Global Microwave Absorbing Materials Market

Market Size in USD Million

CAGR :

%

USD

449.21 Million

USD

749.04 Million

2024

2032

USD

449.21 Million

USD

749.04 Million

2024

2032

| 2025 –2032 | |

| USD 449.21 Million | |

| USD 749.04 Million | |

|

|

|

|

What is the Global Microwave Absorbing Materials Market Size and Growth Rate?

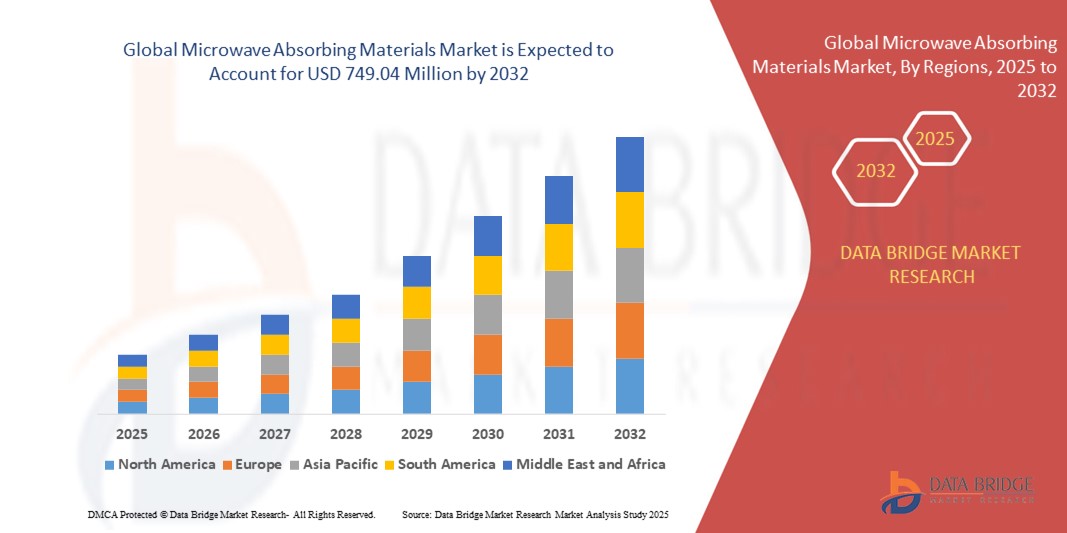

- The global microwave absorbing materials market size was valued at USD 449.21 million in 2024 and is expected to reach USD 749.04 million by 2032, at a CAGR of 6.60% during the forecast period

- The growth of the microwave absorbing materials market can be attributed to the expansion of communication infrastructure, including 5G networks, there is a heightened need for materials that can absorb stray electromagnetic radiation to prevent interference and ensure the reliability of communication systems. Microwave absorbing materials play a vital role in minimizing signal loss and optimizing the performance of wireless communication systems, which propel the market growth in the forecast period

What are the Major Takeaways of Microwave Absorbing Materials Market?

- The automotive industry is increasingly incorporating advanced electronic systems and sensors for safety, connectivity, and autonomous driving features. Microwave absorbing materials play a crucial role in reducing electromagnetic interference (EMI) within vehicles, improving signal quality, and ensuring the proper functioning of electronic components. With the increasing integration of electronic components in modern vehicles, the demand for these materials is expected to rise

- The rising need for advanced radar and stealth technologies in defense applications is driving the demand for microwave absorbing materials. These materials are crucial for reducing the radar cross-section (RCS) of military equipment and enhancing stealth capabilities

- North America dominated the microwave absorbing materials market with the largest revenue share of 42.14% in 2024, driven by rising demand for home automation, security systems, and increased awareness of smart home technology

- Asia-Pacific market is expected to grow at the fastest CAGR of 8.47% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The carbon-based absorbers segment dominated the market in 2024 with a revenue share of 38.5%, driven by their lightweight nature, high absorption efficiency, and broadband performance

Report Scope and Microwave Absorbing Materials Market Segmentation

|

Attributes |

Microwave Absorbing Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Microwave Absorbing Materials Market?

Advancements in Lightweight, Broadband, and Multifunctional Absorbers

- A significant trend in the global microwave absorbing materials (MAM) market is the development of lightweight, broadband, and multifunctional absorbers that can be integrated into diverse applications, including defense, aerospace, electronics, and telecommunications. These innovations are enhancing performance while reducing weight and thickness

- For instance, carbon-based and polymer-composite MAMs are increasingly being incorporated into stealth coatings, EMI shielding solutions, and 5G device enclosures, offering superior absorption over a wide frequency range

- Advances in nanomaterials, metamaterials, and hybrid composites enable MAMs to deliver high absorption efficiency, tunable frequency ranges, and thermal stability, expanding their adoption across both military and commercial applications

- Companies such as Laird Technologies, ARC Technologies, and Mast Technologies are developing next-generation MAMs with multifunctional properties, including radar cross-section reduction, electromagnetic interference mitigation, and structural integration capabilities

- The trend toward miniaturization and multifunctionality is reshaping user expectations for high-performance absorbers, as end-users increasingly demand solutions that combine lightweight design with superior electromagnetic performance

- Consequently, the demand for MAMs with customizable absorption profiles, environmentally friendly materials, and ease of integration is growing rapidly across sectors, including defense, electronics, and telecommunication infrastructure

What are the Key Drivers of Microwave Absorbing Materials Market?

