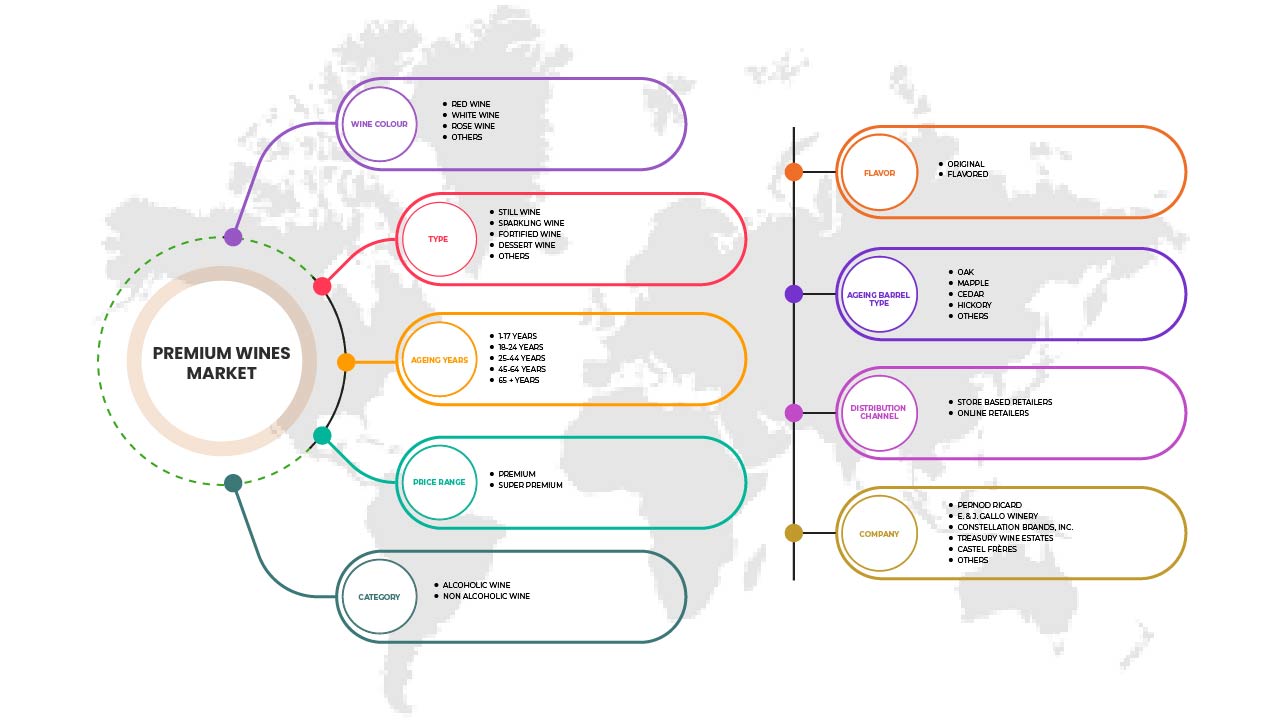

ヨーロッパの高級ワイン市場、ワインカラー別(赤ワイン、白ワイン、ロゼワイン、その他)、製品タイプ別(スティルワイン、酒精強化ワイン、スパークリングワイン、デザートワイン)、製品カテゴリー別(アルコールワイン、ノンアルコールワイン)、フレーバー別(オリジナル、フレーバー付き)、熟成年数別(1~17年、18~24年、25~44年、45~64年、65年以上)、熟成樽タイプ別(オーク、メープル、シダー、ヒッコリー、その他)、価格帯別(プレミアム、スーパープレミアム)、流通チャネル別(店舗型小売業者、オンライン小売業者) - 2029年までの業界動向と予測。

