Global Cosmetic Preservatives Market

Taille du marché en milliards USD

TCAC :

%

USD

383.17 Million

USD

658.36 Million

2021

2029

USD

383.17 Million

USD

658.36 Million

2021

2029

| 2022 –2029 | |

| USD 383.17 Million | |

| USD 658.36 Million | |

|

|

|

|

Global Cosmetic Preservatives Market, By Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic and Their Salts, Others), Raw Material (Synthetic, Natural), Application (Lotions, Facemasks, Sunscreens and Scrubs, Shampoo and Conditioners, Soaps, Shower Cleansers and Shaving Gels, Face Powder and Powder Compacts, Mouthwash and Toothpaste, Others) – Industry Trends and Forecast to 2029.

Cosmetic Preservatives Market Analysis and Size

The global cosmetic preservatives market is expected to drive by improving the consumer’s inclination towards the self-care with up-gradation in the quality of cosmetic product and rising awareness regarding beauty product among end users. The rising demand of natural products over synthetic products towards consumers is another major factor which is adding value to the growth of the cosmetic preservatives market. The “natural cosmetic preservatives” is the highest growing raw material segment due to increasing incorporation of natural ingredients in cosmetic formulations and availability of natural alternatives over the synthetic cosmetic preservatives which has supported by growing consumer awareness towards the harmful nature of chemical ingredients over the forecast period. Furthermore, increasing investment on R&D projects by major market players to bring the latest beauty care product creates immense opportunities for the growth of the cosmetic preservatives market.

