Global Passion Flower Extracts Market

Market Size in USD Billion

CAGR :

%

USD

4.33 Billion

USD

6.47 Billion

2025

2033

USD

4.33 Billion

USD

6.47 Billion

2025

2033

| 2026 –2033 | |

| USD 4.33 Billion | |

| USD 6.47 Billion | |

|

|

|

|

Passion Flower Extracts Market Size

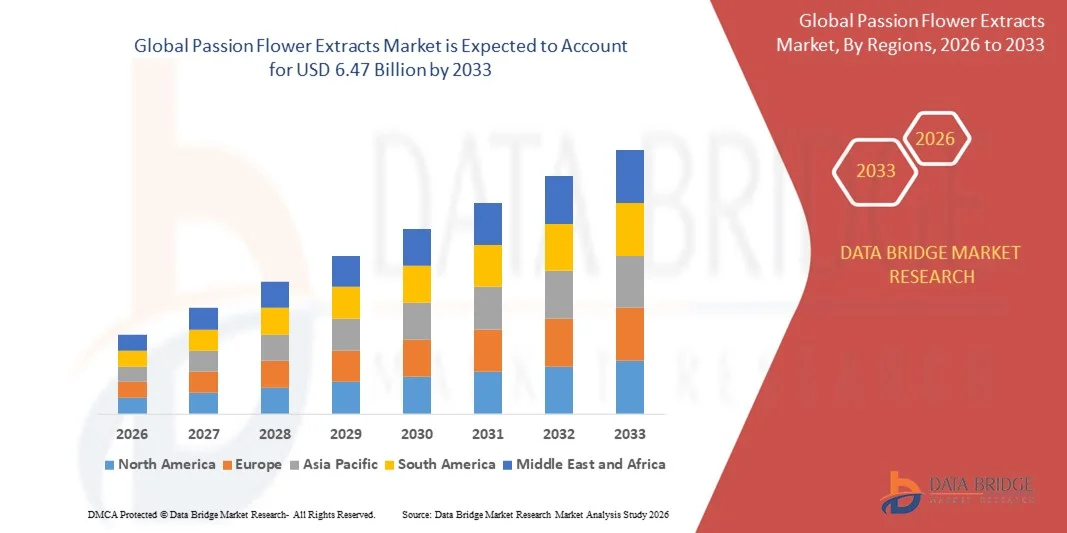

- The global passion flower extracts market size was valued at USD 4.33 billion in 2025 and is expected to reach USD 6.47 billion by 2033, at a CAGR of 5.15% during the forecast period

- The market growth is largely fueled by increasing consumer preference for natural and plant-based ingredients in dietary supplements, nutraceuticals, and functional foods, driving demand for passion flower extracts across wellness and pharmaceutical applications

- Furthermore, rising awareness of stress management, sleep support, and mental wellness benefits is establishing passion flower extracts as a preferred herbal ingredient in supplements, teas, and other consumable products. These converging factors are accelerating adoption, thereby significantly boosting the industry's growth

Passion Flower Extracts Market Analysis

- Passion flower extracts, derived from Passiflora incarnata and other species, are increasingly vital components in herbal supplements, nutraceuticals, and functional food and beverage products due to their anxiolytic, calming, and sleep-enhancing properties

- The escalating demand for passion flower extracts is primarily fueled by growing consumer focus on mental wellness, rising preference for natural alternatives to synthetic drugs, and increasing incorporation of botanical extracts in pharmaceutical, nutraceutical, and cosmetic applications

- Europe dominated the passion flower extracts market with a share of 34.9% in 2025, due to strong demand for herbal remedies, high consumer awareness of mental wellness, and widespread use of botanical ingredients in nutraceuticals and pharmaceuticals

- Asia-Pacific is expected to be the fastest growing region in the passion flower extracts market during the forecast period due to rising health awareness, expanding nutraceutical consumption, and growing adoption of herbal ingredients

- Conventional segment dominated the market with a market share of 85.5% in 2025, due to its wide availability, cost efficiency, and established supply chains across food, pharmaceutical, and nutraceutical industries. Conventional extracts are preferred by large-scale manufacturers due to consistent quality, higher production volumes, and easier regulatory compliance in multiple regions. Their extensive use in stress relief formulations, sleep aids, and functional beverages continues to support steady demand

Report Scope and Passion Flower Extracts Market Segmentation

|

Attributes |

Passion Flower Extracts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Passion Flower Extracts Market Trends

