North America Coated Paper Market, By Product (Coated Ground Wood Paper, Standard Coated Fine Paper, Low Coat Weight Paper, Pigment Coated Paper, Art Paper, Enamel Paper and Others), Coating Layer (One-Side Coated and Two-Side Coated), Coating Material, (Clay, Calcium Carbonate, Talc, Kaolin Clay, Wax, Titanium Dioxide and Others), Finish (Gloss, Satin, Matte, Dull and Others), Coating Method (Hand-Coated, Brush-Coated, Machine Coated and Others), Finishing Process (Online Calendaring and Offline Calendaring), Application (Printing, Packaging and Labelling and Others) - Industry Trends and Forecast to 2030.

North America Coated Paper Market Analysis and Insights

Paper that has had a finishing layer or coating applied to improve its finish and printability during the manufacturing process. The coating is intended to improve certain characteristics of the paper, such as opacity, brightness, whiteness, colour, surface smoothness, gloss, and ink receptivity, so that the finished paper product has the properties required for its intended application. Coated papers are classified according to the amount of coating applied; these classifications include light coated, medium coated, high coated, and art papers (which are used for high resolution artwork).

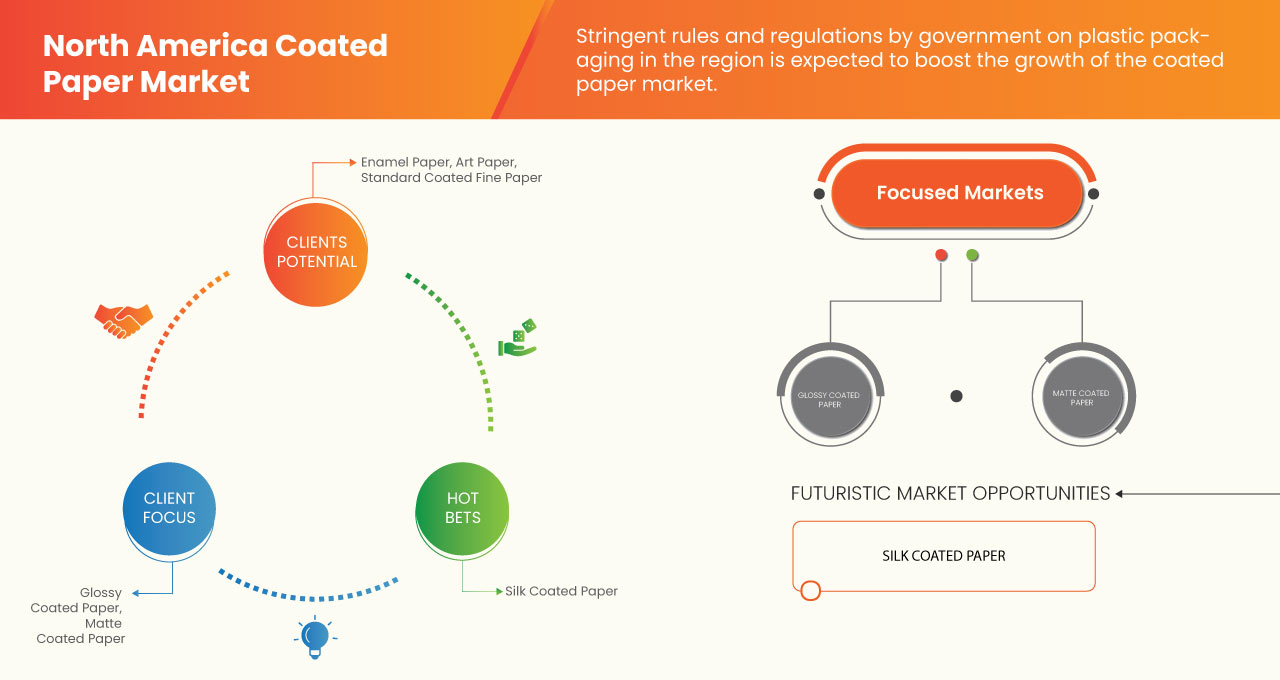

New advances in paper coating technology coupled with consumers' changing and improving lifestyles result in a significant demand for products with coated packaging will create immense opportunity for the manufacturers of coated paper market. The fluctuation in raw material prices is expected to challenge the growth of the market.