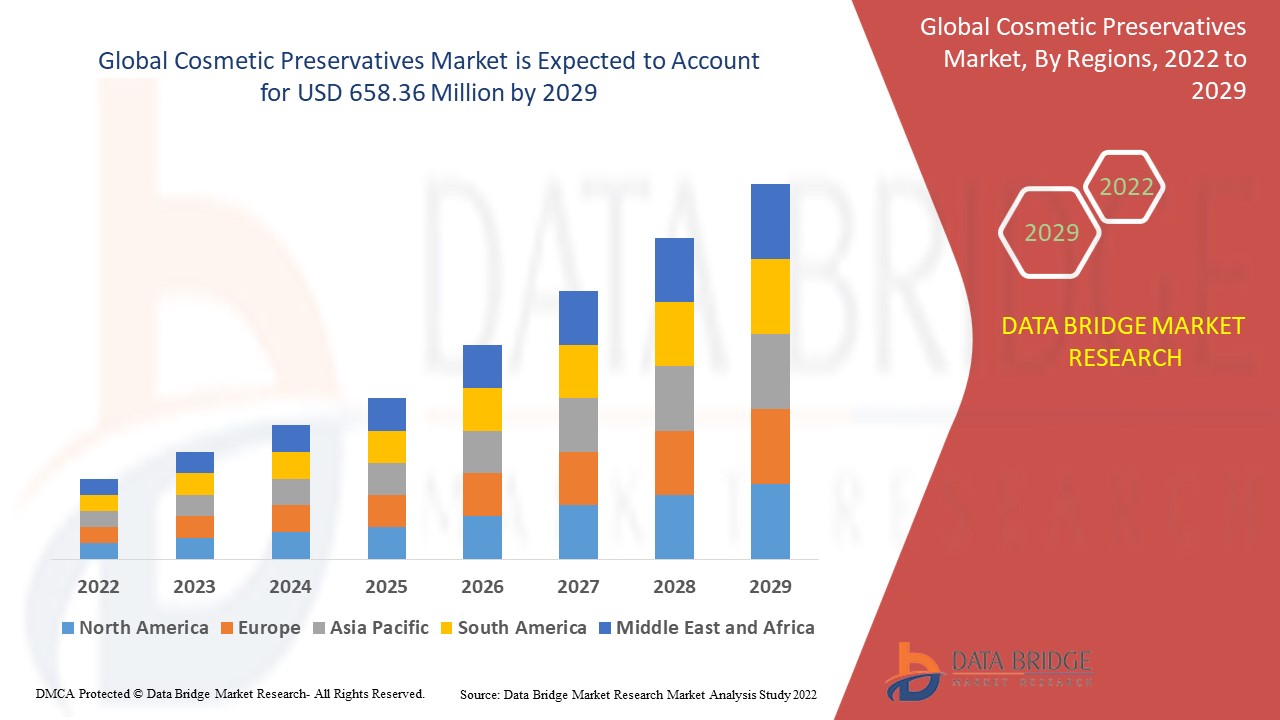

Data Bridge Market Research analyses that the cosmetic preservatives market is expected to undergo a CAGR of 7.00% during the forecast period. This indicates that the market value, which was USD 383.17 million in 2021, would rocket up to USD 658.36 million by 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Cosmetic Preservatives Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic and Their Salts, Others), Raw Material (Synthetic, Natural), Application (Lotions, Facemasks, Sunscreens and Scrubs, Shampoo and Conditioners, Soaps, Shower Cleansers and Shaving Gels, Face Powder and Powder Compacts, Mouthwash and Toothpaste, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Ashland (U.S.), BASF SE (Germany), Evonik Industries (Germany), Akema (Italy), Symrise AG (Germany), Clariant AG (Switzerland), Salicylates and Chemicals Pvt. Ltd (India), Chemipol (Spain), International Flavors and Fragrances Inc. (U.S.), Sharon Laboratories (Israel), Dow (U.S.), The Lubrizol Corporation (U.S.), NIPPON SHOKUBAI CO. LTD (Japan), Henan Qingshuiyuan Technology CO., Ltd., (China), Aurora Fine Chemicals (U.S.), Zouping Dongfang Chemical Co., Ltd. (China), ACURO ORGANICS LIMITED (U.S.), Maxwell Additives Pvt. Ltd (India), Nouryon (Netherlands), Lonza (Switzerland) |

|

Market Opportunities |

|

Market Definition

Cosmetic preservative is a synthetic or natural ingredients added to personal care products to inhibit the unnecessary chemical changes and decay from the microbial growth. The consumption of cosmetic preservatives is important in most products to prevent the damage of product damage and to prevent the cosmetic products from uncalculated contamination. Cosmetic products such as hair-smoothing products, colour cosmetics, fragrances, lipsticks, shampoos, conditioners, lotions, moisturizers, and anti-aging products all consist preservatives.

Cosmetic Preservatives Market Dynamics

Drivers

- Increasing awareness towards the use of cosmetic preservatives

Growing consumer awareness and inclination towards the use of cosmetic preservatives due to its ability to protect the cosmetic products for a longer time. Easy availability of synthetic and natural cosmetic preservatives are expected to boost the demands of the cosmetic preservatives in the market. Growing cosmetic product adoption due to various benefits such as maintaining the product freshness during the long time between the time of manufacture and the time the consumer finishes using the product may contribute towards the expansion of cosmetic preservatives market.

- Stringent regulatory norms to limit the use of ingredients

Cosmetic products contain a wide range of ingredients. These ingredients cover cosmetic preservatives, unique fragrances and cleansing agents. Regulatory authorities are continuously taking initiatives to limit the use of those ingredients that cause health issues. Governments have imposed stringent rules and regulations regarding the use of natural cosmetic preservatives for the manufacture of cosmetic products which are expected to drive the growth rate of the cosmetic preservatives market.

Furthermore, shelf life development, shifting inclination towards the usage of natural cosmetic products amongst consumers, enhanced living standards, growing use of herbal ingredients in cosmetic products and availability of natural and synthetic preservatives are some of the major factors which are expected to drive the growth of the cosmetic preservatives market during the forecast period of 2022 to 2029.

Opportunities

- Increasing focus on male-specific cosmetics

Now-a-days, people are inclined to use those cosmetic products that make them look good. There is a substantial demand for the male-specific cosmetics which is ranging from moisturizers to anti-agers to mud masks. Several problems are faced by younger males related to hair fall, oily skin, acne and wrinkles, among others. All these problems can be overcome with the use of good and natural cosmetic preservatives and awareness regarding the use of the proper cosmetic preservatives. Cosmetic manufacturing companies, thus, have lucrative opportunities for the growth of the cosmetic preservatives specifically targeting the male segment.

