Global Micro Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.15 Billion

USD

4.08 Billion

2024

2032

USD

2.15 Billion

USD

4.08 Billion

2024

2032

| 2025 –2032 | |

| USD 2.15 Billion | |

| USD 4.08 Billion | |

|

|

|

|

Micro packaging Market Size

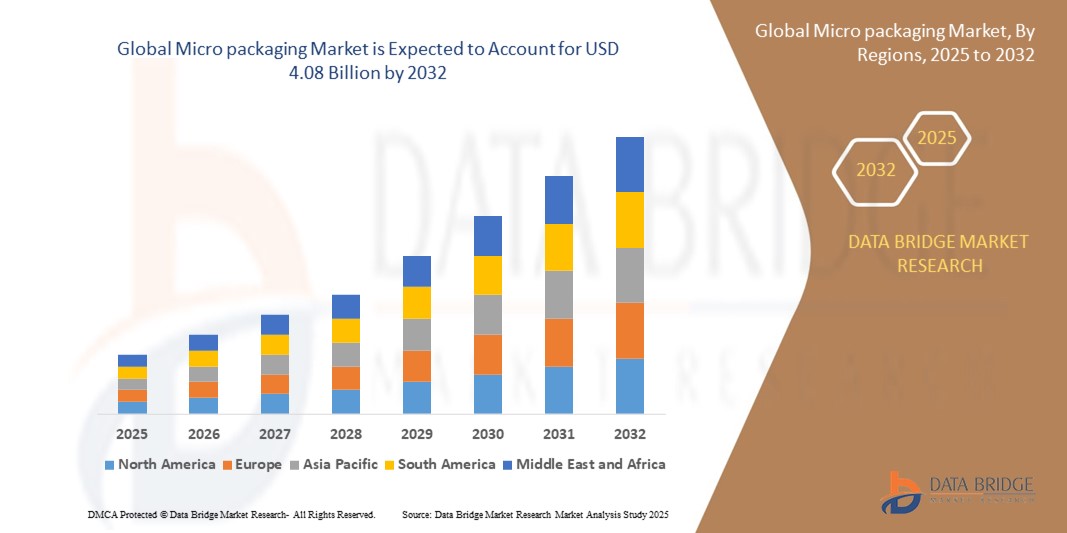

- The global micro packaging market size was valued at USD 2.15 billion in 2024 and is expected to reach USD 4.08 billion by 2032, growing at a CAGR of 8.10% during the forecast period.

- This growth is primarily fueled by increasing demand for high-barrier, sustainable, and smart packaging solutions across sectors such as pharmaceuticals, food & beverages, and electronics, along with the rising emphasis on extended shelf life and contamination prevention in packaged goods.

Micro packaging Market Analysis

- Micro packaging involves the integration of nanoscale or microscale features into packaging materials to enhance functionalities such as barrier performance, antimicrobial properties, and smart responsiveness. These characteristics are increasingly vital for maintaining product integrity and ensuring consumer safety across sensitive applications.

- The market is witnessing strong growth momentum due to the rising penetration of smart packaging technologies, increased adoption in pharmaceutical and food safety applications, and the push for eco-friendly packaging materials with reduced environmental footprint.

- Asia-Pacific is projected to dominate the global micro packaging market with a market share of 38.76%, driven by robust growth in the FMCG, pharmaceutical, and electronics manufacturing sectors across China, India, and Southeast Asia. This region also benefits from government initiatives supporting innovation in sustainable packaging.

- North America is expected to be the fastest-growing region in the micro packaging market during the forecast period, propelled by the adoption of advanced packaging materials in healthcare and personal care products, alongside increasing R&D investments in nanotechnology-based packaging.

- Among materials, the Polyethylene Terephthalate (PET) segment is expected to dominate the market with a share of 33.14%, owing to its high mechanical strength, clarity, and excellent gas barrier properties, making it ideal for food, beverage, and pharmaceutical packaging applications.

Report Scope and Micro packaging Market Segmentation

|

Attributes |

Micro packaging Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Micro packaging Market Trends

“Growing Adoption of Smart and Functional Packaging Technologies”

- A major trend shaping the global micro packaging market is the growing adoption of smart and functional packaging technologies integrated with antimicrobial, oxygen-scavenging, and temperature-sensitive features.

- This trend is driven by increasing demand for product safety, shelf-life extension, and real-time monitoring in sectors such as pharmaceuticals, food & beverages, and electronics.

- For instance, companies like Amcor and Sealed Air are actively developing intelligent micro packaging solutions embedded with nanocoatings and biosensors to maintain product freshness, detect contamination, and ensure tamper evidence.

- With stricter regulatory standards and heightened consumer awareness of product integrity, there is a growing need for packaging that not only protects but also responds to environmental conditions and improves supply chain transparency.

- As industries aim to reduce waste, ensure traceability, and improve consumer trust, the adoption of advanced micro packaging technologies is expected to accelerate, especially in healthcare and perishable food segments.

