Global Generative Ai Cybersecurity Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

976.14 Million

USD

17,601.00 Million

2025

2033

USD

976.14 Million

USD

17,601.00 Million

2025

2033

| 2026 –2033 | |

| USD 976.14 Million | |

| USD 17,601.00 Million | |

|

|

|

|

Global Generative AI Cybersecurity Market Segmentation, By Offering (Software and Services), Generative AI Cybersecurity Software (Threat Detection and Intelligence Software, Risk Assessment Software, Exposure Management Software, Phishing Simulation and Prevention Software, Remediation Guidance Software, Threat Hunting Platforms, and Code Analysis Software), Cybersecurity Software for Generative AI (Generative AI Training Data Security Software, Generative AI Model Security Software, Generative AI Infrastructure Security Software, and Generative AI Application Security Software), Security Type (Network Security, Endpoint Security, Application Security, Database Security, and Others), End User (BFSI, Healthcare, Government, Telecom and IT, Technology Providers, Media and Entertainment, Manufacturing, and Others)- Industry Trends and Forecast to 2033

Generative AI Cybersecurity Market Size

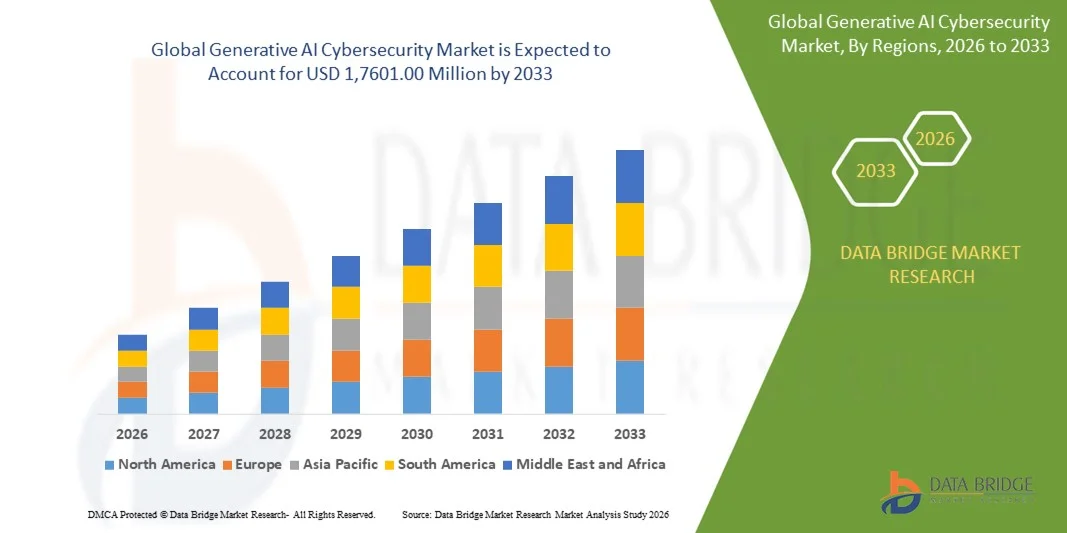

- The global generative AI cybersecurity market size was valued at USD 976.14 million in 2025 and is expected to reach USD 1,7601.00 million by 2033, at a CAGR of 43.55% during the forecast period

- The market growth is largely fuelled by the rising sophistication of cyber threats and the growing adoption of ai-driven security solutions across enterprises

- Increasing investments in ai research, cloud security, and automation tools are accelerating the deployment of generative ai cybersecurity platforms

Generative AI Cybersecurity Market Analysis

- The market is witnessing rapid expansion due to the ability of generative ai to identify complex attack patterns, automate threat intelligence, and enhance real-time security decision-making

- Growing concerns around data breaches, ransomware, phishing attacks, and model vulnerabilities are driving organizations to integrate generative ai-based cybersecurity solutions across diverse industries

- North America dominated the generative AI cybersecurity market with the largest revenue share in 2025, driven by early adoption of advanced cybersecurity solutions, strong presence of leading AI and security vendors, and rising investments in AI-driven threat detection

- Asia-Pacific region is expected to witness the highest growth rate in the global generative AI cybersecurity market, driven by rising cybersecurity threats, accelerated AI adoption, expanding digital economies, and strong government initiatives supporting AI and cybersecurity development

