Mercado de pruebas de seguridad alimentaria de América del Norte, por tipo de prueba (sistema, kits de prueba, consumibles y otros), tipo de pruebas (pruebas de seguridad alimentaria, por tipo de prueba (sistema, kits de prueba y consumibles), tipo de pruebas (pruebas de seguridad alimentaria, pruebas de autenticidad de alimentos y pruebas de vida útil de los alimentos), sitio (laboratorio interno/interno e instalación de subcontratación), aplicación (alimentos, cereales y granos, semillas oleaginosas y legumbres, nueces y bebidas) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de pruebas de seguridad alimentaria en América del Norte

La seguridad y la calidad de los alimentos son preocupaciones importantes para la fabricación de alimentos y la industria minorista y hotelera. La calidad y la higiene de los alimentos tienen un impacto en la productividad. En los últimos años, la adulteración intencional y no intencional se ha convertido en alta tecnología y los laboratorios de pruebas pueden ayudar a detectar estos adulterantes. La función más importante de los laboratorios de pruebas de seguridad alimentaria es analizar los alimentos en busca de adulterantes, patógenos, residuos de pesticidas, contaminantes químicos como metales pesados, contaminantes microbianos, aditivos no permitidos, colorantes, entre otros, y antibióticos en los alimentos. Sin pruebas de alimentos, los productores y fabricantes de alimentos no pueden garantizar la presencia de pesticidas, antibióticos, metales pesados y toxinas naturales, entre otros. Por lo tanto, es importante garantizar la seguridad alimentaria.

La demanda de análisis de alimentos está aumentando, por lo que los fabricantes ahora están más concentrados y participan en el lanzamiento de nuevos productos, la promoción, los premios, la certificación y la participación en eventos en el mercado. Estas decisiones, en última instancia, están mejorando el crecimiento del mercado.

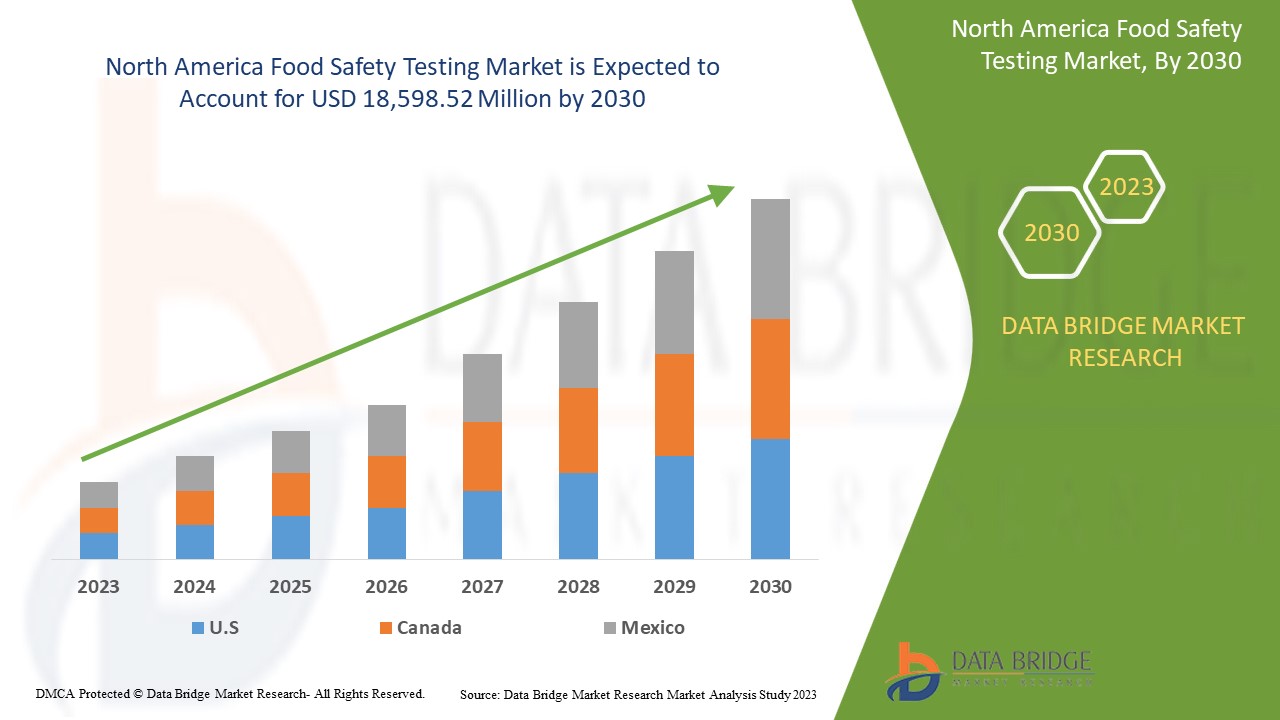

Data Bridge Market Research analiza que se espera que el mercado de pruebas de seguridad alimentaria de América del Norte alcance un valor de USD 18.598,52 millones para 2030, a una CAGR del 8,0 % durante el período de pronóstico. El informe del mercado de pruebas de seguridad alimentaria de América del Norte también cubre todos los parámetros que afectan al mercado cubierto en este estudio de investigación que se han tenido en cuenta, se han visto en detalle, se han verificado a través de una investigación primaria y se han analizado para obtener los datos cuantitativos y cualitativos finales.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2020-1015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de prueba (sistema, kits de prueba y consumibles), tipo de pruebas (pruebas de seguridad alimentaria, pruebas de autenticidad de alimentos y pruebas de vida útil de los alimentos), sitio (laboratorio interno e instalaciones subcontratadas), aplicación (alimentos, cereales y granos, semillas oleaginosas y legumbres, frutos secos y bebidas) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc., NEOGEN Corporation, Spectro Analytical Labs Ltd. y Noack Group, entre otros. |