Restraints/Challenges

- Risk associated with synthetic ingredients

Several side effects are associated with the use of synthetic cosmetic preservatives in the formulation of cosmetic products. For instance, the extensive use of use of hydroquinone affects health such as it causes skin cancer, respiratory tract irritation and organ system toxicity. Also the extensive use of mercury as a functional cosmetic lightens the skin tone and decreases dark spots, however, it can damage the brain, kidneys and liver.

This cosmetic preservatives market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the cosmetic preservatives market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Cosmetic Preservatives Market

The outbreak of covid-19 pandemic has declined the growth of the global cosmetic preservative market due to shutdown of several manufacturing plants. Further several countries have restricted the production activities during the pandemic. The lockdown leads to suddenly dropping down the demand and purchasing of cosmetic products, decreasing the demand for cosmetic preservatives. Also, the halt in the transportation sectors has severely hindered the business of cosmetic preservative market because of the disruption in the product's supply chain management. All these factors may lead to declining manufacturers' profits, which may impact the growth of the cosmetic preservatives market.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- On January 2022, Symrise AG sign a contract with Schaffelaarbos, the European market leader in pet food. Symrise expects to take a major strategic step in pet nutrition with this deal for the expansion globally. Symrise's current capabilities are expected to be perfectly supplemented by integrating the activities of ADF/IsoNova in the U.S. with the state-of-the-art facilities of Schaffelaarbos in Barneveld, NL.

- In March 2022, Sharon Labs has agreed to acquisition RES Pharma Industriale which is a specialized chemical manufacturer in Trezzo sull'Adda, Italy (RPI). This acquisition of RPI is planned to close in March 2022, with RPI's technology, commercial development, R&D, production and customer service capabilities being incorporated into Sharon Laboratories' Personal Care division.

Global Cosmetic Preservatives Market Scope

The cosmetic preservatives market is segmented on the basis of type, raw material and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Paraben Esters

- Formaldehyde Donors

- Phenol Derivatives

- Alcohols

- Inorganics

- Quaternary Compounds

- Organic and Their Salts

- Others

Raw Material

- Synthetic

- Natural

Application

- Lotions

- Facemasks

- Sunscreens and Scrubs

- Shampoo and Conditioners

- Soaps

- Shower Cleansers and Shaving Gels

- Face Powder and Powder Compacts

- Mouthwash and Toothpaste

- Others

Cosmetic Preservatives Market Regional Analysis/Insights

The cosmetic preservatives market is analysed and market size insights and trends are provided by country, type, raw material and application as referenced above.

The countries covered in the cosmetic preservatives market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the cosmetic preservatives market due to the increasing demand for cosmetic among consumers because of increasing awareness regarding beauty products in this region

Asia-Pacific will continue to project the highest compound annual growth rate during the forecast period of 2022-2029due to the rising health consciousness amongst consumers, rising demand for facial creams, hair gels and anti-aging creams and growing awareness of cosmetics preservatives in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cosmetic Preservatives Market Share Analysis

The cosmetic preservatives market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cosmetic preservatives market.

Some of the major players operating in the cosmetic preservatives market are:

- Ashland (U.S.)

- BASF SE (Germany)

- Evonik Industries (Germany)

- Akema (Italy)

- Symrise AG (Germany)

- Clariant AG (Switzerland)

- Salicylates and Chemicals Pvt. Ltd (India)

- Chemipol (Spain)

- International Flavors and Fragrances Inc. (U.S.)

- Sharon Laboratories (Israel)

- Dow (U.S.)

- The Lubrizol Corporation (U.S.)

- NIPPON SHOKUBAI CO. LTD (Japan)

- Henan Qingshuiyuan Technology CO., Ltd., (China)

- Aurora Fine Chemicals (U.S.)