Increased Use of Passion Flower Extracts in Stress and Sleep Products

- A significant trend in the passion flower extracts market is the rising incorporation of these extracts in stress-relief and sleep-enhancing formulations, driven by growing consumer preference for natural wellness solutions. This trend is supporting product innovations in dietary supplements, functional beverages, and herbal teas that target mental well-being and sleep quality

- For instance, Naturex, a subsidiary of Givaudan, supplies standardized passion flower extracts that are increasingly utilized in nutraceutical formulations aimed at promoting relaxation and supporting sleep cycles. Such applications enhance product differentiation and align with consumer demand for plant-based calming solutions

- The growing awareness of the therapeutic benefits of passion flower, including its anxiolytic and mild sedative properties, is encouraging manufacturers to integrate it into daily wellness routines. This is positioning passion flower extracts as key ingredients in preventive health and holistic lifestyle products

- Dietary supplement companies are expanding their portfolios with passion flower-based capsules, powders, and liquid extracts that combine convenience with natural efficacy. These offerings are strengthening brand appeal and capturing attention in both offline and e-commerce wellness channels

- Functional beverage manufacturers are increasingly leveraging passion flower extracts to develop calming teas, relaxation drinks, and sleep-support formulations. This rising adoption is contributing to the expansion of the global herbal ingredients market and enhancing consumer access to plant-based solutions

- The market is witnessing an upward trend in innovation for combination formulations where passion flower is blended with other herbal ingredients such as valerian and chamomile. This trend is reinforcing its role as a versatile natural ingredient and driving overall market growth

Passion Flower Extracts Market Dynamics

Driver

Rising Demand for Natural, Plant-Based Ingredients

- The increasing consumer shift toward clean-label and natural wellness products is driving demand for plant-based ingredients such as passion flower extracts that offer therapeutic benefits without synthetic additives. This preference is supporting the expansion of herbal supplements, functional beverages, and personal care products

- For instance, Sabinsa Corporation provides standardized passion flower extracts that are widely used in nutraceuticals and stress-relief formulations. These ingredients enable manufacturers to meet regulatory standards while delivering consistent bioactive benefits, strengthening market adoption

- The rising interest in preventive health and mental wellness is encouraging food and beverage companies to formulate products enriched with natural botanicals that support relaxation and stress management. This trend is positioning plant-derived extracts as essential components in holistic health solutions

- Cosmetic and personal care industries are incorporating passion flower extracts for their calming and anti-inflammatory properties in skin and hair care formulations. These applications expand market reach and enhance consumer engagement with natural ingredient-based products

- The growing global focus on herbal and functional ingredients in dietary supplements is boosting investments in extraction, standardization, and quality assurance of passion flower extracts. This sustained interest reinforces its role as a reliable and effective plant-based ingredient

Restraint/Challenge

Lack of Standardization and Quality Control

- The passion flower extracts market faces challenges due to variability in raw material quality, extraction processes, and active compound concentrations. This inconsistency can affect product efficacy, safety, and regulatory compliance, creating barriers for manufacturers and suppliers

- For instance, Naturex has highlighted the importance of standardized extraction methods to ensure consistent levels of flavonoids and alkaloids in passion flower extracts. Without such measures, product formulations may deliver uneven therapeutic outcomes, limiting market reliability

- Limited global regulations and standardization protocols for herbal extracts increase the risk of adulteration and mislabeling, impacting consumer trust and market credibility. This challenge underscores the need for rigorous testing and certification processes

- Fluctuations in raw material supply due to seasonal availability, cultivation practices, and geographic variations further complicate quality control. Manufacturers must navigate these challenges to maintain consistent extract potency and formulation stability

- The market continues to grapple with ensuring compliance across multiple regions with differing regulatory frameworks. Addressing these quality and standardization issues is critical for sustaining consumer confidence and driving long-term growth in the passion flower extracts market

Passion Flower Extracts Market Scope

The market is segmented on the basis of nature, form, end-use, and distribution channel.

- By Nature

On the basis of nature, the passion flower extracts market is segmented into organic and conventional. The conventional segment dominated the market with the largest revenue share of 85.5% in 2025, driven by its wide availability, cost efficiency, and established supply chains across food, pharmaceutical, and nutraceutical industries. Conventional extracts are preferred by large-scale manufacturers due to consistent quality, higher production volumes, and easier regulatory compliance in multiple regions. Their extensive use in stress relief formulations, sleep aids, and functional beverages continues to support steady demand.