Definición de mercado

El análisis de alimentos es el análisis científico de los alimentos y su contenido. Se realiza para proporcionar información sobre las distintas características de los alimentos, incluida su estructura, composición y propiedades fisicoquímicas. Las pruebas de seguridad alimentaria incluyen diversas pruebas realizadas por otras razones, como probar la calidad del producto y el control de calidad. Las pruebas de productos alimenticios se pueden realizar utilizando varios métodos altamente avanzados para proporcionar información precisa sobre el valor nutricional y la seguridad de los alimentos. Los métodos más comunes de prueba de productos alimenticios son las pruebas de química analítica, las pruebas sensoriales, las pruebas microbiológicas y el análisis nutricional. Las pruebas de productos alimenticios determinan el contenido de nutrientes mediante análisis nutricionales de laboratorio, llave en mano, software y análisis nutricional en línea. El análisis de laboratorio es el método más preferido.

Las pruebas y análisis de alimentos son esenciales para garantizar la inocuidad de los alimentos y garantizar que sean seguros para el consumo. Esto incluye fortalecer la red de laboratorios de análisis de alimentos, garantizar la calidad de los análisis de alimentos, invertir en recursos humanos y llevar a cabo actividades de vigilancia y educación de los consumidores.

Dinámica del mercado de pruebas de seguridad alimentaria en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento del número de casos de enfermedades transmitidas por alimentos

Se espera que el creciente número de casos de enfermedades transmitidas por alimentos entre personas en todo el mundo impulse el mercado de pruebas de seguridad alimentaria de América del Norte. El consumo de alimentos en mal estado, contaminados o deteriorados con diversos microorganismos, como bacterias, hongos, parásitos, virus y otros, es la principal causa de enfermedades transmitidas por alimentos. Además, otros contaminantes como las micotoxinas, los metales pesados y los productos químicos también están provocando un aumento de los casos de enfermedades transmitidas por alimentos entre las personas. Estos casos crecientes aumentan significativamente la demanda de kits, equipos y sistemas de pruebas de alimentos en toda la región. La principal razón detrás del aumento de las enfermedades transmitidas por alimentos en la industria alimentaria es la falta de concienciación de la fuerza laboral, los manipuladores de alimentos y los fabricantes, ya que carecen de conocimientos sobre tecnologías modernas, buenas prácticas de fabricación (BPF), sistemas de análisis de peligros y puntos críticos de control (HACCP) y control de calidad. La falta de conocimiento entre los trabajadores conduce a una mayor prevalencia de las enfermedades transmitidas por alimentos.

- Aumento de la concienciación de los consumidores respecto a la seguridad alimentaria

Con el aumento del número de casos de enfermedades transmitidas por los alimentos y de intoxicaciones alimentarias, cada vez más consumidores se están dando cuenta de la importancia de comer alimentos seguros y saludables. Esto ha llevado a una mayor demanda de alimentos seguros y de buena calidad entre las personas, generando la demanda de equipos de prueba de seguridad alimentaria. La creciente incidencia de enfermedades transmitidas por los alimentos ha llevado a los consumidores a realizar cambios vitales en su dieta y estilo de vida, lo que los ha hecho más preocupados por la seguridad alimentaria. Los consumidores son conscientes de sus alimentos y la seguridad alimentaria es su principal preocupación.

La seguridad alimentaria es importante para la salud de los consumidores, de toda la industria alimentaria y de las autoridades reguladoras. Ante la creciente preocupación por la seguridad alimentaria entre los consumidores, el gobierno también está tomando iniciativas para promover la seguridad alimentaria entre los consumidores.

- Aumento del número de retiradas de productos alimentarios

El retiro de un producto es una solicitud de un fabricante a los consumidores para que lo devuelvan después de descubrir la presencia de patógenos o problemas de seguridad en el producto que podrían poner en peligro la vida del consumidor. El retiro de un producto puede poner al fabricante en riesgo de acciones legales. El aumento de los casos de retiro de productos en diferentes marcas y empresas debido a la contaminación de los alimentos, ya sea con un patógeno, metales pesados o ciertos productos químicos, está generando una mayor demanda de equipos y sistemas de prueba de seguridad alimentaria. La contaminación de los alimentos puede provocar graves problemas de salud para los consumidores, lo que hace que los kits y sistemas de seguridad alimentaria sean una consideración más importante. Ha habido muchos casos de retiro de productos con diferentes fabricantes.

Restricciones

- Falta de instalaciones de infraestructura para pruebas de alimentos

El creciente número de retiradas de productos, casos de contaminación de alimentos, incidentes de intoxicación alimentaria y la creciente concienciación de los consumidores han llevado a una creciente demanda de instalaciones de seguridad alimentaria en toda la región. Sin embargo, la falta de instalaciones de infraestructura en los laboratorios de análisis de alimentos está obstaculizando el crecimiento del mercado de pruebas de seguridad alimentaria de América del Norte. Para obtener resultados precisos de las pruebas de alimentos, se deben mantener buenas condiciones de higiene en los laboratorios, pero estos no están bien desarrollados en términos de infraestructura, agua potable, capacitación del personal, tecnologías modernas para el control de calidad, operaciones de envasado y procedimientos estándar de desinfección. Además, la implementación de controles microbiológicos en un programa GMP o HACCP está básicamente fuera de discusión debido a las condiciones insuficientes o inadecuadas de la planta.

