Global Lab On A Chip Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6.29 Billion

USD

13.05 Billion

2021

2029

USD

6.29 Billion

USD

13.05 Billion

2021

2029

| 2022 –2029 | |

| USD 6.29 Billion | |

| USD 13.05 Billion | |

|

|

|

|

Global Lab- On-A-Chip Market, By Product (Instrument, Reagents and Consumables, Software and Others), Technology (Microarrays, microfluidics, Tissue Biochip and Others), Application (Genomics, Proteomics, Point of Care Diagnostics, Drug Discovery and Others), End-Use (Hospitals and Clinics, Biotechnology and Pharmaceuticals Companies, Forensic Laboratories, Diagnostics Centers and Academic and Research Institutes) – Industry Trends and Forecast to 2029

Market Analysis and Size

Lab-on-a-chip (LoC) combines many types of analysis such as chemical synthesis, biochemical activities, and DNA sequencing on a single chip. Miniaturization and optimization of these biochemical procedures have increased diagnostic speed and cost efficiency. Furthermore, LoC is a device capable of reducing single or several laboratory tasks down to chip-format, with chip sizes ranging from a few square centimeters to a few millimeters. Electronics, fluidics, optics, and biosensors are all integrated in LoC.

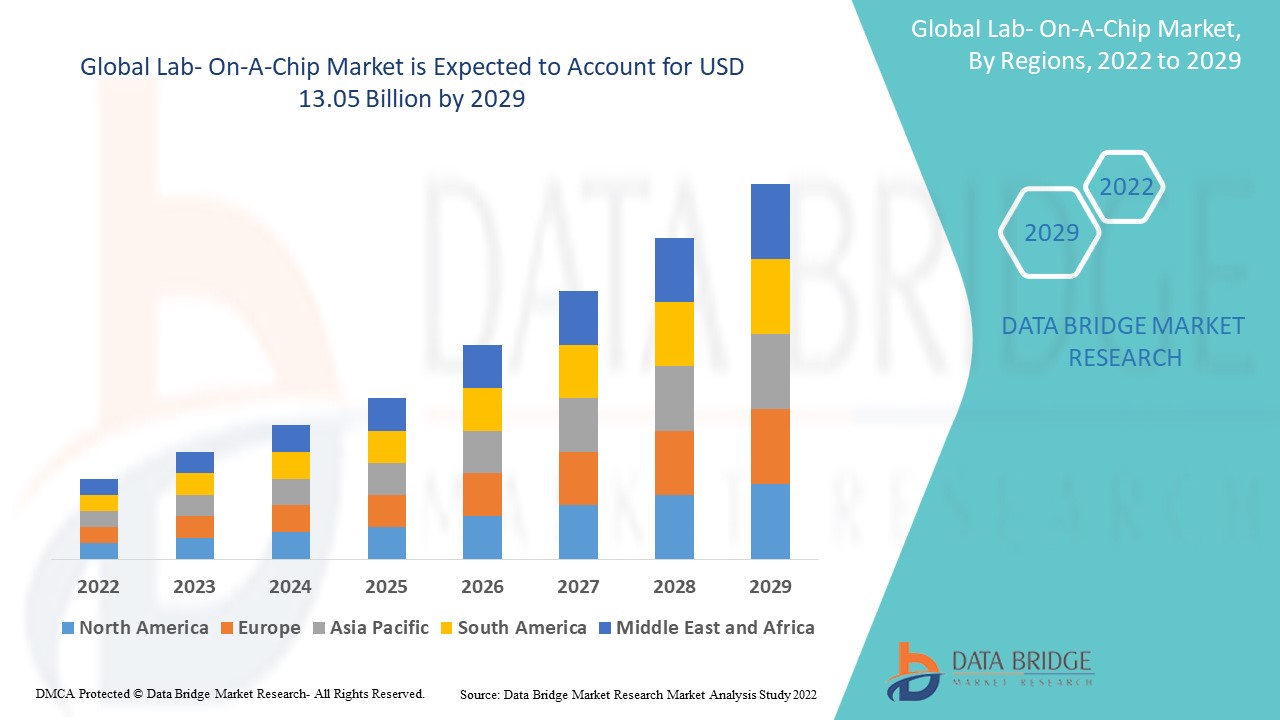

Data Bridge Market Research analyses that the lab-on-a-chip market which was USD 6.29 billion in 2021, would rocket up to USD 13.05 billion by 2029, and is expected to undergo a CAGR of 9.55% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Instrument, Reagents and Consumables, Software and Others), Technology (Microarrays, microfluidics, Tissue Biochip and Others), Application (Genomics, Proteomics, Point of Care Diagnostics, Drug Discovery and Others), End-Use (Hospitals and Clinics, Biotechnology and Pharmaceuticals Companies, Forensic Laboratories, Diagnostics Centers and Academic and Research Institutes) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Siemens (Germany), Abaxis (U.S), Danaher (U.S), Thermo Fisher Scientific Inc. (U.S), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S), Bio-Rad Laboratories Inc. (U.S), BD (U.S), PerkinElmer Inc. (U.S), Agilent Technologies Inc. (U.S) |

|

Market Opportunities |

|

Market Definition

The lab-on-a-chip market is a miniature device that combines several laboratory analysis procedures into a single chip. Lap-on-chip technology is used for biochemical detection, DNA sequencing, and other applications. Chips can be as small as a few square centimeters in size and are capable of handling extremely small fluid quantities.

Lab-On-A-Chip Market Dynamics

Drivers

- Advantages of lab-on-a-chip technology

LoC technology include excellent assay sensitivity, parallelization, ergonomics, waste minimization, and others. This technology is primarily driven by the medical profession for the identification of various diseases, which aids in sample handling, provides accurate findings in a short amount of time, and serves as a market growth driver. Furthermore, in the forecast period of 2022-2029, the rise in demand for small devices, research on biosensors and biomarkers, fabrication technology, and economic feasibility will provide new opportunities for the lab-on-a-chip market.

