Global Hot Fill Packaging Market

Market Size in USD Billion

CAGR :

%

USD

69.04 Billion

USD

96.68 Billion

2024

2032

USD

69.04 Billion

USD

96.68 Billion

2024

2032

| 2025 –2032 | |

| USD 69.04 Billion | |

| USD 96.68 Billion | |

|

|

|

|

Hot Fill Packaging Market Size

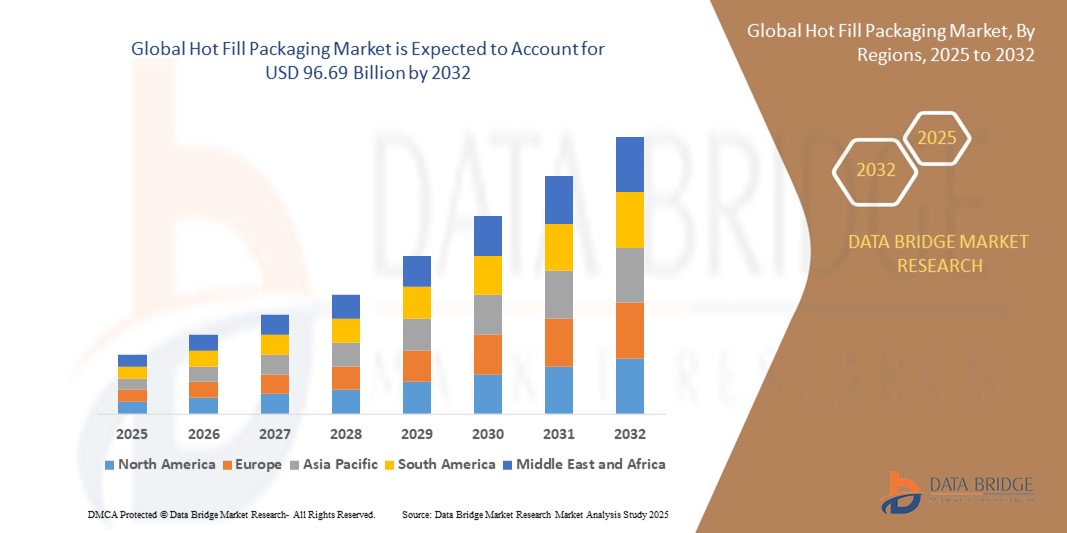

- The global hot fill packaging market size was valued at USD 69.04 billion in 2024 and is expected to reach USD 96.68 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing demand for convenient, shelf-stable food and beverage products, coupled with advancements in packaging technologies that enhance product safety and shelf life

- Rising consumer preference for ready-to-drink beverages, sauces, and other perishable products requiring hot fill processes is further propelling market expansion, particularly in the food and beverage sector

Hot Fill Packaging Market Analysis

- Hot fill packaging, a process involving filling containers with hot liquid products to ensure sterility and extended shelf life, is a critical solution for the food and beverage industry, offering durability, safety, and sustainability

- The growing demand for hot fill packaging is fueled by the rise in consumption of ready-to-drink beverages, increasing awareness of food safety, and the need for cost-effective packaging solutions that maintain product quality

- Asia-Pacific dominated the hot fill packaging market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a booming food and beverage industry, and high demand for packaged goods in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to increasing consumer demand for convenience foods, technological advancements in packaging, and a strong presence of key industry players

- The bottles segment dominated the largest market revenue share of 32.7% in 2024, driven by their widespread use for hot-filled beverages such as fruit juices, flavored water, and ready-to-drink beverages due to their robust design and ability to withstand high temperatures.

