Global Office Based Labs Market

Market Size in USD Billion

CAGR :

%

USD

55.16 Billion

USD

114.00 Billion

2025

2033

USD

55.16 Billion

USD

114.00 Billion

2025

2033

| 2026 –2033 | |

| USD 55.16 Billion | |

| USD 114.00 Billion | |

|

|

|

|

Office-Based Labs Market Size

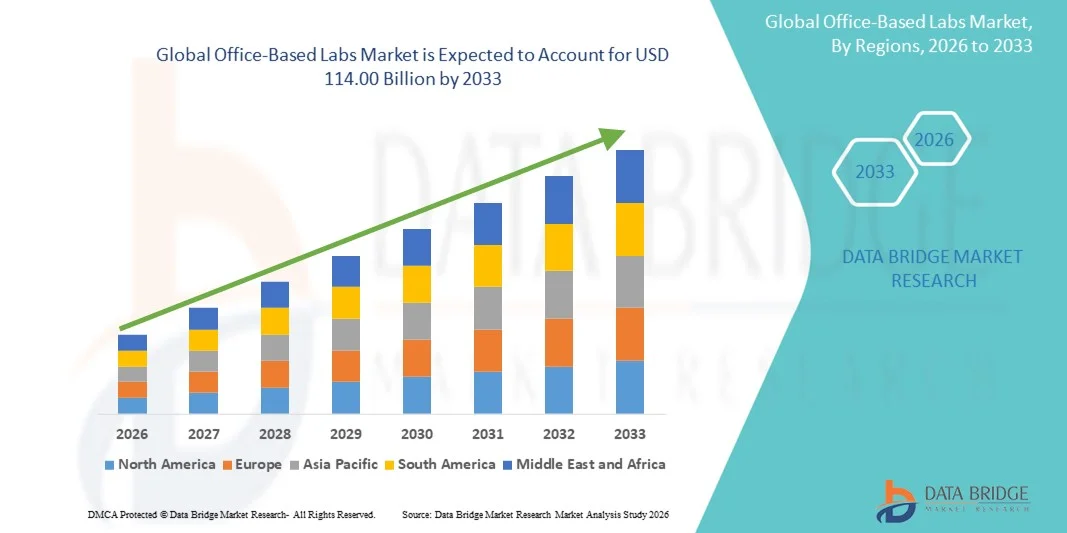

- The global Office-Based Labs market size was valued at USD 55.16 billion in 2025 and is expected to reach USD 114.00 billion by 2033, at a CAGR of9.50% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced diagnostic technologies and the rising demand for efficient, on-site medical testing solutions in outpatient and office-based settings

- Moreover, healthcare providers are increasingly prioritizing rapid, accurate, and cost-effective testing, which is accelerating the deployment of office-based lab solutions and significantly contributing to the market’s expansion

Office-Based Labs Market Analysis

- Office‑Based Labs, providing on‑site diagnostic and laboratory testing services in outpatient and clinical office settings, are becoming increasingly essential in both primary care and specialty practices due to their ability to deliver faster results, improve patient convenience, and enhance overall clinical efficiency

- The growing demand for Office‑Based Labs is primarily driven by healthcare providers’ focus on rapid diagnostics, cost‑effective testing, and improved patient management, as well as the rising need for decentralized healthcare solutions that reduce hospital visits

- North America dominated the office‑based labs market with approximately 39.1% of the global revenue share in 2025, supported by its well‑established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players. The United States continues to lead market activity with substantial growth in office‑based lab adoption, particularly driven by advancements in diagnostic technologies and outpatient procedural services

- Asia‑Pacific is expected to be the fastest‑growing region in the office‑based labs market during the forecast period, driven by increasing healthcare access, growing awareness of the benefits of on‑site diagnostics, rising urbanization, and expanding disposable incomes that support broader adoption of office‑based lab setups

- The Single-Specialty Labs segment dominated the market with a revenue share of 47.5% in 2025, driven by its focused service offerings and ability to provide specialized care efficiently

