Global Fermented Drinks Market

Taille du marché en milliards USD

TCAC :

%

USD

3.59 Billion

USD

5.68 Billion

2021

2029

USD

3.59 Billion

USD

5.68 Billion

2021

2029

| 2022 –2029 | |

| USD 3.59 Billion | |

| USD 5.68 Billion | |

|

|

|

|

Global Fermented Drinks Market, By Type (Probiotic Food, Probiotic Drink, Alcoholic Beverage, Others), Distribution Channel (Supermarket/Hypermarket, Speciality Retail Store, Convenience Store, On Trade, Online Channel, Other Distribution Channels) – Industry Trends and Forecast to 2029

Market Analysis and Size

As the global population grows, consumers are shifting their preferences to fermented drinks and other everyday products that are easier to consume and digest. There is a significant shift in consumer consumption patterns, and as a result, they demand the availability of healthy products that contribute to global market growth. Massive expansion of market players involved in processing and manufacturing plans also augment market growth.

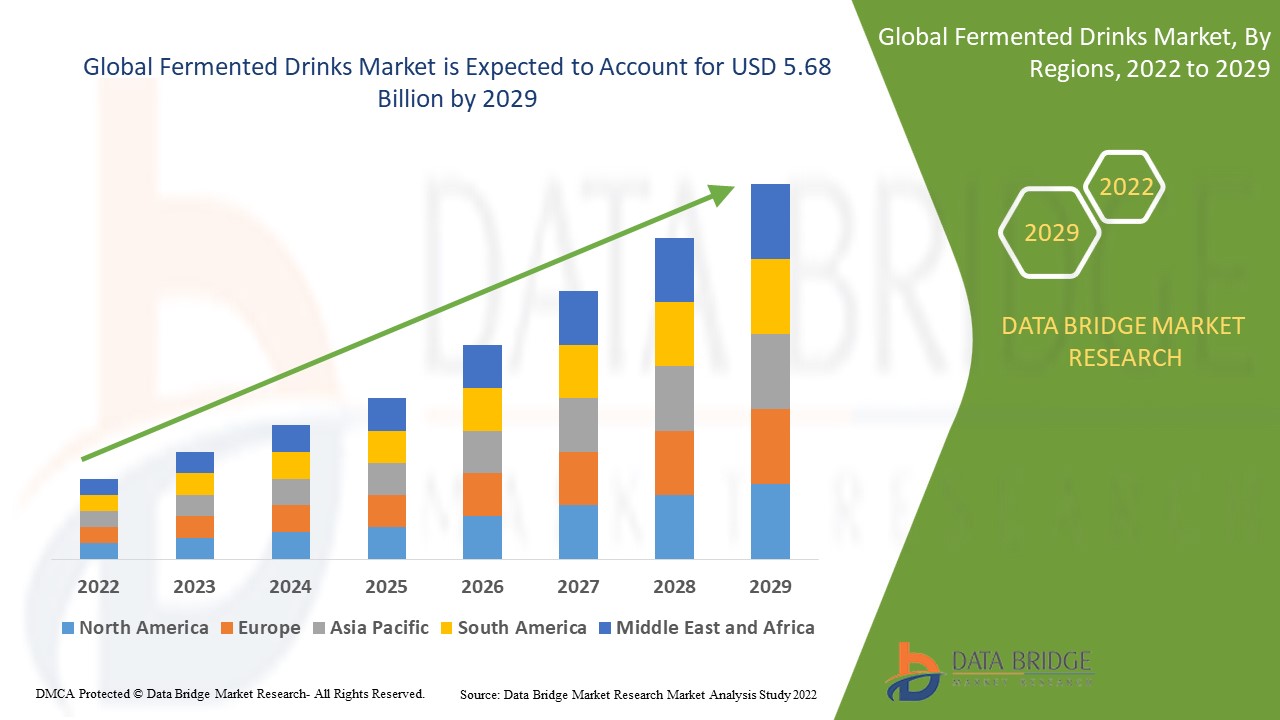

Data Bridge Market Research analyses that the fermented drinks market was valued at USD 3.59 billion and is expected to reach the value of USD 5.68 billion by 2029, at a CAGR of 5.90% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Probiotic Food, Probiotic Drink, Alcoholic Beverage, Others), Distribution Channel (Supermarket/Hypermarket, Speciality Retail Store, Convenience Store, On Trade, Online Channel, Other Distribution Channels) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Bayer AG (Germany), Abbott (U.S.), DSM (Netherlands), DuPont. (U.S.), Amway (U.S.), The Nature's Bounty Co. (U.S.), GlaxoSmithKline plc. (U.K.), Nestlé (Switzerland) Mead Johnson & Company, LLC. (U.S.), Medifast, Inc. (U.S.), Premier Nutrition Corporation (U.S.), Health Food Manufacturers' Association (U.K.), NOW Foods (U.S.), Glanbia PLC (Ireland), Herbalife International of America, Inc. (U.S.), and Bionova (India) |

|

Opportunities |

|

Market Definition

Fermented drinks are flavorful drink mixes containing ethanol, a type of alcohol produced by the fermentation of grains, fruits, and other sugar sources. Fermentation is a natural process in which yeast or bacteria combine with sugar to produce alcohol and carbon dioxide. Beer, wine, and spirits are the most common fermented beverages.

Fermented Drinks Market Dynamics

Drivers

- Shift in consumers diet pattern and growing prevalence of digestive disorders

The market is expanding due to increased demand for fermented beverages among individuals, particularly in developed countries. Consumer preference for optimal hydration has been a key driver of fermented drinks market. Consumers' increased health consciousness has increased demand for fermented beverages. Furthermore, global demand for cultured dairy products is increasing. Lactic acid, which is found in fermented dairy products, can help with these digestive issues. As a result, fermented products become an essential part of everyone's daily diet, leading to an increase in the demand for fermented drinks market.