Micro packaging Market Dynamics

Driver

“Surging Demand for Protective and Sustainable Packaging in Pharma and F&B”

- The rising demand for protective and sustainable packaging solutions in the pharmaceutical and food & beverage industries is a key growth driver for the global micro packaging market.

- These sectors require materials that offer barrier protection against moisture, oxygen, UV radiation, and microbial contamination to ensure product stability and consumer safety.

- Increasing regulatory scrutiny, consumer demand for quality assurance, and global cold-chain expansion are reinforcing the need for micro packaging technologies that combine strength, sterility, and environmental performance.

- For example, Gerresheimer has developed advanced micro vial packaging with ultra-thin barrier coatings for biologics and injectables, while Amcor offers recyclable micro packaging solutions for snack foods and dairy products with high oxygen sensitivity.

- The combination of functionality and sustainability in micro packaging is driving its integration in product lines, particularly as brands look to enhance shelf life and reduce packaging waste.

Restraint/Challenge

“High Production Cost and Complex Manufacturing Processes”

- One of the key challenges restraining the micro packaging market is the high cost of production, especially for smart and bio-based materials that require complex fabrication techniques and high-purity inputs.

- Incorporating nanomaterials, biosensors, or multi-layered composites into packaging increases manufacturing complexity, which can raise final product costs—making it difficult for companies, particularly SMEs, to adopt at scale.

- For instance, manufacturers integrating oxygen-scavenging or anti-counterfeit features into flexible pouches or pharmaceutical vials must invest in specialized infrastructure and R&D, leading to higher operational expenditures.

- This cost barrier can limit adoption in price-sensitive regions and industries, where traditional packaging solutions are still dominant due to affordability and simpler logistics.

- Unless scalable and cost-effective technologies are developed, the high production cost may slow the mainstream adoption of micro packaging, especially in developing markets with tighter margins and limited technological access.

Micro packaging Market Scope

The market is segmented on the basis of type, and application.

- By Material Type

On the basis of material type, the Micro Packaging Market is segmented into Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Polyethylene (PE), Paper & Paperboard, and Others. The Polyethylene Terephthalate (PET) segment dominates the global micro packaging market, accounting for the largest revenue share of 31.6% in 2025. PET’s dominance is attributed to its superior barrier properties, lightweight structure, recyclability, and suitability for both food-grade and pharmaceutical packaging applications. Its clarity, impact resistance, and compatibility with high-speed filling lines make it ideal for single-use and extended shelf-life products.

However, the Paper & Paperboard segment is projected to grow at the highest CAGR of 8.23% during the forecast period of 2025–2032, driven by rising environmental awareness and the growing demand for sustainable and biodegradable packaging alternatives. With regulatory pressure mounting against plastic usage, industries such as personal care and food & beverages are increasingly adopting paper-based micro packaging as a viable eco-friendly solution.

- By Product Type

Based on product type, the Micro Packaging Market is categorized into Vials, Boxes & Pouches, Trays, and Others. The Vials segment is anticipated to hold the largest market share of 29.8% in 2025, primarily due to its extensive use in the pharmaceutical sector for packaging biologics, vaccines, and other injectable formulations that require sterile and tamper-proof micro packaging. Growing demand for precision packaging in biologics and drug delivery systems will continue to drive vial demand across the healthcare sector.

Conversely, the Boxes & Pouches segment is expected to register the highest CAGR of 7.94% from 2025 to 2032, supported by increasing demand in the food and electronics sectors for compact, flexible, and easy-to-handle packaging solutions. These products offer customizability, reduced material use, and better shelf presence, making them attractive in modern retail and e-commerce environments.

- By Application

On the basis of application, the Micro Packaging Market is segmented into Food & Beverages, Pharmaceuticals, Personal Care, Electronics, and Others. The Food & Beverages segment leads the market with the largest share of 33.5% in 2025, owing to the increasing demand for freshness preservation, contamination control, and convenient single-use formats. Micro packaging enables portion control, waste reduction, and barrier protection—features critical to maintaining product quality and shelf life in perishable goods.

However, the Pharmaceuticals segment is anticipated to grow at the fastest CAGR of 8.41% during 2025–2032, driven by innovations in controlled drug release, cold chain packaging, and compliance packaging for patient safety. Rising global healthcare expenditure, coupled with the growing focus on biologics and sensitive formulations, is accelerating the adoption of advanced micro packaging formats in the medical field.

Global Micro packaging Market Regional Analysis

North America Micro packaging Market Insight

North America holds a substantial share in the global micro packaging market in 2024, supported by strong demand from the food & beverage, pharmaceuticals, and personal care industries. The region benefits from early adoption of advanced packaging technologies and rising demand for single-serve, tamper-evident, and shelf-stable packaging formats.

The focus on consumer convenience, coupled with stringent regulatory standards for product safety and labeling, is accelerating the use of micro packaging across sectors. Growth in e-commerce and digital retail is further amplifying demand for compact and protective packaging formats.