- The software segment held the largest market revenue share in 2025 driven by strong demand for ai-powered threat detection, automated response systems, and advanced analytics capabilities across enterprises. Generative ai cybersecurity software enables real-time monitoring, predictive threat intelligence, and scalable deployment, making it a preferred choice among large organizations

Report Scope and Generative AI Cybersecurity Market Segmentation

|

Attributes |

Generative AI Cybersecurity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Generative AI Cybersecurity Market Trends

Rising Adoption Of AI-Driven Threat Detection And Response Solutions

- The increasing complexity and frequency of cyberattacks are significantly shaping the generative ai cybersecurity market, as organizations seek advanced solutions capable of identifying unknown threats and automating security responses. Generative ai technologies are gaining traction due to their ability to analyze vast datasets, simulate attack scenarios, and enhance real-time threat intelligence, strengthening their adoption across BFSI, healthcare, government, and enterprise IT environments

- Growing reliance on cloud computing, digital transformation, and remote work models has accelerated demand for generative ai cybersecurity platforms that can proactively detect vulnerabilities and prevent large-scale data breaches. Enterprises are increasingly deploying ai-powered tools to address ransomware, phishing, zero-day attacks, and insider threats, driving continuous innovation in security architectures

- Regulatory compliance requirements and heightened awareness of data privacy and model security are influencing purchasing decisions, with organizations prioritizing transparent, explainable, and adaptive ai-based cybersecurity solutions. Vendors are emphasizing automation, scalability, and integration with existing security infrastructure to differentiate offerings and build long-term customer trust

- For instance, in 2024, major technology providers in the U.S. and Europe expanded their cybersecurity portfolios by integrating generative ai capabilities for threat hunting, automated incident response, and predictive risk assessment. These developments were introduced to address rising enterprise demand for faster detection and reduced response times, supporting adoption across large enterprises and critical infrastructure sectors

- While adoption of generative ai cybersecurity solutions is accelerating, sustained market growth depends on continuous model training, data quality, and balancing automation with human oversight. Vendors are focusing on improving model accuracy, reducing false positives, and enhancing explainability to support wider enterprise acceptance

Generative AI Cybersecurity Market Dynamics

Driver

Growing Need For Advanced And Automated Cybersecurity Solutions

- Rising cyber threats, including sophisticated malware, ransomware-as-a-service, and ai-powered attacks, are a major driver for the generative ai cybersecurity market. Organizations are increasingly adopting generative ai tools to automate threat detection, improve response speed, and strengthen security posture across complex digital ecosystems

- Expanding deployment of generative ai across enterprise applications, cloud platforms, and connected devices is driving demand for specialized cybersecurity solutions capable of protecting ai models, training data, and application layers. This trend supports broader adoption across industries such as BFSI, telecom and IT, healthcare, and government

- Technology providers and cybersecurity vendors are actively investing in ai-driven security innovation, strategic partnerships, and platform integration to enhance detection accuracy and operational efficiency. These efforts are supported by growing enterprise budgets for cybersecurity modernization and digital resilience initiatives

- For instance, in 2023, leading cybersecurity firms in the U.S. and Europe reported increased adoption of generative ai-based threat intelligence and automated remediation platforms among large enterprises. These deployments improved detection of advanced persistent threats and reduced incident response times, strengthening customer confidence and repeat adoption

- Although automation-driven security supports market expansion, ongoing investment in skilled talent, ethical ai practices, and governance frameworks remains essential to sustain long-term growth and trust

Restraint/Challenge

High Implementation Complexity And Data Privacy Concerns

- The complexity of integrating generative ai cybersecurity solutions with existing security infrastructure remains a key challenge, particularly for small and medium-sized enterprises. High deployment costs, infrastructure requirements, and the need for skilled professionals can limit adoption among budget-sensitive organizations

- Data privacy, model transparency, and regulatory compliance concerns also restrain market growth, as enterprises remain cautious about exposing sensitive data to ai-driven systems. Lack of standardized frameworks for ai security governance further adds to adoption barriers in regulated industries

- Operational challenges such as model bias, false positives, and dependence on high-quality training data can impact solution effectiveness. Organizations must invest in continuous monitoring, validation, and human oversight to ensure reliable performance and compliance

- For instance, in 2024, enterprises in Asia-Pacific and Latin America reported slower adoption of generative ai cybersecurity platforms due to concerns over data sovereignty, compliance requirements, and limited internal ai expertise. These factors led some organizations to delay large-scale deployments

- Addressing these challenges will require simplified deployment models, stronger data protection measures, transparent ai governance, and focused awareness initiatives. Collaboration between technology providers, regulators, and enterprises will be critical to unlocking the full growth potential of the global generative ai cybersecurity market

Generative AI Cybersecurity Market Scope

The market is segmented on the basis of offering, generative ai cybersecurity software, cybersecurity software for generative ai, security type, and end user.

