北米整形外科手術ロボット市場、製品タイプ別(ロボットシステム、ロボットアクセサリ、ソフトウェアとサービス)、エンドユーザー別(病院および外来手術センター(ASCS))、流通チャネル別(直接入札およびサードパーティ販売業者) - 2029年までの業界動向と予測。

北米整形外科手術ロボット市場の分析と洞察

整形外科手術ロボット市場は、分子診断における技術的進歩と、他の組織とのコラボレーションおよびパートナーシップへの主要プレーヤーの急速な焦点の影響を大きく受けています。整形外科手術の最初の使用は、15世紀に始まりました。現代の整形外科手術と筋骨格の研究により、手術の侵襲性が低下し、インプラント部品の品質と耐久性が向上しています。整形外科手術ロボットは、骨の変形を矯正し、人間の骨格系の機能を回復するために使用されます。過去数年間、整形外科手術ロボット市場の成長を促進するために、新しい革新的な整形外科手術ロボット製品が開発されており、市場プレーヤーは製品ポートフォリオを強化しています。多くの市場プレーヤーが、市場の成長への道を開く革新を備えた整形外科手術ロボットの製造に携わっています。

北米整形外科手術ロボット市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から見た機会の分析が提供されます。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

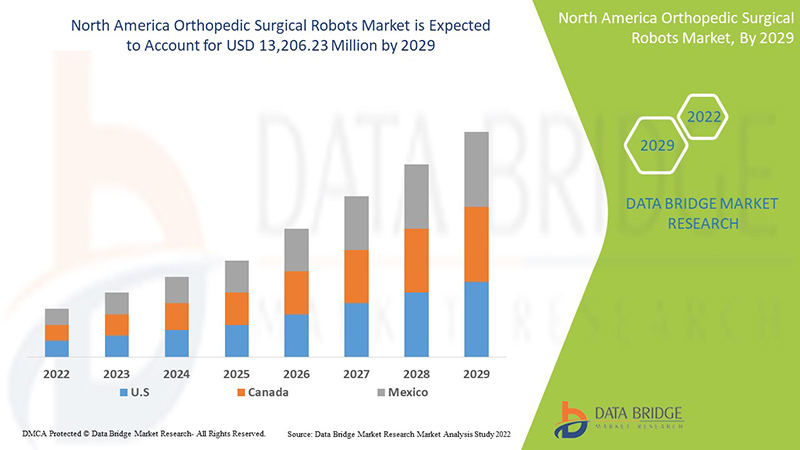

データブリッジマーケットリサーチは、整形外科手術ロボット市場は2022年から2029年の予測期間中に26.3%のCAGRで成長し、2029年までに132億623万米ドルの価値に達すると予測しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品タイプ別(ロボットシステム、ロボットアクセサリ、ソフトウェアおよびサービス)、エンドユーザー別(病院および外来手術センター(ASCS))、流通チャネル別(直接入札およびサードパーティ販売業者) |

|

対象国 |

北米では米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Johnson & Johnson Services, Inc.、Stryker、Zimmer Biomet、Smith & Nephew、Corin Group、NuVasive, Inc.、Brainlab AG、Integrity Implants Inc. d/b/a/ Accelus、Beijing Tinavi Medical Technologies Co., Ltd、Medtronic、Globus Medical, Inc.、Accuray Incorporated、THINK Surgical, Inc.、CUREXO, INC. などが挙げられます。 |

市場の定義

整形外科手術ロボットは、骨の変形を矯正し、人間の骨格系の機能を回復するために使用されます。皮膚と骨組織を密封するために、放射線、無線周波数、超音波などのエネルギーを使用します。整形外科手術ロボットには、電気手術発生器 (ESU) などのエネルギー源と、エネルギーを患者に伝達する器具が必要です。重要なタイプには、無線周波数 (RF)、修正電流、および電流を機械的な動きに変換する超音波があります。より専門的な技術には、アルゴンガス、プラズマ、または技術の組み合わせを使用するものがあります。整形外科手術ロボットで使用される技術的進歩は、超音波、無線周波数、および放射線です。整形外科手術ロボットで使用される診断技術により、整形外科医は新しいレベルの精度と安全性を実現できました。これにより、外科医は整形外科手術を診断、計画、および迅速化して、優れた結果を得ることができます。

