Global Glyoxal Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

673.33 Million

USD

1,027.34 Million

2025

2033

USD

673.33 Million

USD

1,027.34 Million

2025

2033

| 2026 –2033 | |

| USD 673.33 Million | |

| USD 1,027.34 Million | |

|

|

|

|

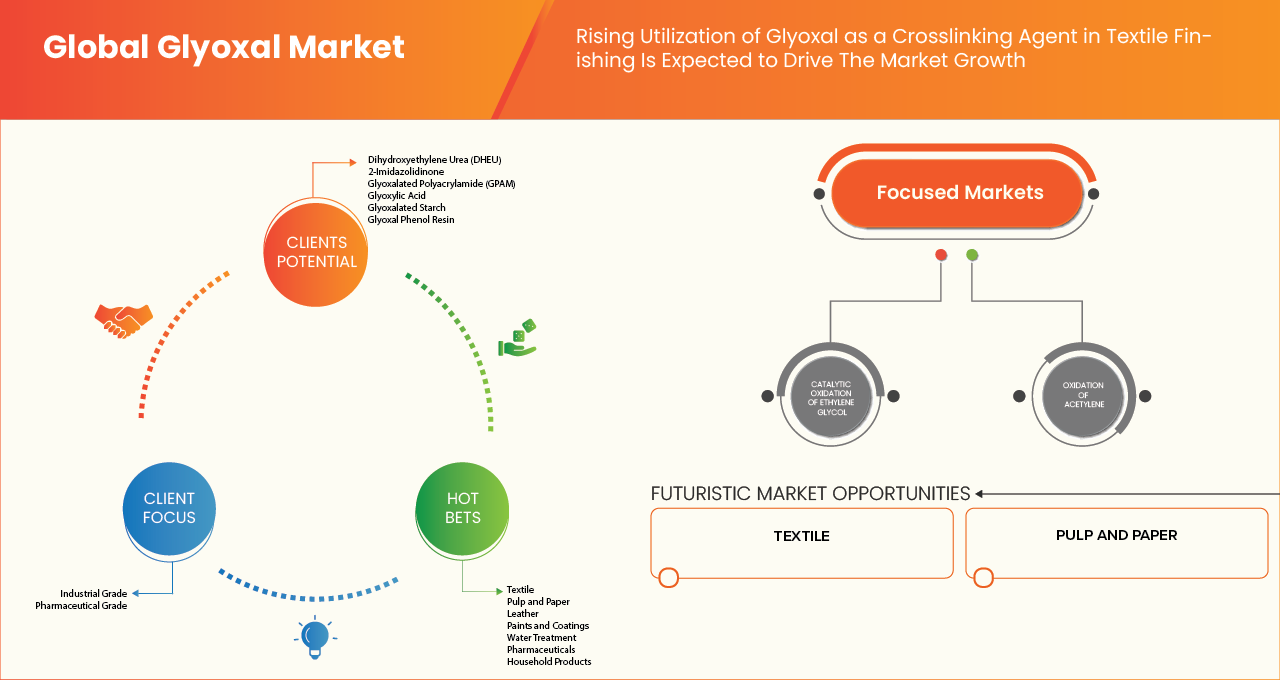

Segmentación del mercado global de glioxal, por grado (grado industrial, grado farmacéutico), por pureza (90%–99%, 40%–60%, otros), proceso de producción (oxidación catalítica de etilenglicol, oxidación de acetileno, otros), empaque (botellas, tambores, bidones, IBC compuestos, a granel), aplicación (reticulación, intermedios químicos y otros), productos químicos de uso final (2-imidazolidinona, 2-metilimidazol, alantoína, dihidroxietilenurea (DHEU), diformiato de etilenglicol, glicolurilo, resina de fenol de glioxal, bisulfito sódico de glioxal, resina de urea de glioxal, poliacrilamida glioxalada (GPAM), almidón glioxalado, glioxal-bis(2-hidroxianil), ácido glioxílico, imidazol, metilol glioxal, Quinoxalina, derivados de quinoxalina, tetrametilol acetilendiurea, concentrado de urea-glioxal, industria de uso final (textil, cuero, productos farmacéuticos, tratamiento de aguas, pinturas y recubrimientos, cosméticos y cuidado personal, productos para el hogar, pulpa y papel, electricidad y electrónica, embalaje, petróleo y gas, otros): tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de glioxal