Report Scope and Office-Based Labs Market Segmentation

|

Attributes |

Office-Based Labs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• LabCorp (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Office-Based Labs Market Trends

Growing Adoption of Advanced Diagnostics and Minimally Invasive Procedures

- A key and accelerating trend in the global office-based labs market is the increasing adoption of advanced diagnostic tools and minimally invasive procedures. These solutions allow healthcare providers to perform procedures in outpatient settings efficiently, reducing the need for hospital visits and improving patient experience

- For instance, many modern office-based labs now incorporate high-resolution imaging systems, point-of-care testing devices, and portable diagnostic equipment, enabling physicians to provide accurate and timely care without the delays associated with hospital-based procedures

- The integration of digital health tools within office-based labs, such as electronic medical records (EMR) and telehealth platforms, facilitates better patient management, appointment scheduling, and remote consultation. This improves workflow efficiency and allows providers to offer more personalized care

- Enhanced procedural efficiency, faster recovery times, and lower overall costs for both patients and providers are encouraging the adoption of office-based labs across multiple specialties, including dermatology, cardiology, gastroenterology, and ophthalmology

- The trend toward outpatient care and minimally invasive interventions is reshaping patient expectations, as more people now prefer convenient, accessible, and high-quality care closer to home. Companies such as Smith & Nephew and Ambu are expanding office-based solutions with compact, easy-to-use diagnostic and procedural equipment

- The demand for office-based labs that enable efficient, patient-centered care is rising rapidly across both developed and emerging markets, as healthcare systems aim to optimize resource utilization and improve patient satisfaction

Office-Based Labs Market Dynamics

Driver

Rising Demand for Cost-Effective, Patient-Centric Care

- The increasing need to reduce healthcare costs while maintaining high-quality care is a major driver for office-based labs. By shifting procedures from hospital settings to outpatient clinics, providers can minimize overhead expenses and improve resource allocation

- For instance, in March 2025, Ambu launched a portable endoscopy system designed for office-based procedures, highlighting the shift toward outpatient diagnostics and interventions. Such innovations are expected to drive the adoption of office-based lab solutions during the forecast period

- Patients are increasingly seeking convenient, accessible, and timely care, which office-based labs provide by reducing wait times and eliminating unnecessary hospital visits

- Furthermore, the push for minimally invasive procedures and preventive care is increasing the demand for well-equipped office-based labs. Physicians can perform routine interventions, diagnostics, and follow-up care in a controlled, patient-friendly environment

- The growing trend of outpatient-focused healthcare delivery and the expansion of insurance coverage for office-based procedures are further supporting market growth

Restraint/Challenge

Regulatory Compliance and Infrastructure Limitations

- Stringent regulatory requirements and the need for proper clinical infrastructure can pose significant challenges to the adoption of office-based labs. Ensuring compliance with local health regulations, quality standards, and safety protocols requires significant investment in training, equipment, and facility management

- For instance, delays in obtaining necessary certifications or meeting hygiene and safety standards can limit the scalability of office-based procedures

- In addition, smaller clinics or practices may face resource constraints, including the availability of trained staff, specialized equipment, or supporting IT infrastructure, which can hinder adoption

- Addressing these challenges through streamlined regulatory guidance, investment in standardized office-based lab setups, and training programs for clinical staff is crucial for sustained market growth

- While advancements in compact and cost-effective diagnostic and procedural equipment are helping mitigate some infrastructure challenges, overcoming regulatory and operational barriers will remain critical for the widespread adoption of office-based labs

Office-Based Labs Market Scope

The market is segmented on the basis of modality, service, and specialist.