ヨーロッパの高級ワイン市場の分析と洞察

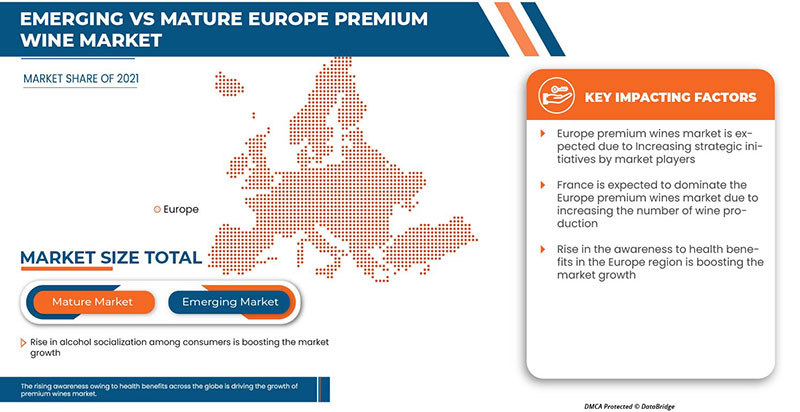

さまざまな健康上の利点によるワインの需要の高まりは、市場全体の成長を後押ししています。eコマース、宅配便、ワイン配達サービスの増加も市場の成長に貢献しています。主要な市場プレーヤーは、さまざまな新しいワインの発売に非常に注力しています。さらに、消費者の間でのアルコールの社交化の増加も、市場の需要の増加に貢献しています。

ヨーロッパの高級ワイン市場は、市場プレーヤーの増加と市場でのさまざまな高級ワインブランドの入手可能性により、予測年度に成長しています。これに伴い、メーカーは市場でさまざまなワインを生産しています。バーやレストランの増加により、市場の成長がさらに加速しています。ただし、ワイン生産の高コストと、消費者が徐々に他のアルコール飲料に移行していることが、予測期間中のヨーロッパの高級ワイン市場の成長を妨げる可能性があります。

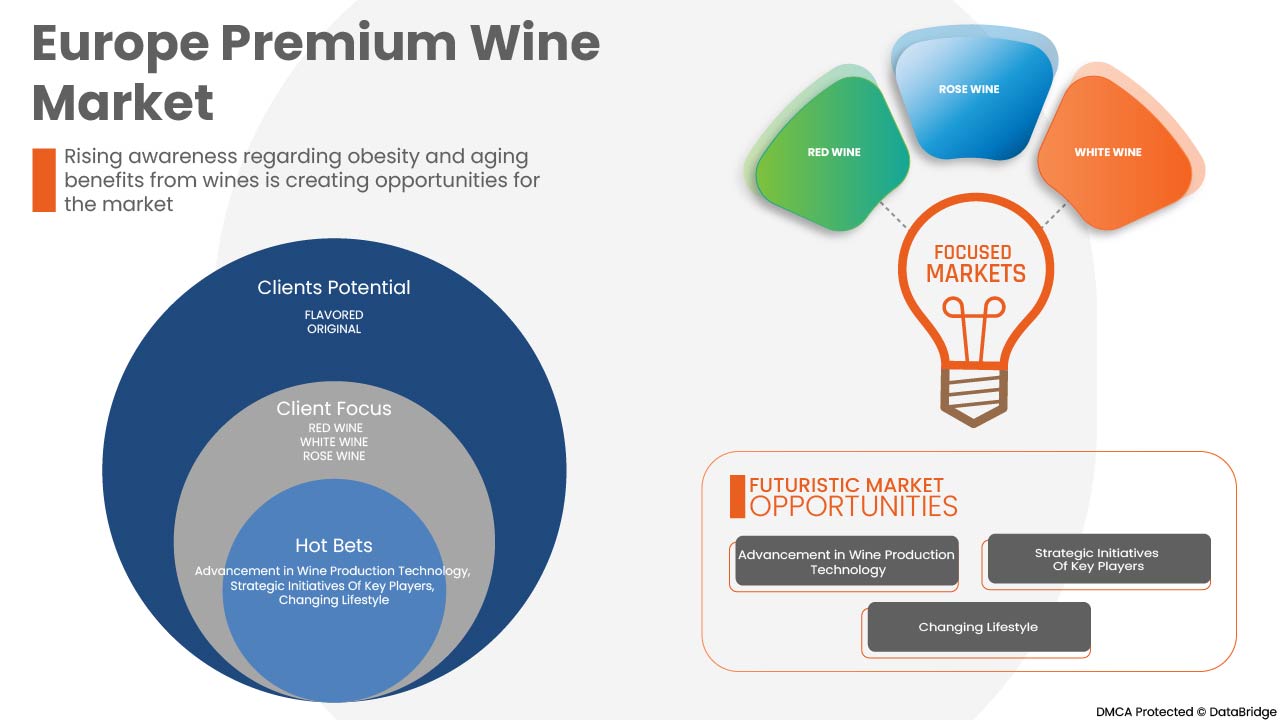

さまざまな健康上の利点、ライフスタイルの変化、市場関係者による戦略的取り組みは、市場にチャンスを与えています。しかし、ワインの過剰消費がさまざまな深刻な病気を妨げていること、消費者の需要を満たすことの難しさや複雑さが、市場の成長にとって重要な課題となっています。

