アジア太平洋カンナビジオール (CBD) 市場、ソース別 (麻とマリファナ)、グレード別 (食品グレードと治療グレード)、性質別 (有機と無機)、用途別 (チンキ剤、食品、飲料、医薬品、外用剤、栄養補助食品など)、製品タイプ別 (CBD オイル、CBD 濃縮物、CBD 分離物など) - 2029 年までの業界動向と予測。

アジア太平洋カンナビジオール(CBD)市場分析と洞察

アジア太平洋地域のカンナビジオール(CBD)市場は、2022年から2029年の予測期間に市場が成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に24.1%のCAGRで成長すると分析しています。カンナビジオール(CBD)薬物治療における技術的進歩、ヘルスケア部門の増加は、予測期間中のアジア太平洋地域のカンナビジオール(CBD)市場の成長を促進するもう1つの要因です。

しかし、CBDオイルに関連する副作用や、市場で入手可能な偽造品や合成品は、市場の成長を抑制するでしょう。主要な市場プレーヤーによるパートナーシップや買収などの戦略的提携の採用は、アジア太平洋カンナビジオール(CBD)市場の成長の機会として機能します。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

原料(麻とマリファナ)、グレード(食品グレードと治療グレード)、性質(有機と無機)、用途(チンキ剤、食品、飲料、医薬品、外用剤、栄養補助食品など)、製品タイプ(CBDオイル、CBD濃縮物、CBD単離物など) |

|

対象国 |

中国、日本、インド、韓国、タイ、マレーシア、オーストラリア、ニュージーランド、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

アジア太平洋地域のカンナビジオール(CBD)市場で活動している主要企業には、CV Sciences、Inc.、VIVO Cannabis Inc.、Gaia Herbs Hemp、Phoena Holdings Inc.、Medical Marijuana、Inc.、The Cronos Group、CHARLOTTE'S WEB、HEXO Corp.、Aurora Cannabis、Canopy Growth Corporation、Jazz Pharmaceuticals、Inc.、Tilray、Curaleaf、KAZMIRA、Freedom Leaf、Inc.、Koi CBD、Groff North America Hemplex、Joy Organics、Elixinol Wellness Limited、Isodiol International Inc.、Healthy Food Ingredients、LLC、NuLeaf Naturals、LLC、Diamond CBD、Medterra CBD、ENDOCA、Green Roads などがあります。 |

カンナビジオール(CBD)市場の定義

カンナビジオール(CBD)は、大麻サティバ植物に含まれる化合物で、麻または大麻から抽出されます。麻から抽出されるのは、天然のカンナビジオール(CBD)含有量が高いためです。不安や発作の治療、痛みの軽減にいくつかの利点があります。その治癒特性により、健康とウェルネス目的でのCBDの需要が高く、これが市場を牽引する主な要因となっています。すべてのカンナビノイドのうち、カンナビジオールは精神活性効果がないため、治療目的で最も広く使用されています。多くの医療用途で、不安やうつ病の治療、ストレス緩和、糖尿病予防、痛みの緩和、癌症状の緩和、炎症など、カンナビジオールオイルが使用されています。病気の治療にCBDベースの製品がますます採用されているため、アジア太平洋市場は予測期間中に有利な速度で成長すると予想されています。カンナビジオールオイルは、ニキビやシワを治療するためのスキンケア製品の製造にますます使用されています。たとえば、セフォラは最近、カンナビジオールまたは CBD スキンケア ラインを店舗に導入しました。同様に、アルタ ビューティーはカンナビジオール ベースの製品ラインを発売する予定です。また、カンナビジオール配合の化粧品市場には、いくつかの新しい企業も参入しています。

さらに、さまざまな国の政府やカンナビノイド市場の主要企業が研究開発活動に投資しています。いくつかの臨床試験では、CBDはてんかんを含むさまざまな神経疾患の効果的な治療薬であると言われています。

市場の動向

ドライバー

- 健康とフィットネスにおけるCBDの需要増加

消費者の健康とフィットネスに関する意識の高まりは、CBD 市場の急速な成長を促すでしょう。医療用大麻の合法化とともに消費者の可処分所得が増加することで、この分野におけるカンナビジオールの需要にプラスの影響を与えることが予想されます。

