Global Glucose Syrup Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

5.34 Billion

USD

7.59 Billion

2025

2033

USD

5.34 Billion

USD

7.59 Billion

2025

2033

| 2026 –2033 | |

| USD 5.34 Billion | |

| USD 7.59 Billion | |

|

|

|

|

Global Glucose Syrup Market Segmentation, By Source (Corn, Wheat, Barley, Potatoes, Rice, Cassava, and Others), Grade (Food, Pharmaceuticals, Industrial, and Others), Form (Liquid, Granular, and Others), Application (Food and Beverages, Confectionery, Pharmaceuticals, and Others) - Industry Trends and Forecast to 2033

Glucose Syrup Market Size

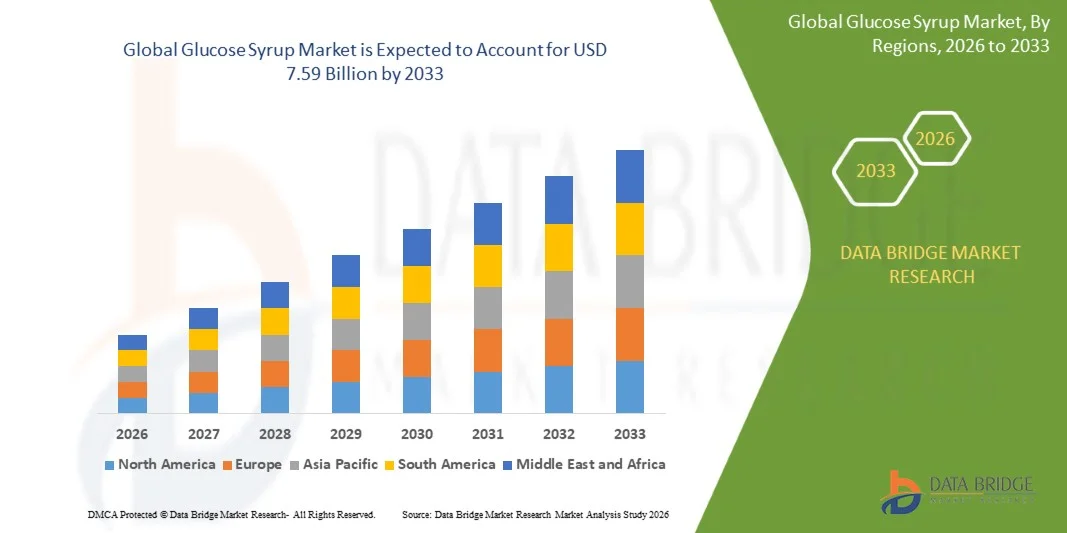

- The global glucose syrup market size was valued at USD 5.34 billion in 2025 and is expected to reach USD 7.59 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely driven by the expanding food and beverage processing industry and the rising consumption of packaged, convenience, and ready-to-eat products, where glucose syrup is widely used as a sweetener, humectant, and texture enhancer

- Furthermore, increasing demand from confectionery, bakery, and pharmaceutical applications, along with the need for consistent sweetness, extended shelf life, and cost-effective formulation solutions, is accelerating the adoption of glucose syrup, thereby significantly supporting overall market growth

Glucose Syrup Market Analysis

- Glucose syrup, derived primarily from starch sources, plays a crucial role in food, beverage, confectionery, and pharmaceutical manufacturing due to its functional properties such as controlled sweetness, moisture retention, and prevention of crystallization

- The rising demand for glucose syrup is mainly fueled by growth in processed food consumption, expanding pharmaceutical production, and increasing utilization of functional ingredients that improve product stability, taste, and texture across multiple end-use industries

- North America dominated the glucose syrup market with a share of 45.4% in 2025, due to high consumption of processed foods, beverages, and confectionery products, along with the strong presence of major food and ingredient manufacturers

- Asia-Pacific is expected to be the fastest growing region in the glucose syrup market during the forecast period due to rapid urbanization, changing dietary patterns, and increasing consumption of packaged foods in countries such as China, India, and Japan

- Food and beverages segment dominated the market with a market share of 59.1% in 2025, due to extensive use of glucose syrup as a sweetener, bulking agent, and stabilizer across a wide range of products. Its ability to enhance mouthfeel, prevent crystallization, and improve product consistency makes it a preferred ingredient for manufacturers. Increasing consumption of ready-to-eat and ready-to-drink products continues to fuel demand in this segment