- By Modality

On the basis of modality, the Office-Based Labs market is segmented into Single-Specialty Labs, Multi-Specialty Labs, and Hybrid Labs. The Single-Specialty Labs segment dominated the market with a revenue share of 47.5% in 2025, driven by its focused service offerings and ability to provide specialized care efficiently. These labs allow physicians to optimize resources and deliver high-quality care for a specific procedure type, such as cardiac, vascular, or gastroenterology interventions. Their operational simplicity makes them easier to manage and reduces overhead costs compared to multi-specialty setups. Single-specialty labs are particularly attractive to smaller practices and emerging markets due to lower infrastructure investment. Moreover, the increasing preference for outpatient procedures, patient convenience, and minimal hospital dependency is fueling their adoption. Technological advancements in equipment tailored for specific procedures further strengthen the dominance of this segment. Patient awareness about specialized outpatient care also contributes to strong demand. Reimbursement policies supporting outpatient procedures enhance profitability. In addition, focused marketing and branding strategies help single-specialty labs maintain a competitive edge. Established healthcare networks increasingly prefer these labs for predictable outcomes and streamlined workflows. The segment’s dominance is also backed by faster patient throughput and reduced scheduling complexity.

The Hybrid Labs segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, owing to their flexibility to combine multiple specialties under one roof. Hybrid labs allow for both diagnostic and interventional procedures, catering to diverse patient needs in a single visit. Their versatility is increasingly appreciated in urban centers and high-volume outpatient facilities. Rising patient demand for one-stop treatment solutions is a key driver for growth. Hybrid labs can efficiently accommodate multi-disciplinary teams, enhancing procedural efficiency. Integration of advanced equipment for multiple procedures ensures better utilization of space and resources. They also offer higher revenue potential for providers due to the broad range of services offered. Growing investments in advanced infrastructure and technology adoption accelerate their expansion. The ability to manage multiple procedures without hospital admission reduces overall healthcare costs for patients. Insurance coverage for outpatient hybrid procedures supports adoption. Increasing healthcare system focus on outpatient care and patient convenience further fuels the segment’s growth. Enhanced procedural efficiency and patient satisfaction make hybrid labs a preferred choice for modern healthcare providers.

- By Service

On the basis of service, the market is segmented into Peripheral Vascular Intervention, Endovascular Interventions, Cardiac, Interventional Radiology, Venous, and Others. The Cardiac segment accounted for the largest revenue share of 41.8% in 2025, driven by the increasing prevalence of cardiovascular diseases and the adoption of minimally invasive cardiac procedures in office-based settings. Outpatient labs allow procedures such as catheterization, electrophysiology studies, and ablations to be performed efficiently. Cardiac procedures benefit from advanced equipment and technology, reducing the need for hospitalization. Growing patient awareness about preventive and elective cardiac care enhances market adoption. The segment is supported by favorable reimbursement policies for outpatient cardiac interventions. Physicians prefer office-based cardiac labs for streamlined workflows and better scheduling flexibility. Quick patient recovery and reduced hospital stays improve satisfaction and throughput. Established healthcare networks invest in specialized cardiac outpatient facilities. Focused infrastructure and experienced staff contribute to higher procedural success rates. The ability to provide continuous follow-up and monitoring strengthens the appeal of cardiac labs. Cost-effectiveness compared to hospital-based interventions also drives adoption. Overall, the cardiac segment remains the backbone of office-based procedural services due to high patient volume and established demand.

The Peripheral Vascular Intervention segment is projected to register the fastest CAGR of 23.0% from 2026 to 2033, driven by technological advancements in minimally invasive vascular treatments. Increasing prevalence of peripheral artery disease globally is fueling demand for outpatient vascular interventions. Office-based labs enable angioplasty, stenting, and other vascular procedures with reduced hospital dependency. Rising patient preference for quick recovery and outpatient treatment supports segment growth. Reimbursement support for vascular procedures in outpatient settings further boosts adoption. The versatility of outpatient labs to perform multiple procedures enhances efficiency. Advanced imaging and diagnostic tools in office-based labs improve procedural success and patient safety. Growing awareness among physicians and patients about early vascular intervention contributes to demand. Expansion in urban healthcare infrastructure accelerates market penetration. Investments in portable, high-quality equipment improve access to peripheral interventions. Healthcare providers benefit from higher patient throughput and lower operational costs. Increasing collaborations between specialists and outpatient facilities reinforce growth potential. Overall, the segment’s growth is underpinned by rising disease prevalence, procedural efficiency, and patient convenience.

