Global Chlorine Dioxide Market

Market Size in USD Million

CAGR :

%

USD

308.84 Million

USD

429.22 Million

2024

2032

USD

308.84 Million

USD

429.22 Million

2024

2032

| 2025 –2032 | |

| USD 308.84 Million | |

| USD 429.22 Million | |

|

|

|

|

Chlorine Dioxide Market Size

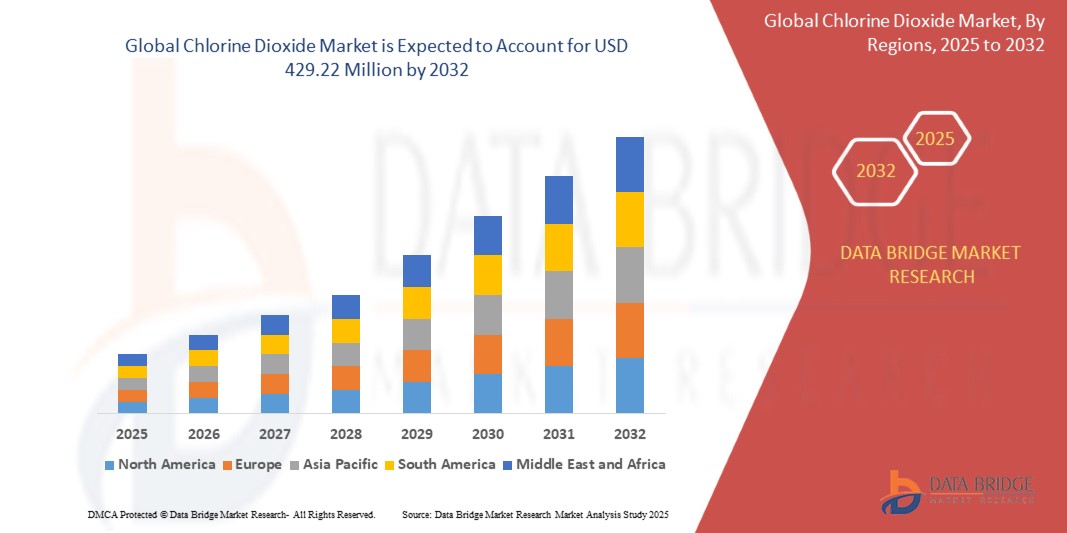

- The global chlorine dioxide market size was valued at USD 308.84 million in 2024 and is expected to reach USD 429.22 million by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fueled by increasing demand for safe and efficient water and wastewater treatment solutions across municipal and industrial sectors, driven by stringent regulatory standards and rising awareness of waterborne pathogens

- Furthermore, the growing focus on sustainable and eco-friendly disinfection methods, combined with the operational advantages of chlorine dioxide such as rapid microbial control and minimal formation of harmful by-products, is accelerating adoption in various applications including municipal water treatment, industrial effluent management, and food & beverage processing

Chlorine Dioxide Market Analysis

- Chlorine dioxide is a highly effective oxidizing and disinfecting agent used for water treatment, industrial cleaning, and sterilization applications. It offers advantages over traditional chlorine, including broad-spectrum microbial control, reduced formation of chlorinated by-products, and compatibility with automated dosing systems

- The escalating demand for chlorine dioxide is primarily driven by increasing urbanization, expansion of industrial infrastructure, rising regulatory compliance requirements, and the need for reliable, cost-effective, and environmentally friendly disinfection solutions across multiple sectors

- Asia-Pacific dominated the chlorine dioxide market with a share of 47.3% in 2024, due to increasing investments in water treatment infrastructure, expanding industrialization, and a strong presence of chemical production hubs

- North America is expected to be the fastest growing region in the chlorine dioxide market during the forecast period due to robust demand for effective water and wastewater treatment chemicals across municipal and industrial sectors

- Liquid segment dominated the market with a market share of 47.5% in 2024, due to its ease of handling, stability during storage, and suitability for on-site generation systems. Liquid chlorine dioxide is widely preferred in water treatment applications, where accurate dosing and consistent effectiveness are critical for disinfection and microbial control. Its ability to deliver rapid oxidation without forming harmful chlorinated by-products enhances its adoption in municipal water and industrial treatment facilities. In addition, liquid form solutions are compatible with automated dosing equipment, which further drives demand across large-scale operations

Report Scope and Chlorine Dioxide Market Segmentation

|

Attributes |

Chlorine Dioxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chlorine Dioxide Market Trends