Report Scope and Hot Fill Packaging Market Segmentation

|

Attributes |

Hot Fill Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hot Fill Packaging Market Trends

“Increasing Adoption of Sustainable and Recyclable Materials”

- The global hot fill packaging market is experiencing a significant trend toward the adoption of sustainable and recyclable materials, driven by consumer demand and regulatory pressures for eco-friendly packaging solutions

- Technologies such as lightweight polyethylene terephthalate (PET) and polypropylene (PP) are being prioritized for their recyclability and ability to withstand high temperatures without compromising product integrity

- Companies are innovating with biodegradable and bio-based plastics to reduce environmental impact, aligning with global sustainability goals and circular economy initiatives

- For instances, in April 2024, Amcor introduced a one-liter PET bottle made from 100% post-consumer recycled (PCR) content for carbonated soft drinks, supporting sustainability goals and meeting consumer demand for greener packaging

- This trend enhances the appeal of hot fill packaging for environmentally conscious consumers and strengthens brand reputation in competitive markets

Hot Fill Packaging Market Dynamics

Driver

“Rising Demand for Convenience Foods and Beverages”

- The increasing consumer preference for convenience foods, ready-to-eat meals, and beverages, such as sauces, fruit juices, vegetable juices, and ready-to-drink (RTD) beverages, is a major driver for the global hot fill packaging market

- Hot fill packaging extends shelf life without preservatives, meeting consumer demand for natural and preservative-free products, particularly in applications such as jams, mayonnaise, and nectars

- Government regulations promoting food safety and quality, especially in the Asia-Pacific region, which dominates the market, are encouraging the adoption of hot fill packaging solutions

- Advancements in 5G and IoT technologies are enabling faster and more reliable data transmission for automated hot fill packaging systems, enhancing efficiency for end-users such as dairy and soup manufacturers

- Manufacturers are increasingly offering hot fill packaging solutions, such as bottles and jars, as standard or customizable options to cater to diverse consumer needs across offline and online distribution channels

Restraint/Challenge

“High Initial Costs and Regulatory Compliance Issues”

- The high initial investment required for hot fill packaging equipment, such as manual and automatic machines, and the integration of advanced materials such as PET and PP, poses a significant barrier, particularly for small-scale manufacturers in emerging market

- The complexity and cost of retrofitting existing production lines to accommodate hot fill packaging processes can deter adoption, especially for products such as sauces, spreads, and flavored water

- Regulatory compliance issues, including varying standards for food safety and packaging across countries, create challenges for manufacturers operating globally, particularly in ensuring compliance for primary, secondary, and tertiary packaging layer

- The need for robust supply chains to support the production and distribution of packaging formats, such as pouches, cans, and caps and closures, further complicates market expansion, especially in regions with underdeveloped infrastructure

- These factors may limit market growth, particularly in cost-sensitive markets or regions with stringent regulatory frameworks

Hot Fill Packaging market Scope

The market is segmented on the basis of product type, material type, packaging layer, capacity, machine type, end-user, and distribution channel.

- By Product Type

On the basis of product type, the global hot fill packaging market is segmented into bottles, jars, containers, pouches, cans, caps and closures, and others. The bottles segment dominated the largest market revenue share of 32.7% in 2024, driven by their widespread use for hot-filled beverages such as fruit juices, flavored water, and ready-to-drink beverages due to their robust design and ability to withstand high temperatures.

The Pouches segment is expected to witness the fastest growth rate, primarily driven by their increasing adoption for single-serving hot-filled products such as sauces, soups, and baby food, offering convenience, reduced material usage, and extended shelf life.

- By Material Type

On the basis of material type, the global hot fill packaging market is segmented into polyethylene terephthalate (PET), glass, polypropylene, polyethylene, and others. The polyethylene terephthalate (PET) segment is expected to hold the largest market revenue share, primarily due to its excellent barrier properties, lightweight nature, and cost-effectiveness, making it a preferred choice for hot-filled beverages and food products.

The glass segment is anticipated to witness significant growth, driven by its premium appeal, inert nature, and recyclability, particularly for high-end hot-filled products where product integrity and shelf life are crucial.

- By Packaging Layer

On the basis of packaging layer, the global hot fill packaging market is segmented into primary, secondary, and tertiary. The primary packaging layer segment is expected to hold the largest market revenue share, as it directly contains the hot-filled product and plays a crucial role in maintaining product freshness, safety, and extending shelf life.

The secondary packaging layer is anticipated to experience robust growth, driven by its importance in protecting primary packaging during transit and storage, as well as providing branding and promotional opportunities.