- By Specialist

On the basis of specialist, the market is segmented into Vascular Surgeons, Ophthalmology, Pain Management, Gastroenterology, Interventional Cardiologists, Interventional Radiologists, Orthopedics, and Others. The Interventional Cardiologists segment dominated the market with a revenue share of 39.6% in 2025, due to the high volume of cardiac interventions performed in office-based labs. Interventional cardiologists benefit from minimally invasive procedures that reduce hospital stays and improve patient outcomes. Advanced diagnostic and procedural equipment tailored for outpatient cardiac care strengthens adoption. Patient demand for accessible, timely cardiac interventions supports market dominance. Established outpatient cardiac labs allow specialists to optimize workflow and improve procedural efficiency. Training and experience of interventional cardiologists enhance patient confidence. Insurance coverage for office-based cardiac procedures further contributes to adoption. Integration with electronic health records improves continuity of care. Focused outpatient cardiac services reduce scheduling conflicts and improve throughput. Growing prevalence of cardiovascular diseases globally ensures sustained demand. Strategic partnerships between cardiologists and outpatient facilities boost segment revenue. Strong patient satisfaction and repeat visits reinforce market dominance. Continuous technology upgrades in cardiac procedures ensure long-term segment leadership.

The Pain Management segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by increasing incidences of chronic pain and rising patient preference for outpatient therapeutic interventions. Office-based labs allow nerve blocks, spinal injections, and minimally invasive treatments efficiently. Reduced costs and quicker recovery compared to hospital settings enhance patient adoption. Awareness about non-surgical pain management solutions is rising globally. Physicians increasingly prefer office-based setups for procedural flexibility and patient throughput. Technological advancements in pain management equipment improve safety and efficacy. Insurance reimbursement for outpatient pain interventions supports segment growth. Clinics offering multi-modal pain treatment attract higher patient volumes. Urban centers are adopting pain management labs to meet growing demand. Streamlined scheduling and follow-up care improve patient satisfaction. Collaborative care models with multidisciplinary teams further fuel growth. Expansion of minimally invasive procedures across specialties strengthens the segment. The convenience, efficiency, and increasing prevalence of chronic pain ensure high growth for the pain management segment.

Office-Based Labs Market Regional Analysis

- North America dominated the office-based labs market with the largest revenue share of approximately 39.1% in 2025, supported by its well-established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- The region is witnessing substantial growth in office-based lab adoption, particularly driven by advancements in diagnostic technologies, point-of-care testing, and outpatient procedural services

- Increasing focus on rapid diagnostics, cost-effective healthcare delivery, and improved patient outcomes is further fueling the market’s expansion across clinics, specialty practices, and outpatient facilities

U.S. Office-Based Labs Market Insight

The U.S. office-based labs market captured the largest revenue share within North America at in 2025, fueled by the swift adoption of office-based diagnostic technologies and outpatient procedural services. Healthcare providers are prioritizing rapid, accurate testing and patient-centric care, driving the expansion of office-based labs in primary care clinics, specialty practices, and outpatient centers. Integration of point-of-care testing, digital health records, and automated diagnostic platforms is significantly contributing to the market’s growth.

Europe Office-Based Labs Market Insight

The Europe office-based labs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and the increasing demand for rapid, on-site diagnostics. Growth is supported by well-established healthcare systems, increasing adoption in outpatient and specialty clinics, and focus on improving patient care efficiency. Key countries such as the U.K. and Germany are seeing growing integration of office-based labs in clinics and specialty centers, fostering market expansion.

U.K. Office-Based Labs Market Insight

The U.K office-based labs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising need for fast and accurate diagnostic services in outpatient clinics and specialty practices. Adoption is further supported by patient demand for convenient diagnostics, integration with digital healthcare systems, and efforts to reduce hospital visits while maintaining high-quality care.

Germany Office-Based Labs Market Insight

Germany’s office-based labs market is expected to expand at a considerable CAGR, fueled by increasing awareness of advanced diagnostics and demand for efficient outpatient procedures. The country’s robust healthcare infrastructure, emphasis on innovation, and focus on patient-centric care support the adoption of office-based labs across hospitals and specialty clinics.

