Mercado europeo de vectorización de par, por componente (hardware, servicios), tecnología (sistema de vectorización de par activo (ATVS), sistema de vectorización de par pasivo (PTVS)), tipo de accionamiento del embrague (eléctrico, hidráulico), tipo de rueda motriz (tracción trasera (RWD), tracción delantera (FWD)), tipo de vehículo ( automóviles de pasajerosvehículos comerciales , vehículos todoterreno), tipo de propulsión (diésel/gasolina/GNC, vehículo eléctrico ) Tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado

Las soluciones de vectorización de par son los sistemas más importantes y cruciales que garantizan la seguridad y ayudan a mejorar el rendimiento del automóvil. Estos sistemas básicamente proporcionan o distribuyen el par entre las ruedas, lo que permite que el vehículo gire de manera efectiva en una curva. La vectorización de par es un enfoque holístico y predictivo de la dinámica del vehículo que utiliza una combinación de hardware y sistemas electrónicos. El mercado mundial de vectorización de par está creciendo rápidamente debido a la aparición de EVS y su sistema de vectorización de par. Las empresas incluso están lanzando nuevos productos para ganar una mayor participación de mercado.

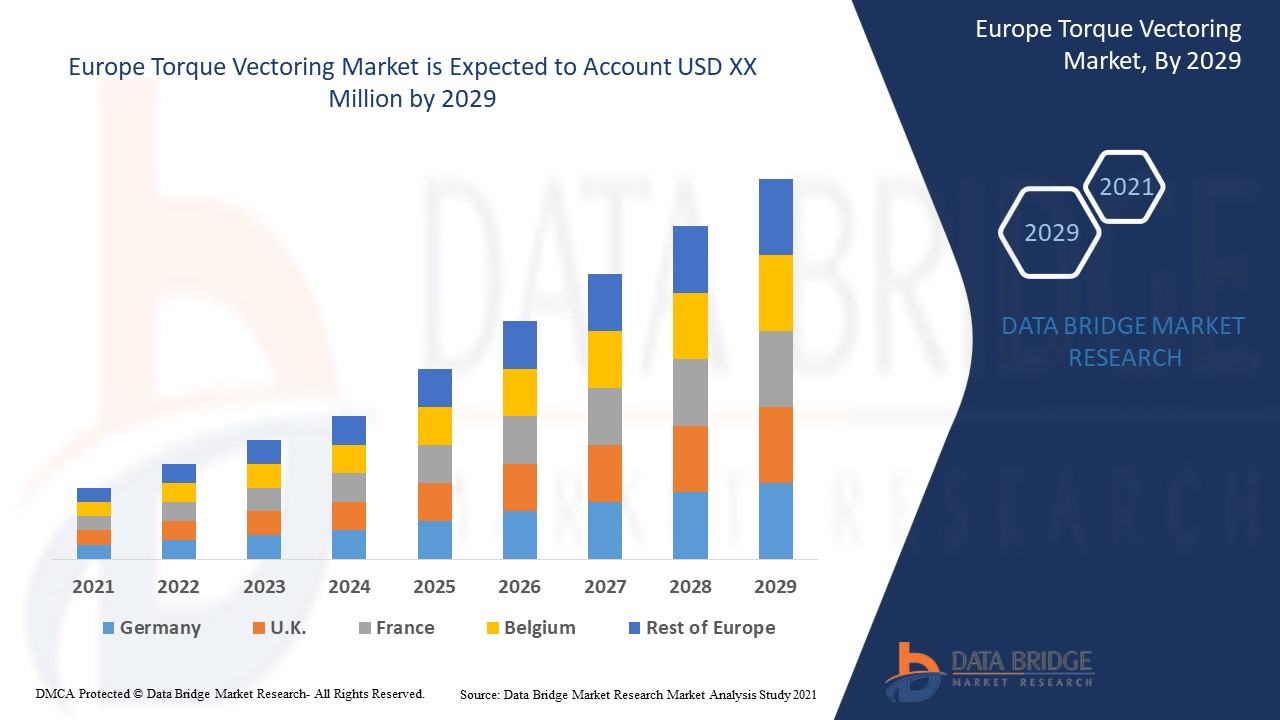

El aumento de la población, la rápida urbanización y la industrialización tienen un impacto proposicional en el crecimiento y la adopción de la vectorización del par, ya que en los últimos tiempos los sistemas de vectorización del par se utilizan ampliamente para mejorar la dinámica del vehículo y las características de seguridad. Data Bridge Market Research analiza que el mercado de vectorización del par crecerá a una CAGR del 17,4 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por componente (hardware, servicios), tecnología (sistema de vectorización de par activo (ATVS), sistema de vectorización de par pasivo (PTVS)), tipo de accionamiento del embrague (eléctrico, hidráulico), tipo de rueda motriz (tracción trasera (RWD), tracción delantera (FWD)), tipo de vehículo (automóviles de pasajeros, vehículos comerciales, vehículos todoterreno), tipo de propulsión (diésel/gasolina/GNC, vehículo eléctrico) |

|

Países cubiertos |

Alemania, España, Francia, Rusia, Turquía, República Checa, Reino Unido, Italia, Polonia, Rumanía, Hungría, Bélgica, Suecia, Países Bajos, Finlandia, Bielorrusia, Suiza y resto de Europa |

|

Actores del mercado cubiertos |

BorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean, Hewland Engineering Ltd, Continental AG, Modelon, GKN Automotive Limited, Inc., Prodrive Holdings Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG entre otros. |

Definición de mercado

