Global Polyamide Nylon Opa Films Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

805.00 Million

USD

1,425.05 Million

2025

2033

USD

805.00 Million

USD

1,425.05 Million

2025

2033

| 2026 –2033 | |

| USD 805.00 Million | |

| USD 1,425.05 Million | |

|

|

|

|

Global Polyamide Nylon (OPA) Films Market Segmentation, By Make Ready Reels (Natural and Printed), End User Reels (Printed and Unprinted) - Industry Trends and Forecast to 2033

What is the Global Polyamide Nylon (OPA) Films Market Size and Growth Rate?

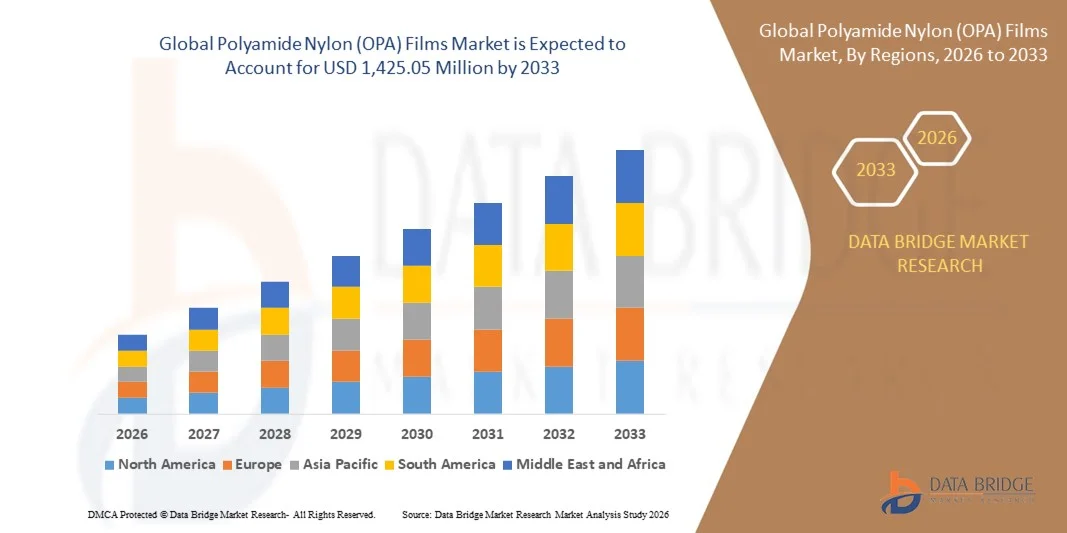

- The global polyamide nylon (OPA) films market size was valued at USD 805.00 million in 2025 and is expected to reach USD 1,425.05 million by 2033, at a CAGR of7.40% during the forecast period

- Major factors that are expected to boost the growth of the polyamide nylon (OPA) films market in the forecast period are the increase in the need for materials for packaging of microwavable food products

What are the Major Takeaways of Polyamide Nylon (OPA) Films Market?

- The rise in the need for nylon films in end use industries such as personal care, pharmaceuticals, and household care will further provide potential opportunities for the growth of the polyamide nylon (OPA) films market in the coming years

- However, the accessibility of alternates such as polypropylene, para-aramid synthetic fibers, and bio-absorbable polymers and their lower inexpensive costs might further challenge the growth of the polyamide nylon (OPA) films market in the near future

- Asia-Pacific dominated the polyamide nylon (OPA) films market with a 39.94% revenue share in 2025, driven by rapid expansion of electronics manufacturing, semiconductor production, 5G deployment, and increasing adoption of advanced packaging solutions across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by increasing demand for premium, printed packaging films, industrial laminates, and food-safe OPA solutions across the U.S. and Canada. Rising adoption of multi-layer, coated, and rotogravure-printed OPA films, coupled with growing e-commerce and packaged food industries, accelerates regional market expansion

- The Natural segment dominated the market with a 52.3% share in 2025, owing to its widespread use in primary packaging, industrial laminates, and specialty film applications where customization is not required

Report Scope and Polyamide Nylon (OPA) Films Market Segmentation

|

Attributes |

Polyamide Nylon (OPA) Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyamide Nylon (OPA) Films Market?