- By Capacity

On the basis of capacity, the global hot fill packaging market is segmented into up to 12 Oz, 13 Oz-32 Oz, 33 Oz-64 Oz, and above 64 Oz. The 13 Oz-32 Oz segment is expected to hold the largest market revenue share, aligning with popular beverage and food portion sizes, offering a balance between consumer convenience and product volume.

The above 64 Oz segment is expected to witness significant growth, driven by the increasing demand for bulk hot-filled products in institutional and food service sectors, as well as for multi-serving household products.

- By Machine Type

On the basis of machine type, the global hot fill packaging market is segmented into manual and automatic. The automatic segment is expected to hold the largest market revenue share, primarily due to the high volume production requirements of hot fill packaging, where automated systems offer efficiency, precision, and reduced labor costs.

The manual segment is anticipated to witness growth in niche markets or for smaller-scale operations where flexibility and lower initial investment are prioritized.

- By End-User

On the basis of end-user, the global hot fill packaging market is segmented into sauces and spreads, fruit juices, vegetable juices, jams, mayonnaise, flavored water, ready to drink beverages, soups, dairy, nectars, and others. The fruit Juices segment is expected to hold the largest market revenue share, driven by the widespread consumption of fruit juices globally and the need for hot fill packaging to preserve freshness and extend shelf life without refrigeration.

The ready to drink beverages segment is anticipated to witness rapid growth, fueled by changing consumer lifestyles and the increasing demand for convenient and healthy beverage options that can be hot-filled to ensure product safety and longevity.

- By Distribution Channel

On the basis of distribution channel, the global hot fill packaging market is segmented into offline and online. The offline segment is expected to hold the largest market revenue share, as traditional retail channels such as supermarkets, hypermarkets, and convenience stores remain the primary points of sale for hot-filled packaged products.

The online segment is anticipated to witness significant growth, driven by the increasing penetration of e-commerce and the convenience it offers consumers for purchasing a wide range of packaged food and beverage products.

Hot Fill Packaging Market Regional Analysis

- Asia-Pacific dominated the hot fill packaging market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a booming food and beverage industry, and high demand for packaged goods in countries such as China and India

- Consumers prioritize hot fill packaging for extending shelf life, ensuring product safety, and maintaining quality without preservatives, particularly in regions with high consumption of beverages and processed foods

- Growth is supported by advancements in packaging technology, including lightweight PET and recyclable materials, alongside rising adoption in both OEM and aftermarket segments

U.S. Hot Fill Packaging Market Insight

The U.S. hot fill packaging market is expected to witness significant growth, fueled by strong demand for ready-to-drink beverages and sauces in the aftermarket. Growing consumer awareness of sustainability and food safety benefits drives market expansion. The trend toward eco-friendly packaging and increasing regulations promoting recyclable materials further boost the market. Manufacturers’ integration of hot fill technology in production lines complements aftermarket sales, creating a diverse product ecosystem.

Europe Hot Fill Packaging Market Insight

The Europe hot fill packaging market is expected to witness significant growth, supported by regulatory emphasis on food safety and sustainability. Consumers seek packaging that preserves product freshness while offering convenience. The growth is prominent in both new production lines and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and demand for healthy food options.

U.K. Hot Fill Packaging Market Insight

The U.K. market for hot fill packaging is expected to witness rapid growth, driven by demand for convenient food and beverage solutions in urban and suburban settings. Increased interest in sustainable packaging and rising awareness of preservative-free products encourage adoption. Evolving food safety regulations influence consumer choices, balancing packaging functionality with compliance.

Germany Hot Fill Packaging Market Insight

Germany is expected to witness rapid growth in hot fill packaging, attributed to its advanced food and beverage manufacturing sector and high consumer focus on product quality and sustainability. German consumers prefer technologically advanced packaging that ensures product safety and reduces environmental impact. The integration of these solutions in premium products and aftermarket options supports sustained market growth.