Report Scope and Glucose Syrup Market Segmentation

|

Attributes |

Glucose Syrup Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glucose Syrup Market Trends

“Increasing Clean-label and Non-GMO Glucose Syrup Adoption”

- A major trend shaping the glucose syrup market is the growing shift toward clean-label and non-GMO formulations, driven by rising consumer awareness regarding ingredient transparency and food sourcing. Food and beverage manufacturers are increasingly reformulating products to align with clean-label expectations, which is strengthening demand for glucose syrups derived from non-GMO corn, wheat, and cassava

- For instance, Tate & Lyle has expanded its portfolio of non-GMO and specialty glucose syrups to support food manufacturers seeking transparent and responsibly sourced sweetening solutions. This has enabled brand owners to meet evolving regulatory and consumer requirements while maintaining functional performance in processed foods

- Confectionery and bakery manufacturers are increasingly adopting clean-label glucose syrups to replace synthetic additives while preserving texture, mouthfeel, and shelf stability. This trend is reinforcing glucose syrup’s role as a multifunctional ingredient in premium and reformulated food products

- The demand for clean-label glucose syrup is also rising in the beverage sector, where manufacturers are focused on simplified ingredient lists and consistent sweetness profiles. This is encouraging suppliers to invest in traceable sourcing and advanced starch processing technologies

- Pharmaceutical and nutraceutical companies are incorporating clean-label glucose syrups in oral syrups and nutritional formulations to align with patient safety and regulatory standards. This broad-based adoption is strengthening the long-term relevance of clean-label glucose syrups across multiple end-use industries

- Overall, the growing preference for natural, transparent, and responsibly produced ingredients is positioning clean-label glucose syrup as a key growth-oriented trend within the global market

Glucose Syrup Market Dynamics

Driver

“Rising Demand from Processed Food and Beverage Manufacturing”

- The rising consumption of processed and packaged foods globally is a key driver accelerating growth in the glucose syrup market. Glucose syrup is widely used in food and beverage manufacturing due to its ability to control sweetness, enhance texture, prevent crystallization, and extend shelf life

- For instance, Ingredion supplies glucose syrups to large-scale food and beverage manufacturers for use in bakery products, confectionery, sauces, and beverages. These solutions support consistent product quality and scalable production for high-volume applications

- The expansion of the confectionery industry is significantly boosting glucose syrup demand, as it is a critical ingredient in candies, chewing gum, and chocolate coatings. Manufacturers rely on glucose syrup to achieve desired viscosity and stability during processing

- The beverage sector is also driving demand, particularly in carbonated drinks, flavored beverages, and energy drinks, where glucose syrup provides rapid solubility and controlled sweetness. This supports efficient production and uniform flavor distribution

- The growth of quick-service restaurants and ready-to-eat food categories is further increasing the need for reliable sweetening and binding agents. As processed food consumption continues to rise globally, this driver is expected to remain a strong foundation for glucose syrup market expansion

Restraint/Challenge

“Volatility in Raw Material Prices”

- The glucose syrup market faces a significant challenge from volatility in raw material prices, particularly starch sources such as corn, wheat, and cassava. Price fluctuations are influenced by climatic conditions, crop yields, trade policies, and global supply-demand imbalances

- For instance, ADM and Cargill are directly exposed to corn price volatility, as corn remains the primary raw material for glucose syrup production. Variations in corn prices can impact production costs and profit margins across the value chain

- Unpredictable agricultural output caused by weather disruptions increases cost uncertainty for manufacturers and can affect long-term supply contracts. This volatility complicates pricing strategies and limits cost predictability for both producers and end users

- Rising input costs also create pressure on small and mid-sized manufacturers who lack the scale to absorb price fluctuations. This can reduce competitiveness and constrain market participation in price-sensitive regions

- The ongoing challenge of stabilizing raw material sourcing while maintaining consistent pricing continues to influence investment decisions and operational planning. Addressing this restraint remains critical for sustaining profitability and long-term growth in the glucose syrup market

Glucose Syrup Market Scope

The market is segmented on the basis of source, grade, form, and application.

• By Source

On the basis of source, the glucose syrup market is segmented into corn, wheat, barley, potatoes, rice, cassava, and others. The corn segment dominated the market in 2025, accounting for the largest revenue share due to its abundant availability, cost efficiency, and high starch yield, which makes large-scale production economically viable. Corn-based glucose syrup is widely preferred by food and beverage manufacturers because of its consistent quality, neutral taste profile, and established processing infrastructure across major producing regions. Strong supply chains and technological advancements in corn wet milling further support the segment’s dominance.