Las soluciones de vectorización de par son los sistemas más importantes y cruciales que garantizan la seguridad y ayudan a mejorar el rendimiento del automóvil. Estos sistemas básicamente proporcionan o distribuyen el par entre las ruedas, lo que permite que el vehículo gire de manera efectiva en una curva. La vectorización de par es un enfoque holístico y predictivo de la dinámica del vehículo que utiliza una combinación de hardware y sistemas electrónicos. Proporciona la distribución más adecuada de par a una rueda en cualquier punto en función de las intenciones del conductor y las condiciones de conducción. Básicamente, existen dos tipos de técnicas de vectorización de par que se utilizan de manera destacada: una es la vectorización de par basada en los frenos y la otra es la vectorización de par basada en la electricidad.

Dinámica del mercado de vectorización de par

Conductores

- Aumento de la población y rápida urbanización

La rápida urbanización, la población, el surgimiento de tecnologías de movilidad como servicio (MaaS) y el cambio en los patrones de comportamiento del consumidor están obligando a los principales actores a ofrecer servicios basados en suscripción para que los consumidores obtengan ventajas en el mercado.

- Aparición de los vehículos eléctricos y su sistema de vectorización del par

En los últimos tiempos, la industria automotriz ha experimentado un enorme crecimiento a lo largo de los años debido a la creciente demanda de vehículos eléctricos de lujo. Los vehículos totalmente eléctricos (VE) se denominan vehículos eléctricos de batería, que utilizan una batería para almacenar la energía eléctrica que alimenta los vehículos.

- Enfoque de vectorización de par inteligente para vehículos ADAS

Los sistemas avanzados de asistencia al conductor (ADAS) son sistemas electrónicos implantados en los automóviles para ayudar a la conducción de vehículos o coches autónomos. Este sistema utiliza sensores como radares y cámaras para el análisis y toma medidas automáticas en función del entorno del vehículo.

- Aumento de la demanda de vehículos de lujo y de alto rendimiento

El concepto de vehículos conectados con funciones avanzadas de seguridad y telemática es posible gracias al avance de la tecnología, como la inteligencia artificial, el big data, la conectividad de red avanzada y la IoT. Además, la vectorización del par es un sistema de control controlado por ordenador que controla la potencia que el motor o los motores del coche pueden generar y enviar a cada rueda individual en función de los datos disponibles sobre el rendimiento.

Oportunidad

-

Adopción masiva del sistema de vectorización de par en vehículos todoterreno

Un vehículo todoterreno (OHV) o vehículo todoterreno es un tipo de vehículo diseñado específicamente para su uso fuera de carretera, básicamente en terrenos difíciles. Estos vehículos están desarrollados específicamente para consumidores que prefieren vehículos todoterreno para la accesibilidad en su zona de residencia o con fines recreativos.