さらに、CBD製品は、不安/ストレス、睡眠/不眠症、慢性疼痛、片頭痛、スキンケア、発作、関節痛と炎症、神経疾患など、さまざまな問題の緩和に使用されています。慢性疼痛治療は、CBDを使用することで得られる追加の利点により、非常に人気が高まっています。カンナビジオール(CBD)製品は、その広範な医療用途と疼痛緩和治療により、近年需要が高まっています。CBDは、体内のさまざまな生物学的プロセスに作用することで、慢性疼痛を軽減するのに役立ちます。さらに、CBDには抗酸化作用、抗炎症作用、鎮痛作用があります。したがって、CBD製品は、慢性疼痛に苦しむ人々が経験する不安を軽減します。したがって、慢性疼痛治療におけるCBDの需要の増加は、市場の成長を促進しています。これは、フィットネス活動中に発生する可能性のある痛みを避けながら、人々が健康とフィットネスのルーチンを維持するのにも役立ちます。

- CBD製品に対する政府の承認と規制の改善

厳しい政府規制があり、CBD ベースの製品は国内および海外市場で販売および供給される前に厳格な承認が必要であり、市場の成長が制限されていました。しかし、時間の経過とともにこれらの制限は緩和され、マリファナおよびマリファナ由来の製品のさまざまな用途での合法化の増加と相まって、精製された CBD 製品の受け入れが増加しています。これにより、市場の成長と需要が促進されます。

さらに、世界中に CBD 製品の大手メーカーが存在するため、政府や、米国の食品医薬品局 (FDA)、ヨーロッパの欧州連合などのその他の規制機関は、CBD および CBD ベースの製品に対する規制を緩和するようさらに促されています。

拘束

-

CBD製品の高コスト

CBD は、痛み、炎症、睡眠障害に悩む人々にとって人気があり、総合的な選択肢です。CBD は研究開発があまり進んでいない新製品であり、最近規制され承認されたため、CBD の価格は変動する可能性があります。2018 年に麻の生産が合法化され、CBD 製品の価格に影響が出ました。その結果、さまざまな CBD 製品で価格が高騰しました。

さらに、多くの農家が CBD 製品の製造に使用される麻の栽培と販売に移行していますが、この製品の人気の高まりにもかかわらず、農業には独自の課題があります。まず、新しい作物に切り替えると、新しい費用が発生します。麻を収穫する最も効率的な方法は、コンバインを使用することです。しかし、イチゴなど、コンバインを必要としない作物を以前に栽培していた農家は、すぐにコンバインを購入する余裕がありません。そのため、麻の収穫を手伝う人を雇う必要があり、原材料が高価になるため、製品全体の価格が上昇します。

さらに、麻の栽培にはより多くの時間と労力が必要であり、農家は栽培中に作物を綿密に検査する必要があります。さらに、収穫後は、カンナビジオールの抽出が難しく、費用のかかるプロセスになります。CBDの加工業者と抽出業者は、エタノールまたは超臨界二酸化炭素(CO2抽出)を使用する必要があります。抽出と精製のプロセスには特別な機械が必要で、長い時間がかかるため、CBDのコストが上昇します。したがって、これらすべての要因がCBD製品のコストに加算され、他の製品よりもはるかに高価になり、市場の需要が抑制される可能性があります。

機会

-

新しいCBDベースの製品の開発への投資の増加

革新的で洗練された製品を市場に提供する傾向が高まる中、メーカーは新しい CBD ベースの製品の製造のための研究開発に多額の費用を費やしています。オイル、チンキ剤、濃縮物、カプセル、スラブなどの局所用溶液、リップクリーム、ローション、焼き菓子、コーヒー、チョコレート、ガム、キャンディーなどの食品は、需要の高い CBD 製品の一部です。

The increasing demand has increased the number of trials to study the impact of CBD on certain health conditions, which is expected to develop new products in turn providing opportunity for the rise in the demand in the forthcoming years. Furthermore, many companies procure CBD oils in bulk and manufacture CBD-infused products. In addition, numerous health and wellness retailers are offering CBD-based products, such as Rite Aid, CVS Health, and Walgreens Boots Alliance.

Moreover, with the ease in regulations and post the approval of cannabis products, the companies are investing huge amounts in the product development and upgrading the raw material production, which will also help them to cut down on costs while meeting the surging demand in the market. The new product development and increasing research and development activities along with various strategic decisions taken by key manufacturers in the market will offer lucrative opportunity for the growth of the Asia-Pacific CBD market.

