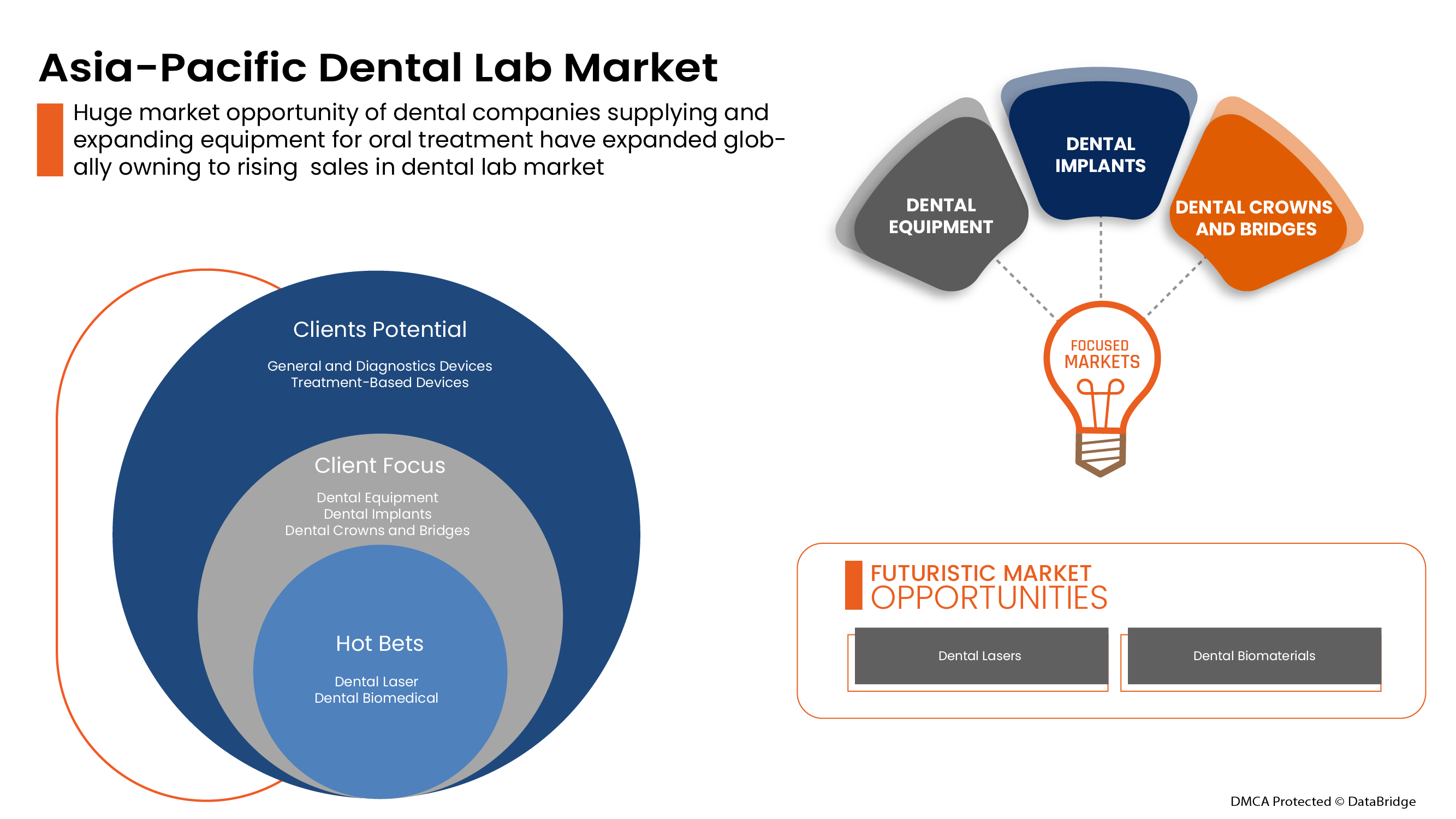

The dental lab market is segmented on the basis of one segment: products. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- General & Diagnostic Devices

- Treatment-Based Devices

- Others

On the basis of products, the Asia-Pacific dental lab market is segmented into general & diagnostic devices, treatment-based devices and others.

Pipeline Analysis

Dental lab Market Regional Analysis/Insights

The Asia-Pacific dental lab market is analysed and market size insights and trends are provided by regions, product as referenced above.

The countries covered in the dental lab market report are Japan, India, China, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia Pacific.

China is expected to dominate the market due to rise in cases of periodontal disorders, rise in medical tourism and the rise in patient population dental lab in Asia-Pacific region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Dental lab Market Share Analysis

يوفر المشهد التنافسي لسوق مختبرات الأسنان في منطقة آسيا والمحيط الهادئ تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في منطقة آسيا والمحيط الهادئ، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق مختبرات الأسنان.