- Zouping Dongfang Chemical Co., Ltd. (China)

- ACURO ORGANICS LIMITED (U.S.)

- Maxwell Additives Pvt. Ltd (India)

- Nouryon (Netherlands)

- Lonza (Switzerland)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COSMETIC PRESERVATIVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COSMETIC PRESERVATIVES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL COSMETIC PRESERVATIVES MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6. PRICING ANALYSIS

7. PRODUCTION CAPACITY OVERVIEW

8. SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9. CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

10. GLOBAL COSMETIC PRESERVATIVES MARKET, BY TYPE, 2021-2030, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 PARABENS

10.2.1 GERMABEN II

10.2.2 METHYLPARBEN

10.2.3 PROPYLPARABEN

10.2.4 BUTYLPARABEN

10.2.5 OTHERS

10.3 FORMALDAHYDE RELEASERS

10.3.1 GERMALL PLUS

10.3.2 DMDM HYDANTOIN

10.3.3 IMADOZOLIDINYL UREA

10.3.4 DIAZOLIDINYL UREA

10.3.5 OTHERS

10.4 ISOTHIAZOLINONES

10.5 PHENOXYETHANOL

10.5.1 OPTIPHEN

10.5.2 OPTIPHEN PLUS

10.5.3 OTHERS

10.6 ORGANIC ACIDS

10.6.1 BENZOIC ACID/SODIUM BENZOATE

10.6.2 SORBIC ACID/POTASSIUM SORBATE

10.6.3 LEVULINIC ACID

10.6.4 ANISIC ACID

10.6.5 OTHERS

10.7 ALCOHOLS

10.8 INORGANICS

10.9 QUATERNARY COMPOUNDS

10.10 OTHERS

11. GLOBAL COSMETIC PRESERVATIVES MARKET, BY NATURE, 2021-2030, (USD MILLION)

11.1 OVERVIEW

11.2 NATURAL

11.3 SYNTHETIC

12. GLOBAL COSMETIC PRESERVATIVES MARKET, BY FORM, 2021-2030, (USD MILLION)

12.1 OVERVIEW

12.2 CRYSTALLINE

12.3 POWDER

12.4 LIQUID

13. GLOBAL COSMETIC PRESERVATIVES MARKET, BY APPLICATION, 2021-2030, (USD MILLION)

13.1 OVERVIEW

13.2 CREAMS

13.3 LOTIONS

13.4 OILS

13.5 TONER

13.6 MASK

13.7 GEL

13.8 SERUM

13.9 FOAMS

13.10 OTHERS

14. GLOBAL COSMETIC PRESERVATIVES MARKET, BY END-USE, 2021-2030, (USD MILLION)

14.1 OVERVIEW

14.2 BABY

14.2.1 BABY, BY CATEGORY

14.2.1.1. BABY POWDER

14.2.1.2. BABY CREAM

14.2.1.3. BABY EYE LINER

14.2.1.4. OTHERS

14.2.2 BABY, BY TYPE

14.2.2.1. PARABENS

14.2.2.2. FORMALDAHYDE RELEASERS

14.2.2.3. ISOTHIAZOLINONES

14.2.2.4. PHENOXYETHANOL

14.2.2.5. ORGANIC ACIDS

14.2.2.6. ALCOHOLS

14.2.2.7. INORGANICS

14.2.2.8. QUATERNARY COMPOUNDS

14.2.2.9. OTHERS

14.3 BATH

