سوق الورق المطلي في أمريكا الشمالية، حسب المنتج (ورق الخشب المطلي، والورق الناعم المطلي القياسي، والورق منخفض الوزن، والورق المطلي بالصبغة، والورق الفني، وورق المينا وغيرها)، وطبقة الطلاء (مطلية من جانب واحد ومطلية من جانبين)، ومواد الطلاء (الطين، وكربونات الكالسيوم ، والتلك، وطين الكاولين، والشمع، وثاني أكسيد التيتانيوم وغيرها)، واللمسة النهائية (اللامع، والساتان، وغير اللامع، والباهت وغيرها)، وطريقة الطلاء (المطلي يدويًا، والمطلي بالفرشاة، والمطلي بالآلة وغيرها)، وعملية التشطيب (التقويم عبر الإنترنت والتقويم غير المتصل بالإنترنت)، والتطبيق (الطباعة والتغليف والتسميات وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2030.

تحليل ورؤى حول سوق الورق المطلي في أمريكا الشمالية

الورق الذي تم وضع طبقة نهائية عليه أو طلاء لتحسين تشطيبه وقابليته للطباعة أثناء عملية التصنيع. والغرض من الطلاء هو تحسين خصائص معينة للورق، مثل العتامة والسطوع والبياض واللون ونعومة السطح واللمعان وقابلية الحبر، بحيث يكون للمنتج الورقي النهائي الخصائص المطلوبة للتطبيق المقصود منه. يتم تصنيف الأوراق المطلية وفقًا لكمية الطلاء المطبقة؛ وتشمل هذه التصنيفات الأوراق المطلية الخفيفة والمتوسطة والعالية والورق الفني (الذي يستخدم للأعمال الفنية عالية الدقة).