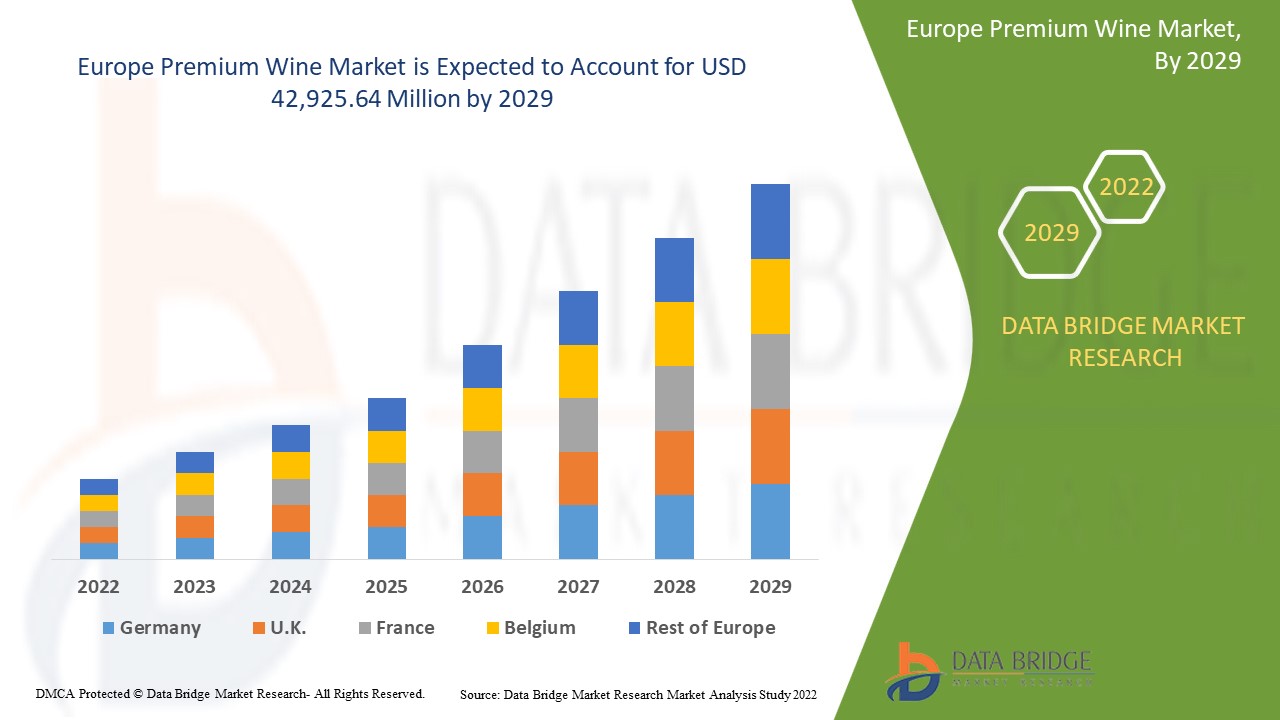

ヨーロッパの高級ワイン市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に6.7%のCAGRで成長し、2029年までに429億2,564万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

ワインの色 (赤ワイン、白ワイン、ロゼワイン、その他)、製品タイプ (スティルワイン、酒精強化ワイン、スパークリングワイン、デザートワイン)、製品カテゴリー (アルコールワイン、ノンアルコールワイン)、フレーバー (オリジナル、フレーバー付き)、熟成年数 (1~17 年、18~24 年、25~44 年、45~64 年、65 年以上)、熟成樽の種類 (オーク、メープル、シダー、ヒッコリー、その他)、価格帯 (プレミアム、スーパープレミアム)、流通チャネル (店舗型小売業者、オンライン小売業者) |

|

対象国 |

ドイツ、フランス、イギリス、イタリア、スペイン、オランダ、ロシア、デンマーク、スイス、トルコ、スウェーデン、ポーランド、スウェーデン、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

この市場で取引している主要企業としては、Vina Concha Y Toro、Treasury Wine Estates、Mount Mary Vineyard、Vins Grands Crus、Sula Vineyards、Moss Wood、Leeuwin Estate、E. & J. Gallo Winery、Constellation Brands、Inc.、Castel Freres、The Wine Group、Accolade Wines、Pernod Ricard、Rockford、Henschke Cellars、Gioconda、Cullen Wines、Bass Philip、Changyu Pioneer Wine Company、Casella、Chateau Cheval Blanc、Miguel Torres SA、Fetzer、GRUPO PENFLOR などがあります。 |