Increasing Shift Toward High-Performance, Sustainable, and Multi-Layer Polyamide Nylon (OPA) Films

- The Polyamide Nylon (OPA) Films market is witnessing strong adoption of high-barrier, heat-resistant, and flexible films designed for packaging, food, and industrial applications

- Manufacturers are introducing multi-layer, co-extruded, and solvent-free OPA films that offer superior mechanical strength, chemical resistance, and compatibility with modern packaging machinery

- Growing demand for lightweight, eco-friendly, and recyclable films is driving usage across food & beverage packaging, medical devices, and industrial laminates

- For instance, companies such as Toray Industries, Honeywell, BASF, Uflex, and Mitsubishi Chemical Holdings are expanding their OPA film portfolios with enhanced barrier properties, heat sealability, and improved processing efficiency

- Increasing need for longer shelf-life packaging, high-speed packaging lines, and multi-functional films is accelerating adoption of advanced OPA films

- As global sustainability standards tighten, Polyamide Nylon (OPA) Films will remain vital for high-performance packaging, industrial insulation, and specialty applications

What are the Key Drivers of Polyamide Nylon (OPA) Films Market?

- Rising demand for high-barrier films to protect packaged food, beverages, and pharmaceutical products from oxygen, moisture, and contamination

- For instance, in 2025, Toray Industries, Uflex, and Honeywell launched next-generation OPA films with superior tensile strength, heat resistance, and optical clarity

- Growing consumption of ready-to-eat foods, frozen products, and pharmaceutical packaging is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in multi-layer co-extrusion, bio-based coatings, and solvent-free film production have strengthened performance, flexibility, and environmental sustainability

- Increasing use of microwaveable, retortable, and flexible packaging is creating demand for high-density, multi-layer OPA films

- Supported by steady investment in sustainable packaging, R&D for barrier films, and industrial laminates, the Polyamide Nylon (OPA) Films market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Polyamide Nylon (OPA) Films Market?

- High costs associated with multi-layer, bio-based, and high-barrier OPA films restrict adoption among small packaging businesses and regional converters

- For instance, during 2024–2025, fluctuations in raw material prices, supply chain disruptions, and rising energy costs increased production costs for several global vendors

- Complexity in film extrusion, multi-layer lamination, and barrier property optimization increases the need for skilled operators and specialized machinery

- Limited awareness in emerging markets regarding recyclable or compostable OPA films slows adoption

- Competition from alternative barrier films such as PET, EVOH, and PLA laminates creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-efficient formulations, sustainable material sourcing, enhanced training, and innovative multi-layer designs to increase global adoption of polyamide nylon (OPA) films

How is the Polyamide Nylon (OPA) Films Market Segmented?

The market is segmented on the basis of make ready reels and end-user reels.

- By Make Ready Reels

On the basis of make ready reels, the polyamide nylon (OPA) films market is segmented into Natural and Printed reels. The Natural segment dominated the market with a 52.3% share in 2025, owing to its widespread use in primary packaging, industrial laminates, and specialty film applications where customization is not required. Natural OPA reels are preferred for their consistent barrier properties, thermal stability, and compatibility with downstream converting equipment. They provide flexibility for laminators and co-extrusion lines, supporting rapid prototyping and efficient manufacturing.

The Printed segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for branded, visually appealing packaging in food, beverage, pharmaceutical, and cosmetic applications. Rising consumer preference for high-quality, pre-printed packaging, coupled with advancements in multi-color and rotogravure printing technologies, is boosting adoption of printed OPA reels globally. The growth is further fueled by enhanced printing durability and UV-resistant coatings.

- By End User Reels

On the basis of end-user reels, the polyamide nylon (OPA) films market is segmented into Printed and Unprinted reels. The Unprinted segment dominated the market with a 55.1% share in 2025, primarily due to its high versatility across food packaging, industrial laminates, and flexible barrier applications where customization is performed later in the value chain. Unprinted reels allow converters and manufacturers to reduce inventory costs, maintain high flexibility, and apply printing or coating as needed for various products.