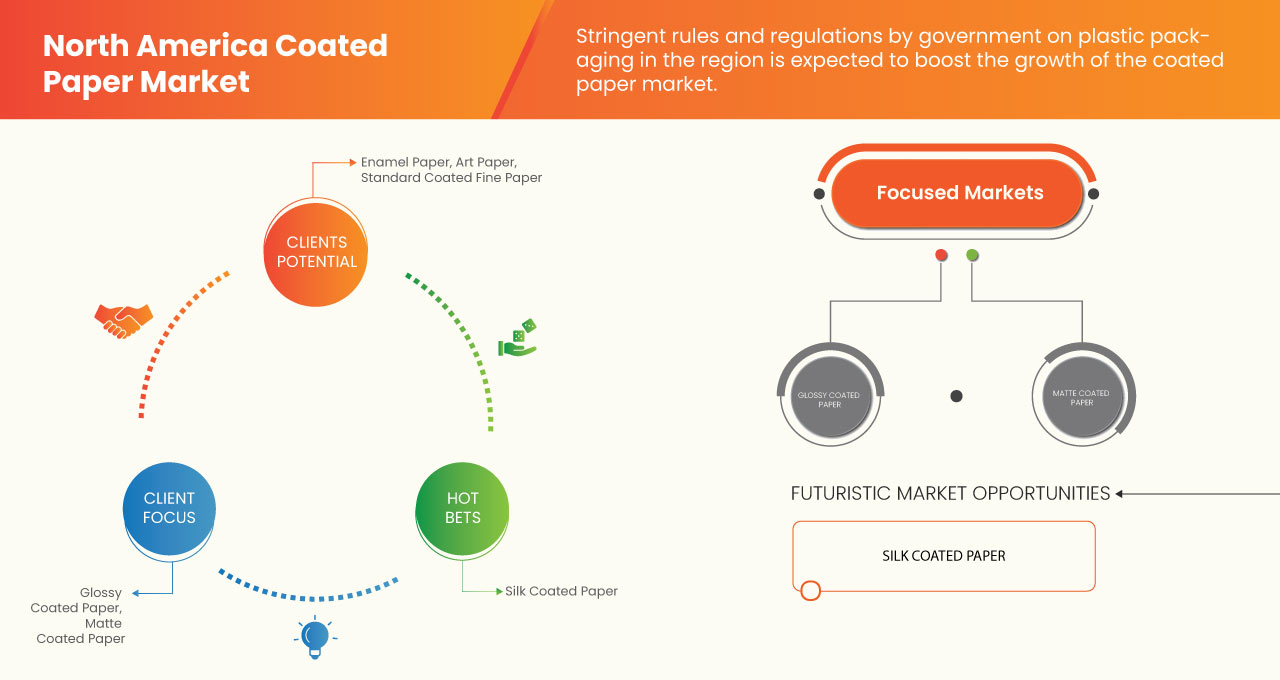

إن التطورات الجديدة في تكنولوجيا طلاء الورق إلى جانب أنماط الحياة المتغيرة والمحسنة للمستهلكين تؤدي إلى زيادة الطلب بشكل كبير على المنتجات ذات التغليف المغلف مما يخلق فرصًا هائلة لمصنعي سوق الورق المغلف. ومن المتوقع أن يشكل التقلب في أسعار المواد الخام تحديًا لنمو السوق.

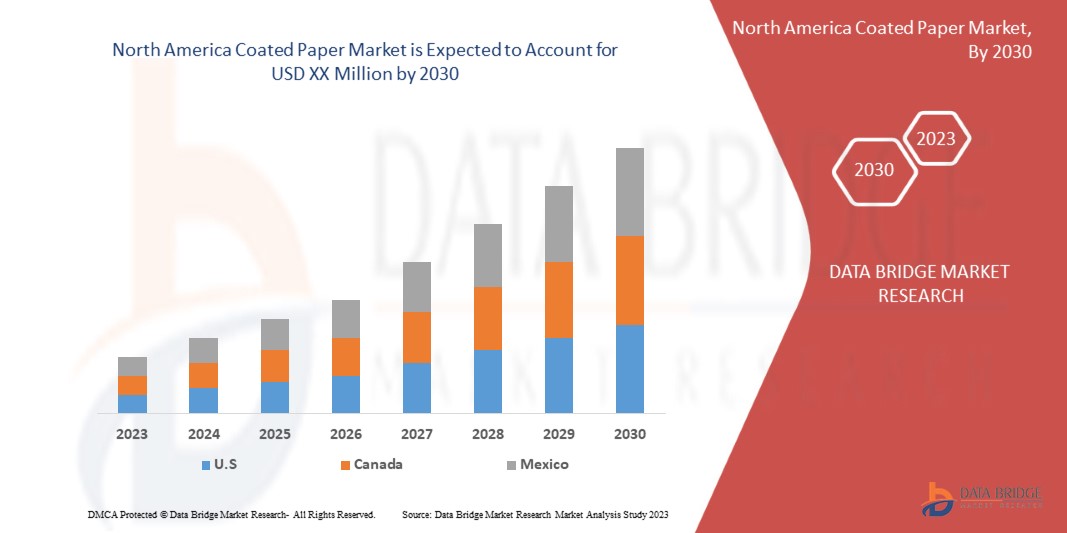

تشير تحليلات Data Bridge Market Research إلى أن سوق الورق المطلي في أمريكا الشمالية سينمو بمعدل نمو سنوي مركب قدره 4.2٪ خلال الفترة المتوقعة من 2023 إلى 2030.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

المنتج (ورق الخشب المطلي، والورق الناعم المطلي القياسي، والورق منخفض الوزن، والورق المطلي بالصبغة، والورق الفني، وورق المينا وغيرها)، طبقة الطلاء (مطلية من جانب واحد ومطلية من جانبين)، مادة الطلاء (الطين، وكربونات الكالسيوم، والتلك، وطين الكاولين، والشمع، وثاني أكسيد التيتانيوم وغيرها)، التشطيب (اللامع، والساتان، وغير اللامع، والباهت وغيرها)، طريقة الطلاء (مطلي يدويًا، ومطلي بالفرشاة، ومطلي آليًا وغيرها)، عملية التشطيب (التقويم عبر الإنترنت والتقويم غير المتصل بالإنترنت)، التطبيق (الطباعة والتغليف والتسميات وغيرها) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

