Global Sports Sunglasses Market

Market Size in USD Billion

CAGR :

%

USD

5.07 Billion

USD

8.78 Billion

2025

2033

USD

5.07 Billion

USD

8.78 Billion

2025

2033

| 2026 –2033 | |

| USD 5.07 Billion | |

| USD 8.78 Billion | |

|

|

|

|

Sports Sunglasses Market Size

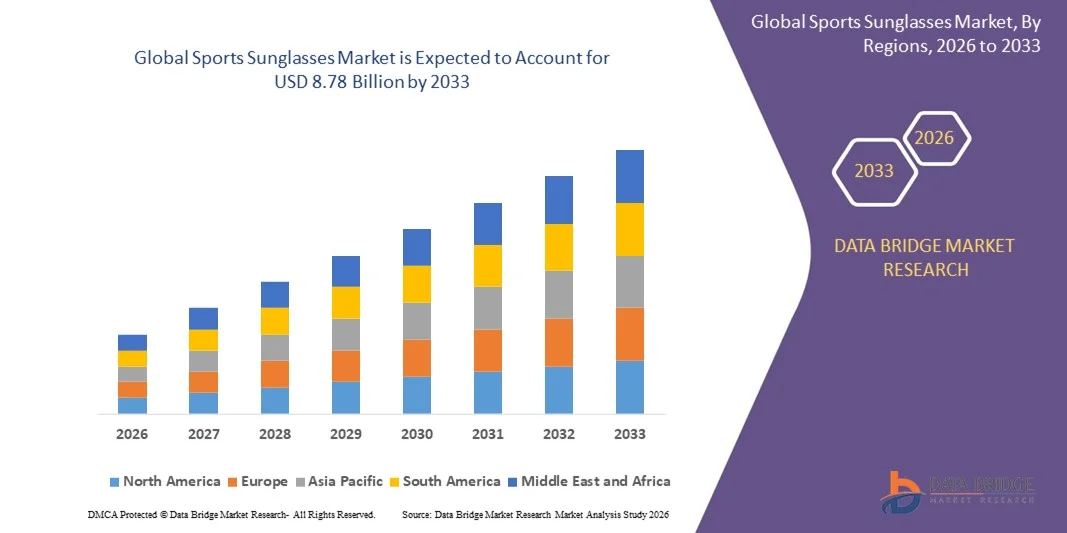

- The global sports sunglasses market size was valued at USD 5.07 billion in 2025 and is expected to reach USD 8.78 billion by 2033, at a CAGR of 7.10 % during the forecast period

- The market growth is largely fuelled by the rising participation in outdoor sports and fitness activities, including cycling, running, trekking, and water sports

- In addition, increasing awareness regarding eye protection from harmful UV radiation and glare during prolonged outdoor exposure is supporting product demand

Sports Sunglasses Market Analysis

- The market is witnessing steady growth driven by increasing consumer focus on performance enhancement, comfort, and durability in sports eyewear across both professional and recreational segments

- Technological advancements in lightweight frames, impact-resistant materials, and customizable lens options, combined with expanding distribution through online and specialty sports stores, are strengthening global market penetration

- North America dominated the sports sunglasses market with the largest revenue share in 2025, driven by rising participation in outdoor sports, fitness activities, and adventure tourism, along with growing awareness regarding eye protection from harmful UV rays

- Asia-Pacific region is expected to witness the highest growth rate in the global sports sunglasses market, driven by increasing urbanization, rising health and fitness awareness, expanding e-commerce penetration, and a growing consumer base for outdoor sporting and recreational activities

- The Polarized segment held the largest market revenue share in 2025 driven by its superior glare reduction capabilities and enhanced visual clarity during outdoor activities. Polarized sports sunglasses are widely preferred for cycling, running, fishing, and driving, as they minimize eye strain and improve contrast in bright environments

Report Scope and Sports Sunglasses Market Segmentation

|

Attributes |

Sports Sunglasses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Sunglasses Market Trends

Growing Popularity of Outdoor Sports and Performance-Enhancing Eyewear

- The increasing participation in outdoor sports and fitness activities is significantly shaping the sports sunglasses market, as consumers seek eyewear that enhances visual clarity, comfort, and eye protection. Sports sunglasses are gaining traction due to their lightweight frames, impact-resistant lenses, and UV protection features. This trend is strengthening adoption across cycling, running, trekking, and water sports segments, encouraging manufacturers to innovate with advanced lens technologies and ergonomic designs that cater to performance-oriented users