The cassava segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption in emerging economies where cassava is locally abundant and competitively priced. Increasing investments in cassava processing facilities and growing demand for non-corn-based sweeteners are accelerating its uptake. Cassava-derived glucose syrup is gaining traction for its suitability in clean-label and regionally sourced ingredient formulations.

• By Grade

On the basis of grade, the glucose syrup market is segmented into food, pharmaceuticals, industrial, and others. The food grade segment dominated the market in 2025, supported by extensive usage in processed foods, beverages, bakery products, and dairy applications as a sweetener, humectant, and texture enhancer. Food-grade glucose syrup offers functional benefits such as moisture retention, shelf-life extension, and controlled sweetness, making it indispensable for large-scale food manufacturers. Rising consumption of packaged and convenience foods continues to reinforce demand for this segment.

The pharmaceutical grade segment is projected to grow at the fastest rate during 2026–2033, driven by expanding use in cough syrups, intravenous solutions, and oral liquid formulations. Pharmaceutical-grade glucose syrup is valued for its high purity, controlled viscosity, and compliance with stringent regulatory standards. Growth in global pharmaceutical production and increasing healthcare expenditure are key factors accelerating this segment.

• By Form

On the basis of form, the glucose syrup market is segmented into liquid, granular, and others. The liquid segment held the dominant market share in 2025, owing to its ease of handling, rapid solubility, and seamless integration into food and beverage processing lines. Liquid glucose syrup is extensively used in confectionery, beverages, and bakery products where precise consistency and uniform blending are required. Its compatibility with automated manufacturing systems further strengthens its widespread adoption.

The granular segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing demand for dry sweetening agents with improved storage stability and lower transportation costs. Granular glucose offers advantages in applications requiring controlled dosing and reduced moisture content. Growing adoption in industrial and specialty food formulations is supporting the accelerated growth of this segment.

• By Application

On the basis of application, the glucose syrup market is segmented into food and beverages, confectionery, pharmaceuticals, and others. The food and beverages segment dominated the market with the largest share of 59.1% in 2025, driven by extensive use of glucose syrup as a sweetener, bulking agent, and stabilizer across a wide range of products. Its ability to enhance mouthfeel, prevent crystallization, and improve product consistency makes it a preferred ingredient for manufacturers. Increasing consumption of ready-to-eat and ready-to-drink products continues to fuel demand in this segment.

The pharmaceutical application segment is expected to grow at the fastest pace during 2026–2033, supported by rising demand for liquid oral formulations and injectable solutions. Glucose syrup plays a critical role as an energy source and excipient in medical and nutritional products. Expansion of pharmaceutical manufacturing capacities and growing focus on patient-friendly dosage forms are key drivers of this rapid growth.

Glucose Syrup Market Regional Analysis

- North America dominated the glucose syrup market with the largest revenue share of 45.4% in 2025, driven by high consumption of processed foods, beverages, and confectionery products, along with the strong presence of major food and ingredient manufacturers

- Consumers in the region show strong preference for packaged and convenience foods, where glucose syrup is widely used for sweetness control, texture enhancement, and shelf-life improvement

- This widespread adoption is supported by advanced food processing infrastructure, high per capita sugar consumption, and continuous product innovation, positioning glucose syrup as a key ingredient across food, beverage, and pharmaceutical industries

U.S. Glucose Syrup Market Insight

The U.S. glucose syrup market captured the largest revenue share within North America in 2025, supported by extensive use in bakery, beverages, dairy, and confectionery products. Strong demand from large-scale food manufacturers and the growing popularity of ready-to-eat foods continue to drive consumption. In addition, the presence of well-established corn processing facilities and reliable raw material availability strengthens the domestic production and supply of glucose syrup.

Europe Glucose Syrup Market Insight

The Europe glucose syrup market is projected to expand at a steady CAGR during the forecast period, primarily driven by rising demand for functional ingredients in food and beverage applications. Increasing focus on product reformulation, clean-label trends, and controlled sweetness levels is supporting glucose syrup adoption. Growth is observed across confectionery, pharmaceuticals, and processed food sectors, supported by a strong regulatory framework ensuring quality and safety standards.