شركة Oji Holdings Corporation، وشركة Nippon Paper Industries Co.، Ltd.، وشركة Stora Enso، وشركة Sappi Ltd.، وشركة Asia Pulp & Paper (APP) Sinar Mas، وشركة skpmil.com، وشركة UPM، وشركة DS Smith، وشركة Dunn Paper Company، وشركة Paradise Packaging، وشركة Burgo Group Spa، وشركة JK Paper، وشركة Emami Paper Mills Ltd.، وشركة Koehler Holding SE & Co. KG، وشركة Lecta، وشركة Twin Rivers Paper Company، وشركة Svenska Cellulosa Aktiebolaget SCA (Publ)، وشركة Billerud Americas Corporation وغيرها. |

تعريف السوق

الورق المطلي هو ورق تم طلاؤه ببوليمر أو خليط من المواد لإضفاء صفات معينة على الورق، مثل الوزن أو لمعان السطح أو النعومة أو امتصاص الحبر المنخفض. لطلاء الورق للطباعة عالية الجودة في صناعة التعبئة والتغليف والمجلات، يمكن استخدام مواد مختلفة مثل الكاولينيت وكربونات الكالسيوم والبنتونيت والتلك. الأوراق المطلية هي تلك التي لها لمسة نهائية لامعة أو شبه لامعة أو غير لامعة. يتم وضع عامل طلاء على سطح الورق المطلي لتحسين السطوع أو النعومة أو خصائص الطباعة الأخرى. تُستخدم الأسطوانات لتلميع الورق بعد طلائه. تملأ الحفر والفجوات الصغيرة بين الألياف لإنشاء سطح أملس ومسطح.

ديناميكيات سوق الورق المطلي في أمريكا الشمالية

السائقين

-

ارتفاع الطلب على الصور المطبوعة عالية الجودة

تطبع الأوراق المطلية صورًا حادة ورائعة بسبب انعكاسيتها العالية. بالإضافة إلى ذلك، توفر سطح طباعة متفوقًا على الأوراق غير المطلية، مما يؤدي إلى طباعة عالية الجودة. الأوراق المطلية مقاومة للأوساخ والرطوبة، ولأنها غير ماصة، فإنها تستخدم حبرًا أقل للطباعة. غالبًا ما يتم طلاء الورق المطلي بالشمع والطين وطين الكاولين واللاتكس وأكسيد التيتانيوم وما إلى ذلك، مما يتيح للورق أن يلمع بشكل أكثر إشراقًا ويعزز جودة الصور المطبوعة عليه. يمكن استخدام الورق المطلي في مجموعة متنوعة من التطبيقات النهائية مثل الكتالوجات وإضافات الصحف ومنتجات الورق المحولة وأوراق الأمان والمجلات والمواد الإعلانية لأنه عادةً ما يكون له لمسة نهائية لامعة أو غير لامعة. نظرًا لأنه ينتج صورًا حادة ومعقدة، يتم استخدام الورق المطلي كثيرًا لأغراض الطباعة.

عادةً ما تكون الأوراق المطلية أثقل وزنًا من الأوراق غير المطلية، مما يزيد من وزن عملية الطباعة. يُعد الورق المطلي أكثر ملاءمة لبعض تقنيات التشطيب مثل طلاء الغمر أو البقع أو طلاءات التشطيب الأخرى لأنه أكثر نعومة ويتمتع بقدرة أفضل على الاحتفاظ بالحبر (أقل امتصاصًا) من الورق غير المطلي. توفر أوراق الطلاء مطبوعات عالية الجودة للعديد من اللاعبين الرئيسيين في سوق الورق المطلي في أمريكا الشمالية، ويتم تصنيعها من قبل العديد من اللاعبين الرئيسيين في سوق الورق المطلي في أمريكا الشمالية.

ومن ثم، من المتوقع أن يؤدي الطلب المتزايد على المطبوعات والصور عالية الجودة في مختلف المجلات والكتيبات والنشرات وما إلى ذلك إلى دفع نمو سوق الورق المطلي في أمريكا الشمالية

-

زيادة الطلب على الورق المطلي في صناعة الأغذية

تستخدم الأوراق المطلية في تطبيقات متعددة في صناعات مختلفة بما في ذلك صناعة الأغذية حيث تُستخدم الأوراق المطلية على نطاق واسع لتغليف المواد الغذائية على مستوى العالم. تتحول أغلفة الأغذية من البلاستيك إلى مواد ورقية أكثر قابلية للتحلل وإعادة التدوير مع ارتفاع الطلب في أمريكا الشمالية على الحلول المستدامة. من أجل تحسين الجودة والأداء الأفضل واستبدال الحشوات البلاستيكية، يجب أن تكون الأوراق المطلية المستخدمة عالية الجودة وطبيعة غير تفاعلية.