- Rise in the chronic diseases

The integration of various disciplines and the downsizing of laboratory procedures are the hallmarks of lab-on-a-chip systems. The high level of integration required to develop LOC devices is expanding into other parts of healthcare like stem cell, drug delivery, synthetic biology, and environmental monitoring. Globally, chronic diseases are on the rise. Other factors contributing to a constant growth in frequent and costly long-term health problems include a rapidly growing global geriatric population and changes in societal behaviour. Other important factors driving the lab-on-a-chip market's growth include the use of lab-on-a-chip in the diagnosis of chronic diseases and infections.

- Usage of LoC

LoC is gaining popularity in the medical area for diagnosing various infections and disorders, including HIV infections and chronic sickness, as well as botany. This is projected to propel the market forward. Because of advantages like easy portability, automated sample processing, and re-configurability, LoC devices are in great demand. Because they deliver fast and on-time diagnosis results, LoC devices are ideal for point-of-care diagnosis.

Opportunities

Due to rising investment in research and development in pharmaceuticals, life sciences, and personalised medicine, the global lab-on-a-chip market is gaining traction. In addition, various microfluidic device makers are forming partnerships or collaborations to develop more unique lab-on-a-chip applications, propelling the industry forward. Future market growth will be fuelled by technological advancements and research into LOC miniaturisation. There are many benefits of microfluidic technologies, growing demand for diagnostics, rise in R&D investments in emerging economies, and increase in global population will provide lucrative opportunities for growth for the lab-on-chip market globally.

Restraints/Challenges

The high initial purchasing cost with lack of awareness regarding lab-on-a-chip devices among the middle income countries will act as a restrain and further challenge the growth of the lab-on-a-chip market in the forecast period mentioned above.

This lab-on-a-chip market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the lab-on-a-chip market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Lab- On-A-Chip Market

The COVID-19 pandemic had a good impact on the lab-on-a-chip market, as it has raised the focus on the creation of less time-consuming diagnostic kits, and the use of the lab-on-a-chip approach in pharmaceutical R&D has expanded. Veredus Laboratories, a Singapore-based molecular diagnostics company, recently revealed the commercial availability of a portable lab-on-a-chip diagnostic tool for detecting and distinguishing 2019-nCoV, SARS CoV, and MERS-CoV. As a result, the VereCoV detection kit combines PCR and microarray technology to give high specificity, sensitivity, and a 2-hour turnaround time. As a result, health-care facilities are time-saving diagnostic techniques.

