Global Sugar Substitutes For Food Applications Market

Market Size in USD Billion

CAGR :

%

USD

5.95 Billion

USD

9.46 Billion

2025

2033

USD

5.95 Billion

USD

9.46 Billion

2025

2033

| 2026 –2033 | |

| USD 5.95 Billion | |

| USD 9.46 Billion | |

|

|

|

|

Sugar Substitutes for Food Applications Market Size

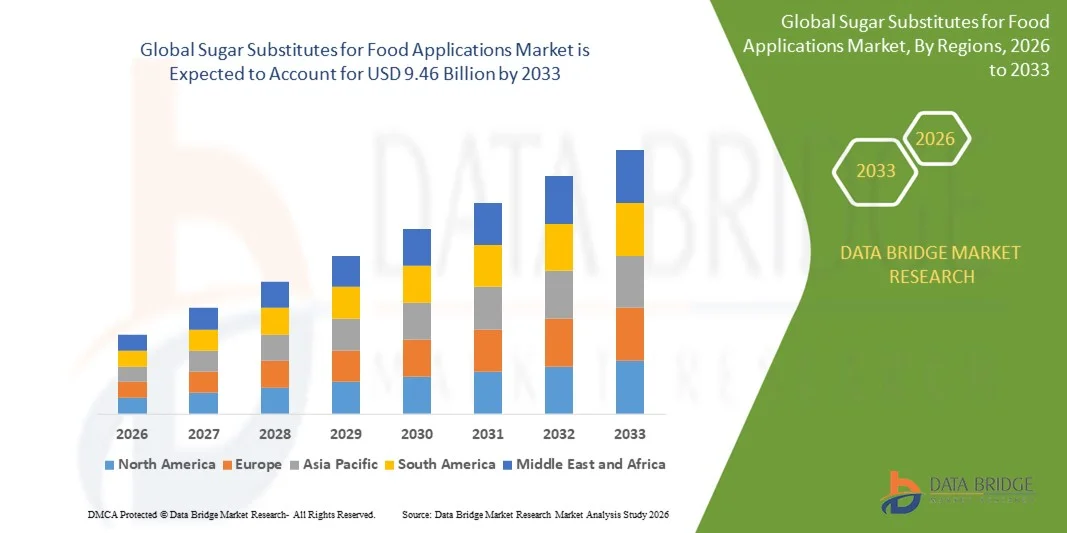

- The global sugar substitutes for food applications market size was valued at USD 5.95 billion in 2025 and is expected to reach USD 9.46 billion by 2033, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the rising demand for low-calorie and diabetic-friendly food products

- Growing health consciousness and the shift toward clean-label, natural sweeteners such as stevia and monk fruit

Sugar Substitutes for Food Applications Market Analysis

- The market is driven by reformulation initiatives undertaken by food manufacturers to reduce sugar content without compromising taste, texture, and product stability

- Rising cases of obesity, diabetes, and lifestyle-related disorders are accelerating the use of artificial and natural sweeteners across mainstream food categories

- North America dominated the sugar substitutes for food applications market with the largest revenue share in 2025, driven by rising health consciousness, growing demand for low-calorie foods, and strong adoption of alternatives to conventional sugar

- Asia-Pacific region is expected to witness the highest growth rate in the global sugar substitutes for food applications market, driven by rapid urbanization, growing disposable incomes, and increasing consumption of processed and low-calorie food and beverage products

- The High-Intensity Sweeteners segment held the largest market revenue share in 2025 driven by its strong sweetening power, cost-effectiveness, and widespread usage across processed foods and low-calorie product formulations. These sweeteners are preferred by manufacturers due to their stability, low caloric value, and ability to deliver high sweetness levels at minimal dosage

Report Scope and Sugar Substitutes for Food Applications Market Segmentation

|

Attributes |

Sugar Substitutes for Food Applications Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Substitutes for Food Applications Market Trends