Asia-Pacific Hot Fill Packaging Market Insight

The Asia-Pacific region dominates the global hot fill packaging market, driven by expanding food and beverage production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of product safety, convenience, and sustainability boosts demand. Government initiatives promoting eco-friendly packaging and food safety further encourage the use of advanced hot fill solutions.

Japan Hot Fill Packaging Market Insight

Japan’s hot fill packaging market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced packaging that enhances product safety and convenience. The presence of major food and beverage manufacturers and integration of hot fill technology in production accelerate market penetration. Rising interest in sustainable aftermarket solutions also contributes to growth.

China Hot Fill Packaging Market Insight

China holds the largest share of the Asia-Pacific hot fill packaging market, propelled by rapid urbanization, rising food and beverage consumption, and increasing demand for shelf-stable solutions. The country’s growing middle class and focus on convenience support the adoption of advanced hot fill packaging. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Hot Fill Packaging Market Share

The hot fill packaging industry is primarily led by well-established companies, including:

- United States Plastic Corp (U.S.)

- Berry Global Inc. (U.S.)

- Imperial Packaging (U.S.)

- DS Smith (U.K.)

- SAMKIN INDUSTRIES (India)

- Smurfit Kappa (Ireland)

- RESILUX NV (Belgium)

- MJS Packaging (U.S.)

- Gualapack S.p.A. (Italy)

- Hetzner Online GmbH (Germany)

- Kaufman Container (U.S.)

- Pipeline Packaging (U.S.)

- Amcor plc (Australia)

- Graham Packaging Company (U.S.)

- Borealis AG (Austria)

What are the Recent Developments in Global Hot Fill Packaging Market?

- In February 2024, Dohler announced the expansion of its Cartersville, Georgia production plant to spur additional development. This project aims to double the capacity and include cutting-edge production lines for Syrups, Compounds, Liquid Flavors, and Extractions, showing the company's dedication to the Americas. It expands the company's hot fill bottling capacity and boosts flavor creation capability

- In October 2023, Sidel Group acquired PET Engineering, strengthening its packaging solutions portfolio across water, soft drinks, liquid dairy products, and beer. This strategic move enhances Sidel’s expertise in hot-fill packaging, expanding its capabilities in container design, qualification, and blowing processes. PET Engineering, known for its innovative packaging designs, brings award-winning expertise to Sidel, reinforcing its commitment to sustainable and efficient packaging solutions

- In August 2023, Amcor acquired Phoenix Flexibles, expanding its capacity in the Indian market. Phoenix Flexibles, located in Gujarat, India, generates approximately USD 20 million per year from the sale of flexible packaging for food, home care, and personal care applications. The acquisition also adds advanced film technology, enabling local production of a broader range of more sustainable packaging solutions, and brings capabilities allowing Amcor to expand its product offering in attractive high-value segments

- In February 2023, Sealed Air (SEE) completed its acquisition of Liquibox for on a cash and debt-free basis. This strategic move unites two leaders in flexible packaging, accelerating the growth of SEE’s CRYOVAC® brand Fluids & Liquids business. Liquibox, known for its Bag-in-Box sustainable packaging solutions, serves fresh food, beverage, consumer goods, and industrial markets. The acquisition enhances SEE’s automation and sustainability efforts, reinforcing its commitment to innovative packaging technologies

- In September 2021, UFlex, Hoffer Plastics, and Mespack partnered to develop a sustainable solution for hot-fill pouch recycling. Their mono-polymer structure enables 100% recyclability, addressing challenges in packaging waste management. The turnkey solution integrates recyclable spout caps and laminate materials, ensuring efficient processing within existing PP recycling streams. This innovation supports eco-conscious brands in achieving sustainability goals while maintaining product integrity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HOT FILL PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HOT FILL PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL HOT FILL PACKAGING MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 PREMIUM INSIGHTS