U.K. Glucose Syrup Market Insight

The U.K. glucose syrup market is anticipated to grow at a moderate CAGR during the forecast period, driven by increasing consumption of confectionery, bakery, and convenience food products. The growing demand for texture-enhancing and shelf-stable ingredients is encouraging manufacturers to incorporate glucose syrup in formulations. In addition, rising innovation in food processing and strong retail distribution networks are contributing to market expansion.

Germany Glucose Syrup Market Insight

The Germany glucose syrup market is expected to expand at a notable CAGR over the forecast period, supported by the country’s robust food and beverage manufacturing base. Germany’s strong emphasis on quality, efficiency, and industrial food processing drives consistent demand for glucose syrup across confectionery and processed food segments. The growing use of glucose syrup in pharmaceutical formulations further supports market growth.

Asia-Pacific Glucose Syrup Market Insight

The Asia-Pacific glucose syrup market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, changing dietary patterns, and increasing consumption of packaged foods in countries such as China, India, and Japan. Rising disposable incomes and expansion of the food processing industry are significantly boosting demand. In addition, the region’s strong agricultural base and growing starch processing capacities are enhancing glucose syrup production.

Japan Glucose Syrup Market Insight

The Japan glucose syrup market is witnessing steady growth due to strong demand from confectionery, bakery, and pharmaceutical applications. The market benefits from Japan’s focus on high-quality food ingredients and precise formulation requirements. Increasing consumption of functional foods and beverages, along with demand for consistent sweetness and texture, continues to support glucose syrup adoption.

China Glucose Syrup Market Insight

The China glucose syrup market accounted for the largest revenue share within Asia Pacific in 2025, driven by rapid expansion of the food and beverage industry and rising consumption of processed and packaged foods. China’s large population base, growing middle class, and increasing demand for confectionery and beverages significantly contribute to market growth. Strong domestic production capabilities and expanding starch processing infrastructure further reinforce China’s leading position in the regional market.

Glucose Syrup Market Share

The glucose syrup industry is primarily led by well-established companies, including:

- AGRANA Beteiligungs-AG (Austria)

- Ingredion, Inc. (U.S.)

- ADM – Archer Daniels Midland Company (U.S.)

- Tate & Lyle PLC (U.K.)

- Cargill, Incorporated (U.S.)

- Roquette Frères (France)

- Grain Processing Corporation (U.S.)

- Royal Avebe U.A. (Netherlands)

- TEREOS S.A. (France)

- Global Sweeteners Holdings Limited (China)

- Emsland Group (Germany)

- BENEO GmbH (Germany)

- Luzhou Bio-chem Technology (Shandong) Co., Ltd. (China)

Latest Developments in Global Glucose Syrup Market

- In November 2023, Tate & Lyle (U.K.) entered a strategic partnership with a biotechnology firm to develop glucose syrups derived from non-GMO sources, strengthening its position in the growing health-conscious and clean-label segment. This move enhances product differentiation, supports sustainability goals, and enables the company to address evolving consumer preferences, thereby improving its competitive standing in premium glucose syrup applications

- In September 2023, Roquette Frères (France) expanded its glucose syrup production facility in the U.S. to increase output capacity and improve supply reliability across North America. This expansion directly supports rising demand from food and beverage manufacturers, shortens lead times, and reinforces Roquette’s regional market presence by ensuring consistent and scalable supply

- In September 2022, Cargill, Inc. announced a USD 50 million investment to build a sustainable corn syrup refinery in Fort Dodge, Iowa, aimed at reducing CO₂ emissions by nearly 50% compared to conventional production methods. This development highlights Cargill’s focus on sustainable manufacturing while strengthening its production efficiency, positioning the company to meet long-term demand from environmentally conscious customers

- In September 2022, Ingredion, Inc. commissioned a new specialty starch and glucose derivatives plant in China to strengthen the global food and beverage supply chain and support local agricultural ecosystems. This investment enhances Ingredion’s regional production capabilities, improves responsiveness to Asia-Pacific demand, and supports market growth through localized manufacturing and reduced supply chain dependencies

- In June 2022, ADM expanded its starch and sweetener processing operations in Asia to support increasing demand for glucose syrup across confectionery, beverage, and pharmaceutical applications. This development improved regional capacity utilization, strengthened ADM’s footprint in high-growth markets, and enabled the company to better serve multinational and local customers amid rising consumption of processed foods

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。