Rise of Clean-Label and Naturally Derived Sugar Substitutes

- The growing shift toward clean-label sweetening solutions is transforming the sugar substitutes market for food applications, with manufacturers increasingly adopting plant-based and minimally processed alternatives. Naturally sourced substitutes such as stevia, monk fruit, and allulose are gaining traction as consumers prioritize healthier, recognizable ingredients. This shift aligns with rising awareness of clean, transparent product labels across global food sectors

- The rising demand for reduced-sugar and low-calorie food products in regions facing high rates of obesity and diabetes is accelerating the adoption of natural sugar substitutes. Food manufacturers are reformulating bakery, beverage, dairy, and confectionery items to meet tightening health regulations. This reformulation trend is strengthening as consumers demand healthier options without sacrificing flavor or texture

- Advancements in purification and formulation technologies are improving the flavor profiles and stability of natural substitutes, making them more suitable for a broader range of food applications. These innovations help minimize aftertaste and enhance blending performance in complex formulations. As a result, natural sweeteners are becoming more competitive with traditional sugar and synthetic options

- For instance, in 2023, several global food companies introduced reformulated product lines using stevia-derived sweeteners with enhanced taste modulation, helping reduce sugar content by up to 50% without affecting sensory experience. These advancements have encouraged food brands to expand low-calorie portfolios. Improved taste fidelity is also encouraging greater adoption across mass-market food products

- While clean-label sweeteners are supporting healthier product portfolios, their scalability depends on sustainable sourcing, cost efficiency, and continuous innovation in flavor optimization to meet the demands of large-scale food production. Supply chain stability remains a key factor in determining long-term adoption. Manufacturers are increasingly investing in R&D to enhance consistency and reliability

Sugar Substitutes for Food Applications Market Dynamics

Driver

Increasing Health Awareness and Growing Demand for Low-Calorie Food Products

- Rising global awareness of health risks associated with excessive sugar consumption, such as obesity, diabetes, and cardiovascular diseases, is driving consumers toward low-calorie alternatives. This shift is prompting food manufacturers to reformulate products across key categories. Increasing health campaigns and nutrition labeling have further strengthened this transition

- Consumers are actively seeking healthier choices, encouraging the use of both natural and artificial sweeteners in packaged foods to reduce overall caloric intake. Demand is particularly strong among millennials and urban populations who prefer functional, healthier food options. This behavioral shift is also influencing brand reformulation strategies worldwide

- Government regulations and health organizations are promoting sugar reduction targets, leading to increased use of sugar substitutes in processed foods. Manufacturers are adjusting their formulations to comply with evolving national guidelines while maintaining taste quality. Regulatory pressure continues to grow as governments respond to public health concerns

- For instance, in 2022, several European countries expanded sugar-tax policies, prompting major food brands to switch to low-calorie sweeteners to maintain competitiveness. This regulatory environment is accelerating innovation in sweetener technologies. Companies are also exploring hybrid sweetener blends to achieve optimal taste and compliance

- While rising health consciousness is driving strong demand, continuous improvement in taste, texture compatibility, and cost efficiency remains essential to ensure widespread adoption across food categories. Manufacturers must address these challenges to maintain consumer acceptance. Ongoing research is focused on enhancing flavor performance and reducing formulation costs

Restraint/Challenge

Fluctuating Raw Material Costs and Taste Limitations of Natural Sweeteners

- Natural sugar substitutes such as stevia and monk fruit often involve high cultivation, extraction, and processing costs, making them more expensive than traditional sugar. This increases production costs in food manufacturing and limits uptake among price-sensitive producers. Cost fluctuations also make long-term planning challenging for food processors

- Taste limitations, such as lingering bitterness or altered flavor profiles, continue to hinder the widespread use of certain substitutes in specific food applications. Achieving sugar-like taste and texture often requires blending multiple sweeteners, adding complexity. These sensory challenges remain a key barrier to mass-market adoption

- Limited availability and supply chain constraints for specialty crops affect production consistency and pricing fluctuations, further challenging manufacturers. Seasonal variations and regional crop dependencies can disrupt procurement cycles. These factors push companies to diversify sourcing strategies or explore synthetic alternatives