- Falta de conocimientos técnicos en las pequeñas empresas

Las pequeñas empresas y los fabricantes de productos alimenticios no tienen suficiente información sobre los nuevos métodos, servicios y programas de seguridad alimentaria de alta tecnología, por lo que no pueden cumplir con los requisitos específicos de seguridad alimentaria. Por lo tanto, la falta de habilidades y conocimientos, especialmente en los países en desarrollo, afectará la evaluación e inspección efectivas de las operaciones alimentarias. La experiencia y los conocimientos técnicos son esenciales para implementar dichos procedimientos. Por lo tanto, el gobierno debe llevar a cabo ciertos programas para educar a los trabajadores de modo que se puedan realizar las pruebas de seguridad alimentaria al máximo y, por lo tanto, se pueda lograr la seguridad. La falta de experiencia y conocimientos técnicos, especialmente en las pequeñas empresas, conducirá a una contaminación grave de los productos alimenticios y bebidas, lo que dará lugar a enfermedades transmitidas por los alimentos y puede causar graves problemas. La falta de experiencia y conocimientos técnicos podría perjudicar a la industria de las pruebas de seguridad alimentaria. La creciente automatización en la industria requiere personas capacitadas y técnicamente sólidas para operar la maquinaria y las pequeñas empresas no pueden encontrar profesionales capacitados para ello.

Oportunidades

- Creciente demanda y popularidad de alimentos con etiqueta limpia

Los productos alimenticios de etiqueta limpia contienen ingredientes alimentarios que son más naturales y menos procesados. Los consumidores están optando por opciones de alimentos saludables y limpios para vivir estilos de vida más saludables, lo que aumenta la demanda de pruebas de seguridad alimentaria. Hoy en día, los consumidores se inclinan más por los alimentos de etiqueta limpia, libres de conservantes o aditivos, para continuar con un cierto estilo de vida. Además, la conciencia sobre la promoción de un medio ambiente sostenible mediante el uso de productos de etiqueta limpia está impulsando el crecimiento del mercado. Con la creciente demanda de alimentos de etiqueta limpia o productos alimenticios de etiqueta segura, la demanda de pruebas de seguridad alimentaria también está aumentando a medida que los fabricantes ofrecen productos de etiqueta alimentaria segura para garantizar a los consumidores que los productos alimenticios están libres de patógenos dañinos, micotoxinas, metales pesados y químicos.

Desafíos

- Falta de un estándar uniforme de seguridad y calidad

En los últimos años, la demanda de productos alimenticios limpios y seguros ha aumentado repentinamente entre los consumidores, lo que ha llevado a los organismos gubernamentales a desarrollar diferentes y nuevos estándares de seguridad alimentaria. Como resultado, el número de estándares nacionales de seguridad alimentaria ha aumentado y ha generado confusión. Además, las regulaciones de seguridad alimentaria difieren de un país a otro, ya que los alimentos se consideran seguros para el consumo en un país, pero no seguros para su importación a otros países. Por lo tanto, la necesidad de armonizar el estándar de seguridad alimentaria está aumentando. El aumento en el número de iniciativas tomadas por las autoridades gubernamentales para dar uniformidad al estándar de seguridad alimentaria ayudará a abordar el gran desafío que enfrenta el mercado de pruebas de seguridad alimentaria de América del Norte.

Acontecimientos recientes

- En mayo, Biomerieux adquirió Specific Diagnostics, una empresa privada que ha desarrollado una prueba de susceptibilidad a los antimicrobianos. Esto ayudó a la empresa a expandir su liderazgo a nivel mundial.

- En abril, FOSS anunció el lanzamiento de modelos de adulteración específicos, que permiten a las instalaciones de análisis de leche programar instrumentos de análisis para analizar muestras de leche cruda en busca de fuentes conocidas de adulteración de la leche. Los nuevos modelos complementan un modelo no específico existente que permite la detección de cualquier anomalía.