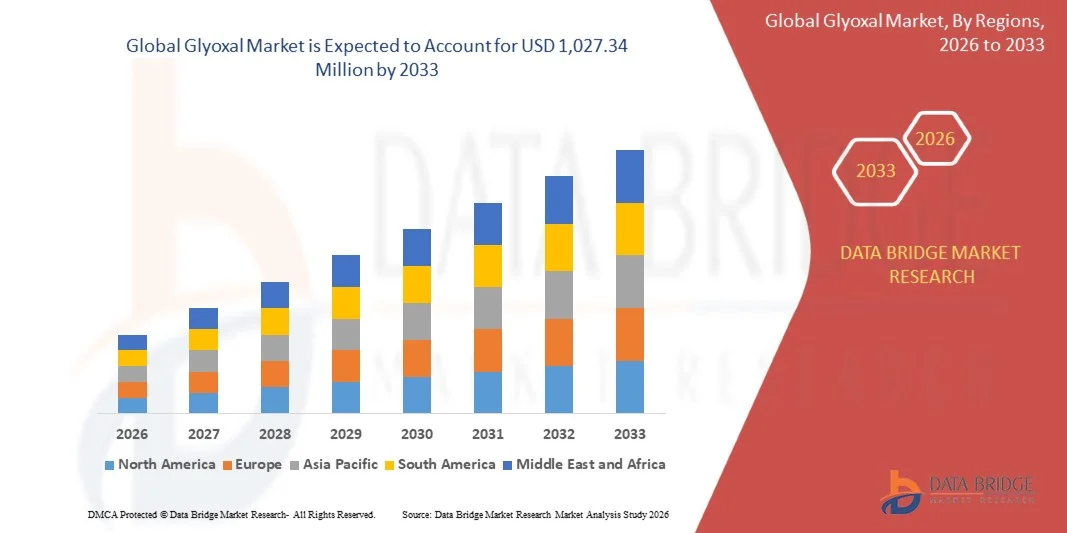

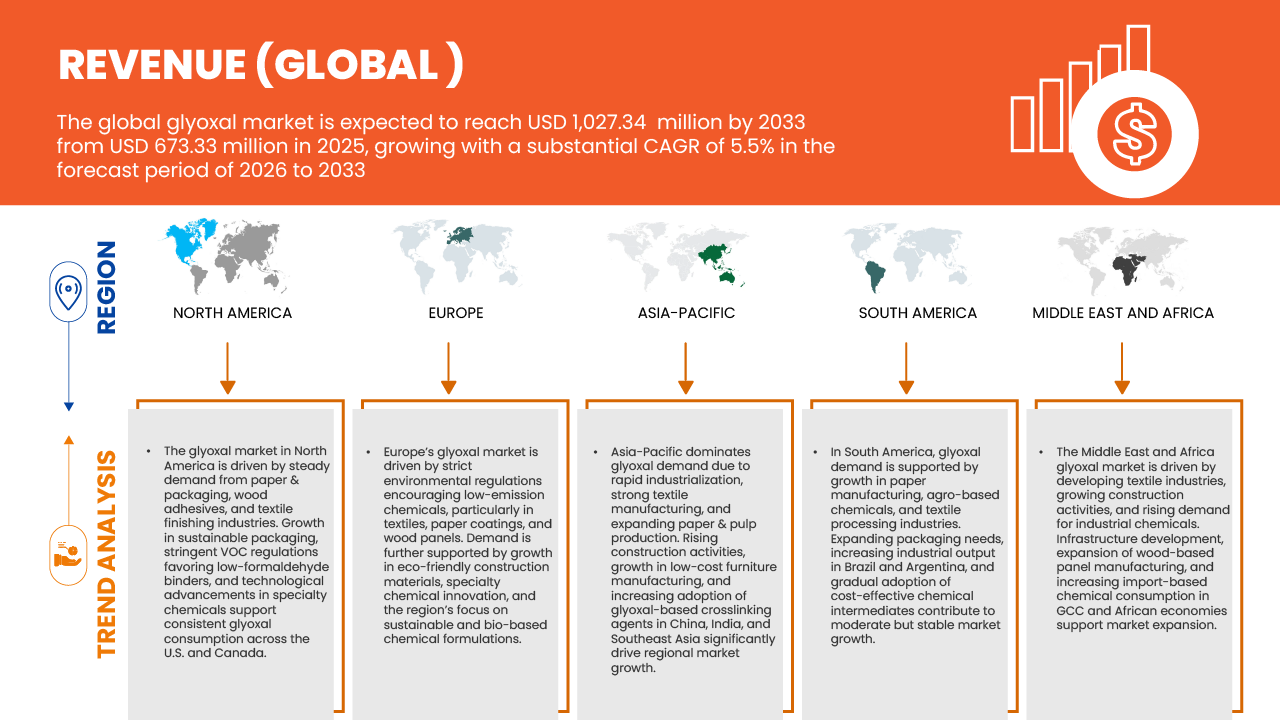

- Se espera que el mercado de glioxal alcance los USD 1.027,34 millones para 2033 desde los USD 673,33 millones en 2025, creciendo con una CAGR del 5,5 % en el período de pronóstico de 2026 a 2033.

- El mercado de glioxal está experimentando un crecimiento constante impulsado por su uso en expansión en las industrias textiles, de papel, de cuero, farmacéutica, agroquímica y de petróleo y gas, donde el glioxal es valorado por sus propiedades de reticulación, unión y acabado.

- Los avances en las tecnologías de procesamiento químico y la eficiencia de la formulación, junto con los grados de pureza mejorados, están respaldando una adopción más amplia de glioxal en aplicaciones de alto rendimiento, como resinas, recubrimientos, acabados textiles y productos químicos especiales, mejorando así la eficacia del producto y el rendimiento del uso final.

- Los marcos regulatorios favorables que promueven alternativas químicas de baja toxicidad y con menor contenido de formaldehído, junto con los crecientes requisitos de cumplimiento ambiental, están alentando a los fabricantes a adoptar soluciones basadas en glioxal como opciones más seguras y sostenibles.

Análisis del mercado del glioxal

- El mercado del glioxal atiende a diversas industrias, como la textil, la papelera, las resinas, la farmacéutica, la cosmética y la de tratamiento de aguas. La demanda se ve impulsada por sus potentes propiedades de reticulación y su papel como intermediario clave en formulaciones químicas especializadas y de alto rendimiento.

- El mercado de glioxal de Asia-Pacífico abastece a diversas industrias, como la textil, la papelera, las resinas, la farmacéutica, la cosmética y la de tratamiento de aguas. La demanda se ve impulsada por sus potentes propiedades de reticulación y su papel como intermediario clave en formulaciones químicas especializadas y de alto rendimiento.

- En 2025, se prevé que el segmento de grado industrial domine el mercado del glioxal con una cuota del 81,49%, gracias a su amplio uso en la fabricación de resinas, adhesivos y productos químicos para el tratamiento del papel. Este segmento se beneficia de la alta demanda en aplicaciones industriales a gran escala y de su rentabilidad para la producción a gran escala, lo que lo convierte en la opción preferida frente a otros grados.

- Se prevé que el mercado de glioxal en Asia-Pacífico crezca a una tasa de crecimiento anual compuesta (TCAC) de alrededor del 6,1 % entre 2026 y 2033, impulsado por la creciente demanda de las industrias textil y agroquímica y su creciente uso en resinas y recubrimientos para aplicaciones industriales. La creciente industrialización y urbanización en la región impulsa aún más el crecimiento del mercado.

Alcance del informe y segmentación del mercado de glioxal

|

Atributos |

Perspectivas del mercado del glioxal |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado del glioxal

“ Integración con ecosistemas de fabricación inteligente, procesamiento de almacén y embalaje de comercio electrónico ”

- El glioxal se utiliza cada vez más en entornos de fabricación inteligente para el acabado de textiles, el tratamiento de papel y aplicaciones de resina, lo que respalda el control de calidad constante, la optimización de procesos y las decisiones de producción basadas en datos alineadas con las iniciativas de la Industria 4.0.

- En las instalaciones de almacenamiento y procesamiento, las formulaciones basadas en glioxal ayudan a estabilizar el material, el rendimiento del recubrimiento y la resistencia a la humedad, mejorando la eficiencia de manipulación, la durabilidad del almacenamiento y la confiabilidad del procesamiento posterior.

- El uso creciente de glioxal en adhesivos para embalajes, refuerzo de papel y tratamientos de superficies favorece la expansión del comercio electrónico al mejorar la integridad de los embalajes, la estabilidad de la carga y la protección del producto en las redes logísticas.

Por ejemplo,

- En enero de 2025, las soluciones químicas basadas en glioxal se integraron cada vez más en líneas automatizadas de procesamiento de textiles y papel, combinadas con controles de procesos avanzados y sistemas de monitoreo digital para mejorar la eficiencia, la consistencia y la sustentabilidad en las operaciones industriales, destacando el papel del glioxal en los ecosistemas de fabricación de próxima generación.

- Los recientes avances de la industria indican una creciente adopción de productos químicos especiales basados en aldehídos, incluido el glioxal, en envases de alto rendimiento y aplicaciones industriales a medida que crecen los volúmenes de comercio electrónico y logística, lo que refuerza su papel en expansión más allá de los sectores de uso final tradicionales.

Dinámica del mercado del glioxal

Conductor

“ La creciente modernización industrial y los requisitos de aplicación de productos químicos orientados al rendimiento ”

- El sector industrial global está presenciando una adopción acelerada de soluciones basadas en glioxal, impulsada por requisitos de rendimiento cada vez más complejos en aplicaciones textiles, papeleras, de resinas, de cuero y de productos químicos especializados. Los fabricantes priorizan el glioxal por sus propiedades de reticulación, aglutinación y acabado, que mejoran la resistencia, la durabilidad y el rendimiento funcional del producto. A medida que los procesos industriales evolucionan hacia una mayor eficiencia y consistencia de calidad, crece la demanda de formulaciones químicas que favorezcan reacciones controladas, reduzcan las emisiones y mejoren la fiabilidad del producto final.

- El creciente papel del glioxal en las iniciativas de modernización industrial ha creado un entorno dinámico para la innovación de los productores químicos, lo que ha dado lugar a avances en la pureza de las formulaciones, la versatilidad de las aplicaciones y la compatibilidad de los procesos. En respuesta a este cambio impulsado por la demanda, los fabricantes están invirtiendo en el desarrollo de grados de glioxal personalizados y adaptados a las necesidades específicas de cada usuario final, incluyendo sistemas con bajo contenido de formaldehído, resinas especiales y tratamientos textiles de alto rendimiento.