Growing Adoption of Eco-Friendly Water Disinfection Solutions

- The chlorine dioxide market is expanding as industries and municipalities increasingly adopt eco-friendly disinfection chemicals. Compared to traditional chlorine, chlorine dioxide produces fewer harmful byproducts, making it safer and more sustainable for long-term applications

- For instance, Evoqua Water Technologies offers chlorine dioxide generation systems designed for municipal water treatment. The company emphasizes reduced formation of trihalomethanes, highlighting its sustainability advantages while appealing to environmentally conscious public utility providers globally

- The global shift toward minimizing chemical pollution is reshaping the water disinfection segment. Chlorine dioxide is gaining traction as regulators encourage safer, eco-friendly alternatives that align with international clean water and sustainability frameworks

- In addition, the food and beverage industry is increasingly adopting chlorine dioxide for surface sanitation and process water treatment. Its strong biocidal efficacy without harmful residuals makes it a preferred disinfectant in premium food production environments

- Rising industrial wastewater treatment initiatives across developing economies are reinforcing market demand. Strict water standards are driving manufacturers to adopt chlorine dioxide as a sustainable option for microbial control and odor management in effluent treatment plants

- Advances in on-site chlorine dioxide generation systems are supporting adoption. Modern generators improve safety in handling, reduce storage-related hazards, and offer scalable solutions for both midsized industries and large municipal water projects globally

Chlorine Dioxide Market Dynamics

Driver

Rise in Demand for Safe Drinking Water

- The growing global concern about drinking water contamination is driving chlorine dioxide adoption. Its strong disinfection capacity helps eliminate pathogens such as viruses, bacteria, and protozoa, making it a viable option for ensuring public health

- For instance, ProMinent developed chlorine dioxide water disinfection solutions for large-scale municipal systems. These applications highlight rising demand for safe alternatives that comply with strict regulatory standards in public water treatment and distribution requirements

- Urban population growth and industrial pollution are intensifying pressure on water quality. Municipal authorities are transitioning toward advanced disinfection chemicals such as chlorine dioxide to ensure safe water delivery to rapidly growing populations worldwide

- In addition, frequent outbreaks of waterborne diseases are reinforcing the importance of effective disinfectants. Chlorine dioxide’s ability to inactivate resistant microorganisms positions it as a critical tool in achieving long-term safe drinking water supply

- Rising government and international investments in water infrastructure, particularly across Asia-Pacific and Africa, are expected to strengthen chlorine dioxide demand. Public health policies and WHO guidelines provide further stimulus to large-scale disinfection chemical adoption

Restraint/Challenge

Fire and Explosion Hazards

- Despite its effectiveness, chlorine dioxide carries risks of fire and explosion when not handled properly. Its unstable composition requires controlled on-site generation, creating operational complexities that raise concerns regarding plant safety and reliability

- For instance, Solvay emphasizes strict generation and storage protocols for chlorine dioxide products used in pulp and paper industries. This approach ensures safety compliance while reducing risks associated with mishandling or accidents during industrial operations

- High safety risks lead to additional investments in protective infrastructure such as specialized reactors, ventilation, and automated monitoring systems. These requirements add to upfront capital costs, creating barriers for smaller wastewater treatment operators

- In addition, lack of skilled personnel in certain regions creates risk factors in maintaining safe chlorine dioxide generation and use. Improper management increases likelihood of hazardous events, limiting adoption across resource-constrained industries and municipalities

- Stringent safety regulations in developed markets restrict chlorine dioxide usage in bulk forms. These regulatory limitations may hinder widespread adoption, forcing companies to invest in research for safer alternatives or improved stabilization techniques

Chlorine Dioxide Market Scope

The market is segmented on the basis of form, application, and end user.

- By Form

On the basis of form, the chlorine dioxide market is segmented into solid, liquid, and gas. The liquid segment dominated the largest market revenue share of 47.5% in 2024, primarily due to its ease of handling, stability during storage, and suitability for on-site generation systems. Liquid chlorine dioxide is widely preferred in water treatment applications, where accurate dosing and consistent effectiveness are critical for disinfection and microbial control. Its ability to deliver rapid oxidation without forming harmful chlorinated by-products enhances its adoption in municipal water and industrial treatment facilities. In addition, liquid form solutions are compatible with automated dosing equipment, which further drives demand across large-scale operations.