Alcance del mercado de pruebas de seguridad alimentaria en América del Norte

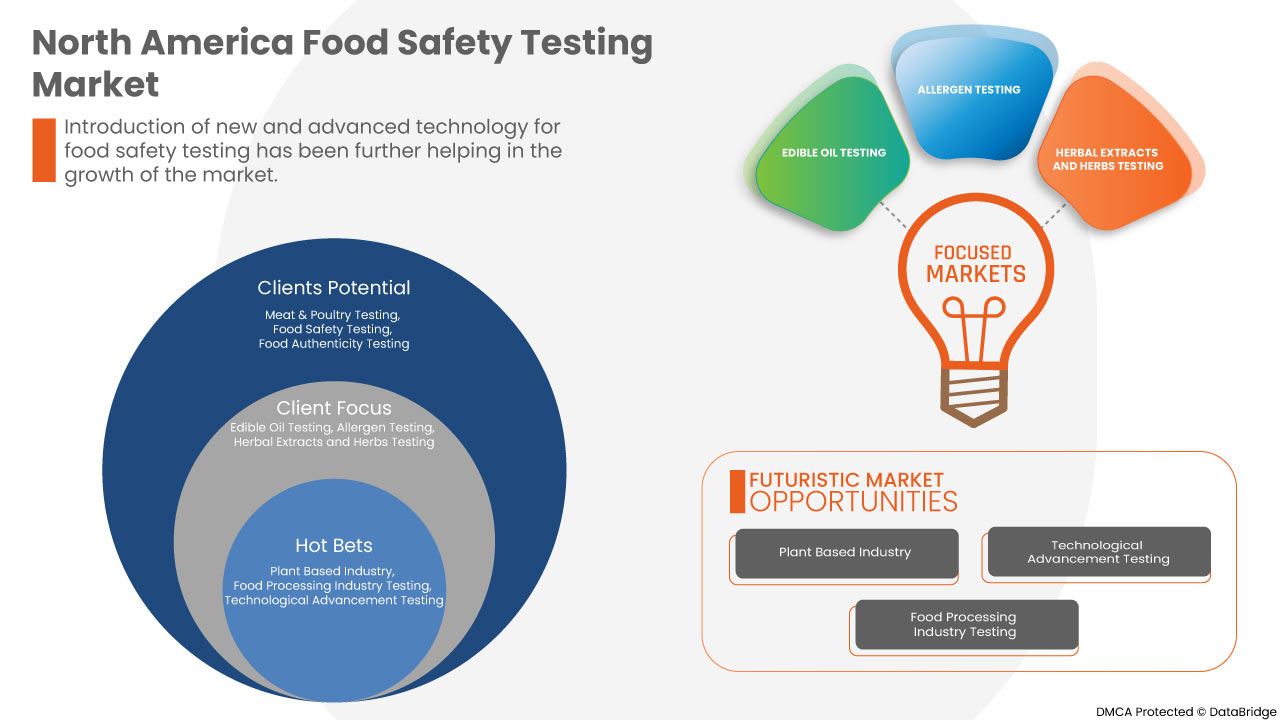

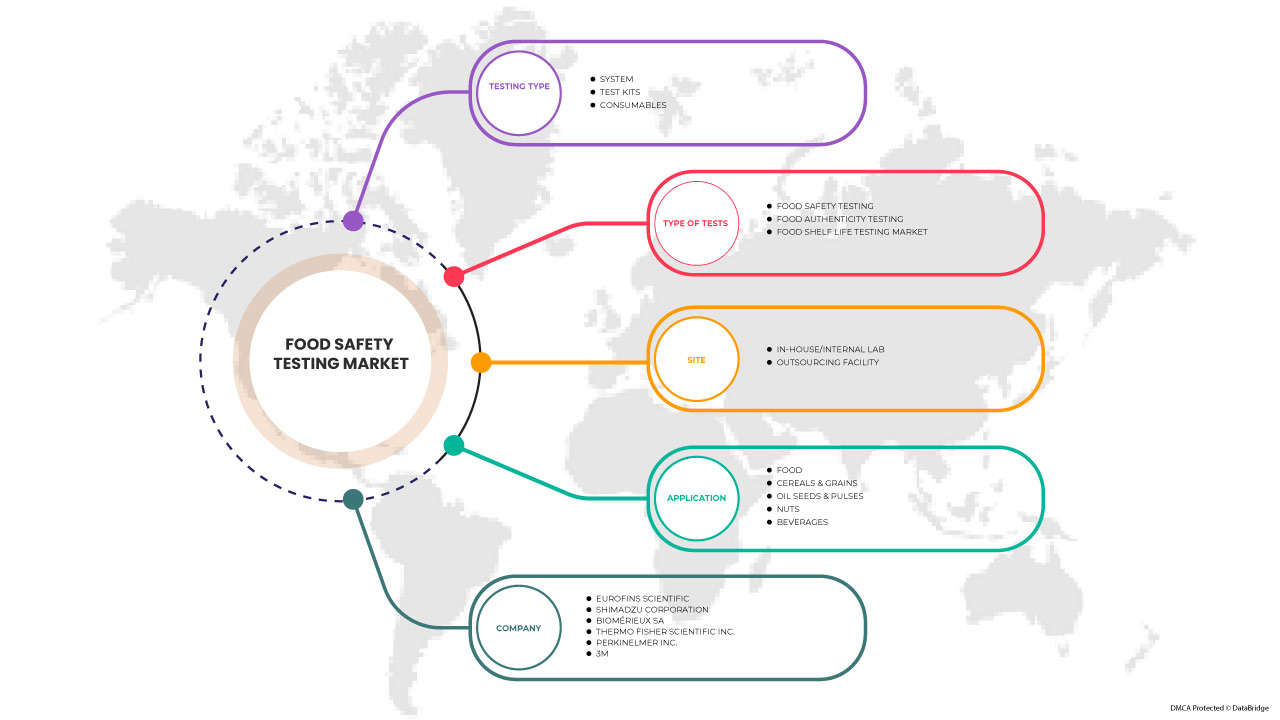

El mercado de pruebas de seguridad alimentaria de América del Norte está segmentado por tipo de prueba, tipo de prueba, sitio y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de prueba

- Sistema

- Kits de prueba

- Consumibles

Según el tipo de prueba, el mercado de pruebas de seguridad alimentaria de América del Norte está segmentado en sistemas, kits de prueba y consumibles.

Tipos de pruebas

- Pruebas de seguridad alimentaria

- Prueba de autenticidad de alimentos

- Prueba de vida útil de los alimentos

Sobre la base del tipo de pruebas, el mercado de pruebas de seguridad alimentaria de América del Norte está segmentado en pruebas de seguridad alimentaria, pruebas de autenticidad de los alimentos y pruebas de vida útil de los alimentos.

Sitio

- Laboratorio interno

- Instalación de subcontratación

Sobre la base del sitio, el mercado de pruebas de seguridad alimentaria de América del Norte está segmentado en laboratorio interno e instalaciones de subcontratación.

Solicitud

- Alimento

- Cereales y granos

- Semillas oleaginosas y legumbres

- Cojones

- Bebidas

Sobre la base de la aplicación, el mercado de pruebas de seguridad alimentaria de América del Norte está segmentado en alimentos, cereales y granos, semillas oleaginosas y legumbres, frutos secos y bebidas.

Análisis y perspectivas regionales del mercado de pruebas de seguridad alimentaria en América del Norte

Se analiza el mercado de pruebas de seguridad alimentaria de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo de prueba, tipo de pruebas, sitio y aplicación como se menciona anteriormente.

Algunos de los países cubiertos en el informe del mercado de pruebas de seguridad alimentaria de América del Norte son Estados Unidos, Canadá y México.