يُعد الورق المشمع مناسبًا للأطعمة، وخاصة لتغليف الأسماك واللحوم وألواح الشوكولاتة، نظرًا لمقاومته للرطوبة والشحوم، مما يجعله مناسبًا بشكل خاص للتلامس المباشر مع الجبن والزبدة وتغليف ألواح الشوكولاتة والأطعمة الزيتية. نظرًا لمقاومته للماء والزيوت والشحوم، يساعد الورق المشمع في الحفاظ على الطعام. تُعد الأوراق المطلية بالراتنج مثالية للأطعمة الطازجة والأطعمة الدهنية والأطعمة الرطبة، بالإضافة إلى الأكياس المخصصة للطعام.

تعتبر العبوات المصنوعة من ورق البولي إيثيلين مناسبة للتلامس المباشر مع الطعام، وتوفر ضمانًا للنضارة والحماية، وتفي بأعلى معايير نظافة الطعام. تُستخدم الأوراق المطلية وأوراق البرجر لتغليف الأطعمة المعروضة على المنضدة مثل اللحوم والأجبان والأطعمة المطبوخة في محلات السوبر ماركت ومحلات الجزارة ومحلات الأطعمة الشهية ومحلات الأطعمة الجاهزة. تُستخدم الأوراق المطلية بالبولي إيثيلين في محلات الجزارة ومحلات الأطعمة الشهية ومحلات السوبر ماركت لتغليف الأطعمة الطازجة. في الواقع، يعمل فيلم البولي إيثيلين عالي الكثافة كحاجز وقائي ضد الرطوبة والدهون والروائح.

فرص

-

تؤدي أنماط حياة المستهلكين المتغيرة والمحسنة إلى طلب كبير على المنتجات ذات العبوات المغلفة

تتغير أنماط حياة المستهلكين وتتحسن مع زيادة دخلهم المتاح، كما يتغير استهلاكهم للرعاية الصحية والأغذية والمشروبات ومنتجات العناية المنزلية، وخاصة في الاقتصادات النامية. ومن المتوقع أن يؤدي هذا في السنوات القادمة إلى زيادة الطلب على الورق المطلي.

بالإضافة إلى ذلك، أصبح أصحاب العلامات التجارية مهتمين بشكل متزايد بالطباعة والتغليف الصديق للبيئة نتيجة للأنظمة الحكومية التي تقيد استخدام البلاستيك الذي يستخدم مرة واحدة. وبسبب هذا، يتجه المصنعون نحو تقنيات طباعة وتغليف أكثر صداقة للبيئة، مما سيساعد في خلق فرص في سوق الورق المطلي.

يفضل جيل الألفية شراء الأطعمة المحضرة بسبب أنماط حياتهم المزدحمة ووعيهم الصحي المتزايد، وهو ما يدفع الطلب على مواد التغليف المطلية بسبب الحاجة المتزايدة إلى التغليف المعدل. وهذا من شأنه أن يولد فرصًا أخرى لتوسيع السوق

القيود/التحديات

- انتشار الرقمنة في مختلف الصناعات مما يحد من استخدام الورق

لقد شهدت جميع الصناعات طفرة في التحول الرقمي. إن السهولة والراحة التي توفرها الرقمنة تمكن الصناعيين من اختيار المنصات الرقمية. ومع استمرار العالم في الخضوع للتحول الرقمي الهائل، تتبنى القطاعات والصناعات الرئيسية التكنولوجيا الرقمية لضمان استعدادها للمستقبل ووضعها الجيد لتحقيق النجاح على مستوى العالم.