6.1 CONSUMER BUYING BEHAVIOUR

6.2 FACTORS AFFECTING BUYING DECISION

6.3 PRODUCT ADOPTION SCENARIO

6.4 PORTER’S FIVE FORCES

6.5 REGULATION COVERAGE

6.6 RAW MATERIAL SOURCING ANALYSIS

6.7 IMPORT EXPORT SCENARIO

6.8 TECHNICAL CONSIDERATIONS WHILE DESIGNING A BOTTLE FOR HOT FILL PACKAGING

6.9 PHYSICAL PROPERTIES OF PET BOTTLES THAT ARE REQUIRED FOR HOT FILL PACKAGING

6.1 CHANGES IN PHYSICAL PROPERTIES OF PET BOTTLE WHEN BLENDED/NOT BLENDED WITH OTHER RESINS

6.11 FUTURE PROSPECTS OF HOT FILL PACKAGING V/S ASEPTIC PACKAGING

6.12 POLYETHYLENE FURONATE (PEF) FOR HOT FILL PACKAGING

7 PRODUCTION CAPACITY OUTLOOK

8 PRICE INDEX

9 BRAND OUTLOOK

9.1 BRAND COMPARATIVE ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 IMPACT OF ECONOMIC SLOWDOWN

10.1 IMPACT ON PRICES

10.2 IMPACT ON SUPPLY CHAIN

10.3 IMPACT ON SHIPMENT

10.4 IMPACT ON DEMAND

10.5 IMPACT ON STRATEGIC DECISIONS

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 GLOBAL HOT FILL PACKAGING MARKET, BY PRODUCT TYPE , 2022-2031 (USD MILLION) (MILLION UNITS)

12.1 OVERVIEW

12.2 BOTTLES

12.2.1 BY PLASTIC TYPE

12.2.1.1. PET

12.2.1.2. HDPE

12.2.1.3. LDPE

12.2.1.4. POLYPROPYLENE (PP)

12.2.1.5. OTHERS

12.3 JARS

12.4 CONTAINERS

12.5 POUCHES

12.6 CANS

12.7 CAPS & CLOSURES

12.8 OTHERS

13 GLOBAL HOT FILL PACKAGING MARKET, BY MATERIAL TYPE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 POLYETHYLENE TEREPHTHALATE (PET)

