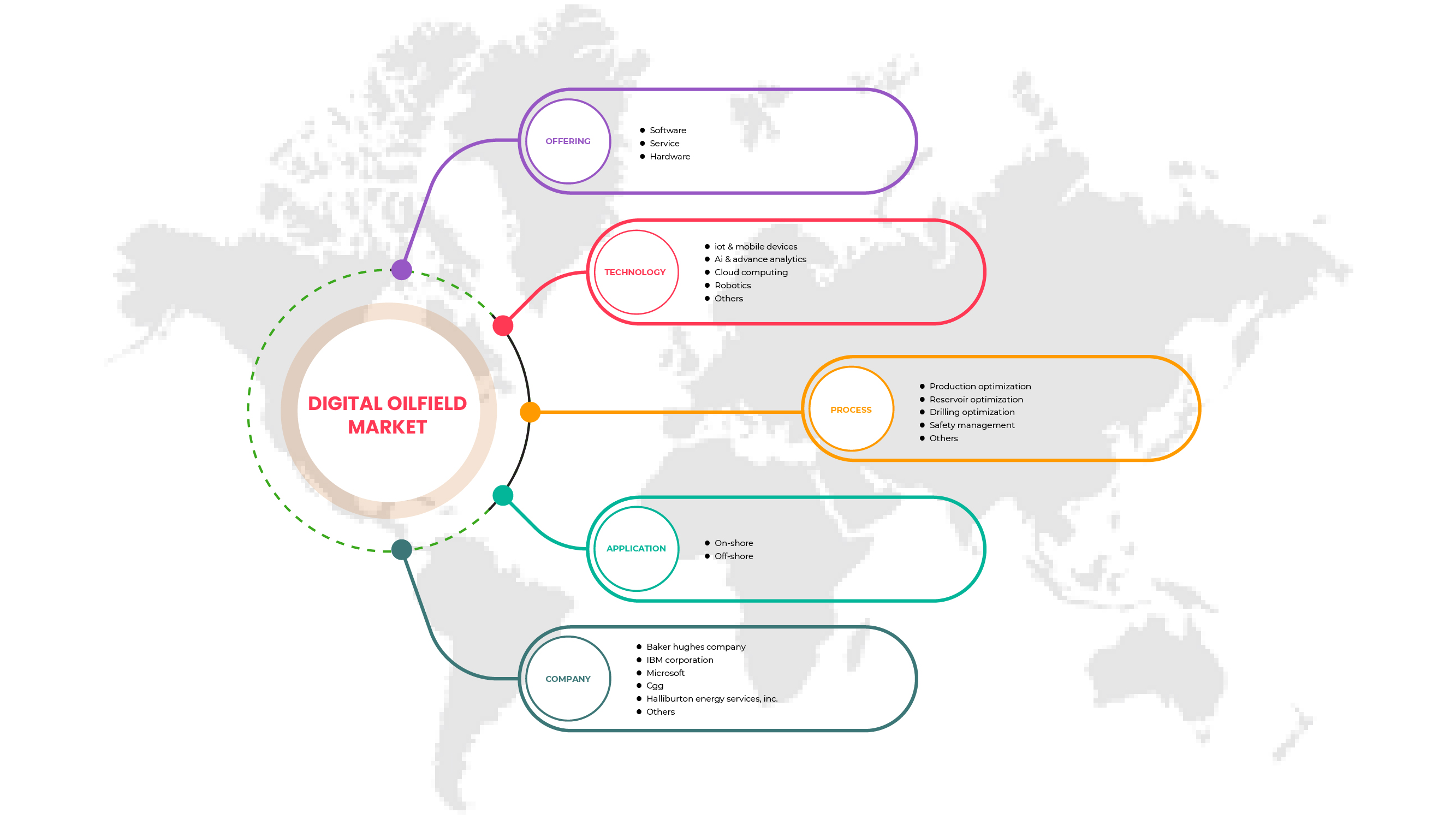

North America Digital Oilfield Market, By Offering (Software, Hardware, and Services), Process (Production Optimization, Reservoir Optimization, Drilling Optimization, Safety Management, and Others), Technology (IoT & Mobile Devices, AI & Advance Analytics, Cloud Computing, Robotics, and Others), Application (On-Shore and Off-Shore) – Industry Trends and Forecast to 2029.