- Rising awareness regarding eye health and protection from harmful UV rays has accelerated demand for high-performance sports sunglasses across professional and amateur athletes. Consumers are actively seeking polarized, anti-glare, and scratch-resistant lenses that improve visibility and reduce eye strain during extended outdoor exposure. This has prompted brands to integrate advanced coatings and durable materials to enhance product longevity and user comfort

- Technological advancements such as photochromic lenses, interchangeable lens systems, and smart sports eyewear integration are influencing purchasing decisions. Manufacturers are emphasizing product differentiation through innovative features, stylish designs, and customizable fits to appeal to diverse consumer preferences. In addition, collaborations with athletes and sports events are strengthening brand visibility and consumer engagement in a competitive market

- For instance, in 2024, Oakley in the U.S. and Adidas in Germany expanded their sports eyewear portfolios with lightweight, high-definition lens models designed for cycling and running enthusiasts. These launches were introduced in response to growing demand for performance-enhancing and protective eyewear, with distribution across specialty sports stores, online platforms, and retail outlets. The products were also marketed for durability and enhanced field clarity, boosting brand recognition and repeat purchases

- While demand for sports sunglasses is increasing, sustained market expansion depends on continuous product innovation, cost optimization, and expanding distribution networks. Manufacturers are focusing on material advancements, improved lens technology, and sustainable frame materials to balance performance, affordability, and environmental responsibility

Sports Sunglasses Market Dynamics

Driver

Increasing Participation in Outdoor Sports and Fitness Activities

- The growing global interest in sports, adventure tourism, and fitness activities is a major driver for the sports sunglasses market. Consumers are increasingly investing in protective eyewear to enhance comfort and performance during cycling, running, skiing, and water sports. This trend is encouraging manufacturers to develop specialized lenses tailored for different environmental conditions and sports requirements

- Expanding awareness of UV-related eye damage and long-term vision health is influencing purchasing behavior. Sports sunglasses with polarized, UV400, and impact-resistant lenses are becoming essential accessories for outdoor enthusiasts. The integration of lightweight materials and ergonomic designs further supports demand among professional athletes and recreational users

- Sports brands are actively promoting high-performance eyewear through sponsorships, endorsements, and digital marketing campaigns. These strategies, combined with product innovation and expansion into emerging markets, are strengthening brand positioning and consumer loyalty. Partnerships with sports organizations and retailers are also enhancing product accessibility and market reach

- For instance, in 2023, Nike Vision in the U.S. and Puma in Germany reported increased sales of sports sunglasses driven by higher participation in outdoor fitness programs and sporting events. The companies emphasized advanced lens technology and stylish frames in marketing campaigns to attract younger consumers and performance-focused athletes. These initiatives supported brand expansion and improved revenue growth

- Although rising sports participation supports market growth, long-term expansion depends on affordability, innovation in lens technology, and strong retail distribution. Investment in research, sustainable materials, and enhanced product durability will be critical to maintaining competitive advantage and meeting evolving consumer expectations

Restraint/Challenge

Availability of Counterfeit Products and Price Sensitivity

- The widespread availability of counterfeit and low-cost imitation sports sunglasses poses a significant challenge to established brands. These products often compromise on quality and safety standards, affecting brand reputation and reducing revenue potential. Consumers in price-sensitive markets may opt for cheaper alternatives, limiting premium segment growth

- Price sensitivity among consumers, particularly in developing regions, restricts adoption of high-end sports sunglasses. Premium models with advanced lens technologies and durable materials are often perceived as expensive, influencing purchasing decisions. This creates competitive pressure on manufacturers to balance pricing with performance and quality

- Distribution challenges and fragmented retail networks in certain regions also impact market penetration. Limited awareness of product differentiation and lens technology benefits further slows adoption in emerging markets. Companies must invest in consumer education and brand awareness campaigns to highlight performance and protective advantages

- For instance, in 2024, retailers in India and Brazil reported increased competition from unbranded and counterfeit sports eyewear products affecting brands such as Ray-Ban and Under Armour. Lower pricing and easy online availability of imitation products reduced premium sales volumes in select urban markets. This scenario also prompted brands to strengthen anti-counterfeiting measures and enhance direct-to-consumer channels

- Overcoming these challenges will require stricter regulatory enforcement, improved brand authentication technologies, and strategic pricing models. Strengthening distribution partnerships, enhancing online presence, and educating consumers about product quality and safety standards will be essential for sustaining long-term growth in the global sports sunglasses market

Sports Sunglasses Market Scope

The market is segmented on the basis of product type, gender, distribution channel, and application.

