アジア太平洋地域のジエチルフタル酸エステル市場、純度別(高純度(≤99%)、超高純度(≥99.5%)、タイプ別(工業用グレード、化粧品グレード、その他)、用途別(可塑剤、バインダー、化粧品成分、溶剤、アルコール変性剤)、エンドユーザー別(包装、化粧品およびパーソナルケア、プラスチックおよびポリマー、界面活性剤、農薬、塗料、その他) - 2030年までの業界動向および予測。

アジア太平洋地域のジエチルフタル酸エステル市場の分析と規模

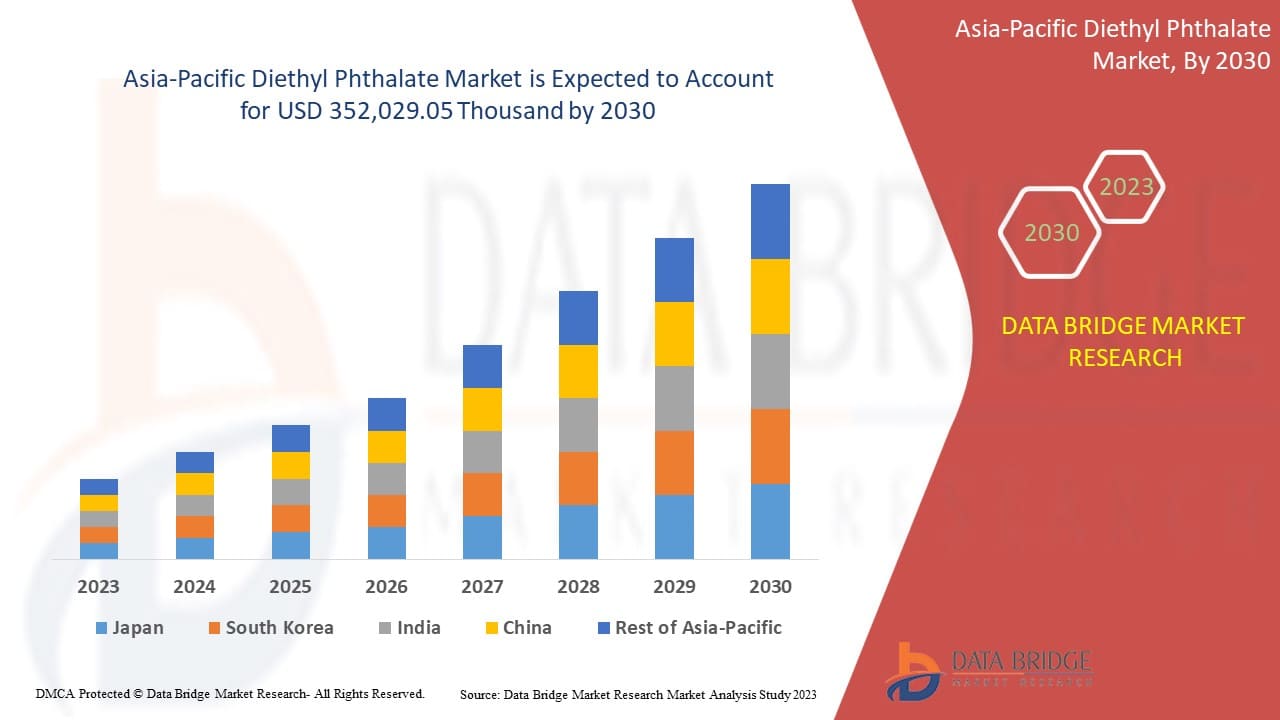

ジエチルフタル酸エステル市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に4.4%のCAGRで成長し、2030年までに352,029.05千米ドルに達すると分析しています。ジエチルフタル酸エステル市場の成長を牽引する主な要因は、化粧品業界による化粧品およびパーソナルケア製品の消費の増加と、プラスチック業界によるジエチルフタル酸エステルの需要の増加です。

ジエチルフタレート市場レポートでは、市場シェア、新しい展開、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、お客様が希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

