北米の水中ロボット市場、タイプ別(遠隔操作車両(ROV)および自律型水中車両(AUV))、作業深度(浅瀬、深海、超深海)、タスクタイプ(観察、調査、検査、建設、介入、埋設および溝掘り、その他)、深度(1000メートル未満、1000メートル~5000メートル、5000メートル以上)、コンポーネント(ライト、カメラ、フレーム、スラスタ、テザー、パイロットコントロール、その他)、アプリケーション(石油・ガス、商業探査、防衛・安全保障、科学研究、その他)– 2029年までの業界動向と予測。

市場分析と規模

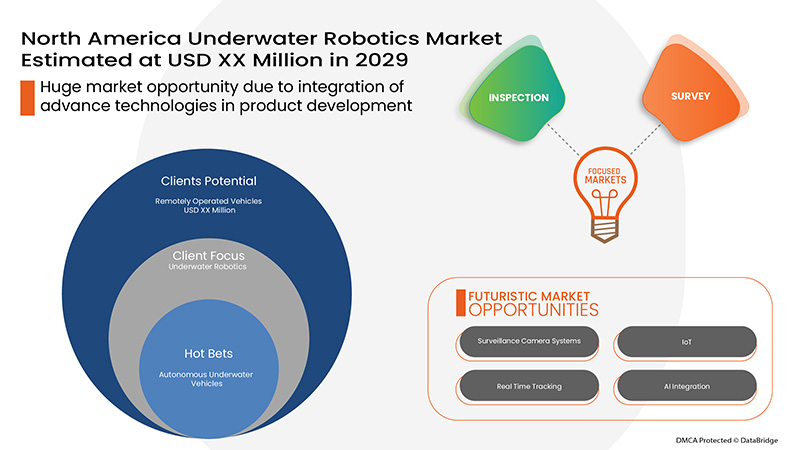

北米の水中ロボット市場は、主にオフショア石油・ガス産業におけるROVの需要の高まりと、海洋探査と科学研究に対する不可欠なニーズによって推進されています。さらに、サルベージ、救助、修理作業への水中ロボットの応用が、市場の成長を急速に促進しています。ただし、アドオン後のROVとAUVの高コストとサイバーセキュリティに関連する脅威が、北米の水中ロボット市場の成長を抑制する可能性があります。さらに、強い水流と氷床下でのAUVとROVのナビゲーションと通信に対する技術的な障壁が、市場の成長を阻害する可能性があります。さらに、センサー技術の進歩の遅れと水中ロボットの高度な技術的複雑さが市場の成長を妨げる可能性があります。ただし、水中車両の可変ペイロード機能の開発が進み、水中ロボットの効率と動作を向上させる高度なテクノロジーが統合されているため、北米の水中ロボット市場には有利な機会が提供されています。