Recent Development

- In June 2020, ImmuSAFE is a lab-based biochip test that leverages Sengenics' unique KREX protein folding technology. It is a multi-antigen COVID-19 biochip test. ImmuSAFE allows researchers to identify target epitopes, titres, and Ig class/sub-class (IgG, IgA, IgM; IgG1-4) of antibodies produced at various stages of COVID-19 infection, including disease development, initial exposure, and post-recovery to post-vaccination.

Global Lab- On-A-Chip Market Scope

The lab-on-a-chip market is segmented on the basis of product type, technology, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Software

- Reagents and Consumables

- Instruments

Technology

- Microarrays

- Microfluidics

Application

- Proteomics

- Genomics

- Drug Discovery

- Diagnostics

End-user

- Diagnostic Labs

- Hospitals

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutes

Lab- On-A-Chip Market Regional Analysis/Insights

The lab-on-a-chip market is analysed and market size insights and trends are provided by country, product type, technology, application and end-user as referenced above.

The countries covered in the lab-on-a-chip market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America holds dominant position in the global lab-on-a-chip market.

Asia-Pacific is the fastest growing region in the global lab-on-a-chip market owing to rising population prone to viral disease.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Lab- On-A-Chip Market Share Analysis

The lab-on-a-chip market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to lab-on-a-chip market.

Some of the major players operating in the lab-on-a-chip market are:

- Siemens (Germany)

- Abaxis (U.S)

- Danaher (U.S)

- Thermo Fisher Scientific Inc. (U.S)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S)

- Bio-Rad Laboratories Inc. (U.S)

- BD (U.S)

- PerkinElmer Inc. (U.S)

- Agilent Technologies Inc. (U.S)

- IDEX (U.S)

- Standard BioTools (U.S)

- Beckman Coulter Inc. (U.S)

- Illumina, Inc (U.S)

- LabSmith (U.S)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LAB-ON-A-CHIP MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LAB-ON-A-CHIP MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 SALES VOLUME

2.2.11 EPIDEMIOLOGY MODELLING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LAB-ON-A-CHIP MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL LAB-ON-A-CHIP MARKET, BY PRODUCT