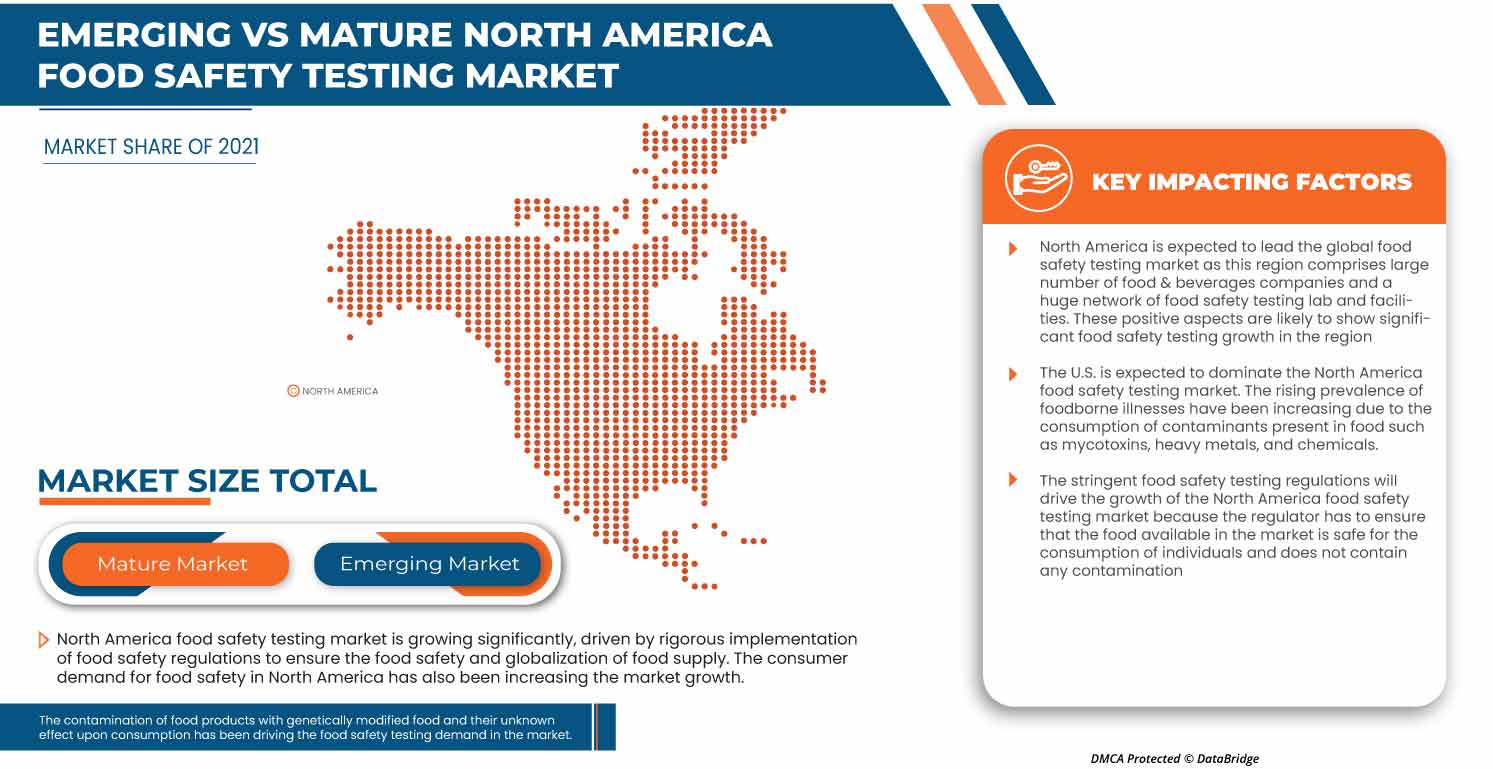

Se prevé que Estados Unidos domine el mercado de pruebas de seguridad alimentaria en América del Norte debido al aumento de los casos de enfermedades transmitidas por los alimentos.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de pruebas de seguridad alimentaria en América del Norte

El panorama competitivo del mercado de pruebas de seguridad alimentaria de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de pruebas de seguridad alimentaria de América del Norte.

Algunos de los principales actores que operan en el mercado de pruebas de seguridad alimentaria de América del Norte son Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc. y NEOGEN Corporation, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD SAFETY TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD SAFETY TESTING TECHNOLOGIES

4.2 EMERGING TREND ANALYSIS

4.3 GROWING FOOD ADULTERATION CASES

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.5.1 INCREASING AUTOMATION IN FOOD TESTING

4.5.2 RISING TREND OF FOODBORNE PATHOGEN TESTING

4.5.3 INCREASING TREND OF ENVIRONMENTAL MONITORING

4.5.4 FOOD TESTING WITH HIGH ACCURACY AND PRECISION TECHNOLOGY

4.5.5 RISING TREND OF GMO TESTING

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 PRODUCTS/SERVICES

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8.1 INTRODUCTION OF ROBOTICS FOR FOOD CONTAMINANT DETECTION

4.8.2 DEVELOPMENT OF BIO-SENSOR-BASED TECHNIQUES FOR PATHOGEN DETECTION

4.8.3 TECHNOLOGICAL ADVANCEMENT IN FOOD CHEMICAL AND MYCOTOXIN TESTING

4.8.4 INTRODUCTION OF DNA FINGERPRINTING TECHNIQUES

5 REGULATIONS ON NORTH AMERICA FOOD SAFETY TESTING MARKET

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS AND RECENTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.4 LAWSUITS RELATED TO FOOD SAFETY TESTING

5.5 FOOD PRODUCTS WITHDRAWALS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE NUMBER OF FOODBORNE ILLNESS CASES

6.1.2 INCREASE IN CONSUMER AWARENESS REGARDING FOOD SAFETY

6.1.3 STRINGENT SAFETY RULES AND REGULATIONS FOR FOOD

6.1.4 RISE IN THE NUMBER OF FOOD PRODUCT RECALLS

6.2 RESTRAINTS

6.2.1 LACK OF INFRASTRUCTURE FACILITIES FOR FOOD TESTING

6.2.2 LACK OF TECHNICAL EXPERTISE IN SMALL ENTERPRISES

6.2.3 HIGH INITIAL INVESTMENT FOR INSTALLATION OF FOOD TESTING EQUIPMENT

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND AND POPULARITY FOR CLEAN-LABEL FOOD