14.3.1 BATH, BY CATEGORY

14.3.1.1. SOAPS

14.3.1.2. BODY WASH

14.3.1.3. SANITIZER

14.3.1.4. CLEANSERS

14.3.1.5. SPORTS THERAPY

14.3.1.6. SHAMPOO

14.3.1.7. CONDITIONER

14.3.1.8. OTHERS

14.3.2 BATH, BY TYPE

14.3.2.1. PARABENS

14.3.2.2. FORMALDAHYDE RELEASERS

14.3.2.3. ISOTHIAZOLINONES

14.3.2.4. PHENOXYETHANOL

14.3.2.5. ORGANIC ACIDS

14.3.2.6. ALCOHOLS

14.3.2.7. INORGANICS

14.3.2.8. QUATERNARY COMPOUNDS

14.3.2.9. OTHERS

14.4 EYE MAKEUP

14.4.1 EYE MAKEUP, BY CATEGORY

14.4.1.1. EYE LINER

14.4.1.2. MASCARA

14.4.1.3. OTHERS

14.4.2 EYE MAKEUP, BY TYPE

14.4.2.1. PARABENS

14.4.2.2. FORMALDAHYDE RELEASERS

14.4.2.3. ISOTHIAZOLINONES

14.4.2.4. PHENOXYETHANOL

14.4.2.5. ORGANIC ACIDS

14.4.2.6. ALCOHOLS

14.4.2.7. INORGANICS

14.4.2.8. QUATERNARY COMPOUNDS

14.4.2.9. OTHERS

14.5 FRAGRANCE AND DEODORANTS

14.5.1 FRAGRANCE AND DEODORANTS, BY APPLICATION

14.5.1.1. AEROSOL DEODORANTS

14.5.1.2. ROLL-ON DEODORANTS

14.5.1.3. GEL DEODRANT

14.5.1.4. INVISIBLE SOLID DEODORANT

14.5.1.5. SOLID DEODORANT

14.5.1.6. CRYSTAL DEODORANT

14.5.1.7. WIPES DEODORANT

14.5.1.8. ANTIPERSPIRANT DEODORANT

14.5.1.9. UNSCENTED DEODORANT

14.5.1.10. STICK DEODORANTS

14.5.1.11. OTHERS

14.5.2 FRAGRANCE AND DEODORANTS, BY TYPE

14.5.2.1. PARABENS

14.5.2.2. FORMALDAHYDE RELEASERS

14.5.2.3. ISOTHIAZOLINONES

14.5.2.4. PHENOXYETHANOL

14.5.2.5. ORGANIC ACIDS

14.5.2.6. ALCOHOLS

14.5.2.7. INORGANICS

14.5.2.8. QUATERNARY COMPOUNDS

14.5.2.9. OTHERS

14.6 HAIR CARE

14.6.1 HAIR CARE, BY APPLICATION

14.6.1.1. HAIR OIL

14.6.1.2. HAIR GEL

14.6.1.3. SHAMPOO

14.6.1.4. OTHERS

14.6.2 HAIR CARE, BY TYPE

14.6.2.1. PARABENS

14.6.2.2. FORMALDAHYDE RELEASERS

14.6.2.3. ISOTHIAZOLINONES

14.6.2.4. PHENOXYETHANOL

14.6.2.5. ORGANIC ACIDS

14.6.2.6. ALCOHOLS

14.6.2.7. INORGANICS

14.6.2.8. QUATERNARY COMPOUNDS

14.6.2.9. OTHERS

14.7 HAIR COLOR

14.7.1 HAIR COLOR, BY APPLICATION

14.7.1.1. DYE

14.7.1.2. MEHENDI

14.7.1.3. OTHERS

14.7.2 HAIR COLOR, BY TYPE

14.7.2.1. PARABENS

14.7.2.2. FORMALDAHYDE RELEASERS

14.7.2.3. ISOTHIAZOLINONES

14.7.2.4. PHENOXYETHANOL

14.7.2.5. ORGANIC ACIDS

14.7.2.6. ALCOHOLS

14.7.2.7. INORGANICS

14.7.2.8. QUATERNARY COMPOUNDS

14.7.2.9. OTHERS

14.8 ORAL CARE

14.8.1 ORAL CARE, BY APPLICATION