- Estas innovaciones se deben en gran medida a las necesidades operativas de las industrias modernas, que requieren soluciones químicas adaptables capaces de funcionar de forma fiable en diversas condiciones de procesamiento y restricciones regulatorias. A medida que las industrias continúan integrando el glioxal en los flujos de trabajo avanzados de fabricación y acabado, este impulso no solo influye en las estrategias de inversión de los proveedores, sino que también refuerza el papel del glioxal como intermediario crucial para mejorar la productividad industrial y el rendimiento de los materiales.

Por ejemplo,

- En septiembre de 2023, las publicaciones de la industria destacaron una mayor adopción de glioxal en procesos avanzados de acabado textil destinados a mejorar la resistencia de las telas y la resistencia a las arrugas, cumpliendo al mismo tiempo con estándares de cumplimiento ambiental más estrictos.

- En febrero de 2024, los datos de la industria química indicaron que los fabricantes de toda Europa intensificaron el uso de resinas a base de glioxal y soluciones de tratamiento de papel para apoyar prácticas de producción sostenibles y reducir la dependencia de alternativas de mayor toxicidad.

- En febrero de 2025, los avances de la industria regional en Asia-Pacífico enfatizaron las crecientes inversiones en la producción de aldehídos especiales, incluido el glioxal, para satisfacer la creciente demanda de los sectores de embalaje, construcción y fabricación industrial centrados en la mejora del rendimiento y la alineación regulatoria.

- La creciente adopción del glioxal en el sector industrial global subraya su creciente importancia como solución química multifuncional, alineada con los cambiantes requisitos de rendimiento, eficiencia y sostenibilidad. A medida que las industrias avanzan hacia productos de mayor calidad y procesos de fabricación más controlados, las capacidades de reticulación, aglutinación y acabado del glioxal lo posicionan como un factor clave para mejorar la resistencia, la durabilidad y la consistencia funcional de los materiales.

Restricción/Desafío

Falta de marcos regulatorios globales armonizados para la fabricación y el uso de sustancias químicas

- La ausencia de regulaciones globales armonizadas que regulen la fabricación, el manejo y las aplicaciones de uso final de productos químicos presenta un desafío notable para el mercado de glioxal, ya que los requisitos regulatorios difieren significativamente entre países y regiones.

- Las autoridades reguladoras aplican diversas normas relacionadas con la clasificación química, los límites de exposición permisibles, el cumplimiento ambiental, el etiquetado, el transporte y el vertido de aguas residuales. Esta fragmentación regulatoria obliga a los fabricantes de glioxal y a los usuarios finales a modificar las formulaciones, la documentación, los protocolos de seguridad y las estrategias de cumplimiento para cada mercado, lo que aumenta la complejidad operativa, los costos de cumplimiento y el plazo de comercialización.

- Como resultado, las empresas enfrentan limitaciones para escalar la producción y distribución de glioxal a nivel mundial, en particular para el comercio transfronterizo y las cadenas de suministro multinacionales que atienden a aplicaciones textiles, de papel, de resinas y de productos químicos especializados.

Por ejemplo,

- A fines de 2025, las autoridades ambientales regionales de Asia y Europa introdujeron diferentes requisitos de cumplimiento para los productos químicos basados en aldehídos, incluido el glioxal, con variaciones en los umbrales de emisión y las obligaciones de presentación de informes, lo que ilustra inconsistencias regulatorias que complican las estrategias estandarizadas de producción y exportación.

- En mayo de 2025, los organismos reguladores nacionales y locales de los mercados emergentes implementaron restricciones más estrictas al manejo y transporte de productos químicos más allá de las pautas centrales existentes, lo que creó interrupciones operativas temporales para los fabricantes y distribuidores de glioxal, quienes debieron obtener aprobaciones adicionales y modificar los flujos de trabajo logísticos durante el período de aplicación.

- La falta de marcos regulatorios globales armonizados continúa representando un desafío estructural para el mercado de glioxal, limitando la facilidad de la producción estandarizada, la distribución y el comercio transfronterizo.

Alcance del mercado del glioxal

El mercado de glioxal se clasifica en siete segmentos notables que se basan en el grado, la pureza, el proceso de producción, el empaque, la aplicación, los productos químicos de uso final y la industria de uso final.

• Por grado

Sobre la base del grado, el mercado de glioxal está segmentado en grado industrial y grado farmacéutico.

En 2026, se prevé que el segmento de grado industrial domine el mercado del glioxal, con la mayor participación (81,49 %), lo que refleja su profunda integración en una amplia gama de aplicaciones industriales. Este dominio se debe principalmente al amplio uso del glioxal de grado industrial en el acabado textil, el procesamiento de papel, la formulación de resinas, el tratamiento del cuero y el tratamiento de aguas, donde el consumo continuo a gran escala es esencial para mantener la eficiencia del proceso y el rendimiento del producto. Su capacidad para ofrecer propiedades fiables de reticulación, aglutinación y acondicionamiento a escala industrial lo convierte en la opción preferida por los fabricantes que operan en entornos de producción de alto rendimiento.

Además, la sólida posición de mercado del segmento de grado industrial se ve reforzada por su rentabilidad y disponibilidad a granel, lo que se alinea con las estrategias de adquisición de los grandes usuarios industriales que buscan optimizar los costos operativos sin comprometer el rendimiento funcional. A medida que los sectores industrial y manufacturero continúan expandiéndose rápidamente tanto en las economías desarrolladas como en las emergentes, se prevé que la demanda de insumos químicos estandarizados y de alto volumen, como el glioxal de grado industrial, se mantenga sólida. Esta demanda sostenida, combinada con su versatilidad y compatibilidad con diversos procesos industriales, posiciona al segmento de grado industrial como el principal contribuyente de ingresos al mercado del glioxal en 2026.

• Por pureza

En función de la pureza, el mercado de glioxal está segmentado en 90%–99%, 40%–60%, otros.

En 2026, se prevé que el segmento de pureza del 40% al 60% domine el mercado del glioxal, con una cuota de mercado del 62,38%, gracias a su rendimiento químico superior y su mayor fiabilidad funcional en aplicaciones avanzadas de uso final. El glioxal, en este rango de alta pureza, ofrece mayor reactividad, estabilidad mejorada y un comportamiento molecular consistente, lo que lo hace especialmente adecuado para procesos donde el control químico preciso y la repetibilidad de los resultados son cruciales. Estas características impulsan significativamente su adopción en la fabricación de productos farmacéuticos, la producción de resinas especiales, el acabado textil de alto rendimiento y las formulaciones cosméticas, donde unos niveles más bajos de impurezas se traducen directamente en una mayor eficacia y seguridad del producto.

Además, la sólida posición de mercado del segmento de pureza del 90% al 99% se ve reforzada por su calidad constante y su cumplimiento de los estrictos estándares regulatorios e industriales, incluyendo los que rigen las aplicaciones farmacéuticas, de cuidado personal y de productos químicos especializados. Los fabricantes prefieren cada vez más el glioxal de alta pureza para cumplir con los requisitos de cumplimiento normativo en constante evolución relacionados con la seguridad del producto, el impacto ambiental y la transparencia de los procesos. A medida que las industrias continúan la transición hacia formulaciones de mayor valor y rendimiento, se espera que la demanda de glioxal de alta pureza se mantenga sólida, consolidando el dominio de este segmento en el mercado del glioxal en 2026.