Challenge

- Side effects associated with CBD oil

Cannabidiol is well-known for its ability to cure a variety of illnesses, including anxiety, seizures, neurological problems, cancer-related nausea, chronic pain, and more. However, being useful for a variety of medical illnesses, various studies and research conducted by numerous organizations have shown that CBD-based medicines can have negative effects as well.

Some of the side effects that are commonly experienced by consumers include dry mouth, drowsiness, low blood pressure, and lightheadedness. CBD is also known to raise the level of Coumadin (a blood thinner) in the body, which can interact with other drugs and cause negative side effects. These factors might impede future adoption of CBD for therapeutic purposes.

Moreover, another cause for concern is the unreliability of the purity and dosage of CBD in products such as CBD oil. High concentration of CBD oil can also have harmful effects on the consumers’ health. In some cases, excessive use of CBD oil may also increase liver enzymes, which is a marker of liver inflammation. Cytochrome P450 (CYP450) is an enzyme which body uses to break down some drugs. CBD oil can block CYP450. That means that taking CBD oil with these drugs could make them have a stronger effect than one needs or make them not work at all.

Further, dietary supplements that contain CBD and a blend of herbal ingredients may not be safe for everyone, as many herbs have the potential to interact with commonly prescribed medications. All these side effects may vary from person to person as minor side effects for some may prove to be serious for others. This may pose as a challenge for the increasing demand of CBD products in the Asia-Pacific CBD market.

Post COVID-19 Impact on Asia-Pacific Cannabidiol (CBD) Market

COVID-19 has resulted in a substantial upsurge in demand for medical supplies from both healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the Asia-Pacific cannabidiol (CBD) market.

Asia-Pacific Cannabidiol (CBD) Market Scope and Market Size

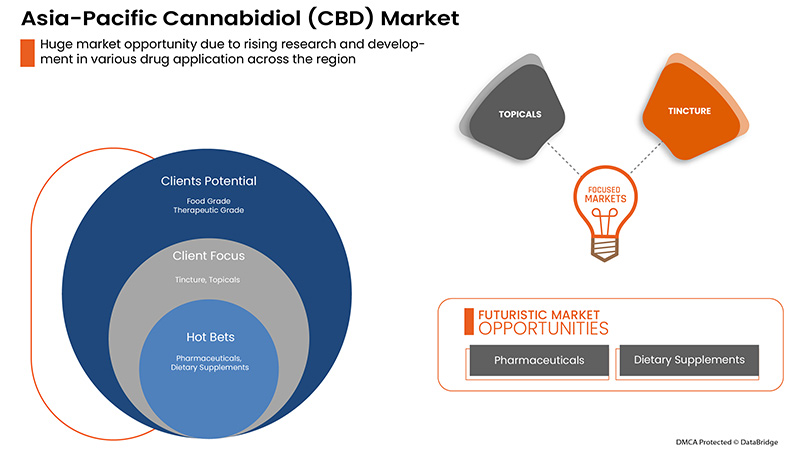

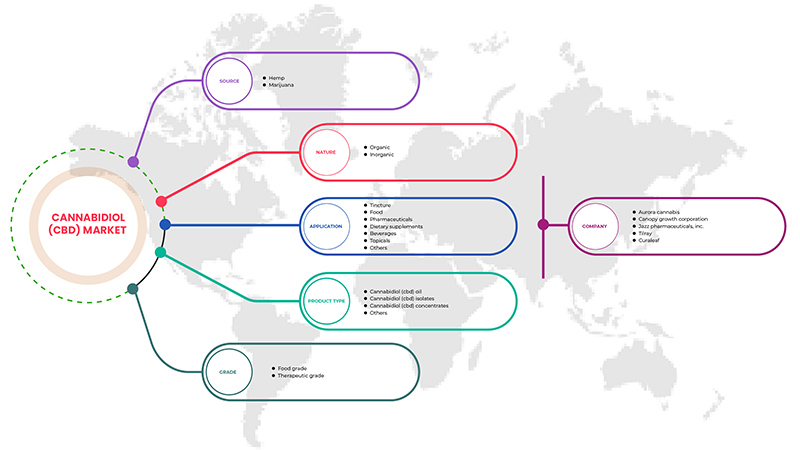

Asia-Pacific cannabidiol (CBD) market is segmented on the basis source, grade, application, product type, nature. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the Difference in your target markets.