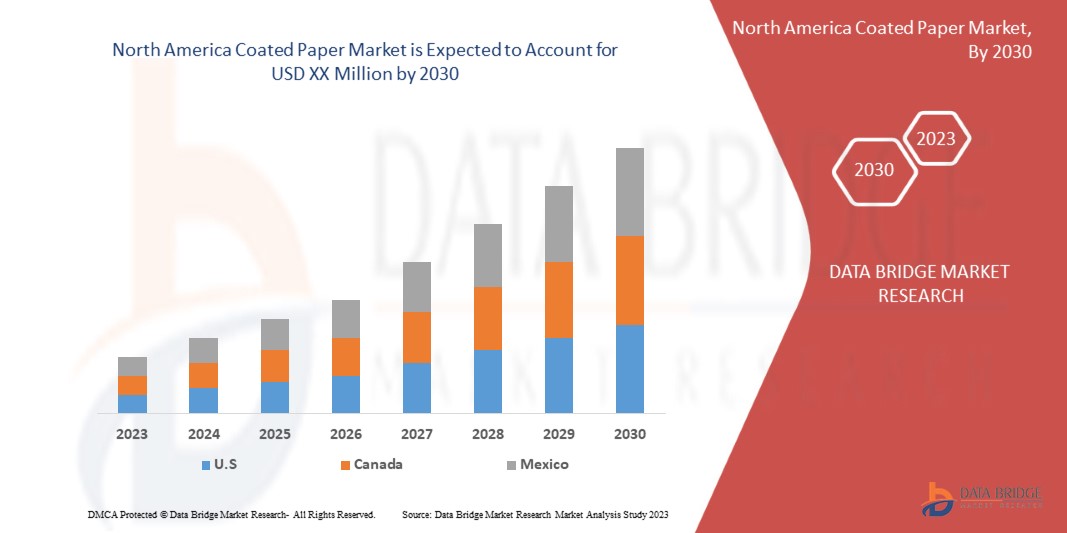

Data Bridge Market Research analyses that the North America coated paper market will grow at a CAGR of 4.2% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Product (Coated Ground Wood Paper, Standard Coated Fine Paper, Low Coat Weight Paper, Pigment Coated Paper, Art Paper, Enamel Paper and Others), Coating Layer (One-Side Coated and Two-Side Coated), Coating Material, (Clay, Calcium Carbonate, Talc, Kaolin Clay, Wax, Titanium Dioxide and Others), Finish (Gloss, Satin, Matte, Dull and Others), Coating Method (Hand-Coated, Brush-Coated, Machine Coated and Others), Finishing Process (Online Calendaring and Offline Calendaring), Application (Printing, Packaging and Labelling and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Français Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ) et Billerud Americas Corporation, entre autres. |

Définition du marché

Le papier couché est un papier qui a été enduit d'un polymère ou d'un mélange de matériaux pour lui conférer des qualités spécifiques, telles que le poids, la brillance de surface, la douceur ou une absorption d'encre réduite. Pour enduire le papier destiné à une impression de haute qualité dans l'industrie de l'emballage et les magazines, divers matériaux tels que la kaolinite, le carbonate de calcium, la bentonite et le talc peuvent être utilisés. Les papiers couchés sont ceux qui ont une finition brillante, semi-brillante ou mate. Un agent de revêtement est appliqué à la surface du papier couché pour améliorer la brillance, la douceur ou d'autres propriétés d'impression. Des rouleaux sont utilisés pour polir le papier après l'avoir enduit. Il comble les minuscules creux et les interstices entre les fibres pour créer une surface lisse et plate.