純度(高純度(≤99%)、超高純度(≥99.5%)、タイプ(工業用グレード、化粧品グレード、その他)、用途(可塑剤、バインダー、化粧品成分、溶剤、アルコール変性剤)、エンドユーザー(包装、化粧品およびパーソナルケア、プラスチックおよびポリマー、界面活性剤、農薬、塗料、その他) |

|

対象国 |

日本、中国、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他アジア太平洋地域 |

|

対象となる市場プレーヤー |

Thirumalai Chemicals Ltd、IG Petrochemicals Ltd.、TCI Chemicals (India) Pvt. Ltd.、Indo Nippon Chemical Co., Ltd.、Agro Extracts Limited.、Maharashtra Aldehydes & Chemicals Ltd.、MaaS Pharma Chemicals、Nishant Organics Pvt. Ltd.、Spectrum Chemical、LobaChemie Pvt. Ltd.、Polynt SpA、KLJ Group、Demon Chemicals Co., Ltd、PCIPL、West India Chemical International など。 |

市場の定義

ジエチルフタレートは、フタル酸エステルファミリーに属する化合物で、フタル酸のジエチルエステルです。ジエチルフタレートは無色の液体で、透明で水よりわずかに密度が高いです。ジエチルフタレートは燃えにくいです。業界では、ジエチルフタレートはソルバノールとも呼ばれています。ジエチルフタレートは通常、Ald-Ox プロセスまたは Oxo プロセスで合成されます。ジエチルフタレートは、濃硫酸を触媒として無水フタル酸とエタノールを反応させることによっても合成できます。ジエチルフタレートの純度は通常 98% から 99.5% の範囲です。

ジエチルフタル酸エステル市場の動向

ドライバー

- 化粧品やパーソナルケア製品の消費量の増加

化粧品やパーソナルケア製品の消費は、肌の健康と個人の衛生に対する個人の関心が高まっているため、大幅に増加しています。若い世代はスキンケアの重要性を認識しており、マニキュア、ヘアスプレー、アフターシェーブローション、クレンザー、シャンプーなどの化粧品やパーソナル製品を大量に使い始めています。消費者が外見や有害な太陽光線に気づき始めているため、アンチエイジング製品や日焼け止め製品のユーザーベースは高くなっています。さらに、経済の発展とライフスタイルの発展により、特に女性の間で身だしなみへの支出が増加しています。このような化粧品やパーソナルケア製品の発展は、長年にわたって拡大しており、今後も拡大していきます。さらに、パーソナル製品の技術的進歩は、今後数年間でアジア太平洋地域のジエチルフタレート市場を牽引するでしょう。

- プラスチックおよびポリマー業界からのジエチルフタレートの需要増加

ジエチルフタレートは、ポリマーおよびプラスチック業界で最終製品の柔軟性を高めるために使用されています。工業化の加速、所得の増加、ライフスタイルの変化、日常生活におけるポリマーベースの製品の用途の増加により、ポリマー業界が急成長しています。ポリマーは、ヘルスケア、農業、衣類、住宅、家具、電子機器、建設に使用されています。可塑剤または軟化剤は、材料(通常はプラスチックまたはエラストマー)に組み込む物質または材料であり、その柔軟性、作業性、または伸張性を高めます。可塑剤は、溶融粘度を低下させたり、2 次遷移の温度を下げたり、溶融物の弾性率を低下させたりします。

- 現代の農業技術におけるジエチルフタル酸エステルの採用

ジエチルフタル酸は、作物から昆虫や害虫を遠ざけるための農薬として使用されています。作物への昆虫の攻撃が増加しているため、殺虫剤の需要も高まっています。ジエチルフタル酸などの不活性成分は、食糧生産のために動物に適用される殺虫剤に使用されています。これにより、殺虫剤や農薬におけるジエチルフタル酸の使用が促進され、一般的に農家の収入の増加につながることが期待されています。

Furthermore, these phthalic acid esters do not only leach from packaging into fertilizers and pesticides, they are also used as a solvent in many pesticides. In modern agriculture, vast use of PVC pipes are being done in agriculture. To make this PVC pipes, diethyl phthalate are used as plasticizers.

Opportunities

- Increasing use of diethyl phthalate to produce plasticizers for automotive industry

In today’s world, there is huge need to decrease weight and fuel usage. Therefore, diethyl phthalates are used in automotive plastics as one of the primary materials. One-third part of an average automotive vehicle is made up of plastic which include dashboards, engine covers, seating, interior wall panels, carburetors, handles, cable insulation, truck bed liners and many others. Polypropylene, polyvinyl chloride, polystyrene, polycarbonate and polyethylene are some of the plastics which are applied in building automotive vehicles. Diethyl phthalate is one of the widely used plasticizers to make these plastics and polymers. They make the plastic more flexible. Moreover, DEP is a biodegradable material and is also used in the manufacturing of automotive parts and tubes used in medical treatment and diagnostics.