North America Digital Oilfield Market Analysis and Size

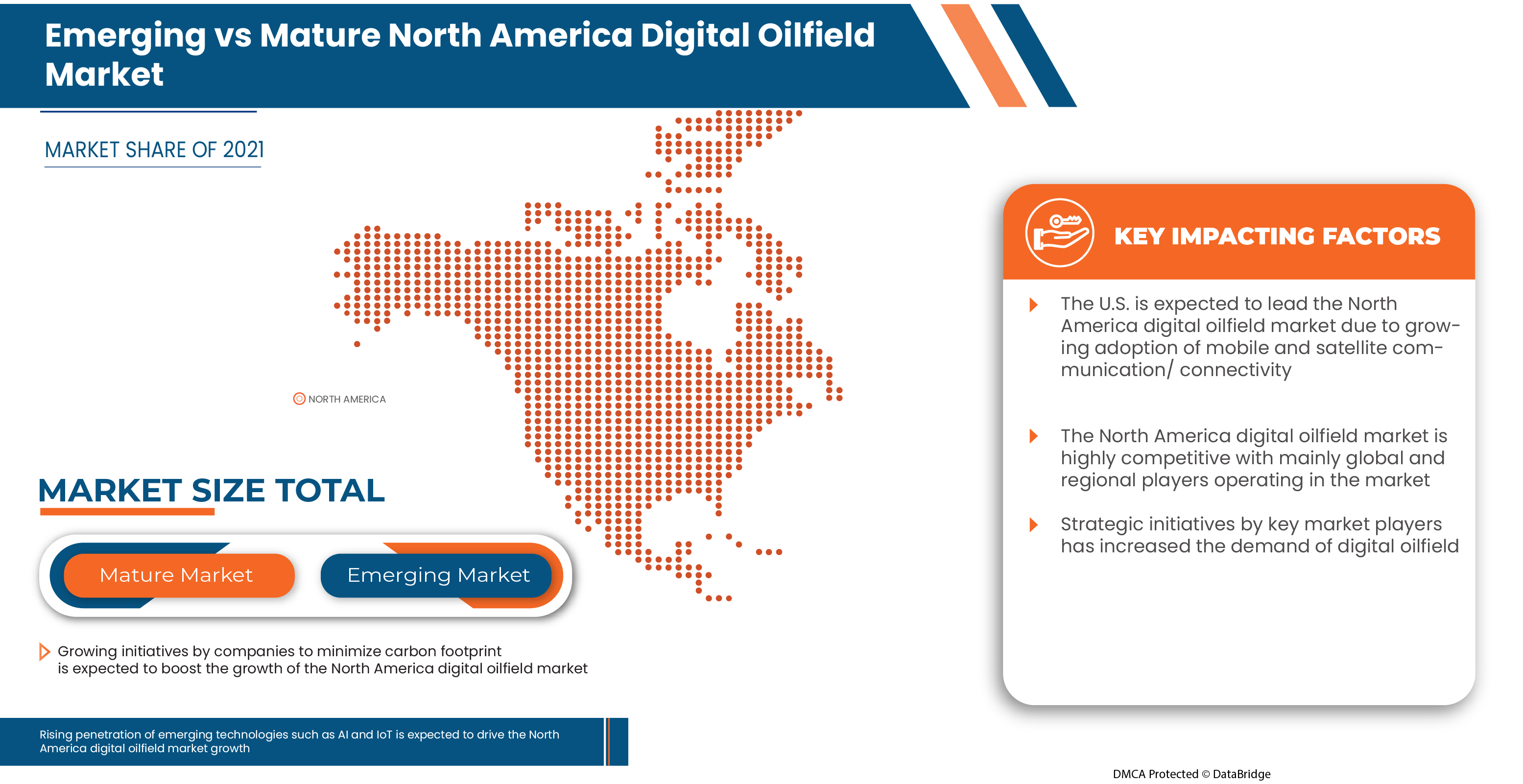

Although the rising ongoing advancement toward wireless technologies, data analysis, mobility, and collection platforms, rising E&P activities across on-shore and off-shore sectors fuelled by ongoing oil price recovery, continuous declining production from conventional wells coupled with a growing inclination toward devising an economic well recovery process, the rising deployment of enhanced oil recovery systems along with the rising number of mature gas fields across the Middle East are the major factors, among others expected to drive the North America digital oilfield market.

However, rising delays in the decision-making process by deploying various analytic tools and rising cyber security threats are the major factors that may restrain engaging new digital talent and rising interoperability of multiple system components from different solution providers.