Asia-Pacific Office-Based Labs Market Insight

Asia-Pacific office-based labs market is expected to be the fastest-growing region in the Office-Based Labs market during the forecast period, driven by increasing healthcare access, rising urbanization, growing awareness of on-site diagnostics, and expanding disposable incomes. Rapid urbanization in countries such as China, Japan, and India, coupled with government initiatives to enhance healthcare delivery, is promoting the adoption of office-based labs. Technological advancements, affordable diagnostic solutions, and rising demand for point-of-care testing are major growth drivers in the APAC region.

Japan Office-Based Labs Market Insight

Japan’s office-based labs market is gaining momentum due to the country’s advanced healthcare infrastructure, rapid urbanization, and demand for convenient and accurate diagnostics. Integration with electronic health records and specialty outpatient clinics, along with increasing focus on elderly patient care, is driving market growth.

China Office-Based Labs Market Insight

China office-based labs market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding healthcare access, and high adoption of medical diagnostic technologies. Government initiatives promoting decentralized healthcare, growing awareness of on-site testing benefits, and rising disposable incomes are key factors propelling the market in China.

Office-Based Labs Market Share

The Office-Based Labs industry is primarily led by well-established companies, including:

• LabCorp (U.S.)

• Quest Diagnostics (U.S.)

• BioReference Laboratories (U.S.)

• Sonic Healthcare (Australia)

• Unilabs (Switzerland)

• Eurofins Scientific (Luxembourg)

• Fulgent Genetics (U.S.)

• Invitae Corporation (U.S.)

• Cerba HealthCare (France)

• Dynacare (Canada)

• Alverno Laboratories (U.S.)

• PathGroup (U.S.)

• Genoptix (U.S.)

• ACM Global Laboratories (U.S.)

• Healthcare Global Enterprises (India)

• MedLabs (South Africa)

• SRL Diagnostics (India)

• VivaDiag (U.S.)

• iGenomix (U.S.)

Latest Developments in Global Office-Based Labs Market

- In September 2025, Quest Diagnostics and Epic announced an industry‑first collaboration to improve laboratory testing experiences by integrating Epic’s healthcare technology suite across Quest’s national network. This initiative aims to streamline lab ordering, results reporting, appointment scheduling, and billing for providers and patients, enhancing convenience and operational efficiency across Quest’s ~2,000 U.S. testing sites

- In November 2025, Labcorp highlighted its strategic investment in at‑home and remote diagnostics through its portfolio companies like Getlabs, expanding access to lab testing and remote specimen collection. The approach focuses on bringing diagnostic services directly to patients’ homes, increasing convenience and improving adherence to testing protocols, reflecting the broader trend toward decentralized diagnostics

- In August 2025, data from industry reports showed that the U.S. office‑based labs market was projected to grow significantly, with estimates suggesting the market size could exceed USD 35 billion by 2033 due to rising outpatient procedures and increased demand for minimally invasive care settings. This projection underscores robust market momentum in office‑based testing and procedural labs

- In 2024, Siemens Healthineers launched an integrated office‑based lab technology platform, resulting in a reported ~15 % increase in their market penetration in North America. This development highlights how advanced lab technologies and platforms are increasingly being adopted to improve workflow efficiency and diagnostic capability in office settings

- In August 2025, Mayo Clinic Laboratories expanded its international footprint through a strategic alliance with a major European healthcare provider, broadening its service offerings and enabling access to new markets. Such partnerships illustrate how key players are leveraging collaborations to extend global reach and enhance service delivery across regions

- In September 2025, Labcorp completed the acquisition of select assets of BioReference Health’s oncology and related clinical testing services businesses, reinforcing its laboratory services portfolio and expanding capabilities, especially in specialized cancer and related diagnostics

- In April 2023, industry reports projected the global office‑based lab market would reach USD 52.2 billion by 2033, driven by rising investments in healthcare infrastructure, growing minimally invasive procedures, and favorable reimbursement frameworks. This milestone emphasizes the long‑term growth trajectory recognized by market research firms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.