プレミアムワイン市場の定義

ワインは、発酵によって自然にアルコールが生成されるアルコール飲料です。発酵はプロセスの第 1 段階であり、ブドウの皮に生息するバクテリアによって行われます。その後、特定の酵母株を主な発酵産物に加えて、望ましい結果を得ます。ブドウの糖分は、ワインの酵母またはバクテリアによって二酸化炭素とエタノールに変換されます。糖分の多いワインは味が異なり、デザート ワインもその 1 つです。破砕、アルコール発酵、マロラクティック発酵、ワインの澱引き、安定化と熟成、瓶内精製は、ワイン製造にかかわる 6 つの基本的なプロセスです。

高級ワイン市場の動向

ドライバー

- さまざまな健康効果によりワインの需要が増加

過去数年間、ワインのさまざまな健康効果に対する認識が高まったため、ワインの消費量が増加しています。研究者によると、アルコール度数が 12% ~ 15% のワインを毎日適度に摂取すると、さまざまな病気の予防に役立ちます。以下は、ワインの健康効果の一部です。

ワインには抗酸化作用があります。抗酸化物質は炎症や酸化ストレスによる細胞の損傷を防ぐ化合物です。ブドウにはポリフェノールや抗酸化物質が多く含まれており、酸化ストレスや炎症を軽減することが分かっています。

- 電子商取引、宅配便、ワイン配達サービスの増加

電子商取引業界は常に変化しており、私たちの日常生活において重要な役割を果たしています。電子商取引は、人々が望むものをいつでも好きなときに売買できるプラットフォームを提供します。商人は、消費者の変化する需要を満たすために、電子商取引ビジネスの戦略とアプローチを継続的に作成し、改善しています。

電子商取引は、世界中でビジネスのやり方を変えました。この業界の成長の多くは、インターネットとスマートフォンの普及率の増加によって引き起こされました。また、技術の進歩と利用可能なマーケットプレイスの成長により、オンライン ポータルを通じて商品を売買することが容易になりました。商店と配送サービスは、オンライン プラットフォームでの消費者の需要に応え続け、記録的な数の電子商取引に群がっています。

- 消費者のアルコールとの付き合いの増加

ワインの生産と消費はここ数十年で急速に成長し、消費量も増加しています。今日では、社交行事、近代化、西洋文化の受容の高まりなどが、消費者がアルコールと付き合うことを奨励する要素となっており、市場の成長をさらに加速させるでしょう。

アルコール消費は社会的ステータスの象徴となりつつあり、低アルコール飲料市場の成長を支えています。また、その爽快感と低アルコール度数(ABV)の製品により、ミレニアル世代や若者の間で大きな人気を集めています。主にさまざまな機会に関連付けられ、発展途上国では日常の食事とともにテーブルドリンクとして提供されています。

需要の増加により、メーカーは革新的な製品の発売や導入をさらに促進し、今後数年間で市場の成長が促進されることも期待されています。

機会

-

ライフスタイルの変化

人々は、本物の味のために高級ワインを好みます。ワインは、健康に良い成分と悪い成分の両方が含まれているにもかかわらず、パーティーやさまざまな機会に欠かせない社会的地位や一般的なものになっています。さまざまな集団を対象とした疫学調査では、毎日適度な量のワインを飲む習慣のある人は、禁酒または過度の飲酒をする人に比べて、全死亡率、特に心血管疾患による死亡率が大幅に低下することが明らかになっています。

-

バーやラウンジの増加

世界中でレストラン、バー、特別なワインバーが増えているため、高級ワインの需要が高まっています。これらの高級ワインはバーやラウンジで簡単に入手できるため、特別なワインバーの需要も高まっています。認定された高級ワインの年間サブスクリプションを提供するワインバーやラウンジは、人々をより贅沢にさせています。

制約/課題

- ワイン生産コストの上昇

世界中で、ワインの生産コストが上昇しています。ワイン業界は、ガソリン価格の上昇により、商品のコストや輸送コストなど、いくつかの課題に直面しています。特にサプライチェーンの課題とガソリン価格の上昇により、実際のワインボトルは入手困難になっています。コロナ、ガソリン価格の上昇、インフレにより、ワインボトルの入手は容易ではありません。ワイン業界では、2022年にコストが30%増加しました。したがって、ワイン生産コストの上昇が市場の成長を妨げています。