整形外科手術ロボット市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

-

骨粗鬆症の罹患率の上昇

骨粗鬆症は骨を圧迫する慢性疾患です。骨粗鬆症を患っている人は、突然の予期せぬ骨折のリスクが高まります。2021年、世界保健機関(WHO)のデータによると、約2億人が骨粗鬆症になると予測されています。

骨粗鬆症は男性にも女性にも発症しますが、男性よりも女性の方が骨粗鬆症になりやすい傾向があります。骨粗鬆症の治療には、股関節骨折や膝関節置換術がありますが、高齢患者の骨量の減少や骨の脆弱性など、以前の身体的健康状態を理解することが重要です。骨粗鬆症の頻度は増加しているため、骨粗鬆症に対する外科的アプローチが増加しています。リーマー洗浄吸引器は、整形外科医が使用するハンドピースの一種です。たとえば、高トルク電動工具は、骨粗鬆症の治療に使用されるリーマーです。

世界中で骨粗鬆症の罹患率が上昇するにつれ、この病気の早期診断の需要も高まっており、それに伴い、高齢者の慢性疾患を治療するためのケア、サービス、技術の需要も高まっています。

-

整形外科手術件数の増加

高齢者人口の増加と骨粗鬆症などの整形外科疾患の増加。整形外科疾患の増加により、整形外科関連の手術件数も増加しています。整形外科手術件数の増加は、整形外科医の数の増加につながります。これにより、整形外科手術ロボットの使用が増加します。整形外科手術ロボットの生産と供給が増加するでしょう。

外科用ロボットはすでに医療市場を変革しつつあります。外科手術件数の増加に伴い、外来センターは医療機器の価格を下げ、支払者と提供者の変化を促すでしょう。したがって、整形外科手術件数の増加が整形外科用ロボット市場の成長を牽引すると予想されます。

拘束

-

整形外科手術に関する認識不足

整形外科手術用エネルギー機器は非侵襲性機器の市場におけるプラットフォームとしての地位を確立していますが、発展途上国では整形外科手術がまだ行われていません。このため、整形外科疾患の診断が遅れ、整形外科手術用ロボットの市場ポジションが低下します。認識と自己効力感の欠如も、潜在的な障壁と不完全な実装に拍車をかけます。

-

整形外科手術で観察されるリスク

整形外科手術は、整形外科疾患、血管の治療、組織の切断、出血の止血を目的として整形外科医が行います。これらは手持ち式の装置であるため、医師の器具の一部として操作する必要があります。診断は行いませんが、より良い治療を可能にする薬剤を投与します。ただし、整形外科手術には一定のリスクが伴います。

しかし、整形外科手術に伴うさまざまなリスクや健康上の合併症、およびそれらのいくつかを修復するためのさらなる外科的介入の必要性が、市場での需要を阻害すると予想されます。したがって、整形外科手術に伴う健康上の合併症は、整形外科手術ロボット市場を抑制すると予想されます。

機会

-

高齢者人口の増加

膝の障害は世界中の高齢者によく見られます。60 歳以上の成人、特に長期療養施設で生活する高齢者は、慢性的な膝の症状に悩まされる傾向があります。高齢化が進むにつれて、高齢者の膝の障害の負担は増加する可能性があり、高齢者の膝の障害を改善するために重要な診断および予防戦略における薬剤およびインプラントの開発への道が開かれます。

As age increases, the susceptibility to knee disorders and other risk factors also increases. For some individuals, it may be hereditary, while for others, knee osteoarthritis can result from injury, infection, or even from being overweight. The increase in the geriatric population is expected to propel the market growth as it leads to greater use of robots in numerous surgeries. These robots were introduced to address the needs of geriatric people, including physical and medical care. Additionally, the senior population is greatly affected by chronic diseases can be a factor in the growth of the orthopedic surgical robots market.

-

RISING HEALTHCARE EXPENDITURE

The expense of money used by a country on its healthcare and its growth rate over time is inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the organization for the health system. In particular, there is a strong association between the whole income level of a country and how much the country's population spends on health care.

Healthcare expenditure has increased across developed, and emerging countries as the disposable income of people are growing. The more money is spent on healthcare the healthier a country's population is. Moreover, to accomplish the population requirements, government bodies and healthcare organizations in different regions are taking the initiative to accelerate healthcare expenditure. Therefore, the rise in healthcare expenditure simultaneously helps healthcare organizations and government bodies to increase healthcare management services in various aspects.