6.3.2 INCREASE IN GOVERNMENT INITIATIVES TO MONITOR FOOD SAFETY

6.3.3 GROWING AUTOMATION IN THE FOOD TESTING INDUSTRY

6.4 CHALLENGES

6.4.1 LACK OF UNIFORM QUALITY FOOD SAFETY STANDARD

6.4.2 INCREASE IN THE NUMBER OF FALSE FOOD TESTING RESULT CASES

7 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE

7.1 OVERVIEW

7.2 SYSTEM

7.2.1 HYBRIDIZATION BASED

7.2.1.1 POLYMERASE CHAIN REACTION(PCR)

7.2.1.2 MIICROARRAYS

7.2.1.3 GENE AMPLIFIERS

7.2.1.4 SEQUNCES

7.2.2 CHROMATOGRAPHY BASED

7.2.2.1 LIQUID CHROMATOGRAPHY

7.2.2.2 GAS CHROMATOGRAPHY

7.2.2.3 COLUMN CHROMATOGRAPHY

7.2.2.4 THIN LAYER CHROMATOGRAPHY

7.2.2.5 PAPER CHROMATOGRAPHY

7.2.3 SPECTROMETRY BASED

7.2.4 IMMUNOASSAY BASED

7.2.5 BIOSENSOR/BIOCHIP

7.2.6 NMR TECHNIQUE/MOLECULAR SPECTROMETRY

7.2.7 ISOTOPE METHODS

7.3 TEST KITS

7.4 CONSUMABLES

8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE

8.1 OVERVIEW

8.2 IN-HOUSE/INTERNAL LAB

8.3 OUTSOURCING FACILITY

9 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 VIBRIO SPP

9.2.2.6 CAMPYLOBACTER

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 PESTICIDES TESTING

9.2.6.1 INSECTICIDES

9.2.6.2 HERBICIDES

9.2.6.3 FUNGICIDES

9.2.6.4 OTHERS

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 ORGANIC CONTAMINANTS TESTING