- The increasing use of radar, satellite, and wireless communication technologies across defense and commercial sectors is a primary driver of the MAM market. Advanced military platforms and 5G infrastructure require high-performance materials to reduce radar signatures and suppress electromagnetic interference

- For instance, in March 2024, Laird Technologies launched a series of lightweight carbon-composite MAM panels designed for aerospace and defense applications, highlighting the push for high-performance absorbers

- Rising adoption of EMI shielding in consumer electronics, automotive, and industrial equipment is further driving demand for microwave absorbers with broadband performance, thermal stability, and structural compatibility

- The shift toward sustainable and multifunctional materials encourages manufacturers to develop eco-friendly MAMs using polymers, graphene, and recycled composites, expanding market potential

- Growth is also fueled by the need for miniaturized devices, as electronics and telecommunication equipment increasingly require compact and efficient absorbers that do not compromise performance

Which Factor is Challenging the Growth of the Microwave Absorbing Materials Market?

- High material and production costs pose a significant barrier to adoption, particularly for advanced nanomaterial- or metamaterial-based absorbers, which involve complex synthesis and fabrication processes

- For instance, aerospace and defense companies may face budget constraints when integrating premium MAMs into large-scale platforms

- Performance limitations under extreme environmental conditions, such as high temperatures, humidity, or mechanical stress, can restrict the use of certain absorbers in aerospace and industrial applications

- Standardization and quality control remain challenges, as variations in material composition and thickness can affect absorption efficiency across different frequency bands

- Overcoming these barriers through cost-effective synthesis, scalable production methods, and enhanced environmental resilience will be crucial for driving sustained growth and broader adoption of microwave absorbing materials

How is the Microwave Absorbing Materials Market Segmented?

The market is segmented on the basis of material, product type, and application.

- By Material

On the basis of material, the microwave absorbing materials market is segmented into ferrite-based absorbers, carbon-based absorbers, metal-based absorbers, dielectric-based absorbers, and others. The carbon-based absorbers segment dominated the market in 2024 with a revenue share of 38.5%, driven by their lightweight nature, high absorption efficiency, and broadband performance. Carbon-based materials are widely used in defense stealth applications, 5G devices, and EMI shielding, owing to their tunable properties and ease of integration into composites.

The ferrite-based absorbers segment is anticipated to witness the fastest CAGR of 22% from 2025 to 2032, supported by growing demand in aerospace and industrial equipment where high thermal stability and frequency-selective absorption are critical. The material trend favors hybrid composites and nanostructured absorbers, meeting the dual demand for lightweight designs and high-performance multifunctionality across industries.

- By Product Type

On the basis of product type, the microwave absorbing materials market is segmented into radar absorbing materials (RAM), microwave absorbing paints and coatings, microwave absorbing sheets and films, microwave absorbing fabrics, and others. The RAM segment dominated the market in 2024 with a revenue share of 42%, largely due to its critical application in defense stealth technology, radar signature reduction, and aerospace platforms. RAM materials offer high absorption efficiency across multiple frequency bands, making them indispensable for military and high-end aerospace applications.

The microwave absorbing paints and coatings segment is projected to grow at the fastest CAGR of 21% from 2025 to 2032, driven by increasing demand for lightweight, conformal coatings that can be applied on complex surfaces in commercial electronics, automotive, and industrial equipment. This segment also benefits from the trend toward eco-friendly, low-VOC formulations, expanding its adoption in environmentally regulated regions.

- By Application

On the basis of application, the microwave absorbing materials market is segmented into defense and military, aerospace, electronics and telecommunications, automotive, medical, and others. The defense and military segment dominated the market in 2024 with a revenue share of 45%, attributed to the high demand for radar signature reduction, stealth coatings, and electromagnetic interference suppression in military platforms.

The electronics and telecommunications segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, fueled by the rising adoption of 5G networks, IoT devices, and consumer electronics that require compact, efficient, and broadband absorbers. The growth in aerospace, automotive, and medical applications further supports the market, as MAMs are increasingly incorporated into aerospace composites, automotive EMI shields, and medical imaging devices. The segment trend emphasizes multi-functional, lightweight, and durable materials to meet performance requirements across diverse environments.