The organic segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising consumer preference for clean-label, chemical-free, and sustainably sourced botanical ingredients. Increasing awareness around organic certifications and traceability is encouraging manufacturers to expand organic product lines. Growth is further supported by premium positioning of organic extracts in nutraceuticals and personal care applications focused on wellness and natural formulations.

- By Form

On the basis of form, the passion flower extracts market is segmented into liquid and dry. The liquid segment accounted for the dominant market share in 2025, driven by its ease of formulation, faster absorption, and widespread use in beverages, tinctures, and liquid supplements. Liquid extracts are favored by manufacturers for their compatibility with functional drinks and syrups, as well as their flexibility in dosage adjustment. Their suitability for pharmaceutical and herbal formulations further strengthens adoption across multiple end-use sectors.

The dry segment is expected to register the fastest growth rate during the forecast period, driven by longer shelf life, ease of storage, and convenience in transportation. Dry extracts are increasingly used in capsules, tablets, and powdered nutraceutical products due to precise dosing and formulation stability. Rising demand for dietary supplements and compact product formats continues to accelerate growth in this segment.

- By End-Use

On the basis of end-use, the passion flower extracts market is segmented into food and beverages, pharmacological, pharmaceutical, nutraceutical, dietary supplements, and cosmetic and personal care. The dietary supplements segment dominated the market in 2025, driven by increasing consumer focus on stress management, sleep quality, and mental wellness. Passion flower extracts are widely incorporated into supplements due to their calming properties and natural positioning. Growing consumption of herbal supplements across developed and emerging markets continues to reinforce segment dominance.

The cosmetic and personal care segment is projected to witness the fastest growth from 2026 to 2033, supported by rising use of botanical extracts in skincare and haircare formulations. Passion flower extracts are increasingly valued for their soothing, antioxidant, and skin-conditioning properties. Expanding demand for natural and plant-based cosmetic products is accelerating adoption across premium and mass-market personal care brands.

- By Distribution Channel

On the basis of distribution channel, the passion flower extracts market is segmented into direct, indirect, wholesale, online retailer, supermarket, and specialty stores. The wholesale segment held the largest revenue share in 2025, driven by bulk procurement by manufacturers and formulators across pharmaceutical, nutraceutical, and food industries. Wholesale channels provide cost advantages, stable supply, and consistent quality, supporting large-scale production requirements. Their established distribution networks continue to play a central role in market expansion.

The online retailer segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing digital adoption and direct-to-consumer sales of herbal ingredients and supplements. Online platforms offer wider product visibility, detailed ingredient information, and easy accessibility for both businesses and consumers. Growing preference for e-commerce purchasing of health and wellness products is further supporting rapid segment growth.

Passion Flower Extracts Market Regional Analysis

- Europe dominated the passion flower extracts market with the largest revenue share of 34.9% in 2025, driven by strong demand for herbal remedies, high consumer awareness of mental wellness, and widespread use of botanical ingredients in nutraceuticals and pharmaceuticals

- Manufacturers across the region increasingly incorporate passion flower extracts in sleep aids, stress management supplements, and functional beverages, supported by favorable regulations for plant-based and traditional herbal products

- This dominance is further supported by advanced extraction technologies, strong R&D activity, and the presence of established herbal ingredient producers, positioning Europe as a mature and quality-focused market

Germany Passion Flower Extracts Market Insight

The Germany passion flower extracts market accounted for the largest share within Europe in 2025, supported by the country’s strong pharmaceutical and nutraceutical manufacturing base. German companies emphasize standardized herbal extracts and clinical validation, driving adoption in dietary supplements and medicinal formulations. Strong consumer trust in herbal products and strict quality standards further reinforce market growth.

U.K. Passion Flower Extracts Market Insight

The U.K. passion flower extracts market is projected to grow at a steady CAGR during the forecast period, driven by rising demand for natural stress relief and sleep-support solutions. Increasing popularity of herbal supplements and functional beverages supports market expansion. Growing interest in clean-label and plant-based wellness products further strengthens growth prospects.

North America Passion Flower Extracts Market Insight

The North America passion flower extracts market holds a significant market share, supported by high consumption of dietary supplements and increasing focus on mental health and holistic wellness. The region benefits from strong distribution networks and widespread acceptance of botanical ingredients. Expanding use of passion flower extracts in nutraceuticals and personal care products continues to drive market development.

U.S. Passion Flower Extracts Market Insight

The U.S. passion flower extracts market represents a key share within North America, driven by strong demand for herbal supplements addressing anxiety, stress, and sleep disorders. The presence of established nutraceutical brands and advanced formulation capabilities supports large-scale adoption. Growing consumer preference for natural and plant-derived ingredients further accelerates market growth.