Data Bridge Market Research analyses that the North America digital oilfield market is expected to reach the value of USD 14,543.91 million by 2029, at a CAGR of 7.6% during the forecast period. The North America digital oilfield market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Offering (Software, Hardware, and Services), Process (Production Optimization, Reservoir Optimization, Drilling Optimization, Safety Management, and Others), Technology (IoT & Mobile Devices, AI & Advance Analytics, Cloud Computing, Robotics, and Others), Application (On-Shore and Off-Shore) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Baker Hughes Company, IBM Corporation, Microsoft, Rockwell Automation, Inc., Halliburton Energy Services, Inc., CGG, Schlumberger Limited, Redline Communications, Osperity, Emerson Electric Co., Siemens AG., ABB, Honeywell International Inc., NOV Inc., OleumTech, Petrolink., Weatherford, Katalyst Data Management, Digi International Inc., Kongsberg Digital (a subsidiary of KONGSBERG), among others |

Market Definition

Digital oilfield is defined as the automation of upstream, midstream, and downstream oilfield activities. It is a part of the energy industry that has incorporated advanced software and data analysis techniques into its operations to provide enhanced outputs and improve the profitability of the production process. They offer advantages such as optimized production rate of hydrocarbons, improved safety, environmental protection, and ease in finding reserves and exploiting them to the fullest. Digital oilfield is about sensors and screens installed on an oil and gas field. Integrating business processes with digital technologies and automating workflows is a concept. It allows a company to reduce human interference and minimize the risks associated with oil and gas operations. The flow of data and information is rapidly integrated with the analysis interface, allowing timely and best decisions for the operation.

North America Digital Oilfield Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Advent of digitization in the oil and gas sector across the region

Digitalization is becoming increasingly evident, and digital technology is transforming the oil and gas sector, further driven by real-time data, cloud computing, and digital worlds. Digital oilfields have been designed to overhaul oil and gas systems and enable full optimization throughout the supply chain by combining process management with digital technologies. Furthermore, adopting digital oilfields helps oil and gas businesses transition into greener practices. For instance, artificial intelligence and predictive analytics can help identify oil spills after or even before they occur, which helps companies to minimize various damages. By investing in digital oilfield technologies, oil and gas operators can automate maintenance and manage equipment more efficiently while continuing to drive innovation.

- Rising penetration of emerging technologies such as artificial intelligence (AI) and IoT

Technology plays an important role in the growth of every business, and also it helps organizations to improve the quality and work speed by supporting and enhancing operations. Companies are adopting big data analytics techniques in their businesses to improve operations and ease facility performance. Disruptive technologies such as artificial intelligence (AI) and the Internet of Things (IoT) are driving digital transformation across the North America digital oilfield market, thereby increasing efficiency, safety, and sustainability.

Opportunities

- Increase in exploration operations in uncharted off-shore/ultra-deep-waters

The rise in the consumption of oil and petroleum products across the globe has been highly uncertain over the past two decades. The uncertainty depicts the demand and supply of petroleum and oil products, which drives oil and gas production or extraction of new oil wells. Moreover, oil companies are surveying oilfields to understand the adoption of digital solutions to increase production capacity. Some companies, such as ABB and CGG, are involved in exploring new off-shore and on-shore oilfields. Nowadays, 70% of the world's oil and gas is extracted from on-shore sites, and the rest 30% is extracted from off-shore oilfields. Thus, exploration of the on-shore oilfield is more and has been very common, and most companies have explored the majority of on-shore oilfields.

Restraints/Challenges

- Increase in cyber security threats due to digital initiatives

Oil and gas companies rely on highly connected data and control systems to facilitate exploration, drilling, and system monitoring and to optimize production from on-shore and off-shore resources. As their dependence on IT technology has grown, the vulnerability to cyberattacks has also increased in the past few years.

The rise of the digital oilfield has left oil and gas companies increasingly dependent on data to sustain production. As these technologies become widespread, the cyber risk for the oil and gas industry has continued to rise.

- Interoperability of multiple system components from different solution providers

Digital oilfield systems are gaining importance in the oil and gas industry due to effective monitoring, supervisory capabilities, and remote control. This digital system or technology integrates oil and gas assets such as pipelines, wells, machinery equipment, and many others. Different vendors offer a wide range of digital oilfield solutions, including SCADA software, computers, wireless sensors, robotics, cloud computing, configuration software, and many others.

Companies in the oil and gas industry usually consider the best and most cost-effective digital solutions, irrespective of vendors and suppliers. However, such decisions are made especially according to the requirement, which dominates the standardization of products based on the requirement, which seems very challenging. Numerous digital solutions are adopted in the industry, creating the need for proper and easy integration techniques. Moreover, the customer-oriented solutions will be a constraint to adding any hardware or software offering.

Post COVID-19 Impact on North America Digital Oilfield Market

COVID-19 negatively impacted the North America digital oilfield market due to lockdown regulations and rules at oilfield facilities.