- Various improved and versatile products offered by the manufacturers

Product launches are also expected to drive growth in the global fermented drinks market during the forecast period. The recent launch of several new products has resulted from the development of new products with improved taste and versatility, combined with strong marketing support. The introduction of several new products during the forecast period is expected to boost the fermented drinks market outlook.

Opportunity

Aside from health benefits, the fermentation process improves the taste and aroma of dairy products while also extending their shelf life. As a result, the versatile properties of fermented dairy products can be attributed to the market's significant growth. Growing e-commerce platform penetration, particularly in developing economies, and stringent laws ensuring high-quality organic beverage production will all drive market value growth.

Restraints

The issues with transportation services and low warehouse storage are causing significant losses to fruit and vegetable growers, restraining the market and challenging the fermented drinks market in the forecasted period.

This fermented drinks market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the fermented drinks market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Fermented Drinks Market

The global pandemic scenario raised by COVID-19 significantly impacted the market due to the health benefits of various fermented drinks such as probiotic drinks. Due to the increased demand, it has created an opportunity for fermented drink products. This is primarily due to increased health awareness and concern about immunity and thus health well-being. However, rising consumption as a result of the target audience's healthy lifestyle and preferences is expected to improve market operations during the forecast period. Furthermore, the government is supporting initiatives to increase beverage consumption and improve public health.

Recent Development

- The Boston Beer Company and PepsiCo announced plans to form a business partnership in August 2021 to produce the alcoholic beverage HARD MTN DEW. Boston Beer's world-class innovation and expertise in alcoholic beverages will be combined with one of PepsiCo's most iconic and beloved brands.

- In addition, Beam Suntory and The Boston Beer Company announced a long-term strategic partnership in July 2021 to expand select iconic brands into some of the fastest-growing beverage alcohol segments.

- Anheuser-Busch InBev (AB InBev) launched its first energy drink Budweiser Beats in India in October 2021.