Dynamique du marché du papier couché en Amérique du Nord

Conducteurs

-

Augmentation de la demande d'images imprimées de haute qualité

Les papiers couchés impriment des images nettes et brillantes en raison de leur réflectivité élevée. De plus, ils offrent une surface d'impression supérieure aux papiers non couchés, ce qui se traduit par une impression de haute qualité. Les papiers couchés sont résistants à la saleté et à l'humidité, et comme ils ne sont pas absorbants, ils utilisent moins d'encre pour imprimer. Le papier couché est souvent enduit de cire, d'argile, de kaolin, de latex, d'oxyde de titane, etc., ce qui permet au papier de briller davantage et d'améliorer la qualité des images imprimées dessus. Le papier couché peut être utilisé dans une variété d'applications finales telles que les catalogues, les encarts de journaux, les produits en papier transformés, les papiers de sécurité, les magazines et les supports publicitaires, car il a généralement une finition brillante ou mate. Parce qu'il produit des images nettes et complexes, le papier couché est fréquemment utilisé à des fins d'impression.

Les papiers couchés sont généralement plus lourds que les papiers non couchés, ce qui donne du poids à un travail d'impression. Le papier couché est plus adapté à certaines techniques de finition telles que le vernissage par projection ou par sélectif ou d'autres revêtements de finition, car il est plus lisse et a une meilleure rétention de l'encre (il est moins absorbant) que le papier non couché. Les papiers couchés fournissent des impressions de haute qualité et sont fabriqués par divers acteurs clés du marché nord-américain du papier couché.

Par conséquent, la demande croissante d'impressions et d'images de haute qualité dans divers magazines, brochures, dépliants, etc. devrait stimuler la croissance du marché du papier couché en Amérique du Nord.

-

Augmentation de la demande de papier couché dans l'industrie alimentaire

Les papiers couchés ont de multiples applications dans différentes industries, notamment dans l'industrie alimentaire, où ils sont largement utilisés pour emballer les produits alimentaires dans le monde entier. Les emballages alimentaires passent du plastique à des matériaux en papier plus biodégradables et recyclables, car la demande nord-américaine de solutions durables augmente. Afin d'améliorer la qualité, d'améliorer les performances et de remplacer les garnitures en plastique, les papiers couchés utilisés doivent être de haute qualité et de nature non réactive.

Le papier ciré est adapté aux aliments, principalement pour emballer le poisson, la viande et les barres chocolatées, en raison de sa résistance à l'humidité et à la graisse, ce qui le rend particulièrement adapté au contact direct avec les fromages, le beurre et l'emballage des barres chocolatées et des aliments gras. Parce qu'il résiste à l'eau, aux huiles et aux graisses, le papier ciré aide à conserver les aliments. Les papiers enduits de résine sont idéaux pour les aliments frais, les aliments gras et les aliments humides, ainsi que pour les sacs de qualité alimentaire.

Les emballages en papier polyéthylène sont adaptés au contact direct avec les aliments, offrent une garantie de fraîcheur, de protection et répondent aux normes d'hygiène alimentaire les plus strictes. Les papiers couchés et les intercalaires pour hamburgers sont utilisés pour emballer les aliments de comptoir tels que les viandes, les fromages et les aliments cuits dans les supermarchés, les boucheries, les épiceries fines et les charcuteries. Les papiers couchés en polyéthylène sont utilisés dans les boucheries, les épiceries fines et les supermarchés pour emballer les aliments frais. En effet, le film polyéthylène haute densité agit comme une barrière protectrice contre l'humidité, la graisse et les odeurs.

Opportunités

-

L'évolution et l'amélioration des modes de vie des consommateurs entraînent une demande importante de produits avec emballage enduit

Le mode de vie des consommateurs évolue et s'améliore à mesure que leur revenu disponible augmente, tout comme leur consommation de produits de santé, d'aliments et de boissons, et de produits d'entretien ménager, en particulier dans les économies en développement. Dans les années à venir, la demande de papier couché devrait augmenter.

De plus, les propriétaires de marques s'intéressent de plus en plus à l'impression et à l'emballage respectueux de l'environnement en raison des réglementations gouvernementales limitant l'utilisation de plastiques à usage unique. Pour cette raison, les fabricants se tournent vers des techniques d'impression et d'emballage plus respectueuses de l'environnement, ce qui contribuera à créer des opportunités sur le marché du papier couché.