The COVID-19 pandemic has impacted the North America digital oilfield market to an extent negative manner. However, the rise in demand for well-intervention services and operational digital oilfield solutions has helped the market to grow after the pandemic. Also, the growth has been high since the market opened after COVID-19. It is expected that there will be considerable growth in the sector owing to the rise of immersive technology and cloud-based digital oilfields solution.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology in the digital oilfield. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for the use of automation technology have led to the market's growth

Recent Developments

- In September 2022, IBM Corporation partnered with Saudi Data, the AI Authority (SDAIA), and the Ministry of Energy to accelerate sustainability initiatives in Saudi Arabia using artificial intelligence. This partnership will help the company to drive digitalization in the oil and gas industry and accelerate revenue growth

- In April 2021, Microsoft announced the partnership with Ambyint to provide oil and gas exploration and production solutions to optimize rod lift and plunger lift wells. This partnership will help the company leverage the solutions and software to transform oil fields, attract customers toward digitalization, and accelerate revenue growth

North America Digital Oilfield Market Scope

North America digital oilfield market is segmented based on offering, process, technology, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Software

- Services

- Hardware

On the basis of offering, the North America digital oilfield market is segmented into software, services, and hardware.

Process

- Production Optimization

- Reservoir Optimization

- Drilling Optimization

- Safety Management

- Others

On the basis of process, the North America digital oilfield market has been segmented into production optimization, reservoir optimization, drilling optimization, safety management, and others.

Technology

- IoT & Mobile Devices

- AI & Advance Analytics

- Cloud Computing

- Robotics

- Others

On the basis of technology, the North America digital oilfield market has been segmented into IoT & mobile devices, AI & advance analytics, cloud computing, robotics, and others.

Application

- On-Shore

- Off-Shore

On the basis of application, the North America digital oilfield market is segmented into on-shore, off-shore.

North America Digital Oilfield Market Regional Analysis/Insights

North America digital oilfield market is analysed, and market size insights and trends are provided by country, offering, process, technology, and application as referenced above.

Countries covered in the North America digital oilfield market report are the U.S., Canada, and Mexico. The U.S. is expected to dominate the North American region as it is home to many tech giants worldwide.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Digital Oilfield Market Share Analysis

The North America digital oilfield market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the North America digital oilfield market.

Some of the major players operating in the North America digital oilfield market are Baker Hughes Company, IBM Corporation, Microsoft, Rockwell Automation, Inc., Halliburton Energy Services, Inc., CGG, Schlumberger Limited, Redline Communications, Osperity, Emerson Electric Co., Siemens AG., ABB, Honeywell International Inc., NOV Inc., OleumTech, Petrolink., Weatherford, Katalyst Data Management, Digi International Inc., Kongsberg Digital (a subsidiary of KONGSBERG), among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DIGITAL OILFIELD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 PRICE TREND ANALYSIS

4.6 LIST OF BUYERS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATIONS AND STANDARDS COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT'S ROLE

4.10.4 ANALYST RECOMMENDATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF DIGITIZATION IN THE OIL AND GAS SECTOR ACROSS THE REGION

5.1.2 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND IOT

5.1.3 GROWING ADOPTION OF MOBILE AND SATELLITE COMMUNICATION/ CONNECTIVITY

5.1.4 GROWING INITIATIVES BY COMPANIES TO MINIMIZE CARBON FOOTPRINT

5.2 RESTRAINT

5.2.1 INCREASE IN CYBER SECURITY THREATS DUE TO DIGITAL INITIATIVES

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR WELL INTERVENTION SERVICES AND OPERATIONAL DIGITAL OILFIELD SOLUTIONS