Global Fermented Drinks Market Scope

The fermented drinks market is segmented on the basis of type and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Probiotic Food

- Probiotic Drink

- Alcoholic Beverage

- Others

Distribution channel

- Supermarket/Hypermarket

- Speciality Retail Store

- Convenience Store

- On Trade

- Online Channel

- Other Distribution Channels

Fermented Drinks Market Regional Analysis/Insights

The fermented drinks market is analysed and market size insights and trends are provided by country, type and distribution channel as referenced above.

The countries covered in the fermented drinks market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market due to growing consumer interest in therapeutic products containing probiotic bacteria.

Asia-Pacific is a promising region for the expansion of the fermented dairy products market. Traditionally, dairy products were fermented, but with newer technologies and innovations, consumers gravitate toward commercialised fermented dairy products. As a result, the market for fermented dairy products is growing faster.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Fermented Drinks Market Share Analysis

The fermented drinks market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to fermented drinks market.

Some of the major players operating in the fermented drinks market are:

- Bayer AG (Germany)

- Abbott (U.S.)

- DSM (Netherlands)

- DuPont. (U.S.)

- Amway (U.S.)

- The Nature's Bounty Co. (U.S.)

- GlaxoSmithKline plc. (U.K.)

- Nestlé SA (Switzerland)

- Mead Johnson & Company, LLC. (U.S.)

- Medifast, Inc. (U.S.)

- Premier Nutrition Corporation (U.S.)

- Health Food Manufacturers' Association (U.K.)

- NOW Foods (U.S.)

- Glanbia PLC (Ireland)

- Herbalife International of America, Inc. (U.S.)

- Bionova (India)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FERMENTED DRINKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL FERMENTED DRINKS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.4.1. KEY PLAYERS

2.2.4.2. DISRUPTORS

2.2.4.3. NICHE PLAYERS

2.2.4.4. PROSPECT LEADERS

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FERMENTED DRINKS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 MARKETING STRATERGY

5.2 RETAILER LIST

5.3 CONSUMPTION AND PRODUCTION ANALYSIS

5.4 RAW MATERIAL EXPORT AND IMPORT ANALYSIS

5.5 SUPPLY CHAIN ANALYSIS

6. IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7. REGULATORY FRAMEWORK AND GUIDELINES

8. PRODUCTION CAPACITY OF KEY MANUFACTURERES

9. BRND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10. GLOBAL FERMENTED DRINKS MARKET, BY TYPE, 2020-2029, (USD MILLION), (MILLION LITRES)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