Les Millennials préfèrent acheter des aliments préparés en raison de leur mode de vie actif et de leur souci croissant de leur santé, ce qui stimule la demande de matériaux d'emballage enduits en raison du besoin croissant d'emballages modifiés. Cela génère également des opportunités d'expansion du marché

Contraintes/Défis

- La numérisation généralisée dans tous les secteurs limite l'utilisation du papier

La numérisation connaît une forte croissance dans tous les secteurs. La facilité et la commodité accrues de la numérisation permettent aux industriels d'opter pour les plateformes numériques. Alors que le monde continue de subir une transformation numérique massive, les secteurs et industries clés adoptent la technologie numérique pour s'assurer qu'ils sont prêts pour l'avenir et bien positionnés pour réussir à l'échelle mondiale.

Par exemple,

- En mars 2022, selon le CII, les entreprises numériques ont évolué au-delà du simple achat et de la vente sur un site Web. Le numérique est désormais davantage un moyen d'échanger des biens et des services tout en garantissant qu'ils atteignent les bonnes personnes. Les marchés multifacettes exploitent la puissance des effets de réseau grâce au commerce collaboratif pour croître de manière exponentielle, créant ainsi de la valeur pour leurs utilisateurs de manière continue.

De plus, la numérisation croissante a permis aux industries de fournir leurs services et informations uniquement sur leurs sites Web. De nombreux fabricants de ces industries sont passés aux brochures, magazines et rapports annuels électroniques, etc., ce qui a entraîné un inconvénient majeur pour l'industrie du papier couché. Les fabricants font de la publicité via des supports en ligne, des publicités télévisées et d'autres plateformes de médias sociaux, ce qui a freiné la croissance des supports papier, ce qui affecte considérablement l'industrie du papier couché.

Par conséquent, la numérisation croissante dans toutes les industries pourrait entraver la croissance du marché du papier couché en Amérique du Nord.

Impact de la pandémie de COVID-19 sur le marché nord-américain du papier couché

Le COVID-19 a affecté le marché dans une certaine mesure. En raison du confinement, la fabrication et la production de nombreuses petites et grandes entreprises ont été interrompues et la demande de papier couché a également diminué, ce qui a influencé le marché. En raison du changement de nombreux mandats et réglementations, les fabricants peuvent concevoir et lancer de nouveaux produits sur le marché, ce qui contribuera à la croissance du marché.

Développements récents

- En décembre 2021, Lecta a annoncé le lancement de papiers de couverture. Linerset CCK Duo est un papier de protection recto verso couché à l'argile pour la siliconisation avec un traitement spécial au verso. Il a élargi le portefeuille de produits de l'entreprise.

Portée du marché du papier couché en Amérique du Nord

Le marché nord-américain du papier couché est segmenté en segments notables en fonction du produit, de la couche de revêtement, du matériau de revêtement, de la finition, de la méthode de revêtement, du processus de finition et de l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Papier couché à base de bois broyé

- Papier fin couché standard

- Papier à faible grammage

- Papier couché pigmenté

- Papier d'art

- Papier émaillé

- Autres

En fonction du produit, le marché nord-américain du papier couché est segmenté en papier couché mécanique, papier fin couché standard, papier à faible grammage, papier couché pigmenté, papier d'art, papier émaillé et autres.

Couche de revêtement

- Revêtement sur une face

- Revêtement recto verso

En fonction de la couche de revêtement, le marché nord-américain du papier couché est segmenté en papier couché une face et papier couché deux faces.

Matériau de revêtement

- Argile

- Carbonate de calcium

- Talc

- Argile de kaolin

- Cire

- Dioxyde de titane

- Autres

En fonction du matériau de revêtement, le marché nord-américain du papier couché est segmenté en argile, carbonate de calcium, talc, argile kaolin, cire, dioxyde de titane et autres.

Finition

- Brillant

- Satin

- Mat

- Terne

- Autres

En fonction de la finition, le marché nord-américain du papier couché est segmenté en brillant, satiné, mat, terne et autres.

Méthode de revêtement

- Enduit à la main

- Revêtement au pinceau

- Revêtement à la machine

- Autres

En fonction de la méthode de revêtement, le marché du papier couché en Amérique du Nord est segmenté en papier couché à la main, couché au pinceau, couché à la machine et autres.

Processus de finition

- Calendrier en ligne

- Calendrier hors ligne

En fonction du processus de finition, le marché nord-américain du papier couché est segmenté en calendriers en ligne et calendriers hors ligne.