• Por proceso de producción

Sobre la base del proceso de producción, el mercado de glioxal está segmentado en oxidación catalítica de etilenglicol, oxidación de acetileno, otros.

En 2026, se prevé que el segmento de oxidación catalítica de etilenglicol domine el mercado del glioxal, con una cuota de mercado del 89,66%, gracias a su superior eficiencia de producción y a su sólida adaptación a los requisitos de fabricación modernos. Esta ruta de producción permite un mejor control del rendimiento, una calidad de salida constante y menores niveles de impurezas, lo que la hace especialmente adecuada para aplicaciones que exigen grados de glioxal fiables y estandarizados. En comparación con los procesos tradicionales basados en acetileno, la oxidación catalítica ofrece un entorno de reacción más controlado, lo que facilita una producción estable a gran escala con una menor variabilidad del proceso.

Además, la sólida posición de mercado del segmento de Oxidación Catalítica de Etilenglicol se ve reforzada por su mayor seguridad operativa, rentabilidad y cumplimiento de las normativas ambientales, cada vez más importantes para los fabricantes de productos químicos. Esta ruta de producción reduce la manipulación de materias primas peligrosas y permite reducir los niveles de emisiones, lo que permite a los productores cumplir con las estrictas normas regulatorias en regiones clave. A medida que la demanda mundial de glioxal continúa creciendo en los sectores textil, de resinas, papel y productos químicos especializados, los fabricantes adoptan cada vez más este método escalable y sostenible, consolidando su liderazgo en el mercado en 2026.

Por embalaje

Sobre la base del embalaje, el mercado de glioxal está segmentado en botellas, tambores, bidones, IBC compuestos y a granel.

En 2026, se prevé que el segmento de bidones domine el mercado, con la mayor cuota de mercado (38,60 %), gracias a su gran versatilidad y ventajas prácticas en una amplia gama de aplicaciones. Las botellas son ampliamente preferidas por su fácil manejo, su almacenamiento seguro y su idoneidad para la dispensación de pequeñas cantidades, lo que las hace especialmente adecuadas para las aplicaciones farmacéuticas, cosméticas y químicas especializadas, donde el uso controlado y la prevención de la contaminación son fundamentales.

Además, la sólida posición de mercado del segmento de IBC Compuestos se ve reforzada por su amplia disponibilidad y producción rentable, que facilitan una distribución y adquisición fluidas tanto en mercados desarrollados como emergentes. Fabricantes y usuarios finales recurren cada vez más a formatos de embalaje estandarizados que simplifican el almacenamiento, el transporte y el cumplimiento normativo, a la vez que garantizan la integridad del producto. Dado que las industrias siguen demandando soluciones de embalaje prácticas y fiables para aplicaciones químicas de alto valor, se prevé que los IBC Compuestos mantengan su liderazgo en el mercado mundial de embalajes en 2026.

Por aplicación

Sobre la base de la aplicación, el mercado de glioxal está segmentado en reticulación, intermedios químicos y otros.

En 2026, se prevé que el segmento de reticulación domine el mercado, con una cuota de mercado del 64,49%, gracias a su amplia aplicación para mejorar la durabilidad de los textiles, la resistencia del papel y el rendimiento de las resinas. La reticulación con glioxal desempeña un papel fundamental en la mejora de la estabilidad del material, la eficiencia de la unión y la resistencia al desgaste, lo que la convierte en un proceso esencial en múltiples cadenas de valor industriales.

Además, el segmento de Intermedios Químicos, con el mayor crecimiento, se ve reforzado por la fuerte demanda de poliacrilamida glioxalada (GPAM) y almidón glioxalado, especialmente en el procesamiento de papel, el tratamiento de aguas residuales y las aplicaciones de resinas especiales. Estos derivados a base de glioxal mejoran el rendimiento, a la vez que permiten un procesamiento industrial eficiente y rentable. Dado que las industrias siguen priorizando el rendimiento de los materiales, la fiabilidad de los procesos y la longevidad de los productos, se prevé que el segmento de reticulación siga siendo un motor clave del crecimiento del mercado en 2026.

Por productos químicos de uso final

Sobre la base de los productos químicos de uso final, el mercado de glioxal está segmentado en 2-imidazolidinona, 2-metilimidazol, alantoína, dihidroxietilen urea (DHEU), diformiato de etilenglicol, glicolurilo, resina de fenol de glioxal, bisulfito de sodio de glioxal, resina de urea de glioxal, poliacrilamida glioxalada (GPAM), almidón glioxalado, glioxal-bis(2-hidroxianil), ácido glioxílico, imidazol, metilol glioxal, quinoxalina, derivados de quinoxalina, tetrametilol acetilendiurea, concentrado de urea-glioxal.

En 2026, se prevé que el segmento de 2-imidazolidinona domine el mercado, con la mayor participación (18,22 %), gracias a su amplio uso en aplicaciones de acabado textil, síntesis de resinas y tratamiento de papel. Este compuesto desempeña un papel fundamental en la mejora de la durabilidad de las telas, el rendimiento de la resina y el fortalecimiento de los productos de papel, lo que lo convierte en una opción preferida en entornos de procesamiento industrial de alto volumen.

Además, el segmento de almidón glioxalado, con el mayor crecimiento, se ve reforzado por su superior eficiencia de reticulación, alta estabilidad química y excelente compatibilidad con procesos industriales consolidados, lo que garantiza un rendimiento constante en diversas condiciones operativas. A medida que aumenta la demanda de intermediarios químicos fiables y de alto rendimiento en diversas industrias de uso final, se prevé que este segmento mantenga una sólida adopción y mantenga su liderazgo en el mercado en 2026.

Por industria de uso final

Sobre la base de la industria de uso final, el mercado de glioxal está segmentado en textiles, cuero, productos farmacéuticos, tratamiento de agua, pinturas y recubrimientos, cosméticos y cuidado personal, productos para el hogar, pulpa y papel, electricidad y electrónica, embalaje, petróleo y gas, otros.

En 2026, se prevé que el segmento textil domine el mercado, con una cuota de mercado del 33,89%, gracias a su amplia aplicación en el acabado de tejidos, la resistencia a las arrugas y los tratamientos antiarrugas. Las soluciones a base de glioxal se utilizan ampliamente para mejorar la durabilidad, la estabilidad dimensional y la calidad estética de los tejidos, lo que las convierte en esenciales para las operaciones modernas de procesamiento y acabado textil.

Además, el creciente segmento de Tratamiento de Agua se ve reforzado por la creciente demanda de textiles duraderos y de alta calidad y la rápida expansión de las industrias de la confección y el mobiliario para el hogar, tanto en mercados desarrollados como emergentes. Dado que los fabricantes siguen priorizando el rendimiento mejorado de los tejidos, garantizando al mismo tiempo la rentabilidad y el cumplimiento de los estándares de calidad, se prevé que el segmento de Tratamiento de Agua siga siendo un motor clave del crecimiento del mercado en 2026.

Análisis regional del mercado de glioxal

- En 2025, la región Asia-Pacífico representará la mayor parte del mercado de glioxal, representando el 40,72 % de la demanda mundial. Con una tasa de crecimiento anual compuesta (TCAC) proyectada del 6,1 %, el crecimiento se ve impulsado por la rápida industrialización, la expansión de las actividades manufactureras, la creciente demanda de las industrias textil y papelera, y la creciente adopción de glioxal en aplicaciones químicas, de embalaje e industriales.