بعض اللاعبين الرئيسيين العاملين في سوق مختبرات الأسنان هم Ultradent Products Inc. و A-dec Inc. و BioHorizons IPH Inc. و Carestream Health و Dentatus و Roland DGA Corporation و 3Shape A/S و Formlabs و PLANMECA OY و Septodont و 3M و BEGO GmbH & Co. KG و VOCO Gmbh و Henry Schein, Inc. و GC Corporation و BIOLASE, Inc. و Bicon, LLC و Dentsply Sirona و Envista (شركة تابعة لشركة Danaher Corporation). و Kulzer GmbH. (شركة تابعة لشركة Mitsui Chemicals, Inc) و CAMLOG Biotechnologies GmbH و Zimvie Inc. (شركة تابعة لشركة Zimmer Biomet) و Institut Straumann AG و OSSTEM UK وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC DENTAL LAB MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC DENTAL LABMARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC DENTAL LAB MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN THE GERIATRIC POPULATION

6.1.2 HIGH PREVALENCE OF DENTAL DISORDERS

6.1.3 RISE IN RESEARCH AND DEVELOPMENT ACTIVITY IN DENTAL INDUSTRIES

6.1.4 INCREASING AWARENESS OF PERIODONTAL DISEASE

6.1.5 GROWING MEDICAL TOURISM FOR DENTAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DENTAL EQUIPMENT AND MATERIALS

6.2.2 LACK OF PROPER REIMBURSEMENT SCENARIO

6.2.3 LACK OF DENTAL KNOWLEDGE IN EMERGING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT RELEASES

6.3.2 INCREASED AESTHETIC DENTISTRY IN DENTAL LABS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED TECHNICIANS

6.4.2 DELAYED ADOPTION OF ADVANCED TECHNOLOGIES IN EMERGING ECONOMIES

7 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 GENERAL AND DIAGNOSTICS DEVICES

7.2.1 DENTAL EQUIPMENT

7.2.1.1 DENTAL CHAIRS

7.2.1.2 HAND PIECES

7.2.1.3 LIGHT CURE EQUIPMENT

7.2.1.4 SCALING UNITS

7.2.2 DENTAL IMPLANTS

7.2.2.1 TITANIUM DENTAL IMPLANTS

7.2.2.2 ZIRCONIA DENTAL IMPLANTS

7.2.3 DENTAL CROWNS & BRIDGES

7.2.3.1 METAL-FUSED CERAMIC CROWNS

7.2.3.2 CERAMIC CAD/CAM

7.2.3.3 CERAMIC CONVENTIONAL CROWNS & BRIDGES

7.2.4 DENTAL SYSTEMS AND PARTS

7.2.4.1 INSTRUMENT DELIVERY SYSTEMS

7.2.4.2 CONE BEAM CT SCANNING

7.2.4.3 CAD/CAM SYSTEMS

7.2.4.4 3D PRINTERS

7.2.4.5 DENTAL MILLING MACHINE

7.2.5 DENTAL RADIOLOGY EQUIPMENT

7.2.5.1 EXTRA-ORAL RADIOLOGY

7.2.5.1.1 FILM-BASED DEVICES

7.2.5.1.2 DIGITAL DEVICES

7.2.5.2 INTRA-ORAL RADIOLOGY

7.2.5.2.1 BITEWINGS

7.2.5.2.2 PERIAPICALS

7.2.5.2.3 OCCUSAL

7.2.6 DENTAL BIOMATERIALS

7.2.7 DENTAL LASERS

7.2.7.1 DIODE LASERS

7.2.7.2 YTTRIUM LASERS

7.2.7.3 CO2 LASERS

7.3 TREATMENT-BASED DEVICES

7.3.1 ORTHODONTICS

7.3.1.1 REMOVABLE

7.3.1.2 FIXED

7.3.1.2.1 BRACKETS

7.3.1.2.2 ARCHWIRES

7.3.1.2.3 ANCHORAGE APPLIANCES

7.3.1.2.4 LIGATURES

7.3.2 ENDOTONICS

7.3.2.1 PERMANENT ENDODONTIC SEALERS

7.3.2.2 OBTURATORS

7.3.3 PERIODONTICS

7.3.3.1 DENTAL ANESTHETICS

7.3.3.1.1 INJECTABLE ANESTHETICS

7.3.3.1.2 TOPICAL ANESTHETICS

7.3.3.2 DENTAL SUTURES

7.3.3.3 DENTAL HEMOSTATS

7.3.3.3.1 COLLAGEN-BASED HEMOSTATS

7.3.3.3.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS

7.3.3.3.3 GELATIN-BASED HEMOSTATS

7.4 OTHERS

7.4.1 OTHER DENTAL LABORATORY MACHINES

7.4.2 HYGIENE MAINTENANCE DEVICES

7.4.3 RETAIL DENTAL CARE ESSENTIALS

7.4.4 OTHER CONSUMABLES

8 ASIA PACIFIC DENTAL LAB MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 INDIA

8.1.4 SOUTH KOREA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC DENTAL LAB MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 HENRY SCHEIN, INC.(2021)

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DENTSPLY SIRONA (2021)