The gas segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by its high effectiveness in air disinfection, sterilization processes, and controlled fumigation applications. Gas-phase chlorine dioxide is gaining popularity in sectors such as healthcare, food processing, and pharmaceutical manufacturing, where stringent hygiene and contamination control are critical. Its capability to penetrate enclosed spaces and eliminate pathogens without leaving toxic residues makes it highly valuable for facility sterilization. Growing awareness of advanced disinfection techniques and the increasing need for cleanroom environments further contribute to the rising demand for gas-based chlorine dioxide solutions.

- By Application

On the basis of application, the chlorine dioxide market is segmented into municipal water treatment, industrial water treatment, swimming pool water treatment, and wastewater treatment. The municipal water treatment segment held the largest revenue share in 2024, supported by the growing demand for safe and efficient drinking water disinfection. Chlorine dioxide is widely used by municipalities as it effectively eliminates bacteria, viruses, and protozoa without generating harmful by-products such as trihalomethanes (THMs), which are common in chlorine-based treatment. Its ability to control taste, odor, and biofilm formation in distribution systems makes it a preferred disinfectant for large-scale water supply networks. Increasing government regulations for water quality further drive the adoption of chlorine dioxide in this segment.

The wastewater treatment segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising need for effective disinfection in industrial and municipal wastewater systems. Chlorine dioxide is highly efficient in oxidizing organic pollutants, sulfides, and phenols, making it suitable for complex wastewater streams across industries such as chemical, pulp and paper, and oil and gas. Growing concerns over industrial effluents, stricter environmental discharge norms, and increasing focus on water reuse practices are propelling the demand for chlorine dioxide in wastewater treatment facilities. Its ability to maintain efficacy in varying pH ranges further strengthens its role in this segment.

- By End User

On the basis of end user, the chlorine dioxide market is segmented into chemical, oil and gas, power generation, pulp and paper, water treatment, food and beverage, construction industry, pharmaceutical industry, and others. The water treatment sector dominated the largest revenue share in 2024, owing to the widespread use of chlorine dioxide in both municipal and industrial water purification processes. Its ability to remove biofilms, eliminate pathogens, and control odor makes it indispensable for ensuring safe water quality. Regulatory pressures and government investments in improving public water infrastructure further fuel demand. Moreover, the compound’s effectiveness at lower concentrations compared to alternatives reduces operational costs, making it the disinfectant of choice in large-scale water treatment systems.

The food and beverage industry is expected to record the fastest growth from 2025 to 2032, driven by rising demand for safe, residue-free disinfection in food processing and packaging facilities. Chlorine dioxide is increasingly used to sanitize equipment, wash raw produce, and control microbial contamination in processing lines without affecting food quality. The shift toward chemical treatments that leave minimal residues and comply with stringent food safety standards supports its rapid adoption. Growing consumer awareness of hygiene, combined with stricter international safety certifications for exports, is encouraging food and beverage manufacturers to incorporate chlorine dioxide-based disinfection solutions.

Chlorine Dioxide Market Regional Analysis

- Asia-Pacific dominated the chlorine dioxide market with the largest revenue share of 47.3% in 2024, driven by increasing investments in water treatment infrastructure, expanding industrialization, and a strong presence of chemical production hubs

- The region’s cost-effective manufacturing landscape, growing adoption of advanced disinfection solutions, and rising focus on safe municipal and industrial water supply are accelerating market expansion

- The availability of skilled labor, favorable government regulations, and rapid urbanization across developing economies are contributing to increased consumption of chlorine dioxide in both municipal and industrial applications

China Chlorine Dioxide Market Insight

China held the largest share in the Asia-Pacific chlorine dioxide market in 2024, owing to its leadership in chemical manufacturing and extensive water treatment projects. The country’s well-established industrial base, supportive government policies, and significant investments in water purification and wastewater management are major growth drivers. Demand is further bolstered by increasing industrial effluent treatment requirements and ongoing expansion in municipal water infrastructure.

India Chlorine Dioxide Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding municipal water treatment sector, increasing industrial wastewater management needs, and rising investments in chemical production facilities. Government initiatives promoting clean water access, coupled with growing industrialization and urban development, are strengthening the demand for chlorine dioxide. The rise in food and beverage, pharmaceutical, and pulp and paper industries is also driving adoption of effective disinfection solutions.

Europe Chlorine Dioxide Market Insight

The Europe chlorine dioxide market is expanding steadily, supported by stringent environmental regulations, high demand for safe and efficient water treatment chemicals, and growing investments in industrial and municipal purification technologies. The region emphasizes quality, regulatory compliance, and eco-friendly disinfection practices, particularly in water-intensive sectors such as food processing, pharmaceuticals, and pulp and paper. Increasing focus on sustainable water management practices is further enhancing market growth.