16.1 OVERVIEW

16.2 CHIPS

16.2.1 CHIPS, BY USABILITY

16.2.1.1. DISPOSABLE

16.2.1.2. REUSABLE

16.2.2 CHIPS, BY MATERIAL

16.2.2.1. POLYMERS

16.2.2.2. GLASS

16.2.2.3. SILICON

16.2.2.4. CERAMICS

16.2.2.5. METALS

16.2.2.6. OTHERS

16.2.3 CHIPS, BY WELL PLATE

16.2.3.1. 96 WELL PLATE

16.2.3.2. 384 WELL PLATE

16.3 INSTRUMENTS

16.3.1 PCR SYSTEMS

16.3.2 ELECTROPHORESIS SYSTEMS

16.3.3 SAMPLE PREPARATION SYSTEMS

16.3.4 FLUID PROCESSOR

16.3.5 CO-CULTURE DEVICES

16.3.6 PATCH-CLAMP DEVICES

16.3.7 DIAGNOSTIC DEVICES

16.3.8 INCUBATOR

16.3.9 OTHERS

16.4 REAGENTS

16.4.1 DRY REAGENTS

16.4.1.1. PCR MASTER MIXES

16.4.1.2. PCR PRIMERS AND PROBES

16.4.1.3. CELL LYSIS REAGENTS

16.4.1.4. BEADS FOR DNA EXTRACTION

16.4.1.5. BUFFER

16.4.2 LIQUID REAGENTS

16.5 CONSUMABLES & ACCESSORIES

16.5.1 FLUIDIC INTERFACE

16.5.2 TUBING

16.5.3 SUPPORT KITS

16.5.4 HANDLING FRAMES

16.5.5 POLYMER SUBSTRATES

16.5.6 PIPETTE

16.5.7 MINI LUER

16.5.8 OTHERS

16.6 SERVICES

16.6.1 CUSTOM MODEL & ASSAY DEVELOPMENT

16.6.2 PROFILING & SCREENING

16.6.3 DRUG DEVELOPMENT

16.6.4 DEVICE DESIGN

16.6.5 COMMERCIALIZATION

16.6.6 OTHERS

16.7 SOFTWARE

16.7.1 LABCHIP GXP SECURITY SOFTWARE

16.7.2 ORACLE(R) DATABASE

16.7.3 OTHER

16.8 OTHERS

17 GLOBAL LAB-ON-A-CHIP MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 MICROARRAYS

17.3 MICROFLUIDICS

17.4 TISSUE BIOCHIP

17.5 OTHERS

18 GLOBAL LAB-ON-A-CHIP MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 DIAGNOSTICS

18.2.1 DNA ISOLATION

18.2.2 PCR

18.2.3 QPCR

18.2.4 ELECTROPHORESIS

18.2.5 SEQUENCING

18.3 GENOMICS

18.3.1 DNA NEXT-GENERATION SEQUENCING

18.3.2 RNA NEXT-GENERATION SEQUENCING

18.4 BIOCHEMICAL ASSAYS

18.4.1 IMMUNOLOGICAL ASSAYS

18.4.2 GLUCOSE MONITORING

18.4.3 OTHERS

18.5 PROTEOMICS

18.5.1 MASS SPECTROMETRY

18.5.2 SDS-PAGE

18.6 CELL RESEARCH

18.6.1 CELL CULTURING

18.6.2 CELL MONITORING

18.6.3 OTHERS

18.7 OTHERS

19 GLOBAL LAB-ON-A-CHIP MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS AND CLINICS

19.2.1 CHIPS

19.2.2 INSTRUMENTS

19.2.3 REAGENTS

19.2.4 CONSUMABLES & ACCESSORIES

19.2.5 SERVICES

19.2.6 SOFTWARE

19.2.7 OTHERS

19.3 BIOTECHNOLOGY AND PHARMACEUTICALS COMPANIES

19.3.1 CHIPS

19.3.2 INSTRUMENTS

19.3.3 REAGENTS

19.3.4 CONSUMABLES & ACCESSORIES

19.3.5 SERVICES

19.3.6 SOFTWARE

19.3.7 OTHERS

19.4 FORENSIC LABORATORIES

19.4.1 CHIPS

19.4.2 INSTRUMENTS

19.4.3 REAGENTS

19.4.4 CONSUMABLES & ACCESSORIES

19.4.5 SERVICES

19.4.6 SOFTWARE

19.4.7 OTHERS

19.5 DIAGNOSTICS CENTERS

19.5.1 CHIPS

19.5.2 INSTRUMENTS

19.5.3 REAGENTS

19.5.4 CONSUMABLES & ACCESSORIES

19.5.5 SERVICES

19.5.6 SOFTWARE

19.5.7 OTHERS

19.6 ACADEMIC AND RESEARCH INSTITUTES

19.6.1 CHIPS

19.6.2 INSTRUMENTS

19.6.3 REAGENTS

19.6.4 CONSUMABLES & ACCESSORIES

19.6.5 SERVICES

19.6.6 SOFTWARE

19.6.7 OTHERS

19.7 OTHERS

20 GLOBAL LAB-ON-A-CHIP MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDERS

20.3 RETAIL SALES

20.3.1 ONLINE SALES

20.3.2 OFFLINE SALES

20.4 OTHERS

21 GLOBAL LAB-ON-A-CHIP MARKET, BY COUNTRY

21.1 GLOBAL LAB-ON-A-CHIP MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1.1 NORTH AMERICA

21.1.1.1. U.S.

21.1.1.1.1. U.S. LAB-ON-A-CHIP MARKET, BY PRODUCT

21.1.1.1.2. U.S. LAB-ON-A-CHIP MARKET, BY TECHNOLOOGY

21.1.1.1.3. U.S. LAB-ON-A-CHIP MARKET, BY APPLICATION

21.1.1.1.4. U.S. LAB-ON-A-CHIP MARKET, END USER

21.1.1.1.5. U.S. LAB-ON-A-CHIP MARKET, DISTRIBUTION CHANNEL

21.1.1.2. CANADA

21.1.1.3. MEXICO

21.1.2 EUROPE

21.1.2.1. GERMANY

21.1.2.2. FRANCE

21.1.2.3. U.K.

21.1.2.4. ITALY

21.1.2.5. SPAIN

21.1.2.6. RUSSIA

21.1.2.7. TURKEY

21.1.2.8. BELGIUM

21.1.2.9. NETHERLANDS

21.1.2.10. SWITZERLAND

21.1.2.11. REST OF EUROPE