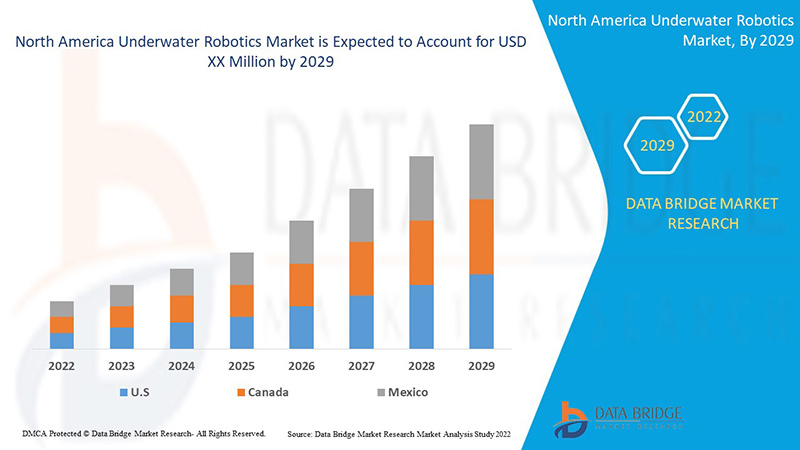

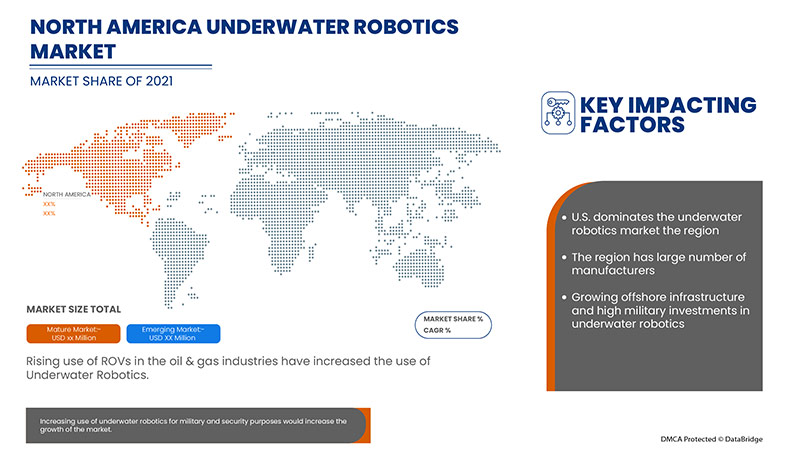

Data Bridge Market Research の分析によると、北米の水中ロボット市場は、予測期間中に 13.3% の CAGR で成長し、2029 年までに XX 百万米ドルに達すると予想されています。「遠隔操作車両 (ROV)」は、この市場で最も重要なタイプのセグメントを占めています。Data Bridge Market Research チームがまとめた市場レポートには、詳細な専門家の分析、輸出入分析、価格分析、生産消費分析、気候連鎖シナリオが含まれています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別 (遠隔操作型無人探査機 (ROV) および自律型無人潜水機 (AUV))、作業深度 (浅瀬、深海、超深海)、タスク タイプ別 (観察、調査、検査、建設、介入、埋設、溝掘りなど)、深度 (1000 メートル未満、1000 メートルから 5000 メートル、5000 メートル以上)、コンポーネント別 (ライト、カメラ、フレーム、スラスター、テザー、パイロット コントロールなど)、用途別 (石油およびガス、商業探査、防衛およびセキュリティ、科学研究など) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

ATLAS ELEKTRONIK GmbH、Deep Ocean Engineering, Inc.、General Dynamics Mission Systems, Inc.、ECA GROUP、International Submarine Engineering Limited、Eddyfi、Phoenix International Holdings, Inc.、Boeing、MacArtney A/S、Oceaneering International, Inc.、VideoRay LLC、Saab AB、Forum Energy Technologies, Inc.、TechnipFMC plc、SUBSEA 7、Fugro、SeaRobotics Corp.、Teledyne Marine、KONGSBERG、三井E&Sホールディングス株式会社、Huntington Ingalls Industries, Inc.、Deep Trekker Inc. |

市場の定義

水中ロボット工学は、水中環境で動作するロボットの研究開発、設計、製造、および応用を扱うロボット工学の分野です。この用語は、水面または水面下で機能するあらゆるロボット (海洋ロボット システム) を指すことができます。ただし、通常は水中で使用するために設計された自律型車両を指します。水中ロボットは自律型水中車両とも呼ばれ、遠隔操作が可能な機械です。継続的な海洋監視のために水中で動作するように設計されています。ロボット工学は、ここ数年で製造業に利用されてきました。驚異的な拡張により、軍事および法律の実施用途において、より洗練され、信頼できるものになりました。水中ロボットは、オフショア産業の拡大において重要な役割を果たしています。さらに、海洋生物学、水中考古学、海洋安全保障の分野でも数多くの実装が行われています。

北米の水中ロボット市場の市場動向には以下が含まれます。

- 軍事および安全保障目的での水中ロボットの利用増加

この地域では近年、海洋作戦を遂行するために軍事装備や海軍装備に巨額の投資が行われています。さまざまな国がこの地域の海洋権益を守るために AUV を開発しており、AUV の役割は今後、特に軍事面で増大するでしょう。

- 石油・ガス産業におけるROVの利用増加

石油とガスの需要は、この地域の都市化と工業化に伴い増加しています。オフショア事業の効率を高めるための近代的なインフラと設備への投資が、市場の需要を牽引しています。

- 水中探査や科学研究のためのAUVの需要増加

多くの業界と連携した研究所による深海探査および研究活動用のROVおよびAUVの需要が、市場の需要を牽引しています。

- Growing demand for underwater robotics for search, rescue and repair operation

Underwater search and rescue, recovery, and investigations are time-sensitive operations often performed in extremely challenging conditions. The increasing emphasis on moving away from the use of human divers and robotics equipment is driving the demand in the market.

Restraints/Challenges faced by the North America Underwater Robotics Market

- High cost of underwater robots/vehicles

There are a variety of features and add-ons that can be highly beneficial for ocean-related industries. Underwater vehicles are used in a variety of industries. The underwater robots are mission-critical and constitute many critical and costly components. This increases the cost of the system and acts as a restrain for the adoption in commercial applications.

- Threats and concerns for cyber security and operational security

As information technology (IT) has advanced, the opportunity for cybercrime has also increased. These threats and concerns for cyber security and operational security for underwater vehicles may restrain the growth of the North America underwater robotics market.