Germany Chlorine Dioxide Market Insight

Germany’s chlorine dioxide market is driven by its strong industrial base, leadership in high-standard water treatment solutions, and robust chemical manufacturing capabilities. Well-established R&D networks, partnerships between industrial players and academic institutions, and growing investments in wastewater treatment innovations support market growth. Demand is particularly strong in municipal water systems, food and beverage processing, and chemical industries.

U.K. Chlorine Dioxide Market Insight

The U.K. market is supported by a mature water treatment industry, increasing focus on sustainable disinfection solutions, and rising demand from pharmaceutical and food processing sectors. With growing emphasis on regulatory compliance, R&D initiatives, and development of eco-friendly treatment methods, the country continues to play a significant role in the adoption of chlorine dioxide for both municipal and industrial applications.

North America Chlorine Dioxide Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for effective water and wastewater treatment chemicals across municipal and industrial sectors. Rising investments in advanced disinfection technologies, stringent water safety regulations, and increasing adoption of chlorine dioxide in industrial effluent management are boosting market growth.

U.S. Chlorine Dioxide Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive water treatment infrastructure, strong regulatory framework, and significant adoption of advanced chemical disinfectants. Focus on ensuring safe drinking water, managing industrial wastewater, and complying with environmental standards is encouraging the use of chlorine dioxide. Presence of key chemical manufacturers and well-established distribution networks further solidify the U.S.’s leading position in the region.

Chlorine Dioxide Market Share

The chlorine dioxide industry is primarily led by well-established companies, including:

- Accepta (U.K.)

- Ecolab (U.S.)

- Evoqua (U.S.)

- CDG Environmental LLC (U.S.)

- Grundfos (Denmark)

- ProMinent (Germany)

- Tecme Srl (Italy)

- Iotronic Elektrogerätebau GmbH (Germany)

- Vasu Chemicals LLP (India)

- BASF SE (Germany)

- Chemours (U.S.)

Latest Developments in Global Chlorine Dioxide Market

- In June 2024, Boulder iQ's division enhanced its chlorine dioxide sterilization capabilities for medical devices, reflecting the rising market demand following the EPA's updated regulatory guidelines. This development strengthens the adoption of chlorine dioxide in the healthcare and medical device sectors, emphasizing its efficiency, reliability, and long-standing efficacy in sterilization. The expansion positions the company to capture increased market share as hospitals and medical facilities seek safer and more effective sterilization methods

- In January 2024, Scotmas Group signed a Memorandum of Understanding (MoU) with ACWA Power to advance “Green Desalination” technologies using chlorine dioxide-based water treatment systems. This collaboration highlights the growing emphasis on sustainable water purification solutions in the power generation and desalination sectors. The partnership is expected to drive innovation in eco-friendly disinfection, strengthen market adoption in large-scale industrial projects, and position both companies as key players in environmentally responsible water treatment initiatives

- In 2024, municipal water utilities in Brazil began shifting focus from traditional chlorine gas (Cl) disinfection to safer alternatives such as chlorine dioxide, following concerns over the risks associated with transporting and handling hazardous chlorine gas in densely populated urban areas. This trend is accelerating the adoption of chlorine dioxide across municipal water treatment plants, enhancing operational safety while maintaining effective microbial control, thereby expanding its market presence in Latin America

- In June 2022, Evoqua Water Technologies inaugurated a new manufacturing facility in Singapore, expanding its footprint in the Asia-Pacific region. The move reflects the increasing demand for innovative chlorine dioxide-based water treatment solutions in APAC, supporting rapid regional industrial growth and urban water infrastructure development. This investment is expected to enhance supply capabilities, improve service delivery, and strengthen the company’s market leadership in advanced water disinfection technologies

- In March 2024, Kemira, a global leader in water chemistry, announced the launch of a next-generation chlorine dioxide generator for industrial and municipal applications. The technology offers enhanced operational efficiency, precise dosing, and reduced chemical consumption, positioning Kemira to meet the growing market demand for sustainable and cost-effective water treatment solutions. This innovation is anticipated to accelerate adoption across emerging economies and strengthen chlorine dioxide’s role as a preferred disinfectant in both industrial and municipal water treatment segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chlorine Dioxide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chlorine Dioxide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chlorine Dioxide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.