- Expansion of the packaging industry

In packaging industry, bubble wrap and plastic films are few of the packaging materials used. To manufacture such materials plasticizers such as diethyl phthalate is effectively used in large quantities. Diethyl phthalate is used as a plasticizer for cellulose ester plastic films and sheets such as photographic, blister packaging, and tape applications and molded and extruded articles. Therefore, the demand of diethyl phthalate will rise in the coming years as the packaging industry expands, which is expected to provide lucrative opportunities for the growth of the Asia-Pacific diethyl phthalate market.

Restraints/Challenges

- Availability of alternatives to diethyl phthalates in the market

Diethyl phthalate has been widely used in cosmetics, consumer goods, plastics and polymers and packaging industry. However because of regulations, environmental and health issues there has been rise in availability and use of various substitutes of diethyl phthalate. Epoxidised soybean oil (ESBO) is used as plasticizers and compatibilizers along with diethyl phthalate. ESBO has also found its application as plasticizers in seals for glass jar and also act as stabilizer to decrease UV degradation of polyvinyl chloride. Similarly, Trimellitates have also been used as a substitute to diethyl phthalate which are used in wall coverings, packaging and flooring. In cosmetic products, acetyl tributyl citrate is used as a plasticizer in cosmetic products and in PVC applications.

- Hazards associated with excessive and long term use of diethyl phthalate

Diet is one of the main ways in which diethyl phthalates are consumed by consumers. Food packaging materials such as gloves used during food preparation, and vinyl plastic tools and materials can leak these chemicals into food. Diethyl phthalate when released in water sources, affects the marine life. Therefore, the presence of such harmful toxin in fish and other sea creatures directly harm the human health when these sea food items are consumed. The use of personal care products, vinyl flooring and wall coverings tends to release diethyl phthalate in large quantities. Such daily exposure to chemical can cause detrimental health effects not only to adults but also to children who are in their early growth.

Recent Developments

- In February, Spectrum Chemical Mfg. Corporation Receives GE Distinguished Partner Award for Applied Markets for Second Consecutive Year. This award will help the company to get recognition on larger scale.

- In December, PCIPL gets recommended again for prestigious ISO certification. Process orientation of the company which is so uncommon amongst most of the distribution companies has given us this edge and is helping us not just in our business but also fetching recognition by professional bodies of high repute like TUV SUD.