Application

- Impression

- Emballage et étiquetage

- Autres

En fonction des applications, le marché nord-américain du papier couché est segmenté en impression, emballage et étiquetage, entre autres.

Analyse/perspectives régionales du marché du papier couché en Amérique du Nord

Le marché du papier couché en Amérique du Nord est analysé et des informations sur la taille et les tendances du marché sont fournies en fonction du pays et comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des revêtements en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain du papier couché en termes de part de marché et de revenus et devraient maintenir leur domination au cours de la période de prévision en raison de la montée en puissance du papier couché dans diverses industries et de la demande croissante des consommateurs de la part des utilisateurs finaux.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du papier couché en Amérique du Nord

Le paysage concurrentiel du marché du papier couché en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par l'entreprise sur le marché du papier couché en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché du papier couché en Amérique du Nord sont Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ) et Billerud Americas Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COATED PAPER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HIGH-QUALITY PRINT IMAGES

5.1.2 INCREASE IN DEMAND FOR COATED PAPER IN THE FOOD INDUSTRY

5.1.3 RISE IN E-COMMERCE AND ONLINE SHOPPING ACTIVITIES THUS CREATING DEMAND FOR THE PACKAGING INDUSTRY

5.1.4 STRINGENT GOVERNMENT RULES ON PLASTIC PACKAGING

5.2 RESTRAINTS

5.2.1 WIDESPREAD DIGITALIZATION ACROSS INDUSTRIES LIMITING THE USE OF PAPER

5.2.2 NEGATIVE IMPACT OF THE PAPER INDUSTRY ON THE ENVIRONMENT

5.2.3 HIGH INITIAL INVESTMENT IN COATED PAPER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 NEW ADVANCES IN PAPER COATING TECHNOLOGY

5.3.2 CONSUMERS' CHANGING AND IMPROVING LIFESTYLES RESULT IN A SIGNIFICANT DEMAND FOR PRODUCTS WITH COATED PACKAGING

5.3.3 SHIFTING TOWARDS THE ECO-FRIENDLY PRINTING AND PACKAGING FORMATS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN PRICES OF RAW MATERIAL

5.4.2 LOW RECYCLING VALUE FOR COATED PAPER

5.4.3 GOVERNMENT OVERSEAS REGULATIONS FOR IMPORT-EXPORT

6 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 STANDARD COATED FINE PAPER