CHALLENGES

-

LACK OF SKILLED PROFESSIONALS

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the unemployed people in one place have skills in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise. Despite the call to increase, the number of podiatrists and some residency training programs remains unknown.

Even as the revalidation process for orthopedic surgeons began in Switzerland, the United Kingdom, and other countries, some orthopedic and medical professionals elsewhere in Europe have not started to address the issue of CME and related requirements. As skill demands are too high, retaining and managing skill-specified professionals has become a challenge. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Podiatrists report significant unmet supportive care needs and barriers in their centers, with only a small minority rating themselves as competently providing supportive care. There is an urgent need for the requirement of podiatrists and professionals to treat chronic knee disorders and procure available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. Therefore, this signifies that the lack of skilled professionals is a challenge to the growth of the orthopedic surgical robots market.

-

STRICT REGULATORY FRAMEWORKS

Regulation of medical devices plays a significant role in healthcare. Achieving the requisite approval for legal selling medical devices in such jurisdictions can entail significant financial expenditure, which could take months or years to complete. If these constraints are not understood or considered, delays can seriously jeopardize the likelihood of success in a highly competitive market. Medical robots are increasingly used in minimally invasive surgeries; assistive surgeries are important for treating various diseases. But their approval and marketing in various regions across different regions require a meeting of stringent regulatory standards and approvals by various regulatory bodies.

Post COVID-19 Impact on Orthopedic Surgical Robots Market

COVID-19 created a major impact on the orthopedic surgical robots market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the orthopedic surgical robots market is increasing prevalence of osteoporosis this sector has increased the demand because it targets patient who has the bone related disease. Other reasons driving the demand for these procedures are increasing aging people and rising requirement of healthcare facilities which can further result in decrease in burden on healthcare facilities. Hence, rise in demand for surgical robots procedure is estimated over the forecast period. However, factors such as inadequate availability of raw material to meet orthopedic surgical robots product production demand are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Recent Developments

- In February 2022, Stryker completes the acquisition of Vocera Communications. This acquisition provides significant opportunities to advance innovations and accelerate our digital aspirations. Vocera brings a highly complementary and innovative portfolio to Stryker’s Medical division that will enhance the company’s Advanced Digital Healthcare offerings and further advance Stryker’s focus on preventing adverse events throughout the continuum of care.

- In March 2022, Corin Group has announced that the company is partnering with Efferent Health, LLC, a leader in medical operations automation technology, delivering innovative solutions that streamline key processes. This results in strengthening the portfolio of interoperability data services as well as expanding the company’s credibility in the market.

North America Orthopedic Surgical Robots Market Scope

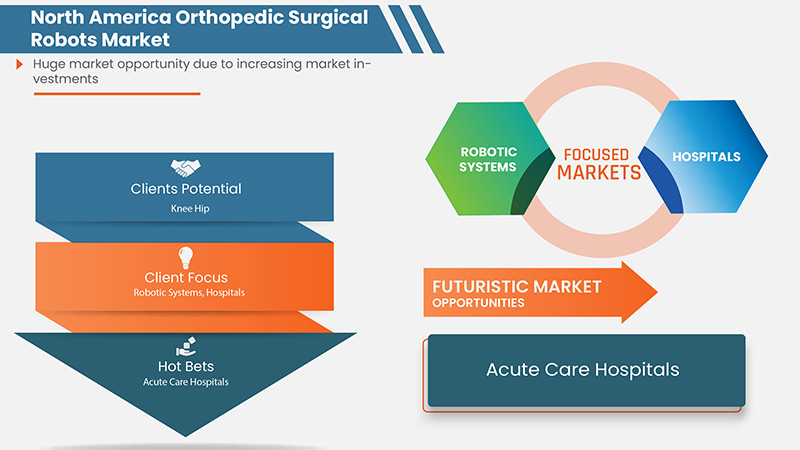

North America orthopedic surgical robots market is segmented on the basis of product type, end user, distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Robotic System

- Robotic Accessories

- Software and Services

On the basis of product type, the North America orthopedic surgical robots market is segmented into robotic system, robotic accessories, and software and services.

By End User

- Hospitals

- Ambulatory Surgical Centers

On the basis of by end user, the North America orthopedic surgical robots market has been segmented into hospitals, and ambulatory surgical centers.