Diethyl Phthalate Market Scope

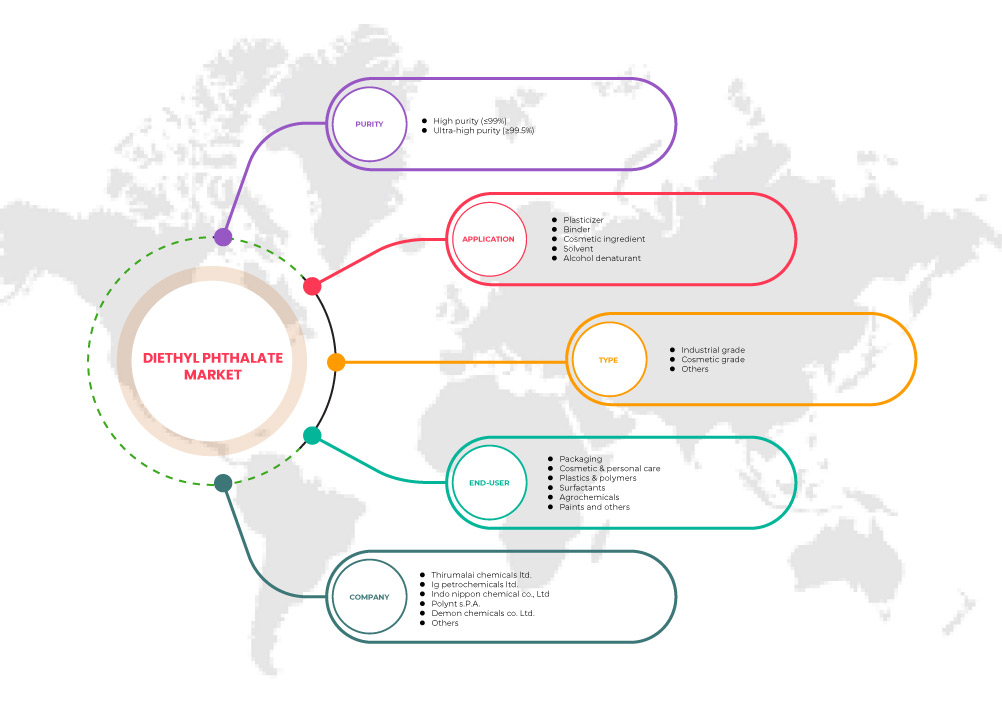

Thediethyl phthalate market is categorized based on purity type, type, application, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Purity Type

- High Purity (≤99%)

- Ultra-High Purity (≥99.5%)

On the basis of purity, the diethyl phthalate market is segmented into high Purity (≤99%) and ultra-high Purity (≥99.5%).

By Type

- Industrial grade

- Cosmetic grade

- Others

On the basis of type, the diethyl phthalate market is segmented into industrial grade, cosmetic grade and others.

Application

- Plasticizer

- Binder

- Cosmetic Ingredient

- Solvent

- Alcohol Denaturant

On the basis of application, the diethyl phthalate market is segmented into plasticizer, binder, cosmetic ingredient, solvent, and alcohol denaturant.

End User

- Packaging

- Cosmetic & Personal Care

- Plastics & Polymers

- Surfactants

- Agrochemicals

- Paints

- Others

On the basis of end-user, the diethyl phthalate market is segmented into packaging, cosmetic & personal care, plastics & polymers, surfactants, agrochemicals, paints and others.

Diethyl Phthalate Market Regional Analysis/Insights

The diethyl phthalate market is segmented on the basis of purity type, by type, applications, and end-user.

The countries in the diethyl phthalate market are the Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific.

China dominates in the Asia-Pacific region due to advanced development in technologies.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Diethyl Phthalate Market Share Analysis

The diethyl phthalate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the diethyl phthalate market.

Some of the major market players operating in the market are Thirumalai Chemicals Ltd, I G Petrochemicals Ltd., T.C.I. Chemicals (India) Pvt. Ltd., Indo Nippon Chemical Co., Ltd., Agro Extracts Limited., Maharashtra Aldehydes & Chemicals Ltd., MaaS Pharma Chemicals, Nishant Organics Pvt. Ltd., Spectrum Chemical, LobaChemie Pvt. Ltd., Polynt S.p.A., K.L.J. Group, Demon Chemicals Co., Ltd, PCIPL, West India Chemical International among others.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC DIETHYL PHTHALATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS

5.1.2 RISING DEMAND FOR DIETHYL PHTHALATE FROM THE PLASTIC & POLYMER INDUSTRY

5.1.3 ADOPTION OF DIETHYL PHTHALATES IN MODERN AGRICULTURAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HAZARDS ASSOCIATED WITH EXCESSIVE AND LONG-TERM USE OF DIETHYL PHTHALATE

5.2.2 STRICT REGULATIONS REGARDING THE TOXICITY OF DIETHYL PHTHALATE

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF DIETHYL PHTHALATE TO PRODUCE PLASTICIZERS FOR THE AUTOMOTIVE INDUSTRY