على سبيل المثال،

- في مارس 2022، وفقًا لـ CII، تطورت الشركات الرقمية إلى ما هو أبعد من مجرد الشراء والبيع على موقع ويب. أصبحت الرقمية الآن بمثابة وسيلة لتبادل السلع والخدمات مع ضمان وصولها إلى الأشخاص المناسبين. تستفيد الأسواق متعددة الجوانب من قوة تأثيرات الشبكة من خلال التجارة التعاونية للنمو بشكل كبير، مما يخلق قيمة لمستخدميها على أساس مستمر.

علاوة على ذلك، مكّنت الرقمنة المتنامية الصناعات من تقديم خدماتها ومعلوماتها على مواقعها الإلكترونية فقط. وقد تحول العديد من المصنعين في الصناعات إلى الكتيبات الإلكترونية والمجلات والتقارير السنوية وما إلى ذلك، مما أدى إلى عيب كبير لصناعة الورق المطلي. يعلن المصنعون من خلال الوسائط عبر الإنترنت والإعلانات التلفزيونية ومنصات التواصل الاجتماعي الأخرى، مما أدى إلى قمع نمو وسائل الإعلام الورقية مما يؤثر بشكل كبير على صناعة الورق المطلي.

ومن ثم، فإن التحول الرقمي المتزايد في جميع الصناعات قد يعيق نمو سوق الورق المطلي في أمريكا الشمالية.

تأثير ما بعد كوفيد-19 على سوق الورق المطلي في أمريكا الشمالية

لقد أثر فيروس كورونا المستجد (كوفيد-19) على السوق إلى حد ما. فبسبب الإغلاق، توقفت عمليات التصنيع والإنتاج للعديد من الشركات الصغيرة والكبيرة، كما انخفض الطلب على الورق المطلي، مما أثر على السوق. وبسبب التغيير في العديد من اللوائح والقوانين، يمكن للشركات المصنعة تصميم وإطلاق منتجات جديدة في السوق، مما سيساعد في نمو السوق.

التطورات الأخيرة

- في ديسمبر 2021، أعلنت شركة Lecta عن إطلاق ورق التبطين. Linerset CCK Duo عبارة عن ورق تبطين مطلي بالطين على الوجهين للسيليكون مع معالجة خاصة للجانب الخلفي. وقد أدى ذلك إلى توسيع مجموعة منتجات الشركة.

نطاق سوق الورق المطلي في أمريكا الشمالية

يتم تقسيم سوق الورق المطلي في أمريكا الشمالية إلى قطاعات بارزة بناءً على المنتج وطبقة الطلاء ومادة الطلاء واللمسة النهائية وطريقة الطلاء وعملية التشطيب والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

منتج

- ورق الخشب المطلي

- ورق فاخر مطلي قياسيًا

- ورق ذو وزن منخفض

- ورق مطلي بالصبغة

- ورق فني

- ورق المينا

- آحرون

بناءً على المنتج، يتم تقسيم سوق الورق المطلي في أمريكا الشمالية إلى ورق أرضي مطلي، وورق ناعم مطلي قياسي، وورق ذو وزن منخفض، وورق مطلي بالصبغة، وورق فني، وورق مينا وغيرها

طبقة الطلاء

- مطلي من جانب واحد

- مطلي على الوجهين

بناءً على طبقة الطلاء، يتم تقسيم سوق الورق المطلي في أمريكا الشمالية إلى ورق مطلي من جانب واحد وورق مطلي من جانبين

مواد الطلاء

- فخار

- كربونات الكالسيوم

- التلك

- طين الكاولين

- الشمع

- ثاني أكسيد التيتانيوم

- آحرون

بناءً على مادة الطلاء، يتم تقسيم سوق الورق المطلي في أمريكا الشمالية إلى الطين وكربونات الكالسيوم والتلك وطين الكاولين والشمع وثاني أكسيد التيتانيوم وغيرها.

ينهي

- لمعان

- صقيل

- مطفي

- ممل

- آحرون

Based on finish, the North America coated paper market is segmented into gloss, satin, matte, dull and others

Coating Method

- Hand-Coated

- Brush-Coated

- Machine Coated

- Others

Based on coating method, the North America coated paper market is segmented into hand-coated, brush-coated and machine coated and others.