9.3 FOOD SHELF LIFE TESTING

9.3.1 BY TYPE

9.3.1.1 CHEMICAL TESTS

9.3.1.2 ACIDITY LEVELS

9.3.1.3 RANCIDITY

9.3.1.3.1 PEROXIDE VALUE (PV)

9.3.1.3.2 FREE FATTY ACIDS (FFA)

9.3.1.3.3 P-ANISIDINE (P-AV)

9.3.2 ORGANOLEPTIC AND APPEARANCE

9.3.2.1 COLOUR

9.3.2.2 TEXTURE

9.3.2.3 AROMA

9.3.2.4 TASTE

9.3.2.5 PACKAGING

9.3.2.6 STRATIFICATION

9.3.3 INGREDIENT ACTIVITY

9.3.4 BROWNING

9.3.4.1 ENZYMATIC BROWNING

9.3.4.2 CHEMICAL BROWNING

9.3.5 NUTRIENT STABILITY

9.3.6 BY METHOD

9.3.6.1 REAL-TIME SHELF LIFE TESTING

9.3.6.2 ACCELERATED SHELF LIFE TESTING

9.3.7 BY PACKED FOOD CONDITION

9.3.7.1 FROZEN (-15°C TO -20°C)

9.3.7.2 REFRIGERATED (2°C TO 8°C)

9.3.7.3 AMBIENT (25°C/60%RH)

9.3.7.4 INTERMEDIATE (30°C/65%RH)

9.3.7.5 ACCELERATED (40°C/75%RH)

9.3.7.6 TROPICAL (30°C/75%RH)

9.3.7.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1 ADULTERATION TESTS

9.4.2 ORGANIC

9.4.3 ALLERGEN TESTING

9.4.4 MEAT SPECIATION

9.4.5 GMO TESTING

9.4.6 HALAL VERIFICATION

9.4.7 KOSHER VERIFICATION

9.4.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.10 FALSE LABELING

10 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD

10.2.1 EDIBLE OILS

10.2.1.1 EDIBLE OILS, BY TYPE

10.2.1.1.1 SUNFLOWER OIL

10.2.1.1.2 PEANUT OIL

10.2.1.1.3 SOYBEAN OIL

10.2.1.1.4 OLIVE OIL

10.2.1.1.5 COCONUT OIL

10.2.1.1.6 OTHERS

10.2.1.2 EDIBLE OILS, BY TESTING TYPE

10.2.1.2.1 FOOD SAFETY TESTING

10.2.1.2.2 FOOD AUTHENTICITY TESTING

10.2.1.2.3 FOOD SHELF LIFE TESTING

10.2.2 SPICES

10.2.2.1 SPICES, BY TESTING TYPE

10.2.2.1.1 FOOD SAFETY TESTING

10.2.2.1.2 FOOD AUTHENTICITY TESTING

10.2.2.1.3 FOOD SHELF LIFE TESTING

10.2.3 DAIRY PRODUCTS

10.2.3.1 DAIRY PRODUCTS, BY TYPE

10.2.3.1.1 CHEESE

10.2.3.1.2 PROCESSED CHEESES

10.2.3.1.3 ICE CREAM

10.2.3.1.4 YOGURT

10.2.3.1.5 MILK DESSERT

10.2.3.1.6 PUDDING

10.2.3.1.7 CUSTARD

10.2.3.1.8 CHEESE BASED DESSERTS

10.2.3.1.8.1 CHEESE CAKE

10.2.3.1.8.2 CHEESE CREAM

10.2.3.1.8.3 CHEESE PUDDING

10.2.3.1.8.4 OTHERS

10.2.3.1.9 OTHERS

10.2.3.2 DAIRY PRODUCTS, BY TESTING TYPE

10.2.3.2.1 FOOD SAFETY TESTING

10.2.3.2.2 FOOD AUTHENTICITY TESTING

10.2.3.2.3 FOOD SHELF LIFE TESTING

10.2.4 CONFECTIONARY

10.2.4.1 CONFECTIONARY, BY TYPE

10.2.4.1.1 CANDY BARS

10.2.4.1.2 JAMS AND JELLIES

10.2.4.1.3 JELLY CANDIES

10.2.4.1.4 MARMALADES

10.2.4.1.5 FRUIT JELLY DESSERT

10.2.4.1.6 MERINGUES

10.2.4.1.7 OTHERS

10.2.4.2 CONFECTIONARY, BY TESTING TYPE

10.2.4.2.1 FOOD SAFETY TESTING

10.2.4.2.2 FOOD AUTHENTICITY TESTING

10.2.4.2.3 FOOD SHELF LIFE TESTING

10.2.5 HERBAL EXTRACTS AND HERBS

10.2.5.1 HERBAL EXTRACTS AND HERBS, BY TESTING TYPE

10.2.5.1.1 FOOD SAFETY TESTING

10.2.5.1.2 FOOD AUTHENTICITY TESTING

10.2.5.1.3 FOOD SHELF LIFE TESTING

10.2.6 MEAT & POULTRY PRODUCTS

10.2.6.1 MEAT & POULTRY PRODUCTS, BY TYPE

10.2.6.1.1 CHICKEN

10.2.6.1.1.1 FROZEN

10.2.6.1.1.2 FRESH

10.2.6.1.2 PORK

10.2.6.1.2.1 FROZEN

10.2.6.1.2.2 FRESH

10.2.6.1.3 SEAFOOD

10.2.6.1.3.1 FROZEN

10.2.6.1.3.2 FRESH

10.2.6.1.4 BEEF

10.2.6.1.4.1 FROZEN

10.2.6.1.4.2 FRESH

10.2.6.1.5 LAMB

10.2.6.1.5.1 FROZEN

10.2.6.1.5.2 FRESH

10.2.6.1.6 OTHERS

10.2.6.1.6.1 FROZEN

10.2.6.1.6.2 FRESH

10.2.6.2 MEAT & POULTRY PRODUCTS, BY TESTING TYPE

10.2.6.2.1 FOOD SAFETY TESTING

10.2.6.2.2 FOOD AUTHENTICITY TESTING

10.2.6.2.3 FOOD SHELF LIFE TESTING

10.2.7 PROCESSED FOOD

10.2.7.1 PROCESSED FOOD, BY TYPE

10.2.7.1.1 CANNED FRUITS & VEGETABLES

10.2.7.1.2 JAMS, PRESERVES & MARMALADES

10.2.7.1.3 FRUIT & VEGETABLE PUREE

10.2.7.1.4 SAUCES, DRESSINGS AND CONDIMENTS

10.2.7.1.5 READY MEALS

10.2.7.1.6 PICKLES

10.2.7.1.7 SOUPS

10.2.7.2 PROCESSED FOOD, BY TESTING TYPE

10.2.7.2.1 FOOD SAFETY TESTING

10.2.7.2.2 FOOD AUTHENTICITY TESTING

10.2.7.2.3 FOOD SHELF LIFE TESTING

10.2.8 HONEY

10.2.8.1 HONEY, BY TESTING TYPE

10.2.8.1.1 FOOD SAFETY TESTING

10.2.8.1.2 FOOD AUTHENTICITY TESTING

10.2.8.1.3 FOOD SHELF LIFE TESTING

10.2.9 BABY FOOD

10.2.9.1 BABY FOOD, BY TESTING TYPE

10.2.9.1.1 FOOD SAFETY TESTING

10.2.9.1.2 FOOD AUTHENTICITY TESTING

10.2.9.1.3 FOOD SHELF LIFE TESTING

10.2.10 PLANT BASED MEAT AND POULTRY ALTERNATIVES

10.2.10.1 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TYPE

10.2.10.1.1 BURGER & PATTIES

10.2.10.1.2 SAUSAGES

10.2.10.1.3 STRIPS & NUGGETS

10.2.10.1.4 MEATBALLS

10.2.10.1.5 TEMPEH

10.2.10.1.6 TOFU

10.2.10.1.7 SEITEN

10.2.10.1.8 OTHERS

10.2.10.2 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TESTING TYPE

10.2.10.2.1 FOOD SAFETY TESTING

10.2.10.2.2 FOOD AUTHENTICITY TESTING

10.2.10.2.3 FOOD SHELF LIFE TESTING

10.2.11 TOBACCO

10.2.11.1 TOBACCO, BY TESTING TYPE

10.2.11.1.1 FOOD SAFETY TESTING

10.2.11.1.2 FOOD AUTHENTICITY TESTING

10.2.11.1.3 FOOD SHELF LIFE TESTING

10.2.12 CBD PRODUCTS

10.2.12.1 CBD PRODUCTS, BY TESTING TYPE

10.2.12.1.1 FOOD SAFETY TESTING

10.2.12.1.2 FOOD AUTHENTICITY TESTING

10.2.12.1.3 FOOD SHELF LIFE TESTING

10.3 CEREALS & GRAINS

10.3.1 CEREALS & GRAINS, BY TYPE

10.3.1.1 WHEAT

10.3.1.2 MAIZE

10.3.1.3 BARLEY

10.3.1.4 RICE

10.3.1.5 OAT

10.3.1.6 SORGHUM

10.3.1.7 OTHERS

10.3.2 CEREALS & GRAINS, BY TESTING TYPE

10.3.2.1 FOOD SAFETY TESTING

10.3.2.2 FOOD AUTHENTICITY TESTING

10.3.2.3 FOOD SHELF LIFE TESTING

10.4 OIL SEEDS & PULSES

10.4.1 OIL SEEDS & PULSES, BY TYPE

10.4.1.1 GRAM

10.4.1.2 PEA

10.4.1.3 LENTILS

10.4.1.4 SUNFLOWER

10.4.1.5 SOYABEAN

10.4.1.6 GROUNDNUT

10.4.1.7 SESAME

10.4.1.8 COTTON SEED

10.4.1.9 PALM

10.4.1.10 OTHERS

10.4.2 OIL SEEDS & PULSES, BY TESTING TYPE

10.4.2.1 FOOD SAFETY TESTING

10.4.2.2 FOOD AUTHENTICITY TESTING

10.4.2.3 FOOD SHELF LIFE TESTING

10.5 NUTS

10.5.1 NUTS, BY TYPE

10.5.1.1 ALMOND

10.5.1.2 WALNUT

10.5.1.3 CASHEW NUT

10.5.1.4 BRAZIL NUT

10.5.1.5 MACADAMIA NUT

10.5.1.6 OTHERS

10.5.2 NUTS, BY TESTING TYPE

10.5.2.1 FOOD SAFETY TESTING

10.5.2.2 FOOD AUTHENTICITY TESTING

10.5.2.3 FOOD SHELF LIFE TESTING

10.6 BEVERAGES

10.6.1 BEVERAGES, BY TYPE

10.6.1.1 NON-ALCOHOLIC

10.6.1.1.1 CARBONATED DRINKS

10.6.1.1.2 MINERAL WATER

10.6.1.1.3 COFFEE

10.6.1.1.4 JUICES

10.6.1.1.5 SMOOTHIES

10.6.1.1.6 TEA

10.6.1.1.7 PLANT-BASED MILK

10.6.1.1.7.1 SOY MILK

10.6.1.1.7.2 ALMOND MILK

10.6.1.1.7.3 OAT MILK

10.6.1.1.7.4 CASHEW MILK

10.6.1.1.7.5 RICE MILK

10.6.1.1.7.6 OTHERS

10.6.1.1.8 SPORTS DRINKS

10.6.1.1.9 NUTRITIONAL DRINKS

10.6.1.1.10 OTHERS

10.6.1.2 ALCOHOLIC

10.6.1.2.1 BEER

10.6.1.2.2 WINE

10.6.1.2.3 WHISKY

10.6.1.2.4 VODKA

10.6.1.2.5 TEQUILA

10.6.1.2.6 GIN

10.6.1.2.7 BRANDS

10.6.1.2.8 OTHERS

10.6.1.3 BEVERAGES, BY TESTING TYPE

10.6.1.3.1 FOOD SAFETY TESTING

10.6.1.3.2 FOOD AUTHENTICITY TESTING