- For instance, in 2023, disruptions in monk fruit cultivation in China caused a temporary increase in global prices, affecting production costs for several food processors. This volatility highlights dependence on geographically concentrated supply chains. Companies were forced to adjust formulations or switch to alternative sweeteners temporarily

- While natural sweeteners offer cleaner labels and health benefits, overcoming cost, flavor, and supply chain challenges is essential for stronger market penetration across large-scale food production systems. Efforts to improve agricultural output, extraction efficiency, and stability are underway. Manufacturers must also invest in taste-improving technologies to address consumer expectations

Sugar Substitutes for Food Applications Market Scope

The market is segmented on the basis of type, composition, and application.

- By Type

On the basis of type, the sugar substitutes for food applications market is segmented into High-Fructose Syrup, High-Intensity Sweeteners, and Low-Intensity Sweeteners. The High-Intensity Sweeteners segment held the largest market revenue share in 2025 driven by its strong sweetening power, cost-effectiveness, and widespread usage across processed foods and low-calorie product formulations. These sweeteners are preferred by manufacturers due to their stability, low caloric value, and ability to deliver high sweetness levels at minimal dosage.

The Low-Intensity Sweeteners segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for clean-label, natural, and calorie-reduced products. Their mild sweetness profile and compatibility with bakery, dairy, and functional food applications are boosting adoption among health-conscious consumers and food formulators.

- By Composition

On the basis of composition, the sugar substitutes for food applications market is segmented into High-Intensity Sweeteners (HIS) and Low-Intensity Sweeteners. The High-Intensity Sweeteners segment accounted for the largest market share in 2025 supported by their extensive use in food processing where high sweetness levels and heat stability are required. These sweeteners remain a preferred choice for reducing sugar without compromising flavor intensity.

The Low-Intensity Sweeteners segment is projected to register the fastest CAGR from 2026 to 2033 due to increasing consumer preference for reduced-calorie products with more natural taste profiles. Their growing incorporation in bakery, confectionery, and dairy formulations is accelerating segment expansion.

- By Application

On the basis of application, the sugar substitutes for food applications market is segmented into Food Products, Beverages, and Health and Personal Care. The Food Products segment dominated the market in 2025 driven by high utilization of sugar substitutes in bakery items, confectionery, dairy products, and packaged foods to meet rising demand for low-sugar and sugar-free alternatives. Manufacturers increasingly adopt sugar substitutes to achieve calorie reduction while maintaining sensory quality.

The Beverages segment is expected to register the highest growth rate from 2026 to 2033, supported by strong demand for low-calorie soft drinks, flavored water, and functional beverages. The shift toward healthier beverage formulations and reduced sugar intake among consumers is accelerating the use of sugar substitutes across beverage manufacturing.

Sugar Substitutes for Food Applications Market Regional Analysis

- North America dominated the sugar substitutes for food applications market with the largest revenue share in 2025, driven by rising health consciousness, growing demand for low-calorie foods, and strong adoption of alternatives to conventional sugar

- Consumers in the region increasingly prefer products formulated with natural and clean-label sweeteners as they seek healthier dietary choices without compromising taste or product quality

- This momentum is further supported by a high prevalence of diabetes and obesity, robust food processing industries, and ongoing reformulation efforts by major manufacturers to meet tightening nutritional guidelines

U.S. Sugar Substitutes for Food Applications Market Insight

The U.S. sugar substitutes for food applications market captured the largest revenue share in 2025 within North America, fuelled by the escalating demand for low-calorie, low-glycemic formulations across bakery, beverages, dairy, and packaged food segments. Food manufacturers are actively replacing traditional sugar with stevia, monk fruit, allulose, and other advanced sweeteners to align with regulatory sugar-reduction targets. The growing preference for clean-label and naturally derived sweetening solutions, along with strong innovation pipelines involving novel blends and improved taste-modulation technologies, continues to propel market growth in the country.