- By Product Type

On the basis of product type, the sports sunglasses market is segmented into Polarized and Non-polarized. The Polarized segment held the largest market revenue share in 2025 driven by its superior glare reduction capabilities and enhanced visual clarity during outdoor activities. Polarized sports sunglasses are widely preferred for cycling, running, fishing, and driving, as they minimize eye strain and improve contrast in bright environments.

The Non-polarized segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its affordability and suitability for general outdoor use. Non-polarized sports sunglasses are particularly popular among casual users and beginners due to their cost-effectiveness, lightweight designs, and availability in a wide range of styles and colors.

- By Gender

On the basis of gender, the sports sunglasses market is segmented into Male, Female, and Unisex. The Male segment accounted for the largest market revenue share in 2025 attributed to higher participation rates in outdoor sports and adventure activities. Manufacturers are increasingly designing performance-oriented frames and durable lenses tailored to male athletes and fitness enthusiasts.

The Unisex segment is expected to witness the fastest growth rate from 2026 to 2033 driven by rising demand for versatile and inclusive product designs. Unisex sports sunglasses offer adaptable frame structures and neutral styling, appealing to a broader consumer base seeking functionality combined with contemporary aesthetics.

- By Distribution Channel

On the basis of distribution channel, the sports sunglasses market is segmented into Hypermarket/ Supermarket, Specialty Stores, Brand Outlets, Online Sales Channel and Other. The Specialty Stores segment held the largest market revenue share in 2025 driven by personalized assistance, availability of premium brands, and access to sport-specific eyewear collections. Consumers often prefer specialty stores for expert recommendations and product trials before purchase.

The Online Sales Channel segment is expected to witness the fastest growth rate from 2026 to 2033 driven by the expansion of e-commerce platforms and increasing consumer preference for convenient shopping experiences. Online platforms provide access to a wide product range, competitive pricing, and customer reviews, supporting higher digital sales penetration.

- By Application

On the basis of application, the sports sunglasses market is segmented into Outdoor Sporting and Traveling, Water Sports, Ski Sports and Others. The Outdoor Sporting and Traveling segment accounted for the largest market revenue share in 2025 driven by growing participation in cycling, running, trekking, and adventure tourism activities. Sports sunglasses in this category emphasize UV protection, durability, and lightweight comfort.

The Water Sports segment is expected to witness the fastest growth rate from 2026 to 2033 driven by increasing engagement in activities such as surfing, sailing, and kayaking. Water sports sunglasses are designed with polarized lenses and anti-slip frames to enhance visibility and stability in high-glare and wet conditions, supporting segment expansion.

Sports Sunglasses Market Regional Analysis

- North America dominated the sports sunglasses market with the largest revenue share in 2025, driven by rising participation in outdoor sports, fitness activities, and adventure tourism, along with growing awareness regarding eye protection from harmful UV rays

- Consumers in the region highly value advanced lens technologies such as polarized and UV-protected lenses, lightweight frames, and durable materials that enhance comfort and performance during sports and travel activities

- This widespread adoption is further supported by high disposable incomes, strong sports culture, and increasing preference for premium branded eyewear, establishing sports sunglasses as an essential accessory for both professional athletes and recreational users

U.S. Sports Sunglasses Market Insight

The U.S. sports sunglasses market captured the largest revenue share in 2025 within North America, fueled by the strong presence of leading eyewear brands and high engagement in outdoor sporting activities such as cycling, running, baseball, and water sports. Consumers are increasingly prioritizing high-performance eyewear that combines style, durability, and superior lens protection. The growing trend of athleisure fashion, combined with expanding e-commerce penetration and product customization options, further propels the sports sunglasses market. Moreover, rising health awareness regarding eye safety and UV exposure is significantly contributing to market expansion.