- La región se beneficia de la mejora de la infraestructura industrial, marcos regulatorios favorables y crecientes inversiones en la producción química sostenible y el procesamiento posterior. La expansión de las aplicaciones de uso final en textiles, procesamiento de papel, resinas y productos químicos especializados continúa impulsando una sólida penetración en el mercado y un potencial de crecimiento a largo plazo en Asia-Pacífico.

Perspectivas del mercado de glioxal en China

El mercado chino de glioxal se encuentra en rápida expansión, impulsado por la capacidad de fabricación de productos químicos a gran escala, la fuerte demanda de textiles, papel, productos químicos para la construcción y agroquímicos, y las políticas gubernamentales favorables. Los avances tecnológicos y la producción competitiva en costos posicionan a China como un importante proveedor mundial de glioxal con un importante potencial de crecimiento.

Perspectivas del mercado del glioxal en India

El mercado indio de glioxal está experimentando un sólido crecimiento, impulsado por la expansión de las industrias textil y papelera, el aumento de la actividad de fabricación de productos químicos y la creciente adopción de glioxal en resinas y aplicaciones especiales. Las iniciativas gubernamentales que promueven la producción química nacional y el crecimiento industrial continúan impulsando el mercado.

Perspectivas del mercado de glioxal en América del Norte

El mercado norteamericano de glioxal se encuentra en constante expansión, liderado por EE. UU. y Canadá, gracias a una infraestructura industrial avanzada, la innovación tecnológica en el procesamiento químico y marcos regulatorios favorables. La creciente demanda de textiles, resinas, procesamiento de papel y productos químicos especializados continúa fortaleciendo las perspectivas de crecimiento regional a largo plazo.

Perspectivas del mercado de glioxal en EE. UU.

El mercado estadounidense de glioxal es un contribuyente global clave, respaldado por una sólida infraestructura industrial, capacidades avanzadas de fabricación de productos químicos y una demanda constante en los sectores textil, papelero, de resinas, farmacéutico y de especialidades químicas. La alta adopción de formulaciones de glioxal de valor añadido, la optimización de procesos y el uso de productos químicos orientados a la sostenibilidad siguen impulsando el crecimiento del mercado y la innovación.

Perspectivas del mercado de glioxal en Canadá

El mercado canadiense de glioxal crece de forma constante, impulsado por las actividades de procesamiento industrial, las iniciativas de cumplimiento ambiental y la demanda de los sectores del papel, los productos de madera y la fabricación de productos químicos. El creciente énfasis en soluciones químicas de baja toxicidad y respetuosas con el medio ambiente está impulsando su adopción en diversas industrias de uso final.

Perspectivas del mercado del glioxal en Alemania

El mercado alemán de glioxal experimenta un crecimiento constante, impulsado por la sólida capacidad de fabricación de productos químicos, la automatización industrial y la demanda de aplicaciones textiles, papeleras y de resinas de alto rendimiento. Las normativas ambientales favorables y la innovación en productos químicos especializados posicionan a Alemania como un mercado clave de glioxal en Europa.

Perspectivas del mercado del glioxal en Francia

El mercado francés de glioxal está en expansión, impulsado por la creciente demanda en el procesamiento de papel, el acabado textil, la industria farmacéutica y las aplicaciones químicas especializadas. La atención del gobierno al uso sostenible de productos químicos y la creciente adopción de formulaciones bajas en emisiones están impulsando el desarrollo del mercado en todos los sectores industriales.

Perspectivas del mercado europeo del glioxal

El mercado europeo del glioxal crece de forma constante, gracias a una sólida supervisión regulatoria, una infraestructura avanzada para la producción química y una creciente adopción en los sectores textil, papelero, químico para la construcción y resinas. La inversión continua en soluciones químicas sostenibles y de alta pureza sustenta la expansión a largo plazo del mercado regional.

Cuota de mercado del glioxal

El Glyoxal está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- Amzole India Pvt. Ltd. (India)

- Asis Scientific Pty Ltd (Australia)

- Productos químicos Ataman (India)

- BASF SE (Alemania)

- Bidvest Chemical (Sudáfrica)

- Bisley Asia (M) Sdn Bhd (Malasia)

- Eastman Chemical Company (EE. UU.)

- Fluorochem Limited (Reino Unido)

- Fujifilm Wako Pure Chemical Corporation (Japón)

- Glentham Life Sciences Limited (Reino Unido)

- Industria de Haihang (China)

- Hanna Instruments Ltd (EE. UU.)

- Laboratorios Himedia (India)

- Kanto Kagaku (Japón)

- Kemira Oyj (Finlandia)

- Merck KGaA (Alemania)

- Meru Chem Pvt. Ltd. (India)

- Productos químicos Muby (India)

- Especialidades Multichem Private Limited (India)

- Oakwood Products Inc. (EE. UU.)

- Otto Chemie Pvt. Ltd. (India)

- Oxford Lab Fine Chem LLP (India)

- Santa Cruz Biotechnology Inc. (EE. UU.)

- Sasol (Sudáfrica)

- Silver Fern Chemical, Inc. (EE. UU.)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Univar Solutions LLC (EE. UU.)

- Weylchem International GmbH (Alemania)

- Química Zhishang (China)

Últimos avances en el mercado del glioxal

- En octubre de 2025, Multichem Specialities Private Limited fue reconocida entre los 10 Mejores Distribuidores de Productos Químicos Especializados de 2025 por la revista Industry Outlook, destacando su calidad, innovación y servicio confiable en el sector. En julio de 2025, la compañía también organizó una exitosa campaña de donación de sangre en colaboración con Breach Candy Hospital Trust, involucrando a empleados y miembros de la comunidad para apoyar las necesidades de atención médica.

- En febrero de 2024, Multichem Specialities Private Limited participó en Vitafoods India, fortaleciendo su presencia en el segmento de nutracéuticos e ingredientes especiales mientras interactuaba con clientes y socios para mostrar su cartera de productos químicos en expansión.

- En octubre de 2024, Otto Chemie Pvt. Ltd. amplió su cartera de productos químicos y reactivos de laboratorio de alta pureza, consolidando su presencia en los sectores farmacéutico, de investigación e industrial. La empresa también reforzó su red de distribución y la capacidad de su cadena de suministro para satisfacer la creciente demanda en la India y los mercados internacionales.

- En julio de 2024, Otto Chemie Pvt. Ltd. organizó una campaña de donación de sangre y concientización sobre la salud en colaboración con hospitales locales, lo que refleja el compromiso de la empresa con el bienestar de la comunidad y la participación de los empleados en iniciativas de responsabilidad social.

- En marzo de 2025, Oxford Lab Fine Chem LLP implementó soluciones de embalaje ecológicas y optimizó las prácticas de gestión de residuos en sus procesos de producción y distribución, reforzando el compromiso de la empresa con la fabricación de productos químicos sostenibles y responsables.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GLYOXAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GLOBAL GLYOXAL MARKET: VALUE CHAIN ANALYSIS

4.1.1 RAW MATERIAL & FEEDSTOCK SUPPLY (5%–10% VALUE SHARE)

4.1.2 MANUFACTURING & PROCESSING (15%–25% VALUE SHARE)

4.1.3 DISTRIBUTION & LOGISTICS (30%–40% VALUE SHARE)

4.1.4 END-USE INDUSTRIES & SALES CHANNELS (10%–20% VALUE SHARE)

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL SOURCING & PROCUREMENT

4.2.2 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.2.3 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.2.4 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.3 PORTER’S FIVE FORCES ANALYSIS

4.3.1 BARGAINING POWER OF BUYERS / CONSUMERS – HIGH

4.3.2 THREAT OF NEW ENTRANTS – LOW TO MODERATE

4.3.3 THREAT OF SUBSTITUTE PRODUCTS – MODERATE TO HIGH

4.3.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.3.5 INTENSITY OF COMPETITIVE RIVALRY – HIGH

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING UTILIZATION OF GLYOXAL AS A CROSSLINKING AGENT IN TEXTILE FINISHING.