10.1 OVERVIEW

10.2 ALCOHLIC

10.2.1 ASP

10.2.2 VALUE

10.2.3 VOLUME

10.2.4 ALCOHLIC, BY TYPE

10.2.4.1. BEER

10.2.4.1.1. BY CATEGORY

10.2.4.1.1.1 ALE

10.2.4.1.1.2 ALE, BY TYPE

10.2.4.1.1.3 BROWN ALE

10.2.4.1.1.4 PALE ALE

10.2.4.1.1.5 INDIA PALE ALE

10.2.4.1.1.6 SOUR ALE

10.2.4.1.1.7 LAGER

10.2.4.1.1.8 PORTER

10.2.4.1.1.9 STOUT

10.2.4.1.1.10 WHEAT

10.2.4.1.1.11 PILSNER

10.2.4.1.2. WINE

10.2.4.1.2.1 BY WINEMAKING TECHNIQUE

10.2.4.1.3. RED WINE

10.2.4.1.3.1 BY VARIETY

10.2.4.1.3.2 PINOT NOIR

10.2.4.1.3.3 ZINFANDEL

10.2.4.1.3.4 SYRAH

10.2.4.1.3.5 CABERNET SAUVIGNON

10.2.4.1.4. WHITE WINE

10.2.4.1.4.1 BY VARIETY

10.2.4.1.4.1.1. RIESLING

10.2.4.1.4.1.2. PINOT GRIS

10.2.4.1.4.1.3. SAUVIGNON BLANC

10.2.4.1.4.1.4. CHARDONNAY

10.2.4.1.5. ROSE WINE

10.2.4.1.6. SPARKLING WINE

10.2.4.1.7. DESSERT WINE

10.3 NON-ALCOHLIC

10.3.1 ASP

10.3.2 VALUE

10.3.3 VOLUME

10.3.3.1. NON-ALCOHLIC, BY TYPE

10.3.3.1.1. PROBIOTIC DRINKS

10.3.3.1.1.1 DAIRY BASED PROBIOTIC DRINK

10.3.3.1.1.1.1. MILK

10.3.3.1.1.1.2. ALMOND

10.3.3.1.1.1.3. SOY

10.3.3.1.1.1.4. COCONUT

10.3.3.1.1.1.5. OATS

10.3.3.1.1.1.6. OTHERS

10.3.3.1.1.2 FRUIT BASED PROBIOTIC DRINK

10.3.3.1.2. SPARKLING PROBIOTIC DRINK

10.3.3.1.2.1 BY FLAVOR

10.3.3.1.2.1.1. GINGER COLADA

10.3.3.1.2.1.2. LEMON CAYENNE

10.3.3.1.2.1.3. MANGO COCONUT

10.3.3.1.2.1.4. POMEGRANATE

10.3.3.1.2.1.5. TANGERINE

10.3.3.1.2.1.6. LEMON GINGER

10.3.3.1.2.1.7. OTHERS

10.3.3.1.3. FRUIT BASED PROBIOTIC DRINK

10.3.3.1.4. SPARKLING PROBIOTIC DRINK

10.3.3.1.4.1 BY FLAVOR

10.3.3.1.4.1.1. GINGER COLADA

10.3.3.1.4.1.2. LEMON CAYENNE

10.3.3.1.4.1.3. MANGO COCONUT

10.3.3.1.4.1.4. POMEGRANATE

10.3.3.1.4.1.5. TANGERINE

10.3.3.1.4.1.6. LEMON GINGER

10.3.3.1.4.1.7. OTHERS

10.3.3.1.5. SPARKLING PROBIOTIC LEMONADE

10.3.3.1.5.1 BY FLAVOR

10.3.3.1.5.1.1. CLASSIC

10.3.3.1.5.1.2. BLACKBERRY

10.3.3.1.5.1.3. PEACH

10.3.3.1.6. PREBIOTIC SHOTS

10.3.3.1.6.1 BY FLAVOR

10.3.3.1.6.1.1. BEET LEMON

10.3.3.1.6.1.2. BLUEBERRY MINT

10.3.3.1.6.1.3. TURMERIC GINGER

10.3.3.1.7. VEGETABLE BASED PROBIOTIC DRINK

10.3.3.1.7.1 KOMBUCHA DRINK

10.3.3.2. KOMBUCHA, BY TEA TYPE

10.3.3.2.1. BLACK TEA

10.3.3.2.2. GREEN TEA

10.3.3.3. KOMBUCHA, BY FLAVOR

10.3.3.3.1. BLACKBERRY HOPS

10.3.3.3.2. BLUEBERRY BASIL

10.3.3.3.3. GINGER

10.3.3.3.4. GRAPEFRUIT

10.3.3.3.5. LAVENDER MELON

10.3.3.3.6. MANGO LIME

10.3.3.3.7. PINEAPPLE PEACH

10.3.3.3.8. RASPBERRY LEMON

10.3.3.3.9. TART CHERRY

10.3.3.3.10. OTHERS

10.3.3.3.11. OTHERS

11. GLOBAL FERMENTED DRINKS MARKET, BY PROBIOTIC STRAIN, 2020-2029, (USD MILLION)

11.1 OVERVIEW

11.2 LACTOBACILLUS

11.3 STREPTOCOCCUS

11.4 BIFIDOBACTERIUM

11.5 OTHERS

12. GLOBAL FERMENTED DRINKS MARKET, BY PACKAGING TYPE, 2020-2029, (USD MILLION)

12.1 OVERVIEW

12.2 CANS

12.3 TERTA PACKS

12.4 GLASS JARS

12.5 BOTTLES

12.5.1 PLASTIC

12.5.2 GLASS

12.6 POUCHES

12.7 OTHERS

13. GLOBAL FERMENTED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029, (USD MILLION)

13.1 OVERVIEW

13.2 ON-TRADE

13.2.1 RETAURANTS

13.2.2 CLUBS, CASINOS & DISCO

13.2.3 HOTELS

13.2.4 EVENTS

13.2.5 OTHERS

14. OFF-TRADE

14.1.1 STORE BASED

14.1.1.1. CONVENIENCE STORES

14.1.1.2. SUPERMARKETS/HYPERMARKETS

14.1.1.3. GROCERY STORES

14.1.1.4. DISCOUNTERS

14.1.1.5. PETROL STATIONS

14.1.1.6. WHOLESALERS

14.1.1.7. OTHERS

14.1.2 NON-STORE BASED

14.1.2.1. ONLINE

14.1.2.2. VENDING

15. GLOBAL FERMENTED DRINKS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16. GLOBAL FERMENTED DRINKS MARKET, BY GEOGRAPHY, 2020-2029, (USD MILLION), (KILO TONS)

16.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.2 NORTH AMERICA

16.2.1 U.S.

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 U.K.

16.3.3 ITALY

16.3.4 FRANCE

16.3.5 SPAIN

16.3.6 SWITZERLAND

16.3.7 NETHERLANDS

16.3.8 BELGIUM

16.3.9 RUSSIA

16.3.10 DENMARK

16.3.11 SWEDEN

16.3.12 POLAND

16.3.13 TURKEY