- By Offering

On the basis of offering, the generative ai cybersecurity market is segmented into software and services. The software segment held the largest market revenue share in 2025 driven by strong demand for ai-powered threat detection, automated response systems, and advanced analytics capabilities across enterprises. Generative ai cybersecurity software enables real-time monitoring, predictive threat intelligence, and scalable deployment, making it a preferred choice among large organizations.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for managed security services, consulting, integration, and continuous model optimization. Organizations are increasingly relying on third-party expertise to deploy, manage, and customize generative ai cybersecurity solutions.

- By Generative AI Cybersecurity Software

On the basis of generative ai cybersecurity software, the market is segmented into threat detection and intelligence software, risk assessment software, exposure management software, phishing simulation and prevention software, remediation guidance software, threat hunting platforms, and code analysis software. The threat detection and intelligence software segment accounted for the largest revenue share in 2025 due to its critical role in identifying advanced threats, zero-day attacks, and anomalous behavior using generative ai models.

The phishing simulation and prevention software segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising frequency of ai-generated phishing attacks and increasing enterprise focus on proactive employee training and email security.

- By Cybersecurity Software for Generative AI

On the basis of cybersecurity software for generative ai, the market is segmented into generative ai training data security software, generative ai model security software, generative ai infrastructure security software, and generative ai application security software. The generative ai model security software segment held the largest market share in 2025 as organizations prioritized protecting ai models from tampering, data leakage, and adversarial attacks.

The generative ai training data security software segment is expected to witness the fastest growth from 2026 to 2033, driven by growing concerns around data poisoning, data privacy, and regulatory compliance related to ai training datasets.

- By Security Type

On the basis of security type, the generative ai cybersecurity market is segmented into network security, endpoint security, application security, database security, and others. The network security segment dominated the market in 2025 due to widespread adoption of ai-driven network monitoring tools capable of detecting complex intrusion patterns and distributed attacks.

The application security segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid deployment of ai-enabled applications and the need to secure application layers from vulnerabilities and malicious exploitation.

- By End User

On the basis of end user, the market is segmented into BFSI, healthcare, government, telecom and IT, technology providers, media and entertainment, manufacturing, and others. The BFSI segment accounted for the largest revenue share in 2025 due to high cybersecurity spending, strict regulatory requirements, and increasing exposure to financial cyber threats.

The healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digitalization, growing use of ai in healthcare systems, and the need to protect sensitive patient data from advanced cyberattacks.

Generative AI Cybersecurity Market Regional Analysis

- North America dominated the generative AI cybersecurity market with the largest revenue share in 2025, driven by early adoption of advanced cybersecurity solutions, strong presence of leading AI and security vendors, and rising investments in AI-driven threat detection

- Organizations in the region highly value real-time threat intelligence, automated response capabilities, and seamless integration of generative AI cybersecurity solutions with existing security infrastructure such as SIEM and SOAR platforms

- This widespread adoption is further supported by high IT spending, a mature digital ecosystem, and growing concerns around AI-driven cyber threats, establishing generative AI cybersecurity as a critical solution across enterprises and government agencies

U.S. Generative AI Cybersecurity Market Insight

The U.S. generative AI cybersecurity market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of generative AI technologies across enterprises and increasing cyberattack sophistication. Organizations are prioritizing advanced AI-based security solutions to protect critical infrastructure, cloud environments, and sensitive data. Strong demand from BFSI, healthcare, and technology providers, along with continuous innovation by domestic cybersecurity firms, continues to propel market growth.

Europe Generative AI Cybersecurity Market Insight

The Europe generative AI cybersecurity market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent data protection regulations and rising focus on AI governance and compliance. Increasing digital transformation across industries and heightened awareness of AI-related security risks are encouraging adoption. Enterprises are increasingly deploying generative AI cybersecurity solutions to ensure regulatory compliance, protect digital assets, and strengthen enterprise-wide security frameworks.