Finishing Process

- Online Calendaring

- Offline Calendaring

Based on finishing process, the North America coated paper market is segmented into online calendaring and offline calendaring

Application

- Printing

- Packaging and Labelling

- Others

Based on application, the North America coated paper market is segmented into printing, packaging and labelling and others

North America Coated Paper Market Regional Analysis/Insights

The North America coated paper market is analyzed, and market size insights and trends are provided based on country and as referenced above.

The countries covered in the North America coated market report are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America coated paper market in terms of market share and revenue and is estimated to maintain its dominance during the forecast period due to the growing surge for coated paper in various industries and growing consumer demand from end users.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Coated Paper Market Share Analysis

The North America coated paper market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company’s focus on the North America coated paper market.

Some of the major players operating in the North America coated paper market are Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ), and Billerud Americas Corporation among others.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COATED PAPER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HIGH-QUALITY PRINT IMAGES

5.1.2 INCREASE IN DEMAND FOR COATED PAPER IN THE FOOD INDUSTRY

5.1.3 RISE IN E-COMMERCE AND ONLINE SHOPPING ACTIVITIES THUS CREATING DEMAND FOR THE PACKAGING INDUSTRY

5.1.4 STRINGENT GOVERNMENT RULES ON PLASTIC PACKAGING

5.2 RESTRAINTS

5.2.1 WIDESPREAD DIGITALIZATION ACROSS INDUSTRIES LIMITING THE USE OF PAPER

5.2.2 NEGATIVE IMPACT OF THE PAPER INDUSTRY ON THE ENVIRONMENT

5.2.3 HIGH INITIAL INVESTMENT IN COATED PAPER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 NEW ADVANCES IN PAPER COATING TECHNOLOGY

5.3.2 CONSUMERS' CHANGING AND IMPROVING LIFESTYLES RESULT IN A SIGNIFICANT DEMAND FOR PRODUCTS WITH COATED PACKAGING

5.3.3 SHIFTING TOWARDS THE ECO-FRIENDLY PRINTING AND PACKAGING FORMATS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN PRICES OF RAW MATERIAL

5.4.2 LOW RECYCLING VALUE FOR COATED PAPER

5.4.3 GOVERNMENT OVERSEAS REGULATIONS FOR IMPORT-EXPORT

6 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 STANDARD COATED FINE PAPER