By Distribution Channel

- Direct Tender

- Third Party Distributors

On the basis of by distribution channel, the North America orthopedic surgical robots market has been segmented into direct tender, and third party distributors.

Orthopedic Surgical Robots Market Regional Analysis/Insights

The orthopedic surgical robots market is analysed and market size insights and trends are provided by country, product type, end user, distribution channel as referenced above.

北米整形外科手術ロボット市場レポートで取り上げられている国は、北米では米国、カナダ、メキシコです。

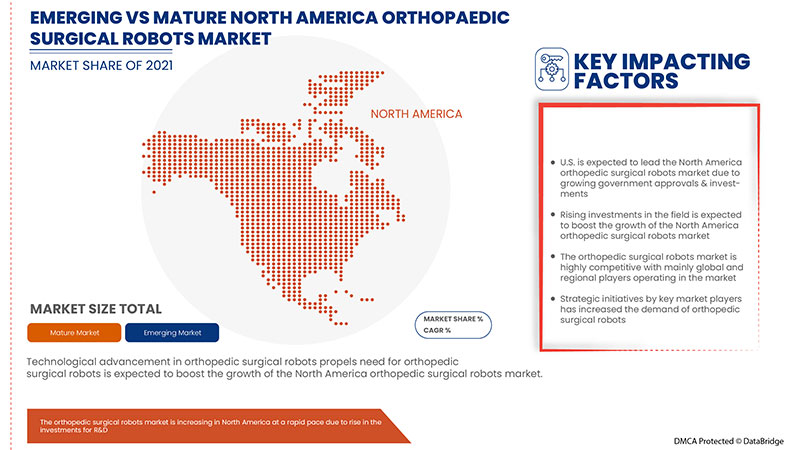

米国は、国内でのロボットシステムの急速な普及により、北米地域で優位に立っています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境と整形外科手術ロボットの市場シェア分析

整形外科手術ロボット市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、整形外科手術ロボット市場に対する会社の重点にのみ関連しています。

整形外科手術ロボット市場で活動している主要企業としては、Johnson & Johnson Services, Inc.、Stryker、Zimmer Biomet、Smith & Nephew、Corin Group、NuVasive, Inc.、Brainlab AG、Integrity Implants Inc. d/b/a/ Accelus、Beijing Tinavi Medical Technologies Co., Ltd、Medtronic、Globus Medical, Inc.、Accuray Incorporated、THINK Surgical, Inc.、CUREXO, INC. などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES

4.3 CLINICAL TRIALS ON ORTHOPEDIC SURGICAL ROBOTS NORTH AMERICALY

4.4 STRATEGIC INITIATIVES

4.4.1 DEMOGRAPHIC TRENDS

4.4.2 KEY PATENT ENROLLMENT STRATEGIES

4.5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF OSTEOPOROSIS

5.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN ROBOTIC SYSTEMS

5.1.3 INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

5.1.4 RISE IN INCIDENCE OF SPORTS AND TRAUMA INJURIES

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

5.2.2 RISKS OBSERVED IN ORTHOPEDIC SURGERIES

5.2.3 HIGH COST ASSOCIATED WITH THE ORTHOPEDIC SURGERY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN GERIATRIC POPULATIONS

5.3.2 RISING HEALTHCARE EXPENDITURE

5.3.3 RISE IN FRACTURE INCIDENCE

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 STRICT REGULATORY FRAMEWORKS