- 消費者が徐々に他のアルコール飲料に移行

近代化の進展とアルコール消費の増加は世界中で進行中の傾向であり、アルコール製造業者はアルコール飲料の革新的で大胆なバリエーションを発売するようになりました。消費者は、手頃な価格で入手できることから、リキュール、スピリッツ、ビールなどのさまざまなアルコール飲料を徐々に好むようになっています。

COVID-19後の高級ワイン市場への影響

The COVID-19 has negatively affected the market. Lockdowns and isolation during pandemics caused the closure for most of the bars and restaurants and thus, affected the sale of wine. Online wine purchase increased as compared to vendor purchase. Thus COVID-19 affected premium wine market negatively.

Recent Developments

- In June 2022, Pernod Ricard announced the launch of a digital label system to better inform consumers about the products they purchase as well as responsible drinking. This initiative aims to offer consumers an efficient solution to their desire for more transparency on product content and health information. A European pilot program has been launched in July 2022, before being rolled out globally across all brands in the Group’s portfolio by 2024. This has helped company to provide better services to consumers through such innovations in the organization.

- In August 2022, E. & J. Gallo Winery announced that the Gallo is the official Wine Sponsor of the National Football League (NFL). This has helped company to increase their Europe presence in the market

Europe Premium Wine Market Scope

Europe premium wine market is segmented into wine colour, product type, product category, ageing barrel type, by price range, distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Wine Colour

- Red Wine

- White Wine

- Rose Wine

- Others

On the basis of wine colour, the Europe premium wine market is segmented into red wine, white wine, rose wine and others.

Product Type

- Still Wine

- Sparkling Wine

- Fortified Wine and

- Dessert Wine

Based on product type, the Europe premium wine market is segmented into still wine, sparkling wine, fortified wine and dessert wine.

Product Category

- Alcoholic Wine

- Non-Alcoholic Wine

Based on product category, the Europe premium wine market is segmented into alcoholic wine and non-alcoholic wine.

Flavour

- Original

- Flavored

Based on flavour, the Europe premium wine market is segmented into original and flavoured.

Aging Years

- 1-7 Years

- 18-24 Years

- 25-44 Years

- 45-64 Years

- 65+ Years

Based on aging years, the Europe premium wine market is segmented into 1-7 years, 18-24 years, 25-44 years, 45-64 years and 65+ years.

Ageing Barrel Type

- Oak

- Maple

- Cedar

- Hickory

- Others

Based on barrel type, the Europe premium wine market is segmented into oak, maple, cedar, hickory and others.

By Price Range

- Premium

- Super Premium

Based on price range, the Europe premium wine market is segmented into premium and super premium.

Distribution Channel

- Store Based Retailers

- Online Retailers

Based on distribution channel, the Europe premium wine market is segmented into store based retailers and online retailers.

Premium Wine Market Regional Analysis/Insights

The premium wine market is analysed and market size insights and trends are provided by country, wine colour, product type, product category, ageing barrel type, by price range, distribution channel.

The countries in the premium wine market are Germany, France, U.K., Italy, Spain, Netherlands, Russia, Denmark, Switzerland, Turkey, Sweden, Poland, Sweden, Rest of Europe.

France dominates the premium wine marketing terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

The France premium wine market is expected to grow due to a rise in wine consumption with meals, consumption of premium wine at social gatherings and celebrations, an increase in consumer preference for premium wines, increase in options to customize the flavor, color, and packaging of premium wine are expected to drive the regional market in the forecasted period.

The rapid technological advancements and perfection in traditional art of wine making are increasing the demand for premium wine. The growing population of alcohol consuming adults is further fuelling the market growth. Moreover, the different packaging options of premium wine, along with its customization, online availability, presence of major market players in the region, and high living standards, are also boosting the market's growth.

Competitive Landscape and Premium Wine Market Share Analysis

The premium wine market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on premium wine market.