21.1.3 ASIA-PACIFIC

21.1.3.1. JAPAN

21.1.3.2. CHINA

21.1.3.3. SOUTH KOREA

21.1.3.4. INDIA

21.1.3.5. AUSTRALIA

21.1.3.6. SINGAPORE

21.1.3.7. THAILAND

21.1.3.8. MALAYSIA

21.1.3.9. INDONESIA

21.1.3.10. PHILIPPINES

21.1.3.11. REST OF ASIA-PACIFIC

21.1.4 SOUTH AMERICA

21.1.4.1. BRAZIL

21.1.4.2. ARGENTINA

21.1.4.3. REST OF SOUTH AMERICA

21.1.5 MIDDLE EAST AND AFRICA

21.1.5.1. SOUTH AFRICA

21.1.5.2. SAUDI ARABIA

21.1.5.3. UAE

21.1.5.4. EGYPT

21.1.5.5. ISRAEL

21.1.5.6. REST OF MIDDLE EAST AND AFRICA

21.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 GLOBAL LAB-ON-A-CHIP MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL LAB-ON-A-CHIP MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL LAB-ON-A-CHIP MARKET, COMPANY PROFILE

24.1 ELVESYS

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 AGILENT TECHNOLOGIES

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 PERKIN ELMER INC.

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 BIO-RAD LABORATRIES

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 SEIMENS HEALTHCARE

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 ABAXIS INC.

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 F. HOFFMANN-LA ROCHE AGX

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 BD

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 ABBOTT

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 IDEX CORPORATION

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 DANAHER CORPORATION

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 BIOCARE AB

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 ENUVIO

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 POREX

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 DIANAX

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 BIOMIMIX

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 FLUID-SCREEN

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 MICRONIT MICROFLUIDICS BV

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 HUDSON MEDICAL INNOVATIONS

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 Z YMERON CORPORATION

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 THERMO FISHER SCIENTIFIC INC.

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 MICROFLUIDIC CHIPSHOP

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 GEOGRAPHIC PRESENCE

24.22.4 PRODUCT PORTFOLIO

24.22.5 RECENT DEVELOPMENTS

24.23 MERCK & CO., INC.

24.23.1 COMPANY OVERVIEW

24.23.2 REVENUE ANALYSIS

24.23.3 GEOGRAPHIC PRESENCE

24.23.4 PRODUCT PORTFOLIO

24.23.5 RECENT DEVELOPMENTS

24.24 EMULATE, INC.

24.24.1 COMPANY OVERVIEW

24.24.2 REVENUE ANALYSIS

24.24.3 GEOGRAPHIC PRESENCE

24.24.4 PRODUCT PORTFOLIO

24.24.5 RECENT DEVELOPMENTS

24.25 BEONCHIP

24.25.1 COMPANY OVERVIEW

24.25.2 REVENUE ANALYSIS

24.25.3 GEOGRAPHIC PRESENCE

24.25.4 PRODUCT PORTFOLIO

24.25.5 RECENT DEVELOPMENTS

24.26 NORTIS BIO

24.26.1 COMPANY OVERVIEW

24.26.2 REVENUE ANALYSIS

24.26.3 GEOGRAPHIC PRESENCE

24.26.4 PRODUCT PORTFOLIO

24.26.5 RECENT DEVELOPMENTS

24.27 INSPHERO

24.27.1 COMPANY OVERVIEW

24.27.2 REVENUE ANALYSIS

24.27.3 GEOGRAPHIC PRESENCE

24.27.4 PRODUCT PORTFOLIO

24.27.5 RECENT DEVELOPMENTS

24.28 AXOSIM

24.28.1 COMPANY OVERVIEW

24.28.2 REVENUE ANALYSIS

24.28.3 GEOGRAPHIC PRESENCE

24.28.4 PRODUCT PORTFOLIO

24.28.5 RECENT DEVELOPMENTS

24.29 BIOIVT

24.29.1 COMPANY OVERVIEW

24.29.2 REVENUE ANALYSIS

24.29.3 GEOGRAPHIC PRESENCE

24.29.4 PRODUCT PORTFOLIO

24.29.5 RECENT DEVELOPMENTS

24.3 ALVEOLIX

24.30.1 COMPANY OVERVIEW

24.30.2 REVENUE ANALYSIS

24.30.3 GEOGRAPHIC PRESENCE

24.30.4 PRODUCT PORTFOLIO

24.30.5 RECENT DEVELOPMENTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.