Europe Sports Sunglasses Market Insight

The Europe sports sunglasses market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing participation in cycling, skiing, and water sports across countries such as Germany, France, and Italy. The rise in sports tourism and outdoor recreational activities is fostering product demand. European consumers are also drawn to sustainable and eco-friendly eyewear materials, encouraging manufacturers to introduce innovative and recyclable frame designs. The region is experiencing steady growth across both professional sports segments and lifestyle-oriented consumers.

U.K. Sports Sunglasses Market Insight

The U.K. sports sunglasses market is expected to witness the fastest growth rate from 2026 to 2033, driven by growing interest in outdoor fitness, cycling events, and adventure travel. Increasing awareness regarding eye protection against changing weather conditions and UV exposure is encouraging consumers to invest in specialized sports eyewear. In addition, strong online retail channels and brand collaborations with sports influencers are supporting market expansion across diverse consumer groups.

Germany Sports Sunglasses Market Insight

The Germany sports sunglasses market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for technologically advanced and performance-oriented eyewear. Germany’s strong sports infrastructure and growing interest in winter sports and cycling promote product adoption. Consumers prefer durable, precision-engineered sunglasses that offer clarity, comfort, and protection, aligning with the country’s emphasis on quality and innovation.

Asia-Pacific Sports Sunglasses Market Insight

The Asia-Pacific sports sunglasses market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and expanding sports participation in countries such as China, Japan, and India. Growing interest in outdoor activities, coupled with expanding retail networks and online sales platforms, is driving product accessibility. Furthermore, the presence of cost-competitive manufacturers in the region supports affordability and wider adoption among middle-income consumers.

Japan Sports Sunglasses Market Insight

The Japan sports sunglasses market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s active lifestyle culture and increasing participation in running, golf, and winter sports. Japanese consumers place strong emphasis on lightweight design, ergonomic fit, and advanced lens clarity. Integration of innovative materials and compact designs tailored to local preferences is fueling product demand in both professional and recreational segments.

China Sports Sunglasses Market Insight

The China sports sunglasses market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, a growing middle-class population, and increasing awareness of eye health. China represents a significant market for sports and outdoor accessories, with rising demand across cycling, hiking, and water sports activities. The expansion of domestic brands, competitive pricing strategies, and strong online retail penetration are key factors propelling the market in China.

Sports Sunglasses Market Share

The Sports Sunglasses industry is primarily led by well-established companies, including:

- Under Armour, Inc. (U.S.)

- adidas America Inc. (U.S.)

- Nike, Inc. (U.S.)

- PUMA SE (Germany)

- SHOP4REEBOK.COM (U.K.)

- LUXOTTICA GROUP (Italy)

- TITAN LTD. (India)

- Decathlon Sports India Pvt Ltd. (India)

- SAFILO GROUP S.P.A. (Italy)

- Liberty Sport. (U.S.)

- Yiwu Conchen Glasses Co., Ltd (China)

- Rudy Project (Italy)

- ZOGGS (U.K.)

- CHARMANT Group (Japan)

- De Rigo Vision S.p.A. (Italy)

- XIAMEN ASA SUNGLASSES CO., LTD. (China)

- Kyboe.nl (Netherlands)

Latest Developments in Global Sports Sunglasses Market

- In August 2025, Oakley (U.S.) introduced a new product development with the launch of an eco-friendly sports sunglasses collection made from sustainable materials. This initiative aims to address rising consumer demand for environmentally responsible products while strengthening the company’s sustainability positioning. By incorporating green manufacturing practices, Oakley enhances its brand image among environmentally conscious consumers. The move is expected to improve customer loyalty, attract new sustainability-focused buyers, and set competitive benchmarks within the sports eyewear market

- In September 2025, Ray-Ban (U.S.) announced a strategic partnership development by collaborating with a leading technology company to integrate augmented reality features into its sunglasses. The company plans to enhance user experience by offering real-time data display and interactive functionalities tailored for athletes. This innovation blends fashion with advanced technology, targeting tech-savvy and younger demographics. The development is anticipated to expand product differentiation, create new revenue streams, and accelerate the convergence of wearable technology and sports eyewear

- In October 2025, Nike (U.S.) launched a marketing and promotional campaign to support its latest performance sunglasses line, featuring endorsements from prominent athletes. The campaign focuses on highlighting product performance, durability, and athletic credibility. By leveraging high-profile endorsements, Nike aims to strengthen brand visibility and consumer engagement. This strategic initiative is likely to boost sales momentum, reinforce its leadership position, and intensify competition in the global sports sunglasses market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.