- U.S. Micro Packaging Market Insight

The U.S. dominates the North American micro packaging market in 2025, driven by robust demand in the healthcare and ready-to-eat food sectors. Increasing consumption of convenience foods, pharmaceuticals, and nutraceuticals is fostering the adoption of micro packaging solutions such as vials, pouches, and blister packs. Additionally, the presence of major packaging manufacturers and ongoing innovation in smart and sustainable materials are propelling market growth.

- Canada Micro Packaging Market Insight

The Canadian micro packaging market is projected to expand steadily, supported by rising demand in organic food, personal care, and OTC pharmaceuticals. Consumers are increasingly seeking portable, eco-friendly packaging formats, prompting manufacturers to invest in recyclable and compostable materials. Government support for sustainable packaging initiatives is also encouraging a shift from traditional plastics to paper-based and bio-based micro packaging alternatives.

Europe Micro Packaging Market Insight

Europe is expected to witness significant growth in the micro packaging market through the forecast period, driven by strict environmental regulations, demand for sustainable materials, and innovations in pharmaceutical and personal care packaging. The region is leading in packaging sustainability and circular economy efforts, prompting strong adoption of paperboard and bio-based polymers in micro packaging formats.

- Germany Micro Packaging Market Insight

Germany is a key market in Europe, benefiting from a well-established pharmaceutical and personal care manufacturing base. The country’s emphasis on product integrity and regulatory compliance has boosted the demand for micro packaging formats such as sterile vials, dose-specific trays, and recyclable pouches. Innovations in smart packaging and RFID-integrated solutions are also gaining traction in the German market.

- France Micro Packaging Market Insight

France is poised to experience steady growth in micro packaging demand, particularly in the organic food and luxury personal care segments. The country’s strong push toward eco-design and sustainable consumption is encouraging manufacturers to adopt minimalist, biodegradable, and recyclable packaging materials. Growth in high-end cosmetics and export-oriented gourmet foods is also contributing to premium micro packaging adoption.

Asia-Pacific Micro Packaging Market Insight

The Asia-Pacific region is projected to register the fastest CAGR exceeding 25% in 2025, fueled by booming urbanization, middle-class expansion, and rising consumer spending on packaged goods. Rapid industrial growth and evolving retail landscapes are creating strong demand for compact, safe, and visually appealing packaging across food, pharmaceuticals, electronics, and cosmetics sectors.

- China Micro Packaging Market Insight

China leads the Asia-Pacific micro packaging market, underpinned by its massive FMCG, electronics, and pharmaceutical industries. The shift toward convenience foods, growing healthcare needs, and expansion of online retail channels are driving demand for efficient micro packaging solutions. Government initiatives promoting green packaging and domestic innovation in flexible formats are reshaping the packaging landscape.

- India Micro Packaging Market Insight

India’s micro packaging market is expected to grow at a remarkable CAGR, driven by increasing consumption of packaged snacks, personal hygiene products, and generics. Rising consumer awareness, improved cold chain infrastructure, and supportive government policies on food safety and pharmaceutical packaging are pushing the market forward. The push toward sustainable packaging in metropolitan areas is further encouraging the adoption of paper and biodegradable formats.

Micro packaging Market Share

The Micro packaging industry is primarily led by well-established companies, including:

- Amcor plc (UK)

- Sealed Air Corporation (U.S.)

- Berry Global Inc. (U.S.)

- Huhtamaki Oyj (Finland)

- Sonoco Products Company (U.S.)

- Uflex Ltd. (India)

- Winpak Ltd. (Canada)

- CCL Industries Inc. (Canada)

- Smurfit Kappa Group (Ireland)

- Printpack Inc. (U.S.)

- ProAmpac LLC (U.S.) – Privately held

- WestRock Company (U.S.)

- Tetra Pak International S.A. (Switzerland)

- SteriPack Group (Ireland)

Latest Developments in Global Micro packaging Market

- In February 2025, Amcor plc (UK) unveiled a new range of ultra-lightweight, recyclable PET vials and pouches tailored for the pharmaceuticals and personal care industries. These innovations aim to meet growing consumer demand for sustainable micro packaging solutions while reducing carbon footprint and improving shelf-life integrity for sensitive formulations.

- In November 2024, Berry Global Inc. (U.S.) launched an advanced micro tray packaging solution using bio-based polyethylene for food applications. The new trays, designed for minimal material use and enhanced product protection, align with the company's commitment to circular economy goals and expanding sustainable packaging in the food sector.

- In June 2024, Uflex Ltd. (India) developed a new line of barrier-coated paper-based micro packaging formats for single-serve food and beverage sachets. This development reduces plastic usage and improves recyclability while maintaining product safety and performance, enhancing Uflex’s role in the FMCG micro packaging space, especially in emerging markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Micro Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Micro Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Micro Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.