Restricción/Desafío

Sin embargo, la elevada huella de carbono del sector automotor obligará a los organismos gubernamentales a adoptar medidas y reglamentaciones estrictas para controlar el nivel de emisiones, lo que puede reducir la adopción de soluciones de vectorización del par. Además, la oferta limitada de vehículos debido a la escasez de chips semiconductores y controladores tiene una correlación directa con las ventas y la disponibilidad de nuevos sistemas de vectorización del par.

Impacto de Covid-19 en el mercado de vectorización de par

El COVID-19 ha afectado negativamente al mercado. Como los sistemas de vectorización de par tenían una gran demanda, empresas como JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean y otras en Europa se enfrentan a una absoluta dificultad para proporcionar sistemas avanzados para vehículos nuevos y antiguos debido a la escasez de chips y controladores de control de semiconductores, debido a las estrictas regulaciones impuestas por el gobierno. Además, la oferta limitada de chips y dispositivos semiconductores ha afectado significativamente a la oferta de vehículos en el mercado.

Desarrollo reciente

- En marzo de 2022, Prodrive Holdings Limited lanzó el primer hipercoche todoterreno del mundo. La característica principal del lanzamiento de este automóvil fue su vehículo de aventura todoterreno con tracción en las cuatro ruedas y 600 bhp con una capacidad y un rendimiento inigualables en cualquier paisaje. A través de esto, la empresa amplió su mercado ofreciendo soluciones innovadoras para sus consumidores.

Alcance del mercado de vectorización de par en Europa

El mercado de vectorización de par está segmentado en función de los componentes, la tecnología, el tipo de accionamiento del embrague, el tipo de rueda motriz, el tipo de vehículo y el tipo de propulsión. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Hardware

- Servicios

Sobre la base de los componentes, el mercado europeo de vectorización de par se ha segmentado en hardware y servicios.

Tecnología

- Sistema de distribución de par activo (ATVS)

- Sistema de vectorización de par pasivo (PTVS)

Sobre la base de la tecnología, el mercado europeo de vectorización de par se ha segmentado en sistema de vectorización de par activo (ATVS) y sistema de vectorización de par pasivo (PTVS).

Tipo de accionamiento del embrague

- Eléctrico

- Hidráulico

Sobre la base del tipo de actuación del embrague, el mercado europeo de vectorización de par se ha segmentado en eléctrico e hidráulico.

Tipo de rueda motriz

- Tracción trasera (RWD)

- Tracción delantera (FWD)

- Tracción en las cuatro ruedas/Tracción en las cuatro ruedas (AWD/4WD)

Sobre la base del tipo de rueda motriz, el mercado europeo de vectorización de par se ha segmentado en tracción trasera (RWD), tracción delantera (FWD) y tracción total/tracción en las cuatro ruedas (AWD/4WD).

Tipo de vehículo

- Automóviles de pasajeros

- Vehículos comerciales

- Vehículo todoterreno

Sobre la base del tipo de vehículo, el mercado europeo de vectorización de par se ha segmentado en automóviles de pasajeros, vehículos comerciales y vehículos todoterreno.

Tipo de propulsión

- Diésel/Gasolina/GNC

- Vehículo eléctrico

Sobre la base del tipo de propulsión, el mercado europeo de vectorización de par se ha segmentado en vehículos diésel/gasolina/GNC y eléctricos.

Análisis y perspectivas regionales del mercado de vectorización de par en Europa

Se analiza el mercado de vectorización de par y se proporcionan información sobre el tamaño del mercado y las tendencias por país, componente, tecnología, tipo de accionamiento del embrague, tipo de rueda motriz, tipo de vehículo y tipo de propulsión, como se mencionó anteriormente. El mercado europeo se segmenta además en Alemania, España, Francia, Rusia, Turquía, República Checa, Reino Unido, Italia, Polonia, Rumania, Hungría, Bélgica, Suecia, Países Bajos, Finlandia, Bielorrusia, Suiza y el resto de Europa.