14.8.1.1. MOUTH WASH

14.8.1.2. TOOTHPASTE

14.8.1.3. SPRAYMINTS

14.8.1.4. OTHERS

14.8.2 ORAL CARE, BY TYPE

14.8.2.1. PARABENS

14.8.2.2. FORMALDAHYDE RELEASERS

14.8.2.3. ISOTHIAZOLINONES

14.8.2.4. PHENOXYETHANOL

14.8.2.5. ORGANIC ACIDS

14.8.2.6. ALCOHOLS

14.8.2.7. INORGANICS

14.8.2.8. QUATERNARY COMPOUNDS

14.8.2.9. OTHERS

14.9 SHAVING

14.9.1 SHAVING, BY APPLICATION

14.9.1.1. SCRUB

14.9.1.2. CLEANSER

14.9.1.3. NOURISHING OIL

14.9.1.4. SHAVING CRÈME

14.9.1.5. AFTER-SHAVE LOTION

14.9.1.6. BEARD CARE

14.9.1.6.1. CREAMS

14.9.1.6.2. OILS

14.9.1.6.3. OTHERS

14.9.1.7. OTHERS

14.9.2 SHAVING, BY TYPE

14.9.2.1. PARABENS

14.9.2.2. FORMALDAHYDE RELEASERS

14.9.2.3. ISOTHIAZOLINONES

14.9.2.4. PHENOXYETHANOL

14.9.2.5. ORGANIC ACIDS

14.9.2.6. ALCOHOLS

14.9.2.7. INORGANICS

14.9.2.8. QUATERNARY COMPOUNDS

14.9.2.9. OTHERS

14.10 SKIN CARE

14.10.1 SKIN CARE, BY APPLICATION

14.10.1.1. MULTI-PURPOSE

14.10.1.2. ANTI-AGING COSMETIC

14.10.1.3. SKIN WHITENING COSMETIC

14.10.1.4. SENSITIVE SKIN CARE

14.10.1.5. ANTI-ACNE

14.10.1.6. DRY SKIN CARE

14.10.1.7. WARTS REMOVAL

14.10.1.8. INFANT SKIN CARE

14.10.1.9. ANTI-SCARS SOLUTION

14.10.1.10. MOLE REMOVAL

14.10.1.11. MULTI UTILITY

14.10.1.12. MAKE UP REMOVAL

14.10.1.13. MOISTURIZING

14.10.1.14. UV PROTECTIVE

14.10.1.15. OTHERS

14.10.2 SKIN CARE, BY TYPE

14.10.2.1. PARABENS

14.10.2.2. FORMALDAHYDE RELEASERS

14.10.2.3. ISOTHIAZOLINONES

14.10.2.4. PHENOXYETHANOL

14.10.2.5. ORGANIC ACIDS

14.10.2.6. ALCOHOLS

14.10.2.7. INORGANICS

14.10.2.8. QUATERNARY COMPOUNDS

14.10.2.9. OTHERS

14.11 LIP CARE

14.11.1 LIP CARE, BY APPLICATION

14.11.1.1. LIP BALM

14.11.1.2. LIPSTICS

14.11.1.3. OTHERS

14.11.2 LIP CARE, BY TYPE

14.11.2.1. PARABENS

14.11.2.2. FORMALDAHYDE RELEASERS

14.11.2.3. ISOTHIAZOLINONES

14.11.2.4. PHENOXYETHANOL

14.11.2.5. ORGANIC ACIDS

14.11.2.6. ALCOHOLS

14.11.2.7. INORGANICS

14.11.2.8. QUATERNARY COMPOUNDS

14.11.2.9. OTHERS

14.12 OTHERS

15. GLOBAL COSMETIC PRESERVATIVES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16. GLOBAL COSMETIC PRESERVATIVES MARKET, BY GEOGRAPHY, 2021-2030, (USD MILLION) (KILO TONS)

GLOBAL COSMETIC PRESERVATIVES MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 FRANCE