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ENVISTA (A SUBSIDIARY OF DANAHER CORPORATION) (2021)

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 INSTITUT STRAUMANN AG (2021)

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALTSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 PLANMECA OY. (2021)

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 3M (2021)

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 A-DEC-IN (2021)

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 BIOHORIZONS IPH, INC. (2021)

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 BIOLASE, INC.(2021)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENTS

11.1 BEGO GMBH & CO. KG

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 BICON, LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 CAMLOG BIOTECHNOLOGIES GMBH

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENTS

11.13 CARESTREAM HEALTH (2021)

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENTS

11.14 DENTATUS (2021)

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 FORMLABS (2021)

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 GC CORPORATION

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENTS

11.17 KULZER GMBH (A SUBSIDIARY OF MITSUI CHEMICALS, INC) (2021)

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT DEVELOPMENTS

11.18 OSSTEM U.K.(2021)

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENTS

11.19 PINDAN DENTAL LABORATORY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 ROLAND DG CORPORATION (2021)

11.20.1 COMPANY SNAPSHOT

11.20.2 REVENUE ANALYSIS

11.20.3 PRODUCT PORTFOLIO

11.20.4 RECENT DEVELOPMENTS

11.21 SEPTODONT (2021)

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 3 SHAPE A/S (2021)

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENTS

11.23 ULTRADENT PRODUCTS INC (2021)

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENTS

11.24 VOCO GMBH (2021)

11.24.1 COMPANY SNAPSHOT

11.24.2 PRODUCT PORTFOLIO

11.24.3 RECENT DEVELOPMENTS

11.25 YOUNG INNOVATIONS, INC (2021)

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENTS

11.26 ZIMVIE INC. (A SUBSIDIARY OF ZIMMET BIOMET HOLDINGS)(2021)

11.26.1 COMPANY SNAPSHOT

11.26.2 REVENUE ANALYSIS

11.26.3 PRODUCT PORTFOLIO

11.26.4 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 DENTAL TREATMENT COSTS IN THE U.K.

TABLE 2 AESTHETIC PROCEDURES AND COST RANGES IN THE U.S. (2018)

TABLE 3 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY PRODUCTS ,2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DENTAL CROWNS & BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DENTAL RADIOLOGY EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ENDODONTICS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC DENTAL LAB MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 43 CHINA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 44 CHINA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 45 CHINA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 46 CHINA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 47 CHINA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 48 CHINA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 49 CHINA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 50 CHINA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 51 CHINA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 52 CHINA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 CHINA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 54 CHINA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 55 CHINA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 56 CHINA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 57 CHINA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 58 CHINA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 59 CHINA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 60 CHINA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 61 JAPAN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 62 JAPAN GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 63 JAPAN DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 64 JAPAN DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 65 JAPAN DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 66 JAPAN DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 67 JAPAN DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 68 JAPAN EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 JAPAN INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 70 JAPAN DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 72 JAPAN ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 73 JAPAN FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 76 JAPAN DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 77 JAPAN DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 78 JAPAN OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 79 INDIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 80 INDIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 81 INDIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 82 INDIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 83 INDIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 84 INDIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 INDIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 86 INDIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 87 INDIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 88 INDIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 89 INDIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 90 INDIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 91 INDIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 92 INDIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 93 INDIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 94 INDIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 95 INDIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 96 INDIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 151 THAILAND DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 152 THAILAND GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 153 THAILAND DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 154 THAILAND DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 155 THAILAND DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 156 THAILAND DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 157 THAILAND DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 158 THAILAND EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 159 THAILAND INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 161 THAILAND TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 162 THAILAND ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 163 THAILAND FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 164 THAILAND ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 165 THAILAND PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 166 THAILAND DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 167 THAILAND DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 168 THAILAND OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 198 INDONESIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 199 INDONESIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 217 PHILIPPINES FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 218 PHILIPPINES ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 223 REST OF ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC DENTAL LAB MARKET : SEGMENTATION

FIGURE 2 ASIA PACIFIC DENTAL LABMARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DENTAL LABMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DENTAL LABMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DENTAL LABMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DENTAL LABMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC DENTAL LABMARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC DENTAL LABMARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC DENTAL LAB MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC DENTAL LAB MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASED INCIDENCE OF DENTAL DISEASES, RISE IN PRODUCT LAUNCHES AND MEDICAL TOURISM FOR DENTAL TREATMENT ACROSS THE WORLD IS EXPECTED TO DRIVE THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC DENTAL LAB MARKET

FIGURE 14 FORECAST GERIATRIC POPULATION 2010-2050 TIME PERIOD (IN MILLIONS)

FIGURE 15 INCREASED INCIDENCE OF PERIODONTAL DISEASE IN THE U.S., 2020

FIGURE 16 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2021

FIGURE 17 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DENTAL LAB MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC DENTAL LAB MARKET: BY PRODUCTS (2022-2029)

FIGURE 25 ASIA PACIFIC DENTAL LAB MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.