13.3 GLASS

13.4 POLYPROPYLENE

13.5 OTHERS

14 GLOBAL HOT FILL PACKAGING MARKET,BY PACKAGING LAYER, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 PRIMARY

14.3 SECONDARY

14.4 TERTIARY

15 GLOBAL HOT FILL PACKAGING MARKET,BY CAPACITY, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 UP TO 12 OZ

15.3 13 OZ - 32 OZ

15.4 33 OZ – 64 OZ

15.5 ABOVE 64 OZ

16 GLOBAL HOT FILL PACKAGING MARKET,BY MACHINE TYPE, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 MANUAL

16.3 AUTOMATIC

17 GLOBAL HOT FILL PACKAGING MARKET, BY END-USE, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 BEVERAGES

17.2.1 BEVERAGES, BY CATEGORY

17.2.1.1. JUICES

17.2.1.2. SPORTS DRINKS

17.2.1.3. TEAS

17.2.1.4. FLAVORED WATERS

17.2.1.5. OTHERS

17.2.2 BEVERAGES, BY PRODUCT TYPE

17.2.2.1. BOTTLES

17.2.2.1.1. JARS

17.2.2.1.2. CONTAINERS

17.2.2.1.3. POUCHES

17.2.2.1.4. CANS

17.2.2.1.5. CAPS & CLOSURES

17.2.2.1.6. OTHERS

17.3 SAUCES, DRESSINGS AND CONDIMENTS

17.3.1 SAUCES, DRESSINGS, AND CONDIMENTS, BY CATEGORY

17.3.1.1. SAUCES

17.3.1.2. JAMS

17.3.1.3. JELLIES

17.3.1.4. MAYONNAISE

17.3.1.5. OTHERS

17.3.2 SAUCES, DRESSINGS, AND CONDIMENTS, BY PRODUCT TYPE

17.3.2.1. BOTTLES

17.3.2.2. JARS

17.3.2.3. CONTAINERS

17.3.2.4. POUCHES

17.3.2.5. CANS

17.3.2.6. CAPS & CLOSURES

17.3.2.7. OTHERS

17.4 LIQUID FOOD PRODUCTS

17.4.1 LIQUID FOOD PRODUCTS, BY CATEGORY

17.4.2 SOUPS

17.4.3 BROTHS

17.4.4 READY-TO-EAT MEALS

17.4.4.1. LIQUID FOOD PRODUCTS, BY PRODUCT TYPE

17.4.4.1.1. BOTTLES

17.4.4.1.2. JARS

17.4.4.1.3. CONTAINERS

17.4.4.1.4. POUCHES

17.4.4.1.5. CANS

17.4.4.1.6. CAPS & CLOSURES

17.4.4.1.7. OTHERS

17.5 OTHERS

17.5.1 OTHERS, BY PRODUCT TYPE

17.5.1.1. BOTTLES

17.5.1.2. JARS

17.5.1.3. CONTAINERS

17.5.1.4. POUCHES

17.5.1.5. CANS

17.5.1.6. CAPS & CLOSURES

17.5.1.7. OTHERS

18 GLOBAL HOT FILL PACKAGING MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

18.1 GLOBAL HOT FILL PACKAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.2 NORTH AMERICA

18.2.1 U.S.

18.2.2 CANADA

18.2.3 MEXICO

18.3 EUROPE

18.3.1 GERMANY

18.3.2 U.K.

18.3.3 ITALY

18.3.4 FRANCE

18.3.5 SPAIN

18.3.6 RUSSIA

18.3.7 SWITZERLAND

18.3.8 TURKEY

18.3.9 BELGIUM

18.3.10 NETHERLANDS

18.3.11 LUXEMBURG

18.3.12 REST OF EUROPE

18.4 ASIA-PACIFIC

18.4.1 JAPAN

18.4.2 CHINA

18.4.3 SOUTH KOREA

18.4.4 INDIA

18.4.5 SINGAPORE

18.4.6 THAILAND

18.4.7 INDONESIA

18.4.8 MALAYSIA

18.4.9 PHILIPPINES

18.4.10 AUSTRALIA & NEW ZEALAND

18.4.11 REST OF ASIA-PACIFIC

18.5 SOUTH AMERICA

18.5.1 BRAZIL

18.5.2 ARGENTINA

18.5.3 REST OF SOUTH AMERICA

18.6 MIDDLE EAST AND AFRICA

18.6.1 SOUTH AFRICA

18.6.2 EGYPT

18.6.3 SAUDI ARABIA

18.6.4 UNITED ARAB EMIRATES

18.6.5 ISRAEL

18.6.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL HOT FILL PACKAGING MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS AND ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

21 GLOBAL HOT FILL PACKAGING MARKET- COMPANY PROFILES

21.1 AMCOR PLC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT UPDATES

21.2 SIDEL

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT UPDATES

21.3 GRAHAM PACKAGING COMPANY

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT UPDATES

21.4 BERRY GLOBAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT UPDATES

21.5 IMPERIAL PACKAGING

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT UPDATES

21.6 DS SMITH

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT UPDATES

21.7 RPC GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT UPDATES

21.8 SMURFIT KAPPA

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT UPDATES

21.9 KLÖCKNER PENTAPLAST

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT UPDATES

21.1 KAUFMAN CONTAINER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT UPDATES

21.11 AISAPACK SA

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT UPDATES

21.12 SAN MIGUEL YAMAMURA PACKAGING CORPORATION (SMYPC)

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT UPDATES

21.13 BOREALISAG

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT UPDATES

21.14 RESILUX NV

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT UPDATES

21.15 MJS PACKAGING

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT UPDATES

21.16 GUALA PACK S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 LOG PLASTIC PRODUCTS COMPANY LTD.

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT UPDATES

21.18 PIPELINE PACKAGING

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT UPDATES

21.19 PRETIUM PACKAGING

21.2 NOVOLEX

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT UPDATES

21.21 CROWN

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 PRODUCT PORTFOLIO

21.21.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 CONCLUSION

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Hot Fill Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hot Fill Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hot Fill Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.