BY SOURCE

- HEMP

- MARIJUANA

On the basis of source, the Asia-Pacific cannabidiol (CBD) market is segmented into hemp and marijuana.

BY PRODUCT TYPE

- CBD OIL

- CBD ISOLATES

- CBD CONCENTRATES

- OTHERS

On the basis of product type, the Asia-Pacific cannabidiol (CBD) market is segmented into CBD oil, CBD concentrates, CBD isolates and others

BY NATURE

- ORGANIC

- INORGANIC

On the basis of nature, the Asia-Pacific cannabidiol (CBD) market is segmented into organic and inorganic.

BY GRADE

- FOOD GRADE

- THERAPEUTIC GRADE

On the basis of grade, the Asia-Pacific cannabidiol (CBD) market is segmented into food grade and therapeutics grade.

BY APPLICATION

- Tincture

- Food

- Beverages

- Pharmaceutical

- Topicals

- Dietary supplements

- Others

On the basis of application, the Asia-Pacific cannabidiol (CBD) market is segmented into tincture, food, beverages, pharmaceutical, topicals, dietary supplements and others.

Asia-Pacific Cannabidiol (CBD) Market Country Level Analysis

The cannabidiol (CBD) market is analyzed and market size information is provided by source, grade, application, product type, nature.

The countries covered in the cannabidiol (CBD) market report are China, Japan, India, South Korea, Thailand, Malaysia, Australia, New Zealand and rest of Asia-Pacific.

In 2022, China is dominating due to the presence of key market players along the largest consumer market with high GDP. China is expected to grow due to rise in technological advancement in drug treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

カンナビジオール (CBD) 市場は、ヘルスケア業界における各国の成長に関する詳細な市場分析も提供します。さらに、ヘルスケア サービスと治療、規制シナリオの影響、カンナビジオール (CBD) 市場に関するトレンド パラメータに関する詳細な情報も提供します。

競争環境とアジア太平洋カンナビジオール(CBD)市場シェア分析

アジア太平洋カンナビジオール (CBD) 市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供されている上記のデータ ポイントは、カンナビジオール (CBD) 製品に関連する会社の焦点にのみ関連しています。

カンナビジオール(CBD)市場を扱っている主要企業としては、CV Sciences, Inc.、VIVO Cannabis Inc.、Gaia Herbs Hemp、Phoena Holdings Inc.、Medical Marijuana, Inc.、The Cronos Group、CHARLOTTE'S WEB、HEXO Corp.、Aurora Cannabis、Canopy Growth Corporation、Jazz Pharmaceuticals, Inc.、Tilray、Curaleaf、KAZMIRA、Freedom Leaf, Inc.、Koi CBD、Groff North America Hemplex、Joy Organics、Elixinol Wellness Limited、Isodiol International Inc.、Healthy Food Ingredients, LLC、NuLeaf Naturals, LLC、Diamond CBD、Medterra CBD、ENDOCA、Green Roads などがあります。

主要な市場プレーヤーによる合併、買収、合意などの戦略的提携により、カンナビジオール(CBD)製品の成長がさらに加速すると予想されます。

例えば、

- 2022年5月、Canopy Growth Corporationと、カリフォルニアを拠点とする高品質大麻抽出物の生産者であり、クリーンベイプ技術の先駆者であるLemurian, Inc.は、米国でTHCの連邦政府許可が得られ次第、またはCanopy Growthの選択によりそれ以前に、Jettyの発行済み資本金の最大100%を取得する権利をCanopy Growthの完全子会社を通じて提供する正式契約を締結したことを発表しました。これにより、同社は市場での事業を拡大することができました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CANNABIDIOL (CBD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 BENCHMARKING ANALYSIS

4.2 CBD PRODUCTS, INCLUDING CANNABINOIDS (IN %)

4.3 CBD RAW MATERIAL DEVELOPMENT TREND

4.3.1 MORE CONTROLLED CBD LEVELS:

4.3.2 CBD AND GENETICS:

4.3.3 ADVANCEMENTS MADE IN EXTRACTION:

4.3.4 NANOTECHNOLOGY

4.3.5 CONCLUSION

4.4 COMPANY POSITIONING GRID

4.4.1 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

4.4.1.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

4.4.1.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.3 COMPANY SHARE ANALYSIS: EUROPE