6.2.1 TWO-COATED

6.2.1.1 MACHINE COATED

6.2.1.2 HAND-COATED

6.2.1.3 BRUSH-COATED

6.2.1.4 OTHERS

6.2.2 ONE-SIDE COATED

6.2.3 MACHINE COATED

6.2.4 BRUSH-COATED

6.2.5 OTHERS

6.3 COATED GROUND WOOD PAPER

6.3.1 TWO-COATED

6.3.1.1 MACHINE COATED

6.3.1.2 HAND-COATED

6.3.1.3 BRUSH-COATED

6.3.1.4 OTHERS

6.3.2 ONE-SIDE COATED

6.3.3 MACHINE COATED

6.3.4 HAND-COATED

6.3.5 BRUSH-COATED

6.3.6 OTHERS

6.4 ART PAPER

6.4.1 TWO-COATED

6.4.1.1 MACHINE COATED

6.4.1.2 HAND-COATED

6.4.1.3 BRUSH-COATED

6.4.1.4 OTHERS

6.4.2 ONE-SIDE COATED

6.4.2.1 MACHINE COATED

6.4.2.2 HAND-COATED

6.4.2.3 BRUSH-COATED

6.4.2.4 OTHERS

6.5 PIGMENT COATED PAPER

6.5.1 TWO-COATED

6.5.1.1 MACHINE COATED

6.5.1.2 HAND-COATED

6.5.1.3 BRUSH-COATED

6.5.1.4 OTHERS

6.5.2 ONE-SIDE COATED

6.5.2.1 MACHINE COATED

6.5.2.2 HAND-COATED

6.5.2.3 BRUSH-COATED

6.5.2.4 OTHERS

6.6 ENAMEL PAPER

6.6.1 TWO-COATED

6.6.1.1 MACHINE COATED

6.6.1.2 HAND-COATED

6.6.1.3 BRUSH-COATED

6.6.1.4 OTHERS

6.6.2 ONE-SIDE COATED

6.6.2.1 MACHINE COATED

6.6.2.2 HAND-COATED

6.6.2.3 BRUSH-COATED

6.6.2.4 OTHERS

6.7 LOW COAT WEIGHT PAPER

6.7.1 TWO-COATED

6.7.1.1 MACHINE COATED

6.7.1.2 HAND-COATED

6.7.1.3 BRUSH-COATED

6.7.1.4 OTHERS

6.7.2 ONE-SIDE COATED

6.7.2.1 MACHINE COATED

6.7.2.2 HAND-COATED

6.7.2.3 BRUSH-COATED

6.7.2.4 OTHERS

6.8 OTHERS

6.8.1 TWO-COATED

6.8.1.1 MACHINE COATED

6.8.1.2 HAND-COATED

6.8.1.3 BRUSH-COATED

6.8.1.4 OTHERS

6.8.2 ONE-SIDE COATED

6.8.2.1 MACHINE COATED

6.8.2.2 HAND-COATED

6.8.2.3 BRUSH-COATED

6.8.2.4 OTHERS

7 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER

7.1 OVERVIEW

7.2 TWO-SIDE COATED

7.3 ONE-SIDE COATED

8 NORTH AMERICA COATED PAPER MARKET, BY FINISH

8.1 OVERVIEW

8.2 GLOSS

8.3 SATIN

8.4 MATTE

8.5 DULL

8.6 OTHERS

9 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND LABELLING

9.2.1 STANDARD COATED FINE PAPER

9.2.2 COATED GROUND WOOD PAPER

9.2.3 ART PAPER

9.2.4 PIGMENT COATED PAPER

9.2.5 ENAMEL PAPER

9.2.6 LOW COAT WEIGHT PAPER

9.2.7 OTHERS

9.3 PRINTING

9.3.1 STANDARD COATED FINE PAPER

9.3.2 COATED GROUND WOOD PAPER

9.3.3 ART PAPER

9.3.4 PIGMENT COATED PAPER

9.3.5 ENAMEL PAPER

9.3.6 LOW COAT WEIGHT PAPER

9.3.7 OTHERS

9.4 OTHERS

9.4.1 STANDARD COATED FINE PAPER

9.4.2 COATED GROUND WOOD PAPER

9.4.3 ART PAPER

9.4.4 PIGMENT COATED PAPER

9.4.5 ENAMEL PAPER

9.4.6 LOW COAT WEIGHT PAPER

9.4.7 OTHERS

10 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS

10.1 OVERVIEW

10.2 ONLINE CALENDARING

10.3 OFFLINE CALENDARING

11 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD

11.1 OVERVIEW

11.2 MACHINE COATED

11.3 HAND-COATED

11.4 BRUSH-COATED

11.5 OTHERS

12 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL

12.1 OVERVIEW

12.2 CALCIUM CARBONATE

12.2.1 PRECIPITATED CALCIUM CARBONATE (PCC)

12.2.2 GROUND CALCIUM CARBONATE (GCC)

12.3 KAOLIN CLAY

12.4 CLAY

12.5 TITANIUM DIOXIDE

12.6 WAX

12.7 TALC

12.8 OTHERS

13 NORTH AMERICA COATED PAPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COATED PAPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SAPPI

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BILLERUD AMERICAS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UPM

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DS SMITH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 STORA ENSO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 OJI HOLDINGS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 NIPPON PAPER INDUSTRIES CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 LECTA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EMAMI PAPER MILLS LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.10.1 COMPANY SNAPSHOT

16.10.2 RECENT FINANCIALS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 DUNN PAPER COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 KOEHLER HOLDING SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BURGO GROUP S.P.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JK PAPER

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 ASIA PULP & PAPER (APP) SINAR MAS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 TWIN RIVERS PAPER COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SKPMILL.COM

16.17.1 COMPANY SNAPSHOT

16.17.2 RECENT FINANCIALS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 PARADISE PACKAGING

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 3 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 5 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 7 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 9 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 11 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 13 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 15 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 17 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 19 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 21 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 23 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 25 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 27 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 29 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 31 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 33 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 35 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)(B2C)