Which Region Holds the Largest Share of the Microwave Absorbing Materials Market?

- North America dominated the microwave absorbing materials market with the largest revenue share of 42.14% in 2024, driven by rising demand for home automation, security systems, and increased awareness of smart home technology

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by microwave absorbing materials with other smart devices such as thermostats, lighting systems, and connected appliances

- This widespread adoption is further supported by high disposable incomes, a technology-savvy population, and the growing preference for remote monitoring and control, positioning microwave absorbing materials as a favored solution across residential and commercial sectors

U.S. Microwave Absorbing Materials Market Insight

U.S. captured the largest revenue share in 2024 within North America, propelled by the swift adoption of connected devices and the growing trend of home automation. Consumers are increasingly prioritizing home security through intelligent, keyless entry systems. The growing interest in DIY smart home setups, combined with strong demand for voice-controlled systems and mobile app integration, continues to drive market expansion. In addition, the increasing integration of platforms such as Alexa, Google Assistant, and Apple HomeKit significantly supports the industry’s growth.

Europe Microwave Absorbing Materials Market Insight

Europe market is projected to expand at a substantial CAGR over the forecast period, driven by strict security regulations and the rising demand for enhanced safety in homes and offices. Increasing urbanization and the growing prevalence of connected devices are fostering Microwave Absorbing Materials adoption. European consumers are attracted to the convenience, energy efficiency, and multi-functional capabilities these devices offer. The market is witnessing strong growth across residential, commercial, and multi-family housing applications, with Microwave Absorbing Materials being integrated into both new constructions and renovation projects.

U.K. Microwave Absorbing Materials Market Insight

U.K. market is expected to grow at a notable CAGR during the forecast period, driven by the increasing adoption of home automation and rising concerns about burglary and safety. Homeowners and businesses are opting for keyless entry solutions that provide convenience and enhanced security. The U.K.’s strong e-commerce and retail infrastructure, combined with widespread adoption of connected devices, continues to propel market growth.

Germany Microwave Absorbing Materials Market Insight

Germany market is anticipated to expand at a considerable CAGR during the forecast period, fueled by growing awareness of digital security and demand for eco-conscious, technologically advanced solutions. Germany’s advanced infrastructure, emphasis on innovation, and sustainability initiatives promote the integration of Microwave Absorbing Materials, particularly in residential and commercial buildings. Increasing adoption of home automation systems and preference for secure, privacy-focused solutions further supports market expansion.

Which Region is the Fastest Growing Region in the Microwave Absorbing Materials Market?

Asia-Pacific market is expected to grow at the fastest CAGR of 8.47% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Growing interest in smart homes, coupled with government initiatives promoting digitalization, is boosting Microwave Absorbing Materials adoption. In addition, as APAC becomes a manufacturing hub for these components and systems, affordability and accessibility are expanding to a broader consumer base.

Japan Microwave Absorbing Materials Market Insight

Japan market is gaining momentum due to high-tech culture, rapid urbanization, and demand for convenience. Security remains a key priority, and the adoption of microwave absorbing materials is increasing with the rise of smart homes and connected buildings. Integration with other IoT devices such as home security cameras and lighting systems is driving growth. Furthermore, Japan’s aging population is such asly to fuel demand for easy-to-use, secure access solutions across residential and commercial sectors.

China Microwave Absorbing Materials Market Insight

China market held the largest revenue share in Asia-Pacific in 2024, driven by a growing middle class, rapid urbanization, and high technological adoption rates. China is one of the largest markets for smart home devices, and microwave absorbing materials are increasingly deployed in residential, commercial, and rental properties. Government initiatives promoting smart cities, availability of cost-effective solutions, and strong domestic manufacturers are key factors propelling market growth.

Which are the Top Companies in Microwave Absorbing Materials Market?

The microwave absorbing materials industry is primarily led by well-established companies, including:

- Laird Technologies (U.S.)

- ESCO Technologies Corporation (U.S.)

- ARC Technologies Inc. (U.S.)

- Western Rubber & Supply Inc. (India)

- Cuming Microwave (U.S.)

- Mast Technologies (U.S.)

- Thorndike Corporation (U.S.)

What are the Recent Developments in Global Microwave Absorbing Materials Market?

- In November 2023, Micromag was recognized as a significant player in RAM coating processes, highlighting its growing influence in the materials market and reinforcing its position in advanced coating solutions

- In September 2024, 3M expanded its product portfolio to serve the defense, telecommunications, and aerospace sectors, leveraging advanced research and development to introduce high-performance RAM solutions and maintain its industry leadership

- In July 2023, L3Harris Technologies was identified as a key contributor to the RAM market within Advanced Research and Technologies (ARTA), strengthening its market presence through rapid advancements in RAM applications for defense and aerospace radars, further solidifying its competitive position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Microwave Absorbing Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Microwave Absorbing Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Microwave Absorbing Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.