10.6.1.3.3 FOOD SHELF LIFE TESTING

11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE: NORTH AMERICA FOOD SAFETY TESTING MARKET

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 RECENT FINANCIALS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SHIMADZU CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 BIOMÉRIEUX SA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 RECENT FINANCIALS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 PERKINELMER INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 3M

14.6.1 COMPANY SNAPSHOT

14.6.2 RECENT FINANCIALS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ALS

14.8.1 COMPANY SNAPSHOT

14.8.2 RECENT FINANCIALS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BIOREX FOOD DIAGNOSTICS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CLEAR LABS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 FOSS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INVISIBLE SENTINEL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LEXAGENE

14.13.1 COMPANY SNAPSHOT

14.13.2 RECENT FINANCIALS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 NEOGEN CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 NOACK GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 OMEGA DIAGNOSTICS GROUP PLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RANDOX FOOD DIAGNOSTICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 RING BIOTECHNOLOGY CO LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 ROKA BIO SCIENCE

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ROMER LABS DIVISION HOLDING GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

14.21.1 COMPANY SNAPSHOT

14.21.2 RECENT FINANCIALS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 SPECTRO ANALYTICAL LABS LTD.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TEST KITS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CONSUMABLES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA IN-HOUSE IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OUTSOURCING FACILITY IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HERBAL EXTRACTS AND HERBS PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA CEREALS AND GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OIL SEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA OILSEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA OIL SEEDS AND PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PLANT-BASED MILK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 131 U.S. FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 U.S. CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.S. FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 136 U.S. FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 U.S. ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 U.S. PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 U.S. MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 U.S. HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 U.S. ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 148 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 149 U.S. FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 151 U.S. FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 152 U.S. FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 153 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 U.S. CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 U.S. BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 U.S. OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 U.S. HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 168 U.S. HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 170 U.S. BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 189 CANADA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 190 CANADA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 CANADA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 194 CANADA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 CANADA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 206 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 207 CANADA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 CANADA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 CANADA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 CANADA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 223 CANADA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 229 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 239 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 CANADA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 CANADA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 CANADA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 MEXICO CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 249 MEXICO FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 261 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 262 MEXICO FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 MEXICO FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 269 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 291 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 293 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 295 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 297 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 MEXICO ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 MEXICO NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 MEXICO PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD SAFETY TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD SAFETY TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD SAFETY TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD SAFETY TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD SAFETY TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 10 STRINGENT RULES AND REGULATIONS REGARDING FOOD SAFETY BY DIFFERENT GOVERNMENT ORGANIZATIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN THE FORECAST PERIOD

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN 2023 & 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 14 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2022

FIGURE 15 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2022

FIGURE 16 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2022

FIGURE 17 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA MANGO MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA MANGO MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA MANGO MARKET: BY TESTING TYPE (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.