6.2.1 TWO-COATED

6.2.1.1 MACHINE COATED

6.2.1.2 HAND-COATED

6.2.1.3 BRUSH-COATED

6.2.1.4 OTHERS

6.2.2 ONE-SIDE COATED

6.2.3 MACHINE COATED

6.2.4 BRUSH-COATED

6.2.5 OTHERS

6.3 COATED GROUND WOOD PAPER

6.3.1 TWO-COATED

6.3.1.1 MACHINE COATED

6.3.1.2 HAND-COATED

6.3.1.3 BRUSH-COATED

6.3.1.4 OTHERS

6.3.2 ONE-SIDE COATED

6.3.3 MACHINE COATED

6.3.4 HAND-COATED

6.3.5 BRUSH-COATED

6.3.6 OTHERS

6.4 ART PAPER

6.4.1 TWO-COATED

6.4.1.1 MACHINE COATED

6.4.1.2 HAND-COATED

6.4.1.3 BRUSH-COATED

6.4.1.4 OTHERS

6.4.2 ONE-SIDE COATED

6.4.2.1 MACHINE COATED

6.4.2.2 HAND-COATED

6.4.2.3 BRUSH-COATED

6.4.2.4 OTHERS

6.5 PIGMENT COATED PAPER

6.5.1 TWO-COATED

6.5.1.1 MACHINE COATED

6.5.1.2 HAND-COATED

6.5.1.3 BRUSH-COATED

6.5.1.4 OTHERS

6.5.2 ONE-SIDE COATED

6.5.2.1 MACHINE COATED

6.5.2.2 HAND-COATED

6.5.2.3 BRUSH-COATED

6.5.2.4 OTHERS

6.6 ENAMEL PAPER

6.6.1 TWO-COATED

6.6.1.1 MACHINE COATED

6.6.1.2 HAND-COATED

6.6.1.3 BRUSH-COATED

6.6.1.4 OTHERS

6.6.2 ONE-SIDE COATED

6.6.2.1 MACHINE COATED

6.6.2.2 HAND-COATED

6.6.2.3 BRUSH-COATED

6.6.2.4 OTHERS

6.7 LOW COAT WEIGHT PAPER

6.7.1 TWO-COATED

6.7.1.1 MACHINE COATED

6.7.1.2 HAND-COATED

6.7.1.3 BRUSH-COATED

6.7.1.4 OTHERS

6.7.2 ONE-SIDE COATED

6.7.2.1 MACHINE COATED

6.7.2.2 HAND-COATED

6.7.2.3 BRUSH-COATED

6.7.2.4 OTHERS

6.8 OTHERS

6.8.1 TWO-COATED

6.8.1.1 MACHINE COATED

6.8.1.2 HAND-COATED

6.8.1.3 BRUSH-COATED

6.8.1.4 OTHERS

6.8.2 ONE-SIDE COATED

6.8.2.1 MACHINE COATED

6.8.2.2 HAND-COATED

6.8.2.3 BRUSH-COATED

6.8.2.4 OTHERS

7 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER

7.1 OVERVIEW

7.2 TWO-SIDE COATED

7.3 ONE-SIDE COATED

8 NORTH AMERICA COATED PAPER MARKET, BY FINISH

8.1 OVERVIEW

8.2 GLOSS

8.3 SATIN

8.4 MATTE

8.5 DULL

8.6 OTHERS

9 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND LABELLING

9.2.1 STANDARD COATED FINE PAPER

9.2.2 COATED GROUND WOOD PAPER

9.2.3 ART PAPER

9.2.4 PIGMENT COATED PAPER

9.2.5 ENAMEL PAPER

9.2.6 LOW COAT WEIGHT PAPER

9.2.7 OTHERS

9.3 PRINTING

9.3.1 STANDARD COATED FINE PAPER

9.3.2 COATED GROUND WOOD PAPER

9.3.3 ART PAPER

9.3.4 PIGMENT COATED PAPER

9.3.5 ENAMEL PAPER

9.3.6 LOW COAT WEIGHT PAPER

9.3.7 OTHERS

9.4 OTHERS

9.4.1 STANDARD COATED FINE PAPER

9.4.2 COATED GROUND WOOD PAPER

9.4.3 ART PAPER

9.4.4 PIGMENT COATED PAPER

9.4.5 ENAMEL PAPER

9.4.6 LOW COAT WEIGHT PAPER

9.4.7 OTHERS

10 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS

10.1 OVERVIEW

10.2 ONLINE CALENDARING

10.3 OFFLINE CALENDARING

11 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD

11.1 OVERVIEW

11.2 MACHINE COATED

11.3 HAND-COATED

11.4 BRUSH-COATED

11.5 OTHERS

12 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL

12.1 OVERVIEW

12.2 CALCIUM CARBONATE

12.2.1 PRECIPITATED CALCIUM CARBONATE (PCC)

12.2.2 GROUND CALCIUM CARBONATE (GCC)

12.3 KAOLIN CLAY

12.4 CLAY

12.5 TITANIUM DIOXIDE

12.6 WAX

12.7 TALC

12.8 OTHERS

13 NORTH AMERICA COATED PAPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COATED PAPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SAPPI

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BILLERUD AMERICAS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UPM

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DS SMITH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 STORA ENSO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 OJI HOLDINGS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 NIPPON PAPER INDUSTRIES CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 LECTA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EMAMI PAPER MILLS LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.10.1 COMPANY SNAPSHOT

16.10.2 RECENT FINANCIALS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 DUNN PAPER COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 KOEHLER HOLDING SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BURGO GROUP S.P.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JK PAPER

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 ASIA PULP & PAPER (APP) SINAR MAS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 TWIN RIVERS PAPER COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SKPMILL.COM

16.17.1 COMPANY SNAPSHOT

16.17.2 RECENT FINANCIALS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 PARADISE PACKAGING

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 3 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 5 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 7 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 9 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 11 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 13 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 15 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 17 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 19 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 21 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 23 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 25 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 27 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 29 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 31 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 33 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 35 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)(B2C)