The Printed segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by the increasing trend of ready-to-use packaging, rising brand awareness, and demand for premium packaging aesthetics in snacks, confectionery, pharmaceuticals, and cosmetics. Advanced printing techniques, including gravure and flexographic printing, combined with ink and coating innovations, are enhancing print quality and durability, driving adoption of printed OPA reels across global end users.

Which Region Holds the Largest Share of the Polyamide Nylon (OPA) Films Market?

- Asia-Pacific dominated the polyamide nylon (OPA) films market with a 39.94% revenue share in 2025, driven by rapid expansion of electronics manufacturing, semiconductor production, 5G deployment, and increasing adoption of advanced packaging solutions across China, Japan, India, South Korea, and Southeast Asia. High-volume production of flexible packaging, industrial laminates, and food-grade OPA films continues to fuel demand for high-performance reels and specialty films across diverse applications

- Leading companies in Asia-Pacific are investing in high-quality, multi-layer, and functionalized OPA films, including printed and natural reels, enhancing barrier properties, printability, and mechanical strength, thereby reinforcing the region’s technological leadership. Continuous innovations in polymer processing, extrusion, and coating technologies further drive market expansion

- Strong industrial infrastructure, government-backed manufacturing incentives, and skilled workforce availability strengthen regional dominance and accelerate market penetration

China Polyamide Nylon (OPA) Films Market Insight

China is the largest contributor to Asia-Pacific due to massive investments in electronics packaging, high-volume industrial film production, and government support for advanced materials. Rising demand for flexible, high-barrier films for food, pharma, and industrial applications drives adoption of both natural and printed OPA reels. Local manufacturing capabilities, competitive pricing, and export opportunities further expand domestic and global market share.

Japan Polyamide Nylon (OPA) Films Market Insight

Japan demonstrates steady growth supported by advanced packaging infrastructure, precision manufacturing, and strong focus on high-quality, functional OPA films. Rising adoption of premium packaging solutions, robotics, and industrial automation reinforces market expansion.

India Polyamide Nylon (OPA) Films Market Insight

India is emerging as a significant growth hub, driven by expanding flexible packaging industry, startup activity in specialty films, and government initiatives supporting polymer manufacturing. Increasing demand for food, pharmaceutical, and consumer product packaging fuels adoption of natural and printed OPA reels. R&D investments and modernized processing facilities further enhance market penetration.

South Korea Polyamide Nylon (OPA) Films Market Insight

South Korea contributes significantly due to strong production of high-performance films, advanced packaging solutions, and rising demand in food, electronics, and industrial sectors. Development of functionalized OPA films and innovative printing technologies drives adoption. Strong industrial base and technological capabilities support sustained regional growth.

North America Polyamide Nylon (OPA) Films Market

North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by increasing demand for premium, printed packaging films, industrial laminates, and food-safe OPA solutions across the U.S. and Canada. Rising adoption of multi-layer, coated, and rotogravure-printed OPA films, coupled with growing e-commerce and packaged food industries, accelerates regional market expansion. Leading companies in North America are investing in high-speed extrusion, coating, and printing technologies to develop lightweight, high-barrier OPA films suitable for food, pharmaceutical, and industrial applications. Continuous innovation in functional films, sustainability initiatives, and flexible packaging solutions further enhance market growth.

Which are the Top Companies in Polyamide Nylon (OPA) Films Market?

The polyamide nylon (OPA) films industry is primarily led by well-established companies, including:

- UNITIKA LTD. (Japan)

- Toray Industries, Inc. (Japan)

- Honeywell International Inc. (U.S.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- BASF SE (Germany)

- WINPAK LTD. (Canada)

- Kolon Industries, Inc. (South Korea)

- HYOSUNG (South Korea)

- TOYOBO CO., LTD. (Japan)

- Domo Chemicals (Netherlands)

- Mondi (U.K.)

- Sealed Air (U.S.)

- Berry Global Inc. (U.S.)

- ProAmpac (U.S.)

- Nampak Ltd. (South Africa)

- ELOPAK (Norway)

- OLON Industries Inc. (Italy)

- SIG Combibloc Group AG (Switzerland)

- Uflex Limited (India)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.