5.1.2 GROWING ADOPTION IN PAPER & PACKAGING FOR WET-STRENGTH AND SURFACE TREATMENT APPLICATIONS.

5.1.3 EXPANSION OF INTERMEDIATE CHEMICAL DEMAND IN PHARMACEUTICALS AND AGROCHEMICALS.

5.1.4 INCREASING PREFERENCE FOR LOW-MOLECULAR-WEIGHT ALDEHYDES IN RESIN AND ADHESIVE SYSTEMS.

5.2 RESTRAINTS

5.2.1 HANDLING COMPLEXITY DUE TO HIGH REACTIVITY AND STABILITY SENSITIVITY

5.2.2 AVAILABILITY OF APPLICATION-SPECIFIC CHEMICAL SUBSTITUTES.

5.3 OPPORTUNITY

5.3.1 VOLATILITY IN FEEDSTOCK PRICING AFFECTING COST STRUCTURE

5.3.2 STRINGENT ENVIRONMENTAL AND OCCUPATIONAL SAFETY REGULATIONS.

5.3.3 LIMITED PRODUCT DIFFERENTIATION IN A PRICE-COMPETITIVE MARKET

5.4 CHALLENGES

5.4.1 DEVELOPMENT OF MODIFIED AND APPLICATION-SPECIFIC GLYOXAL GRADES.

5.4.2 RISING DEMAND FROM EMERGING INDUSTRIAL ECONOMIES

6 GLOBAL GLYOXAL MARKET, BY GRADE

6.1 OVERVIEW

6.2 INDUSTRIAL GRADE

6.3 PHARMACEUTICAL GRADE

6.4 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS

6.4.1 INDUSTRIAL GRADE

6.4.2 PHARMACEUTICAL GRADE

6.5 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST & AFRICA

6.5.5 SOUTH AMERICA

6.6 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.6.1 ASIA-PACIFIC

6.6.2 NORTH AMERICA

6.6.3 EUROPE

6.6.4 MIDDLE EAST & AFRICA

6.6.5 SOUTH AMERICA

7 GLOBAL GLYOXAL MARKET, BY PURITY

7.1 OVERVIEW

7.1.1 40%-60%

7.1.2 90%-99%

7.1.3 OTHERS

7.2 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.2.1 ASIA-PACIFIC

7.2.2 NORTH AMERICA

7.2.3 EUROPE

7.2.4 MIDDLE EAST & AFRICA

7.2.5 SOUTH AMERICA

7.3 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.3.1 ASIA-PACIFIC

7.3.2 NORTH AMERICA

7.3.3 EUROPE

7.3.4 MIDDLE EAST & AFRICA

7.3.5 SOUTH AMERICA

7.4 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.4.1 ASIA-PACIFIC

7.4.2 NORTH AMERICA

7.4.3 EUROPE

7.4.4 MIDDLE EAST & AFRICA

7.4.5 SOUTH AMERICA

8 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS

8.1 OVERVIEW

8.1.1 CATALYTIC OXIDATION OF ETHYLENE GLYCOL

8.1.2 OXIDATION OF ACETYLENE

8.1.3 OTHERS

8.2 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.2.1 ASIA-PACIFIC

8.2.2 NORTH AMERICA

8.2.3 EUROPE

8.2.4 MIDDLE EAST & AFRICA

8.2.5 SOUTH AMERICA

8.3 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.3.1 ASIA-PACIFIC

8.3.2 NORTH AMERICA

8.3.3 EUROPE

8.3.4 MIDDLE EAST & AFRICA

8.3.5 SOUTH AMERICA

8.4 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 MIDDLE EAST & AFRICA

8.4.5 SOUTH AMERICA

9 GLOBAL GLYOXAL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 DRUMS

9.3 COMPOSITE IBC

9.4 BULK

9.5 JERRYCANS

9.6 BOTTLES

9.7 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 PLASTIC DRUMS (HDPE)

9.7.2 TIGHT-HEAD DRUMS

9.7.3 LINERS INSIDE DRUMS

9.7.4 DRUMS WITH CHEMICAL COMPATIBILITY COATINGS

9.7.5 OPEN-TOP DRUMS

9.8 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 MIDDLE EAST & AFRICA

9.8.5 SOUTH AMERICA

9.9 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 COMPOSITE IBCS

9.9.2 RIGID IBCS

9.9.3 IBCS WITH INSULATION

9.9.4 OTHERS

9.1 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.10.1 ASIA-PACIFIC

9.10.2 NORTH AMERICA

9.10.3 EUROPE

9.10.4 MIDDLE EAST & AFRICA

9.10.5 SOUTH AMERICA

9.11 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 MIDDLE EAST & AFRICA

9.11.5 SOUTH AMERICA

9.12 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 PLASTIC JERRYCANS

9.12.2 STACKABLE JERRYCANS

9.12.3 METAL JERRYCANS

9.12.4 OTHER JERRYCANS

9.13 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 NORTH AMERICA

9.13.3 EUROPE

9.13.4 MIDDLE EAST & AFRICA

9.13.5 SOUTH AMERICA

9.14 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.14.1 SMALL LABORATORY BOTTLES

9.14.2 COSMETIC / PERSONAL CARE USE BOTTLES

9.14.3 SPECIAL FEATURE BOTTLES

9.14.4 OTHER BOTTLES

9.15 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.15.1 ASIA-PACIFIC

9.15.2 NORTH AMERICA

9.15.3 EUROPE

9.15.4 MIDDLE EAST & AFRICA

9.15.5 SOUTH AMERICA

10 GLOBAL GLYOXAL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CROSS-LINKING

10.3 CHEMICAL INTERMEDIATES

10.4 OTHERS

10.5 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.5.1 GLYOXALATED POLYACRYLAMIDE (GPAM)

10.5.2 GLYOXALATED STARCH

10.6 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 NORTH AMERICA

10.6.3 EUROPE

10.6.4 MIDDLE EAST & AFRICA

10.6.5 SOUTH AMERICA

10.7 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.7.1 BULK CHEMICALS MANUFACTURING

10.7.2 POLYMER PROCESSING

10.8 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 2-IMIDAZOLIDINONE

10.8.2 ETHYLENE GLYCOL DIFORMATE

10.8.3 QUINOXALINE DERIVATIVES

10.9 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 GLYOXAL UREA RESIN

10.9.2 GLYOXAL PHENOL RESIN

10.9.3 GLYOXAL-BIS(2-HYDROXYANIL)

10.1 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 MIDDLE EAST & AFRICA

10.10.5 SOUTH AMERICA

10.11 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 DIHYDROXYETHYLENE UREA (DHEU)