U.K. Generative AI Cybersecurity Market Insight

The U.K. generative AI cybersecurity market is expected to witness strong growth from 2026 to 2033, driven by rising adoption of AI technologies across enterprises and increasing concerns around cyber resilience. The growing focus on securing AI models, training data, and cloud-based applications is accelerating demand. Government-led cybersecurity initiatives and investments in advanced threat intelligence further support market expansion.

Germany Generative AI Cybersecurity Market Insight

The Germany generative AI cybersecurity market is expected to witness steady growth from 2026 to 2033, fueled by increasing emphasis on data privacy, industrial cybersecurity, and secure AI deployment. Germany’s strong manufacturing and industrial base is driving demand for AI-powered security solutions to protect connected systems and operational technologies. The focus on compliance, transparency, and secure digital infrastructure supports continued market adoption.

Asia-Pacific Generative AI Cybersecurity Market Insight

The Asia-Pacific generative AI cybersecurity market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digitalization, expanding cloud adoption, and rising cyber threats across emerging economies. Growing investments in AI, increasing internet penetration, and government initiatives supporting digital security are accelerating market growth across sectors such as BFSI, telecom, and manufacturing.

Japan Generative AI Cybersecurity Market Insight

The Japan generative AI cybersecurity market is expected to witness notable growth from 2026 to 2033 due to strong adoption of advanced technologies and increasing focus on securing AI-driven systems. Enterprises are investing in generative AI cybersecurity solutions to protect critical infrastructure, data assets, and intelligent applications. The integration of AI security with enterprise IT systems and smart infrastructure is further supporting market growth.

China Generative AI Cybersecurity Market Insight

The China generative AI cybersecurity market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid AI adoption, large-scale digital transformation, and growing emphasis on data security. The expansion of smart cities, cloud platforms, and AI-powered applications has increased demand for robust generative AI cybersecurity solutions. Strong domestic technology providers and supportive government initiatives continue to drive market expansion.

Generative AI Cybersecurity Market Share

The Generative AI Cybersecurity industry is primarily led by well-established companies, including:

• OpenAI (U.S.)

• Microsoft (U.S.)

• Google (U.S.)

• IBM (U.S.)

• Palo Alto Networks (U.S.)

• Darktrace (U.K.)

• Sophos (U.K.)

• CrowdStrike (U.S.)

• Fortinet (U.S.)

• Check Point Software Technologies (Israel)

• Cisco Systems (U.S.)

• Broadcom (U.S.)

• Rapid7 (U.S.)

• Trend Micro (Japan)

• Splunk (U.S.)

Latest Developments in Global Generative AI Cybersecurity Market

- In August 2025, SentinelOne, acquisition, announced the acquisition of Prompt Security to strengthen its AI-native Singularity Platform, enabling enhanced real-time visibility and advanced security controls for generative AI and agentic AI workloads. This development improves proactive threat detection and intelligent incident response. The move is expected to strengthen enterprise-level AI security adoption. It also raises competitive intensity in the AI cybersecurity market by expanding platform capabilities

- In July 2025, Accenture and Microsoft, strategic partnership expansion, jointly invested in generative AI-powered cybersecurity solutions focused on modernizing Security Operations Centers. The initiative deploys AI-driven threat analysis and automated security workflows to accelerate threat detection and response. This collaboration enhances operational efficiency across complex IT and AI environments. It is expected to accelerate enterprise adoption of AI-enabled cybersecurity platforms

- In July 2025, Palo Alto Networks, acquisition, acquired Protect AI to enhance its generative AI cybersecurity portfolio and integrate AI security deeper into its Security Operating Platform. The development strengthens protection of AI models, training data, and AI-specific threat detection. This enables enterprises to secure AI deployments more effectively. The acquisition reinforces Palo Alto Networks’ position in AI-focused cybersecurity solutions

- In July 2025, CrowdStrike and NVIDIA, technology collaboration, partnered to integrate GPU-optimized AI pipelines with large language models for advanced cybersecurity applications. The collaboration enables faster AI-driven threat detection, real-time anomaly identification, and accelerated response times. Leveraging GPU performance improves scalability for large-scale threat environments. This partnership addresses rising complexity and volume of modern cyberattack

- In April 2025, Fortinet, product enhancement, expanded its FortiAI capabilities within the Security Fabric platform by adding advanced generative AI features across multiple products. These upgrades improve threat detection accuracy, speed up incident triage, and support secure AI model usage. The enhancements help organizations defend against AI-powered attacks. This development supports regulatory compliance and strengthens market confidence in AI-integrated cybersecurity solutions

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.