Se espera que Alemania domine en Europa, debido a la necesidad del mercado de vectorización de par, ya que tiene grandes fabricantes y altas demandas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de Torque Vectoring

El panorama competitivo del mercado de vectorización de par proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de la solución, la amplitud y la variedad del producto, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de vectorización de par.

Algunos de los principales actores que operan en el mercado de vectorización de par son Continental AG, Schaeffler AG, Robert Bosch GmbH, GKN Automotive Limited, ZF Friedrichshafen AG, BorgWarner Inc., Eaton, Magna International Inc., Dana Limited, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TORQUE VECTORING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF EVS & AND ITS TORQUE VECTORING SYSTEM

5.1.3 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH IMPLEMENTING TORQUE VECTORING/AWD/4WD SYSTEMS

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 HEAVING ADOPTION OF TORQUE VECTORING SYSTEM IN OFF-ROAD VEHICLES

5.3.2 GROWING AWARENESS ABOUT ENHANCED SAFETY AND VEHICLE DYNAMICS

5.4 CHALLENGES

5.4.1 HAMPERED SUPPLY OF SEMICONDUCTOR EQUIPMENT LIMITS TORQUE VECTORING SYSTEM

5.4.2 CHANGING AUTOMOTIVE PRODUCT LIFE CYCLE AND LONG PRODUCTION CYCLE OF AUTOMOTIVE VEHICLES

6 EUROPE TORQUE VECTORING MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DRIVE CONTROL UNIT (DCU)

6.2.2 MOTOR CONTROLLERS

6.2.3 SENSORS

6.2.4 MOTOR

6.2.5 CAN BUS

6.2.6 OTHERS

6.3 SERVICES

7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

7.3 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

8 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE

8.1 OVERVIEW

8.2 ELECTRIC

8.3 HYDRAULIC

9 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE

9.1 OVERVIEW

9.2 FRONT-WHEEL DRIVE (FWD)

9.3 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

9.4 REAR-WHEEL DRIVE (RWD)

10 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 BY TYPE

10.2.1.1 SEDAN

10.2.1.2 HATCHBACK

10.2.1.3 CROSSOVERS

10.2.1.4 SUV

10.2.1.5 OTHERS

10.2.2 BY TECHNOLOGY

10.2.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.2.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.3 COMMERCIAL VEHICLES

10.3.1 BY TYPE

10.3.1.1 LIGHT COMMERCIAL VEHICLE

10.3.1.2 HEAVY COMMERCIAL VEHICLE

10.3.1.2.1 BUS

10.3.1.2.2 TRUCKS

10.3.2 BY TECHNOLOGY

10.3.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.3.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.4 OFF ROAD VEHICLE

10.4.1 BY TECHNOLOGY

10.4.1.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.4.1.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

11 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE

11.1 OVERVIEW

11.2 DIESEL/PETROL/CNG

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 HYBRID ELECTRIC VEHICLE (HEV)

12 EUROPE TORQUE VECTORING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY (LEFT HAND DRIVE)

12.1.2 SPAIN (LEFT HAND DRIVE)

12.1.3 FRANCE (LEFT HAND DRIVE)

12.1.4 RUSSIA (LEFT HAND DRIVE)

12.1.5 TURKEY (LEFT HAND DRIVE)

12.1.6 CZECH REPUBLIC (LEFT HAND DRIVE)

12.1.7 U.K. (RIGHT HAND DRIVE)

12.1.8 ITALY (LEFT HAND DRIVE)

12.1.9 POLAND (LEFT HAND DRIVE)

12.1.10 ROMANIA (LEFT HAND DRIVE)

12.1.11 HUNGARY (LEFT HAND DRIVE)

12.1.12 BELGIUM (LEFT HAND DRIVE)

12.1.13 SWEDEN (LEFT HAND DRIVE)

12.1.14 NETHERLANDS (LEFT HAND DRIVE)

12.1.15 FINLAND (LEFT HAND DRIVE)

12.1.16 BELARUS (LEFT HAND DRIVE)

12.1.17 SWITZERLAND (LEFT HAND DRIVE)

12.1.18 REST OF EUROPE

13 EUROPE TORQUE VECTORING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMERICAN AXLE & MANUFACTURING, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY PROFILE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CONTINENTAL AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EATON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SCHAEFFLER AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JTEKT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BORGWARNER INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DRAKO MOTORS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCTS PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GKN AUTOMOTIVE LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCTS PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HALDEX