16.3.14 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 JAPAN

16.4.2 CHINA

16.4.3 SOUTH KOREA

16.4.4 INDIA

16.4.5 AUSTRALIA

16.4.6 SINGAPORE

16.4.7 THAILAND

16.4.8 INDONESIA

16.4.9 MALAYSIA

16.4.10 PHILIPPINES

16.4.11 NEW ZEALAND

16.4.12 VIETNAM

16.4.13 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SOUTH AFRICA

16.6.2 UAE

16.6.3 SAUDI ARABIA

16.6.4 OMAN

16.6.5 QATAR

16.6.6 KUWAIT

16.6.7 REST OF MIDDLE EAST AND AFRICA

17. GLOBAL FERMENTED DRINKS MARKET, SWOT & DBMR ANALYSIS

18. GLOBAL FERMENTED DRINKS MARKET, COMPANY PROFILE

18.1 BIOGROUPE S.A

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHICAL PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 KEVITA.COM

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHICAL PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 DENONE

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHICAL PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 CHOBANI, LLC.

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHICAL PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 FONTERRA CO-OP GROUP LTD.

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHICAL PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 NEXTFOODS.

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHICAL PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 THE COCA-COLA COMPANY.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHICAL PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 CHR. HANSEN HOLDING A/S

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHICAL PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 YAKULT HONSHA CO. LTD

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHICAL PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.10 DUPONT DE NUMEROUS INC.

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHICAL PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 KIZAKURA CO., LTD.

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHICAL PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 ENVASADOS EVA, S.A.

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHICAL PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BODEGAS SANVIVER S.L.

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHICAL PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 ECPLAZA NETWORK INC.

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHICAL PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 CALDWELL BIO FERMENTATION CANADA INC.

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHICAL PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 DOHLER GMBH

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHICAL PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 ARIZONA BEVERAGES USA

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHICAL PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 ALASKAN BREWING

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHICAL PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 HEINEKEN HOLDING N.V.

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHICAL PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.20 BEAVER BREWING COMPANY

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHICAL PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 ACE CIDER

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHICAL PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 GLANBIA PLC

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHICAL PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 HERBALIFE INTERNATIONAL OF AMERICA, INC.

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHICAL PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 BIONOVA

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHICAL PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19. RELATED REPORTS

20. CONCLUSION

21. QUESTIONNAIRE

22. ABOUT DATA BRIDGE MARKET RESEARCH

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.