4.4.1.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

4.4.2 COMPANY’S CURRENT VENDORS

4.5 OVERALL VOLUME (KILO TONS) & QUANTITY OF COMPLETED TRANSACTIONS: ASIA PACIFIC CANNABIDIOL (CBD) MARKET

4.6 LIST OF COUNTRIES THAT LEGALIZED CANNABIDIOL (CBD)

4.7 REGULATION COVERAGE

4.8 IMPORT & EXPORT REGULATION

4.8.1 IMPORT REGULATIONS

4.8.2 EXPORT REGULATIONS

4.9 IMPORT STANDARDS

4.1 GOVERNMENT POLICIES

4.11 QUALIFICATION/CERTIFICATION REQUIRED

4.12 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: PRICING ANALYSIS & DEAL PRICING

4.13 RAW MATERIAL EXTRACTOR POSITIONING GRID

4.13.1 KEY EXTRACTION

4.13.2 LINE CAPABILITY

4.14 TECHNOLOGICAL ADVANCEMENTS:

4.15 VENDOR/ DISTRIBUTOR SHARE ANALYSIS

4.16 VENDOR/DISTRIBUTOR KEY BUYERS

5 CLIMATE CHANGE SCENARIO: ASIA PACIFIC CANNABIDIOL (CBD) MARKET

5.1 ENVIRONMENT CONCERNS-

5.2 INDUSTRY RESPONSE-

5.3 GOVERNMENT INITIATIVES

5.4 ANALYST RECOMMENDATIONS

6 SUPPLY CHAIN OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN DEMAND FOR CBD IN HEALTH & FITNESS

7.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

7.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

7.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AS WELL AS RECREATIONAL USE