15.10.1 COMPANY SNPASHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HEWLAND ENGINEERING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LINAMAR CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MAGNA INTERNATIONAL INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MITSUBISHI MOTORS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCTS PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MODELON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PRODRIVE HOLDINGS LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCTS PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTEAN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICARDO

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 ROBERT BOSCH GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 THE TIMKEN COMPANY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 UNIVANCE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 ZF FRIEDRICHSHAFEN AG

15.22.1 COMPANY SNAPSHOT

15.22.2 SOLUTION PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 PERFORMANCE TABLE

TABLE 2 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS & SUVS

TABLE 3 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ACTIVE TORQUE VECTORING SYSTEMS (ATVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PASSIVE TORQUE VECTORING SYSTEMS (PTVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ELECTRIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE HYDRAULIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRONT-WHEEL DRIVE (FWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE REAR-WHEEL DRIVE (RWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE COMMERCIAL VEHICLES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIESEL/PETROL/CNG IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 EUROPE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 49 GERMANY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 GERMANY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 SPAIN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SPAIN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 SPAIN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 FRANCE (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 FRANCE (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 105 TURKEY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 TURKEY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 119 CZECH REPUBLIC (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 123 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 124 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CZECH REPUBLIC (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 CZECH REPUBLIC (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 CZECH REPUBLIC (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 U.K. (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.K. (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 U.K. (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 ITALY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 ITALY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 161 POLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 164 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 165 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 166 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 POLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 POLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 175 ROMANIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 178 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 180 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ROMANIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ROMANIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 187 ROMANIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 189 HUNGARY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 192 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 193 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 HUNGARY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 HUNGARY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 200 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 HUNGARY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 217 SWEDEN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 221 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 222 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 224 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWEDEN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 227 SWEDEN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 228 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWEDEN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 230 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 231 NETHERLANDS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 238 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 241 NETHERLANDS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 244 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 245 FINLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 247 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 248 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 249 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 250 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 FINLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 255 FINLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 256 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 257 FINLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 258 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 259 BELARUS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 262 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 263 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 264 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 266 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 BELARUS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 269 BELARUS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 271 BELARUS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 272 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 275 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 276 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 277 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 280 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 SWITZERLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 SWITZERLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 285 SWITZERLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 286 REST OF EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 2 EUROPE TORQUE VECTORING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TORQUE VECTORING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TORQUE VECTORING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE TORQUE VECTORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TORQUE VECTORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE TORQUE VECTORING MARKET: DBMRMARKET POSITION GRID

FIGURE 8 EUROPE TORQUE VECTORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 10 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES IS EXPECTED TO DRIVE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE TORQUE VECTORING MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TORQUE VECTORING MARKET

FIGURE 14 PERCENTAGE OF URABANIZATION ACROSS THE GLOBE

FIGURE 15 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 16 ROAD TRANSPORT EMISSIONS

FIGURE 17 EUROPE TORQUE VECTORING MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE TORQUE VECTORING MARKET: BY TECHNOLOGY, 2021

FIGURE 19 EUROPE TORQUE VECTORING MARKET: BY CLUTCH ACTUATION TYPE, 2021

FIGURE 20 EUROPE TORQUE VECTORING MARKET: BY DRIVING WHEEL TYPE, 2021

FIGURE 21 EUROPE TORQUE VECTORING MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 EUROPE TORQUE VECTORING MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 EUROPE TORQUE VECTORING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE TORQUE VECTORING MARKET: BY COMPONENT (2022-2029)

FIGURE 28 EUROPE TORQUE VECTORING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.