5.3.2 INCREASE IN EXPLORATION OPERATIONS IN UNCHARTED OFFSHORE/ULTRA-DEEP-WATERS

5.3.3 RISE OF IMMERSIVE TECHNOLOGY AND CLOUD-BASED DIGITAL OILFIELDS SOLUTION

5.4 CHALLENGES

5.4.1 INTEROPERABILITY OF MULTIPLE SYSTEM COMPONENTS FROM DIFFERENT SOLUTION PROVIDERS

5.4.2 TRADE BARRIERS, LOW PRODUCTION, AND RESTRICTIONS IN LOGISTICS

6 NORTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 HOSTED

6.2.2 ON-PREMISE

6.3 SERVICES

6.4 HARDWARE

6.4.1 DISTRIBUTED CONTROL SYSTEMS

6.4.2 SUPERVISORY CONTROL AND DATA ACQUISITION

6.4.3 COMPUTER EQUIPMENT AND APPLICATION HARDWARE

6.4.4 SMART-WELLS

6.4.5 WIRELESS SENSORS

6.4.6 PROCESS AUTOMATION

6.4.7 SAFETY SYSTEMS

6.4.8 OTHERS

7 NORTH AMERICA DIGITAL OILFIELD MARKET, BY PROCESS

7.1 OVERVIEW

7.2 PRODUCTION OPTIMIZATION

7.3 RESERVOIR OPTIMIZATION

7.4 DRILLING OPTIMIZATION

7.5 SAFETY MANAGEMENT

7.6 OTHERS

8 NORTH AMERICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 IOT & MOBILE DEVICES

8.3 AI & ADVANCE ANALYTICS

8.4 CLOUD COMPUTING

8.5 ROBOTICS

8.6 OTHERS

9 NORTH AMERICA DIGITAL OILFIELD MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ON-SHORE

9.3 OFF-SHORE

10 NORTH AMERICA DIGITAL OILFIELD MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA DIGITAL OILFIELD MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 BAKER HUGHES COMPANY

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SOLUTION PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 IBM CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MICROSOFT

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 CGG

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 HALLIBURTON ENERGY SERVICES, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 SOLUTIONS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 DIGI INTERNATIONAL INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SOLUTION PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCTS PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 KATALYST DATA MANAGEMENT

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KONGSBERG DIGITAL (A SUBSIDIARY OF KONGSBERG)

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCTS PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 NOV INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCTS PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 OLEUMTECH

13.13.1 COMPANY SNAPSHOT

13.13.2 SOLUTION PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 OSPERITY

13.14.1 COMPANY SNAPSHOT

13.14.2 SOLUTION PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PETROLINK.

13.15.1 COMPANY SNAPSHOT

13.15.2 TECHNOLOGY PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 REDLINE COMMUNICATIONS

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 SERVICE PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 ROCKWELL AUTOMATION, INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 SOLUTION PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SCHLUMBERGER LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCTS PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SIEMENS AG.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SOLUTION PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WEATHERFORD

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HARDWARE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HARDWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PRODUCTION OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA RESERVOIR OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DRILLING OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SAFETY MANAGEMENT IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA IOT & MOBILE DEVICES IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA AI & ADVANCE ANALYTICS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CLOUD COMPUTING IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ROBOTICS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DIGITAL OILFIELD MARKET, BY APPLICATION 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ON-SHORE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OFF-SHORE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA DIGITAL OILFIELD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 U.S. DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 30 U.S. SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 31 U.S. HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 33 U.S. DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 34 U.S. DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 CANADA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 36 CANADA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 37 CANADA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 CANADA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 39 CANADA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 40 CANADA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MEXICO DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 MEXICO SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 45 MEXICO DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 MEXICO DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA DIGITAL OILFIELD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIGITAL OILFIELD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIGITAL OILFIELD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIGITAL OILFIELD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIGITAL OILFIELD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIGITAL OILFIELD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIGITAL OILFIELD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIGITAL OILFIELD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIGITAL OILFIELD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DIGITAL OILFIELD MARKET: SEGMENTATION

FIGURE 11 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND IOT IS EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA DIGITAL OILFIELD MARKET IN THE FORECAST PERIOD

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIGITAL OILFIELD MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA DIGITAL OILFIELD MARKET

FIGURE 14 INCREASING NUMBER OF RESEARCH AND PATENT FILLING IN THE LAST FEW YEARS

FIGURE 15 ESTIMATED INVESTMENTS IN DIGITAL TECHNOLOGIES IN THE OIL AND GAS INDUSTRY (%) (2021-2025)

FIGURE 16 NORTH AMERICA OIL CONSUMPTION IN EXAJOULE (EJ) FROM THE YEAR 2000 TO 2021:

FIGURE 17 NORTH AMERICA DIGITAL OILFIELD MARKET: BY PRODUCT, 2021

FIGURE 18 NORTH AMERICA DIGITAL OILFIELD MARKET : BY PROCESS, 2021

FIGURE 19 NORTH AMERICA DIGITAL OILFIELD MARKET : BY TECHNOLOGY, 2021

FIGURE 20 NORTH AMERICA DIGITAL OILFIELD MARKET : BY APPLICATION, 2021

FIGURE 21 NORTH AMERICA DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA DIGITAL OILFIELD MARKET: BY OFFERING (2022-2029)

FIGURE 26 NORTH AMERICA DIGITAL OILFIELD MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.