10.11.2 METHYLOL GLYOXAL

10.12 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 MIDDLE EAST & AFRICA

10.12.5 SOUTH AMERICA

11 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS

11.1 OVERVIEW

11.2 DIHYDROXYETHYLENE UREA (DHEU)

11.3 2-IMIDAZOLIDINONE

11.4 GLYOXALATED POLYACRYLAMIDE (GPAM)

11.5 GLYOXYLIC ACID

11.6 GLYOXALATED STARCH

11.7 GLYOXAL PHENOL RESIN

11.8 GLYOXAL UREA RESIN

11.9 ETHYLENE GLYCOL DIFORMATE

11.1 UREA-GLYOXAL CONCENTRATE

11.11 QUINOXALINE DERIVATIVES

11.12 METHYLOL GLYOXAL

11.13 GLYOXAL-BIS(2-HYDROXYANIL)

11.14 GLYOXAL SODIUM BISULFITE

11.15 QUINOXALINE

11.16 2-METHYLIMIDAZOLE

11.17 IMIDAZOLE

11.18 GLYCOLURIL

11.19 ALLANTOIN

11.2 TETRAMETHYLOL ACETYLENEDIUREA

11.21 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.21.1 ASIA-PACIFIC

11.21.2 NORTH AMERICA

11.21.3 EUROPE

11.21.4 MIDDLE EAST & AFRICA

11.21.5 SOUTH AMERICA

11.22 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.22.1 ASIA-PACIFIC

11.22.2 NORTH AMERICA

11.22.3 EUROPE

11.22.4 MIDDLE EAST & AFRICA

11.22.5 SOUTH AMERICA

11.23 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.23.1 ASIA-PACIFIC

11.23.2 NORTH AMERICA

11.23.3 EUROPE

11.23.4 MIDDLE EAST & AFRICA

11.23.5 SOUTH AMERICA

11.24 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.24.1 ASIA-PACIFIC

11.24.2 NORTH AMERICA

11.24.3 EUROPE

11.24.4 MIDDLE EAST & AFRICA

11.24.5 SOUTH AMERICA

11.25 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.25.1 ASIA-PACIFIC

11.25.2 NORTH AMERICA

11.25.3 EUROPE

11.25.4 MIDDLE EAST & AFRICA

11.25.5 SOUTH AMERICA

11.26 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.26.1 ASIA-PACIFIC

11.26.2 NORTH AMERICA

11.26.3 EUROPE

11.26.4 MIDDLE EAST & AFRICA

11.26.5 SOUTH AMERICA

11.27 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.27.1 ASIA-PACIFIC

11.27.2 NORTH AMERICA

11.27.3 EUROPE

11.27.4 MIDDLE EAST & AFRICA

11.27.5 SOUTH AMERICA

11.28 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.28.1 ASIA-PACIFIC

11.28.2 NORTH AMERICA

11.28.3 EUROPE

11.28.4 MIDDLE EAST & AFRICA

11.28.5 SOUTH AMERICA

11.29 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.29.1 ASIA-PACIFIC

11.29.2 NORTH AMERICA

11.29.3 EUROPE

11.29.4 MIDDLE EAST & AFRICA

11.29.5 SOUTH AMERICA

11.3 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.30.1 ASIA-PACIFIC

11.30.2 NORTH AMERICA

11.30.3 EUROPE

11.30.4 MIDDLE EAST & AFRICA

11.30.5 SOUTH AMERICA

11.31 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.31.1 ASIA-PACIFIC

11.31.2 NORTH AMERICA

11.31.3 EUROPE

11.31.4 MIDDLE EAST & AFRICA

11.31.5 SOUTH AMERICA

11.32 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.32.1 ASIA-PACIFIC

11.32.2 NORTH AMERICA

11.32.3 EUROPE

11.32.4 MIDDLE EAST & AFRICA

11.32.5 SOUTH AMERICA

11.33 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.33.1 ASIA-PACIFIC

11.33.2 NORTH AMERICA

11.33.3 EUROPE

11.33.4 MIDDLE EAST & AFRICA

11.33.5 SOUTH AMERICA

11.34 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.34.1 ASIA-PACIFIC

11.34.2 NORTH AMERICA

11.34.3 EUROPE

11.34.4 MIDDLE EAST & AFRICA

11.34.5 SOUTH AMERICA

11.35 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.35.1 ASIA-PACIFIC

11.35.2 NORTH AMERICA

11.35.3 EUROPE

11.35.4 MIDDLE EAST & AFRICA

11.35.5 SOUTH AMERICA

11.36 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.36.1 ASIA-PACIFIC

11.36.2 NORTH AMERICA

11.36.3 EUROPE

11.36.4 MIDDLE EAST & AFRICA

11.36.5 SOUTH AMERICA

11.37 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.37.1 ASIA-PACIFIC

11.37.2 NORTH AMERICA

11.37.3 EUROPE

11.37.4 MIDDLE EAST & AFRICA

11.37.5 SOUTH AMERICA

11.38 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.38.1 ASIA-PACIFIC

11.38.2 NORTH AMERICA

11.38.3 EUROPE

11.38.4 MIDDLE EAST & AFRICA

11.38.5 SOUTH AMERICA

11.39 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.39.1 ASIA-PACIFIC

11.39.2 NORTH AMERICA

11.39.3 EUROPE

11.39.4 MIDDLE EAST & AFRICA

11.39.5 SOUTH AMERICA

12 GLOBAL GLYOXAL MARKET, BY END USER

12.1 OVERVIEW

12.2 TEXTILE

12.3 PULP AND PAPER

12.4 LEATHER

12.5 PAINTS AND COATINGS

12.6 WATER TREATMENT

12.7 PHARMACEUTICALS

12.8 HOUSEHOLD PRODUCTS

12.9 COSMETICS AND PERSONAL CARE

12.1 PACKAGING

12.11 ELECTRICAL AND ELECTRONICS

12.12 OIL AND GAS

12.13 OTHERS

12.14 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 MIDDLE EAST & AFRICA

12.14.5 SOUTH AMERICA

12.15 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.15.1 ASIA-PACIFIC

12.15.2 NORTH AMERICA

12.15.3 EUROPE

12.15.4 MIDDLE EAST & AFRICA

12.15.5 SOUTH AMERICA

12.16 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 MIDDLE EAST & AFRICA

12.16.5 SOUTH AMERICA

12.17 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.17.1 ASIA-PACIFIC

12.17.2 NORTH AMERICA

12.17.3 EUROPE

12.17.4 MIDDLE EAST & AFRICA

12.17.5 SOUTH AMERICA

12.18 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 MIDDLE EAST & AFRICA

12.18.5 SOUTH AMERICA

12.19 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.19.1 ASIA-PACIFIC

12.19.2 NORTH AMERICA

12.19.3 EUROPE

12.19.4 MIDDLE EAST & AFRICA

12.19.5 SOUTH AMERICA

12.2 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 MIDDLE EAST & AFRICA

12.20.5 SOUTH AMERICA

12.21 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.21.1 LOTIONS AND CREAMS