Recent Developments

- In July 2019, Deep Ocean Engineering, Inc. launched a new ROV named the Phantom X8 in its product line. Phantom X8 is a light work class that is designed for deep-sea manoeuvrability. The company had set up high definition front and rear camera, a lighting control system, and auto functions for heading, altitude, depth, and positioning of ROV. The company aimed to sell this machine for deep-sea exploration and light intervention for depths up to 1,000 meters

- In January 2022, General Dynamics partnered with MIT during the U.S. Navy's biennial Ice Exercise to develop a product that can navigate autonomously under the ice. Company UUV, named Bluefin-21, and has been used to integrate with a new communication and navigation system developed with MIT for a machine capable of navigating automatically under the ice for navigation and maneuvering purposes. Through this, the company aims to sell the same product to the different market players and gain more market share in underwater robotics

North America Underwater Robotics Market Scope

North America underwater robotics market is segmented based on type, working depth, task type, depth, components and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Remotely Operated Vehicles (ROV)

- Autonomous Underwater Vehicle (AUV)

On the basis of type, North America underwater robotics market is segmented into remotely operated vehicles (ROV) and autonomous underwater vehicle (AUV).

Working Depth

- Shallow

- Deep water

- Ultra-Deep Water

On the basis of working depth, the North America underwater robotics market is segmented into shallow, deep water, and ultra-deep water.

Task Type

- Observation

- Survey

- Inspection

- Construction

- Intervention

- Burial and Trenching

- Others

On the basis of the task type, the North America underwater robotics market is segmented into observation, survey, inspection, construction, intervention, burial and trenching and others.

Depth

- Less Than 1000 Mts

- 1000 Mts to 5000 Mts

- More Than 5000 Mts

On the basis of depth, the North America underwater robotics market is segmented into less than 1000 mts, 1000 mts to 5000 mts and more than 5000 mts.

Component

- Light

- Camera

- Frame

- Thrusters

- Tethers

- Pilot Controls

- Others

On the basis of component, the North America underwater robotics market is segmented into light, camera, frame, thrusters, tethers, pilot controls and others.

Application

- Oil and Gas

- Commercial Exploration

- Defense and Security

- Scientific Research

- Others

On the basis of application, the North America underwater robotics market is segmented into oil and gas, commercial exploration, defense and security, scientific research and others.

North America Underwater Robotics Market Regional Analysis/Insights

North America underwater robotics market is analyzed, and market size insights and trends are provided by country, type, working depth, task type, depth, components and application, as referenced above.

The countries covered in the North America underwater robotics market report are the U.S., Canada and Mexico in North America.

U.S. dominates the North America underwater robotics market because of a large number of manufacturers and developed offshore infrastructure.

The U.S. is expected to witness significant growth during the forecast period of 2022 to 2029 as the region has seen high investments in equipment for search and rescue, military, recreation and discovery, aquaculture, marine biology, oil, gas, offshore energy, shipping, submerged infrastructure, and more.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Underwater Robotics Market Share Analysis

北米の水中ロボット市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、北米の水中ロボット市場に対する会社の重点にのみ関連しています。

北米の水中ロボット市場で活動している主要企業としては、ATLAS ELEKTRONIK GmbH、Deep Ocean Engineering, Inc.、General Dynamics Mission Systems, Inc.、ECA GROUP、International Submarine Engineering Limited、Eddyfi、Phoenix International Holdings, Inc.、Boeing、MacArtney A/S、Oceaneering International, Inc.、VideoRay LLC、Saab AB、Forum Energy Technologies, Inc.、TechnipFMC plc、SUBSEA 7、Fugro、SeaRobotics Corp.、Teledyne Marine、KONGSBERG、三井E&Sホールディングス株式会社、Huntington Ingalls Industries, Inc.、Deep Trekker Inc. などがあります。

調査方法: 北米 北米水中ロボット市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせ内容をドロップダウンしてください。

DBMR 研究チームが使用する主要な研究手法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これ以外にも、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、専門家分析、輸入/輸出分析、価格分析、生産消費分析、気候チェーン シナリオ、企業ポジショニング グリッド、企業市場シェア分析、測定基準、世界対地域、ベンダー シェア分析が含まれます。研究手法について詳しくは、お問い合わせを送信して、当社の業界の専門家にご相談ください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.S. UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 U.S. UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 U.S. UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 U.S. CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 CANADA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 CANADA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 CANADA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 MEXICO UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 MEXICO REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 MEXICO UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 MEXICO UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 MEXICO CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA UNDERWATER ROBOTICS MARKET

FIGURE 16 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA UNDERWATER ROBOTICS MARKET: BY TYPE (2022-2029)

FIGURE 27 NORTH AMERICA UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。