16.2.3 U.K.

16.2.4 ITALY

16.2.5 SPAIN

16.2.6 RUSSIA

16.2.7 TURKEY

16.2.8 NETHERLANDS

16.2.9 SWITZERLAND

16.2.10 BELGIUM

16.2.11 NORWAY

16.2.12 SWEDEN

16.2.13 FINLAND

16.2.14 DENMARK

16.2.15 POLAND

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA

16.3.6 NEW ZEALAND

16.3.7 SINGAPORE

16.3.8 THAILAND

16.3.9 MALAYSIA

16.3.10 INDONESIA

16.3.11 PHILIPPINES

16.3.12 VIETNAM

16.3.13 HONG KONG

16.3.14 TAIWAN

16.3.15 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 SAUDI ARABIA

16.5.3 UAE

16.5.4 EGYPT

16.5.5 ISRAEL

16.5.6 OMAN

16.5.7 QATAR

16.5.8 KUWAIT

16.5.9 BAHRAIN

16.5.10 REST OF MIDDLE EAST AND AFRICA

17. GLOBAL COSMETIC PRESERVATIVES MARKET, COMPANY PROFILE

17.1 THE DOW CHEMICAL COMPANY

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 SWOT ANALYSIS

17.1.5 PRODUCTION CAPACITY OVERVIEW

17.1.6 RECENT DEVELOPMENTS

17.2 ARKEMA FINE CHEMICALS

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 SWOT ANALYSIS

17.2.5 PRODUCTION CAPACITY OVERVIEW

17.2.6 RECENT DEVELOPMENTS

17.3 ASHLAND INC.

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 SWOT ANALYSIS

17.3.5 PRODUCTION CAPACITY OVERVIEW

17.3.6 RECENT DEVELOPMENTS

17.4 SPECTRUM CHEMICAL MANUFACTURING CORPORATION

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 SWOT ANALYSIS

17.4.5 PRODUCTION CAPACITY OVERVIEW

17.4.6 RECENT DEVELOPMENTS

17.5 FINETECH INDUSTRY LIMITED

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 SWOT ANALYSIS

17.5.5 PRODUCTION CAPACITY OVERVIEW

17.5.6 RECENT DEVELOPMENTS

17.6 BASF SE

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 SWOT ANALYSIS

17.6.5 PRODUCTION CAPACITY OVERVIEW

17.6.6 RECENT DEVELOPMENTS

17.7 JINAN HAOHUA INDUSTRY CO., LTD

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 SWOT ANALYSIS

17.7.5 PRODUCTION CAPACITY OVERVIEW

17.7.6 RECENT DEVELOPMENTS

17.8 CLARIANT AG

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 SWOT ANALYSIS

17.8.5 PRODUCTION CAPACITY OVERVIEW

17.8.6 RECENT DEVELOPMENTS

17.9 BRENNTAG AG

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 SWOT ANALYSIS

17.9.5 PRODUCTION CAPACITY OVERVIEW

17.9.6 RECENT DEVELOPMENTS

17.10 AE CHEMIE, INC.

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 SWOT ANALYSIS

17.10.5 PRODUCTION CAPACITY OVERVIEW

17.10.6 RECENT DEVELOPMENTS

17.11 LONZA GROUP LTD.

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 SWOT ANALYSIS

17.11.5 PRODUCTION CAPACITY OVERVIEW

17.11.6 RECENT DEVELOPMENTS

17.12 SYMRISE AG

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 SWOT ANALYSIS

17.12.5 PRODUCTION CAPACITY OVERVIEW

17.12.6 RECENT DEVELOPMENTS

17.13 CHEMIPOL

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 SWOT ANALYSIS

17.13.5 PRODUCTION CAPACITY OVERVIEW

17.13.6 RECENT DEVELOPMENTS

17.14 ISCA UK LTD

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 SWOT ANALYSIS

17.14.5 PRODUCTION CAPACITY OVERVIEW

17.14.6 RECENT DEVELOPMENTS

17.15 ZHENGZHOU BAINAFO BIOENGINEERING CO., LTD.

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 SWOT ANALYSIS

17.15.5 PRODUCTION CAPACITY OVERVIEW

17.15.6 RECENT DEVELOPMENTS

17.16 SCHÜLKE & MAYR GMBH

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 SWOT ANALYSIS

17.16.5 PRODUCTION CAPACITY OVERVIEW

17.16.6 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18. RELATED REPORTS

19. QUESTIONNAIRE

20. ABOUT DATA BRIDGE MARKET RESEARCH

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.