12.21.2 PERFUMES AND DEODORANTS

12.21.3 OTHERS

12.22 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 MIDDLE EAST & AFRICA

12.22.5 SOUTH AMERICA

12.23 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.23.1 ASIA-PACIFIC

12.23.2 NORTH AMERICA

12.23.3 EUROPE

12.23.4 MIDDLE EAST & AFRICA

12.23.5 SOUTH AMERICA

12.24 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.24.1 ASIA-PACIFIC

12.24.2 NORTH AMERICA

12.24.3 EUROPE

12.24.4 MIDDLE EAST & AFRICA

12.24.5 SOUTH AMERICA

12.25 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.25.1 ASIA-PACIFIC

12.25.2 NORTH AMERICA

12.25.3 EUROPE

12.25.4 MIDDLE EAST & AFRICA

12.25.5 SOUTH AMERICA

12.26 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.26.1 ASIA-PACIFIC

12.26.2 NORTH AMERICA

12.26.3 EUROPE

12.26.4 MIDDLE EAST & AFRICA

12.26.5 SOUTH AMERICA

13 GLOBAL GLYOXAL MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA PACIFIC

13.2.1 CHINA

13.2.2 INDIA

13.2.3 JAPAN

13.2.4 SOUTH KOREA

13.2.5 TAIWAN

13.2.6 VIETNAM

13.2.7 INDONESIA

13.2.8 THAILAND

13.2.9 AUSTRALIA

13.2.10 MALAYSIA

13.2.11 SINGAPORE

13.2.12 PHILIPPINES

13.2.13 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 ITALY

13.4.4 FRANCE

13.4.5 RUSSIA

13.4.6 SPAIN

13.4.7 SWITZERLAND

13.4.8 NETHERLANDS

13.4.9 TURKEY

13.4.10 BELGIUM

13.4.11 DENMARK

13.4.12 SWEDEN

13.4.13 NORWAY

13.4.14 REST OF EUROPE

13.5 MIDDLE EAST AND AFRICA

13.5.1 SAUDI ARABIA

13.5.2 U.A.E

13.5.3 EGYPT

13.5.4 IRAN

13.5.5 SOUTH AFRICA

13.5.6 KUWAIT

13.5.7 QATAR

13.5.8 REST OF MIDDLE EAST & AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

14 GLOBAL GLYOXAL MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BASF

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MERCK KGAA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 THERMO FISHER SCIENTIFIC INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 WEYLCHEM INTERNATIONAL GMBH

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 ALPHA CHEMIKA.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 AMZOLE INDIA PVT. LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 EMCO DYESTUFF

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 FLUOROCHEM LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 FUJIFILM WAKO PURE CHEMICAL CORPORATION

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 GETCHEM CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GLENTHAM LIFE SCIENCES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HANNA EQUIPMENTS (INDIA) PVT. LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HEZE RUNQUAN CHEMICAL CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 HIMEDIA LABORATORIES

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HUBEI SHUNHUI BIO-TECHNOLOGY CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 KANTO KAGAKU

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 KEMIRA

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 LOBACHEMIE PVT. LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MERU CHEM PVT.LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MULTICHEM SPECIALITIES PRIVATE LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OTTO CHEMIE PVT. LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OXFORD LAB FINE CHEM LLP.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SANTA CRUZ BIOTECHNOLOGY INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SHANDONG ZHISHANG CHEMICAL CO.LTD,

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SIHAULI CHEMICALS PRIVATE LIMITED

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SILVER FERN CHEMICAL LLC

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SIMSON PHARMA LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TOKYO CHEMICAL INDUSTRY UK LTD.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 UNIVAR SOLUTIONS LLC

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 WUXI LANSEN CHEMICALS CO., LTD.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MAJOR END USE PRODUCTS FOR GLYOXAL

TABLE 2 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 4 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 34 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 GLOBAL GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 54 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 GLOBAL GLYOXAL MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 GLOBAL GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 GLOBAL GLYOXAL MARKET, 2018-2033, (THOUSAND TONS )

TABLE 70 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 71 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 72 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 73 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 GLOBAL GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 75 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 77 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 79 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 81 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 GLOBAL GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 83 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 85 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 88 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 GLOBAL GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 99 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 102 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 103 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 104 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 105 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 106 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 107 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 108 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 109 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 111 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 112 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 113 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 115 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 117 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 118 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 119 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 120 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 121 GLOBAL GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 122 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 123 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 124 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 125 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 126 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 127 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 128 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 129 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 131 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 132 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 133 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 134 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 135 ASIA-PACIFIC GLYOXAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 136 ASIA-PACIFIC GLYOXAL MARKET, BY COUNTRY, 2018-2033 (THOUSAND TONS)

TABLE 137 USD THOUSAND

TABLE 138 ASIA-PACIFIC GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 139 ASIA-PACIFIC GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 140 ASIA-PACIFIC GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 141 ASIA-PACIFIC GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 142 ASIA-PACIFIC GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 143 ASIA-PACIFIC DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 ASIA-PACIFIC COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 ASIA-PACIFIC JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 ASIA-PACIFIC BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 ASIA-PACIFIC GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 148 ASIA-PACIFIC CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 ASIA-PACIFIC CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 ASIA-PACIFIC BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 ASIA-PACIFIC POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 ASIA-PACIFIC OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 ASIA-PACIFIC GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 154 ASIA-PACIFIC GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 155 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CHINA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 157 CHINA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 158 CHINA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 159 CHINA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 160 CHINA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 161 CHINA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 CHINA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 CHINA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 CHINA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 CHINA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 166 CHINA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 CHINA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 CHINA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 CHINA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 CHINA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 CHINA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 172 CHINA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 173 CHINA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDIA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 175 INDIA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 176 INDIA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 177 INDIA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 178 INDIA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 179 INDIA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDIA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDIA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 INDIA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDIA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 184 INDIA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDIA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDIA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 INDIA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 INDIA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 INDIA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 190 INDIA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 191 INDIA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 JAPAN GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 193 JAPAN GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 194 JAPAN GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 195 JAPAN GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 196 JAPAN GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 197 JAPAN DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 JAPAN COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 JAPAN JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 JAPAN BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 JAPAN GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 202 JAPAN CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 JAPAN CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 JAPAN BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 JAPAN POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 JAPAN OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 JAPAN GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 208 JAPAN GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 209 JAPAN COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 SOUTH KOREA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 211 SOUTH KOREA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 212 SOUTH KOREA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 213 SOUTH KOREA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 214 SOUTH KOREA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 215 SOUTH KOREA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 SOUTH KOREA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 SOUTH KOREA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 SOUTH KOREA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 SOUTH KOREA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 220 SOUTH KOREA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 SOUTH KOREA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 SOUTH KOREA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 SOUTH KOREA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 SOUTH KOREA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SOUTH KOREA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 226 SOUTH KOREA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 227 SOUTH KOREA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 TAIWAN GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 229 TAIWAN GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 230 TAIWAN GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 231 TAIWAN GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 232 TAIWAN GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 233 TAIWAN DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 TAIWAN COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 TAIWAN JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 TAIWAN BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 TAIWAN GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 238 TAIWAN CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 TAIWAN CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 TAIWAN BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 TAIWAN POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 TAIWAN OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 TAIWAN GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 244 TAIWAN GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 245 TAIWAN COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 VIETNAM GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 247 VIETNAM GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 248 VIETNAM GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 249 VIETNAM GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 250 VIETNAM GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 251 VIETNAM DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 VIETNAM COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 VIETNAM JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 VIETNAM BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 VIETNAM GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 256 VIETNAM CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 VIETNAM CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 VIETNAM BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 VIETNAM POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 VIETNAM OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 VIETNAM GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 262 VIETNAM GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 263 VIETNAM COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 INDONESIA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 265 INDONESIA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 266 INDONESIA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 267 INDONESIA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 268 INDONESIA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 269 INDONESIA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 INDONESIA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 INDONESIA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 INDONESIA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 INDONESIA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 274 INDONESIA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 INDONESIA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 INDONESIA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)