6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ROBOTIC SYSTEMS

6.2.1 KNEE

6.2.1.1 SURGERY TYPE

6.2.1.1.1 TOTAL KNEE ARTHROPLASTY

6.2.1.1.2 UNICOMPARTMENTAL KNEE ARTHROPLASTY

6.2.1.1.3 ANTERIOR CRUCIATE LIGAMENT RECONSTRUCTION

6.2.1.1.4 OTHERS

6.2.1.1.5 ROBOT TYPE

6.2.1.1.6 MAKO

6.2.1.1.7 CORI

6.2.1.1.8 NAVIO

6.2.1.1.9 TIROBOT

6.2.1.1.10 TSOLUTION ONE

6.2.1.1.11 OTHERS

6.2.2 HIP

6.2.2.1 SURGERY TYPE

6.2.2.1.1 TOTAL HIP ARTHROPLASTY

6.2.2.1.2 OTHERS

6.2.2.1.3 ROBOT TYPE

6.2.2.1.4 MAKO

6.2.2.1.5 TSOLUTION ONE

6.2.2.1.6 OTHERS

6.2.3 SPINE

6.2.3.1 SURGERY TYPE

6.2.3.1.1 PEDICLE SCREW IMPLANTATION

6.2.3.1.2 VERTEBRAL AUGMENTATION

6.2.3.1.3 LAPAROSCOPIC ANTERIOR LUMBAR INTERBODY FUSION

6.2.3.1.4 SPINE TUMOR RESECTION SURGERY

6.2.3.1.5 INTRAOPERATIVE LOCALIZATION

6.2.3.1.6 ANTERIOR LUMBER INTERBODY FUSION

6.2.3.1.7 OTHERS

6.2.3.1.8 ROBOT TYPE

6.2.3.1.9 MAZOR

6.2.3.1.9.1 RENAISSANCE

6.2.3.1.9.2 MAZOR X

6.2.3.1.9.3 SPINE ASSIST

6.2.3.1.10 ROSA

6.2.3.1.11 CIRQ

6.2.3.1.12 EXCELSIUSGPS

6.2.3.1.13 OTHERS

6.2.4 FEMUR

6.2.4.1 SURGERY TYPE

6.2.4.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.4.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.4.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.4.1.4 OTHERS

6.2.4.1.5 ROBOT TYPE

6.2.4.1.6 TIROBOT

6.2.4.1.7 OTHERS

6.2.5 PELVIS

6.2.5.1 SURGERY TYPE

6.2.5.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.5.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.5.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.5.1.4 OTHERS

6.2.5.1.5 ROBOT TYPE

6.2.5.1.6 TIROBOT

6.2.5.1.7 OTHERS

6.2.6 HAND

6.2.6.1 SURGERY TYPE

6.2.6.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.6.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.6.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.6.1.4 OTHERS

6.2.6.1.5 ROBOT TYPE

6.2.6.1.6 TIROBOT

6.2.6.1.7 OTHERS

6.2.7 ELBOW

6.2.7.1 SURGERY TYPE

6.2.7.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.7.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.7.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.7.1.4 OTHERS

6.2.7.1.5 ROBOT TYPE

6.2.7.1.6 TIROBOT

6.2.7.1.7 OTHERS

6.2.8 OTHERS

6.3 ROBOTIC ACCESSORIES

6.4 SOFTWARE AND SERVICES

7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITALS

7.2.1 ACTUE CARE HOSPITALS

7.2.2 LONG-TERM CARE HOSPITALS

7.2.3 NURSING FACILITIES

7.2.4 REHABILITATION CENTERS

7.3 AMBULATORY SURGICAL CENTERS

8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 STRYKER

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SMITH & NEPHEW

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 JOHNSON & JOHNSON SERVICES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MEDTRONIC

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ZIMMER BIOMET

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACCURAY INCORPORATED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BEIJING TINAVI MEDICAL TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRAINLAB AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CORIN GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 CUREXO, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GLOBUS MEDICAL, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 INTEGRITY IMPLANTS INC. D/B/A/ ACCELUS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NUVASIVE, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 THINK SURGICAL, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2021-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 4 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 5 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 6 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 7 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 8 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 9 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 10 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 11 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 12 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 VOLUME, (UNITS)

TABLE 13 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 14 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 15 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 16 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 17 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 18 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 19 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 20 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 21 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 22 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 23 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 24 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 25 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 26 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 27 NORTH AMERICA ROBOTIC ACCESSORIES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SOFTWARE AND DEVICES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 42 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 48 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 50 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 53 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 70 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 73 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 76 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 78 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 81 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 84 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 87 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 90 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 U.S. HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 98 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 101 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 104 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 106 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 109 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 112 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 115 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 118 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 CANADA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 126 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 129 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 132 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 134 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 137 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 140 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 143 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 146 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: MARKET END USER GRID

FIGURE 9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVELANCE OF OESTOPOROSIS AND INCREASE INCIDENCE OF SPORTS AND TRAUMA INJURY IS EXPECTED TO DRIVE THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 PRODUCT TYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

FIGURE 14 CURRENT HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 15 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, CAGR (2021-2029)

FIGURE 18 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2021

FIGURE 20 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。