Some of the major players operating in the premium wine market are Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres S.A., Fetzer, GRUPO PENFLOR and among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 EUROPE PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 EUROPE PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 EUROPE PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 EUROPE PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 EUROPE PREMIUM WINE MARKET, BY REGION

19.1 EUROPE

19.1.1 FRANCE

19.1.2 ITALY

19.1.3 UK

19.1.4 GERMANY

19.1.5 RUSSIA

19.1.6 SPAIN

19.1.7 NETHERLANDS

19.1.8 SWITZERLAND

19.1.9 BELGIUM

19.1.10 SWEDEN

19.1.11 POLAND

19.1.12 DENMARK

19.1.13 TURKEY

19.1.14 REST OF EUROPE

20 COMPANY LANDSCAPE

20.1 EUROPE PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: EUROPE

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

表のリスト

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 EUROPE RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 EUROPE WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 EUROPE FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 EUROPE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 EUROPE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 EUROPE 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 EUROPE ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 EUROPE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 EUROPE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 EUROPE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 EUROPE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 EUROPE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 EUROPE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 EUROPE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 EUROPE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 EUROPE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 EUROPE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 FRANCE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 FRANCE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 FRANCE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 FRANCE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 FRANCE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 FRANCE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 FRANCE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 FRANCE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 FRANCE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 FRANCE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 FRANCE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 FRANCE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 FRANCE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 ITALY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 ITALY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 ITALY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 ITALY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 ITALY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 ITALY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 ITALY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 ITALY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 ITALY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 ITALY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 ITALY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 ITALY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 ITALY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 ITALY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 ITALY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 U.K. PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 U.K. RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.K. DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 U.K. NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 U.K. PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 U.K. FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 U.K. FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 U.K. BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 U.K. FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 U.K. HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 U.K. SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 U.K. PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 U.K. PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.K. PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 U.K. PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 U.K. STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 GERMANY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 123 GERMANY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 GERMANY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 GERMANY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 GERMANY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 GERMANY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 128 GERMANY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 GERMANY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 GERMANY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 131 GERMANY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 132 GERMANY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 133 GERMANY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 134 GERMANY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 GERMANY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 136 GERMANY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 137 GERMANY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 138 GERMANY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 GERMANY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 146 RUSSIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 SPAIN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 159 SPAIN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SPAIN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 SPAIN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 SPAIN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 163 SPAIN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 164 SPAIN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 165 SPAIN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 166 SPAIN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 167 SPAIN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 168 SPAIN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 169 SPAIN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 170 SPAIN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 171 SPAIN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 172 SPAIN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 173 SPAIN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 174 SPAIN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SPAIN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 177 NETHERLANDS RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 NETHERLANDS PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 195 SWITZERLAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 SWITZERLAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 199 SWITZERLAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 201 SWITZERLAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 202 SWITZERLAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 203 SWITZERLAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 204 SWITZERLAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 205 SWITZERLAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 209 SWITZERLAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 210 SWITZERLAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 SWITZERLAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 217 BELGIUM NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 218 BELGIUM PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 219 BELGIUM FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 230 SWEDEN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 231 SWEDEN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SWEDEN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWEDEN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 234 SWEDEN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 SWEDEN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 236 SWEDEN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 237 SWEDEN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 238 SWEDEN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 239 SWEDEN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 240 SWEDEN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 241 SWEDEN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 242 SWEDEN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 243 SWEDEN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 244 SWEDEN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 245 SWEDEN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 246 SWEDEN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 247 SWEDEN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 POLAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 249 POLAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 POLAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 251 POLAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 252 POLAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 253 POLAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 254 POLAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 255 POLAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 256 POLAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 257 POLAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 258 POLAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 259 POLAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 260 POLAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 261 POLAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 262 POLAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 263 POLAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 264 POLAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 265 POLAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 266 DENMARK PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 267 DENMARK RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 DENMARK PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 269 DENMARK DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 270 DENMARK PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 271 DENMARK NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 272 DENMARK PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 273 DENMARK FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 274 DENMARK FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 275 DENMARK BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 276 DENMARK FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 277 DENMARK HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 278 DENMARK SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 279 DENMARK PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 280 DENMARK PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 281 DENMARK PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 282 DENMARK PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 283 DENMARK STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 284 TURKEY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 285 TURKEY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 TURKEY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 287 TURKEY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 288 TURKEY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 289 TURKEY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 290 TURKEY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 291 TURKEY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 292 TURKEY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 293 TURKEY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 294 TURKEY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 295 TURKEY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 296 TURKEY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 297 TURKEY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 298 TURKEY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 299 TURKEY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 300 TURKEY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 301 TURKEY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 302 REST OF EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 EUROPE PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 EUROPE PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PREMIUM WINE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 EUROPE PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE EUROPE PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 EUROPE PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 EUROPE PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 EUROPE PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 EUROPE PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 EUROPE PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 EUROPE PREMIUM WINE MARKET: BY WINE COLOR (2022-2029)

FIGURE 53 EUROPE PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。