7.2 RESTRAINTS

7.2.1 HIGH COST OF CBD PRODUCTS

7.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

7.3 OPPORTUNITIES

7.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

7.3.2 GROWING MEDICAL APPLICATIONS OF CBD

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

7.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

8 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 CANNABIDIOL (CBD) OIL

9.2.1 CARBON DIOXIDE EXTRACTION

9.2.2 STEAM DISTILLATION

9.2.3 SOLVENT EXTRACTION

9.2.4 OTHERS

9.3 CANNABIDIOL (CBD) ISOLATES

9.4 CANNABIDIOL (CBD) CONCENTRATES

9.5 OTHERS

10 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE

11.1 OVERVIEW

11.2 FOOD GRADE

11.3 THERAPEUTIC GRADE

12 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TINCTURE

12.3 FOOD

12.3.1 CHOCOLATE & CONFECTIONERY

12.3.1.1 CANDY

12.3.1.2 CHOCOLATE

12.3.1.3 CHEWS

12.3.1.4 GUMMIES

12.3.1.5 OTHERS

12.3.2 HONEY

12.3.3 DAIRY BASED EDIBLE

12.3.3.1 MILK

12.3.3.2 ICE CREAM

12.3.3.3 OTHERS

12.3.4 SAUCES AND SEASONINGS

12.3.5 BAKERY EDIBLE

12.3.5.1 COOKIES AND BISCUITS

12.3.5.2 BROWNIES

12.3.5.3 OTHERS

12.3.6 OTHERS

12.3.7 PHARMACEUTICALS

12.3.7.1 DRAVET SYNDROME

12.3.7.2 MULTIPLE SCLEROSIS DRUG APPLICATIONS

12.3.7.3 NEUROLOGICAL DRUG APPLICATIONS

12.3.7.4 CANCER DRUG APPLICATIONS

12.3.7.5 OTHERS

12.3.8 DIETARY SUPPLEMENTS

12.3.8.1 CAPSULES

12.3.8.2 GUMMIES

12.3.8.3 OTHERS

12.3.9 BEVERAGES

12.3.9.1 NON-ALCOHOLIC BEVERAGES

12.3.9.1.1 ENERGY DRINKS

12.3.9.1.2 SOFT DRINKS

12.3.9.1.3 RTD COFFEE

12.3.9.1.4 TEA

12.3.9.1.5 SPARKLING WATER

12.3.9.1.6 OTHERS

12.3.9.2 FLAVORED DRINKS

12.3.9.2.1 ORANGE

12.3.9.2.2 LEMON

12.3.9.2.3 BERRIES

12.3.9.2.4 COCONUT

12.3.9.2.5 OTHERS

12.3.9.3 ALCOHOLIC BEVERAGES

12.3.9.3.1 BEER

12.3.9.3.2 WINE

12.3.9.3.3 OTHERS

12.3.9.4 OTHERS

12.3.10 TOPICAL

12.3.10.1 LOTION

12.3.10.2 SALVE

12.3.10.3 LIP BALM

12.3.10.4 OTHERS

12.3.11 OTHERS

12.3.11.1 VAPES

12.3.11.2 CIGARETTES

12.3.11.3 SPA AND RECREATION

13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 AUSTRALIA

13.1.4 INDIA

13.1.5 THAILAND

13.1.6 MALAYSIA

13.1.7 SOUTH KOREA

13.1.8 NEW ZEALAND

13.1.9 REST OF ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CURALEAF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TILRAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JAZZ PHARMACEUTICALS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CANOPY GROWTH CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AURORA CANNABIS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CHARLOTTE’S WEB.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CV SCIENCES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DIAMOND CBD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ELIXINOL WELLNESS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ENDOCA.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FREEDOM LEAF, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GAIA HERBS HEMP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GREEN ROADS.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GROFF NORTH AMERICA HEMPLEX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HEXO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HEALTHY FOOD INGREDIENTS, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ISODIOL INTERNATIONAL INC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 JOY ORGANICS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KAZMIRA

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KOI CBD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MEDICAL MARIJUANA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 EVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 MEDTERRA CBD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NULEAF NATURALS, LLC

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 PHOENA HOLDINGS INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 THE CRONOS GROUP

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 VIVO CANNABIS INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 BENCHMARK ANALYSIS

TABLE 2 AVERAGE VOLUME TREND FOR ASIA PACIFIC CANNABIDIOL (CBD) MARKET (KILO TONS)

TABLE 3 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 4 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HEMP IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MARIJUANA IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC CANNABIDIOL (CBD) ISOLATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CANNABIDIOL (CBD) CONCETRATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC INORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FOOD GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC THERAPEUTIC GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC TINCTURE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTICALS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC TOPICAL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 CHINA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 61 CHINA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 CHINA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 63 CHINA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 CHINA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CHINA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 CHINA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 79 JAPAN CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 JAPAN FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 JAPAN BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 JAPAN DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 JAPAN BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 JAPAN ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 JAPAN NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 JAPAN FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 JAPAN TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 JAPAN DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 JAPAN OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 113 INDIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 115 INDIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 116 INDIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 117 INDIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 INDIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 INDIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 INDIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 INDIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 THAILAND CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 THAILAND CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 133 THAILAND CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 THAILAND FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 THAILAND NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 THAILAND FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 THAILAND PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 THAILAND TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 THAILAND DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 THAILAND OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 MALAYSIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 167 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 SOUTH KOREA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 169 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 170 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 171 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 SOUTH KOREA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 SOUTH KOREA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 SOUTH KOREA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 SOUTH KOREA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SOUTH KOREA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SOUTH KOREA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 SOUTH KOREA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SOUTH KOREA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 SOUTH KOREA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SOUTH KOREA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 SOUTH KOREA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 185 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 NEW ZEALAND CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 187 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 188 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 189 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 NEW ZEALAND FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NEW ZEALAND CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 NEW ZEALAND BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 NEW ZEALAND DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 NEW ZEALAND BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NEW ZEALAND ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 NEW ZEALAND FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 NEW ZEALAND PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 NEW ZEALAND TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 NEW ZEALAND DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 NEW ZEALAND OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 REST OF ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE INCREASING DEMAND FOR CANNABIDIOL (CBD) DUE TO ITS HEALING PROPERTIES AND HEALTH AND WELLNESS PURPOSES IS HIGH, WHICH IS THE MAJOR FACTOR DRIVING THE MARKET IS EXPECTED TO DRIVE THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEMP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 14 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 15 EUROPE CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 16 SOUTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 17 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: VENDOR/ DISTRIBUTOR SHARE ANALYSIS (%)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET

FIGURE 19 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, 2021

FIGURE 20 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 24 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 28 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 32 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 36 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE (2022-2029)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。