5.3.2 EXPANSION OF THE PACKAGING INDUSTRY

5.4 CHALLENGE

5.4.1 AVAILABILITY OF ALTERNATIVES TO DIETHYL PHTHALATES IN THE MARKET

6 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY

6.1 OVERVIEW

6.2 HIGH PURITY (≤99%)

6.3 ULTRA HIGH PURITY (≥99.5%)

7 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL GRADE

7.3 COSMETIC GRADE

7.4 OTHERS

8 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PLASTICIZER

8.3 BINDER

8.4 COSMETIC INGREDIENT

8.5 SOLVENT

8.6 ALCOHOL DENATURANT

9 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY END-USER

9.1 OVERVIEW

9.2 PACKAGING

9.3 COSMETIC & PERSONAL CARE

9.3.1 COSMETIC & PERSONAL CARE, BY TPE

9.3.1.1 BATH PRODUCTS

9.3.1.2 PERFUMES

9.3.1.3 HAIR CARE

9.3.1.4 NAIL ENAMEL & REMOVERS

9.3.1.5 SKIN CARE PRODUCTS

9.3.1.6 PERSONAL HYGIENE

9.3.1.7 OTHERS

9.4 PLASTICS & POLYMERS

9.5 SURFACTANTS

9.6 AGROCHEMICALS

9.7 PAINTS

9.8 OTHERS

10 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 SINGAPORE

10.1.6 INDONESIA

10.1.7 THAILAND

10.1.8 AUSTRALIA & NEW ZEALAND

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC DIETHYL PHTHALATE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 AWARDS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 THIRUMALAI CHEMICALS LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 I G PETROCHEMICALS LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 INDO NIPPON CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 POLYNT S.P.A.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DEMON CHEMICALS CO. LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 AGRO EXTRACTS LIMITED.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 KLJ GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 LOBACHEMIE PVT. LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAHARASHTRA ALDEHYDES & CHEMICALS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 MAAS PHARMA CHEMICALS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 NISHANT ORGANICS PVT. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

13.12 PCIPL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

13.13 SPECTRUM CHEMICAL

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 TCI CHEMICALS (INDIA) PVT. LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 WEST INDIA CHEMICAL INTERNATIONAL

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 5 ASIA PACIFIC HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 ASIA PACIFIC ULTRA HIGH PURITY (≥99.5%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC INDUSTRIAL GRADE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC COSMETIC GRADEIN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC PLASTICIZER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC BINDER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC COSMETIC INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC SOLVENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC ALCOHOL DENATURANT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC PACKAGING IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA PACIFIC PLASTICS & POLYMERS INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SURFACTANTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA PACIFIC AGROCHEMICALS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC PAINTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA PACIFIC OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 30 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 32 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 38 CHINA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 CHINA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 CHINA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 41 CHINA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 INDIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 43 INDIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 44 INDIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 INDIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 INDIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 47 INDIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 JAPAN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 49 JAPAN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 50 JAPAN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 JAPAN DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 JAPAN DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 53 JAPAN COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 55 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 56 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SINGAPORE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 61 SINGAPORE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 62 SINGAPORE DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SINGAPORE DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 64 SINGAPORE DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 65 SINGAPORE COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 INDONESIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 67 INDONESIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 68 INDONESIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 INDONESIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 70 INDONESIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 THAILAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 73 THAILAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 74 THAILAND DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 80 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 PHILIPPINES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 85 PHILIPPINES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 86 PHILIPPINES DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 PHILIPPINES DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 88 PHILIPPINES DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 89 PHILIPPINES COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 MALAYSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 91 MALAYSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 92 MALAYSIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 REST OF ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 97 REST OF ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

図表一覧

FIGURE 1 ASIA PACIFIC DIETHYL PHTHALATE MARKET

FIGURE 2 ASIA PACIFIC DIETHYL PHTHALATE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DIETHYL PHTHALATE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DIETHYL PHTHALATE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DIETHYL PHTHALATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DIETHYL PHTHALATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC DIETHYL PHTHALATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC DIETHYL PHTHALATEMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC DIETHYL PHTHALATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC DIETHYL PHTHALATE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC DIETHYL PHTHALATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC DIETHYL PHTHALATEMARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC DIETHYL PHTHALATE MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS IS EXPECTED TO DRIVE THE ASIA PACIFIC DIETHYL PHTHALATE MARKET IN THE FORECAST PERIOD

FIGURE 15 HIGH PURITY (≤99%) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC DIETHYL PHTHALATE MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC DIETHYL PHTHALATE MARKET

FIGURE 17 ASIA PACIFIC DIETHYL PHTHALATE MARKET: BY PURITY, 2022

FIGURE 18 ASIA PACIFIC DIETHYL PHTHALATE MARKET: BY TYPE, 2022

FIGURE 19 ASIA PACIFIC DIETHYL PHTHALATE MARKET: BY APPLICATION, 2022

FIGURE 20 ASIA PACIFIC DIETHYL PHTHALATE MARKET: BY END-USER, 2022

FIGURE 21 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 22 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 23 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 26 ASIA PACIFIC DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。