TABLE 36 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 37 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 39 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 41 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 43 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 45 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 47 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 49 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 51 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 53 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 55 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 57 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 59 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 61 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 63 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 65 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 67 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 69 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 71 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 73 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 75 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 77 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 79 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 81 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 83 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 85 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 87 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 89 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 91 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 93 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 95 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 97 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 99 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 101 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 103 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 105 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 107 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 109 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 111 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 113 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 115 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 117 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 119 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 121 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 123 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 125 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (KILO TON)

TABLE 127 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 128 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 130 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 131 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 133 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 135 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 137 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 139 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 141 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 143 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 145 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 147 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 149 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 151 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 153 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 155 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 157 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 159 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 161 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 163 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 165 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 167 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 169 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 171 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 173 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 175 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 176 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 178 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 179 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 181 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 183 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 184 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 185 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 186 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 187 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 188 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 189 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 190 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 192 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 193 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 195 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 196 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 197 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 199 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 200 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 201 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 202 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 203 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 204 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 205 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 206 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 207 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 208 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 209 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 210 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 211 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 212 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 213 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 214 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 215 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 216 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 217 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 218 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 219 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 220 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 221 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 222 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 223 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 224 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 225 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 226 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 227 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 228 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 229 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 230 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 231 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 232 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 233 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 234 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 235 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 236 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 237 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 238 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 239 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 240 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 241 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 242 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 243 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 244 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 245 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 246 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 247 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 248 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 249 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 250 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 251 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 252 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 253 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 254 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 255 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 256 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 257 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 258 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 259 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 260 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 261 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 262 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 263 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 264 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 265 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 266 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 267 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 268 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 269 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 270 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 271 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 272 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 273 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 274 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 275 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 276 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 277 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 278 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 279 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 280 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 281 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 282 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 283 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 284 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 285 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 286 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 287 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 288 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 289 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 290 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 291 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 292 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 293 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 294 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 295 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 296 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 297 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 298 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 299 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 300 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 301 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 302 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 303 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 304 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 305 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 306 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 307 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 308 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 309 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 310 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 311 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 312 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 313 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 314 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 315 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 316 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 317 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 318 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 319 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 320 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 321 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 322 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 323 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 324 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 325 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 326 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 327 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 328 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 329 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 330 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 331 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 332 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 333 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 334 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 335 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 336 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 337 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 338 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 339 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 340 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 341 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 342 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 343 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 344 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 345 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 346 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 347 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 348 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 349 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 350 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 351 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 352 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 353 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 354 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 355 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 356 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 357 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 358 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 359 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 360 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 361 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 362 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 363 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 364 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 365 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 366 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 367 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 368 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 369 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 370 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 371 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 372 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 373 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 374 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 375 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 376 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 377 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 378 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 379 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 380 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 381 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 382 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 383 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 384 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 385 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 386 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 387 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 388 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 389 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 390 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 391 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 392 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 393 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 394 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 395 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 396 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 397 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 398 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 399 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 400 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 401 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 402 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 403 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 404 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 405 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 406 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 407 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 408 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 409 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 410 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 411 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

List of Figure

FIGURE 1 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COATED PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COATED PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COATED PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COATED PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COATED PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COATED PAPER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COATED PAPER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA COATED PAPER MARKET VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF COATED PAPER IN FOOD INDUSTRY IS DRIVING THE COATED PAPER MARKET IN THE FORECAST PERIOD

FIGURE 12 STANDARD COATED FINE PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COATED PAPER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COATED PAPER MARKET

FIGURE 14 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2022

FIGURE 16 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2022

FIGURE 17 NORTH AMERICA COATED PAPER MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA COATED PAPER MARKET: BY FINISHING PROCESS, 2022

FIGURE 19 NORTH AMERICA COATED PAPER MARKET: BY COATING METHOD, 2022

FIGURE 20 NORTH AMERICA COATED PAPER MARKET: BY COATING MATERIAL, 2022

FIGURE 21 NORTH AMERICA COATED PAPER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA COATED PAPER MARKET: BY PRODUCT (2023-2030)

FIGURE 26 NORTH AMERICA COATED PAPER MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.