Europe Sugar Substitutes for Food Applications Market Insight

The Europe sugar substitutes for food applications market is expected to witness a significant growth rate from 2026 to 2033, driven by stringent food safety regulations, increasing consumer demand for reduced-sugar formulations, and expanding adoption of natural sweeteners. Rising health concerns related to obesity and high sugar intake are accelerating product reformulation across the food and beverage sector. Moreover, the growing popularity of functional and low-calorie food products is prompting European manufacturers to incorporate advanced sweetening systems, supporting widespread usage across bakery, confectionery, beverage, and dairy applications.

U.K. Sugar Substitutes for Food Applications Market Insight

The U.K. sugar substitutes for food applications market is expected to witness strong growth from 2026 to 2033 due to government-led sugar reduction programs and intensifying consumer preference for healthier product alternatives. The implementation of sugar taxes and public health campaigns has encouraged manufacturers to reduce sugar content in beverages, snacks, and ready-to-eat foods. Increasing interest in natural sweeteners such as stevia and allulose, along with expanding clean-label initiatives, continues to stimulate market demand across both retail and food service channels.

Germany Sugar Substitutes for Food Applications Market Insight

The Germany sugar substitutes for food applications market is poised to witness notable growth from 2026 to 2033, driven by rising awareness of healthy eating, strong demand for premium and natural ingredients, and rapid innovation within the country’s advanced food processing sector. German consumers show a high inclination toward clean-label, plant-derived sweetening options, supporting the shift away from synthetic sweeteners. Furthermore, the country’s emphasis on sustainability and high regulatory standards encourages manufacturers to adopt efficient, high-quality sweetening systems across bakery, dairy, beverages, and functional nutrition categories.

Asia-Pacific Sugar Substitutes for Food Applications Market Insight

The Asia-Pacific sugar substitutes for food applications market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rapid urbanization, expanding middle-class populations, and increasing awareness of lifestyle-related diseases such as diabetes and obesity. Growing adoption of western dietary patterns and rising demand for low-calorie packaged foods are driving the use of both natural and artificial sweeteners. The region also benefits from cost-effective manufacturing capabilities and the strong presence of local and international ingredient producers, accelerating market penetration across food and beverage categories.

Japan Sugar Substitutes for Food Applications Market Insight

The Japan sugar substitutes for food applications market is expected to witness substantial growth from 2026 to 2033 due to the country’s advanced food technology ecosystem, emphasis on health-focused diets, and strong consumer preference for clean-label, low-calorie ingredients. The rising elderly population and increasing demand for functional foods are encouraging the adoption of natural sweeteners such as stevia and monk fruit. In addition, Japan’s food manufacturers continue to innovate with high-quality sweetening systems that enhance taste, stability, and compatibility across a broad range of traditional and modern food products.

China Sugar Substitutes for Food Applications Market Insight

The China sugar substitutes for food applications market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising disposable incomes, accelerated urban lifestyle changes, and a growing demand for healthier, low-sugar food products. The country’s strong manufacturing base and increasing investments in sweetener production—such as stevia, erythritol, and allulose—support rapid market expansion. Government focus on public health awareness and the fast-growing food processing industry further contribute to the widespread adoption of sugar substitutes across snacks, beverages, bakery, and dairy applications.

Sugar Substitutes for Food Applications Market Share

The Sugar Substitutes for Food Applications industry is primarily led by well-established companies, including:

• DuPont (U.S.)

• ADM (U.S.)

• Tate & Lyle (U.K.)

• Ingredion Incorporated (U.S.)

• Cargill, Incorporated (U.S.)

• PureCircle (Malaysia)

• MacAndrews & Forbes Incorporated (U.S.)

• JK Sucralose Inc (China)

• Ajinomoto (Japan)

• steviahubindia (India)

• Suminter India Organics (India)

• Sweetly SteviaUSA (U.S.)

• Pyure (U.S.)

• Xilinat (Mexico)

• Fooditive B.V. (Netherlands)

• SAGANÀ Association (Philippines)

• Hearthside Food Solutions LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sugar Substitutes For Food Applications Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sugar Substitutes For Food Applications Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sugar Substitutes For Food Applications Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.