Asia-Pacific Passion Flower Extracts Market Insight

The Asia-Pacific passion flower extracts market is expected to witness the fastest CAGR from 2026 to 2033, driven by rising health awareness, expanding nutraceutical consumption, and growing adoption of herbal ingredients. Manufacturers increasingly integrate passion flower extracts into functional foods and supplements to meet evolving wellness trends. Improving distribution infrastructure and increasing disposable income further support regional growth.

China Passion Flower Extracts Market Insight

China dominated the Asia-Pacific passion flower extracts market in 2025, supported by its large herbal medicine industry and growing demand for plant-based wellness products. Integration of passion flower extracts into traditional and modern formulations drives widespread usage. Expanding domestic production capacity and rising consumer interest in natural health solutions contribute to market expansion.

India Passion Flower Extracts Market Insight

The India passion flower extracts market is emerging as a high-growth segment, supported by increasing awareness of herbal remedies and expanding nutraceutical and dietary supplement industries. Strong demand for natural stress-relief and sleep-support products encourages adoption. Growing investments in herbal extraction facilities and emphasis on Ayurveda and plant-based wellness further position India as a promising growth market.

Passion Flower Extracts Market Share

The passion flower extracts industry is primarily led by well-established companies, including:

- Alchem International Pvt. Ltd (India)

- Avena Botanicals (U.S.)

- Herb Pharm (U.S.)

- Martin Bauer Group (Germany)

- Indena S.p.A (Italy)

- Naturalin Bio-Resources Co., Ltd (China)

- Saw Palmetto Harvesting Company (U.S.)

- The Good Scents Company (U.S.)

- HERBCO (U.S.)

- Bio‑Botanica, Inc. (U.S.)

- Nexira (France)

- Euromed S.A. (Spain)

- Xi’an Sost Biotech Co., Ltd (China)

- SBL Global (U.S.)

Latest Developments in Global Passion Flower Extracts Market

- In November 2025, Gaia Herbs launched a high‑potency passion flower extract product targeting stress relief and improved sleep using an ethanol‑free extraction process to meet clean‑label consumer demand. This launch strengthened Gaia Herbs’ presence in the premium botanical supplements segment, responding to rising consumer preference for natural wellness solutions. The product’s introduction enhanced market competitiveness by offering standardized quality, increased bioactive retention, and broad applicability in functional beverages, dietary supplements, and nutraceuticals, further driving overall market adoption of high-quality passion flower extracts

- In November 2025, DHC Corporation introduced premium passion flower extract supplements with high-purity quality controls for relaxation and sleep support in the Japanese market. This development reinforced DHC’s leadership in Japan’s natural stress-relief segment and tapped into the growing consumer trend of plant-based wellness products. By providing standardized, high-efficacy extracts, the launch improved market confidence in herbal supplement quality, encouraged adoption in pharmaceutical and nutraceutical applications, and contributed to expanding the regional passion flower extracts market

- In October 2025, NOW Foods invested USD 14 million to upgrade its herbal extraction and purity testing facilities for passion flower and other botanicals, improving extraction quality and supply chain reliability. This strategic investment allowed the company to meet increasing demand for standardized, high-quality extracts and ensured consistent supply for large-scale commercial production. It positioned NOW Foods as a reliable supplier in the natural supplements market, boosted confidence among manufacturers and retailers, and supported the expansion of passion flower extract usage across functional foods, beverages, and dietary supplements

- In September 2025, Nature’s Way introduced standardized passion flower capsules with improved preservation of bioactive components to support anxiety relief and relaxation benefits. This product expansion strengthened Nature’s Way’s herbal therapeutics portfolio and attracted consumers seeking effective natural solutions for mental wellness. By offering scientifically standardized extracts, the company enhanced product credibility, encouraged market growth in the anxiety and stress-support segment, and contributed to the broader adoption of passion flower extracts in nutraceuticals and dietary supplements

- In August 2025, Solaray launched dual‑action passion flower blends formulated with complementary calming ingredients such as lemon balm and magnesium to enhance stress management and sleep support. This introduction expanded Solaray’s offerings in multifunctional botanical solutions, meeting diverse consumer needs for combined efficacy in a single product. The innovation strengthened the company’s presence in the functional wellness market, encouraged cross-category usage of passion flower extracts in dietary supplements, and further drove awareness and demand in both domestic and international herbal extract markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Passion Flower Extracts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Passion Flower Extracts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Passion Flower Extracts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.