TABLE 36 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 37 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 39 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 41 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 43 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 45 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 47 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 49 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 51 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 53 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 55 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 57 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 59 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 61 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 63 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 65 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 67 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 69 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 71 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 73 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 75 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 77 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 79 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 81 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 83 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 85 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 87 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 89 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 91 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 93 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 95 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 97 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 99 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 101 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 103 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 105 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 107 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 109 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 111 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 113 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 115 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 117 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 119 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 121 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 123 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 125 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (KILO TON)

TABLE 127 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 128 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 130 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 131 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 133 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 135 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 137 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 139 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 141 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 143 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 145 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 147 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 149 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 151 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 153 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 155 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 157 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 159 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 161 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 163 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 165 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 167 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 169 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 171 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 173 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 175 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 176 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 178 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 179 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 181 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 183 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 184 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 185 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 186 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 187 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 188 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 189 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 190 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 192 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 193 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 195 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 196 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 197 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 199 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 200 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 201 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 202 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 203 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 204 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 205 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 206 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 207 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 208 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 209 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 210 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 211 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 212 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 213 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 214 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 215 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 216 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 217 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 218 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 219 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 220 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 221 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 222 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 223 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 224 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 225 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 226 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 227 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 228 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 229 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 230 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 231 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 232 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 233 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 234 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 235 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 236 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 237 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 238 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 239 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 240 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 241 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 242 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 243 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 244 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 245 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 246 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 247 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 248 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 249 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 250 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 251 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 252 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 253 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 254 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 255 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 256 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 257 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 258 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 259 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 260 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 261 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 262 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 263 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 264 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 265 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 266 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 267 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 268 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 269 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 270 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 271 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 272 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 273 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 274 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 275 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 276 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 277 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 278 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 279 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 280 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 281 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 282 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 283 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 284 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 285 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 286 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 287 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 288 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 289 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 290 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 291 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 292 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 293 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 294 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 295 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 296 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 297 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 298 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 299 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 300 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 301 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 302 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 303 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 304 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 305 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 306 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 307 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 308 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 309 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 310 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 311 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 312 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 313 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 314 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 315 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 316 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 317 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 318 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 319 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 320 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 321 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 322 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 323 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 324 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 325 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 326 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 327 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 328 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 329 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 330 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 331 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 332 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 333 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 334 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 335 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 336 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 337 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 338 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 339 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 340 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 341 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 342 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 343 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 344 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 345 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 346 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 347 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 348 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 349 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 350 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 351 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 352 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 353 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 354 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 355 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 356 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 357 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 358 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 359 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 360 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 361 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 362 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 363 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 364 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 365 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 366 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 367 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 368 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 369 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 370 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 371 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 372 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 373 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 374 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 375 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 376 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 377 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 378 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 379 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 380 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 381 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 382 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 383 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 384 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 385 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 386 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 387 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 388 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 389 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 390 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 391 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 392 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 393 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 394 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 395 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 396 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 397 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 398 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 399 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 400 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 401 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 402 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 403 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 404 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 405 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 406 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 407 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 408 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 409 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 410 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 411 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

Liste des figures

FIGURE 1 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COATED PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COATED PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COATED PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COATED PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COATED PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COATED PAPER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COATED PAPER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA COATED PAPER MARKET VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF COATED PAPER IN FOOD INDUSTRY IS DRIVING THE COATED PAPER MARKET IN THE FORECAST PERIOD

FIGURE 12 STANDARD COATED FINE PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COATED PAPER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COATED PAPER MARKET

FIGURE 14 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2022

FIGURE 16 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2022

FIGURE 17 NORTH AMERICA COATED PAPER MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA COATED PAPER MARKET: BY FINISHING PROCESS, 2022

FIGURE 19 NORTH AMERICA COATED PAPER MARKET: BY COATING METHOD, 2022

FIGURE 20 NORTH AMERICA COATED PAPER MARKET: BY COATING MATERIAL, 2022

FIGURE 21 NORTH AMERICA COATED PAPER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA COATED PAPER MARKET: BY PRODUCT (2023-2030)

FIGURE 26 NORTH AMERICA COATED PAPER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.